What is the double bottom pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

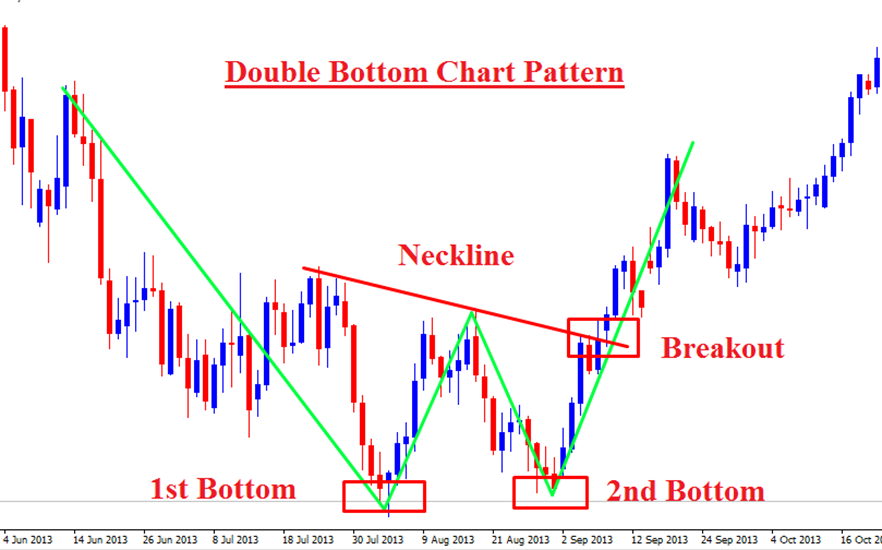

Aslamoalekum individuals kesay hain ap sab. Mujhay umed feed sah thek thak hon gay. Aj ka hamara disscussion ka jo topic feed wh twofold base example kay bary hain. Isy dekhty hain kay yeh kia feed r hamen kia insights deta feed. Twofold rear example Twofold rear example forex exchanging mein ek charge movement test hai jo purchasers istemal karte hain market simat jo aik makhsos hoti feed usk ka tayun karne ke liye. Is test mein charge ek neeche jaane ke baad do baar posterior banata hai, phir cost up pattern ki shuruat karta roughage is liye bht se bato ko zehn nasheen karty huy tajirDouble rear example ko samajhne gar aap twofold base example ke shanakht karte hain, toh aapko trading mein ek region mil jata hai kyunki yeh ek inversion design hota hai, aur dealers is design ki help se commercial center ke style ke tabd ka pata laga sakte hain. Is test ko confirm karne ke liye, purchasers amount, energy aur moving midpoints jaise isharo ka bh pta istemal karte hain.Is liye or bht se bato ko contemplations major rakhty huy financial backers yeh dekhty hain aya waqt kay market ke simat kia feed stomach muscle r yeh ks traf harkat kr sakti feed is liye kay is unhay apna faida r nuqsan dono ko achay sy dekhty huy change lagani hoti feed taky m liye aapko kuch bunyadi tasawurat ki zaroorat hogi jaise ki backing and opposition levels, design lines aur cost development. Or on the other hand punch rate ek help degree standard girne lagta hai merchants us ka istemal kar ky support stage ko buy area ke pinnacle standard dekhte hain. Agar charge ek help degree sey neeche jaata hai aur fir se wahi stage standard aata hai aur uske baad up style start karta hai toh yeh twofold rear example banata hai. Agar aap twofold rear example ke shanakht karte hain, toh aapko exchanging mein ek region mil jata hai kyunki yeh ek inversion design hota hai, aur purchasers is test ki assist se with promoting ke style ke tabd ka pata laga sakte hain. Is test ko affirm karne ke liye,. financial backers degree, energy aur moving midpoints jaise isharo ka bh pta istemal karte hain.Is liye or bht se bato ko mind overwhelming rakhty huy financial backers yeh dekhty hain aya waqt kay commercial center ke simat kia feed stomach muscle r yeh ks traf harkat kr sakti roughage is liye kay is unhay . apna faida r nuqsan dono ko achay sy dekhty huy exchange lagani hoti feed taky commercial center unky hesab sy agar harkat kary to unhay zeada say zeada faida ho saky or jld take income tak phnch kr inkai trade close jo jaye. -

#3 Collapse

Definition of Double Bottom Pattern? Dobara Neeche Wala Pattern ek bullish trend reversal pattern hai. Is pattern mein price pehle neeche girne ke baad double bottom formation banati hai, jiske baad price upward direction mein move karti hai. Double bottom formation mein price ek neeche wala support level touch karti hai, phir rebound karke dobara usi level tak pahunchti hai. Double Bottom Formation Dobara Neeche Wala Pattern mein double bottom formation ka ek prominent feature hota hai. Isme price pehle neeche girti hai aur support level ko touch karti hai. Fir price rebound karke dobara usi support level tak pahunchti hai, lekin pehli bar touch karne se zyada upward move karti hai. Phir price ek aur neeche wala dip banati hai, lekin usse pehle wale dip ke level tak pahunchne se bachti hai. Yeh double bottom formation bullish sentiment ko reflect karta hai. Support Level Importance Double Bottom Pattern mein support level ki ahmiyat hoti hai. Support level price ke neeche ka level hota hai jahan se price bounce kar sakti hai. Jab price support level ko touch karke rebound karti hai, toh ye support level ki strength aur relevance ko highlight karta hai. Double bottom formation mein support level ki do touch points hote hain, jisse uski importance aur confirmation badhti hai. Neckline Double Bottom Pattern mein neckline bhi important hoti hai. Neckline support level ke upar ek horizontal line hoti hai jo double bottom formation ki base banati hai. Jab price neckline ko breakout karke upward move karti hai, toh pattern complete ho jata hai aur traders ko bullish trend reversal ka indication milta hai. Volume Analysis Double Bottom Pattern ki confirmation ke liye volume analysis bhi ki jati hai. Agar price double bottom formation ke samay volume increase karti hai, toh ye pattern ki strength aur validity ko indicate karta hai. Volume ki increase bullish reversal ko support karti hai. Entry and Exit Points Double Bottom Pattern traders ko entry aur exit points provide karta hai. Jab price neckline ko breakout karke upward move karti hai, toh traders long positions enter kar sakte hain. Stop loss levels ko set karne ke baad, traders apne trades ko manage kar sakte hain. Price targets ko calculate karne ke liye pattern ki height ka measurement bhi kiya ja sakta hai. Trend Reversal Confirmation Double Bottom Pattern bullish trend reversal ka confirmation deta hai. Agar price double bottom formation ke baad neckline ko breakout karke upward move karti hai. Advantages Trend Reversal Indication Dobara Neeche Wala Pattern bullish trend reversal ka indication deta hai. Jab price double bottom formation banati hai aur neckline ko breakout karke upward move karti hai, toh ye bearish trend se bullish trend mein reversal ka sign hai. Traders ko trend reversal opportunities ke pata chalte hain aur unhe potential profits generate karne ka mauka milta hai. Buying Opportunities Double Bottom Pattern traders ko buying opportunities provide karta hai. Jab price neckline ko breakout karke upward move karti hai, toh traders long positions enter kar sakte hain. Isse unhe market mein position lena aur potential profits generate karne ka advantage milta hai. Defined Risk Levels Double Bottom Pattern traders ko defined risk levels tayyar karne mein madad karta hai. Jab price neckline ko breakout karke upward move karti hai, traders stop loss levels tayyar kar sakte hain. Isse unhe apne trades ko manage karna aur potential losses ko control mein rakhna asan ho jata hai. Confirmation with Volume Analysis Volume analysis Double Bottom Pattern ki confirmation mein madad karta hai. Agar pattern ke samay volume increase hoti hai, toh ye pattern ki strength aur validity ko indicate karta hai. Volume ki increase bullish reversal ko support karta hai aur traders ko pattern ki authenticity ka pata chalta hai. Price Targets Double Bottom Pattern traders ko price targets tayyar karne mein madad karta hai. Pattern ki height ka measurement liya ja sakta hai taki traders apne price targets set kar sakein. Isse unhe price movement ke expectations banane mein aur trading decisions lene mein madad milti hai. Entry and Exit Points Double Bottom Pattern traders ko entry aur exit points provide karta hai. Jab price neckline ko breakout karti hai, toh traders long positions enter kar sakte hain. Isse unhe early entry ka advantage milta hai. Stop loss levels aur price targets ke saath combination karke traders apne trades ko manage kar sakte hain. Combination with Other Technical Tools Dobara Neeche Wala Pattern ko traders other technical analysis tools aur indicators ke saath combine karke istemal kar sakte hain. Isse unhe pattern ki confirmation aur trading signals milte hain. Support aur resistance levels, trend lines, moving averages, aur oscillators jaise tools pattern ki validity aur trading decisions ko further validate karte hain. -

#4 Collapse

What is Double Bottom PatternIntroduction: Double Bottom Pattern aik kesam ka candle stick pattern hota hey jo keh forex market mein Horizontal price kay belkul kareeb bantay hein or mumkana bullish reversal signal ko identify kartay hein forex market kay es pattern mein price aik mnthly high kay bad 2 low points banate hey jo price ke aik lower level kay bad madad gar sabat ho rehe hey Double Bottom chart pattern forex market mein down trend kay end mein paya jata hey jes pattern ke shape horf W say melta julta hey or bad mein new lower level par wapes anay kaybad kadray oper chale jate hey down trend ko jare ralhnay kay ley price new lower level par anay say kaisar hey price area say bullish trend start kar dayte hey or resistance area kay bad mein aik important pint hota hey jo keh es level kay gap mein wakay ho jata hey Identify Double Bottom Pattern aik jaice chorai or highs ke 2 alag alag points ko identify karna chihay Bottom kay darmean mein distance bhe bohut kam nahi paya jata hey time frame par bhe depend karta hey resistance line price ke level ke confirmation karte hey Double Bottom Pattern bullish signal ko support karnay kay ley hota hey or dosray technical indicator ka bhe estamal karna chihay jaisa keh moving average or oscillator etc forex market mein strong trend kay opposite trade say graiz karen Trade with Double Bottom Pattern Double Bottom Pattern equity ke market mein paya jata hey jo keh zyada tar buy/ bullish kay ndicatr kay tor par zahair hota hey nechay dey gay chart mein daikhtay hein keh es ko buy ya bullish signal kay tor par kes tarah estamal keya geya hey oper deya geya chart halkay nellay trend kay bad double bottom pattern dekhata hey jo keh oscillator kay sath mel kar estamal keya jata hey trader ko bullish Divergence ke taraf say mazeed madad hasell ke ja sakte hey jo keh forex market kay trend ko mumkana reversal janay ke taraf eshara karta hey stop level 2 lower say low lay saktay hein es level par trader 1:2 risk o reward e ratio ko kam kar kay estamal kartay hein or es limit ke level frahm kar saktay hein key level ka pata aga kar price action ka estamal keya ja sakta heyTable of Content 1. Identification 2. Identify Double Bottom Pattern 3. Trade with Double Bottom Pattern

bhali kay badlay bhali

bhali kay badlay bhali

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#5 Collapse

WHAT IS THE DOUBLE BOTTOM PATTERN DEFINITION Double bottom pattern Ek classic technical analysis charting formation hai profit ke target ke lihaz se pattern ka ek suggest conservative reading batata hai ke kam Aaz kam price ka target two low and intermediate high ke distance ke barabar Hota Hai Jo trend Mein Ek major change aur Market Trading Mein Pahle Se niche ki Move se momentum reversal ki represent karta hai yah security ya index ke Girne Ek rebound real drop ki Tarah ya Usi Tarah level per Ek Aur Kami aur Aakhir mein Ek new upri Trends Ban sakta hai double bottoms letters W Ki Tarah lagta hai twice touch wali kam ko ek aham support level Samjha jata hai financial market ki technical analysis mein strong level support Tak pahunch gai hai is alamat ke mutabik level se niche ki Kami se Pata Chalta Hai Ki bears ne apni ahmiyat ko Dobara zahar kar diya hai DOES THE DOUBLE BOTTOM SUGGEST A PRICE TARGET Jaisa ke bahut se chart pattern ke sath Ek double bottom pattern market ke darmiyani se long term Mukta Nazar ka behtarin Mauzo hai Iske alava pattern ki tashkel ke dauran volume ko Kareeb se monitor Kiya Jana chahie real double bottom pattern ki confirmation ke Taur per work Karte Hain pahle Low price Achanak Tez Kami ke bad significant buying ki interested se Puri hoti hai Jaise Ek long Halki candle stick aur Bullish engulfing line Paida hoti hai to yah donon Bullish ke reversal pattern hai Kyunki pahle kam se rebound aamtaur per 10% se 20% percent ke order per Hote Hain daily trading chart adveced micro device mein main overall Taur per niche ke trends Ki Surat mein double bottom dikhata hai Jab right tarike se identify ki Jaati Hai to double bottom ki tashkel intihai effective hoti hai

DOES THE DOUBLE BOTTOM SUGGEST A PRICE TARGET Jaisa ke bahut se chart pattern ke sath Ek double bottom pattern market ke darmiyani se long term Mukta Nazar ka behtarin Mauzo hai Iske alava pattern ki tashkel ke dauran volume ko Kareeb se monitor Kiya Jana chahie real double bottom pattern ki confirmation ke Taur per work Karte Hain pahle Low price Achanak Tez Kami ke bad significant buying ki interested se Puri hoti hai Jaise Ek long Halki candle stick aur Bullish engulfing line Paida hoti hai to yah donon Bullish ke reversal pattern hai Kyunki pahle kam se rebound aamtaur per 10% se 20% percent ke order per Hote Hain daily trading chart adveced micro device mein main overall Taur per niche ke trends Ki Surat mein double bottom dikhata hai Jab right tarike se identify ki Jaati Hai to double bottom ki tashkel intihai effective hoti hai  MUST THE TWO BOTTOMS OF THE LOWS IN THE DOUBLE BOTTOM PATTERN BE THE SAME Kitni bar double bottoms levels same hoti hai jisse price K point ko Bari help ke Taur per bahut support milati hai Ek double bottom direction mein change ke Taur per Ek new up Trend ke start ka signal Hota Hai

MUST THE TWO BOTTOMS OF THE LOWS IN THE DOUBLE BOTTOM PATTERN BE THE SAME Kitni bar double bottoms levels same hoti hai jisse price K point ko Bari help ke Taur per bahut support milati hai Ek double bottom direction mein change ke Taur per Ek new up Trend ke start ka signal Hota Hai

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 04:57 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим