Trading with : Exponential Moving Average (EMA)

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

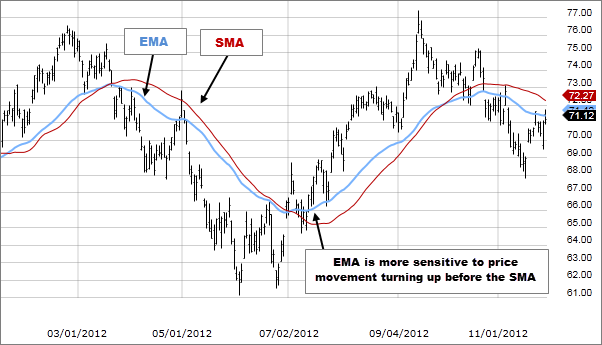

Assalamu Alaikum Dosto!Exponential Moving AverageExponential Moving Average basic "Morning Average" ka aik pechida shakal hai, jo kisi makhsos timeframe k average ki calculation karte waqat sab se latest data point ko made nazar rakhti hai. EMA iss baat ki zamanat deta hai, k porane data points aur duhraye jane wale data points ka indicator par wahi asar nahi parega, jaisa k taza tareen deta points ka hota hai. Simple moving average main sare data ko same value k hisab se calculate kia jata hai lekin EMA ki calculation haleya data point par ziada focus ki waja se uss se mukhtalif hai. Simple moving average main aik nuqas ye hai k iss main pechle data k aham points par bulkul bhi focus nahi kia jata hai, jiss ki waja se bohut sare halat main ye value darust sabit nahi hoti hai. Misal k tawar par agar aik compney ka data uss k stock exchange data se ziada behtar sabit hota hai, to simple moving average uss ko focus nahi karta hai, aur iss ko zahir karne main kafi time lag sakta hai. Exponential moving averages iss k bar akas maojooda trends par zoor de kar iss qisam ki adjustment ko behtar banata hai. Baqi ye traders par depend karta hai, k wo haleya data ko kitna zarori aur aham samajhta hai, to wo uss k hisab se apni adjustment kar sakta hai. Iss bunuad par EMAs simple moving average se ziada moasar aur behtar sabit hote hen.EMAs CalculationEMAs ki calculation bhi SMAs se mukhtalif hai, yanni calculation k tareeqay kar main thora sa difference hai. SMAs ki calculation bohut asaan hai. Misal k tawar par, agar aik 20 dino ki SMAs ki calculation karni hoti hai, to iss main yotal closing price ko total days par divid kia jata hai, jiss se 20 dino ka total SMAs calculate ho jata hai, jo k sare price k leye aik jaisa hota hai. EMAs iss se thora sa mukhtalif hai, iss main haleya data ko ziada focus kia jata hai, jab k SMAs main sab ki calculation same hoti hai, agar 10 days SMAs ka EMAs malom karna ho to18.18% (Traders ki apni marzi par depend karta hai) se zarab deya jata hai, lekin issi tarah se 20 days EMAs ka result 9.52% ata hai, yani ye calculation aseets k value par depend karta hai. EMAs ki calculation main closing price ki bajaye open, high, low aur medium price par ki jati hai.EMA = Closing price multiplied by multiplier + EMA (prior day) multiplied by multiplier (1-multiplier)Explaination and Usage of EMAs12 aur 26 days k Exponential Moving Average ka aksar istemal kia jata hai, jo k short term k trading k elye bhi bohut ziada istemal kia jata hai. Kuch indicators jaise moving average convergence divergence (MACD) bulkeh sath hi sath percentage price oscillator bhi 12 aur 26 days EMAs k base par banaye gaye hen. Iss k elawa 50 days aur 200 days k moving averages ko long term trading k leye design keye hen, jab bhi kisi assets ki prices 200 EMAs tak jati hai to yahan par trend reversal hone k pake chances hote hen. Moving averages ka istemal agar munasib tareeqay se technical analysis main ki jati hai to ye traders k leye bohut ziada faida mand sabit hote hen. Lekin inn indicators ka ghalat istemal bohut bare pemane par losses ka sabab bhi ban sakten hen, jinn ka janna aik trader k leyw bohut zarori hai. Moving averages k sare indicator jo technical analysis main istemal hote hen wo lagging indicator main shamil hote hen. EMAs simple moving average ki nisbat ziada fast signals deta hai, q k ye indicator taza tareen data ki analysis karta hai, jab k simple moving average sare data ko yaksan ahmeyat deta hai, jiss ki waja se SMAs thora sa lagging indicator sabit hota hai, jab k single k base par EMAs ziada tez hai. TradingTrading k leye traders moving averages k bagher analysis nahi kar sakte hen, EMAs traders k leye market main entry aur kuch had tak exit ka signal bhi deta hai. Lekin koi bhi indicator akele bohut ziada accurate signal tab tak nahi de sakta hai, jab tak uss k sath dosre indicators ya prices action ko sath shamil nahi kia jata hai. Moving average k line tak prices pohunchne par aksar yahan se trend reversal hone knchances hote hen, jo k long term k trading k leye ziada perfect signal dete hen. Traders ko dosre indicators k base par market main entry aur exit k sath take profit k sahi position ka intekhab karna chaheye. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#3 Collapse

Define EMA Indicator

EMA (Exponential Moving Average) Indicator ek laghuatmaak technical indicator hai jo traders ko market trend ko samajhne aur trading signals generate karne mein madad karta hai. Yeh indicator price data ka laghupant karta hai aur recent price movements ko zyada weight deta hai, jisse recent market trends ko reflect karta hai.

EMA ko calculate karne ke liye, har price data point ko weight di jati hai, jismein recent data points ko zyada weight diya jata hai aur older data points ko kam weight diya jata hai. Isse EMA current market conditions ko jyada accurately represent karta hai compared to simple moving average (SMA) jo sabhi price points ko equal weight

Yahan, "Close" current price ko represent karta hai, "EMA(previous)" previous EMA value ko darust karta hai, aur "n" smoothing period ko darust karta hai.

Kuch key points EMA indicator ke baare mein hain:

Trend Identification

EMA indicator ka mukhya use trend identification mein hota hai. Jab EMA ka line price ke upar hota hai, to yeh uptrend ko indicate karta hai, jabke jab EMA line price ke neeche hota hai, to yeh downtrend ko indicate karta hai.

Trading Signals

EMA indicator trading signals generate karne mein bhi istemal hota hai. Jab price EMA line ko cross karta hai (upward cross ya downward cross), to yeh buy ya sell signals provide karta hai.

Smoothing Effects

EMA ki smoothing effect ki wajah se, iska istemal short-term aur medium-term trends ko identify karne ke liye bhi kiya jata hai. Iski help se traders market volatility ko filter karke clear trading signals generate kar sakte hain.

Parameter Setting

EMA ke parameter setting important hoti hai. Traders smoothing period ko adjust kar sakte hain taki indicator unke trading strategy aur market conditions ke according ho.

EMA indicator ek versatile aur popular technical indicator hai jo traders ke liye trend identification aur trading signals generate karne mein madadgar sabit ho sakta hai. Magar, traders ko hamesha doosre technical indicators aur price action analysis ke saath combine karke trading decisions lena chahiye.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 04:33 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим