Butterfly candlestick pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Assalam o alaikum Dears Kaise han ap sb umeed hai k ap sb khariyat se hon ge Aj ka jo hamara topic hai woh hai Butterfly candlestick Pattern What is Butterfly candlestick pattern yeh patteren harmonic patteren ka hissa hai aur chaar tangon aur paanch points par mushtamil hai, jo qeemat ke ulat jane ki nishandahi karta hai. yeh chart patteren ki terhan hai kyunkay tangon ko ab, xa, bc, aur cd ke tor par nishaan zad kya gaya hai. yeh qeemat ke rujhan ke ekhtataam ka taayun karne ke liye mufeed hai taakay aap reversal ke douran tijarat ko khol saken. aap ko is patteren ke do version milein ge jo taizi aur mandi ke hain. agar aap ko taizi ka namona nazar aata hai to aap asasa farokht kar den ge patteren ki soorat mein, aap beech dete hain. taham, market se bahar niklny aur daakhil honay ke lamhay ka taayun karte waqt bilkul durust hona zaroori hai. maahir takneeki tajzia ke mutabiq, titliyan aik bohat hi durust namona hain aur taiz ulat rujhanaat bhi dukhati hain. titlee ka namona kya zahir karta hai? titlee ka namona kya zahir karta hai? chart ka tajzia qeemat ka tajzia karne ka aik tareeqa hai jo baar baar anay walay adaad o shumaar ko pehchanta hai jis ki shakal kam o besh hindsi hoti hai. How Does Chart pattern Indicate chart patteren ke do ahem khandan hain : ulat aur tasalsul patteren. dono sooraton mein, yeh adaad o shumaar signal ke sath sath aik simt bhi paish karte hain. SaSabi waqt zahir hota hai jab murawaja rujhan aik hi simt mein jari rehta hai, aam tor par tawaquf ke baad. seconds rujhan ki simt mein tabdeeli ka ishara den ge. rujhan ki tabdeelian jo market ke oopri hissay mein hoti hain taqseem ke marhalay se mutabqat rakhti hain. is ke bar aks, market ki kami par ulat patteren jama honay ke marahil hain. chahay yeh ulat palat ho ya tasalsul ka patteren, patteren ban'nay mein jitna ziyada waqt lagey ga, is patteren ke break out par qeemat ki harkat itni hi taaqatwar hogi. titlee ka namona rujhan mein ulat jane ki nishandahi karta hai. jaisa ke is ke naam se pata chalta hai, aik ulat patteren rujhan ke mumkina ulat jane se pehlay pishrft mein raftaar ko kho deta hai. trading mein, ulat palat patteren ki do kasmain hain : oopar ki taraf patteren : jo neechay ke rujhan ke khatmay ki pishin goi karte hain. neechay ki taraf ulatnay walay patteren oopar ke rujhan ke ekhtataam ki pishin goi karte hain. yaad rakhnay ke liye aik bohat ahem nuqta yeh hai ke ulat palat chart patteren ki toseeq sirf is waqt ki ja sakti hai jab asasa ki qeemat patteren ko chore deti hai. dosray lafzon mein, rujhan ki tabdeeli sirf patteren ki tashkeel ke baad waqay hogi. titlee ke namonon ko daghna course ke ulat jane ki paish goi karne mein qeemti madad faraham kar sakta hai. un ka pata laganay se kamyaab tijarat ke imkanaat barh jatay hain. lehaza, yeh tijarat shuru karne ke liye aik zaroori tool hai . Using Butterfly pattern in Stock trading yeh bohat mazboot isharay hain aur talaash karna kaafi aasaan hai. yeh behtareen tijarti mawaqay ka pata laganay ke qabil bharosa tareeqon mein se aik hai. yeh patteren barray pemanay par stap nuqsaan ya hadaf ki satah ka taayun karne ke liye istemaal kya jata hai. doosri taraf, stap lasz ki soorat mein aik khaas margin chhorna danishmandi ki baat ho gi taakay mukhalif simt mein qeemat ki bahaali se pehlay moakhar az zikr ko mutharrak honay se bachaya ja sakay. dosray isharay par faida yeh hai ke un ki sthin mutharrak ost ke bar aks mustahkam hain. un sthon ki jaamad noiyat fori aur aasaan shanakht ki ijazat deti hai, balkay test ke douran is ke mutabiq radd amal zahir karne ki bhi tawaqqa karti hai. yeh sthin points hain jahan rad-e-amal ki tawaqqa ki jati hai, ya to ulat ya break out. mukhtasir mein, titlee ke namonon ko support aur muzahmat ki satah samjha jata hai. khatraat ko mehdood karne ke liye, yeh mahswara diya jata hai ke –apne aap ko barray rujhan ki simt mein rakhen. titlee ke namonon ke istemaal ke nuqsanaat takneeki tajzia mein koi kaamil chart patteren nahi hai, is liye titlee patteren ke bhi –apne manfi pehlu hain. – Disadvantages of Using Butterfly candlestick pattern apne forex, astaks, ya trading mein is patteren ko istemaal karte waqt aap ko darj zail nuqsanaat ka khayaal rakhna chahiye. sab se pehlay, har patteren mukammal aur geherai se takneeki tajzia ke ilm ka mutalba karta hai, chahay woh titlee, shark, ya koi aur patteren ho. is ke ilawa, behtar durustagi ke liye, aap ko siray ka taayun karne aur aik acha tijarti faisla karne ke liye mutadid namonon ko yakja karna chahiye. lehaza, yeh waqai bohat sabr aur tafseeli tehqeeq ki zaroorat hai. taajiron ko aam tor par dosray namonon ko is lehaaz se ziyada amli lagta hai ke woh kam sakht hain. agar aap aik ibtidayi hain, to aap tajzia karne aur usay sayaq o Sabaq mein daalnay ke liye yeh namona mayoos kin pa satke hain. is liye yakeeni banayen ke aap titlee ke patteren ke sath shuru karne se pehlay takneeki tajzia ke deegar tasawurat ko samajh len. graph mein titlee ke namonon ko kaisay talaash karen. graph mein titlee ke namonon ko kaisay talaash karen. How to spot Butterfly candlestick pattern in graph yeh patteren harf w ya baaz auqaat harf m se milta jalta hai harmonic butter flayi patteren qeemat ki tashkeel hai jo 5 points par mushtamil hai jo qeemat ke chaar utaar charhao ki wazahat karti hai. ne usay 1935 mein daryaft kya. taham, patteren bananay walay rujhanaat ke darmiyan qatee taluqaat ( tanasub ke mutabiq ) ki wazahat scot karni ne apni kitaab" di harmonic tridr" mein 1998 mein ki thi. un ki mojoodgi is baat ke Qawi imkaan ki nishandahi karti hai ke market badal jaye gi. simt -

#3 Collapse

Asslam-O-Alaikum! Dear members Me ummed kerti hoke ap sb ka forex trading py kam bht acha chl rha hoga. Aj jis topic py hum baat kre gy wo Neeche mention hy. ​TOPIC: BUTTERFLY CANDLESTICK PATTERN Butterfly candle stick pattern aik takneeki tajzia ka tool hai jisay tajir maliyati mandiyon mein mumkina rujhan ki tabdeelion ki nishandahi karne ke liye istemaal karte hain. yeh namona chaar mom btyon se bantaa hai aur butterfly ki shakal se milta hai, is liye yeh naam rakha gaya hai . Butterfly pattern do deegar Maroof candle stick patteren ka majmoa hai : bullish gartly pattern aur bearish gartly pattern. Bullish gartly pattern aik up trained se bantaa hai jis ke baad retracment, retracment se really, aur aik naya up trained shuru honay se pehlay aik hatmi retracment hota hai. bearish gartly patteren taizi ke gartly pattern ki aaina daar tasweer hai, jis mein kami ka rujhan hai jis ke baad retracment, retracment se kami, aur aik naya down trained shuru honay se pehlay aakhri really . EXPLAINATION: Butterfly pattern gartly patteren se milta jalta hai kyunkay is mein aik restracment bhi shaamil hota hai jis ke baad mukhalif simt mein harkat hoti hai. taham, titlee ke patteren ki aik allag saakht hai jo usay Gartly pattern se mukhtalif karti hai. patteren ka aaghaz aik simt mein qeemat ki taiz harkat se hota hai, is ke baad aik restment jo ibtidayi iqdaam ke 0. 618 fibonacci restracment level se tajawaz kar jata hai. is retrracent ke baad aik really hoti hai jo ibtidayi iqdaam ke 0. 786 fabnoki retracment level par khatam hoti hai. aakhir mein, aik aur restment hai jo pehlay retracment ke nuqta aaghaz se agay khatam hota hai, aik allag" m" shakal banata hai. pattern ko mukammal samjha jata hai jab qeemat doosri retracment ki oonchai se oopar jati hai . BUTTERFLY pattern aik nadir namona hai jo aksar nahi hota, yeh un taajiron ke liye aik qeemti tool banata hai jo is ki shanakht kar satke hain. jab titlee ka pattern bantaa hai, to yeh ishara karta hai ke rujhan ka ulat jana qareeb aa sakta hai, neechay ke rujhan mein mumkina taizi ke ulat ya oopar ke rujhan mein mandi ke ulat jane ke sath . tajir Butterfly patteren ki durustagi ki tasdeeq ke liye mutadid takneeki isharay istemaal karte hain. aisa hi aik isharay rishta daar taaqat ka asharih ( rsi ) hai, jo security ki qeemat ke amal ki taaqat ko mapta hai. agar rsi down trained ke douran over sealed territory mein hai ya up trained ke douran ziyada khareeda sun-hwa ilaqa hai jab Butterfly patteren bantaa hai, to is se rujhan ke ulat jane ke imkanaat barh jatay hain. aik aur isharay jisay tajir istemaal kar satke hain woh hai moving average knorjns divergence ( macd ), jo do harkat Pazeer aust ke darmiyan farq ki pemaiesh karta hai. agar macd line down trained ke douran signal line ke oopar ya up trained ke douran signal line se neechay cross karti hai jab butter flayi patteren bantaa hai, to is se rujhan ke ulat jane ki mazeed tasdeeq hoti hai . yeh note karna zaroori hai ke titlee ka namona, tamam takneeki tajzia ke alaat ki terhan, 100 % durust nahi hai aur usay dosray isharay aur tajzia ke sath mil kar istemaal kya jana chahiye. taajiron ko ghalat signals se bhi aagah hona chahiye, jo is waqt hota hai jab koi patteren bantaa dikhayi deta hai lekin is ke nateejay mein rujhan tabdeel nahi hota hai. market mein utaar charhao ya qeemat ki naqal o harkat ko mutasir karne walay deegar bairooni awamil ki wajah se ghalat signals ho satke hain . aakhir mein, Butterfly candle stick pattern aik nayaab lekin qeemti takneeki tajzia ka tool hai jisay tajir maliyati mandiyon mein mumkina rujhan ki tabdeeli ki nishandahi karne ke liye istemaal karte hain. pattern chaar mom btyon se bantaa hai aur titlee ki shakal se milta hai. yeh taizi aur mandi walay gartly pattern ka majmoa hai aur jab qeemat dosray restment ki bulandi se oopar jati hai to usay mukammal samjha jata hai. traders patteren ki durustagi ki tasdeeq ke liye mutadid takneeki isharay istemaal karte hain, lekin usay dosray tajziyon ke sath mil kar istemaal kya jana chahiye aur ahthyat brtni chahiye . -

#4 Collapse

Sure! Here's an explanation of the Butterfly candlestick pattern in Forex Trading, using headings in Roman Urdu: I. Introduction Butterfly candlestick pattern, ya Phool Patta pattern, ek aham Forex Trading pattern hai. Ye pattern traders ke liye visual indication provide karta hai jab market trend change hone ki sambhavna hoti hai. II. Identifying Characteristics Butterfly pattern ki pehchan kuch khas khusoosiyat se ki ja sakti hai: a. Yeh pattern 4 candlesticks se bana hota hai. b. Do middle candlesticks hawa ke nishaan ko banate hain, jabki side wale candlesticks uski pankh ki shakal ko banate hain. c. Ye pattern generally trend reversal ka indication deta hai, matlab jab market ki trend change hone ki sambhavna hoti hai. III. Anatomy of Butterfly Pattern Butterfly pattern mein 4 candlesticks hote hain, jo is tarah se arrange hote hain: a. Pehla candlestick ek upward trend ki starting ko represent karta hai. b. Dusra aur teesra candlesticks neeche ki taraf chale jate hain, jabki teesra candlestick doosre se bada hota hai. c. Chotha candlestick phir se ek upward movement ko dikhata hai, lekin pehle candlestick se kam length mein. IV. Interpretation and Trading Strategy Butterfly pattern ki samajh aur trading strategy kaafi mahatvapurna hota hai. Ye pattern ko samajhne ke baad traders iske anusaar trade lene ke liye strategies bana sakte hain. Kuch samajhne wale points niche diye gaye hain: a. Jab butterfly pattern complete ho jaye, matlab 4 candlesticks complete ho jaayein, tab traders ko trend reversal ki sambhavna samajhni chahiye. b. Agar butterfly pattern ek uptrend ke baad aata hai, toh ye bearish reversal signal ho sakta hai. c. Agar butterfly pattern ek downtrend ke baad aata hai, toh ye bullish reversal signal ho sakta hai. d. Traders butterfly pattern ke baad confirmation ki prakriya bhi istemaal kar sakte hain, jaise ki price action indicators, support and resistance levels, ya trend line breaks. V. Conclusion Butterfly candlestick pattern ek aham tool hai Forex Trading mein trend reversal ki sambhavna samajhne ke liye. Traders ko is pattern ko samajhna chahiye aur uske anusaar trading decisions leni chahiye. Hamesha ek sahi risk management strategy aur stop-loss order ka istemal karna zaruri hai. -

#5 Collapse

Dear Ye pattern hamain bearish trend ka bullish trend man reverse honay ka signal daita hay aur ye pattern show kerta ha kay seller ki strength kmFry pan bottom ik bht special case of pattern hai. Ye tub bnta hau jub choti choti candlestick downward move krme lgti hian aur kuch waqt yehi chlta rehta hai thra deep janay k baad jaati hai ki market mein is waqt acchi khabar hai aur Market acche tarike se movement karne wali hai aisi market ham kafi achcha fayda utha sakte hain aur Market mein hamen kafi acchi trade mil sakti hai isliye is patron ko jarur analyse karna chahie aur isase fayda uthane ki koshish Karni chahie. ho gye ha aur slowly buyer power gain kar rahay han aur aik bullish trend start ho jata ha. Ye pattern aik strong signals dena wala pattern ha, iska signals kafi reliable hotay han. Lakin ye pattern hamain chart main kam nazar ata hay, is pattern kay baad bannay wali bullish candle jo gap-up sath open hoti ha lakin wo banna k bad is gap ko fill ker leti ha to ye pattern valid nahi rehta aur trader ko trade active nahe kerni chaiay, is liay zaruri ha kay trader gap-up kay sath bannay wali candle kay complete honay ka wait karain...Butterfly candlestick pattern Dear ye pat banati hai to tab hamen bahut acchi confirmation mil surat hoti ha, jis sa hmain trend k further reversal ki confirmation milti ha, ye dumpling top pattern k opposite hota ha, ye long term trading kay liay aik acha pattern Fry pattern marktern downtrend sa start hota ha aur us k baad sideways ho jata ha, jo market ki unstable condition ko show karta ha us kay bad trend ki direction main reversal show hota ha aur ye aik uptrend ma change ho jata ha, ye aik boht kam nazar anay wala pattern hay jis ma sideways trend k baad aur uptrend start honay sa pehlay gap up ki ruk jaty hain aur thri straight movemnt aati hai aur phir wapis up janay lgty hain istype k pattern k fry pan bottom bolty hain. Fry Pan bottom pattern ki importance is vajah se kafi jyada Hoti hai kyunki jab bhi market gap ke sath open hoti hai aur Market mein shutterent aur power hoti hai aur Market ek acchi bullish candleet kay different spots par appear ho sakta hai. Ye market ki different situations ko represent karta hai. Agr ye market kay bottom ma appear ho to eski confirmation kay bad trader ko buy ki trade ko prefer karna chahe. But agr ye pattern market kay top par appear ho to again eski confirmation zaruri hai or es kay bad trader ko sell ki trade ko open karna chahe. Confirmation es laye zaruri hai kay aksar ye pattern invalid ho jata hai or bhot kam time par ye valid rehta hai. So validity ko verify karna bhot zaruri hai. Trader ko blindly trade ma in ho jaty hain wo ik bar to luck kay bahrosy acha profit hasil karny ma kamyab ho jayn gy but har bar success hasil ni kar sakyn gy...

-

#6 Collapse

Butterfly pattern ka Introduction kya hy patteren ka hissa hai aur chaar tangon aur paanch points par mushtamil hai, jo qeemat ke ulat jane ki nishandahi karta hai. yeh chart patteren ki terhan hai kyunkay tangon ko ab, xa, bc, aur cd ke tor par nishaan zad kya gaya hai. yeh qeemat ke rujhan ke ekhtataam ka taayun karne ke liye mufeed hai taakay aap reversal ke douran tijarat ko khol saken. aap ko is patteren ke do version milein ge jo taizi aur mandi ke hain. agar aap ko taizi ka namona nazar aata hai to aap asasa farokht kar den ge patteren ki soorat mein, aap beech dete hain. taham, market se bahar niklny aur daakhil honay ke lamhay ka taayun karte waqt bilkul durust hona zaroori hai. maahir takneeki tajzia ke mutabiq, titliyan aik bohat hi durust namona hain aur taiz ulat rujhanaat bhi dukhati hain Butterfly Pattern Ki Phchan kya hy ulat aur tasalsul patteren. dono sooraton mein, yeh adaad o shumaar signal ke sath sath aik simt bhi paish karte hain. SaSabi waqt zahir hota hai jab murawaja rujhan aik hi simt mein jari rehta hai, aam tor par tawaquf ke baad. seconds rujhan ki simt mein tabdeeli ka ishara den ge. rujhan ki tabdeelian jo market ke oopri hissay mein hoti hain taqseem ke marhalay se mutabqat rakhti hain. is ke bar aks, market ki kami par ulat patteren jama honay ke marahil hain. chahay yeh ulat palat ho ya tasalsul ka patteren, patteren ban'nay mein jitna ziyada waqt lagey ga, is patteren ke break out par qeemat ki harkat itni hi taaqatwar hogi. titlee ka namona rujhan mein ulat jane ki nishandahi karta hai. jaisa ke is ke naam se pata chalta hai, aik ulat patteren rujhan ke mumkina ulat jane se pehlay pishrft mein raftaar ko kho deta hai. trading mein, ulat palat patteren ki do kasmain hain : oopar ki taraf patteren : jo neechay ke rujhan ke khatmay ki pishin goi karte hain. neechay ki taraf ulatnay walay patteren oopar ke rujhan ke ekhtataam ki pishin goi karte hain. yaad rakhnay ke liye aik bohat ahem nuqta yeh hai ke ulat palat chart patteren ki toseeq sirf is waqt ki ja sakti hai jab asasa ki qeemat patteren ko chore deti hai. dosray lafzon mein, rujhan ki tabdeeli sirf patteren ki tashkeel ke baad waqay hogi. titlee ke namonon ko daghna course ke ulat jane ki paish goi karne mein qeemti madad faraham kar sakta hai. un ka pata laganay se kamyaab tijarat ke imkanaat barh jatay hain

Butterfly Pattern Ki Phchan kya hy ulat aur tasalsul patteren. dono sooraton mein, yeh adaad o shumaar signal ke sath sath aik simt bhi paish karte hain. SaSabi waqt zahir hota hai jab murawaja rujhan aik hi simt mein jari rehta hai, aam tor par tawaquf ke baad. seconds rujhan ki simt mein tabdeeli ka ishara den ge. rujhan ki tabdeelian jo market ke oopri hissay mein hoti hain taqseem ke marhalay se mutabqat rakhti hain. is ke bar aks, market ki kami par ulat patteren jama honay ke marahil hain. chahay yeh ulat palat ho ya tasalsul ka patteren, patteren ban'nay mein jitna ziyada waqt lagey ga, is patteren ke break out par qeemat ki harkat itni hi taaqatwar hogi. titlee ka namona rujhan mein ulat jane ki nishandahi karta hai. jaisa ke is ke naam se pata chalta hai, aik ulat patteren rujhan ke mumkina ulat jane se pehlay pishrft mein raftaar ko kho deta hai. trading mein, ulat palat patteren ki do kasmain hain : oopar ki taraf patteren : jo neechay ke rujhan ke khatmay ki pishin goi karte hain. neechay ki taraf ulatnay walay patteren oopar ke rujhan ke ekhtataam ki pishin goi karte hain. yaad rakhnay ke liye aik bohat ahem nuqta yeh hai ke ulat palat chart patteren ki toseeq sirf is waqt ki ja sakti hai jab asasa ki qeemat patteren ko chore deti hai. dosray lafzon mein, rujhan ki tabdeeli sirf patteren ki tashkeel ke baad waqay hogi. titlee ke namonon ko daghna course ke ulat jane ki paish goi karne mein qeemti madad faraham kar sakta hai. un ka pata laganay se kamyaab tijarat ke imkanaat barh jatay hain  Treading pattern ka Principle kya hy yeh behtareen tijarti mawaqay ka pata laganay ke qabil bharosa tareeqon mein se aik hai. yeh patteren barray pemanay par stap nuqsaan ya hadaf ki satah ka taayun karne ke liye istemaal kya jata hai. doosri taraf, stap lasz ki soorat mein aik khaas margin chhorna danishmandi ki baat ho gi taakay mukhalif simt mein qeemat ki bahaali se pehlay moakhar az zikr ko mutharrak honay se bachaya ja sakay. dosray isharay par faida yeh hai ke un ki sthin mutharrak ost ke bar aks mustahkam hain. un sthon ki jaamad noiyat fori aur aasaan shanakht ki ijazat deti hai, balkay test ke douran is ke mutabiq radd amal zahir karne ki bhi tawaqqa karti hai. yeh sthin points hain jahan rad-e-amal ki tawaqqa ki jati hai, ya to ulat ya break out. mukhtasir mein, titlee ke namonon ko support aur muzahmat ki satah samjha jata hai. khatraat ko mehdood karne ke liye, yeh mahswara diya jata hai ke –apne aap ko barray rujhan ki simt mein rakhen. titlee ke namonon ke istemaal ke nuqsanaat takneeki tajzia mein koi kaamil chart patteren nahi hai,

Treading pattern ka Principle kya hy yeh behtareen tijarti mawaqay ka pata laganay ke qabil bharosa tareeqon mein se aik hai. yeh patteren barray pemanay par stap nuqsaan ya hadaf ki satah ka taayun karne ke liye istemaal kya jata hai. doosri taraf, stap lasz ki soorat mein aik khaas margin chhorna danishmandi ki baat ho gi taakay mukhalif simt mein qeemat ki bahaali se pehlay moakhar az zikr ko mutharrak honay se bachaya ja sakay. dosray isharay par faida yeh hai ke un ki sthin mutharrak ost ke bar aks mustahkam hain. un sthon ki jaamad noiyat fori aur aasaan shanakht ki ijazat deti hai, balkay test ke douran is ke mutabiq radd amal zahir karne ki bhi tawaqqa karti hai. yeh sthin points hain jahan rad-e-amal ki tawaqqa ki jati hai, ya to ulat ya break out. mukhtasir mein, titlee ke namonon ko support aur muzahmat ki satah samjha jata hai. khatraat ko mehdood karne ke liye, yeh mahswara diya jata hai ke –apne aap ko barray rujhan ki simt mein rakhen. titlee ke namonon ke istemaal ke nuqsanaat takneeki tajzia mein koi kaamil chart patteren nahi hai,

-

#7 Collapse

Butterfly candlestick pattern ek technical analysis pattern hai jo market mein ek potential trend reversal ki indication deta hai. Is pattern mein chaar candlesticks hote hain aur iska shape ek butterfly ki tarah hota hai. Is pattern mein dusri aur teesri candle pehli aur chauthi candle ke high aur low se zyada hote hain. Butterfly pattern ka kuch alag-alag variations hote hain, jaise bullish aur bearish patterns. Bullish butterfly pattern mein pehli aur chauthi candle bearish hote hain, jabki dusri aur teesri candle bullish hote hain. Vaise hi, bearish butterfly pattern mein pehli aur chauthi candle bullish hote hain, jabki dusri aur teesri candle bearish hote hain. Butterfly candlestick pattern ka pehchan karna aur samajhna kai fawaid hasil karne mein madad karta hai, jaise: 1. Trend reversal ka pata lagana: Butterfly pattern traders ko potential trend reversal ka pata lagane mein madad karta hai, jisse wo apne positions ko sahi samay par enter ya exit kar sakte hain. 2. Entry aur exit timing ka behtar hona: Butterfly pattern ko pehchan kar traders apne entry aur exit timing ko behtar tarike se samajh sakte hain, jisse unki trades ki profitability badh jati hai. 3. Aur indicators ke saath confirmation: Traders butterfly pattern ko often dusre technical indicators, jaise trend lines, moving averages ya oscillators ke saath combine karte hain, taki unki trading decisions ko aur mazboot bana sake aur accuracy ko badha sake. 4. Risk management: Butterfly pattern traders ko stop-loss levels set karne aur risk ko effectively manage karne mein madad karta hai. Pattern ke completion point se aage stop-loss order place karna potential losses ko limit karne mein madad karta hai. 5. Scalping opportunities: Butterfly pattern traders ko scalping opportunities deta hai, jisse wo short-term trades mein bhi fayda utha sakte hain. Conclusion: In conclusion, butterfly candlestick pattern forex market mein trend reversal ki indication deta hai aur traders ko entry, exit timing aur risk management mein madad karta hai. Lekin, is pattern ko samajhne aur istemal karne ke liye traders ko proper training aur practice ki zaroorat hoti hai. -

#8 Collapse

Forex mein tijarat karte waqt, technical analysis ek ahem hissa hai jise traders apne faislay mein madad lete hain. Candlestick patterns is analysis ka aik ahem hissa hain jo market ke mukhtalif mor par hone wale tabdiliyon ko samajhne mein madad karte hain. Butterfly candlestick pattern bhi aik aesa pattern hai jo traders ko market ke mukhtalif muddaton ke andar hone wale tabdiliyon ki taraf ishara kar sakta hai.

Butterfly pattern ek reversal pattern hai, yaani ke jab market ek specific trend mein hoti hai aur phir uska rukh badalne wala hota hai, to yeh pattern dikhai deta hai. Butterfly pattern ko samajhne ke liye, aapko candlesticks ki jhalak leni hogi jo market chart par dikhai deti hain. Yeh pattern traders ko ye batata hai ke market mein ek naya rukh ane wala hai.

Butterfly pattern ko samajhne ke liye, sabse pehle humein ye samajhna hoga ke candlesticks kya hote hain. Candlestick ek technical analysis ka tool hai jo market movement ko darust taur par represent karta hai. Har candlestick ek specific muddat ko darust karta hai aur iski body aur shadows hote hain. Candlestick ke pattern se traders ko ye maloom hota hai ke market mein buyers ya sellers ka control kis tarah ka hai.

Ab, butterfly pattern ki taraf aate hain. Butterfly pattern mein kuch khas candlesticks ko dekha jata hai jo ek specific sequence mein aate hain. Ye sequence typically 4 candlesticks par mabni hota hai. Butterfly pattern ko identify karne ke liye, traders ko in 4 candlesticks ki formation ko dhyan se dekhna hota hai.

Pehla candlestick ek strong uptrend ko darust karta hai, jo ke buyers ka control dikhaata hai. Iske baad, doji ya small-bodied candle hoti hai jo indicate karta hai ke market mein uncertainty hai aur buyers aur sellers mein equal competition hai. Tisra candlestick phir se ek strong uptrend ko darust karta hai, lekin iski body pehle candlestick se choti hoti hai. Akhri candlestick phir ek doji ya small-bodied candle hoti hai.

Butterfly pattern ka ye sequence dekhte waqt, traders ko ye samajhna chahiye ke market mein ek reversal hone wala hai. Yani ke, pehle ki strong uptrend ke baad, market mein uncertainty aati hai aur phir ek naya rukh shuru hone wala hai. Is pattern ko samajh kar, traders apne trading strategies ko adjust kar sakte hain.

Butterfly pattern ko dekhte waqt, kuch important points ka bhi dhyan rakhna zaroori hai. Sabse pehle, is pattern ki confirmation ke liye traders ko market ke aur indicators ka bhi support lena chahiye. Kisi bhi ek pattern par pura bharosa karne se pehle, market analysis ke dusre tools aur indicators ki bhi zarurat hoti hai.

Dusri baat, risk management ka bhi khayal rakhna zaroori hai. Butterfly pattern sirf ek indicator hai, aur is par pura bharosa karke trading karna risky ho sakta hai. Traders ko apne trading capital ko barbaad hone se bachane ke liye risk management ka istemal karna chahiye.

Iske alawa, butterfly pattern ko time frame ke sath bhi dekhna zaroori hai. Kuch traders short-term time frames par is pattern ko use karte hain, jabki doosre long-term time frames par. Time frame ke chunav par depend karta hai ke aap kis tarah ke trader hain aur aapko market ke movement ko kis tarah se interpret karna pasand hai.

Butterfly pattern ke alawa bhi kai aur candlestick patterns hain jo traders istemal karte hain. Har ek pattern apne tajurbe aur market conditions ke mutabiq kaam karta hai. Traders ko apne trading plan mein flexibility rakhna chahiye aur market ke mukhtalif halat ke mutabiq apne strategies ko adjust karna chahiye.

-

#9 Collapse

Introduction

Butterfly candlestick pattern ek reversal pattern hai jo forex trading mein frequently use hota hai. Yeh pattern indicate karta hai ke market trend change hone wala hai. Butterfly pattern dho tarah ke hote hain: bullish butterfly aur bearish butterfly.

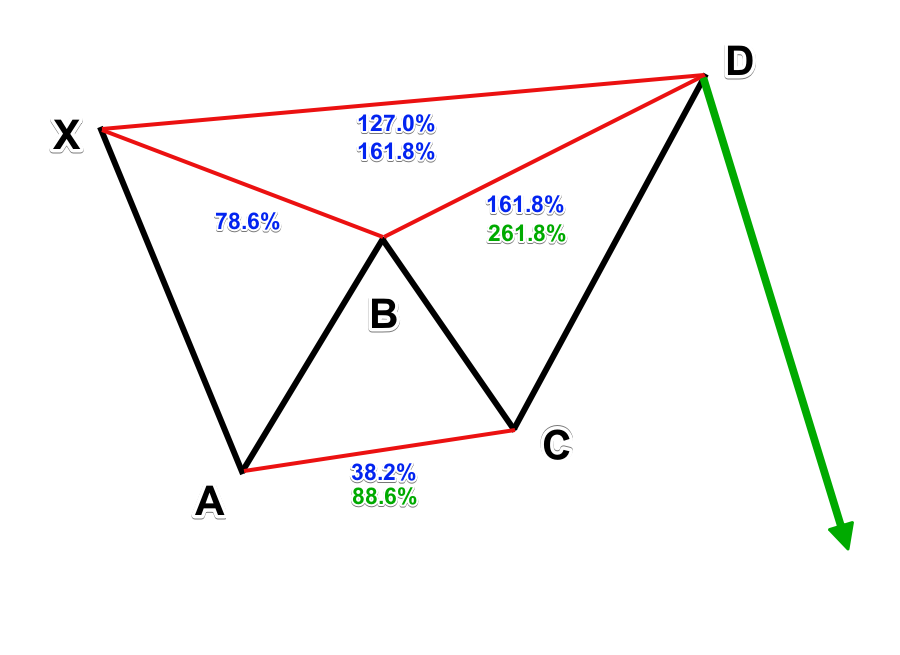

Components of Butterfly Pattern

Butterfly candlestick pattern do main components par consist karta hai:

Wings: Yeh pattern ke do sides hain jo ke almost symmetric hoti hain. Yeh wings high volatility ke indicators hain.

Body: Center mein ek small body hoti hai jo ke trend reversal indicate karti hai.

Bullish Butterfly Pattern

Formation

Bullish butterfly pattern tab banta hai jab market mein bearish trend ho aur phir ek reversal aata hai. Yeh pattern char legs par consist karta hai:

XA Leg: Pehla move downward hota hai.

AB Leg: Market uptrend mein small correction karta hai.

BC Leg: Downtrend phir se start hota hai, jo ke pehle downward move se chota hota hai.

CD Leg: Last leg ek significant upward move hoti hai, jo ke market reversal ko indicate karta hai.

Identification

Bullish butterfly pattern ko identify karne ke liye Fibonacci retracement levels use kiye jate hain. Yeh levels kuch is tarah hain:

AB Leg: XA leg ka 78.6% retracement.

BC Leg: AB leg ka 38.2% to 88.6% retracement.

CD Leg: BC leg ka 161.8% to 224% extension.

Bearish Butterfly Pattern

Formation

Bearish butterfly pattern tab banta hai jab market mein bullish trend ho aur phir ek reversal aata hai. Yeh pattern bhi char legs par consist karta hai:

XA Leg: Pehla move upward hota hai.

AB Leg: Market downtrend mein small correction karta hai.

BC Leg: Uptrend phir se start hota hai, jo ke pehle upward move se chota hota hai.

CD Leg: Last leg ek significant downward move hoti hai, jo ke market reversal ko indicate karta hai.

Identification

Bearish butterfly pattern ko bhi Fibonacci retracement levels se identify kiya jata hai. Yeh levels kuch is tarah hain:

AB Leg: XA leg ka 78.6% retracement.

BC Leg: AB leg ka 38.2% to 88.6% retracement.

CD Leg: BC leg ka 161.8% to 224% extension.

Trading Strategy

Entry Point

Jab bullish butterfly pattern form ho, to CD leg complete hone par buy entry le sakte hain. Wahan se market ka uptrend start hone ke chances hote hain. Isi tarah, bearish butterfly pattern ke case mein, CD leg complete hone par sell entry le sakte hain kyunki wahan se downtrend start hone ke chances hote hain.

Stop Loss

Stop loss levels set karna zaroori hai taake unexpected market moves se protection mil sake. Bullish butterfly pattern ke case mein, stop loss CD leg ke neeche set kar sakte hain. Bearish butterfly pattern ke case mein, stop loss CD leg ke upar set kar sakte hain.

Take Profit

Take profit levels bhi pre-determined hote hain. Fibonacci extensions ka use karke yeh levels set kiye jate hain. Bullish pattern mein, pehla target 61.8% extension ho sakta hai aur doosra target 100% extension. Bearish pattern mein bhi similar levels use kiye jate hain.

Practical Application

Example

Ek practical example le kar is pattern ko samajhna aasaan hota hai. Agar market mein bearish trend chal raha ho aur ek bullish butterfly pattern form ho raha ho, to trader pehle Fibonacci retracement levels ko check karega. Agar sab levels match karte hain, to CD leg complete hone par buy order place karega.

Tools

Different trading platforms par Fibonacci tools available hote hain jo is pattern ko identify karne mein madad karte hain. TradingView aur MetaTrader jaise platforms isme kaafi useful hain.

Advantages

Reversal Indication: Yeh pattern market reversals ko accurately indicate karta hai.

Risk Management: Is pattern ka use karke proper risk management techniques apply ki ja sakti hain.

Profit Potential: Market ke major moves ko capture karne mein yeh pattern kaafi effective hota hai.

Disadvantages

Complexity: Is pattern ko accurately identify karna thoda mushkil hota hai, especially beginners ke liye.

False Signals: Kabhi kabhi market mein false signals bhi generate ho sakte hain jo loss ka sabab ban sakte hain.

Conclusion

Butterfly candlestick pattern ek valuable tool hai forex traders ke liye. Is pattern ko samajhne aur accurately apply karne se trading strategies enhance ho sakti hain. Fibonacci retracement levels aur proper risk management techniques ka use karke yeh pattern kaafi profitable trading opportunities provide kar sakta hai..

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#10 Collapse

Butterfly candlestick pattern

The Butterfly candlestick pattern is a technical analysis tool used in trading to predict potential price reversals in financial markets. Here’s a brief explanation of the Butterfly candlestick pattern in Roman Urdu:

**Butterfly Candlestick Pattern:**

Butterfly candlestick pattern aik advanced harmonic pattern hai jo price reversals ko identify karne ke liye use hota hai. Yeh pattern chaar price swings se mil kar banta hai: X-A, A-B, B-C, aur C-D. Pattern ki pehchan ke liye Fibonacci retracement aur extension levels ka istemal hota hai.

**Key Points:**

1. **X-A:** Pehla swing jo kisi bhi direction mein ho sakta hai.

2. **A-B:** X-A ka 78.6% retracement.

3. **B-C:** A-B ka 38.2% se 88.6% retracement.

4. **C-D:** X-A ka 127.2% se 161.8% extension.

Butterfly pattern bullish aur bearish dono ho sakta hai. Bullish Butterfly price reversal ka indicate karta hai neeche se upar ki taraf, aur Bearish Butterfly ooper se neeche ki taraf.

**Istemaal:**

1. **Pattern Pehchan:** Pehle Butterfly pattern ko identify karen. Fibonacci levels ka istemal karke ensure karen ke pattern theek ban raha hai.

2. **Entry Point:** Jab pattern complete ho jaye (C-D point), wahan entry karen.

3. **Stop Loss:** Last swing (C point) ke thoda neeche stop loss lagayen.

4. **Target:** X-A ka 61.8% se 78.6% retracement ko target banaen.

**Example:**

Agar price X-A move karta hai $100 se $150 (50 points up), toh A-B move $150 se $120 (78.6% retracement), B-C move $120 se $135 (38.2% to 88.6% retracement), aur C-D move $135 se $80 (127.2% to 161.8% extension) hona chahiye.

Yeh pattern zaroori nahi ke har baar accurate ho, isliye risk management ka khayal rakhen aur doosri technical indicators ka bhi istemal kaskta h

This explanation should give you a good understanding of the Butterfly candlestick pattern and its application in trading, described in

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 07:35 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим