Active Trading Kya Hai?

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

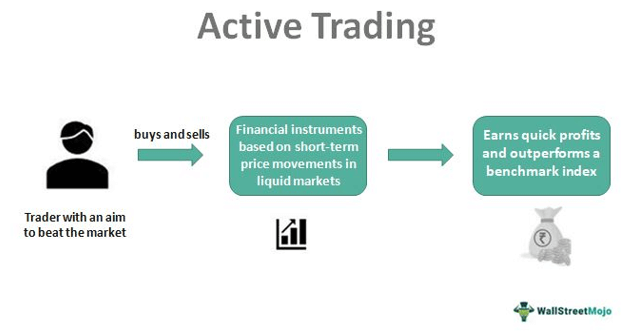

Active Trading Kya Hai? Active Trading, ya tajarba karne wali trading, ek tijarati strategy hai jisme traders rozmarra ke jazbat aur chhoti muddaton mein maaliyat karte hain. Isme traders regularly stocks, currencies, commodities, ya anya financial instruments ko kharidte hain aur unhe short time period mein bechte hain, iski umeed mein ki unhe chhoti si muddat mein munafa mil jaye. Active Trading ka maqsad market volatility aur chhoti term ke price movements ka faida uthana hota hai. Isme traders tajarbati analysis, technical indicators, aur chart patterns ka istemal karke sahi waqt par khareedne aur bechne ki koshish karte hain. Active traders apne trades ko ghanton, minutes, ya seconds tak hold kar sakte hain. Active Trading ke faide bahut se hote hain. Pehle, yeh traders ko jald az-jald return deta hai. Kyunki trades chhoti muddat tak hold ki jati hain, isliye munafa kam waqt mein mil jata hai. Doosra, active trading traders ko azadi aur khud mukhtar hone ka ehsas deta hai. Woh apne trading decisions par poora control rakhte hain aur apne tijarati rujhan aur strategy par tawajjo dete hain. Teesra, active trading tijarat mein izafa karne ka mauqa deti hai. Jab traders regularly aur active tarike se maaliyat karte hain, toh unhe naye tajarati asar, market trends, aur trading techniques ka pata lagane ka mauqa milta hai. Isse unki tijarati samajh aur kamai dono mein izafa hota hai. Active trading mein ahtiyat ke bawajood bhi achi kamai ki jaa sakti hai. Traders apne risk management strategies ko behatar kar sakte hain aur apne trading decisions ko tehqeeqat aur analysis par adharit bana sakte hain. Isse unka nuqsaan kam hota hai aur kamai mein izafa hota hai. In sabhi faido ke saath, active trading professional growth ka mauqa bhi deti hai. Traders apne tijarati maharat ko behtar karke aur tajarbat se seekh kar apni trading skills ko improve kar sakte hain. Isse unki credibility aur market mein maqbooliyat badhti hai. Overall, active trading tijarat mein hamesha aagay rehne, behtar risk management karne, aur market ki maloomat aur analysis ke liye acha mahol banane ka zariya hai. Yeh traders ko tajarati maqasid ko poora karne ka mauqa deti hai aur unhe tijarat ki dunya mein successful banane ka rasta pradan karti hai. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

"Active Trading"- Active Trading:

Active Trading ki kuch key characteristics hai:

- Frequent Trading: Active Traders short-term trades karte hain aur multiple positions open aur close karte rehte hain. Is strategy mein trades minutes se hours tak active rehte hain, aur traders price fluctuations ka fayda uthate hain.

- Technical Analysis: Active Trading mein technical analysis tools jaise ki charts, indicators aur price patterns ka istemal hota hai. Traders short-term price movements ko analyze karte hain aur entry aur exit points identify karte hain.

- Risk Management: Active Trading mein risk management ka bahut mahatvapurna hissa hai. Traders apne trades par tight stop-loss orders lagate hain aur risk exposure ko control karte hain. Proper position sizing aur risk-reward ratio ka dhyan rakhna zaruri hota hai.

- Quick Decision Making: Active Traders ko market mein tezi se decisions lena aata hai. Price fluctuations ke beech mein traders ko jaldi se trade execute karna hota hai. Active Trading mein traders ko market trends, price levels aur technical indicators ko actively monitor karna hota hai.

Strategy :

- Goal Setting : Apne trading goals ko clear karein. Kya aap short-term profits banane ki koshish kar rahe hain ya long-term wealth accumulation ki strategy par focus kar rahe hain?

- Market Analysis : Market trends, price movements, aur market conditions ko analyze karein. Fundamental analysis aur technical analysis ka istemal karke market ko samjhein.

- Risk Management: Khatra prabandhan strategy ke liye zaruri hai. Stop-loss orders aur profit target levels set karke apne trades ko manage karein. Apne risk tolerance ke hisaab se position sizing aur risk-reward ratio ko plan karein.

- Entry aur Exit Points: Entry aur exit points ko identify karein. Technical indicators, price patterns, aur price levels ka istemal karke aap apne trades ke entry aur exit points decide kar sakte hain.

- Position Sizing : Apne trades ke liye position sizing plan karein. Apne account size, risk tolerance aur market conditions ke hisaab se position ka size decide karein.

- Testing aur Evaluation: Strategy ko backtesting aur demo trading ke through test karein. Apne trades aur performance ko evaluate karein aur apni strategy ko refine karein.

- Discipline aur Patience : Strategy ke sath discipline aur patience maintain karein. Emotions par control rakhein aur apne rules ko follow karein.

- Continuous Learning: Trading field mein hamesha seekhna aur improve karna zaruri hai. New strategies, market trends aur techniques ke bare mein updated rahen.

- useges:

- Trading Decisions: Ek acchi strategy traders ko trading decisions lene mein madad karta hai. Traders apne entry aur exit points, stop-loss levels aur profit targets ko strategy ke hisaab se set kar sakte hain.

- Risk Management: Strategy risk management ko handle karne mein madad karta hai. Traders apne trades ke liye stop-loss orders, position sizing aur risk-reward ratio ko plan kar sakte hain. Isse unka risk exposure control mein rehta hai.

- Consistency: Strategy ko follow karne se traders ki trading consistency improve hoti hai. Unko apni strategy par rely karke trades ko execute karna hota hai, jisse emotions aur impulsive decisions se bacha ja sakta hai.

- Analysis aur Evaluation: Strategy traders ko market analysis aur apne trades ki evaluation ke liye guideline deta hai. Technical indicators aur price patterns ka istemal karke traders market trends aur price movements ko analyze kar sakte hain.

- Confidence: Ek acchi strategy ke sath traders ka confidence level badh jata hai. Unko apne trades par confidence hota hai kyunki unhone apne strategy ko test kiya hai aur use karke profits banaye hain.

- Trading Discipline: Strategy trading discipline ko maintain karne mein madad karta hai. Traders apne strategy ke rules aur guidelines ko follow karke discipline maintain kar sakte hain.

limitation:

- Market Volatility: Strategy jo ek specific market condition par based ho, woh dusre market conditions mein kam effective ho sakta hai. Jab market volatility high hoti hai ya market trends change hote hain, strategy ke results par asar padh sakta hai.

- Historical Data Reliance: Strategy banane ke liye historical market data ka istemal hota hai. Lekin market dynamics badalte rehte hain aur past performance future results ko guarantee nahi karta hai. Isliye, strategy ke backtesting aur performance ko present market conditions ke hisaab se evaluate karna zaruri hota hai.

- Emotional Factors: Strategy ko implement karne ke liye discipline aur control zaruri hai. Lekin traders ke emotions, jaise greed aur fear, decision-making process ko influence kar sakte hain. Emotionally driven trading strategy ke results par negative impact padh sakta hai.

- False Signals: Kuch strategies false signals generate kar sakte hain, jahan trades execute karne ke baad price opposite direction mein move karte hain. False signals ko identify karna aur unse bachna zaruri hai.

- Time and Effort: Strategy development aur implementation me samay aur mehnat ki zaroorat hoti hai. Market analysis, testing, aur monitoring, traders ke liye time-consuming ho sakta hai.

- No Guarantee of Profits: Strategy ke istemal se guaranteed profits nahi milte hain. Market unpredictable hoti hai aur losses bhi ho sakte hain. Strategy ka istemal karne se pehle risk aur reward ka balance rakhna zaruri hai.

- External Factors: Market mein external factors, jaise economic news, geopolitical events, aur central bank policies, strategy ke results par asar dal sakte hain. In factors ko monitor karna aur strategy ko adapt karna zaruri hota hai.

Active Trading ke advantages:

- Short-Term Profit Potential: Active Traders short-term price movements ka advantage lete hain aur quick profits generate kar sakte hain.

- Opportunities in Volatile Markets: Active Trading volatility ke time par zyada opportunities provide karta hai. Traders volatile market conditions mein trading karke profit bana sakte hain.

- Flexibility: Active Trading mein traders apne trading strategy ko adapt kar sakte hain aur market conditions ke hisaab se trades ko adjust kar sakte hain.

Active Trading ke disadvantages:

- High Transaction Costs: Frequent trading ki wajah se transaction costs zyada ho sakte hain. Spread, commissions, aur other fees traders ke profits ko affect kar sakte hain.

- Time and Effort: Active Trading mein market ko regularly monitor karna aur quick decisions lena time-consuming aur mentally demanding ho sakta hai.

- Emotional Stress: Frequent trading aur quick decision-making stress aur emotional pressure create kar sakta hai. Traders ko apne emotions ko control karke rational decisions lena zaruri hota hai.

Conclusion:

-

#4 Collapse

Introduction. Active Trading ya Tajarbay Ki Rooh, ek tarah ka stock market ka kaam hai jahan par traders rozana stocks ko kharidte hain aur bechte hain. Is tarike ka trading bazaar mein kam waqt mein jaldabazi se maaloom hota hai. Ismein traders khud ke faislon aur tajarbay par bharosa karte hain, aur masroofiati tareekon se faida kamana chahte hain. Yeh article Active Trading ke bare mein Roman Urdu mein tafseel se batayega. Active Trading Ka Maqsad Active Trading ka maqsad hota hai rozana ya chotey arsay mein stocks ko khareedna aur bechna taki jaldabazi se faida hasil kiya ja sake. Is tarike ka trading usually short-term hota hai, matlab traders stocks ko kuch ghante, din ya weeks ke liye hold karte hain. Active Trading ka maqsad hai price movements aur market trends ko chunne mein jaldabazi, tajurba, aur samajh se faida uthana. Section 2: Active Trading Mein Istemal Honay Wali Strategies Active Trading mein traders kuch khaas strategies ka istemal karte hain. Yeh strategies unko stocks ke buying aur selling points par madad deti hain. Kuch pramukh strategies Roman Urdu mein darj hain: 1. Scalping: Scalping ek strategy hai jahan traders stocks ko kuch hi samay ke liye hold karte hain, jaise chand seconds ya minutes. Is strategy mein traders small price movements par fawaida uthate hain. Scalping ki kamyabi tezi aur samajh se mutasir hoti hai. 2. Day Trading: Day Trading mein traders stocks ko ek din ke liye hold karte hain. Woh stocks ko subah khareedte hain aur shaam tak bechte hain. Day traders market trends, chart patterns, aur technical indicators ka istemal karke stocks ko chunte hain. 3. Swing Trading: Swing Trading mein traders stocks ko kuch din ya weeks ke liye hold karte hain. Is strategy mein traders price swings, trend reversals, aur market volatility ko dekhte hue stocks ko chunte hain. Section 3: Active Trading Mein Istemal Honay Wali Tools Active Trading mein kuch khaas tools traders ke liye bahut ahem hote hain. Yeh tools traders ko market ki tezi, trends, aur data analysis mein madad dete hain. Kuch aham tools Roman Urdu mein darj hain: 1. Candlestick Charts: Candlestick charts traders ko stocks ke price movements aur market psychology ko samajhne mein madad dete hain. Ismein har candlestick ek time period ko darshata hai aur price range ko represent karta hai. 2. Technical Indicators: Technical indicators traders ko price trends, momentum, aur market strength ke bare mein jankari dete hain. Examples: moving averages, RSI, aur MACD. 3. Level II Quotes: Level II Quotes traders ko real-time order book data provide karte hain, jisse woh stocks ke bid aur ask prices aur volumes ke bare mein jankari prapt kar sakte hain. Section 4: Active Trading Ke Fayde aur Nuksan Active Trading ke kuch fayde aur nuksan darj hain: Fayde: - Jaldabazi se fayda: Active Trading mein traders short-term price movements ka fayda utha sakte hain aur tezi se paise kama sakte hain. - Khud ka maalik: Active Trading mein traders apne faislon par depend karte hain aur apne trades ki jimmedari lete hain. - Nazr e bad ki kam mumkinat: Active Trading mein traders short-term trades karte hain, jiski wajah se unki positions kam waqt tak market mein hoti hain, isse nazr e bad ki kam mumkinat hoti hai. Nuksan: - Jyada stress: Active Trading mein market ki tezi aur price fluctuations ke saath deal karna hota hai, jisse traders ko jyada stress ho sakta hai. - Nuqsaan ki mumkinat: Jaldabazi se trading karne ke wajah se traders nuqsaan ka bhi shikar ho sakte hain. - Research aur samay ki zarurat: Active Trading mein traders ko market trends, stocks, aur technical analysis par constant research karna padta hai. Iske liye samay aur mehnat ki zarurat hoti hai. -

#5 Collapse

Aslamoalekum members kesay hain ap sab. Mujhay umed hay sah thek thak hon gay. Aj ka hamara disscussion ka jo topic hay wh active trading kay bary hain. Isy dekhty hain kay yeh kia hay r hamen kia information deta hay. active trading Forex trading, ya foreign exchange trading, mein currencies ki khareed o farokht ki jati hai. Ye market dunya bhar mein active hoti hai aur 24 ghantay 5 dinon tak kaam karti hai. Forex trading ka sabse bada maqsad currency rates mein hone wale tabdeeliyon se faida uthana hota hai.Forex market mein active trading bahut tarah ki hoti hai. Yahan kuch mukhtalif tarah ki trading strategies istemal hoti hain. Kuch log chotay arsay ki trading karte hain, jahan woh positions ko chand kay minutes, ghante ya dinon tak hi hold karte hain. Ye traders am tor par small price ke harkaat par gor karte hain aur jaldi se faida uthane ki koshish karte hain.Dusri taraf lammbay arsay trading mein traders positions ko hafte, mahine ya saal tak hold karte hain. Ye traders economic trends, news events aur lambay arsay kay waqat currency ki tagayurat par gor karte hain. Benefits Forex trading ke liye traders ko market ka tajziya karna hota hai. Woh charts aur technical indicators ka istemal karte hain, jaise ki moving averages, MACD, aur jo RSI, taki currency price movements aur trend patterns ko samajh sakein.bunyadi tajziya bhi important hoti hai, jahan traders economic indicators, monetary policy aur geopolitical events ka dhyaan rakhte hain.Forex trading mein leverage bhi istemal kiya jata hai. Leverage, trader ko apni investment se zyada funds use karney ki tawaja deta hai. Lekin iske sath hi high risk bhi hoti hai, kyunki nuqsanat bhi leverage se zyada ho sakti hain.Forex trading mein traders online trading platforms ka istemal karte hain, jahan woh currency kay joray misal ke tor par USD/JPY, EUR/USD ki trading kar sakte hain. Trading platform par charts, real-time quotes sy order types, aur risk management tools bhi hote hain.Forex trading mein knowledge, experience aur discipline ki zarurat hoti hai. Beginners ko pahle demo acount sy accounts mein practice karna chahiye aur trading strategies aur risk management ko samajhna chahiye, taaki unhein asani se trading karne mein madad mile. Forex trading mein risk management ka istemal karna bhi zaruri hai, jismein stop loss orders aur take profit orders ka istemal hota hai.Ye important hai ki forex sy trading mein paisa lagane se pahle acchi tarah se research ki jaye aur apne maliyati goals aur risk tolerance ko samjha jaye. Trading mein hamesha apni khas sey investment ki rakam par control rakhein aur sirf utni hi rakam lagayein, jisko haarne ki mein bhi apne maliyati andaz par asar na ho. -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Active Trading, forex market mein ek trading strategy hai jahan traders frequent trades execute karte hain aur short-term price movements ka fayda uthate hain. Is strategy mein traders regular basis par market ko monitor karte hain, short-term price trends aur volatility ka advantage lete hain, aur quick profits banane ki koshish karte hain.

Strategy :

- Trading Decisions: Ek acchi strategy traders ko trading decisions lene mein madad karta hai. Traders apne entry aur exit points, stop-loss levels aur profit targets ko strategy ke hisaab se set kar sakte hain.

- Risk Management: Strategy risk management ko handle karne mein madad karta hai. Traders apne trades ke liye stop-loss orders, position sizing aur risk-reward ratio ko plan kar sakte hain. Isse unka risk exposure control mein rehta hai.

- Consistency: Strategy ko follow karne se traders ki trading consistency improve hoti hai. Unko apni strategy par rely karke trades ko execute karna hota hai, jisse emotions aur impulsive decisions se bacha ja sakta hai.

- Analysis aur Evaluation: Strategy traders ko market analysis aur apne trades ki evaluation ke liye guideline deta hai. Technical indicators aur price patterns ka istemal karke traders market trends aur price movements ko analyze kar sakte hain.

- Confidence: Ek acchi strategy ke sath traders ka confidence level badh jata hai. Unko apne trades par confidence hota hai kyunki unhone apne strategy ko test kiya hai aur use karke profits banaye hain.

- Trading Discipline: Strategy trading discipline ko maintain karne mein madad karta hai. Traders apne strategy ke rules aur guidelines ko follow karke discipline maintain kar sakte hain.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#7 Collapse

Assalamualaikum! Umeed hai k ap sb khariyat sy hongy. R apky trading sessions achy jaa rhy hongy.Aj ka hmra or discussion topic "Active trading". Dekhty hain k ye hmein Kya information deta hai r hmry ilam Mai Kesy ezafa krta hai. Introduction aykto trading se morad qeemat mein qaleel mudti harkat ki bunyaad par fori munafe ke liye sikyortiz ki khareed o farokht hai. iradah sirf thoray waqt ke liye is ohday par to Faiz rehne ka hai. fa-aal tijarat ke liye waqt ki koi durust pemaiesh nahi hai. din ke tajir jo rozana dsyon ya senkron karte hain woh bohat fa-aal tor par tijarat karte to hain, jabkay aik soyng tridr jo har chand dinon mein pozishnin khol raha hai ya band kar raha hai usay bohat se log aik fa-aal tajir bhi samajh satke hain. Keysteps fa-aal tijarat mukhtasir muddat ki qeemat ke utaar or to charhao se faida uthany ki koshish kar rahi hai. fa-aal sy taajiron ka iradah sirf mukhtasir muddat ke liye tijarat to rakhnay ka hota hai. day traders, , aur soyng traders sabhi ko aykto tridr samjha jata hai, aur day traders soyng traders se ziyada fa-aal hotay hain. Understanding fa-aal trading intehai maya marketon mein qeemat ki koi naqal o harkat se faida uthana chahti hai. is wajah se, fa-aal tajir aam tor par stock, ghair mulki currency ki tijarat, fyochrz, aur bohat saaray hajam ke ikhtiyarat par tawajah markooz karte hain jis ki wajah se woh aasani se koi to pozishnon mein daakhil aur bahar nikal satke hain. fa-aal tajir umooman munafe kamanay ke liye bohat ziyada sy tijarat ka istemaal karte hain, kyunkay qaleel muddat mein qeematon mein honay walay jhool nisbatan chhootey sy hotay hain. woh sorat e haal ke lehaaz se mukhtalif qisam ke order ka bhi istemaal karen ge. break out capture karne ke liye woh stop order istemaal kar satke hain. misaal ke tor par, agar $ 50 par muzahmat hoti hai, to woh khareed stap order ko $ 50. 05 par set kar satke hain, jo ke agar qeemat $ 50 se toot jati hai aur $ 50. 05 tak pahonch jati hai to kharidne ka order bhejta hai. agar qeemat tajir ke khilaaf chalti hai to nuqsanaat ko qabil intizam rakhnay mein madad karta hai. aik sazgaar qeemat haasil karne ke liye fa-aal tajir had ke orders ka istemaal kar sakta hai. or agar koi stock $ 30 par trade kar raha hai, lekin aik tajir yeh dekhna chahta hai ke aaya woh fori gravt par $ 29. 50 par khareed sakta hai, to woh $ 29. 50 par aik had khareed order day sakta hai. isi terhan, woh $ 31 par position se bahar niklny ke liye aik had farokht ka order day satke to hain. is terhan ke orders fa-aal tajir ko din ke har second mein qeemat dekhe baghair khareed o farokht karne ki ijazat dete hain. woh –apne orders set karte hain aur to jantay hain ke agar qeemat un sthon tak pahonch jati hai to un ke orders shuru ho jayen ge . Active Trading strategies fa-aal tajir aam tor par teen zmron mein atay hain. har koi qisam ke tajir mukhtalif aur mukhtalif time faremon par tijarat karte hain, halaank woh tamam qaleel mudti tajir hain. day trading mein aik hi tijarti din ke andar security khareedna aur bechna shaamil hota hai, aam tor par stock ki qeemat par assar andaaz honay walay makhsoos event se faida uthany ki koshish mein. misaal ke tor par, aik din ka tajir ghair mutazalzal qeemat ki karwai ko tijarat kar sakta hai jo company ki aamdani ke elaan ya markazi sy bank ki taraf se sood ki sharah mein tabdeeli ke baad hoti hai. yeh tajir aam tor par aik, paanch, ya pandrah minute ke chart istemaal karen ge. scalping bohat hi mukhtasir muddat mein qeematon ke chhootey tazadat se faida to uthany ke liye bohat ziyada tijarat ka istemaal karta hai. misaal ke tor par, tajir tik charts aur aik minute ke charts ki bunyaad par qeemat mein choti movement se munafe ko badhaane ke liye ghair mulki currency brokr se dastyab ahem lyorij ka istemaal kar satke hain. bohat si khudkaar aur miqdari tijarti hikmat e amli ke zamray mein aati hai. soyng trading mein kayi dinon se le kar kayi hafton tak ki positions shaamil hoti hain. soyng tridr qeemat ki chalon se faida utha raha hai jo fi ghanta, chaar ghantay, aur / ya yomiya qeemat ke chart par hota hai .

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 01:35 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим