Trade With Hammer Pattern

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Trade With Hammer Pattern -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

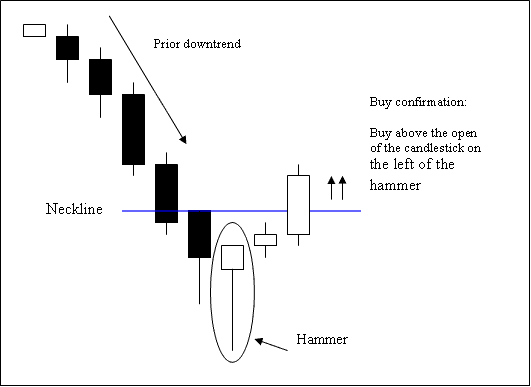

Hammer Pattern forex market mein istemal hone wale aik mukhtasar lehja mein samjha jaa sakta hai. Hammer Pattern, aik Japanese candlestick pattern hai jo price action analysis ka hissa hai. Ye pattern ek bullish reversal signal provide karta hai, jisay traders forex market mein trend reversal ki pehchan karne ke liye istemal karte hain. Hammer Pattern ka naam uski shape ki wajah se hai, jo aik hammer ki tarah dikhta hai. Is pattern mein aik candle hota hai jo long shadow aur chhota body ke sath hota hai. Candle ki shadow neeche ki taraf extend hoti hai, jabkay body candle ki upper taraf hoti hai. Hammer Pattern ko dekh kar traders bullish signal samajhte hain kyunki ye price chart par downtrend ke baad show hota hai aur bullish reversal ki possibility indicate karta hai. Is pattern ki shape ko samajhne ke liye, kuch important points ko dhyan mein rakhna zaroori hai. Sab se pehle Hammer Pattern ki shape ko samajhna zaroori hai. Is pattern mein body, candle ki upper taraf hoti hai aur shadow neeche ki taraf extend hoti hai. Shadow ki lambai body ki lambai se zyada hoti hai. Is distinctive shape ko dekh kar traders hammer pattern ko identify kar sakte hain. Hammer Pattern tab samajhne ke liye relevant hota hai jab ye downtrend ke baad show ho. Agar ye uptrend ke baad dikhe, to iski validity kam ho jati hai. Downtrend ke baad jab hammer pattern dikhta hai, ye ek bullish reversal signal hai jisay traders interpret karte hain. Ye indicate karta hai ke downtrend khatam hone ka chance hai aur market ab upar ki taraf move karne ki possibility hai. Hammer Pattern ko samajhne ke liye, uski context aur surrounding price action ko bhi consider karna zaroori hai. Ye pattern single indicator ki tarah use nahi hota. Traders ko is pattern ko confirm karne ke liye dusre technical indicators aur price patterns ka bhi istemal karna chahiye. Is tarah, hammer pattern ko validate karne ke liye traders ko overall market trend aur momentum ko analyze karna chahiye.

Sab se pehle Hammer Pattern ki shape ko samajhna zaroori hai. Is pattern mein body, candle ki upper taraf hoti hai aur shadow neeche ki taraf extend hoti hai. Shadow ki lambai body ki lambai se zyada hoti hai. Is distinctive shape ko dekh kar traders hammer pattern ko identify kar sakte hain. Hammer Pattern tab samajhne ke liye relevant hota hai jab ye downtrend ke baad show ho. Agar ye uptrend ke baad dikhe, to iski validity kam ho jati hai. Downtrend ke baad jab hammer pattern dikhta hai, ye ek bullish reversal signal hai jisay traders interpret karte hain. Ye indicate karta hai ke downtrend khatam hone ka chance hai aur market ab upar ki taraf move karne ki possibility hai. Hammer Pattern ko samajhne ke liye, uski context aur surrounding price action ko bhi consider karna zaroori hai. Ye pattern single indicator ki tarah use nahi hota. Traders ko is pattern ko confirm karne ke liye dusre technical indicators aur price patterns ka bhi istemal karna chahiye. Is tarah, hammer pattern ko validate karne ke liye traders ko overall market trend aur momentum ko analyze karna chahiye.  Hammer Pattern ka mukhtalif variations bhi hote hain jaise ki inverted hammer pattern. Inverted hammer pattern mein bhi shape hammer ki tarah hoti hai, lekin ye downtrend ke baad show hota hai aur bearish reversal signal provide karta hai. Inverted hammer pattern bullish hammer pattern ki opposite hai. Isko bhi traders apne trading strategies mein istemal kar sakte hain. Hammer Pattern ka istemal karke traders trend reversal points ko identify kar sakte hain aur potential entry aur exit points ko determine kar sakte hain. Agar hammer pattern ek downtrend ke baad show ho raha hai, to traders long positions enter kar sakte hain ya existing short positions ko close kar sakte hain. Stop-loss orders aur take-profit levels ko bhi set karne mein hammer pattern ki help li ja sakti hai. Hammer Pattern ke sath-sath dusre technical analysis tools jaise ki support aur resistance levels, moving averages, aur oscillators ka istemal karna zaroori hai. Is tarah traders apni trading decisions ko validate kar sakte hain aur false signals ko avoid kar sakte hain. Ek achhe trading plan aur risk management strategy ke sath hammer pattern ka istemal traders ko forex market mein successful trading opportunities provide kar sakta hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Hammer Pattern ka mukhtalif variations bhi hote hain jaise ki inverted hammer pattern. Inverted hammer pattern mein bhi shape hammer ki tarah hoti hai, lekin ye downtrend ke baad show hota hai aur bearish reversal signal provide karta hai. Inverted hammer pattern bullish hammer pattern ki opposite hai. Isko bhi traders apne trading strategies mein istemal kar sakte hain. Hammer Pattern ka istemal karke traders trend reversal points ko identify kar sakte hain aur potential entry aur exit points ko determine kar sakte hain. Agar hammer pattern ek downtrend ke baad show ho raha hai, to traders long positions enter kar sakte hain ya existing short positions ko close kar sakte hain. Stop-loss orders aur take-profit levels ko bhi set karne mein hammer pattern ki help li ja sakti hai. Hammer Pattern ke sath-sath dusre technical analysis tools jaise ki support aur resistance levels, moving averages, aur oscillators ka istemal karna zaroori hai. Is tarah traders apni trading decisions ko validate kar sakte hain aur false signals ko avoid kar sakte hain. Ek achhe trading plan aur risk management strategy ke sath hammer pattern ka istemal traders ko forex market mein successful trading opportunities provide kar sakta hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 08:16 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим