What is the Deliberation in forex

`

X

new posts

-

#1 Collapseٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Introduction Assalamualaikum Alaikum dear for part ummid Karti hun ki aap sab khairiyat se honge aur Forex exchanging business Mein Apne errand or targets acche tarike se unadulterated kar rahi honge dear poke aap is business Mein kam karte hain to aapko apna Kam acche information aur experience ke sath karna hota hai aur kuchh significant chijon ke uncovered mein information aur data rakhna aapke liye bahut significant hota hai Kyunki vah aapki regular routine per working mein shamil ho Rahi hoti hain jiski vajah se agar aap inke exposed mein koi information Nahin rakhte to aapko market Mein Los Ka samna karna cushion sakta hai isiliye aisi circumstance se bachne ke liye aapko Chhoti si Chhoti baat Ka dhyan rakhna aur uske mutabik apna Kam karna jaruri Hota Hai. Distinguishing proof: Dear Punch aap Forex exchanging business Mein kam karte Hain To Kisi bhi design ke mutabik apni working karne se pahle aapke liye jaruri hota hai ki aap use design ko pahle totally recognize Karen isiliye consideration candle design ko distinguish karne ke liye aapko is design ko acchi tarike se samajhne ki jarurat Hoti hai yah design three bullish candles for every mujhmein per mil hota hai jo ki succession mein banti hai is design mein shamil pahli candle bhi huge stick hoti hai aur second light pichhali candle ki opening cost se above open hoti hai aur yah pichhali industry ki hight se upar hey apni shutting deti hai aur is design ki third aur last candles take bhi little genuine body mein hoti hai aur sem cost ke sath uski opening hoti hai lekin iski shutting pichhali candle se above ya underneath apni shutting deti hai three bullish candles thought candistic design energy of purchasers ko show karta hai pehli police candle high force of purchasers ko address karti hai aur agale meeting of May energy of purchasers kam ho jata hai aur last candle mein purchasers energy essentially kam ho jata hai little candle ki arrangement ki vajah se aur yah is baat ka ishara hota hai ki purchasers ki force kam ho rahi hai market mein aur dealers ki power increment ho rahi hai aur aakhri endeavor mein purchasers bullish energy ko kho dete Hain aur merchants overwhelm ho jaati hai isiliye aisi circumstance ki vajah se market Mein use chij ki kimat kam hona start ho jaati Hai.Yeh samjhen ke Forex exchanging aam taur standard gamble wali tijarat hai aur ismein tabdeeliyan achi tareekay se samajhna zaroori hai. Forex market ka tajurba, ilm aur samayikta talab karti hai. Isliye, forex exchanging mein shamil sharpen se pehle, achi tarah se istrahat hasil karna zaroori hai aur mahir dealers ya mashawaron se madad lena munasib ho sakta hai.Forex, jo kay Unfamiliar Trade ka short structure hai, tijarat mein istemal honay wala aik mahir termin hai. Forex ki consideration ya charcha tijarat kay mahireen aur financial backers kay darmiyan hoti hai, jahan un logon ko tajzia aur tasawwur kay liye mauqa milta hai kay kis tarah kay money matches mein purchasing aur selling kay zariye faida hasil kia ja sakta hai.Forex thought mein, cash trade rates, monetary pointers, international occasions, aur market patterns kay baray mein tafseeli guftagoo ki jati hai. Yeh pondering forex brokers, banks, monetary establishments, aur market investigators kay darmiyan hoti hai takay woh samajh sakay kee kis cash pair mein venture karna munasib ho sakta hai.Forex consideration kay dauran, tijarat kay mahireen specialized examination aur crucial investigation jaisay instruments ka istemal kartay hain takay market ka tajzia kia ja sakay. Specialized investigation mein authentic cost information, diagram designs, aur pointers ka istemal hota hai, jabkay key examination mein financial information, news, aur international occasions ko samjha jata hai. -

#3 Collapse

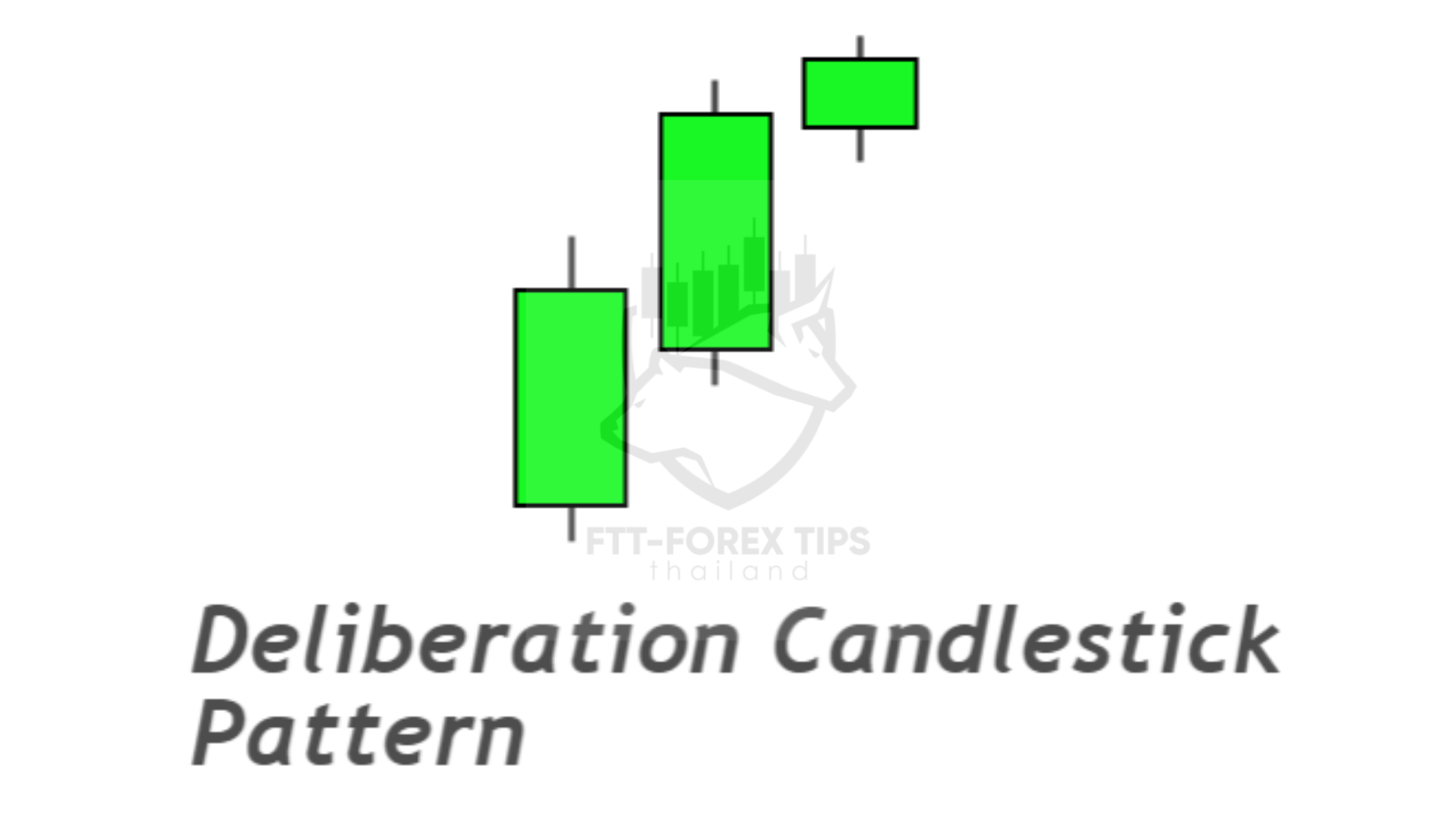

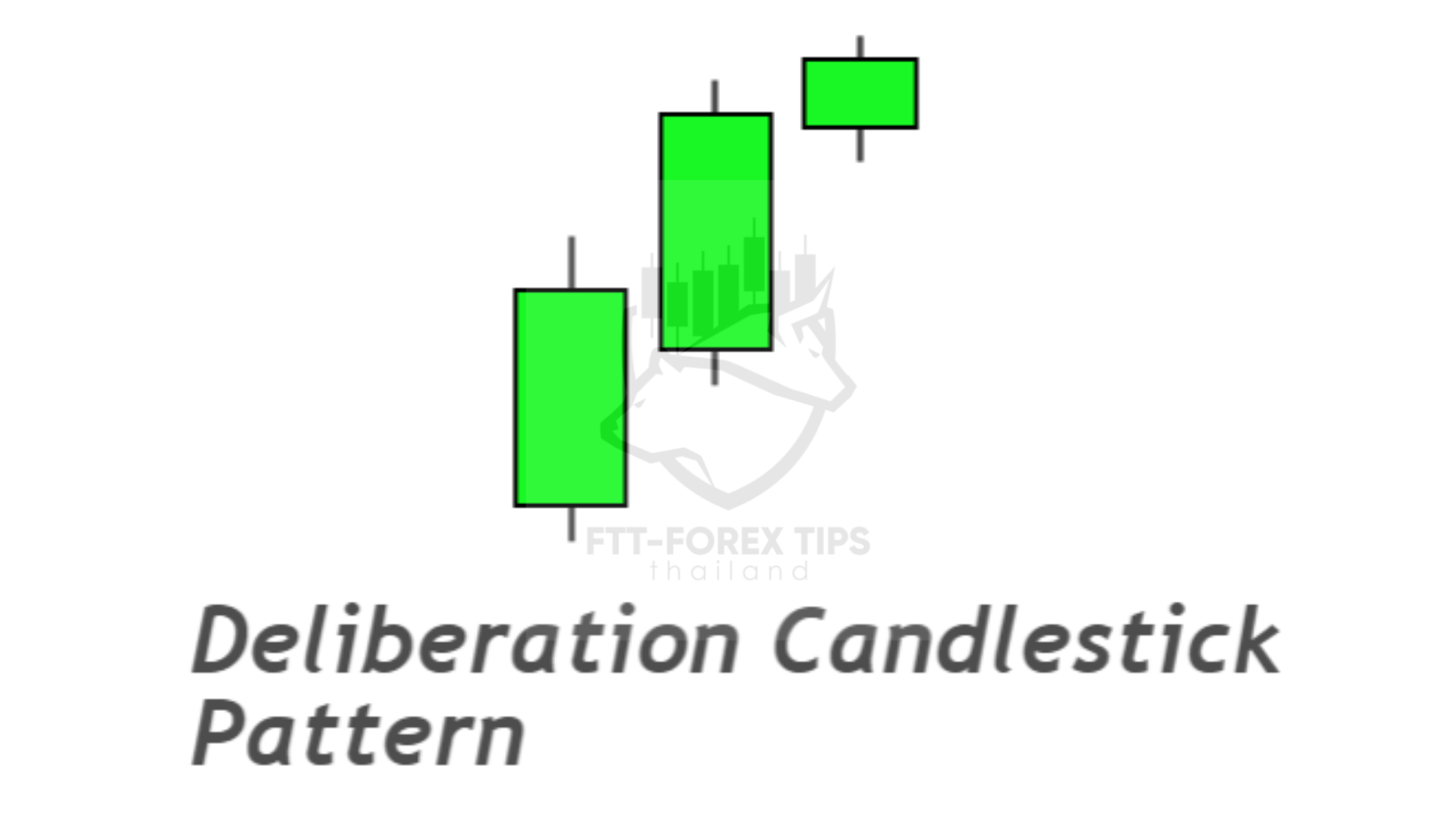

Assalamu Alaikum Dosto!Deliberation Candlestick PatternDeliberation candlestick patteren bearish trend reversal signal dene wala pattern hai, jo aik wazeh uptrend ke baad yeh pattern amal mein aata hai. Deliberation candlestick patteren ki tashkeel teen bullish ya white candles par mushtamil hai aur jo price chart par bottom prices par banne wale three white soldier pattern se mushabihat rakhta hai. Deliberation candlestick pattern ki tashkeel mein pehli candlestick aik lambi bullish candle hai, jis ka upper ya lower side par shadow bohat kam banta hai. Pattern ki baqi do candles yani dosri aur teesri candles bhi bullish candles hoti hai. Pattern ki dosri aur teesri candle ki real body pehli candle k muqabele main kam hoti hai, lekin dosi candle k upper side par shadow bohut lamba hota hai. Pattern ki dusri aur teesi candle pehli candle k real body main open hoti hai,j jiss mein teesri candle aik small marubozu candle hoti hai.Candles FormationDeliberation candlestick patteren prices k top main ziada buying k baad market k mumkina bearish trend reversal ka ishara deta hai, jo k teen musalsal bullish candles par mushtamil hota hai. Ye pattern bullish candles ka hone k bawajood bhi bullish trend confirmation k muqabele main prices ko downtrend ka rasta deti hai. Pattern main candlestick ki formation darjazzel tarah se hoti hai;- First Candle: Deliberation candlestick patteren ki pehli candle aik bullish candles hoti hai, jo k real body main strong candle banti hai, aur ye candle prices k uptrend ki tasalsul ki alamat hoti hai. Pattern ki pehli candle aik bagher upper aur lower shadow ki hoti hai, jiss ka open price close price se ooper hota hai.

- Second Candle: Deliberation candlestick patteren ki dosri candle bhi same pehli candle ki tarah aik bullish candle hoti hai. Ye candle pehli candle k real body ya uss k close price k baad open hoti hai, jo k upper par close hoti hai. Iss ka candle ki real body pehli candle k muqabele main kam hoti hai, jab k upper side par aik lamba shadow hota hai.

- Third Candle: Deliberation candlestick patteren ki teesri candle bhi same pechli do candles ki tarah aik bullish candle hoti hai, jo k dosri candle k real body ya uss k close price par open ho kar upper par close hoti hai. Ye candle ziada tar pechli dono candles se size main kam hoti hai, jab k ye candle aik marubozu candle hoti hai.

ExplainationDeliberation candlestick patteren chart par teen lagatar bullish candles ka aik majmoa hai, jiss k leye market ka top area hona zarori hai. Ye pattern teen bullish candles par mushtamil hai, jo k prices k leye bearish trend reversal pattern ka kaam karta hai. Pattern dekhne main same three white soldier pattern jaisa hai, q k teeno candles bullish hone k sath sath higher high par close hoti hai. Pattern ki pehli candle aik long real body wali bullish Marubozu candle hoti hai, last teesri candle bhi aik Marubozu candle hoti hai leki size main pehli candle se bohut small hoti hai. Pattern ki dosri candle upper shadow k sath hoti hai, jiss ki real body pehli candle ki nisbat kam hoti hai.TradingDeliberation candlestick patteren main pehli candle strong bullish trend ki alamat hoti hai, lekin baad wali dosri aur teesri candles market main bulls ki kamzori zahir karti hai, jo k market main dilchaspi lena kam karte hen. Pattern ki teeno candles ka bullish hone ki waja se confirmation candle ka hona zarori hai, jo k real body main bearish honi chaheye aur last bullish candle k bottom par close honi chaheye. Pattern k baad bullish candle banne se pattern invalid tasawar hoga, jab k trend ki confirmation indicators se bhi ki ja sakti hai, aggar CCI, RSI indicator aur stochastic oscillator par value overbought zone main trade kar raha ho. Stop Loss pattern k sab se top ya teesri bearish candle k high price se two pips above set karen. -

#4 Collapse

Forex market, yaani foreign exchange market, duniya ka sabse bara financial market hai. Yeh market currencies ki trading ke liye hota hai. Isme har roz trillions of dollars ka lein-dein hota hai. Forex market mein deliberation ki bohot ahmiyat hai. Is deliberation ka matlab hai soch samajh kar faisla lena. Isme multiple factors aur strategies involve hoti hain jo trader ko profitable trading karne mein madad deti hain. Forex market mein currencies ko ek dusre ke against trade kiya jata hai. Yeh trading pairs mein hoti hai, jaise ke EUR/USD, GBP/JPY, etc. Har currency pair ka apna exchange rate hota hai, jo ke market ke supply aur demand ke hisaab se change hota rehta hai. Is market mein major players central banks, commercial banks, financial institutions, corporations, aur individual traders hote hain.

Deliberation Ka Concept

Deliberation ka concept trading decisions mein deeply involved hota hai. Yeh process ek systematic approach hai jisme traders apni strategies ko evaluate karte hain, market conditions ko analyze karte hain, aur informed decisions lete hain. Yeh decisions impulsive nahi hote, balke thoughtful aur well-researched hote hain.

Factors Involved in Deliberation

Market Analysis

Market analysis forex trading ka ek buniyadi hissa hai. Yeh analysis do qisam ka hota hai: Fundamental Analysis aur Technical Analysis.- Fundamental Analysis: Isme economic indicators, political events, aur financial reports ko study kiya jata hai. Yeh analysis help karta hai samajhne mein ke kisi country ki economy kaisa perform kar rahi hai, jo ultimately currency ke value ko affect karta hai. GDP growth, unemployment rate, interest rates, aur inflation ke figures fundamental analysis ke important elements hain.

- Technical Analysis: Isme price charts aur historical data ko study kiya jata hai. Traders different indicators aur chart patterns use karte hain, jaise ke moving averages, MACD, RSI, aur Fibonacci retracements. Yeh analysis traders ko market trends aur price movements ko predict karne mein madad deta hai.

Forex market inherently risky hai. Deliberate trading ka ek bohot important hissa risk management hai. Isme different techniques include hoti hain jaise:- Stop-Loss Orders: Yeh orders trader ko protect karte hain zyadah loss se. Yeh pre-determined price pe trade ko automatically close kar dete hain agar market unfavorable direction mein move kare.

- Position Sizing: Is technique mein trader apni capital ka ek fixed percentage use karte hain har trade mein. Yeh strategy ensure karti hai ke ek single loss trader ke overall capital ko khatam na karde.

- Diversification: Different currency pairs mein trading se risk spread ho jata hai aur overall portfolio ka risk kam ho jata hai.

Trading mein psychological factors bhi important role play karte hain. Trader ki emotions aur mindset deliberation process ko affect kar sakti hain. Kuch common psychological challenges hain:- Fear and Greed: Yeh dono emotions trader ko impulsive decisions lene par majboor kar sakte hain. Fear loss hone ka dar hai aur greed zyadah profit kamane ka desire.

- Overconfidence: Kabhi kabhi traders ko apni skills par zyada confidence hota hai jo ke risk ko underestimate karne ki wajah ban sakta hai.

- Stress Management: Forex trading stressful ho sakti hai, aur stress ka high level trader ki performance ko negatively affect kar sakta hai. Isliye relaxation techniques aur mental discipline ki zarurat hoti hai.

Developing a Trading Plan

Ek strong trading plan deliberate trading ka pehla step hai. Isme multiple components hote hain:- Goals and Objectives: Short-term aur long-term goals define karna. Yeh goals realistic aur achievable hone chahiye.

- Trading Style: Scalping, day trading, swing trading, ya position trading ka selection. Har style ka apna risk aur reward profile hota hai.

- Risk Tolerance: Apne risk tolerance ko understand karna aur uske mutabiq trading strategies banana.

- Evaluation Criteria: Regularly apne trades ko evaluate karna aur mistakes se seekhna.

Before real money invest karna, backtesting aur paper trading se apni strategies ko test karna zaruri hai. Backtesting mein historical data pe trading strategies ko apply kiya jata hai. Paper trading se real-time market conditions mein practice kiya jata hai bina real money lose kiye.

Continuous Learning and Adaptation

Forex market constantly change ho raha hai, isliye continuous learning aur adaptation ki zarurat hoti hai. Market ke new trends, tools, aur strategies ko learn karte rehna chahiye. Successful traders apne mistakes se seekhte hain aur apne trading plan ko continuously improve karte hain.

Role of Technology in Deliberation

Trading Platforms

Modern trading platforms advanced tools aur features provide karte hain jo deliberation process ko support karte hain. MetaTrader, NinjaTrader, aur TradingView kuch popular trading platforms hain jo charting tools, automated trading, aur backtesting capabilities offer karte hain.

Automated Trading Systems

Algorithmic trading ya automated trading systems deliberation ko streamline karte hain. Yeh systems predefined criteria ke basis pe trades execute karte hain. Automated trading emotions ko eliminate karta hai aur market opportunities ko efficiently exploit karta hai.

Artificial Intelligence and Machine Learning

AI aur machine learning forex trading mein revolution la rahe hain. Yeh technologies large datasets ko analyze karte hain aur complex patterns ko identify karte hain jo human traders ke liye mushkil hote hain. AI-based trading systems market trends ko accurately predict kar sakte hain aur profitable trading strategies develop kar sakte hain.

Forex market mein deliberation ek essential aspect hai jo trader ke success ke liye crucial hai. Yeh process systematic aur informed decision-making ko promote karta hai. Market analysis, risk management, psychological control, aur advanced technologies ka istemal karke traders apne trading performance ko significantly improve kar sakte hain. Deliberate trading se hi long-term success aur sustainability achieve ki ja sakti hai. Forex market ki complexity ko understand karne aur deliberate approach se trading karne se hi trader consistent profits earn kar sakte hain aur market ke inherent risks ko manage kar sakte hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#5 Collapse

Forex Market Kya Hai?

Forex yaani "Foreign Exchange" market duniya ka sab se bara financial market hai. Yahan mukhtalif mulkon ki currencies ka lein-dein hota hai. Forex market me currencies ko buy aur sell kiya jata hai, jahan logon ka maksad profit kamaana hota hai. Yeh market 24 ghantay, 5 din kaam karti hai aur is me trillion dollars ka transaction hota hai har din. Is market ka koi physical location nahi hota, yeh poori duniya me electronically operate karti hai.

Forex Market Kaam Kaise Karti Hai?

Forex market me currencies pairs me trade hoti hain. Misaal ke taur par, agar aap USD/EUR pair trade kar rahe hain, to aap USD ko sell aur EUR ko buy kar rahe hain, ya phir uska ulta. Har currency pair me pehli currency ko "base currency" aur doosri ko "quote currency" kaha jata hai. Forex market me har currency pair ki ek specific rate hoti hai jo market ke demand aur supply par depend karti hai. Yeh rate constantly change hoti rehti hai aur traders in fluctuations ka faida uthate hain.

Forex Market Ke Participants

Forex market me mukhtalif tarah ke participants hote hain jo apne apne maqsad ke liye trade karte hain.

1. Banks

Duniya ke bara banks forex market ke sab se bara players hote hain. Yeh banks apne clients ke liye aur apni trading desks ke liye currencies ka lein-dein karte hain.

2. Corporations

International corporations forex market me apne international business transactions ko hedge karne ke liye participate karte hain. Misaal ke taur par, ek American company jo Europe me business kar rahi hai, usay USD ko EUR me convert karna parta hai.

3. Governments aur Central Banks Governments aur central banks bhi forex market me apni currencies ki value ko manage karne ke liye participate karte hain. Yeh log monetary policies ko implement karte hain aur apni currencies ke reserves ko manage karte hain.

4. Hedge Funds aur Investment Managers

Yeh participants forex market me speculative purposes ke liye aate hain. Inka maksad market ke price movements ka faida uthana hota hai.

5. Retail Traders

Yeh wo chhotay traders hote hain jo online trading platforms ke zariye forex market me trade karte hain. Yeh log chhoti amounts me trade karte hain lekin inki tadaad buhat zyada hoti hai.

Forex Trading Ke Instruments

Forex market me mukhtalif instruments use kiye jate hain jo traders ko alag alag tariqon se trading karne ka moka dete hain.

1. Spot Market

Yeh wo market hai jahan currencies ka immediate exchange hota hai. Spot trades do din ke andar settle hote hain.

2. Forward Market

Forward contracts me currencies ka exchange ek specific future date par hota hai. Yeh contracts customized hote hain aur parties ke darmiyan negotiate hote hain.

3. Futures Market

Futures contracts standardized hote hain aur exchange-traded hote hain. Yeh contracts bhi future date par settle hote hain lekin yeh standardized terms ke sath hote hain.

4. Options Market

Options contracts traders ko ek specific price par ek future date me currency buy ya sell karne ka option dete hain, lekin yeh unka obligation nahi hota.

Forex Market Ki Technical aur Fundamental Analysis

Forex trading me success hasil karne ke liye do basic approaches use hoti hain: Technical analysis aur Fundamental analysis.

1. Technical Analysis

Is method me historical price data aur trading volumes ko analyze karke future price movements ka andaza lagaya jata hai. Technical analysts charts aur graphs ka use karte hain taake price patterns aur trends ko identify kar sakein.

2. Fundamental Analysis

Is approach me economic indicators, news events, aur financial reports ka analysis kiya jata hai taake currency values ko predict kiya ja sake. Fundamental analysts interest rates, GDP growth, unemployment rates, aur political stability jese factors ko dekhte hain.

Forex Trading Ke Risks

Forex trading profitable ho sakti hai lekin isme buhat se risks bhi hote hain.

1. Market Risk

Yeh risk market price movements se related hota hai. Currency prices rapidly change ho sakti hain jo traders ke profits ko affect kar sakti hain.

2. Leverage Risk

Forex trading me leverage ka use hota hai jo profits ko bada sakta hai lekin losses bhi zyada ho sakte hain. Leverage se traders apni positions ko multiply kar sakte hain lekin agar market unke against chali jaye to unka sara capital loss ho sakta hai.

3. Interest Rate Risk

Interest rates me changes bhi currency values ko affect karti hain. Agar ek country ka central bank interest rates increase karta hai to uski currency ki value increase ho sakti hai aur agar rates decrease hotay hain to currency ki value gir sakti hai.

4. Political Risk

Political instability aur government policies bhi forex market par asar dalti hain. Mulkon ke political changes aur policies se currency values rapidly fluctuate kar sakti hain.

Forex Trading Ki Strategies

Forex trading me success ke liye mukhtalif strategies use ki jati hain.

1. Scalping

Yeh strategy short-term trades par focus karti hai jo kuch seconds se lekar kuch minutes tak ke liye hoti hain. Scalpers market ke chhote movements ka faida uthate hain.

2. Day Trading

Is strategy me traders din bhar trades karte hain aur har trade ek din ke andar close kar dete hain. Day traders intraday price movements ka faida uthate hain.

3. Swing Trading

Swing traders medium-term trades karte hain jo kuch dinon se lekar kuch hafton tak chal sakti hain. Yeh traders market ke short-term trends ko identify karte hain aur unka faida uthate hain.

4. Position Trading

Position trading me traders long-term trades karte hain jo mahino ya saalon tak chal sakti hain. Position traders fundamental analysis par zyada focus karte hain.

- CL

- Mentions 0

-

سا0 like

-

#6 Collapse

Forex Mein Deliberation';';';

Forex" ya "foreign exchange" market duniya ki sabse badi aur sabse zyada liquid market hai jahan pe currencies ka trading hota hai. Forex mein deliberation ka matlab hota hai soch-vichar karna ya vishleshan karna trading se pehle. Yani ki kisi bhi currency pair mein trading karne se pehle market ke analysis, trends, aur potential risks ko dekhna aur samajhna.

Forex Mein Deliberation Ke Aspects';';';

Isme kuch important aspects shamil hain:- Fundamental Analysis: Isme countries ki economic indicators jaise GDP growth, interest rates, inflation, political stability, aur economic policies ko study kiya jata hai. Yeh factors currency ki value ko affect karte hain.

- Technical Analysis: Isme historical price data aur trading volumes ka study kiya jata hai charts aur graphs ke zariye. Technical indicators aur patterns ka use karke future price movements ka prediction karne ki koshish ki jati hai.

- Sentiment Analysis: Isme market participants ke overall mood aur sentiments ko samajhne ki koshish ki jati hai. Yeh analysis news reports, market surveys, aur social media trends ke zariye kiya jata hai.

- Risk Management: Forex trading mein risk kaafi zyada hota hai, isliye risk management strategies develop karna zaroori hota hai. Isme stop-loss orders, position sizing, aur diversification jese tools ka use kiya jata hai.

Forex mein deliberation ek trader ko informed decisions lene mein madad karta hai aur market volatility ke against protect karta hai. -

#7 Collapse

What is the Deliberation?

Forex yaani foreign exchange market aik bohat bara aur mashhoor market hai jahan mukhtalif mulkon ki currencies ki trading hoti hai. Forex trading ki duniya mein, deliberation aik ahem concept hai jo traders ko samajhna chahiye. Isay samajhnay ke liye hum kuch headings ke zariye isko explain karenge.

Deliberation Ka Matlab

Deliberation ka matlab hai ghor o fikar karna, soch samajh kar faisla lena. Forex trading mein, deliberation se murad wo process hai jismein trader market ke trends, economic indicators aur doosri relevant information ko dekh kar trading decisions leta hai.

Market Analysis

Deliberation mein sab se pehla qadam market analysis hota hai. Ismein do tarah ke analysis shamil hain:

Technical Analysis: Ismein charts aur graphs ka istemal kar ke past market data ko analyze kiya jata hai. Indicators aur patterns ko dekh kar future price movements ko predict kiya jata hai.

Fundamental Analysis: Ismein economic indicators jaise ke GDP growth, interest rates, inflation rates aur political stability ko analyze kiya jata hai. Is se trader ko pata chalta hai ke kis currency ki value barhne ya girne wali hai.

Risk Management

Risk management bhi deliberation ka aik ahem hissa hai. Forex trading mein risk ko kam karne ke liye stop-loss orders aur proper position sizing ka istemal kiya jata hai. Isse potential losses ko control karna asaan ho jata hai.

Decision Making

Deliberation ka agla step decision making hai. Market analysis aur risk management ke baad, trader decide karta hai ke kis currency pair mein trade karni hai aur kab entry aur exit karni hai. Yeh decision carefully aur logically liya jata hai taake maximum profit earn kiya ja sake aur risk ko minimize kiya ja sake.

Continuous Learning

Forex market dynamic aur ever-changing hai. Is liye deliberation ka aik hissa continuous learning bhi hai. Successful traders apni knowledge ko barhate rehte hain aur naye trading strategies aur tools ko apnaate hain.

Conclusion

Forex trading mein deliberation bohot zaroori hai. Yeh wo process hai jismein trader soch samajh kar aur analysis kar ke trading decisions leta hai. Market analysis, risk management aur continuous learning se trader apni skills ko improve karta hai aur profitable trading karta hai.

-

#8 Collapse

What is the Deliberation?

Forex yaani foreign exchange market aik bohat bara aur mashhoor market hai jahan mukhtalif mulkon ki currencies ki trading hoti hai. Forex trading ki duniya mein, deliberation aik ahem concept hai jo traders ko samajhna chahiye. Isay samajhnay ke liye hum kuch headings ke zariye isko explain karenge.

Deliberation Ka Matlab

Deliberation ka matlab hai ghor o fikar karna, soch samajh kar faisla lena. Forex trading mein, deliberation se murad wo process hai jismein trader market ke trends, economic indicators aur doosri relevant information ko dekh kar trading decisions leta hai.

Market Analysis

Deliberation mein sab se pehla qadam market analysis hota hai. Ismein do tarah ke analysis shamil hain:

Technical Analysis: Ismein charts aur graphs ka istemal kar ke past market data ko analyze kiya jata hai. Indicators aur patterns ko dekh kar future price movements ko predict kiya jata hai.

Fundamental Analysis: Ismein economic indicators jaise ke GDP growth, interest rates, inflation rates aur political stability ko analyze kiya jata hai. Is se trader ko pata chalta hai ke kis currency ki value barhne ya girne wali hai.

Risk Management

Risk management bhi deliberation ka aik ahem hissa hai. Forex trading mein risk ko kam karne ke liye stop-loss orders aur proper position sizing ka istemal kiya jata hai. Isse potential losses ko control karna asaan ho jata hai.

Decision Making

Deliberation ka agla step decision making hai. Market analysis aur risk management ke baad, trader decide karta hai ke kis currency pair mein trade karni hai aur kab entry aur exit karni hai. Yeh decision carefully aur logically liya jata hai taake maximum profit earn kiya ja sake aur risk ko minimize kiya ja sake.

Continuous Learning

Forex market dynamic aur ever-changing hai. Is liye deliberation ka aik hissa continuous learning bhi hai. Successful traders apni knowledge ko barhate rehte hain aur naye trading strategies aur tools ko apnaate hain.

Conclusion

Forex trading mein deliberation bohot zaroori hai. Yeh wo process hai jismein trader soch samajh kar aur analysis kar ke trading decisions leta hai. Market analysis, risk management aur continuous learning se trader apni skills ko improve karta hai aur profitable trading karta hai.

-

#9 Collapse

**Forex Mein Deliberation Kya Hai?**

Forex trading mein "deliberation" ek ahem concept hai jo trading decisions aur market analysis ko behtar banane mein madad karta hai. Forex, yaani foreign exchange market, ek global market hai jahan currencies ki trading hoti hai. Is market mein successful hone ke liye, traders ko aksar mukhtalif factors ko consider karna padta hai aur deliberation ek ahem hissa hai is process ka.

Deliberation ka matlab hota hai soch vichar karna ya ghor se kisi cheez ko dekhna. Forex trading mein, iska matlab hota hai ki traders apni trades ko execute karne se pehle achi tarah se soch vichar karte hain. Yeh process market trends, news, aur technical analysis ko madde nazar rakhtay hue kiya jata hai. Jab traders deliberate karte hain, to wo apne past trades aur market behavior ka bhi analysis karte hain taake wo future decisions behtar bana saken.

Deliberation ka ek aham pehlu yeh hai ke iske zariye traders risk ko assess karte hain. Forex market mein volatility aur risk hamesha hota hai, aur traders ko yeh samajhna zaroori hota hai ke kis trade mein kitna risk involved hai aur potential reward kya ho sakta hai. Iske liye, traders technical indicators, fundamental analysis aur market news ka ghor se jaiza lete hain.

Ek aur important aspect yeh hai ke deliberation se traders apne emotions ko control kar sakte hain. Forex trading mein kabhi kabhi emotional decisions lene ka khatra hota hai, jo ke losses ko barha sakta hai. Deliberation ke zariye, traders apne emotional biases ko door rakhte hue, rational aur informed decisions lete hain.

In sab cheezon ko madde nazar rakhtay hue, yeh kehna galat nahi hoga ke deliberation forex trading mein ek must-have skill hai. Yeh traders ko behtar decision-making aur risk management ki capacity provide karta hai, jo ke ultimately unke trading success ko enhance kar sakta hai. Isliye, agar aap forex trading mein serious hain, to deliberation ko apne trading strategy ka ek essential part bana lein.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#10 Collapse

### Forex Mein Deliberation Kya Hai?

Forex trading ek dynamic aur complex market hai jahan traders mukhtalif strategies aur techniques ka istemal karte hain. Deliberation ka lafz yahan decision-making process ko darshata hai, jismein traders market conditions, technical analysis, aur emotional factors ko madde nazar rakhte hain. Is post mein hum dekhenge ke deliberation forex trading mein kya hoti hai aur iski ahmiyat kya hai.

**Deliberation Ki Pehchan:**

Forex mein deliberation ka matlab hai soch-vichar karna ya kisi faisle par pohanchne se pehle ghor-fikar karna. Ye process traders ko allow karta hai ke wo apne decisions ko data aur analysis par buniyad dein, taake wo impulsive decisions lene se bachein. Deliberation se traders ko ye samajhne mein madad milti hai ke market kis disha mein ja raha hai aur unki trading strategies kaise adjust karni chahiye.

**1. Data Analysis:**

Deliberation ka pehla marahil data analysis hota hai. Traders charts, indicators, aur historical data ko analyze karte hain. Is analysis ke zariye wo market ki trends aur potential reversals ko samajhte hain. Yeh step bohot zaroori hai kyunki bina sahi data analysis ke, traders market ki movements ko nahi samajh sakte.

**2. Market Conditions Ka Jaiza:**

Market conditions ko samajhna bhi deliberation ka ek hissa hai. Economic indicators, geopolitical events, aur news releases market par asar daal sakte hain. Jab traders in factors ko samajhte hain, to wo apne trades ko behtar tarike se plan kar sakte hain. Yeh sab kuch karne ke liye waqt aur ghor-fikar ki zaroorat hoti hai, jo deliberation ka hissa hai.

**3. Emotional Control:**

Forex trading ke dauran emotions bhi kaafi ahmiyat rakhte hain. Fear aur greed jese emotions aksar impulsive decisions ka sabab bante hain. Deliberation ke zariye traders apne emotions ko control karne ki koshish karte hain. Jab wo soch-vichar karte hain to wo emotional reactions ko limit karte hain aur more rational decisions lete hain.

**4. Strategy Development:**

Ek baar jab traders analysis aur market conditions ko samajh lete hain, to wo apni trading strategy tayar karte hain. Yeh strategy unki analysis aur deliberation par buniyad rakhte hue hoti hai. Strategy development ka process deliberation ko mazid strengthen karta hai kyunki ismein planning aur risk management shamil hota hai.

**5. Continuous Improvement:**

Deliberation ka ek aur faida yeh hai ke ye traders ko continuous improvement ka mauqa deta hai. Jab traders apne decisions aur outcomes ka review karte hain, to wo seekhte hain aur apne future trades ko behtar bana sakte hain. Yeh self-reflection ka process unki trading skills ko enhance karta hai.

**Conclusion:**

Forex mein deliberation ek vital process hai jo traders ko informed decisions lene mein madad karta hai. Is process ka istemal karne se traders data analysis, market conditions, aur emotional control par focus karte hain. Jab aap apne trading decisions ko soch-vichar kar ke lete hain, to aap impulsive actions se bachte hain aur apni trading success ko enhance karte hain. Deliberation se traders ko ek structured approach milta hai, jo unhe forex market mein behtar perform karne mein madad karta hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 11:01 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим