What is bullish thrusting line pattern :

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

n me movement ka ishara lete hen. Ye pattren bohut hi ziada bante hen aur is ko sahi mano me samajhne ki bohut hi ziada zarorat hai. Bullish thrusting line candlestick pattern hamen strongly ishara deti hai k market ka maojoda trend downtrend ki bajaye same bullish trend main continue hoga. Aam tawar par ye pattren do dino k darmeyane hese me ziada bante hen jab market ki movement normal up down ho rahi hoti hai. Pattern do candles par mushtamil hota hai, jiss ki pehli candle aik bullish candle hoti hai, bullish candle aik normal real body wali white candle hoti hai. Bullish candle k baad aik bearish candle prices k top par gap main open ho kar ussi k real body k darmeyan se above close hoti hai. UNDERSTANDING BULLISH THRUSTING LINE PATTERNai jo black candlestick kay real body kay midpoint kay qareeb band hoti hai.pattren ko aik continuation pattren kay tor par kaam karny kay baray main socha jata hai,lekin haqeeqat main,yeh taqriban half time reversal pattren kay tor par kaam karta hai.thrusting patteren kafi aam hain,zaroori nahi k is kay natijay main qeemat barhay, aur deegar types k shawahid kay sath mil kar sab say ziyada mufeed hotay hain.aik thrusting pattern is waqt hota hai jab aik black candlestick kay baad white candlestick aati hai.white candlestick ka distance kam hota hai,lekin phir yeh black candlestick kay real body kay midpoint kay qareeb period ko band kar deta hai.Thrusting patteren ki umomi definitiin yeh hai k yeh qeematon main kami kay baad mudakhlat karny ki bulls ki koshisho ki akkasi karta hai.black candlestick ke mid point kay opar white candlestick kay thrusting main nakami say pata chalta hai k bulls main bearish kay trend ko reverse karne ki taaqat ki kami hai.is liye,kuch ka khayaal hai k thrusting pattren nichay k trend kay continuation ko zahir karta hai kyunckay bull aakhir kaar apni really ki koshish khatam kar

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamu Alaikum Dosto!Bullish Thrusting Line Candlestick PatternBullish thrusting line candlestick pattern se traders bearish trend ki same direction me movement ka ishara lete hen. Ye pattren bohut hi ziada bante hen aur is ko sahi mano me samajhne ki bohut hi ziada zarorat hai. Bullish thrusting line candlestick pattern hamen strongly ishara deti hai k market ka maojoda trend downtrend ki bajaye same bullish trend main continue hoga. Aam tawar par ye pattren do dino k darmeyane hese me ziada bante hen jab market ki movement normal up down ho rahi hoti hai. Pattern do candles par mushtamil hota hai, jiss ki pehli candle aik bullish candle hoti hai, bullish candle aik normal real body wali white candle hoti hai. Bullish candle k baad aik bearish candle prices k top par gap main open ho kar ussi k real body k darmeyan se above close hoti hai.Candles FormationBullish thrusting line candlestick pattern pehli din ki candle aik bullish candle hoti hai, lekin dosre din ki candle bearish candle k close prices par hone ki bajaye top gap main open ho kar ussi k midpoint se ooper close hoti hai. Pattern main shamil candles ki formation darjazzel tarah se hoti hai:- First Candle: Bullish thrusting line candlestick pattern ki pehli candle aik bullish candle hoti hai, jo prices k top par ya bullish trend ki continuation ka kaam karti hai, q k ye aik real body wali candle hoti hai. Ye candle white ya green color ki candle hoti hai.

- Second Candle: Bullish thrusting line candlestick pattern ki dosri candle aik real body wali bearish candle hoti hai. Ye candle open pehli candle k top par gap main hoti hai, jab k close pehli candle k darmeyan se above hoti hai. Bearish candle black ya red color main hoti hai, jo k prices k leye bearish trend reversal ki nakam koshash karti hai.

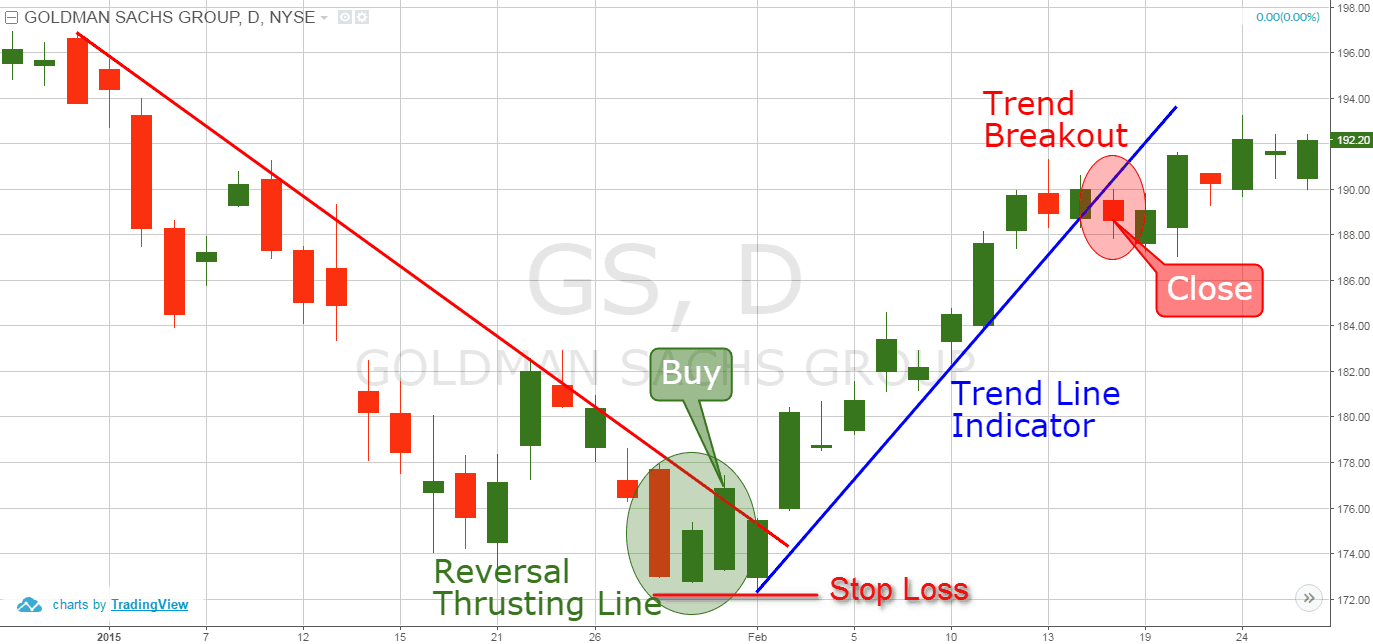

ExplainationBullish thrusting line candlestick pattern prices main aksar do dino k darmeyan main banta hai, jiss se market ki same bullish trend main jane ka ishara melta hai. Pattern ki pehli candle k baad dosri candle ussi k closing price par open hone ki bajaye top gap main open ho kar ussi k center se ooper close hoti hai. Normal ye pattern ziada tadad main bante hen, lekin top prices ya bullish trend main banne par ye prices ko bullish trend continuation ka kaam karti hai. Pattern ki pehli candle bullish aur dosri bearish candle hoti hai, jiss ki lazmi real body honi chaheye, jab k dono candles shadow samet ya shadow k bagher ho sakti hai. Pattern main dono candles aik dosre k opposite direction main open hote hen, jab k dosri candle pehli candle k midpoint se above aur close price se below close hoti hai.TradingBullish thrusting line candlestick pattern prices main traders k leye bullish trend continuation ki indication deta hai, jiss par buy ki entry ki jati hai. Pattern k baad aik confirmation candle ka hona zarori hai. Ye candle real body main bearish honi chaheye, jo k dosri candle k top main ban jati hai. Pattern k baad bearish candle banne se pattern trading invalid ho jayega, jab k CCI, RSI indicator aur stochastic oscillator par value above 50 zone main honi chaheye. Pattern ziada reliable na hone ki waja se stop loss ka istemal zarrori hai. Pattern ka Stop Loss pehli candle k bottom ya open price se two pips below par set karen. -

#4 Collapse

"Bullish Thrusting Line" ek candlestick pattern hai jo forex market mein dekha jata hai. Yeh pattern typically downtrend ke baad dekha jata hai aur bullish reversal ko suggest karta hai. **Bullish Thrusting Line Candlestick Pattern:** Bullish Thrusting Line pattern ek do candlestick se bana hota hai. Pehla candlestick ek strong bearish (downward) candlestick hota hai, aur doosra candlestick ek bullish (upward) candlestick hota hai. Doosre candlestick ka open price pehle candlestick ke close price ke qareeb hota hai, aur iska close price pehle candlestick ke body ke neeche hota hai. **Pattern Formation:** Pattern formation mein pehle candlestick ek bearish trend ko highlight karta hai. Doosre candlestick ka open price pehle candlestick ke close price ke qareeb hota hai, aur phir iska price upar move karta hai, lekin close price pehle candlestick ke body ke neeche hota hai. **Pattern Indication:** Bullish Thrusting Line pattern bullish reversal ko suggest karta hai, jahan price ka momentum badalne ki possibility hoti hai. **Benefits of Bullish Thrusting Line Pattern:**- 1. **Bullish Reversal Indication:** Bullish Thrusting Line pattern downtrend ke baad bullish reversal ko indicate karta hai, jisse traders trend change ke anticipation mein hote hain.

- 2. **Clear Signal:** Pattern ka clear structure traders ko entry aur exit points define karne mein madad karte hain.

- 1. **False Signals:** Kabhi-kabhi pattern false signals generate ho sakte hain, jahan price movement expected direction mein nahi hota.

- 2. **Market Volatility:** Market volatility ki wajah se pattern ki confirmation challenging ho sakti hai.

-

#5 Collapse

Bullish thrusting line candlestick pattern se traders bearish trend ki same direction me movement ka ishara lete hen. Ye pattren bohut hi ziada bante hen aur is ko sahi mano me samajhne ki bohut hi ziada zarorat hai. Bullish thrusting line candlestick pattern hamen strongly ishara deti hai k market ka maojoda trend downtrend ki bajaye same bullish trend main continue hoga. Aam tawar par ye pattren do dino k darmeyane hese me ziada bante hen jab market ki movement normal up down ho rahi hoti hai. Pattern do candles par mushtamil hota hai, jiss ki pehli candle aik bullish candle hoti hai, bullish candle aik normal real body wali white candle hoti hai. Bullish candle k baad aik bearish candle prices k top par gap main open ho kar ussi k real body k darmeyan se above close hoti hai.Candles FormationBullish thrusting line candlestick pattern pehli din ki candle aik bullish candle hoti hai, lekin dosre din ki candle bearish candle k close prices par hone ki bajaye top gap main open ho kar ussi k midpoint se ooper close hoti hai. Pattern main shamil candles ki formation darjazzel tarah se hoti hai:- First Candle: Bullish thrusting line candlestick pattern ki pehli candle aik bullish candle hoti hai, jo prices k top par ya bullish trend ki continuation ka kaam karti hai, q k ye aik real body wali candle hoti hai. Ye candle white ya green color ki candle hoti hai.

- Second Candle: Bullish thrusting line candlestick pattern ki dosri candle aik real body wali bearish candle hoti hai. Ye candle open pehli candle k top par gap main hoti hai, jab k close pehli candle k darmeyan se above hoti hai. Bearish candle black ya red color main hoti hai, jo k prices k leye bearish trend reversal ki nakam koshash karti hai.

movement ka ishara lete hen. Ye pattren bohut hi ziada bante hen aur is ko sahi mano me samajhne ki bohut hi ziada zarorat hai. Bullish thrusting line candlestick pattern hamen strongly ishara deti hai k market ka maojoda trend downtrend ki bajaye same bullish trend main continue hoga. Aam tawar par ye pattren do dino k darmeyane hese me ziada bante hen jab market ki movement normal up down ho rahi hoti hai. Pattern do candles par mushtamil hota hai, jiss ki pehli candle aik bullish candle hoti hai, bullish candle aik normal real body wali white candle hoti hai. Bullish candle k baad aik bearish candle prices k top par gap main open ho kar ussi k real body k darmeyan se above close hoti hai.candlestick kay real body kay midpoint kay qareeb band hoti hai.pattren ko aik continuation pattren kay tor par kaam karny kay baray main socha jata hai,lekin haqeeqat main,yeh taqriban half time reversal pattren kay tor par kaam karta hai.thrusting patteren kafi aam hain,zaroori nahi k is kay natijay main qeemat barhay, aur deegar types k shawahid kay sath mil kar sab say ziyada mufeed hotay hain.aik thrusting pattern is waqt hota hai jab aik black candlestick kay baad white candlestick aati hai.white candlestick ka distance kam hota hai,lekin phir yeh black candlestick kay real body kay midpoint kay qareeb period ko band kar deta hai.Thrusting patteren ki umomi definitiin yeh hai k yeh qeematon main kami kay baad mudakhlat karny ki bulls ki koshisho ki akkasi karta hai.black candlestick ke mid point kay opar white candlestick kay thrusting main nakami say pata chalta hai k bulls main bearish kay trend ko reverse karne ki taaqat ki kami hai.is liye,kuch ka khayaal hai k thrusting pattren nichay k trend kay continuation ko zahir karta hai kyunckay bull aakhir kaar apni really ki koshish khatam karUNDERSTANDING BULLISH THRUSTING LINE PATTERN

Bullish Thrusting Line" ek candlestick pattern hai jo forex market mein dekha jata hai. Yeh pattern typically downtrend ke baad dekha jata hai aur bullish reversal ko suggest karta hai.Thrusting Line pattern forex trading mein bullish reversal ko suggest karta hai. Iska sahi istemal karne ke liye traders ko pattern ko samjhna zaroori hai, aur practice aur experience bhi zaroori hai. Pattern ko samjhne ke liye historical price data analyze karna zaroori hai. Hamesha market conditions aur risk factors ko samajh kar trading decisions lena zaroori hai. Pattern ki confirmation ke liye price movement ko closely monitor karna zaroori hai, taki false signals se bacha ja sake. Iske saath hi, risk management ko bhi priority dena zaroori hai.Bullish thrusting line candlestick pattern prices main aksar do dino k darmeyan main banta hai, jiss se market ki same bullish trend main jane ka ishara melta hai. Pattern ki pehli candle k baad dosri candle ussi k closing price par open hone ki bajaye top gap main open ho kar ussi k center se ooper close hoti hai. Normal ye pattern ziada tadad main bante hen, lekin top prices ya bullish trend main banne par ye prices ko bullish trend continuation ka kaam karti hai. Pattern ki pehli candle bullish aur dosri bearish candle hoti hai, jiss ki lazmi real body honi chaheye, jab k dono candles shadow samet ya shadow k bagher ho sakti hai. Pattern main dono candles aik dosre k opposite direction main open hote hen, jab k dosri candle pehli candle k midpoint se above aur close price se below close hoti hai.

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Introduce. A.O.A Me omeed karta ho sa khareyat say ho gay aj me ap ko Bullish thrusting line candlestick pattern se traders bearish trend ki same direction me movement ka ishara lete hen. Ye pattren bohut hi ziada bante hen aur is ko sahi mano me samajhne ki bohut hi ziada zarorat hai. Bullish thrusting line candlestick pattern hamen strongly ishara deti hai k market ka maojoda trend downtrend ki bajaye same bullish trend main continue hoga. Aam tawar par ye pattren do dino k darmeyane hese me ziada bante hen jab market ki movement normal up down ho rahi hoti hai. Pattern do candles par mushtamil hota hai, jiss ki pehli candle aik bullish candle hoti hai, bullish candle aik normal real body wali white candle hoti hai. Bullish candle k baad aik bearish candle prices k top par gap main open ho kar ussi k real body k darmeyan se above close hoti hay Candles Formation Bullish thrusting line candlestick pattern pehli din ki candle aik bullish candle hoti hai, lekin dosre din ki candle bearish candle k close prices par hone ki bajaye top gap main open ho kar ussi k midpoint se ooper close hoti hai. Pattern main shamil candles ki formation darjazzel tarah se hoti hay.- First Candle. Bullish thrusting line candlestick pattern ki pehli candle aik bullish candle hoti hai, jo prices k top par ya bullish trend ki continuation ka kaam karti hai, q k ye aik real body wali candle hoti hai. Ye candle white ya green color ki candle hoti hay.

- Second Candle. Bullish thrusting line candlestick pattern ki dosri candle aik real body wali bearish candle hoti hai. Ye candle open pehli candle k top par gap main hoti hai, jab k close pehli candle k darmeyan se above hoti hai. Bearish candle black ya red color main hoti hai, jo k prices k leye bearish trend reversal ki nakam koshash karti hay

movement ka ishara lete hay. Ye pattren bohut hi ziada bante hen aur is ko sahi mano me samajhne ki bohut hi ziada zarorat hai. Bullish thrusting line candlestick pattern hamen strongly ishara deti hai k market ka maojoda trend downtrend ki bajaye same bullish trend main continue hoga. Aam tawar par ye pattren do dino k darmeyane hese me ziada bante hen jab market ki movement normal up down ho rahi hoti hai. Pattern do candles par mushtamil hota hai, jiss ki pehli candle aik bullish candle hoti hai, bullish candle aik normal real body wali white candle hoti hai. Bullish candle k baad aik bearish candle prices k top par gap main open ho kar ussi k real body k darmeyan se above close hoti hai.candlestick kay real body kay midpoint kay qareeb band hoti hai.pattren ko aik continuation pattren kay tor par kaam karny kay baray main socha jata hai,lekin haqeeqat main,yeh taqriban half time reversal pattren kay tor par kaam karta hai.thrusting patteren kafi aam hain,zaroori nahi k is kay natijay main qeemat barhay, aur deegar types k shawahid kay sath mil kar sab say ziyada mufeed hotay hain.aik thrusting pattern is waqt hota hai jab aik black candlestick kay baad white candlestick aati hai.white candlestick ka distance kam hota hai,lekin phir yeh black candlestick kay real body kay midpoint kay qareeb period ko band kar deta hai.Thrusting patteren ki umomi definitiin yeh hai k yeh qeematon main kami kay baad mudakhlat karny ki bulls ki koshisho ki akkasi karta hai.black candlestick ke mid point kay opar white candlestick kay thrusting main nakami say pata chalta hai k bulls main bearish kay trend ko reverse karne ki taaqat ki kami hai.is liye,kuch ka khayaal hai k thrusting pattren nichay k trend kay continuation ko zahir karta hai kyunckay bull aakhir kaar apni really ki koshish khatam kar saktay hay.

-

#7 Collapse

The Bullish Thrusting Line is a candlestick pattern commonly used in technical analysis to predict potential bullish reversals in the price of a financial instrument, such as stocks, forex pairs, or commodities. This pattern consists of two candlesticks and is usually observed within a downtrend, suggesting a possible shift towards an uptrend. Here's how the Bullish Thrusting Line pattern is formed: First Candlestick: The first candlestick is a bearish (downward) candle that closes near its low, indicating selling pressure and a continuation of the existing downtrend. Second Candlestick: The second candlestick is a bullish (upward) candle that opens below the close of the first candlestick but then closes well above the midpoint of the first candlestick's body. This demonstrates a strong bullish rebound and indicates potential buying interest. The significance of the Bullish Thrusting Line pattern lies in the fact that the second candlestick, despite opening lower, manages to close significantly higher, suggesting that buyers are entering the market with strength. This pattern is seen as a possible signal that the bears are losing control and that a trend reversal could be in the works. However, like all technical patterns, the Bullish Thrusting Line is not foolproof and should be used in conjunction with other technical indicators and analysis tools. Traders often look for confirmation from other signals or patterns before making trading decisions based solely on the Bullish Thrusting Line. Additionally, market context and overall trend should also be taken into consideration before placing trades based on any pattern. Remember that trading involves risks, and it's important to have a well-rounded understanding of technical analysis and risk management before making trading decisions.

First Candlestick: The first candlestick is a bearish (downward) candle that closes near its low, indicating selling pressure and a continuation of the existing downtrend. Second Candlestick: The second candlestick is a bullish (upward) candle that opens below the close of the first candlestick but then closes well above the midpoint of the first candlestick's body. This demonstrates a strong bullish rebound and indicates potential buying interest. The significance of the Bullish Thrusting Line pattern lies in the fact that the second candlestick, despite opening lower, manages to close significantly higher, suggesting that buyers are entering the market with strength. This pattern is seen as a possible signal that the bears are losing control and that a trend reversal could be in the works. However, like all technical patterns, the Bullish Thrusting Line is not foolproof and should be used in conjunction with other technical indicators and analysis tools. Traders often look for confirmation from other signals or patterns before making trading decisions based solely on the Bullish Thrusting Line. Additionally, market context and overall trend should also be taken into consideration before placing trades based on any pattern. Remember that trading involves risks, and it's important to have a well-rounded understanding of technical analysis and risk management before making trading decisions.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#8 Collapse

"بلش تھرسٹنگ لائن پیٹرن" Ùاریکس میں ایک اÛÙ… تکنیکل پیٹرن ÛÛ’ جو ایک Ù…ÙˆØ¬ÙˆØ¯Û Ø¨Ù„Ø´ کینڈل Ú©Ùˆ Ù¾Ø´ÛŒÙ…Ø§Ù†Û Ú©Ø±ØªØ§ ÛÛ’ اور اگلے دن Ú©ÛŒ کینڈل Ú©Û’ ساتھ ایک جزوی اوپری رخ Ú©ÛŒ Ø*رکت کا Ø§Ø´Ø§Ø±Û Ø¯ÛŒØªØ§ ÛÛ’Û” اس پیٹرن Ú©Ùˆ قیمت Ú©ÛŒ تبدیلیوں Ú©Û’ ساتھ جڑے ترنڈ Ú©ÛŒ تصدیق Ú©Û’ لئے استعمال کیا جاتا ÛÛ’Û”

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 04:29 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим