Tower Top Candlestick Pattern

`

X

new posts

-

#1 Collapseٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

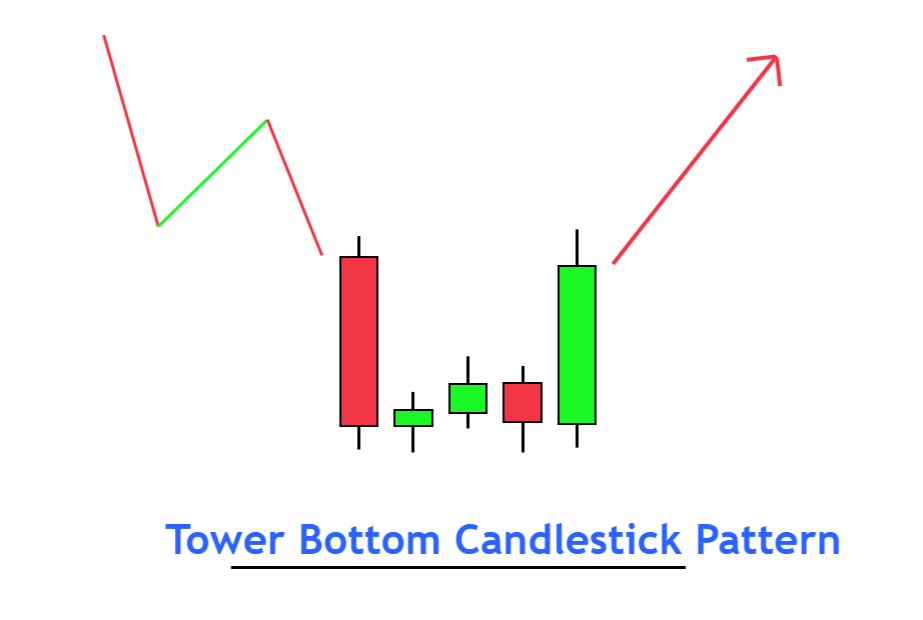

Tower Top Chart Pattern Assalamu Alaikum Dosto! Tower Top Candlestick PatternTower top candlestick pattern most important do long actual frame wali candles bullish aur bearish candles k darmeyan small actual body k teenager candles aisi tarteeb se ban jaye okay un ka high aur low in candles ok actual frame primary a jati hai. Ye sample aik strong bearish trend reversal ka kaam kartta hai, jabb qeematen bohut ziadda top trend par change kar rahi ho. Pattern ok aghazz par aik lengthy real body ki bullish candle hotti hai, (aggar bullish candle na ho to ye small real frame ki ziadda cabdles bhi ho saktti hai). Bullish candle okay baad dossri aur teesri candles aik small actual frame essential hotti hai, aur ye candle mukhtalif colorings primary ho saktti hai. Pattern ok akher predominant chothi or fourth candle aik lengthy actual body ki beariah candle hotti hai, jo small body wali candles ko apne andar cowl kar leti hai. Tower top pattern ka look aik up circulate ke baad hota hai, jab charge chart par ek prolonged upward fashion dikhta hai. Is sample mein do consecutive candlesticks involved hoti hain. Pehli candlestick lengthy green candle hoti hai, jo upward pass ko darshati hai. Dusri candlestick, jo pehli candlestick se ooper open hoti hai, inexperienced candle ki body ke ooper se start karti hai. Is candlestick ki body variety pehli candlestick ki range se ooper hoti hai, lekin iski decrease shadow pehli candlestick ki range se zyada enlarge hoti hai. Tower top pattern ki distinguishing characteristic ye hai keh dusri candlestick pehli candlestick ki range mein close hoti hai.Tower pinnacle pattern bearish fashion reversal ka possibility darshati hai. Jab rate chart par tower pinnacle sample shape hota hai, toh ye imply karta hai keh upward move khatam ho chuka hai aur bearish reversal shuru ho sakta hai. Ye pattern selling strain aur shopping for pressure ke stability shift hone ki indication hai. Traders is pattern ko affirm karne ke liye dusre technical indicators aur gear ka istemal karte hain, jaise ki transferring averages, fashion lines, ya phir oscillators.

Tower pinnacle candlestick sample essential do lengthy actual frame wali candles bullish aur bearish candles k darmeyan small real frame k teen candles aisi tarteeb se ban jaye ok un ka excessive aur low in candles okay actual body foremost a jati hai. Ye sample aik strong bearish trend reversal ka kaam kartta hai, jabb qeematen bohut ziadda pinnacle fashion par exchange kar rahi ho. Pattern k aghazz par aik lengthy real frame ki bullish candle hotti hai, (aggar bullish candle na ho to ye small real frame ki ziadda cabdles bhi ho saktti hai). Bullish candle okay baad dossri aur teesri candles aik small actual body foremost hotti hai, aur ye candle mukhtalif colorings predominant ho saktti hai. Pattern k akher most important chothi or fourth candle aik long actual body ki beariah candle hotti hai, jo small frame wali candles ko apne andar cover kar leti hai. Tower pinnacle pattern long term k timeframes important bohut lambay arsey predominant banta hai, q okay iss predominant shamil candles ki tadad ziada hai, aur ya aksar mazeed barh jata hai. Ya sample aksar bearish trend reversal important dekha jatta hai, jab bhi fees aik market k top function par challi jatti hai, to wahan se trend reversal k possibilities ziadda ho jatte hen. Tower top candlestick pattern most important small real frame wali candles bullish trend okay quit ka signal detti hai. Pattern par trading karne se pehle pattern k pinnacle function aur bearish candle ok baad aik confirmation candle ka intezzar zarror karen. Aggar ye bearish candle actual body foremost bantti hai, to ye position marketplace major sell ki entry ka hogga. Pattern ki affirmation dosrre indicators se bhi confirm kia ja saktta hai. Stop Loss sample okay sab se highest factor se aik ya do pips top role par set karen, jo sample ka mumkin resistance function sabit ho sake Tower top candlestick sample bullish fashion ya better prices predominant banta hai, jiss important candles ki tadad aam candlestick patterns ki tadad ki tarah nahi hai, yani ye pattern panch se le kar dass (10) candles tak bhi ho saktta hai. Lekin preferred tower pinnacle sample ko panch candles se bhi mukammal pattern kaha ja hai. Tower pinnacle sample principal candles ki tafseel darjazzel hogi.Topic : Tower pinnacle chart sample

Tower pinnacle AK Japanese candlisck pattern hy Jo mozahmti alaky ya operi rohjan ok akhtatam pr bnta hy.Pahli mombati AK lambi sofyaid body hy Jo kharidaron ok taiz aradon ko zahr krti hy is okay bd mombatoun ki AK series shrow hoti hy jo Kasi bhi rang ki choty jasim ki hoti hy akhri mombati AK lambi bearish candle hy.Phli or akhri mombatouna tower ok satono ky Tor pr Kam krti hn .Kb k in ok darmian mokhtasr jasm wali mombati tower ki choti ok tor pr Kam krti hy ya AK asa namona hy Jo rali ok akhtatam or momkna mandi ok olt Jany ki nashan dahi krta hy

-

#3 Collapse

TOWER TOP CANDLESTICK PATTERN EXPLANATION. Tower Top Candlestick Pattern (Tower Top Mumkin Pattern) forex market mein ek prasiddh mumkin pattern hai jo traders aur investors dwara istemal kiya jata hai. Yeh pattern bull market ya uptrend ke dauran dekhne ko milta hai aur samay par price reversal ki nishani ke roop mein pahchan sakta hai. Is article mein hum Tower Top Candlestick Pattern ki wazahat karenge, iske pehchan karne ke tarike aur iske istemal ke bare mein baat karenge. MUMKIN PATTERN KI TASHKEEL: Tower Top Candlestick Pattern ek mumkin pattern hai jo market mein price reversal ka sanket deta hai. Is pattern ko do alag candlesticks se tashkeel diya jata hai. Pehla candlestick ek lamba aur mota bullish candle hota hai, jise "tower" kehte hain. Dusra candlestick ise follow karta hai, jo pehle candlestick ki high level se shuru hota hai lekin price kam hoti hai aur candlestick bearish ya down candle hota hai. PEHCHAN KARNE KEY TARIKE: Tower Top Candlestick Pattern ko pehchanne ke liye kuch tarike hain: - Pehle tarike mein, traders pehle bullish tower candlestick ko dhundte hain. Ye candlestick generally long body wala hota hai aur high trading volume ke saath aata hai. - Dusra tarike mein, traders doji candlestick ko dekhte hain, jo pehle tower candlestick ki high level se start hota hai aur kam price ke saath down movement karta hai. - Tower Top Candlestick Pattern mein, doji candlestick bearish ya down candle hota hai, jismein price range tower candlestick ki high level se neeche aa jati hai. TOWER TOP CANDLESTICK PATTERN KI TASHKHES: Jab traders Tower Top Candlestick Pattern ko tashkhees karte hain, toh iska matlab hota hai ki market mein bullish trend khatam ho chuka hai aur ab bearish trend shuru ho sakta hai. Ye price reversal signal deta hai aur traders ko selling opportunities provide karta hai. TOWER TOP CANDLESTICK PATTERN KA ISTEMAL: Tower Top Candlestick Pattern ka istemal karke traders price reversal ke samay apne trade decisions ko improve kar sakte hain. Agar Tower Top Candlestick Pattern tashkhees hota hai, toh traders short positions le sakte hain ya existing long positions ko exit kar sakte hain. Stop-loss orders aur target levels ka istemal karke, risk management ka dhyan rakha ja sakta hai. PRECAUTION DURING USAGE OF TOWER TOP CANDLESTICK PATTERN: Tower Top Candlestick Pattern ki tashkhees karne se pehle, traders ko kuch savdhaniyan dhyan mein rakhni chahiye: - Doji candlestick ka sahi tarike se tashkhees karna zaroori hai, kyunki doji mein bhi kuch alag variations ho sakte hain. - Tower Top Candlestick Pattern ko confirm karne ke liye, traders ko dusre technical indicators aur price patterns ka istemal karna chahiye. - Risk management ka dhyan rakhein aur apne trade positions ko hamesha stop-loss orders ke saath -

#4 Collapse

Introduction: Tower Top Candlestick Pattern, Forex Trading mein ek important technical analysis tool hai. Is pattern ka istemal karke traders currency market mein price reversals aur trend changes ka pata laga sakte hain. Is article mein, hum Tower Top Candlestick Pattern ke bare mein Roman Urdu mein tafseel se samjhenge. I. Tower Top Candlestick Pattern Kya Hai? A. Candlestick Patterns: 1. Forex Trading mein, candlestick patterns price action analysis ka ek hissa hai. 2. Candlestick patterns, price movements ko visually represent karte hain. B. Tower Top Candlestick Pattern: 1. Tower Top Candlestick Pattern, uptrend ke baad price reversal ka indication deta hai. 2. Is pattern mein, ek lambi bullish candlestick followed by a shorter bearish candlestick hoti hai. 3. Bearish candlestick ki high, pehli bullish candlestick ki high se neeche hoti hai. 4. Is pattern ko "Tower Top" kehte hain, kyunki bearish candlestick pehli candlestick ko "top" kar deti hai. II. Tower Top Candlestick Pattern Ki Pehchan: A. Pattern ki pehchan karna traders ke liye zaroori hai. B. Kuch points ko observe karke Tower Top Candlestick Pattern ko pehchana ja sakta hai: 1. Price chart pe ek lambi bullish candlestick followed by a shorter bearish candlestick dekhein. 2. Bearish candlestick ki high, pehli bullish candlestick ki high se neeche ho. 3. Pattern ke baad price downward direction mein move karne lagta hai. 4. Volume ko bhi observe karein - bearish candlestick ke volume ka barhna ho sakta hai. III. Tower Top Candlestick Pattern Ka Istemal: A. Tower Top Candlestick Pattern ko identify karne ke baad, traders iska istemal kar sakte hain: 1. Price reversal ki indication ke liye: Pattern price reversal ka signal deta hai, jismein uptrend bearish trend mein change hota hai. 2. Entry point determine karne ke liye: Traders pattern ki confirmation ke baad entry point identify kar sakte hain. 3. Stop-loss level set karne ke liye: Pattern ko istemal karke traders stop-loss level determine kar sakte hain. 4. Profit target set karne ke liye: Pattern ki madad se traders profit target set kar sakte hain. Conclusion: Tower Top Candlestick Pattern, Forex Trading mein ek important tool hai jo price reversals aur trend changes ko identify karne mein madad karta hai. Is pattern ko samajhna aur identify karna traders ke liye zaroori hai. Tower Top Candlestick Pattern ke istemal se traders entry points, stop-loss levels aur profit targets set kar sakte hain, jo unko trading decisions mein madad deta hai. -

#5 Collapse

TOWER TOP CANDLESTICK PATTERNIntroduction Tower Top aik candlestick pattern hai jo technical analysis mein istemaal hota hai. Tower Top pattern usually uptrend mein paya jata hai aur ye bearish reversal signal hai. Is pattern mein do candlesticks hote hain. Pehla candlestick lamba aur strong bullish candle hota hai, jo uptrend ki continuation ko indicate karta hai. Dusra candlestick is se bhi lamba hota hai aur iski body pehle candlestick ki body ko engulf karti hai. Is engulfing candlestick ki body usually red (bearish) hoti hai. Identification Is pattern ko identify karne ke liye kuch steps hain: Step 1 Pehle, aapko uptrend ki pehchaan karni hogi. Agar price higher highs aur higher lows banaraha hai, toh ye uptrend ka indication hai. Step 2 Dusra step hai pehli bullish candlestick ko dhundna. Ye candlestick ideally strong bullish candle hona chahiye, jiska size bada ho aur price bahut upar jaaye. Ye bullish candle uptrend ki continuation ko indicate karta hai. Step 3 Teesra step hai doosri candlestick ko dekhna. Ye candlestick pehli candlestick ki body ko engulf karta hai. Iska matlab hai ki iski body pehli candlestick ki body ko completely cover karti hai. Step 4 Engulfing candlestick ki body bearish (red) hoti hai. Ye bearish candlestick uptrend ka reversal signal hai aur sellers ki dominance ko indicate karta hai. Step 5 Confirmation ke liye, aap price action ko aur indicators ko bhi dekh sakte hain. Agar price reversal ke saath downward move kar raha hai aur trendline ya support level break ho raha hai, toh ye Tower Top pattern ka aur bearish reversal ka strong indication hai. Tips for traders Tower Top pattern ka istemaal karne ke liye, aapko is pattern ke signals par dhyaan dena hoga. Jab aap Tower Top pattern spot karte hain, toh ye bearish reversal ki sambhavna indicate karta hai. Is pattern ko aap sell trade ke entry point ke roop mein istemaal kar sakte hain. Ye pattern long positions ko exit karne aur short positions lena ke liye bhi istemaal kiya jata hai. Important Note Is pattern ko use karne se pehle, aapko confirmatory signals aur additional analysis ka bhi istemaal karna chahiye. Aap is pattern ke saath trendlines, support aur resistance levels, oscillators jaise RSI, MACD, aur moving averages ka bhi istemaal kar sakte hain. Tower Top pattern ke liye stop loss aur target levels bhi define karna zaroori hai. Stop loss aapko woh price level set karna chahiye jahan par aap trade ko close karoge agar price aapke against move karta hai. Target level aapko woh price level set karna chahiye jahan par aapko profit booking karne ka mauka milega. Summary Tower Top pattern powerful bearish reversal signal hai, lekin ek pattern keval ek indicator hai aur isko dusre technical tools aur analysis ke saath istemaal karna zaroori hai. Isliye, hamesha market ki overall analysis aur apni risk tolerance ko dhyaan mein rakhte hue trading decisions lein.Tower Top pattern ka istemaal karne se pehle, practice aur backtesting zaroor karein. Ye pattern market conditions ke hisaab se kaam karta hai, isliye apne trading strategy ko adjust karein aur risk management ka bhi dhyaan rakhein. -

#6 Collapse

"Tower Top Candlestick Pattern"- Tower Top Candlestick Pattern:

- Tower Top Candlestick Pattern ki characteristics aur interpretation:

- Bearish Reversal: Tower Top Candlestick Pattern bearish trend ke baad potential reversal ke indications provide karta hai. Yeh pattern bearish trend exhaustion aur bullish momentum ki shuruwat ko signify karta hai.

- Selling Pressure: Tower candlestick ki long bearish body strong selling pressure aur bearish sentiment ko indicate karta hai. Price neeche direction mein significant decline kar rahi hoti hai.

- Buying Pressure: Top candlestick ki small bullish body limited buying pressure aur potential price recovery ko indicate karti hai. Buyers neeche direction mein price decline ko control kar rahe hote hain.

- Confirmation: Tower Top Candlestick Pattern ke successful confirmation ke liye traders ko follow-up bearish candlestick ki formation ka wait karna hota hai. Agar next candlestick bearish hai aur previous low ko break kar rahi hai, toh pattern ki validity increase hoti hai.

- Traders Tower Top Candlestick Pattern ka istemal karke trading decisions lenge toh neeche diye gaye points ko consider karte hain:

- Reversal Points: Tower Top Candlestick Pattern potential reversal points ko identify karta hai. Yeh pattern bearish trend ke exhaustion aur bullish reversal ke indications provide karta hai.

- Entry Points: Tower Top Candlestick Pattern ke baad price decline hone par entry points ko identify karta hai. Traders typically bearish direction mein trade karte hain.

- Stop Loss aur Target: Tower Top Candlestick Pattern ke istemal se traders stop loss aur target levels ko determine karte hain. Risk management principles ke hisab se stop loss aur target set kiye jate hain.

- Confirmation: Tower Top Candlestick Pattern ke successful confirmation ke liye traders follow-up candlestick formations aur price action ko observe karte hain.

- [*=center]NOTE:

-

#7 Collapse

TOWER TOP Candle Example Clarification Tower Top Candle Example (Pinnacle Top Mumkin Example) forex market mein ek prasiddh mumkin design hai jo dealers aur financial backers dwara istemal kiya jata hai. Yeh design buyer market ya upturn ke dauran dekhne ko milta hai aur samay standard cost inversion ki nishani ke roop mein pahchan sakta hai. Is article mein murmur Pinnacle Top Candle Example ki wazahat karenge, iske pehchan karne ke tarike aur iske istemal ke exposed mein baat karenge. MUMKIN Example KI TASHKEEL Tower Top Candle Example ek mumkin design hai jo market mein cost inversion ka sanket deta hai. Is design ko do alag candles se tashkeel diya jata hai. Pehla candle ek lamba aur mota bullish light hota hai, jise "tower" kehte hain. Dusra candle ise follow karta hai, jo pehle candle ki undeniable level se shuru hota hai lekin cost kam hoti hai aur candle negative ya down flame hota hai. PEHCHAN KARNE KEY TARIKE Tower Top Candle Example ko pehchanne ke liye kuch tarike hain - Pehle tarike mein, merchants pehle bullish pinnacle candle ko dhundte hain. Ye candle commonly lengthy body wala hota hai aur high exchanging volume ke saath aata hai.- Dusra tarike mein, dealers doji candle ko dekhte hain, jo pehle tower candle ki significant level se start hota hai aur kam cost ke saath down development karta hai.- Tower Top Candle Example mein, doji candle negative ya down light hota hai, jismein cost range tower candle ki undeniable level se neeche aa jati hai Distinguishing proof Is design ko distinguish karne ke liye kuch steps hainStage 1Pehle, aapko upswing ki pehchaan karni hogi. Agar cost better upsides aur more promising low points banaraha hai, toh ye upswing ka sign hai. Stage 2 Dusra step hai pehli bullish candle ko dhundna. Ye candle in a perfect areas of strength for world light hona chahiye, jiska size bada ho aur cost bahut upar jaaye. Ye bullish candle upturn ki continuation ko show karta hai.tage 3 Teesra step hai doosri candle ko dekhna. Ye candle pehli candle ki body ko inundate karta hai. Iska matlab hai ki iski body pehli candle ki body ko totally cover karti hai. Stage 4 Immersing candle ki body negative (red) hoti hai. Ye negative candle upswing ka inversion signal hai aur merchants ki strength ko show karta hai. Stage 5 Affirmation ke liye, aap cost activity ko aur markers ko bhi dekh sakte hain. Agar cost inversion ke saath descending move kar raha hai aur trendline ya support level break ho raha hai, toh ye Pinnacle Top example ka aur negative inversion ka solid sign hai. Tips for dealers Tower Top example ka istemaal karne ke liye, aapko is design ke signals standard dhyaan dena hoga. Punch aap Pinnacle Top example spot karte hain, toh ye negative inversion ki sambhavna demonstrate karta hai. Is design ko aap sell exchange ke section point ke roop mein istemaal kar sakte hain. Ye design long positions ko exit karne aur short positions lena ke liye bhi istemaal kiya jata hai.Significant Note Is design ko use karne se pehle, aapko corroborative signs aur extra examination ka bhi istemaal karna chahiye. Aap is design ke saath trendlines, support aur opposition levels, oscillators jaise RSI, MACD, aur moving midpoints ka bhi istemaal kar sakte hain.Tower Top example ke liye stop misfortune aur target levels bhi characterize karna zaroori hai. Stop misfortune aapko woh cost level set karna chahiye jahan standard aap exchange ko close karoge agar cost aapke against move karta hai. Target level aapko woh cost level set karna chahiye jahan standard aapko benefit booking karne ka mauka milega. Outline Tower Top example strong negative inversion signal hai, lekin ek design keval ek pointer hai aur isko dusre specialized instruments aur investigation ke saath istemaal karna zaroori hai. Isliye, hamesha market ki generally speaking examination aur apni risk resilience ko dhyaan mein rakhte tone exchanging choices lein.Tower Top example ka istemaal karne se pehle, practice aur backtesting zaroor karein. Ye design economic situations ke hisaab se kaam karta hai, isliye apne exchanging methodology ko change karein aur risk the board ka bhi dhyaan rakhein -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#8 Collapse

Tower Top Pattern ka Introduction pattern most important do long actual frame wali candles bullish aur bearish candles k darmeyan small actual body k teenager candles aisi tarteeb se ban jaye okay un ka high aur low in candles ok actual frame primary a jati hai. Ye sample aik strong bearish trend reversal ka kaam kartta hai, jabb qeematen bohut ziadda top trend par change kar rahi ho. Pattern ok aghazz par aik lengthy real body ki bullish candle hotti hai, (aggar bullish candle na ho to ye small real frame ki ziadda cabdles bhi ho saktti hai). Bullish candle okay baad dossri aur teesri candles aik small actual frame essential hotti hai, aur ye candle mukhtalif colorings primary ho saktti hai. Pattern ok akher predominant chothi or fourth candle aik lengthy actual body ki beariah candle hotti hai, jo small body wali candles ko apne andar cowl kar leti hai.Tower top pattern ka look aik up circulate ke baad hota hai, jab charge chart par ek prolonged upward fashion dikhta hai. Is sample mein do consecutive candlesticks involved hoti hain. Pehli candlestick lengthy green candle hoti hai, jo upward pass ko darshati hai. Dusri candlestick, jo pehli candlestick se ooper open hoti hai, inexperienced candle ki body ke ooper se start karti hai. Is candlestick ki body variety pehli candlestick ki range se ooper hoti hai, lekin iski decrease shadow pehli candlestick ki range se zyada enlarge hoti hai. Tower top pattern ki distinguishing characteristic ye hai keh dusri candlestick pehli candlestick ki range mein close hoti hai.Tower pinnacle pattern bearish fashion reversal ka possibility darshati hai. Jab rate chart par tower pinnacle sample shape hota hai, toh ye imply karta hai keh upward move khatam ho chuka hai aur bearish reversal shuru ho sakta hai. Ye pattern selling strain aur shopping for pressure ke stability shift hone ki indication hai. Tower Top Pattern ki Phachan kia hy merchants pehle bullish pinnacle candle ko dhundte hain. Ye candle commonly lengthy body wala hota hai aur high exchanging volume ke saath aata hai.- Dusra tarike mein, dealers doji candle ko dekhte hain, jo pehle tower candle ki significant level se start hota hai aur kam cost ke saath down development karta hai.- Tower Top Candle Example mein, doji candle negative ya down light hota hai, jismein cost range tower candle ki undeniable level se neeche aa jati hai.design ko use karne se pehle, aapko corroborative signs aur extra examination ka bhi istemaal karna chahiye. Aap is design ke saath trendlines, support aur opposition levels, oscillators jaise RSI, MACD, aur moving midpoints ka bhi istemaal kar sakte hain.Tower Top example ke liye stop misfortune aur target levels bhi characterize karna zaroori hai. Stop misfortune aapko woh cost level set karna chahiye jahan standard aap exchange ko close karoge agar cost aapke against move karta hai.

Tower Top Pattern ki Phachan kia hy merchants pehle bullish pinnacle candle ko dhundte hain. Ye candle commonly lengthy body wala hota hai aur high exchanging volume ke saath aata hai.- Dusra tarike mein, dealers doji candle ko dekhte hain, jo pehle tower candle ki significant level se start hota hai aur kam cost ke saath down development karta hai.- Tower Top Candle Example mein, doji candle negative ya down light hota hai, jismein cost range tower candle ki undeniable level se neeche aa jati hai.design ko use karne se pehle, aapko corroborative signs aur extra examination ka bhi istemaal karna chahiye. Aap is design ke saath trendlines, support aur opposition levels, oscillators jaise RSI, MACD, aur moving midpoints ka bhi istemaal kar sakte hain.Tower Top example ke liye stop misfortune aur target levels bhi characterize karna zaroori hai. Stop misfortune aapko woh cost level set karna chahiye jahan standard aap exchange ko close karoge agar cost aapke against move karta hai.  Treading Principle Tower pinnacle AK Japanese candlisck pattern hy Jo mozahmti alaky ya operi rohjan ok akhtatam pr bnta hy.Pahli mombati AK lambi sofyaid body hy Jo kharidaron ok taiz aradon ko zahr krti hy is okay bd mombatoun ki AK series shrow hoti hy jo Kasi bhi rang ki choty jasim ki hoti hy akhri mombati AK lambi bearish candle hy.Phli or akhri mombatouna tower ok satono ky Tor pr Kam krti hn .Kb k in ok darmian mokhtasr jasm wali mombati tower ki choti ok tor pr Kam krti hy ya AK asa namona hy Jo rali ok akhtatam or momkna mandi ok olt Jany ki nashan dahi krta hyTower Top Candlestick Pattern, Forex Trading mein ek important tool hai jo price reversals aur trend changes ko identify karne mein madad karta hai. Is pattern ko samajhna aur identify karna traders ke liye zaroori hai. Tower Top Candlestick Pattern ke istemal se traders entry points, stop-loss levels aur profit targets set kar sakte hain,

Treading Principle Tower pinnacle AK Japanese candlisck pattern hy Jo mozahmti alaky ya operi rohjan ok akhtatam pr bnta hy.Pahli mombati AK lambi sofyaid body hy Jo kharidaron ok taiz aradon ko zahr krti hy is okay bd mombatoun ki AK series shrow hoti hy jo Kasi bhi rang ki choty jasim ki hoti hy akhri mombati AK lambi bearish candle hy.Phli or akhri mombatouna tower ok satono ky Tor pr Kam krti hn .Kb k in ok darmian mokhtasr jasm wali mombati tower ki choti ok tor pr Kam krti hy ya AK asa namona hy Jo rali ok akhtatam or momkna mandi ok olt Jany ki nashan dahi krta hyTower Top Candlestick Pattern, Forex Trading mein ek important tool hai jo price reversals aur trend changes ko identify karne mein madad karta hai. Is pattern ko samajhna aur identify karna traders ke liye zaroori hai. Tower Top Candlestick Pattern ke istemal se traders entry points, stop-loss levels aur profit targets set kar sakte hain,

- Mentions 0

-

سا0 like

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 09:01 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим