Dark Cloud Cover

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Dark Cloud Cover -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

asil karne ke liye zaruri hai ky murmur bury mama candle design ko kabhi bhi overlook na karein hamein in candle design ke related total information hona chahiye ta ky murmur in candle apne exchange d Siblings Foreboding shadow Cover candle design primary poke second flame Hole up ky sath open hoti hai to ye is design ki first affirmation hai aur phir punch second light first candle ki genuine body ky half sa nicha close de to ye is design ki complete hona ki last affirmation hai. Is ky badh dealer ko new candle ky open per "Sell ki exchange dynamic kerni chahiye, aur Stop misfortune ko second light ky high per place karna chahiye aur take benefit ko next help levels per Tp-1, Tp-2 aur Tp-3 ker ky place kerDear Merchant Accomplices Forex exchanging ki market mein Foreboding shadow Cover candle design ek bohot howdy significant example hai foreboding shadow coDark Cloud Cover i market sdeeq ho gae hai agar negative light ko.Band honay standard ya aglay term mn outline dakhil hota hai to negative candle ki oonchai k oppar aik stop nuqsaan rakha ja saktaa hai.Traders procedure tajzaiy mn jo ki jo.Degar aqsam OK sath mil kar darkish cloud cowl pattren mn aik dark lampi light shamil hote ha jo phlay wali light standard kahraa sayia bnate hai ayish overwhelming example ki tarha khareedar khulay mn Keemat ko ooncha dahkail kids hn lkn baichny waly b awful mn setion media standard qrabza ki traf yeh tabdeli bat ki nishandhaii krti hai OK qematon mn kami success hasil karne ke liye zaruri hai ky hum inter ma candlestick pattern ko kabhi bhi ignore na karein hamein in candlestick pattern ke related complete knowledge hona chahiye ta ky hum in candlestick apne trade d Brothers Dark Cloud Cover candlestick pattern main jab second candle Gap-up ky sath open hoti hai to ye is pattern ki first confirmation hai aur phir jab second candle first candle ki real body ky 50% sa nicha close de to ye is pattern ki complete hona ki final confirmation hai. Is ky badh trader ko new candle ky open per "Sell ki trade active kerni chahiye, aur Stop loss ko second candle ky high per place karna chahiye aur take profit ko next support levels per Tp-1, Tp-2 aur Tp-3 ker ky place kerDear Trader Partners Forex trading ki market mein Dark Cloud Cover candlestick pattern ek bohot hi important pattern hai dark cloud cover candlestick pattern ki real body bohot long hoti hai aur ismein pahle candle hamesh istemal kar sak

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

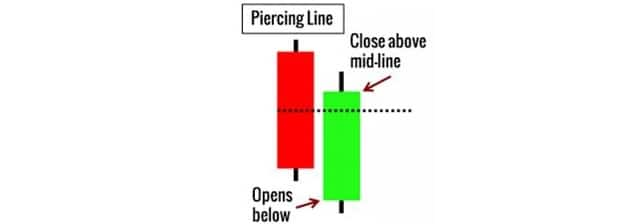

Assalamu Alaikum Dosto!Dark Cloud Cover Candlestick PatternDark cloud cover candlestick pattern aik bearish trend reversal pattern hai, jo price chart par do candles se mel kar banta hai. Pattern main shamil pehli candles bullish hoti hai, issi waja se pattern k leye prices ka pehle se high area ya bullish trend main hona zarori hai. Two days candles ki accuracy single day pattern se behtar hota hai, q k iss main aik candle thori bohut confirmation bhi deti hai. Jab bhi market main buyers prices ko aik khas level tak ooper push karte hen, to yahan par trend reversal k imkanat ziada hote hen, ye trend confirmation aksar kuch pattern se confirm ho jati hai, jiss main dark cloud cover pattern bhi shamil hai.Candles FormationDark cloud cover candlestick pattern prices k uptrend ya higher par low demand ki waja se banta hai, jahan par trend reversal k ziada imkanat hote hen. Pattern main shamil candles mukhtalif pattern ki yanni bearish aur bullish hoti hen, jiss ki formation darjazzel tarah se hoti hai;- First Candle: Dark cloud cover candlestick pattern ki pehli candle aik bullish candle hoti hai, jo k prices ko uptrend ya bullish trend ki akasi karti hai. Ye candle bullish trend ko mazeed ooper ki taraf push karti hai, aur market main high demand ko zahir karti hai. Ye candle aik normal real body wali candle hoti hai.

- Second Candle: Dark cloud cover candlestick pattern ki dosri candle aik bearish candle hoti hai. Ye candle pehli candle k top par gap main open hoti hai, jab k close ussi candle k real body k midpoint se thora sa nechay hoti hai. Pattern k bearish candle ko lazmi bullish candle k center point aur open price k darmeyan close hona chaheye, Ye candle bullish trend k khatme ka bahis banti hai.

ExplainationDark cloud cover candlestick pattern prices main bullish trend k dowran ban kar prices ko mazeed ooper jane se rok leti hai. Ye pattern aik strong trend reversal ka signal deti hai. Pattern two days candles par mushtamil hai, jiss ki pehli candle aik strong bullish candle hoti hai, jo k prices k bullish ya up trend ki alamat hoti hai. Pattern ki dosri candle aik bearish candle hoti hai, aur iss candle ka open price pehli candle se gap main hota hai. Pattern ki dosri candle pehli candle k prices ko ooper jane se rokh deti hai, jiss se prices ka mazeed up-rise stop ho jata hai. Pattern ki dosri candle ka open pehli candle k close se top par gap main hota hai, jab k close pehli candle k real body main darmeyan se thora sa nechay hota hai.TradingDark cloud cover candlestick pattern prices k top main banne ki waja se aik bearish signal genrate karta hai, jiss par market main sell ki entry ki ja sakti hai. Pattern par trade enter karne se pattern ki dosri candle aik confirmation candle ki zarorat parti hai, jo k real body main aik bearish candle honi chaheye, aur dosri candle k bottom par close bhi honi chaheye. Pattern ki confirmation CCI, RSI, MACD indicator aur stochastic oscillator se bhi ki ja sakti hai, jiss ki value overbought zone main honi chaheye. Pattern k baad bullish candle se pattern invalid tasawar kia jayega. Pattern ka Stop Loss sab se higher ya dosri candle k open price se two pips above par set karen. -

#4 Collapse

-:Dark Cloud Cover:-

Dark Cloud Cover ek bearish reversal candlestick pattern hai jo forex aur doosre financial markets mein hota hai. Isme do candlesticks hote hain aur ye aksar yeh signal karta hai ke current trend mein kisi badalao ki sambhavna hai. Yeh hai Dark Cloud Cover pattern kaise banta hai.

-:Dark Cloud Cover k parts:-- Bullish Candlestick (Day 1): Pattern ek strong bullish candlestick ke saath shuru hota hai, jo market mein uptrend ko darust karti hai.

- Bearish Candlestick (Day 2): Dusre din ka candlestick pehle din ke body ke midpoint ke neeche close hota hai, lekin pehle din ke high se upar open hota hai. Iska matlab hai ke bears market mein dakhil ho gaye hain aur pehle din ke gains ko kuch had tak reverse kar rahe hain.

- Confirmation Signals: Dark Cloud Cover pattern ko confirm karne ke liye traders doosre technical indicators ka istemal karte hain. Isme RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), aur doosre oscillators shamil hote hain.

- Market Context: Dark Cloud Cover pattern ko samajhne mein market ke context ka bhi dhyan rakhna zaroori hai. Agar market mein strong trend hai, toh Dark Cloud Cover ka impact kam ho sakta hai.

- Risk Management: Trading mein risk management ka moolya bohot high hota hai. Dark Cloud Cover signal par trade karne se pehle traders ko apne risk tolerance ke hisab se stop-loss orders lagana chahiye, taaki nuksan se bacha ja sake.

- Time Frame: Different time frames par Dark Cloud Cover pattern alag-alag tarah ka signal de sakta hai. Chhoti time frames par ise confirm karne ke liye zyada cautious hona chahiye.

Yeh important considerations hain jo traders ko Dark Cloud Cover pattern ko samajhne aur us par amal karne mein madad karti hain. Trading mein success ke liye ek comprehensive approach aur consistent analysis ki zarurat hoti hai.

Dark Cloud Cover pattern yeh suggest karta hai ke bullish momentum kamzor ho raha hai aur bearish reversal ki sambhavna hai. Traders is pattern par trading decisions lene se pehle confirmation signals aur doosre technical analysis ka istemal karte hain. -

#5 Collapse

Dark Cloud Cover

"Dark Cloud Cover" ek technical term hai jo candlestick chart analysis mein istemal hota hai, khas kar financial markets mein. Candlestick charts traders ko price movements ko analyze karne mein madad karte hain.

Dark Cloud Cover pattern ek bearish reversal pattern hai, jo uptrend ke baad aata hai aur indicate karta hai ke market mein trend reversal hone ke chances hain. Is pattern mein do consecutive candles hote hain:

Pehla Candle (Bullish Candle):

Yeh candle uptrend mein hota hai aur bada hota hai.

Dusra Candle (Bearish Candle):

Yeh candle pehle candle ke upar open hota hai aur downtrend mein close hota hai. Iska size bhi bada hota hai.

Dark Cloud Cover pattern ki pehchan karne ke liye, traders ko do candles ko dekhte hue iska confirm hona zaroori hai. Is pattern ko dekhte hi traders ko ye samajh aata hai ke buyers ki initially strong presence ke baad sellers ne control lene ka attempt kiya hai.

Yeh pattern market mein trend reversal ko suggest karta hai, lekin is par pura bharosa karne se pehle, dusre technical indicators aur analysis tools ka bhi istemal kiya jata hai. Trading mein risk management ka bhi dhyan rakhna important hai.

Dark Cloud Cover pattern ka interpretation ye hai ke market mein bullish momentum kamzor ho raha hai aur bearish pressure barh rahi hai, jiski wajah se trend reversal hone ki sambhavna badh jaati hai.

Traders is signal ko confirm karne ke liye dusre technical indicators aur analysis tools ka istemal bhi karte hain. It's important to note that while these patterns can be useful, they are not foolproof, and other factors should be considered in the overall analysis of the market. -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Dark Cloud Cover Pattern

market mein izafay ke baad, dark cloud cover patteren aik bearish reversal candle stuck patteren hai. yeh taajiron ko qeemat mein kami aur rujhan ke ulat jane ke imkaan se aagah karta hai. patteren mein do candle stuck shaamil hain : doosri candle stuck pehli candle stuck ke body ke wast point ke neechay band hoti hai aur pichlle din ke band se ziyada khulti hai. dark cloud cover patteren ki mukammal tafseelaat darj zail hain :

1. Formation:

manhoos shadow cover design mein izafah hota hai .

pehli, aam tor par aik lambi sabz ya safaid mom batii, aik taiz mom batii hai, jo aik ahem oopar ki harkat ki nishandahi karti hai .

jab doosri mom batii pichlle din ki bandish se ziyada khulti hai to aik khalaa ban jata hai .

ulat jane ki nishandahi doosri candle stuck se hoti hai, aik bearish candle stuck jo aam tor par siyah ya surkh hoti hai .

manfi mom batii markazi mom batii ke jism ke wast point ke neechay band hojati hai .

2. Characteristics:

patteren se pata chalta hai ke market ka jazba taizi se mandi mein badal gaya hai .

is se pata chalta hai ke reechh belon ko control kar satke hain kyunkay woh taaqat kho rahay hain .

market ki harkiyaat mein tabdeeli pehli aur doosri mom batii ke darmiyan farq se zahir hoti hai .

3. Confirmation:

dark cloud cover patteren ki bunyaad par koi bhi karwai karne se pehlay tajir aksar tasdeeq talabb karte hain .

tasdeeq ki misalon mein darj zail candle stuck par kam band ya izafi bearish andikitrz jaisay bearish chart patteren, bearish divergence, ya reletive strength index ( rsi ) ya moving average knorjns divergence ( macd ) jaisay takneeki isharay mein kami shaamil hain .

4. Trading Implications:

dark cloud cover patteren tajweez karta hai ke taajiron ko apni lambi pozishnon se farokht ya munafe haasil karne par ghhor karna chahiye .

yeh rujhan ke ulat jane ya up trained mein pal back ki nishandahi kar sakta hai .

traders patteren ki tasdeeq ke liye aksar izafi bearish signals talaash karte hain, aur woh market ko mukhtasir karne ya patteren ke oopar hifazati stop set karne par ghhor kar satke hain .

5. Limitations:

kisi bhi takneeki patteren ki terhan, dark cloud cover gumraah kin signal faraham kar sakta hai .

tijarti faislay karne se pehlay taajiron ko izafi takneeki isharay aur awamil ko hamesha mad e nazar rakhna chahiye .

durust pishin goyyon ke imkanaat ko badhaane ke liye, yeh tajweez kya jata hai ke patteren ko tajzia ke deegar alaat ke sath jor diya jaye .

munafe bakhash tijarat ke liye, mohtaat tajzia aur rissk managment zaroori hai. agarchay dark cloud cover patteren takneeki tajzia ke liye aik kaar amad tool ho sakta hai, lekin usay mazeed durust pishin goyyon ke liye deegar isharay aur hikmat amlyon ke sath mil kar istemaal kya jana chahiye .

-

#7 Collapse

DARK CLOUD COVER DEFINITION

Dark cloud cover Ek bearish reversal candlestick pattern hai yah pattern important hai Kyunki yah momentum main ulta se niche ki taraf tabdeeli ko zahar karta hai traders and next Teesri candles per price kam karne ke liye dekhte hain usse confirmation Kahate Hain Jahan niche candle aamtaur per black ya green prior up candles aamtaur per white ya green ke upar khulati Hain aur phir Upar candle ke mid point Ke Niche close Ho Jaati Hai bearish engulfing pattern Ki Tarah buyers open mein price ko Uncha dhakel Dete Hain aur seller session per kabza kar lete hain buying ya selling ki taraf se yah tabdili is baat ki ki taraf Ishara Karti Hai Ki price may Kami Aane wali ho sakti hai

UP SIDE GAP TWO CROWS KI MEANING

zyadatar traders dark cloud cover pattern ko sirf is Surat mein useful samajhte Hain Jab yah Upar ka Trend ya price Mein overall taur per izaafe ke baad hota hai Jabi yah price barhati Hai To yah Bullish candle Mein mid point Ke Niche close ho jata hai Jinke real bodies long Hote Hain is mein short ya current Shadow Hote Hain traders pattern ke bad price Mein Kami ki Tawaka hai agar aisa Nahin Hota To pattern nakam ho jata hai bearish candle ke close ko long position se bahar nikalne ke liye istemal Kiya jata hai aur prices Musalsal girti rahti hai to traders next day by nikal sakte hain

DARK CLOUD COVER KA DETERMINE

Agar Bearish candle ke close hone per ya next.period Mein short inter Hota Hai to Bearish candle ki unchai ke Upar ek stop loss Rakha Ja sakta hai traders technical analysis ki dusri types ke sath Milkar dark cloud cover istemal kar sakte hain example ke Taur per traders 70 se zyada relatives strength index kar sakte hain to is baat ki confirmation karta hai ki security zyada kharidi gai hai Ek traders dark cloud cover pattern support level se kharabi ko bhi is signals ke Taur per dekh sakta hai ke Trends Aane Wala Hai

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#8 Collapse

:Dark Cloud Cover

Dark Cloud Cover: A Tale of Market Reversal

"Dark Cloud Cover" is a candlestick pattern widely recognized in the realm of technical analysis, signaling a potential reversal in the market trend. This pattern consists of two candlesticks that provide valuable insights into the balance of power between bulls and bears. Let's delve into the intricacies of this pattern to understand its significance in the world of financial markets.

Dark Cloud Cover (DCC): The Anatomy

The Dark Cloud Cover pattern is a bearish reversal pattern that typically occurs after an uptrend. It involves two candlesticks – the first being a bullish (white or green) candle, representing an optimistic market sentiment. This candle is followed by a bearish (black or red) candle that opens above the high of the previous candle but closes below its midpoint, creating a dark cloud-like appearance on the chart.

Interpreting the Dark Cloud Cover Pattern

The Dark Cloud Cover pattern suggests a shift in momentum from buyers to sellers. The first candle of the pattern reflects a strong buying interest, pushing the prices higher. However, the optimism is short-lived as the second candle opens higher, indicating a potential continuation of the uptrend. Yet, it ultimately closes below the midpoint of the first candle, revealing the emergence of selling pressure.

The significance of the Dark Cloud Cover pattern lies in its ability to highlight a potential trend reversal. It serves as a warning signal for traders and investors to exercise caution, especially if they were considering long positions in the market.

Key Characteristics and Criteria

To identify a Dark Cloud Cover pattern, traders look for specific characteristics:- Uptrend in Place: The Dark Cloud Cover pattern is most meaningful when it appears after a sustained uptrend, signifying a potential reversal of the bullish trend.

- First Candle Bullish: The first candle should be a bullish candle, representing the prevailing optimism in the market.

- Second Candle Bearish: The second candle must be a bearish candle that opens above the high of the first candle but closes below its midpoint.

- Confirmation: Traders often wait for additional confirmation, such as a follow-up bearish candle on the next trading day, to strengthen the reliability of the signal.

Implications and Trading Strategies

Once the Dark Cloud Cover pattern is identified, traders assess its implications for their trading strategies. The appearance of this pattern suggests that the bullish momentum is waning, and a potential shift in favor of bears is underway. Traders may consider the following strategies:- Short Positions: Traders may initiate short positions or liquidate existing long positions in anticipation of a downtrend.

- Risk Management: Implementing risk management strategies, such as setting stop-loss orders, becomes crucial to mitigate potential losses if the reversal does not materialize.

- Confirmation Signals: Some traders wait for additional confirmation signals, such as a close below a key support level or a bearish technical indicator, before making trading decisions.

- Time Frame Consideration: The effectiveness of the Dark Cloud Cover pattern may vary based on the time frame. Traders often consider multiple time frames to confirm the validity of the signal.

Conclusion

In the dynamic world of financial markets, understanding and recognizing candlestick patterns like the Dark Cloud Cover is a valuable skill for traders and investors. While these patterns do not guarantee future price movements, they provide insightful clues about the market sentiment and potential trend reversals. Incorporating technical analysis, risk management, and confirmation signals can enhance the effectiveness of trading strategies based on the Dark Cloud Cover pattern. As with any trading signal, it is essential to combine technical analysis with a comprehensive understanding of market fundamentals and external factors influencing price movements.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 08:58 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим