What is the channel trading

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

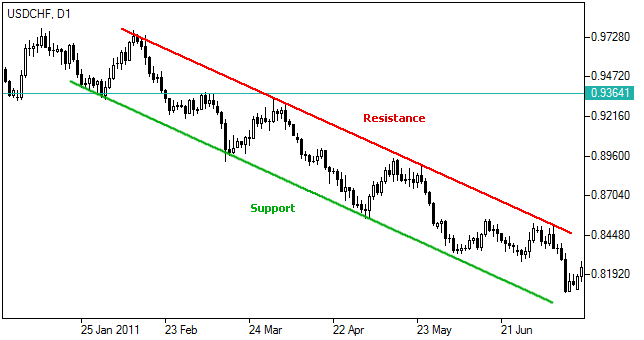

Channel trading Dear jub market ki development bullish pattern primary ho ya negative pattern principal ya phir market sideways pattern fundamental development kar rehi ho hamesha market ki development in four channels primary greetings hoti hai jo ky equidistant channel standard deviation channel relapse channel aur Andrew's pitchfork channels hain ky punch ham in channels primary market ki development ko read kerty hain tou hamain market ki future development ka pata chal jata hai kyun ky market hamesha kisi aik channel principal long time ke liye apni development ko proceed rakhti hai tou agar ham same channel principal market ki current channel fundamental development ko read karty hain toa hamein same development per market ki forecast kerny fundamental bhi aur market fundamental exchange enter kerny primary bhi koi pareshani nahi hoti ham channels principal market ki sharpen wali development ki continuation per exchange enter kar lete hain aur market hit tak same channel principal apni development ko proceed rakhti hai tab tak hamain benefit hasil hota rehta. Channel trading strategy ka istemal karne se traders ko trend ke andar price movement ka acchi tarah se pata chalta hai. Is strategy mein traders price action ko observe karte hain aur support-resistance levels ko identify karte hain. Channel trading mein trend lines ka istemal karke traders entry aur exit points ko sahi tarike se dhundh sakte hain. Lekin, jaise har trading strategy mein hota hai, channel trading mein bhi risk management ko samjhna aur follow karna zaroori hai. Traders ko price movement ko closely monitor karna chahiye aur channel ki validity ko confirm karne ke liye confirmatory indicators ka istemal kar sakte hain. Sorts of Channels. Equidistant channel. Relapse Channel. Equidistant channel. Dear Equidistant channel primary youngster lines hoti hain aur upper line ko obstruction level aur nicha wali line opposition level kehta han. Relapse Channel. Dear Relapse Channel primary high swing line ko aur dosri swing line low ko le ker banai jati ha punch k ak center line b hoti ha.. -

#3 Collapse

Definition of Channel trading?

Channel trading ek technical analysis strategy hai jise traders istemal karte hain taake price charts par support aur resistance levels ke darmiyan bane hue channels ke andar trade ko pehchanein aur karein. Channel trading ka mool uddeshya ye hota hai ke do parallel trendlines ke darmiyan bane hue channel ke andar price ke movement ko pehchana jaaye, jise upper aur lower channel lines kehte hain.

Yahan channel trading ka tafseeli bayan:

Price Channels:

Price channels do trendlines ke zariye bante hain: ek upper trendline jo swing highs ko jodti hai aur ek lower trendline jo swing lows ko jodti hai. Ye trendlines ek channel banate hain jahan price ke beech mein oscillate hota hai.

Range-Bound Market:

Channel trading sabse zyada range-bound ya sideways markets mein effective hota hai jahan kisi ek direction mein koi wazeh trend nahi hota. Traders upper ya lower channel lines se bounce hone ke mauke ko dekhte hain, jo potential trading opportunities ko indicate karta hai.

Support aur Resistance:

Upper channel line ek resistance level ke taur par kaam karta hai, jabki lower channel line ek support level ke taur par kaam karta hai. Traders lower channel line ke paas buy karte hain jab price oversold hota hai aur upper channel line ke paas sell karte hain jab price overbought hota hai.

Breakouts aur Breakdowns:

Jabki channel trading primarily range ke andar trade par zyada focus karta hai, traders channel ke boundaries ka breakout aur breakdown bhi dekhte hain. Upper channel line ke breakout bullish momentum ko suggest karta hai, jabki lower channel line ke breakdown bearish momentum ko suggest karta hai.

Volatility Ka Dhyan:

Traders ko channel trading strategies implement karte waqt market volatility ka dhyan rakhna zaroori hai. Zyada volatility wide price swings aur false breakouts ka matlab bana sakta hai, isliye trading tactics ko adjust karna zaroori ho sakta hai.

Confirmation Signals:

Traders aksar trading signals ko confirm karne ke liye additional technical indicators ya chart patterns ka istemal karte hain jo channel ke andar hote hain. Ye oscillators jaise ke Relative Strength Index (RSI) ya chart patterns jaise flags ya triangles shamil ho sakte hain.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#4 Collapse

Channel trading Dear jub market ki development bullish pattern primary ho ya negative pattern principal ya phir market sideways pattern fundamental development kar rehi ho hamesha market ki development in four channels primary greetings hoti hai jo ky equidistant channel standard deviation channel relapse channel aur Andrew's pitchfork channels hain ky punch ham in channels primary market ki development ko read kerty hain tou hamain market ki future development ka pata chal jata hai kyun ky market hamesha kisi aik channel principal long time ke liye apni development ko proceed rakhti hai tou agar ham same channel principal market ki current channel fundamental development ko read karty hain toa hamein same development per market ki forecast kerny fundamental bhi aur market fundamental exchange enter kerny primary bhi koi pareshani nahi hoti ham channels principal market ki sharpen wali development ki continuation per exchange enter kar lete hain aur market hit tak same channel principal apni development ko proceed rakhti hai tab tak hamain benefit hasil hota rehta. Channel trading strategy ka istemal karne se traders ko trend ke andar price movement ka acchi tarah se pata chalta hai. Is strategy mein traders price action ko observe karte hain aur support-resistance levels ko identify karte hain. Channel trading mein trend lines ka istemal karke traders entry aur exit points ko sahi tarike se dhundh sakte hain. Lekin, jaise har trading strategy mein hota hai, channel trading mein bhi risk management ko samjhna aur follow karna zaroori hai. Traders ko price movement ko closely monitor karna chahiye aur channel ki validity ko confirm karne ke liye confirmatory indicators ka istemal kar sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 10:53 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим