What is Margin

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

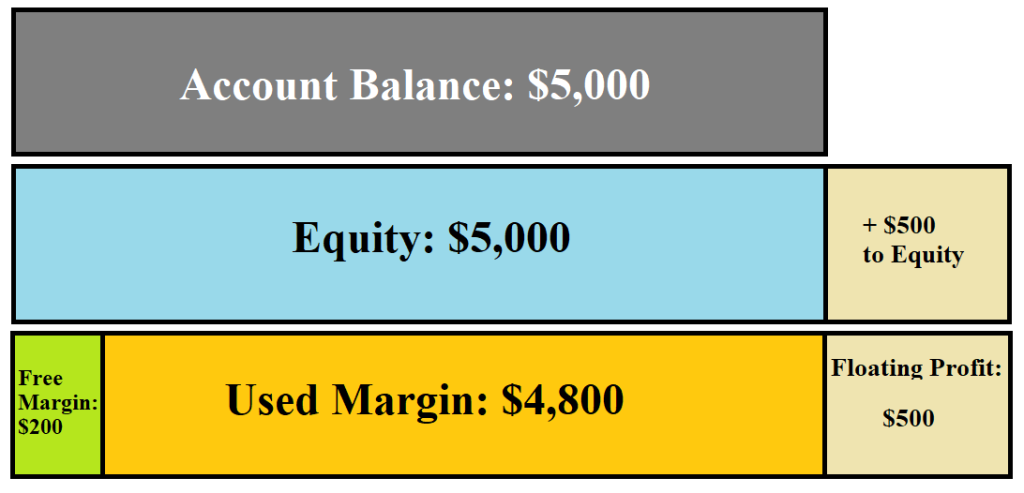

What is Margin Dear Friends, Forex trading me broker margin ke facilities dety hen Jo ham traders us ko use karty hain to har broker ka aap k account aur jab ap trade me nuqsan hoty hen to us wakt margin Kam reh jata hy hai. agar aapka 100$ ka account hai aur aap ke margin ke percentage 10% hai. To jab aap margin wali trade open karin to aapko loss main aany ke soorat main jab aap ke equity 10% sy kam reh jaay ge to aapko margin call aa jay ge. Forex market main margin trading ak ya ak say zeada currency main position hasil krny ya usy barqarar rakhnay ka liye broker kay sath sahi tarah say deal krnay ka amal hay. Margin koi lagat ya fees ni hay , balkay yeh sarif kay acount balance ka aik hisa hay jo order trade main sab say alag rakha jata hay . Matloba margin ki miqdar brokage firm kay lehaz say mukhtlif ho sakti hay or practice sy related boht say results hmaray samany atay hain . Forex main margin trading main aik ya ak say zeada position ka hasol hay . margin ka matlab hay leverage ka sath tejarat , jis ka faida hoga ky wh khatra kam kr k munafa ko barha sakti hay. Margin ki raqam amm tor pr forex position kay size ka percentage hoti hay or wh hr tarah say forex brokker kay lehaz say zra hat kay hoti hay. Condition for Margin Margin call hasil hony Kay baad ya to aap ko apny account main mazeed amount jama karwani hoti hay. Ya phir broker khud sy trades close karna suru kar deta hai Trading main margin wo loan hai jo aap ka broker aap ko provide karta hai. Aur es margin ko istemaal karty huy aap choti amount laga kar broker kay zariey bari amount ke trades open kar sakty hain. Maslan agar aap 5000$ ka account open karty hain to broker aapko margin ke sahoolat sy 10000$ ke trade position open karny ke sahoolat deta hai. To ye 5000$ ke amount trading margin kehlaati hai trade boht zyda loss main chali jati hai yani ka ap ki amount katm hony lagti hai us wqt broker ap ka margin ko red color kar dyta hai jas ka mutlab hota hai ap ka account ab zyda dar tak nai chal sakta. Margin Call From Broker Dosto har broker apny hasb say say margin call show karwta hai jas say ya pata chalta hai ka agher ap nay apny account ko save karna hai to investment kar lay ya pher apny account main huge kar lay aur market ki potion ka wait karny agher ap nay ya dono km nai kay to ap ka account wash ho jay ga jas say ap ko investment zayz ho jay gi as lay humsa apni trading money management ka sath karny takay ap apny account ko save rak saky. -

#3 Collapse

Asalamualikum dear members ummed Hy ap sb khariyat Sy hon gy or forex py mehnat kr rhy hon gy.dear members aaj hm apni post mein margin call k bary mein knowledge share krein gy Jo k new traders k liye bht he helpful ho ga . What is margin call: Dear members Jb ap market mein enter hoty hain or ap ki trade zyada loss mein ja rhe hoti hy , or jb ap ka loss ap k account balance ke basis pr zyada ho raha hota hy, or ap ke account mein just 20% to 30% balance reh jta Hy, to us condition mein ap ko broker ke trf sy margin call receive hoti hy , jis mein ap ko yeh information provide ke ja rahi hoti hy k ap ko ab extra investment karni hoge, otherwise ap ka account completely washed ho jay ga, es ko Forex trading market mein Margin Call kehty Hain.yeh bht he important factor Hy. Reason of margin call: Dear members Margin call ko definitely kuch reason ho skti hain. Jb ap market mein apni working complete kar rahy hoty hain, to following important reasons ke wja sy ap ko marjan call receive ho skti hy, is liye ap ko sb sy pehly in reasons ko eliminate krna hota hy. without analysis trading : Forex trading mein market analysis bht zaruri hy. Market analysis sy he achi decision making ke ja skty hain or achi Trading ki ja skti hy.Market ka analysis na krny ke wja sy trades mein loss hota hy or loss zyada hony ke wja sy margin call ati hy. Is situation mein agr mazed deposit na kiya jaye to account wash ho sakta hy. esi liye achy Sy market ka analysis kr k he market mein Entry lne chaheay Ta k loss na ho or acha profit earn kiya ja skta hy. Over trading : Forex trading mein hmesha balance or equity ko daikhty howay trade open karni chaheay or market ka analysis bhi lzmi krna chaheay kbi b over trading nhi karni chaheay, or na he lalach krni chaheay. Over trading sy loss ho sakta hy or margin call ki reason ban skti hy. Large lot size : Dear friends forex trading mein according to money management rules and regulations apni working nai krty hain, or maximum lot size select krty Hain, to asi condition mein ap ko margin call receive ho skti hy. or ap out off balance ho sakty hain, es liye ap ko hmesha money management k mutabiq apni working krni chaheay or profit hasil krna chaheay. How to save account : Dear members jitna possible ho saky hm market mein margin call sy bachna or es k liye hmein kuch learning krny ke zarurat hy . es k sath sath rules ko follow krny ke zarurat hy.Tb he ham margin call sy bach skty hain otherwise hmara market mein loss hota rehta Hy or Margin call sy bachney ke liye hmein kuch important steps lny ke zarurat hy. Tb he ham Apne account ko safe rakh sakte hain.or easily trading Kr skty Hain. -

#4 Collapse

Margin; Forex mein "margin" ek aham mudda hai. Margin, ya tashkeel kar, foreign exchange trading mein istemal hone wala aik maliat hai. Margin ka matlab hota hai ke aap apni trading account mein jama kardah paisay se zyada raqam istemal kar sakte hain. Margin aapko leverage ya qarz ke roop mein di jati hai, jis se aap apne trading positions ko barhane ya ghatane ke liye istemal kar sakte hain.Margin ki tadad aur qism trading platform aur broker par milti hai. Margin ek aisi raqam hoti hai jo aapko apne trading account mein jama karni hoti hai, aur broker aapko us se zyada raqam istemal karne ki ijazat deta hai. Margin percentage ke roop mein di jati hai, jaise 1%, 2%, 5% ya 10%. Agar aapke pass $1000 margin aur 1% margin requirement hai, to aap $100,000 ki trading position le sakte hain.Benefits of margin; Margin istemal karne ke faide hain ke aap kam paisay mein zyada maal kharid sakte hain aur zyada munafa kamana chahenge. Lekin, margin istemal karne ke sath sath khudara risk bhi hota hai. Agar market mein aapki trading position ki value ghata hai, to aapko margin call milti hai, jis mein aapko apne account mein mazeed paisay jama karna hota hai, warna aapki position band ho jati hai.Margin forex trading mein aik ahem concept hai, is liye zaroori hai ke aap is ke bare mein achi tarah se samajhain aur broker ke margin requirements aur policies ko samjhein, taake aap apni trading mein sahi faislay kar sakein. Reasons of margin; Forex mein "margin" ek financial term hai jo currency trading mein istemaal hoti hai. Margin aapko leverage deta hai, yaani aap apne trading account mein available funds ke multiple tak trading positions hold kar sakte hain.Margin trading mein aapko apne broker ko ek certain percentage of the total trade value deposit karna hota hai, jise "margin requirement" kehte hain. Margin requirement broker se broker vary kar sakti hai aur ye trading account size, leverage level, aur traded instrument par depend karti hai.Margin trading mein, jab aap ek position open karte hain, aapko margin requirement ke hisaab se ek certain amount of margin deposit karna hota hai. Margin requirement usually aapko trading account currency mein di gayi hoti hai. Agar aap USD-based account use kar rahe hain, to margin requirement bhi USD mein di jayegi.Margin requirement ko pura karne ke liye, aapko apne trading account mein sufficient funds available rakhne hote hain. Agar aap margin requirement ko pura nahi kar pate hain, to aapko trading positions open karne ki permission nahi milti.Margin trading mein aap leverage ka istemaal karke apne invested capital se zyada exposure prapt kar sakte hain. Lekin margin trading risky bhi ho sakti hai, kyunki agar aapke trades loss mein chale jayein to aapko apne deposited margin amount ko bhi khona pad sakta hai. Yeh important hai ki aap forex trading aur margin trading ke baare mein puri tarah se samajh lein, aur apne broker ke margin requirements aur policies ko samajhne ke baad hi trading karein. Aapko apne risk tolerance ke hisaab se margin level aur leverage ko decide karna chahiye.Forex mein margin, yaad dila deta hai, apki trading position ke liye required equity amount ko represent karti hai. Margin trading aik tareeqa hai jis mein aap trading ke liye apne available funds se zyada paisa istemaal kar sakte hain. Jab aap Forex broker ke saath margin trading karte hain, toh aapko margin requirements puri karni hoti hain, jo trading ki size aur leverage pe depend karti hain.Margin trading mein aap ek certain percentage ya ratio of the total trade value as margin deposit karne hote hain. Yeh deposit aapke trading account mein jama hota hai, aur aap uska istemaal kar sakte hain apni trading positions ko open karne ke liye. Margin trading aapko flexibility deta hai, kyunki aap apne available funds ke barabar se zyada trading positions open kar sakte hain.Forex market mein commonly istemaal hone wali term hai "margin level" jo aapke trading account ke equity aur used margin ratio ko represent karti hai. Margin level aapke trading account ki health aur risk tolerance ko indicate karta hai. Agar aapki margin level low ho jati hai, toh aapko "margin call" mil sakti hai, jisme aapko additional funds deposit karne ke liye kaha jata hai, warna aapke open positions ko close kar diya jayega.Margin trading ke benefits ke saath, ismein associated risks bhi hote hain. Agar aapke trades negative hojate hain, toh aapko additional funds deposit karne ki zaroorat ho sakti hai, aur aap apne invested funds ko lose bhi kar sakte hain. Isliye, margin trading mein participate karte waqt, aapko apni risk tolerance ko samajhna aur money management ko dhyaan mein rakhna zaroori hai. -

#5 Collapse

What is Margin?- Margin:

- Margin trading ke 2 terms hote hain:

- Required Margin: Required margin wo minimum amount hai jo trader ko apne account mein rakhna hota hai, takay leverage se positions open kar sake. Broker leverage ratio ke hisab se required margin ko calculate karta hai. Agar trader ka leverage ratio 1:100 hai aur wo $1000 ka position open karna chahta hai, toh required margin $10 hoga (1000/100).

- Used Margin: Used margin, trader ke account mein actual position open karne ke liye use kiya gaya margin amount hai. Jab trader position open karta hai, toh used margin account se deduct hota hai aur position close hone tak hold kiya jata hai. Used margin position size aur leverage ratio par depend karta hai.

- Margin trading ke advantages:

- Leverage: Margin trading leverage provide karta hai, jisse trader apne available funds se zyada amount ka position open kar sakta hai. Isse profit potential increase hota hai.

- Increased Trading Power: Margin trading se trader ko increased trading power milti hai. Isse wo multiple trades karke portfolio diversification kar sakta hai.

- Flexibility: Margin trading trader ko flexibility deta hai multiple trading strategies istemal karne mein. Trader small amount of funds se bhi large positions open kar sakta hai.

- Margin trading ke disadvantages:

- High Risk: Margin trading high risk ke saath aata hai. Leverage se positions open karne ke baad small price movements bhi significant losses cause kar sakte hain.

- Margin Calls: Agar trade against trader ki expectations move karta hai, toh margin call situation create ho sakti hai. Margin call mein broker trader se additional funds deposit karne ya position close karne ke liye request karta hai.

- Loss Amplification: Margin trading mein losses bhi amplify ho sakte hain. Agar trade against trader move karta hai, toh losses initial investment se zyada ho sakte hain.

- conclusion

- [*=center]NOTE:

Margin trading ka istemal karte waqt trader ko proper risk management aur margin requirements ko samajhna zaroori hai. Trader ko leverage ka istemal samajh se bahar positions open karne se pehle acche se samajh lena chahiye, takay unwanted losses se bacha ja sake. -

#6 Collapse

Assalamualaikum! Umeed hai k ap sb khariyat sy hongy. R apky trading sessions achy jaa rhy hongy.Aj ka hmra or discussion topic "Margin". Dekhty hain k ye hmein Kya information deta hai r hmry ilam Mai Kesy ezafa krta hai. Introduction fnans mein, margin woh zamanat hai jisay aik sarmaya car ko –apne brokr ya exchange ke paas jama karna parta hai taakay holdar brokr ya exchange ke liye la-haq crdt rissk ko poora kere. aik sarmaya car crdt rissk peda kar sakta hai agar woh maliyati alaat kharidne ke liye brokr se naqad udhaar le, maali alaat ko mukhtasir farokht karne ke liye udhaar le, ya mushtaq moahida kere. margin par kharidari is waqt hoti hai jab koi sarmaya car brokr se balance sy udhaar le kar asasa kharidata hai. margin par kharidari se morad asasa ke liye brokr ko ki jane wali ibtidayi adaigi hai. sarmaya car –apne brokrij account mein margin able sikyortiz ko zamanat ke tor par istemaal karta hai. aik aam karobari sayaq o Sabaq mein, margin kisi numeral ya koi or service ki farokht ki qeemat aur pedawar ki laagat, ya munafe aur aamdani ke tanasub ke darmiyan farq hai. Or margin aydjstmnt index ki sharah mein shaamil kardah sy adjust able rate margij ( arm ) par sood ki sharah ke hissay ka bhi hawala day sakta hai . Importance margin sarmaya kaari ki kharidari ke liye brokr se udhaar li gayi raqam hai aur sarmaya kaari ki kal qeemat aur koi sy karzzzz ki raqam ke darmiyan farq hai. margin trading se morad maliyati asasay ki tijarat ke liye brokr se udhaar liye gaye funds ko istemaal karne ki mashq hai, jo brokr se koi.karzzzz ke liye zamin bantaa hai. margin account aik mayaari brokrij account hai jis mein aik sarmaya car ko –apne account mein mojooda naqad ya sikyortiz ko karzzzz ke liye zamanat ke tor par istemaal karne ki ijazat hai. or Koi margin se diya jane wala faida faida aur nuqsaan sy dono ko berhata hai. nuqsaan ki soorat mein, margin cal ke liye aap ke brokr ko paishgi razamandi ke baghair or to sikyortiz ko khatam karne ki zaroorat par sakti hai. Working margin par khareedna stock kharidne ke liye brokr se bhe raqam udhaar lena hai. aap usay –apne brokrij se karzzzz ke tor par soch satke hain. margin trading aap ko is se or ziyada stock kharidne ki ijazat deti hai jo aap aam tor par kar satke hain. margin par tijarat karne ke liye, aap ko to margin account ki zaroorat hai. yeh aik aam cash account se mukhtalif hai, jis mein aap account mein mojood or Koi raqam ka istemaal karte hue tijarat karte hain. margin sy account ke sath, aap naqad raqam jama karte hain, jo ho sikyortiz ki kharidari ke liye karzzzz ke liye zamanat ke tor par kaam karta hai. aap usay kisi sarmaya kaari ki qeemat khareed ke 50 % tak udhaar lainay ke liye istemaal kar to satke hain. lehaza agar aap $ 5, 000 jama karte hain, to aap $ 10, 000 tak ki sikyortiz khareed satke hain. aap ka brokr is karzzzz par sood wusool kere ga jo aap istemaal kar rahay hain, jisay aap ko wapas karna hoga. agar aap apni sikyortiz baichtay hain, to is se haasil honay wali sy raqam pehlay aap ke karzzzz ki adaigi kere gi, aur jo bacha hai usay aap rakh satke hain. financial industry regulatory authority ( finra ) aur sikyortiz and exchange commission ( sec ) margin trading ko rigolit karte hain, sakht qawaneen ke sath ke aap ko kitni raqam jama karni hogi, aap kitna karzzzz le satke hain, aur kitni raqam aap ko –apne to account mein rakhni chahiye . Advantages and disadvantages fawaid beyana ki wajah se ziyada faida ho sakta hai. Or koi qowat khareed mein izafah karta hai. aksar deegar qisam ke qarzon se ziyada lachak dar hotay hain. khud ko poora karne wala mauqa cycle ho sakta hai jahan sy bhe zamanat ki qeemat mein izafah faida uthany ke mawaqay ko mazeed berhata hai. nuqsanaat lyorij ki wajah se ziyada nuqsaan ho sakta hai. account ki fees aur sood ke ilzamaat lagtay hain. margin calls ka nateeja ho sakta hai jis mein izafi aykoyti sarmaya kaari ki zaroorat hoti hai. jabri ka nateeja ho sakta hai jis ke nateejay mein sy bhe sikyortiz ki farokht hoti hai ( aksar nuqsaan mein ). The Bottom line tijarat par naffa aur nuqsaan ke imkanaat ko badhaane ke khwahan sarmaya car margin par tijarat par ghhor kar to satke hain. margin trading raqam udhaar lainay, zamanat ke tor par kaam karne ke liye naqad raqam jama karne, aur udhaar liye gaye funds ka istemaal karte hue tijarat mein daakhil honay ki mashq hai. karzzzz aur lyorij ke istemaal ke zariye, margin ke nateejay mein is se ziyada munafe ho sakta hai jo sarmaya kaari karne walay ko sirf apni zaati raqam istemaal karne par lagaya ja sakta tha. doosri taraf, agar hifazati eqdaar mein kami aati hai to, aik sarmaya car ko zamanat ke tor par paish kardah raqam se ziyada ho to raqam ka saamna karna par sakta hai . -

#7 Collapse

ager loge as ko bhtear tur per samaj ly gy tu wh margin tranding ko achi trh kr saky gy ar ap chi trandin kr saky gy -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#8 Collapse

Asslam-O-Alaikum! Dear members Me ummed kerti hoke ap sb ka forex trading py kam bht acha chl rha hoga. Aj jis topic py hum baat kre gy wo Neeche mention hy. TOPIC:What is Margin margin call is waqt hoti hai jab margin account mein sarmaya car ki aykoyti ka feesad brokr ki matlooba raqam se neechay ajata hai. aik sarmaya car ke margin account mein sarmaya car ki apni raqam aur sarmaya car ke brokr se udhaar li gayi raqam ke imtezaaj se kharidi gayi sikyortiz hoti hain . margin call khaas tor par broker ke is mutalbe ki taraf ishara karti hai ke aik sarmaya car account mein izafi raqam ya sikyortiz jama kere taakay sarmaya car ki aykoyti ( aur account ki qeemat ) ki qeemat dekh bhaal ki zaroorat se zahir ki gayi kam az kam qeemat tak pahonch jaye . margin call aam tor par aik ishara hota hai ke margin account mein rakhi gayi sikyortiz ki qader mein kami waqay hui hai. jab margin cal hoti hai to, sarmaya car ko ya to account mein izafi funds ya margin able sikyortiz jama karne ka intikhab karna chahiye ya –apne account mein mojood kuch asason ko farokht karna chahiye . EXPLAINATION: margin call is waqt hoti hai jab margin account mein funds kam hotay hain, aam tor par tijarti khasaray ki wajah se . margin calls aik margin account ko dekh bhaal ki zaroorat tak laane ke liye izafi sarmaye ya sikyortiz ke mutalibaat hain . brokrz kisi tajir ko asasay baichnay par majboor kar satke hain, bazaar ki qeemat se qata nazar, margin call ko poora karne ke liye agar tajir funds jama nahi karta hai . margin calls is waqt bhi ho sakti hain jab kisi stock ki qeemat barh jati hai aur nuqsanaat un accounts mein bherne lagtay hain jinhon ne stock ko kam farokht kya hai . sarmaya car apni aykoyti ki nigrani karkay aur zaroori dekh bhaal ki satah se oopar ki qeemat ko barqarar rakhnay ke liye –apne account mein kaafi raqam rakh kar margin kalon se bach satke hain . jab koi sarmaya car –apne funds aur brokr se udhaar li gayi raqam ke imtezaaj ka istemaal karte hue sikyortiz ki khareed o farokht ke liye adaigi karta hai, to sarmaya car margin par khareed raha hota hai. sarmaya kaari mein aik sarmaya car ki aykoyti sikyortiz ki market value minus udhaar ki raqam ke barabar hai . margin cal is waqt shuru hoti hai jab sarmaya car ki aykoyti, sikyortiz ki kal market value ke feesad ke tor par, aik makhsoos matlooba satah se neechay ajati hai ( jisay maintenance margin kaha jata hai ) . account ki qeemat mein kami ki wajah se margin calls kisi bhi waqt ho sakti hain. taham, market ke utaar charhao ke douran un ke honay ka ziyada imkaan hota hai . yahan aik misaal hai ke kis terhan margin account ki qader mein tabdeeli sarmaya car ki aykoyti ko is satah tak kam kar deti hai jahan brokr ko margin cal jari karna zaroori hai margin cal ka ihata kaisay karen . agar kisi sarmaya car ke account ki qeemat is satah tak gir jati hai jahan un ke brokr ke zariye margin cal jari ki jati hai, to sarmaya car ke paas usay poora karne ke liye aam tor par do se paanch din hotay hain. oopar di gayi margin cal ki misaal ka istemaal karte hue, aisa karne ke ikhtiyarat yeh hain : account mein $ 200 naqad jama karwaen . –apne account mein $ 285 margin able sikyortiz ( mukammal tor par ada shuda ) jama karwaen. yeh raqam $ 200 ke matlooba funds ko ( 30 % aykoyti ki zaroorat se 1 kam ) taqseem karkay haasil ki jati hai : 200 / ( 1-. 30 ) = $ 285 . mandarja baala do ikhtiyarat ka majmoa istemaal karen . matlooba naqdi haasil karne ke liye deegar sikyortiz farokht karen . agar koi sarmaya car margin cal ko poora karne ke qabil nahi hai to, aik brokr account ko kam az kam matlooba qeemat tak bharnay ke liye kisi bhi khuli position ko band kar sakta hai. woh sarmaya car ki manzoori ke baghair aisa kar satke hain. mazeed bar-aan, brokr kisi sarmaya car se un lain deen par commission bhi wusool kar sakta hai. is amal ke douran honay walay kisi bhi nuqsaan ke liye is sarmaya car ko zimma daar thehraya jata hai . margin karzzzz ki raqam security ki kharidari ki qeemat par munhasir hai, aur is liye yeh aik muqarara raqam hai. taham, maintenance margin ki zaroorat se tay shuda dollar ki raqam current account value par mabni hoti hai, nah ke ibtidayi qeemat khareed par. is liye is mein utaar charhao aata hai . margin account kholnay se pehlay, sarmaya karon ko ahthyat se ghhor karna chahiye ke aaya inhen waqai is ki zaroorat hai. ziyada tar taweel mudti sarmaya karon ko thos munafe haasil karne ke liye margin par kharidne ki zaroorat nahi hai. is ke ilawa, qarzay muft nahi hain. brokrij un par sood wusool karte hain .

- Mentions 0

-

سا0 like

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 07:37 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим