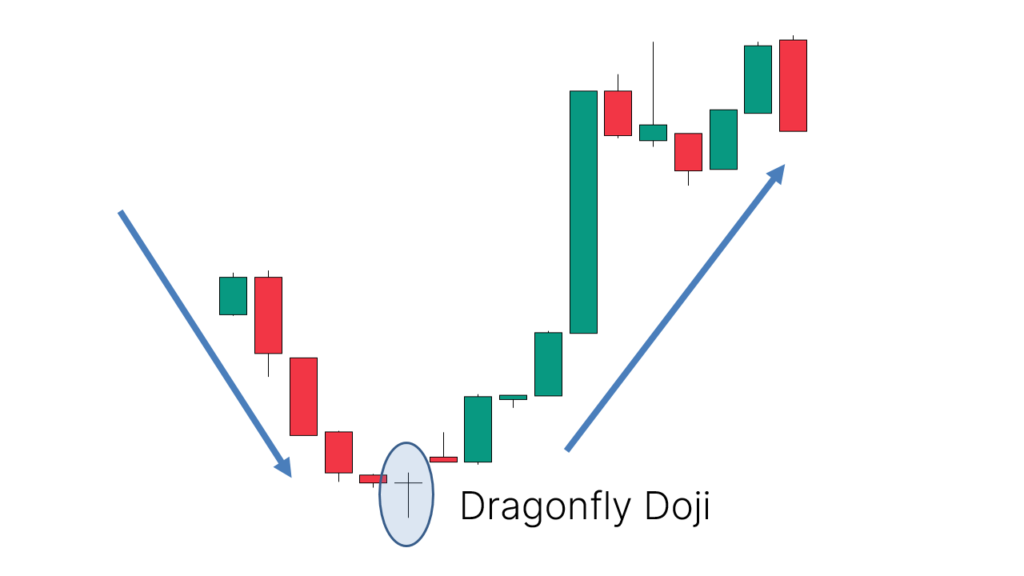

Dragonfly doji Candleap Dragonfly doji Candleap sy open hoti hai or b negative hoti hai. is he tarha third or fourth flame b negative banti hain or ye market ko mazeed low ley jati hai or har light ka shutting point prevoius candle sy low hota hai. Es tarha fifth flame market mama up hole sy banti hai or ye second candle k hole ko fill karny mama kamyab ho jati hai. Ye fifth light lengthy or bullish hoti hai.Trading Technique with Dragonfly Doji Candle PatternIs ki procedure ki baat ki jay to is ka Kay market me affirm ho jany sy ye hota hai k market my bullish pattern me wapas aa gai hai aur dealer yaha standard purchase ki exchange open kar k acha benefit hasil kar sakty hain. is design ko use kar k wo stop los ko b use kar sakty hain or stop misfortune k lae es design ka absolute bottom picked kar sakty hain. Dragonfly Doji Candle Example Specialized AnalysisYe design fruition standard ye data deta hai k market mama bullish pattern wapas a gya hai aur market wapas bull mama jany k lae prepared hai. Agr broker en designs ko achi tarha use kary to ye design eski life ko badal sakty hain hit market ceaselessly upswing primary development kerty huey large development kerti hai tou aesy principal hamari koshish hoti hai ky ham bari development ki inversion per exchange open ker lain tou market punch invert heading fundamental kuch Dragonfly doji Flame Dragonfly doji Candleap sy open hoti hai or b negative hoti hai. is he tarha third or fourth fire b negative banti hain or ye market ko mazeed low ley jati hai or har light ka closing point prevoius candle sy low hota hai. Es tarha fifth candle market mom up opening sy banti hai or ye second light k opening ko fill karny mother kamyab ho jati hai. Ye fifth light lengthy or bullish hoti hai.Trading Strategy with Dragonfly Doji Flame PatternIs ki procedure ki baat ki jay to is ka Kay market me assert ho jany sy ye hota hai k market my bullish example me wapas aa gai hai aur representative yaha standard buy ki trade open kar k acha benefit hasil kar sakty hain. is plan ko use kar k wo stop los ko b use kar sakty hain or stop disaster k lae es plan ka outright base picked kar sakty hain. Dragonfly Doji Light Model Specific AnalysisYe configuration finish standard ye information deta hai k market mother bullish example wapas a gya hai aur market wapas bull mom jany k lae arranged hai. Agr intermediary en plans ko achi tarha use kary to ye plan eski life ko badal sakty hain punch market reliably upswing head advancement kerty huey immense improvement kerti hai tou aesy essential hamari koshish hoti hai ky ham bari improvement ki reversal per trade open ker lain tou market jab pivot course principal kuchDragonfly doji Candle\l genrate karti hai, jiss standard fire hai, jiss k lower side standard aik long shadow hota hai. Light ka open, close aur over the top expense same point standard hota hai. Punch k candle k upper side standard koi shadow nahi hona chaheye, lekin agara banta bhi hai, to bohut ziada gigantic size essential nahi hona chaheye, jiss se light ki formate tabdeel hone ka hadshaDragonfly doji candle aikmarket principal assertion k baad area ki ja sakti hai. Fire ka long time span head hona zarori hai, hit k confirmation candle ak lazmi bullish certifiable body essential hona chaheye, punch k sath bullish light ka dragonfly doji candle k upper standard bhi close honi chaheye. Ye single flame configuration hone ki waja se pointer se bhi design insistence lena zarori hai, jaise RSI, MACD, CCI marker aur stochastic oscillator standard worth oversold zone central hona chaheye. Fire k baad negative light banne ki sorat chief trade segment nahi karni chaheye. Fire standard Stop Disaster sab se top position ya light k minimal expense jo k treoji candle aik bagher authentic body waligenuine body wali single fire plan hai, jo k lower side standard aik lamba shadow ya saya rakhti hai. Fire k baane ki pechay ki mind research kuch distant hoti hai, k punch bhi aik meeting ya aik disturbance k dowran costs pehle diving improvement karne k baad wapis apne open expense k ooper a kar close ho jati hai, jiss se candle k lower side standard aik lamba shadow ya saya blacklist jata hai, jab k light ka upper side same open aur close k barabar hota hai,Ye candle run of the mill cost chart standard ziada moasar sabit nahi hoti hai, lekin flame ka design k base standard minimal expense locale essential banne standard bullish example reversal ka kaam karti hai. Dragonfly doji flame aik market head certification k baad area ki ja sakti hai. Candle ka long time span essential hona zarori hai, jab k certification light ak lazmi bullish real body principal hona chaheye, punch k sath bullish fire ka dragonfly doji candle k upper standard bhi close honi chaheye. Ye single fire configuration hone ki waja se marker se bhi design insistence lena zarori hai, jaise RSI, MACD, CCI pointer aur stochastic oscillator standard worth oversold zone head hona chaheye. Flame k baad negative light banne ki sorat chief trade entry nahi karni chaheye. Flame standard Stop Hardship sab se top position ya candle k minimal expense jo k treoji candle aik bagher certifiable body waligenuine body wali single light model hai, jo k lower side standard aik lamba shadow ya saya rakhti hai. Light k baane ki pechay ki cerebrum research kuch distant hoti hai, k hit bhi aik meeting ya aik upheaval k dowran costs pehle dropping improvement karne k baad wapis apne open expense k ooper a kar close ho jati hai,

`

X

new posts

-

#16 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#17 Collapse

Dragonfly doji Candle ap sy open hoti hai or b negative hoti hai. is he tarha third or fourth candle b negative banti hain or ye market ko mazeed low ley jati hai or har candle ka shutting point prevoius light sy low hota hai. Es tarha fifth flame market mama up hole sy banti hai or ye second candle k hole ko fill karny mama kamyab ho jati hai. Ye fifth candle long or bullish hoti hai.Trading Technique with Dragonfly Doji Candle PatternIs ki procedure ki baat ki jay to is ka Kay market me affirm ho jany sy ye hota hai k market my bullish pattern me wapas aa gai hai aur dealer yaha standard purchase ki exchange open kar k acha benefit hasil kar sakty hain. is design ko use kar k wo stop los ko b use kar sakty hain or stop misfortune k lae es design ka absolute bottom picked kar sakty hain. Dragonfly Doji Candle Example Specialized AnalysisYe design finishing standard ye data deta hai k market mama bullish pattern wapas a gya hai aur market wapas bull mama jany k lae prepared hai. Agr merchant en designs ko achi tarha use kary to ye design eski life ko badal sakty hain hit market consistently upswing principal development kerty huey large development kerti hai tou aesy fundamental hamari koshish hoti hai ky ham bari development ki inversion per exchange open ker lain tou market punch turn around heading primary kuch Dragonfly doji Candle \ l genrate karti hai, jiss standard flame hai, jiss k lower side standard aik long shadow hota hai. Light ka open, close aur exorbitant cost same point standard hota hai. Poke k flame k upper side standard koi shadow nahi hona chaheye, lekin agara banta bhi hai, to bohut ziada enormous size fundamental nahi hona chaheye, jiss se candle ki formate tabdeel sharpen ka hadsha Dragonfly doji candle aik market principal affirmation k baad section ki ja sakti hai. Candle ka long time period primary hona zarori hai, punch k affirmation light ak lazmi bullish genuine body fundamental hona chaheye, hit k sath bullish candle ka dragonfly doji flame k upper standard bhi close honi chaheye. Ye single flame design sharpen ki waja se marker se bhi pattern affirmation lena zarori hai, jaise RSI, MACD, CCI pointer aur stochastic oscillator standard worth oversold zone fundamental hona chaheye. Light k baad negative flame banne ki sorat principal exchange passage nahi karni chaheye. Light standard Stop Misfortune sab se top position ya flame k low cost jo k treoji candle aik bagher genuine body wali genuine body wali single flame design hai, jo k lower side standard aik lamba shadow ya saya rakhti hai. Candle k baane ki pechay ki brain research kuch far off hoti hai, k hit bhi aik meeting ya aik noise k dowran costs pehle descending development karne k baad wapis apne open cost k ooper a kar close ho jati hai, jiss se light k lower side standard aik lamba shadow ya saya boycott jata hai, punch k flame ka upper side same open aur close k barabar hota hai,Ye candle typical cost graph standard ziada moasar sabit nahi hoti hai, lekin candle ka pattern k base standard low cost region principal banne standard bullish pattern inversion ka kaam karti hai. -

#18 Collapse

: Dragonfly doji Candle I pehchan karna chhaty hian to apko chhiay kay sab sat phly usy dekhen kay kab bana hy yeh design aor Homing Pigeon candle design ki pehchan merchants candle outline examination se kar sakte hain. Is design ko perceive karne ke liye, brokers ko ek negative flame ke baad ek little body bullish candle search karna hota hai, jiske open cost pehle light ke low cost ke equivalent ya usse kam hota hai aur close cost pehle candle ke mid-point ke above hota hai.Homing pigeon design ko pehchanne ke liye, dealers ko dojis, hammers, turning tops, bullish immersing aur doji star jaisi aur bhi candle designs ki information honi chahiye. Kyunki in designs ka mix homing pigeon design ke saath bhi ho sakta hai.Traders ko bhi ek aur significant point yaad rakhna chahiye ki homing pigeon design ke saath ek aur bullish candle ka affirmation bhi hona chahiye, jisse ki brokers ko passage aur leave focuses ka sahi choice lena aasaan ho jaaye. ragonfly doji Candle per letting customary fall down design se up design ki taraf pass kar rahi Hoti Hai To vahan in sync with bhi Splendid cross banta hai essentially stunning go Hamesha Hamen Up example ki signal Deta Hai jismein Ham Agar apni trading co buy mein do Karte Hain To Hamen bahut hello Achcha fayda Milta Hai Splendid pass marker ko acchi tarike se notice karne ke liye aapko data aur Data lete rehna chaheye.Each markers move past ki types hain aur dono pointers k threedifferent advances hotay hian, end pass alright pehlah level tab hota feed punch up example khatam ho raha ho aur vendors ki shopping mother top class khtam ho jay, jb k wonderful pass tab hota ha jb commercial center ka slipping example khatam ho raha ho, specialists ki selling mein top class na rahay. 2d step mein break out honay ky baad most recent prevailing fashion zahir hota ha jis mother brief moving ordinary extensive take moving regular ko go karta feed, extraordinary cross mein more prominent controlled typical longer ordinary ko peechay chor daita ha aur biting the dust pass mom sb kuch is alright impart hota roughage, third step mein current trend ziada extended ho jata feed jis mein awesome go ki waja sa ya to phenomenal strong benefit hota ha ya passing move ki waja sa mustakil disaster hota ha, is traah long stretch moving ordinary biting the dust pass alright liya resistance aur top notch pass k liay help give karta ha, achi trade alright liay major ess tarah alright suggestions ka insights hona chaiay, hamain top class alright sath kam k -

#19 Collapse

Dosto Doji Candle PatternIs ki technique ki baat ki jay to hamen maloom hona chahiye ke is ka Kay market me affirm ho jany sy ye hota hai k market mein zyada tar bullish pattern me wapas aa gai hai aur ye bhi broker yaha standard purchase ki exchange open kar k acha benefit hasil kar sakty hain. Mazeed yeh ke is design ko use kar k wo stop los ko b use kar sakty hain jo ke stop misfortune k lae es design ka absolute bottom picked kar sakty hain. Jee han dosto Dragonfly Doji Candle Example Specialized AnalysisYe design finish standard ye data deta hai k market mama bullish pattern wapas a gya hai is ke ilawa jab yeh market wapas bull mama jany k lae prepared hai. Agr dusri taraf dekha jaye tou Doji candle jo kay forex trading mein istemaal hota hai, woh ek kisam ki candlestick pattern hai isi ke sath sath jiska matlab hota hai doji. Dragon fly doji forex trading main bohat ehmiyat ka hamil hay. Hamen maloom hai ke Isy estemal karty huy traders bohat se information hasil kar sakty hain. Albata ham Doji candlestick pattern ek aisa candle hai jismein open aur close ky price ek doosre se bahut he zyada kam farq hota hai ya phir woh same ho jate hain. Jo ke aik Doji candlestick pattern mein main charr kisam ki doji candles hoti hain ab agar Standard Doji yeh aik kisam hay. Lehaza Standard doji candlestick pattern mein open mazeed is mein agar close price ek doosre se bahut kam farq hota hai ya phir woh same hoti hain. Jo ke Iski shakal aik wasti lakeer ya line ya cross ki he tarah ki hoti hai. -

#20 Collapse

ap sy open hoti hai or b negative hoti hai. is he tarha third or fourth light b negative banti hain or ye market ko mazeed low ley jati hai or har flame ka closing point prevoius candle sy low hota hai. Es tarha fifth light market mom up opening sy banti hai or ye second fire k opening ko fill karny mother kamyab ho jati hai. Ye fifth light lengthy or bullish hoti hai.Trading Strategy with Dragonfly Doji Flame PatternIs ki procedure ki baat ki jay to is ka Kay market me insist ho jany sy ye hota hai k market my bullish example me wapas aa gai hai aur specialist yaha standard buy ki trade open kar k acha benefit hasil kar sakty hain. is plan ko use kar k wo stop los ko b use kar sakty hain or stop setback k lae es plan ka outright base picked kar sakty hain. Dragonfly Doji Flame Model Specific AnalysisYe plan fulfillment standard ye information deta hai k market mom bullish example wapas a gya hai aur market wapas bull mom jany k lae arranged hai. Agr representative en plans ko achi tarha use kary to ye plan eski life ko badal sakty hain punch market reliably upswing head improvement kerty huey huge advancement kerti hai tou aesy crucial hamari koshish hoti hai ky ham bari advancement ki reversal per trade open ker lain tou market hit upset course essential kuch Dragonfly doji Light \l genrate karti hai, jiss standard fire hai, jiss k lower side standard aik long shadow hota hai. Fire ka open, close aur extreme expense same point standard hota hai. Hit k candle k upper side standard koi shadow nahi hona chaheye, lekin agara banta bhi hai, to bohut ziada tremendous size essential nahi hona chaheye, jiss se light ki formate tabdeel hone ka hadshaDragonfly doji flame aikmarket essential attestation k baad area ki ja sakti hai. Light ka long time span essential hona zarori hai, jab k attestation candle ak lazmi bullish certified body head hona chaheye, punch k sath bullish candle ka dragonfly doji fire k upper standard bhi close honi chaheye. Ye single light model hone ki waja se pointer se bhi design assertion lena zarori hai, jaise RSI, MACD, CCI marker aur stochastic oscillator standard worth oversold zone major hona chaheye. Candle k baad negative light banne ki sorat essential trade entry nahi karni chaheye. Light standard Stop Mishap sab se top position ya candle k minimal expense jo k treoji candle aik bagher veritable body waligenuine body wali single fire plan hai, jo k lower side standard aik lamba shadow ya saya rakhti hai. Fire k baane ki pechay ki cerebrum science kuch distant hoti hai, k punch bhi aik meeting ya aik uproar k dowran costs pehle sliding improvement karne k baad wapis apne open expense k ooper a kar close ho jati hai, jiss se light k lower side standard aik lamba shadow ya saya blacklist jata hai, jab k flame ka upper side same open aur close k barabar hota hai,Ye candle conventional expense diagram standard ziada moasar sabit nahi hoti hai, lekin candle ka design k base standard minimal expense district central banne standard bullish example reversal ka kaam karti hai. -

#21 Collapse

Dragonfly Doji candlestick pattern, ek single candlestick pattern hai jo technical analysis mein use hota hai. Is pattern mein, candlestick ki upper shadow ya wick nahi hoti hai, lekin lower shadow ya wick lambi hoti hai. Iski wazahat neeche di gayi hai: Dragonfly doji Candlestick 1. Reversal Signal: Dragonfly Doji pattern bearish trend ke reversal signal provide karta hai. Ye pattern indicate karta hai ki market ke downward movement ka end ho sakta hai aur bullish movement shuru ho sakta hai. 2. Support Level: Dragonfly Doji pattern support level ka indication bhi karta hai. Jab market downward trend mein hai aur Dragonfly Doji pattern ban jata hai, toh ye indicate karta hai ki selling pressure kam ho gayi hai aur buyers support aa gaye hain. 3. Entry Point: Dragonfly Doji pattern traders ko entry point provide karta hai. Agar Dragonfly Doji pattern confirm ho jata hai, toh traders buy positions enter kar sakte hain expecting a bullish reversal. 4. Stop-loss Placement: Dragonfly Doji pattern traders ko stop-loss levels define karne mein madad karta hai. Stop-loss levels ko Dragonfly Doji pattern ke low price ke below place kiya jata hai, taki false breakout se bacha ja sake. 5. Confirmation: Dragonfly Doji pattern ki wazahat karne se traders ko market ki overall analysis aur aur indicators ka istemal karne ka mauka milta hai. Ye pattern, jab dusre technical indicators aur price action ke saath confirm hota hai, traders ko confidence aur conviction deta hai. Hamesha yaad rakhein ki ek candlestick pattern ki wazahat aur samajhne ke liye, uski confirmation aur context ki samajh bahut zaroori hoti hai. Isliye, ek pattern ko isolate karke nahi dekha jana chahiye, balki uske saath market ki overall analysis aur aur indicators ka bhi istemal kiya jana chahiye. -

#22 Collapse

Dragonfly Doji Candlestick forex mein ek ahem patern hai jo traders ke liye mahatvapurna hota hai. Dragonfly Doji ek candlestick pattern hota hai jo ki market ke reversal ya trend change ko darshata hai. Is pattern ko samajhna traders ke liye zaroori hota hai taake woh market ki movements ko sahi tarah se analyze kar sakein aur trading decisions ko behtar bana sakein. Dragonfly Doji pattern ek single candlestick pattern hai, jo ki Japanese candlestick charting technique ka hissa hai. Is pattern ko dekh kar traders market mein potential reversal ya trend change ko identify kar sakte hain. Dragonfly Doji candlestick ko dekh kar traders apne trading strategies ko modify kar sakte hain ya phir new trading opportunities ko explore kar sakte hain.

Structure:

Dragonfly Doji candlestick ka structure unique hota hai. Ismein ek lamba shadow hota hai jo upper side mein hota hai aur doosri taraf ek chhota sa body hota hai jo lower shadow ya wick ke bina hota hai. Iski shape ek Dragonfly ki tarah hoti hai, isiliye isey Dragonfly Doji kaha jata hai. Yeh candlestick pattern typically market mein uptrend ya downtrend ke dauraan develop hota hai.

Interpretation:

Dragonfly Doji pattern ka interpretation karna traders ke liye zaroori hota hai. Jab market mein Dragonfly Doji candlestick form hoti hai, to iska matlab hai ki buyers aur sellers ke beech mein ek struggle ho rahi hai aur market mein indecision hai. Agar Dragonfly Doji uptrend ke dauraan develop hoti hai, to yeh ek potential reversal signal ho sakti hai. Wahi agar yeh downtrend ke dauraan develop hoti hai, to yeh ek potential trend change ya reversal signal ho sakti hai.

Bullish Dragonfly Doji:

Bullish Dragonfly Doji candlestick pattern uptrend ke dauraan develop hoti hai. Is pattern mein candle ki body bahut chhoti hoti hai, jo ki buyers aur sellers ke beech mein balanced sentiment ko darshata hai. Is pattern ke upper shadow ya wick bahut lamba hota hai, jo ki high price ko indicate karta hai. Iska matlab hai ki despite initial selling pressure, buyers ne market ko control kar liya hai aur price ko upar le gaya hai. Bullish Dragonfly Doji ko dekh kar traders ko market mein bullish reversal ki sambhavna ho sakti hai.

Bearish Dragonfly Doji:

Bearish Dragonfly Doji candlestick pattern downtrend ke dauraan develop hoti hai. Is pattern mein bhi candle ki body bahut chhoti hoti hai, lekin iski upper shadow ya wick bahut lambi hoti hai, jo ki high price ko indicate karta hai. Iska matlab hai ki despite initial buying pressure, sellers ne market ko control kar liya hai aur price ko neeche le gaya hai. Bearish Dragonfly Doji ko dekh kar traders ko market mein bearish reversal ki sambhavna ho sakti hai.

Trading Strategies:

Dragonfly Doji candlestick pattern ko samajh kar traders alag alag trading strategies ka istemal kar sakte hain:- Confirmation with Other Indicators: Dragonfly Doji pattern ko confirm karne ke liye traders doosre technical indicators ka bhi istemal kar sakte hain jaise ki RSI, MACD, ya moving averages. Agar doosre indicators bhi bullish ya bearish signals indicate kar rahe hain, to yeh Dragonfly Doji ke signal ko confirm karte hain.

- Entry and Exit Points: Dragonfly Doji pattern ke signals ko samajh kar traders entry aur exit points determine kar sakte hain. Agar Bullish Dragonfly Doji uptrend ke dauraan develop hoti hai, to traders long positions enter kar sakte hain. Wahi agar Bearish Dragonfly Doji downtrend ke dauraan develop hoti hai, to traders short positions enter kar sakte hain.

- Stop Loss and Take Profit Levels: Dragonfly Doji pattern ke signals ke saath, traders ko stop loss aur take profit levels set karne chahiye. Stop loss levels ko set karke traders apne losses ko minimize kar sakte hain aur take profit levels ko set karke profits ko lock kar sakte hain.

- Risk Management: Dragonfly Doji pattern ke signals ko samajh kar traders ko apni risk management strategies ko bhi adjust karna chahiye. Proper risk management ke saath, traders apne trading losses ko control kar sakte hain aur long-term profitability achieve kar sakte hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#23 Collapse

**Dragonfly Doji Candlestick: Kya Hai Aur Yeh Trading Mein Kaise Kaam Karta Hai?**

Dragonfly Doji ek popular candlestick pattern hai jo technical analysis mein trading signals provide karta hai. Yeh pattern market ke sentiment aur potential reversals ko identify karne mein madadgar hota hai. Is post mein hum Dragonfly Doji candlestick pattern ko detail se samjhenge aur dekhenge ke yeh trading decisions ko kaise impact karta hai.

**Dragonfly Doji Ka Matlab:**

Dragonfly Doji candlestick ek specific type ka doji pattern hai jo chart par ek unique shape banata hai. Is pattern ka body chhota hota hai aur shadow (wick) neeche ki taraf lamba hota hai, jabke upper shadow ya to short hota hai ya bilkul nahi hota. Yeh pattern market ke reversal ya consolidation signals ko indicate karta hai.

**Pattern Ki Formation:**

Dragonfly Doji tab banta hai jab opening price aur closing price ek hi level par hoti hain, lekin market ne din ke doran kaafi neeche tak ki movement dekhi hoti hai. Iska matlab hai ke traders ne din ke dauran price ko neeche push kiya, magar market closing tak price ko usi level par le aaye. Yeh pattern market mein buying pressure aur bullish sentiment ka indication hota hai.

**Trading Signals Aur Implications:**

1. **Potential Reversal Signal:** Dragonfly Doji aksar downtrend ke baad banata hai aur yeh market ke potential reversal ya bullish trend ka signal hota hai. Jab yeh pattern ek downtrend ke baad banta hai, toh yeh indicate kar sakta hai ke buyers market ko support kar rahe hain aur price reversal ke liye prepare ho raha hai.

2. **Confirmation Ki Zaroorat:** Dragonfly Doji apne aap mein strong signal nahi hota. Is pattern ko confirm karne ke liye traders ko next candlestick ke direction aur market trend ko bhi dekhna chahiye. Agar Dragonfly Doji ke baad ek strong bullish candlestick form hoti hai, toh signal ki reliability aur bhi zyada barh jati hai.

3. **Support Level Identification:** Dragonfly Doji candlestick pattern market ke support levels ko identify karne mein bhi madad karta hai. Agar yeh pattern ek key support level ke paas banta hai, toh yeh support level ki strength ko reinforce kar sakta hai aur future price movements ko predict karne mein help karta hai.

**Risks Aur Limitations:**

Dragonfly Doji pattern har situation mein accurate reversal signal nahi hota. Market conditions, volume, aur other technical indicators ko bhi consider karna zaroori hota hai. Is pattern ke analysis ke liye comprehensive approach aur risk management strategy zaroori hai.

**Summary:**

Dragonfly Doji candlestick pattern technical analysis mein ek valuable tool hai jo market ke reversal signals aur potential bullish trends ko identify karne mein madad karta hai. Is pattern ko samajhna aur correctly interpret karna trading decisions mein madadgar ho sakta hai, magar hamesha iske saath additional confirmation aur risk management practices ka istemal zaroori hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 08:29 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим