Overlaping In Forex

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

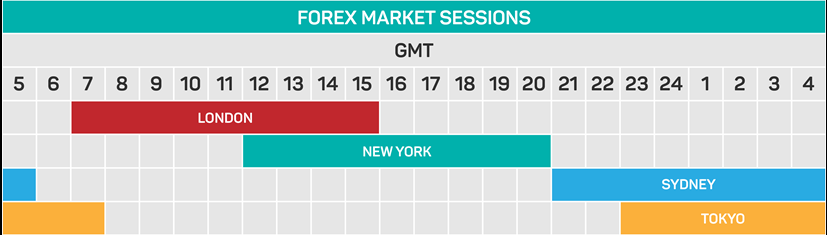

Overlapping forex market mein ek muddati time hai jahan ek saath do ya zyada trading sessions ka overlap hota hai. Yeh overlap tab hota hai jab ek trading session khatam ho rahi hoti hai aur doosri session shuru hone wali hoti hai. Overlapping ka samay market ki liquidity, volatility, aur trading opportunities par asar dalta hai. Forex market mein chaar mukhtalif trading sessions hoti hain: Sydney session, Tokyo session, London session, aur New York session. Har session specific geographic area ke financial centers ke saath juda hoti hai. Har session apni opening aur closing times ke saath operate karta hai aur market mein activity aur liquidity ko influence karta hai. Overlapping waqt mein do sessions ek saath active hote hain. Ismein kuch important overlapping periods hote hain:

- Sydney-Tokyo Overlap: Sydney session jab khatam hoti hai aur Tokyo session shuru hoti hai, tab is overlap ka waqt hota hai. Iss waqt mein market activity Pacific region ke financial centers, jaise Sydney aur Tokyo, ke participation se badh jati hai. Yeh overlap typically Asia-Pacific traders aur investors ke liye important hota hai. Iss samay mein yen currency pairs aur Asia-Pacific region ke stocks ki trading activity zyada hoti hai.

- London-Tokyo Overlap: Tokyo session jab khatam hoti hai aur London session shuru hoti hai, tab yeh overlap hota hai. Yeh overlap Europe aur Asia ke financial centers ke participation se characterized hota hai. London, jo ki forex market ka major hub hai, aur Tokyo, jo ki important Asian financial center hai, ke participation se market volatility aur trading volume badh jate hain. Iss samay mein yen currency pairs aur major European currency pairs, jaise EUR/USD aur GBP/USD, ki trading activity zyada hoti hai.

- London-New York Overlap: London session jab khatam hoti hai aur New York session shuru hoti hai, tab yeh overlap hota hai. Yeh overlap Europe aur North America ke financial centers ke participation se characterized hota hai. Iss waqt mein market liquidity aur trading activity zyada hoti hai. London aur New York dono sessions ka overlap, jise hum Power Overlap bhi kehte hain, forex market ka sabse active aur volatile waqt mana jata hai. Yeh waqt traders aur investors ke liye important hota hai kyun ke ismein major currency pairs, jaise EUR/USD, GBP/USD, aur USD/JPY, ki trading activity zyada hoti hai.

Overlapping waqt mein trading activity aur volatility zyada hone ke saath, risk bhi zyada hota hai. Price fluctuations jaldi aur unpredictable ho sakte hain, jis se stop-loss levels hit ho sakte hain. Isliye, traders ko overlapping waqt mein risk management strategies ko implement karna zaroori hai. Overlapping sessions forex market mein important hote hain kyun ke is waqt mein market activity, liquidity, aur volatility zyada hoti hai. Yeh waqt traders aur investors ke liye trading opportunities aur price movements ko monitor karne ka mauqa dete hain. Overlapping waqt ko samajhna aur uska istemal karna traders ke liye zaroori hai takay woh sahi samay par trade entry aur exit points ka faisla le sakein.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Overlapping waqt mein trading activity aur volatility zyada hone ke saath, risk bhi zyada hota hai. Price fluctuations jaldi aur unpredictable ho sakte hain, jis se stop-loss levels hit ho sakte hain. Isliye, traders ko overlapping waqt mein risk management strategies ko implement karna zaroori hai. Overlapping sessions forex market mein important hote hain kyun ke is waqt mein market activity, liquidity, aur volatility zyada hoti hai. Yeh waqt traders aur investors ke liye trading opportunities aur price movements ko monitor karne ka mauqa dete hain. Overlapping waqt ko samajhna aur uska istemal karna traders ke liye zaroori hai takay woh sahi samay par trade entry aur exit points ka faisla le sakein.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 06:43 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим