Trading me pending order se kea muraad ha ???

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

TRADING ME PENDING ORDER SE KEA MURAAD HA ??? TRADING ME PENDING ORDER OVERVIEW:- Zair iltiwa order par amal-dar-aamad ki aik qisam hai jahan aap brokr ko kuch sharait poori honay par baad mein koi tijarat kholnay ki hadaayat karte hain. Yeh orders maqbool market orders se mukhtalif hain jahan tijarat fori tor par injaam di jati hai.Uy ya promote ki education hai Akshar Aisi situation Paida hoti hai Jo Kisi particular asset ko current fee constant with buy ya promote instance ke Taur in line with Kisi asset ki charge useful resource degree ke kareeb hai lekin trade ko open karne ke liye bahut jaldi hoti hai Ek customers subsequent target pahunchne ke liye fee ke resistance stage ke guzarne ka wait kar rahe hain Iske alava sometimes marketplace volatility ka Shikar hoti hai to vah customers ke liye Sab Se zyada earnings desk Nahin ho sakti hain ek pen pending order banane ke liye ha.TRADING ME PENDING ORDER PROCESS:-- Ofit bhi hota hai agar traders sparkling thoughts and morning ke time paintings karte hain t to kamyabi ho sakti hai investor ko marketplace mein enter hone se pahle sabse pahle marketplace ko analysis karna chahie aur Apna Ek actual account banana chahie Uske horrible aap a achievement buyers ho sakte hain pending order ka determin pullback Se Kiya jata hai marketplace ki motion ko dekhna chahie Ek dealers Agar Forex change important Kisi fee ka apprehend Karte Hain agents ko foreign exchange ke pair ko follow karna chahie pending order mein time body increase karna chahie pending order ki type hoti hai technical indicator and oscillator indicator hai demo account strong studying hoti hai jiss mein practic ki jati.

TRADING ME PENDING ORDER ME BUY OR SELL LIMIT:- Ding order sy hio trad leg gy tu okay market ko evaluation kia nhe jata hai tu ek traders kabi b kamyabi nhe pata hain foreign exchange shopping for and promoting complete danger wala busniess hain jis principal oder located karne adequate liye kafi wait karna parta hian pending oder placed karne ok liye hum market number one oder set karte dete hain jaab market waha tak aati hain tu oder confrim ho jata hain is liye pending oder adequate liye market ko analysis karna have to hain keh ap sath sath trad len gy tu ge okay liye market ko watch karna b ought to hain qk jaab tak koi strong phase nhe mil jati hain tu kabi b kaam nhe karna foreign exchange converting precept purchase cutoff and promote limit ok oder b hote hain jis principle ek sellers agar foreign exchange converting essential kisi price ka stand thru karte hain tu vo traders fofrex changing precept mt4 ok programming number one kafi had tak examination karte hain qk jaaab tak market ko anlaysi.

TRADING ME PENDING ORDER ME BUY OR SELL LIMIT:- Ding order sy hio trad leg gy tu okay market ko evaluation kia nhe jata hai tu ek traders kabi b kamyabi nhe pata hain foreign exchange shopping for and promoting complete danger wala busniess hain jis principal oder located karne adequate liye kafi wait karna parta hian pending oder placed karne ok liye hum market number one oder set karte dete hain jaab market waha tak aati hain tu oder confrim ho jata hain is liye pending oder adequate liye market ko analysis karna have to hain keh ap sath sath trad len gy tu ge okay liye market ko watch karna b ought to hain qk jaab tak koi strong phase nhe mil jati hain tu kabi b kaam nhe karna foreign exchange converting precept purchase cutoff and promote limit ok oder b hote hain jis principle ek sellers agar foreign exchange converting essential kisi price ka stand thru karte hain tu vo traders fofrex changing precept mt4 ok programming number one kafi had tak examination karte hain qk jaaab tak market ko anlaysi. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamu Alaikum Dosto!

Forex Trading Market Orders

A market order ek darkhwast hai ek broker ko ek trade foran sab se behtar keemat par kholne ke liye. Ye jald az jald mojooda market keemat par amal hoti hai, jo mojooda market keemat par amal hoti hai, jo ek bari miqdar mein bhari jaane ki buland imkan faraham karti hai. Market orders foran trade execution ke liye istemal hoti hain, lekin un par gap risks ka samna ho sakta hai aur market liquidity ki zaroorat hoti hai.

Dusri taraf, a limit order ek darkhwast hai ek broker ko aik khaas keemat ke satah par trade karna jo aam tor par mojooda market ke qeemat se behtar hoti hai. Traders woh zyada se zyada keemat set karte hain jis par woh khareedna chahte hain ya woh kam se kam keemat set karte hain jis par woh bechna chahte hain. Limit orders trade ke daam par control faraham karte hain aur risk ko manage karne aur dakhli aur kharji nukaat ko behtar banana ke liye faida mand hote hain. Magar agar market mukarrar keemat ke satah tak nahi pohanchti to woh pura nahi hota.

Company jo order qubool karti hai us ka iraada hota hai ke woh ise 'fill' kar de phir yeh khatam ho jata hai. Orders jo nahi band hue hote hain unhe khule hue orders kaha jata hai. Aam tor par, orders dene ke liye phone par ya online diye jate hain.

Orders un ke muddat tak khule rehne ki muddat aur kis tarah se fill hone chahiye ke shartein ki mukhtalif hoti hain. Market orders, masalan, aap ke broker se assets ko behtar keemat par din ke ikhtitam tak trade karne ki darkhwast karte hain. Stop aur limit orders assets ko khareedne ya bechne ke liye mukarrar keemat ki shartein kehte hain.

Forex market orders ek darkhwast ko refer karte hain jo ek broker ko ek mojooda market keemat par ek currency pair khareedne ya bechne ke liye dete hain. Traders apne trades ko effectively manage karne ke liye alag alag qisam ke forex orders ka istemal karte hain. Mulk main forex orders ke asal types shamil hain:- Market Order: Ye sab se bunyadi order type hai jahan ek trader foran mojooda keemat par market mein dakhil hota hai. Ye scalpers aur day traders ke liye jaldi se market mein dakhil hone aur nikalne ke liye aam tor par istemal hota hai.

- Entry Order: Ye orders mojooda market prices se door set kiye jate hain aur jab keemat mukarrar satah tak pohanchti hai to amal hota hai. Ye traders ke liye faida mand hote hain jo market ko hamesha nahi nazar rakhte hain.

- Stop Orders: Stop orders khaas keemat ke satah par trade dakhil ya nikalne ke liye istemal hoti hain. Ye trade kholne ke liye stop orders aur trade band karne ke liye stop orders shamil hain, jo traders ko risk management tools faraham karte hain.

- Limit Orders: Limit orders mojooda market keemat se neeche kharidne ya us se ooper bechnay ke liye rakhe jate hain. Ye traders ko specify karte hain ke woh trade mein dakhil ya nikalne ke liye keemat kaun si hai, jo execution ke daam par zyada control faraham karte hain.

Forex Trading Open Order

"Open order" ka matlab hai ki ek trader ne market me ek specific currency pair ke liye trading order place kiya hai, lekin uska execution nahi hua hai. Yani, "Open order" ek pending order hota hai jise market me execute hone ke liye wait karna hota hai.

Open order place karne se pehle traders ko kuch important factors ko consider karna hota hai. In factors me se sabse important hai market analysis. Traders ko market ke movement ko samajhna aur analyze karna hota hai, aur phir uske hisaab se apni trades ko place karna hota hai. Traders ke pass kai tarah ke tools hote hain jaise ki technical indicators, price action analysis, news analysis, etc. Jo unhe market me successful trading ke liye help karte hain.

Open Order me Take Profit aur Stop Loss Zarori hai

Traders ko apni trades ke liye stop loss aur take profit level ko bhi set karna hota hai. Stop loss level ek specific price level hota hai jahan trader apni trade ko close karne ke liye place karta hai, agar market us level ko touch karta hai. Take profit level ek level hota hai jahan trader apni trade ko close karne ke liye place karta hai, agar market us level ko touch karta hai.

Open order place karne se pehle traders ko apni trading plan ko sahi tarike se define karna hota hai. Traders ko apni trading strategy ko sahi tarike se set karna hota hai aur phir uske hisaab se apni trades ko place karna hota hai. Agar traders apni trading plan ko sahi tarike se set karenge, to unhe market me successful trading ke liye help milti hai.

Open Order k Monetaoring Zarori hai

Open order place karne ke baad traders ko unke orders ko monitor karna zaruri hota hai. Market me price movement ko monitor karne se traders ko apni trades ke liye sahi tarike se management karne me help milti hai. Traders ko apni trades ko manage karne ke liye apne stop loss aur take profit levels ko regularly update karna hota hai.

Open order place karne se pehle traders ko market analysis aur trading plan ko define karna hota hai. Traders ko apne orders ko monitor karne ke liye ready rehna hota hai aur apni trades ko management karne ke liye sahi tarike se set karna hota hai. Open order ka use karke traders market me apni trades ke liye flexibility rakhte hain aur unhe apni trades ko place karne ke liye time bhi dete hain.

Open order ka use karke traders ko market me apni trades ke liye flexibility mil jati hai, jisse woh apni trades ko sahi tarike se manage kar sakte hain. Open order place karne se pehle traders ko apni trades ke liye sahi tarike se analysis karna hota hai aur phir uske hisaab se order place karna hota hai. Traders ko apni trades ko monitor karna aur uske hisaab se management karna bhi zaruri hota hai.

Open Order Cautiousions

Open order place karne ka sabse bada benefit yeh hai ki traders ko apni trades ke liye flexibility aur time mil jata hai. Traders apni trades ke liye order place karke bhi dusre kaam kar sakte hain aur phir market me price movement ko monitor karte hue apni trades ko manage kar sakte hain.

Lekin open order place karne se pehle traders ko kuch risks bhi consider karna hota hai. Agar market me price movement ki unexpected change ho jati hai, to traders ke open order execution me problems ho sakte hain. Isliye traders ko market me price movement ko constantly monitor karna hota hai aur apne trades ko sahi tarike se manage karna hota hai.

Overall, open order forex trading me ek important concept hai jo traders ko apni trades ke liye flexibility aur time deta hai. Traders ko apni trades ke liye market analysis, trading plan aur risk management ko define karne ke baad open order place karna chahiye. Open order place karne ke baad traders ko apne orders ko monitor karna aur unhe sahi tarike se management karna hota hai. Agar traders apni trades ko sahi tarike se manage karenge, to unhe market me successful trading ke liye opportunities mil sakte hain.

Pending Orders

Pending Orders Foreign Exchange Market mein bahut hi mukhtalif orders hote hain, jo ke trader apni trading strategies ke hisab se use karte hain. In orders ke zariye trader apne trades ko ek specific level pe open kar sakte hain, jis se unhein apne risk ko manage karne mein madad milti hai. Ye orders tab execute hote hain jab market mein specific price level ko touch karta hai, jiske baad trader ka order execute ho jata hai.

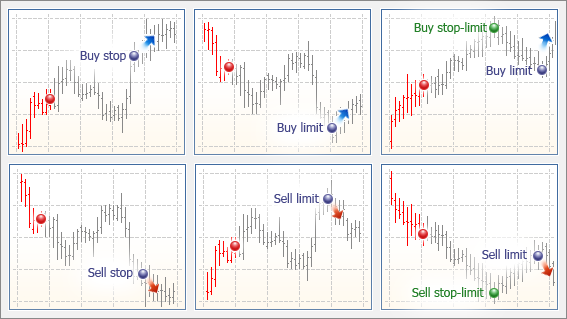

Types of Pending Orders:

- Buy Limit Order:

Buy Limit Order woh order hota hai jisse trader kisi bhi currency pair ke liye ek specific price level set karta hai, jo ke market price se neechay hota hai. Is order ke zariye trader market price ki decrease ki umeed karta hai aur usi price level pe apna trade open karta hai, jab market us level tak aaye toh order execute ho jata hai.

Sell Limit Order:

Sell Limit Order woh order hota hai jisse trader kisi bhi currency pair ke liye ek specific price level set karta hai, jo ke market price se upar hota hai. Is order ke zariye trader market price ki increase ki umeed karta hai aur usi price level pe apna trade open karta hai, jab market us level tak aaye toh order execute ho jata hai.

Buy Stop Order:

Buy Stop Order woh order hota hai jisse trader kisi bhi currency pair ke liye ek specific price level set karta hai, jo ke market price se upar hota hai. Is order ke zariye trader market price ki increase ki umeed karta hai aur usi price level pe apna trade open karta hai, jab market us level tak aaye toh order execute ho jata hai.

Sell Stop Order:

Sell Stop Order woh order hota hai jisse trader kisi bhi currency pair ke liye ek specific price level set karta hai, jo ke market price se neechay hota hai. Is order ke zariye trader market price ki decrease ki umeed karta hai aur usi price level pe apna trade open karta hai, jab market us level tak aaye toh order execute ho jata hai.

In orders ko execute karne ke liye, trader ko apne broker se apne trading platform ke zariye order place karna hota hai. Ye orders aam taur pe stop loss aur take profit ke sath use kiye jate hain, jo ke trader ke liye risk management ke liye bahut zaroori hote hain.

Is tarah ke orders ke istemal se trader apne trading strategies ko improve kar sakte hain aur market volatility aur risk ko manage kar sakte hain. Isliye, ye orders bahut important hote hain forex trading mein.

Take Profit & Stop-loss Pending Orders

Forex trading mein, "Take Profit" aur "Stop Loss" do ahem qisam ke pending orders hain jo traders ko un ke positions ko manage karne aur nuqsaan ko kam karte hue faida zyada karne mein madad karte hain. Ye orders trading platforms dwara khud ba khud amal mein aate hain, jo traders ko khas keemat satah tay karnay ki ijazat dete hain jahan trade ko band karna hai, ya to faida mukammal karna hai ya nuqsaan ko mehdood karna hai.

Key Points- Stop Loss aur Take Profit orders Forex trading mein risk ko manage karne aur faida mukammal karne ke liye istemal hotay hain.

- Stop Loss orders trader ke khilaf chalne par trade ko khud ba khud band karne ke liye istemal hotay hain takay potential nuqsaan ko mehdood kiya ja sake.

- Take Profit orders trader ke liye istemal hotay hain takay trade aik mukarar munafa ke darje tak pohanchte hi band hojaye.

- Dono orders trading platforms dwara khud ba khud amal mein aate hain, jo traders ko khas keemat satah tay karnay ki ijazat dete hain jahan trade ko band karna hai.

- Ye orders Forex market mein ahem hain, jahan market ke haalaat tezi se tabdeel ho sakte hain, aur traders ko apne positions ko mehfooz karne ke liye jaldi se tabdeel ho sakte hain.

- Take Profit (TP)

Aik Take Profit order us waqt trade ko band karne ke liye tayyar kiya jata hai jab market aik khaas keemat satah tak pohanchti hai, faida mukammal karte hue. Ye order aik Stop Loss order ka ulta hota hai. Aam tor par is ka istemal nuqsaan ko mehdood karne ke liye kiya jata hai ke kisi mukarar darje ki munafa ko hasil karne ke baad trade ko band karne ke liye aik maqsood keemat satah tay karte hue. Masalan, agar aik trader long position mein dakhil hota hai aur market keemat aik darja tak pohanch jati hai jahan woh apna faida mukammal karna chahte hain, to woh us satah par aik Take Profit order tay karsakta hai. Jab market keemat us satah par pohanchti hai, to trade khud ba khud band ho jayegi, aur trader apna faida hasil kar lega. - Stop Loss (SL)

A Stop Loss order us waqt trade ko band karne ke liye tayyar kiya jata hai jab market aik khaas keemat satah tak pohanchti hai, nuqsaan ko mehdood karte hue. Ye order trader ke capital ko mehfooz karne ke liye istemal kiya jata hai ke agar trade un ke khilaf chalay jaye to woh khud ba khud band hojaye. Misal ke taur par, agar aik trader long position mein dakhil hota hai aur market keemat girne lagti hai, to woh us satah par Stop Loss order tay kar sakta hai jahan woh nuqsaan qabool karne ke liye tayar hain. Jab market keemat us satah par pohanchti hai, to trade khud ba khud band ho jati hai, aur trader apna nuqsaan mehdood kar leta hai. - Stop Loss aur Take Profit ki Ahmiyat

Dono Stop Loss aur Take Profit orders Forex traders ke liye zaroori tools hain. Ye risk ko manage karne mein madad karte hain ke potential nuqsaan ko mehdood karte hain aur faida mukammal karte hain. Ye orders khaas tor par Forex market mein ahem hain, jahan market ke haalaat tezi se tabdeel ho sakte hain, aur traders ko apne positions ko mehfooz karne ke liye jaldi se tabdeel ho sakte hain. In orders ko tay karte hue, traders ye ensure kar sakte hain ke woh zyada se zyada risk lenge nahi aur ke woh munafa faraham kar sakte hain.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#4 Collapse

### Trading Mein Pending Order Se Kya Muraad Hai?

Trading mein pending orders ek aisi strategy hai jo traders ko market ke specific price levels par trade execute karne ki suvidha deti hai, bina manually monitor kiye hue. Yeh orders market ki conditions aur specific price targets ke sath align hote hain aur trading decisions ko automate karte hain. Is post mein hum pending orders ki types, benefits, aur use cases ko detail mein discuss karenge.

**1. Pending Order Kya Hai:**

Pending order ek aisa trading order hai jo market ke specific price level par execute hota hai jab price us level ko reach karti hai. Yeh order traders ko market conditions ke sath align karke trades place karne mein madad karta hai, bina real-time monitoring ke. Pending orders ko set karke, traders apne trading strategies ko automate kar sakte hain aur market opportunities ko miss nahi karte.

**2. Pending Orders Ki Types:**

**a. Buy Limit Order:**

Buy limit order tab place kiya jata hai jab trader market price se lower price par buy karna chahte hain. Yeh order tab execute hota hai jab market price specified limit price ya usse lower level tak reach karti hai. Buy limit orders trend reversal ya retracement points ke liye useful hote hain.

**b. Sell Limit Order:**

Sell limit order tab place kiya jata hai jab trader market price se higher price par sell karna chahte hain. Yeh order tab execute hota hai jab market price specified limit price ya usse higher level tak reach karti hai. Sell limit orders overbought conditions ke liye use hote hain.

**c. Buy Stop Order:**

Buy stop order tab place kiya jata hai jab trader market price se higher price par buy karna chahte hain, usually breakout ke liye. Yeh order tab execute hota hai jab market price specified stop price ya usse higher level tak reach karti hai. Buy stop orders strong bullish trends ke liye effective hote hain.

**d. Sell Stop Order:**

Sell stop order tab place kiya jata hai jab trader market price se lower price par sell karna chahte hain, usually breakdown ke liye. Yeh order tab execute hota hai jab market price specified stop price ya usse lower level tak reach karti hai. Sell stop orders bearish trends ke liye useful hote hain.

**3. Pending Orders Ke Faide:**

**a. Automation:**

Pending orders trading ko automate karte hain, jisse traders ko continuously market monitor karne ki zaroorat nahi hoti. Orders automatically execute hote hain jab market price specific levels ko reach karti hai.

**b. Precision:**

Pending orders se traders apne entry aur exit points ko precise manner mein define kar sakte hain. Yeh order types specific price levels ko target karte hain aur trading decisions ko more accurate banate hain.

**c. Risk Management:**

Pending orders risk management ko improve karte hain. Traders stop-loss aur take-profit levels ko set karke apne risk aur reward ratios ko control kar sakte hain. Yeh strategy potential losses ko minimize aur profits ko lock karne mein madad karti hai.

**4. Pending Orders Ke Use Cases:**

**a. Breakouts:**

Breakout trading strategies mein, buy stop aur sell stop orders use kiye jate hain. Traders market ke breakout levels ko target karke positions open karte hain.

**b. Pullbacks:**

Pullback trading strategies mein, buy limit aur sell limit orders use kiye jate hain. Traders market ke pullback levels ko target karke favorable prices par positions open karte hain.

**c. News Trading:**

Pending orders news trading mein bhi use hote hain. Traders economic reports aur news events ke baad market ke reaction ko anticipate karke pending orders place karte hain.

**5. Pending Orders Ke Limitations:**

**a. Slippage:**

Market volatility ke dauran pending orders slippage face kar sakte hain. Yeh tab hota hai jab price rapidly move karti hai aur order specified price par execute nahi hota.

**b. False Triggers:**

Kabhi-kabhi pending orders false triggers generate kar sakte hain, especially jab market short-term fluctuations ko show karta hai. Yeh orders unnecessary trades ko trigger kar sakte hain.

**Conclusion:**

Pending orders trading mein automation, precision, aur risk management ko enhance karte hain. Yeh orders traders ko market ke specific price levels par trades execute karne ki suvidha dete hain aur continuous monitoring ki zaroorat ko eliminate karte hain. Buy limit, sell limit, buy stop, aur sell stop orders ki understanding aur effective use se traders apni trading strategies ko streamline kar sakte hain aur market opportunities ko maximize kar sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 05:58 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим