High Wave Candlestick Pattern:

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

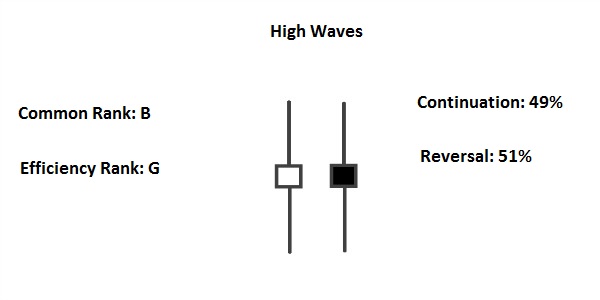

High Wave Pattern: Dear members High wave candle eik small real body main banny wali upper or lower sides pr long shadows rkhny wali eik single candle pattern hy, jis ko price chart pattern pr eik neutral candle mana jta hy. Yeh candle market main bullish or bearish, supply or demand, resistance or support power main equal hony ke wja sy bnti hy. Candle es trha Sy bnti hy, eik special timeframe k darmiyan price chart pr pehly investors prices ko eik side pr ly jany k bd same dusri side pr b usi trah sy push krti hy, lekin eik day k end pr prices apny start wali position k pr close hoti hy.jis Sy hm easily smjh skty Hain . Identification: Dear frorex members High wave candles prices main zyada daikhty hain, Kun k yeh eik neutral candle mani jati hain. Yeh candle eik he time mein market mein buyers or sellers k equal power rkhti hain, jo prices ko eik position pr pai jati hy. Candle ke formation es trha Sy hoti hy. Spinning Top: High wave candlestick prices k darmiyan mein zyada tr neutral hoti hy, jb k bottom or top prices pr trend reversal ke salaheyat rkhti hy. Yeh candle eik small real body main hoti hy, jb k yeh candle single hony ke wja sy bullish or bearish dono trah sy ho skti hy. Candle k upper or lower sides pr shadow hota hy, jo k dono sides pr size main equal hota h Expalination: High wave candlestick mein prices candle k center ya darmiyan mein eik small real body bnati hy, jis k upper or lower side pr eik long shadow hota hy. Yeh candle a eik neutral candle smjhe jati hy, jis ko price chart pr boht zyada daikha jta hy. Yeh candle prices k center main ya eik trend k neutral value hoti hy, jb k prices k top ya bottom pr banney par yeh trend reversal Jasi importance rkhti hy. High wave candlestick b Spinning top candle, long-legged doji candle or doji star candle ke trah hoti hy, jis main market k prices zyada tr same trend ko he follow krti hy. Trading Strategy: Dear members High wave candlestick trading k leye zyada perfect signals es wja sy nai dy skti hy, Kun k yeh candles zyada tr neutral hoti hy. Zyada tr yeh candles price chart main boht zyada nazar ati hy, lekin trend pr yeh boht kam asar andaz hoti hy. Price chart k top pr banney pr yeh candles thori boht trend reversal ho skti hy. Candle pr trading k liye zaruri hy, k prices trend k top ya bottom main hona chaheay, jab k candle k bd eik confirmation candle ka hona zaruri hota hy, jo k real body main lazmi hona chaheay. Jb k same trend ke candle banney pr yeh trend continuation ka role play krti hy.*Stop Loss*candle k sb sy top ya bottom end sy two pips above ya below set Karein.stop loss set kr he hm save trading kr skty Hain.stoploss or take porfit set krna bht he zaruri Hy.

- Mentions 0

-

سا0 like

-

#3 Collapse

Asslam-O-Alaikum! Dear members Me ummed kerti hoke ap sb ka forex trading py kam bht acha chl rha hoga. Aj jis topic py hum baat kre gy wo Neeche mention hy. TOPIC :HIGH WAVE CANDLESTICK PATTERN high wave candle stick patteren, jisay lambi tangon wala doji bhi kaha jata hai, aik aisa namona hai jo is waqt bantaa hai jab kisi asasay ki ibtidayi aur ikhtitami qeematein aik dosray ke bohat qareeb hoti hain. yeh aam tor par market mein Adam faisla aur uljan ki alamat hai, jahan khredar aur baichnay walay yaksaa tor par mumasil hain . EXPLAINATION: aik forex tridr ke tor par, aik sab se ahem cheez jisay aap ko samajhney ki zaroorat hai woh hai candle stick chart patteren ka istemaal. candle stick patteren market ki nafsiat ki numaindagi karte hain aur qeemat ke amal ki tashreeh ke liye aik frame work paish karte hain. mom batii ke la tadaad namoonay wahan mojood hain, lekin is mazmoon mein, hum sab se mashhoor, aur un sab mein se sab se ziyada khofnaak, high wave candle stick patteren par baat karen ge . high wave patteren aik bohat lambi oopri aur nichli vÙk par mushtamil hota hai jis mein aik chhota sa asli jism hota hai jo mom batii ke wast ke qareeb khilta aur band hota hai. patteren yeh zahir karta hai ke market ne bohat utaar charhao dekha, jis ke sath poooray trading session mein qeematein onche aur nichli dono taraf barhti rahen, sirf isi qeemat ko ibtidayi qeemat par wapas laane ke liye, bohat ziyada mandi aur taizi ke dabao ki nishandahi karta hai . johar mein, aik aala lehar patteren is baat ki alamat hai ke talabb aur rasad dono yaksaa tor par mumasil hain, aur koi bhi taraf ghalib nahi hai. yeh forex traders ke liye dekhna aik ahem namona banata hai kyunkay yeh market ki simt mein mumkina tabdeeli ka ishara deta hai . high wave candles forex traders ke liye bohat ahem hain kyunkay yeh market ke jazbaat mein mumkina tabdeelion ka ishara deti hain. un ki ahmiyat is haqeeqat mein Muzmer hai ke lamba saya yeh zahir karta hai ke belon aur reacho ke darmiyan larai din ke waqt hui lekin bil akhir dara par khatam hui. lehaza, high wave patteren tareef ke lehaaz se aik ghair faisla kin patteren hai aur market ke tamam halaat mein paaya ja sakta hai . patteren ko aam tor par up trained mein bearish reversal aur down trained mein taizi ke ulat ke tor par dekha jata hai. lamba saya belon aur reacho ke darmiyan larai ki nishandahi karta hai jis ke nateejay mein chhootey jism un bazari quwatoon ke darmiyan aik ta-attul ki numaindagi karte hain, is liye high wave candles aik ahem support / muzahmat walay ilaqay mein market ki be tarteebi ki alamat hain . buland lehar ka namona mandi aur taizi dono market ke halaat mein tashkeel paata hai, jo Adam faisla ki taraf ishara karta hai aur aksar is baat ka ishara karta hai ke aik ulat anay wala hai. aik taizi ki onche lehar ka patteren aksar neechay ke rujhan ke neechay dekha jata hai. is ke bar aks, bearish high wave patteren aam tor par up trained ke oopri hissay par banay ga . high wave patteren trading ke douran mohtaat rehne aur market ki simt wazeh honay tak koi position nah lainay ka ishara ho sakta hai. high wave candle stick patteren ko tijarat karne ke liye, taajiron ko pehlay market mein himayat aur muzahmat ki kaleedi sthon ki nishandahi karni chahiye aur phir un sthon ke ird gird ban'nay walay high wave patteren ko talaash karna chahiye . muzahmati sthon par ban'nay wali onche lehar ka namona mumkina ulat phair ki nishandahi kar sakta hai, yeh ishara karta hai ke mandi ka dabao bherne ke sath hi neechay ka rujhan anay wala hai. is ke bar aks, aik onche lehar ka patteren jo support level par bantaa hai woh taizi ke dabao ki nishandahi kar sakta hai, jis se yeh zahir hota hai ke oopri rujhan honay ka imkaan hai . taajiron ko aala lehar ke patteren ke ird gird tijarat karte waqt bhi mohtaat rehna chahiye aur kisi bhi bunyadi awamil ko note karna chahiye jo market ki simt ko mutasir kar satke hain. is ke bar aks, traders takneeki isharay jaisay moving average, occilator, aur trained lines bhi istemaal kar satke hain taakay market ke mumkina rdobdl ki tasdeeq ki ja sakay . aakhir mein, high wave candle stick patteren forex traders ke liye aik ahem patteren hai. yeh market mein Adam faisla ki numaindagi karta hai aur aksar mumkina ulat jane ka ishara deta hai. taajiron ko market mein himayat aur muzahmat ki kaleedi sthon ko note karna chahiye aur patteren ki durustagi ki tasdeeq ke liye takneeki isharay istemaal karna chahiye . aala lehar ke patteren ke ird gird tijarat karte waqt khatray ko kam karna bhi zaroori hai, kyunkay agar tajir ghalat faislay karte hain to woh taizi se paisay kho satke hain. munasib rissk managment aur position sayzng takino ko barooay car laa kar, traders forex market ki pechidgion ko navigate kar satke hain aur high wave candle stick patteren ke ishaaron se faida utha satke hain . -

#4 Collapse

Candlestick patterns forex trading mein technical analysis mein ahem kirdar ada karte hain. Ye patterns traders ko market sentiment, mukhtalif trends aur mukhtalif muddaton mein potential reversals ke baray mein wazeh fehmi faraham karte hain. Bohat si candlestick patterns mein se, High Wave Candlestick Pattern ek ahem formation hai. High Wave Candlestick Pattern ki tafseelat par guzarnay se pehle, forex trading mein candlestick patterns ki bunyadi samajh qaim karna ahem hai.

Importance of Candlestick Patterns

Candlestick patterns tajziati tajarbay ki tareekh ko darust karne wale prices ka mafhoom hote hain. Har candlestick aam tor par aik jism aur sarhad yaani ke wicks, shadows ya tails se musharraf hoti hai, jism ko opening aur closing prices aur wicks ko ooncha aur neecha prices ke doraan ke darust karte hain. Candlestick patterns traders ko market ke amal, trend reversals aur potential dakhilay ya nikalne ke points ke baray mein qabil-e-aetemad maloomat faraham karte hain. In patterns ko pehchan karne aur samajhne se traders apni strategies ko behtar banate hain.

Understanding the High Wave Candlestick Pattern

High Wave Candlestick Pattern ko is ki lambi upper aur lower wicks aur naqal jism ke nisbatan chhote hone ke liye pehchana jata hai. Ye formation beech mei market ke bahmi faraiz aur shadid ghaflat ko numaind karta hai.

Characteristics of the High Wave Candlestick Pattern- Long Upper and Lower Wicks: High Wave Candlestick Pattern ki sab se khasoosiyat is ke lambi upper aur lower wicks hain, jo ke mukhtalif price fluctuations ko darust karte hain.

- Small Body: Candlestick ka jism nisbatan chhota hota hai, jo ke opening aur closing prices ke darmiyan aik tang trading range ko numaind karta hai.

- Indecision: Lambi wicks aur chhota jism hone ki mojoodgi traders mein ghaflat ka izhar karta hai, jahan na kharidari walay na farokht karne walay market par mazboot control dikhate hain.

Jabke classic High Wave Candlestick Pattern lambi upper aur lower wicks ke saath chhota jism dikhati hai, is pattern ke ibtidaat mein chand izafaat bhi ho sakti hain. Ye izafaat ab bhi ghaflat aur shadid ghaflat ke liye samjhi jati hain lekin in ke khasosiyat ke mutabiq farq kar sakti hain.

Trading Strategies Utilizing the High Wave Candlestick Pattern

High Wave Candlestick Pattern ko trading strategies mein shamil karna is ka mafhoom aur potential natayej ke liye aham hai. Yahan kuch asar daar strategies darj ki gayi hain jo High Wave Candlestick Pattern ko forex trading mein istemal karne ke liye kaam aati hain:

Reversal Trading Strategy- Identifying Reversal Signals: Tafseeli trend ke baad High Wave Candlestick Pattern ki taraf dekhein, kyun ke ye market ke rukh mein mukhtalif ko numaind karte hain.

- Confirmation Signals: Reversal signals ko tasdeeq karne ke liye mazeed technical indicators ya muttafiq candlestick patterns ka istemal karen.

- Entry and Exit Points: Reversal signal tasdeeq hone par prevailing trend ke mutaabiq dakhilay ki taraf dakhilay karen. Rishwat ko manage karne ke liye stop-loss orders ko set karen aur jab price action reversal ka nakaam hone ka ishaara deta hai to trades se nikal jayen.

- Range Identification: Consolidation ya range-bound trading conditions ki doraan trading range ki periods ko shinaakht karen jahan market mein koi wazeh trend na ho.

- Trade Within Range: High Wave Candlestick Pattern ko istemal karen taake established trading range mein dakhilay aur nikalne ke points ko shinaakht karen.

- Buy Low, Sell High: Jab ek bullish High Wave Candlestick Pattern banta hai, to bechen ki taraf dakhilay karein aur jab ek bearish High Wave Pattern nazar aata hai to bechne ki taraf dakhilay karen.

- Volatility Assessment: Market mein izafi shadid movement aur beqarar movement ki muddaton ko moniter karen.

- Trading Breakouts: High Wave Candlestick Pattern ko signal ke taur par istemal karen jab price aham support ya resistance levels ke qareeb pohanchti hai.

- Confirmatory Signals: Breakout trades mein dakhilay karne se pehle aur baad mein tafseeli technical indicators ya candlestick patterns se tasdeeq karen taake galat signals ko kam karen.

High Wave Candlestick Pattern, market ke ahem asarat, ghor karte waqt traders ko kuch amli asarat aur factors ko mad e nazar rakhna chahiye jab ye pattern unki trading strategies mein shamil hota hai:

Risk Management- Mukhtalif haaziri management techniques ko amal mein laen, jese ke stop-loss orders set karna aur position size karna, takay High Wave Candlestick Pattern par trading karne se nuqsaan ka khatra kam ho.

- Overleveraging ya trading capital ko single trades ke liye barhaane se bachein, khaaskar shadid market conditions mein.

- High Wave Candlestick Pattern se generate hone wale signals ko tasdeeq karne ke liye mazeed technical indicators ya candlestick patterns se tasdeeq karen.

- Sirf High Wave Pattern par trading decisions par bharosa na karen, kyun ke galat signals ka imkan hai, khaaskar choppy ya ghaflat ke market conditions mein.

- Market conditions aur mazeed muashiyati factors ko ghor karen jab High Wave Candlestick Pattern ko samajhne ki koshish karen. Market sentiment, liquidity, aur geopolitical events is pattern ke aghaz aur nataij ko mutasir kar sakte hain.

- Market conditions ke mutaabiq trading strategies ko adapt karen, aur agar market dynamics badal jayein to positions ko adjust karen ya trades se bahir nikal jayein.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#5 Collapse

High Wave Candlestick Pattern:

High Wave Candlestick Pattern ek technical analysis tool hai jo market charts par paya jata hai. Ye pattern market mein uncertainty ko represent karta hai aur traders ko indicate karta hai ke buyers aur sellers ke darmiyan strong competition ho rahi hai.

High Wave Candlestick Pattern Key Points:- Appearance (ظاہریت):

- High Wave Pattern, market mein aise candles ko describe karta hai jo ke lambi shadows (upper aur lower wicks) ke sath aati hain, lekin unki opening aur closing prices aik dosre ke buhat qareeb hoti hain.

- Is pattern mein candle ki body chhoti hoti hai aur shadows lambi hoti hain.

- Indication of Uncertainty (غیر یقینی کا اظہار):

- High Wave Candlestick Pattern, market mein uncertainty aur indecision ko point out karta hai.

- Iska matlab hai ke buyers aur sellers mein kisi ne clear control nahi liya hota aur market mein kisi particular direction ka pata nahi hota.

- Market Reversal Indicator (مارکیٹ ریورسل انڈیکیٹر):

- Agar High Wave Pattern kisi trend ke baad aata hai, to ye market reversal ki possibility ko indicate kar sakta hai.

- Lekin, ye confirmatory signals ke saath hi samjha jana chahiye.

High Wave Pattern Ka Istemal (Usage):- Market Analysis (مارکیٹ تجزیہ):

- High Wave Candlestick Pattern ka istemal market ki health aur direction ko analyze karne mein hota hai.

- Agar ye pattern aaye to traders ko alert karta hai ke market mein uncertainty hai.

- Reversal Signals (ریورسل سگنلز):

- Is pattern ke aane par traders ko reversal ki possibility ka dhyan rakhna chahiye, lekin confirmatory signals ke bina koi trade na karein.

- Risk Management (خطرہ منصوبہ):

- High Wave Pattern ko dekhte hue traders apne risk management strategies ko adjust kar sakte hain.

- Is pattern ke baad market mein sudden movements hone ki possibilities ko dhyan mein rakha jana chahiye.

Conclusion (ختم): High Wave Candlestick Pattern, market uncertainty aur indecision ko highlight karta hai. Iska istemal smartly aur confirmatory signals ke sath karna important hai. Traders ko ye pattern ke appearance ke baad market situation ko carefully assess karna chahiye aur trading decisions ko responsible taur par lena chahiye.

- Appearance (ظاہریت):

-

#6 Collapse

High Wave Candlestick Pattern

High Wave Candlestick Pattern ek price action pattern hai jo market mein uncertainty ya indecision ko darust karta hai. Yeh pattern ek single candlestick se bana hota hai aur typically market ke volatile ya choppy periods mein dikhai deta hai.

High Wave Candlestick Pattern ka formation is tarah hota hai:

Body: Candlestick ka body chhota hota hai aur wick (upper aur lower shadow) lamba hota hai. Iska matlab hai ke price movement ke dauraan buyers aur sellers ke darmiyan intense fight ya competition hai.

Upper aur Lower Shadow: Candlestick ke upper aur lower shadow lambi hoti hai, jo indicate karta hai ke market mein price fluctuations zyada hain aur kisi ek taraf ka clear dominance nahi hai.

Open aur Close: Candlestick ke open aur close levels aapas mein close hote hain ya phir kafi similar hote hain, jisse ek doosre ke paas candlestick ka body chhota hota hai.

Pehla Candlestick: Pehla candlestick ek long wick ke saath hota hai, jo upward aur downward price movement ko indicate karta hai. Is candlestick ka body chhota hota hai.

Dusra Candlestick: Dusra candlestick bhi pehle candlestick ke jaise hota hai, jisme bhi long wick hoti hai aur body chhoti hoti hai. Price range dono candlesticks mein wide hoti hai.

High Wave Candlestick Pattern market mein uncertainty ya indecision ko darust karta hai, jahan price ek range mein fluctuate kar rahi hai aur kisi ek direction ka clear signal nahi mil raha hai. Is pattern ko samajhne ke liye, traders ko market context aur doosre technical indicators ka bhi analysis karna chahiye.

Yeh pattern market ko samajhne aur potential trend changes ko identify karne mein madad karta hai, lekin hamesha yaad rahe ke kisi bhi single pattern ko istemal karte waqt aur confirmation aur risk management ka khayal rakhna zaroori hai.

-

#7 Collapse

High Wave Candlestick Pattern:

High Wave Candlestick Pattern, technical analysis mein ek specific candlestick pattern hai jo traders ko market ke indecision ya uncertainty ki suchai ko dikhane ka maqsad rakhta hai. Is pattern ko samajhne ke liye, chaliye detail mein iske key features aur interpretation par baat karte hain:

Key Features of High Wave Candlestick Pattern:- Lambi Upper Shadow aur Lower Shadow: Is pattern ki pehchaan iske lambi upper aur lower shadows se hoti hai. Yani, ek High Wave Candlestick mein candle ki body choti hoti hai jabke uski upper aur lower wicks (shadows) lambi hoti hain.

- Choti Body: High Wave Candlestick ki body (rectangle shape ka central part) choti hoti hai, jo dikhata hai ke opening price aur closing price mein kam farq hai.

- Indecision ka Daur: Is pattern ka appearance market mein indecision ya uncertainty ko represent karta hai. Iska matlab hai ke traders ke darmiyan buyers aur sellers ke darmiyan koi clear winner nahi hai, aur market mein kisi particular direction ki strong movement nahi ho rahi.

Interpretation of High Wave Candlestick Pattern:- Volatility ka Sujhav: High Wave Candlestick Pattern market mein increased volatility ko suggest karta hai. Is pattern ke hone par traders ko ye samajh aata hai ke market mein strong moves hone ke chances hain.

- Trend Reversal Indicator: Agar High Wave Candlestick Pattern kisi trend ke against appear hota hai, to ye trend reversal indicator bhi ho sakta hai. Is pattern ke appearance ke baad, market mein trend change hone ke chances hote hain.

- Risk Management: Traders is pattern ko apni risk management strategy mein shamil kar sakte hain. Is pattern ke hone par, traders apne stop-loss levels ko adjust kar sakte hain taki market ki increased volatility se bacha ja sake.

- Confirmation ke Liye: Is pattern ko confirm karne ke liye, traders ko doosre technical indicators aur analysis tools ka bhi istemal karna chahiye. Multiple indicators ka istemal karke hi traders ko confident trading decisions lena chahiye.

High Wave Candlestick Pattern ek powerful tool ho sakta hai agar ise sahi tarah se samjha jaye aur doosre technical factors ke saath mila kar istemal kiya jaye. Is pattern ki pehchaan karne ke baad, traders ko market ke potential moves ko better anticipate karne mein madad milti hai.

- CL

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#8 Collapse

### High Wave Candlestick Pattern

High wave candlestick pattern forex aur stock trading mein ek aham indicator hai. Is pattern ka asal maqsad market ki uncertainty aur volatility ko dikhana hai. Ye pattern aksar market ke reversal points ya trend continuation ko signal karta hai. Aayiye, is pattern ke baare mein tafseel se jaan lete hain.

#### High Wave Candlestick Kya Hai?

High wave candlestick ek aisa candle hai jismein body choti aur wicks (shadows) bohot lambi hoti hain. Ye is baat ka izhar karti hai ke market ne kuch waqt ke liye high volatility dekhi, lekin closing price ke aas paas koi significant movement nahi hui. Ye pattern dikhata hai ke buyers aur sellers dono hi market par control hasil karne ki koshish kar rahe hain.

#### High Wave Pattern Ki Shakal

Is pattern ki pehchaan asan hai. Jab ek high wave candlestick banta hai, toh uski body choti hoti hai, aur uski upper aur lower wicks lambi hoti hain. Ye pattern bullish ya bearish dono tarah se ban sakta hai, lekin iska asal maqsad market ki uncertainty ko samajhna hai. Agar ye pattern trend ke beech mein banta hai, toh ye trend reversal ka signal ho sakta hai.

#### High Wave Pattern Ki Pehchan

High wave pattern ki pehchan karne ke liye, aapko kuch factors dekhnay honge. Pehla, candlestick ki body ka size. Agar body choti ho aur wicks lambi ho, toh ye high wave pattern ki nishani hai. Dosra, ye pattern tab zyada impactful hota hai jab ye support ya resistance levels ke paas banta hai. Ye indicate karta hai ke market mein buyers aur sellers ke beech kafi takraav hai.

#### Trading Strategy

High wave candlestick pattern ka istemal karte waqt, traders ko kuch strategies apnani chahiye. Agar aap bullish high wave pattern dekhte hain, toh aap sell position lene ka soch sakte hain, lekin confirmation ke liye dusre indicators jese ke RSI ya MACD ka istemal karein. Bearish high wave pattern ke liye, buy position lene se pehle market ki reversal ko confirm karein.

#### Conclusion

High wave candlestick pattern traders ko market ki uncertainty aur potential reversals ko samajhne mein madad karta hai. Is pattern ko achi tarah se samajhkar aur trading strategies mein shamil karke, aap apne trading decisions ko behtar bana sakte hain. Hamesha yaad rakhein, effective trading ke liye patience aur practice zaroori hai.

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 08:12 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим