What is double top patterns?

`

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔ٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

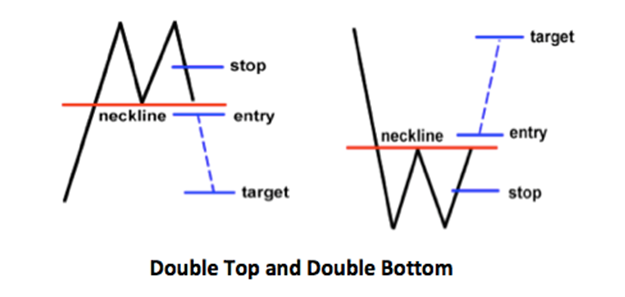

"Double Top" forex market mein ek price pattern hai, jo trend reversal signal provide karta hai. Is pattern mein price chart par ek specific formation banata hai, jisme price pehle ek peak banata hai, phir price downmove karta hai, firse upmove karke ek similar level par doosra peak banata hai, aur phir downtrend shuru hota hai.Double Top pattern ek bearish reversal pattern hai, jisme price ki bullish momentum khatam hoti hai aur sellers ki dominance shuru hoti hai. Is pattern mein, price pehle ek uptrend mein hota hai, jisme higher highs aur higher lows banate hain. Fir, price ek point par peak banata hai (first top), lekin uske baad price downmove karta hai. Firse upmove karte hue, price dobara pehle wale peak ke paas aata hai (second top), lekin usse aage upmove nahi hota aur price downtrend mein shift ho jata hai, lower lows aur lower highs banate hue.Double Top pattern ka important aspect hai ki yeh pattern do peaks par form hota hai, jiske beech price downmove karta hai. Yeh pattern ek bearish bias aur potential trend reversal ko indicate karta hai.Traders double top pattern ko identify karne ke liye price chart analysis aur technical indicators ka upyog karte hain. Candlestick patterns, trend lines, support and resistance levels, aur oscillators jaise RSI (Relative Strength Index) ya MACD (Moving Average Convergence Divergence) ki madad se double top pattern ki confirmations dhoondhe ja sakte hain.Double Top pattern traders ko bearish price movement ko anticipate karne mein madad karta hai. Traders is pattern ke upyog se trading decisions, jaise ki short sell positions lena ya long positions ko exit karna, lete hain.Hamesha dhyan dein ki double top pattern ek indicator hai, aur uske saath aur confirmation aur analysis ki zaroorat hoti hai. Price patterns ke sath sath, aapko baki technical analysis tools ka sahi istemal karna chahiye aur risk management ko bhi dhyan mein rakhna chahiye. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamualaikum! Umeed hai k ap sb khariyat sy hongy. R apky trading sessions achy jaa rhy hongy.Aj ka hmra or discussion topic "Double top pattern". Dekhty hain k ye hmein Kya information deta hai r hmry ilam Mai Kesy ezafa krta hai. Definition double taap aik intehai mandi ka takneeki reversal ke koi tarhn patteren hai jo kisi asasay ke musalsal do martaba buland qeemat tak pounchanay ke baad bantaa hai jis sy mein do bulandiyon ke darmiyan mamooli kami wastes hoti hai. jab asasa ki qeemat do Sabin ke darmiyan kam ke barabar support level se neechay ajati hai to is ki koi to tasdeeq hoti hai. keysteps double taap bearish technical reversal patteren hai. is ko talaash karna itna aasaan nahi jitna koi sochta hai jis ke kyunkay support ke neechay waqfay ke sath tasdeeq ki zaroorat hoti hai. jab ke double taap bearish signal hota hai, jabkay double bottom bearish signal hota hai. oopar ki chotyon mein aam tor par oopar ki chouti, ibtidayi chouti, , doosri chouti, aur gardan ki lakeer hoti hai. sarmaya car waqfay ke baad mukhtasir tijarat kar satke hain ya choti tijarat kar satke hain, kyunkay double taap par munafe ki mehdood salahiyat ho sakti hai . Identification of double top pattern double taap ki shanakht mein kayi ahem iqdamaat hain. To yaad rakhen ke double taap ki har misaal qadray ho mukhtalif ho sakti hai, aur ghalat isharay sarmaya karon ko yaqeen karne par majboor kar satke hain ke double taap ban raha hai jab ke haqeeqat mein aisa nahi hai. aam tor par, yahan aik double taap ki shanakht ke liye iqdamaat hain. aik talaash karen : double taap bananay se pehlay qeemat ki harkat wazeh tor par oopar ke rujhan mein honi chahiye. is se zahir hota hai ke qeemat musalsal onche onche aur onche neechi bana rahi hai. ibtidayi chouti sy talaash karen : up trained ki pehli chouti ka taayun karen. girna shuru honay se pehlay qeemat ab apni ziyada se ziyada satah par pahonch gayi hai. To talaash karen : ibtidayi chouti ke baad, qeemat mukhtasir tor par gir jaye gi. ibtidayi chouti ke baad tayyar honay wali waadi ya ko talaash karen. doosri chouti talaash karen : qeemat phir aik nai bulandi tak pounchanay ki koshish mein aik baar phir barhay gi. lekin yeh doosri really pehli chouti ki koi bulandi se kam ho jaye gi aur aik baar phir girna shuru ho jaye gi. patteren ki tasdeeq karen : double taap patteren ki tasdeeq karne ke liye, is baat ko yakeeni banayen ke koi to doosri chouti ke baad anay wali kami pehli chouti ke baad anay wali se kam hai. is se zahir hota hai ke qeemat ki to taraf se pichli muzahmati satah ko kamyabi se qaboo nahi kya gaya tha. naik line khinchin. yeh ufuqi line ke sath do ke nichale points ko jor kar kya jata hai. gardan ki lakeer, jo support ki satah ko zahir karti hai, yeh line hai. yeh aik or zaroori patteren refrences ke tor par kaam karta hai. Elements of double top pattern jaisa ke aap double taap farmishnz ki shanakht karte hain, darj zail kaleedi anasir par ghhor karen : oopar ka rujhan : patteren ban'nay se pehlay qeemat ko wazeh tor par oopar ki taraf barhna chahiye, jaisa ke onche onche aur onche se dekha jata hai. do chotiyan : patteren do chotyon par koi mushtamil hai jo qeemat ke lehaaz se aik dosray se koi bhe taqreeban masawi hai. yeh chotiyan muzahmati satah ke tor par kaam karti hain jahan qeemat ruk jati hai aur girna shuru ho jati hai. ya waadi : do chotyon ke darmiyan aik ya waadi bani hai. yeh qeemat mein kami ya koi or to istehkaam ki aik mukhtasir muddat ki nishandahi karta hai. naik line : naik line aik ufuqi lakeer hai jo waadi ya ke nichale maqamat ko jornay se banti hai. yeh muawnat ki degree ke tor par kaam karta hai aur patteren ki tasdeeq ke liye zaroori hai. naik line ka break : naik line ka tootna double ​​top patteren ka aik ahem jazo hai. jab qeemat ho neckline se neechay girty hai, mumkina rujhan ke ulat jane ki tajweez karti hai, patteren ki tasdeeq ki jati hai. hajam : hajam patteren ki hamari samajh mein izafah kar sakta hai. hajam aksar is waqt barhta hai jab qeemat gardan se neechay ajati hai aur do chotyon ki takhleeq ke douran ho kam hoti hai. patteren ki durustagi kharabi par hajam mein is izafay se mazboot hosakti hai. Advantages and disadvantages aik double taap patteren rujhan mein mumkina tabdeeli ka aik basri ishara paish karta hai jo oopar se neechay ke koi rujhan ki taraf jata hai. un taajiron ke liye jo market ki to raftaar mein tabdeeli se faida uthany ki umeed rakhtay hain aur naye munafe ke imkanaat ko haasil karte hain, yeh sazgaar ho sakta hai. is ke ilawa, umooman aik or makhsoos muzahmati satah hoti hai jo is waqt banti hai jab taqreeban aik hi qeemat ki satah par do chotiyan sy lagataar zahir hoti hain. is satah ko tajir stap las orders aur munafe ke maqasid ko qaim karne, rissk managment aur tijarti mansoobah bandi ko behtar bananay ke liye aik miyaar ke tor par istemaal kar satke hain. taajiron ke liye mukhtasir position shuru karne ke liye aik acha entry point double taap farmission mein naik line ko torna hai. agar qeemat gardan se neechay nahi tuutatii hai, to yeh aik muqarara satah faraham karta hai jis par market mein daakhil hona hai aur patteren ke baatil honay ka taayun karne mein madad karta hai. patteren ki oonchai ko koi to munafe ke ahdaaf ka andaza laganay ke liye bhi istemaal kya ja sakta hai, jis se taajiron ko bahar niklny ka aik allag lamha milta hai. hajam ka tajzia patteren ki durustagi ki mazeed yaqeen dehani kar sakta hai. hajam aksar is waqt barhta hai jab qeemat gardan se neechay ajati hai aur do chotyon ki takhleeq ke douran kam hoti hai. is hajam mein izafay se patteren ki signaling ki taaqat mein mazeed to izafah ho sakta hai. is liye, kuch tareeqon se, aik double taap doosri hikmat amlyon ke muqablay mein ziyada qabil aitbaar, qabil aetmaad namona ho sakta hai .

- Mentions 0

-

سا0 like

-

#4 Collapse

Assalamu Alaikum Dosto!Double Bottom Candlesticks PatternDouble bottom candlestick pattern bullish trend reversal ko signify karta hai aur traders ko buying opportunities provide karta hai. Double Bottom pattern ki tareef karte hue, iski pehchaan yeh hoti hai ki woh ek sahi upar neeche movement ke saath form hota hai jahan price pehle downward trend follow karta hai, phir ek support level par bottom banata hai, uske baad phir se downward movement follow karta hai lekin ek aur bottom banata hai jo pehle bottom se neeche nahi jaata hai. Yeh pattern traders ke liye ek bullish trend reversal signal hai jismein buying ki possibilities hoti hain.Pattern FormationDouble Bottom Pattern ki formation kuch steps ke through samjha ja sakta hai. Sabse pehle, price ek downward trend mein hota hai aur lower lows banata hai. Jab price neeche jaata hai, woh ek support level ko touch karta hai aur phir se upward movement shuru karta hai. Is upward movement ke dauran, price ek naya high banata hai aur phir se neeche jaata hai lekin pehle bottom level se kam nahi jaata. Dusra bottom level pe price support banata hai aur phir se upward movement start hota hai. Jab price pehle top level ko break karke upar jaata hai, tab Double Bottom Pattern confirm ho jaata hai. Is point par traders buying opportunities ko explore karte hain.ExplanationDouble Bottom Pattern mein, pehle bottom level aur doosre bottom level ke beech ek resistance level hota hai. Jab price pehle bottom level ko break karke neeche jaata hai, woh support level ke paas aakar rebound karta hai aur phir se upar jaata hai. Jab price doosri baar bottom level ko touch karta hai, woh support banata hai aur phir se upar ki taraf move karta hai. Jab price pehle top level ko break karke upar jaata hai, tab yeh pattern confirm hota hai. Double Bottom Pattern bullish trend reversal ko indicate karta hai aur traders ko buying opportunities provide karta hai. Stop loss aur target levels ko sahi tarike se set karke, traders is pattern ko istemal karke apne trading decisions ko support kar sakte hain.TradingDouble Bottom Pattern ko trading mein istemal karne ke liye, traders ko pattern ke confirmations ko dhyan mein rakhna zaroori hai. Jab price pehle bottom level ko break karke neeche jaata hai aur phir se rebound karke upar jaata hai, tab traders ko entry point ke roop mein consider kar sakte hain. Stop loss level ko set karke, traders apne positions ko protect kar sakte hain. Target level ko set karne ke liye, traders pattern ke height ko measure kar sakte hain aur usko breakout level se upar project kar sakte hain. Double Bottom Pattern ki trading mein success ke liye, sahi risk management aur disciplined approach zaroori hai. Traders ko market conditions, other technical indicators aur price action ke saath pattern ke sahi interpretation par focus karna chahiye. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#5 Collapse

Define Double Top Pattern Assalam o aliakum!Mere pyare dosto jesa ky Double Top pattern eik aisa pattern hai js 2 dafa market oper jati hai oper ja kr resist krti hai or jaisy he confirmation deiti bilkul eik line pr a kr tu aisa me market ya chart me market down jana shoro ho jati hai es me b $ 100 capital sy 0.05 ke eik trade lga bohat acha profit book kia ja skta hai agr es pattern ke confirmation ky zaroorat ho tu RSI EMA sy b madad le ja skti hai esko Pattern me Fibonacci ke madad sy b check kia ja skta hai kh market ya chart me mazeed oper jany ky qabil hai ya ni es me be time frame bohat matter krta hai agr H1 ka frame hai tu ye b small time frame me he ata hai H4 sy Month ka Time frame big time frame hoty hain es liay agr ap H1 me work krty hain tu apny small profit jaisy $10 to $90 ya $150 mil jaty hain ya in ky darmeeyan mein be apka profit ho jata hai tu profit ko furan book kr lein or trade off kr dein or mazeed trade krny ky liay dobara sy analysis shoro kr lein jaisy he dobara apka koi point mily tb trade karein wrna market mein up and down ward trend mein sara profit zero ho jay ga market me jb tk confirmation na ho jay tb tk trade open ni krni hai. Details Market ka acha technical analysis hamari achi training ke liye bahut hi zaruri hai isliye forex trading se pahle hamen market ko achi tarah se analyse karna chahie aur zyada se zyada forex market mein hamen apna time invest karna chahie aur forex mein hamen market ka fundamental aur technical analysis karna chahie jis ki madad se forex mein hum achi trading kar sakte hain aur achi earning aur achi kamyabi hasil kar sakte hain aur forex mein ham kamyab aur ache trader bhi ban sakte hain aur forex mein hamen koshish karna chahie k forex mein ham trading se pahle apne experience our knowledge ko increase karen aur forex chart mein chart pattern ko ache se samjhen forex mein achi trading ke liye chart pattern ka acha knowledge hamare liye bahut hi zaruri hai aur forex chart main candlesticks ko bhi samajhna chahie forex main achi trading k liye candlesticks ka acha knowledge bhi hamari achi trading ke liye bahut hi zaruri hai forex main hamen koshish karni chahie ki forex mein ham achi trading ke liye ache indicators ko use karen kyunki forex mein kuch indicators ki wajah se ham achi trading kar sakte hain aur achi earning aur achi kamyabi hasil kar sakte hain aur forex mein ham kamyab our ache trader bhi ban sakte hain aur forex mein hamen trading money management ke sath karni chahie forex main achi trading ke liye sabar bahut hi zaruri hai isliye forex main trading sabar ke sath karna chahie jisse forex mein hum achi trading kar sakte hain aur achi earning aur achi kamyabi hasil kar sakte hain aur forex main hum loss se bhi bach sakte hain.

Details Market ka acha technical analysis hamari achi training ke liye bahut hi zaruri hai isliye forex trading se pahle hamen market ko achi tarah se analyse karna chahie aur zyada se zyada forex market mein hamen apna time invest karna chahie aur forex mein hamen market ka fundamental aur technical analysis karna chahie jis ki madad se forex mein hum achi trading kar sakte hain aur achi earning aur achi kamyabi hasil kar sakte hain aur forex mein ham kamyab aur ache trader bhi ban sakte hain aur forex mein hamen koshish karna chahie k forex mein ham trading se pahle apne experience our knowledge ko increase karen aur forex chart mein chart pattern ko ache se samjhen forex mein achi trading ke liye chart pattern ka acha knowledge hamare liye bahut hi zaruri hai aur forex chart main candlesticks ko bhi samajhna chahie forex main achi trading k liye candlesticks ka acha knowledge bhi hamari achi trading ke liye bahut hi zaruri hai forex main hamen koshish karni chahie ki forex mein ham achi trading ke liye ache indicators ko use karen kyunki forex mein kuch indicators ki wajah se ham achi trading kar sakte hain aur achi earning aur achi kamyabi hasil kar sakte hain aur forex mein ham kamyab our ache trader bhi ban sakte hain aur forex mein hamen trading money management ke sath karni chahie forex main achi trading ke liye sabar bahut hi zaruri hai isliye forex main trading sabar ke sath karna chahie jisse forex mein hum achi trading kar sakte hain aur achi earning aur achi kamyabi hasil kar sakte hain aur forex main hum loss se bhi bach sakte hain.  Trading Double top Base outline design mein, 2 bottoms ke beech opposition level hota hai. Poke cost level opposition level ko break kar deta hai, toh brokers long positions enter karte hain. Is design ko exchange karne ke liye, brokers ko passage, stop misfortune aur take benefit positions ko painstakingly set karna chahiye.Double Base diagram design ki arrangement ke dauran volume ko bhi intently notice karna chahiye. Punch cost bounce back karta hai, toh volume bhi increment sharpen lagta hai. Agar doosre base ki arrangement ke dauran volume first base se kam rehta hai, toh yeh Twofold Base outline design ki legitimacy ko khatre mein daal sakta hai. graph design ki arrangement, long time period mein sharpen ke chances zyada hote hain. Is design ko distinguish karne ke liye, brokers ko graph ko cautiously break down karna chahiye aur various time periods standard iski legitimacy ko affirm karna chahiye.

Trading Double top Base outline design mein, 2 bottoms ke beech opposition level hota hai. Poke cost level opposition level ko break kar deta hai, toh brokers long positions enter karte hain. Is design ko exchange karne ke liye, brokers ko passage, stop misfortune aur take benefit positions ko painstakingly set karna chahiye.Double Base diagram design ki arrangement ke dauran volume ko bhi intently notice karna chahiye. Punch cost bounce back karta hai, toh volume bhi increment sharpen lagta hai. Agar doosre base ki arrangement ke dauran volume first base se kam rehta hai, toh yeh Twofold Base outline design ki legitimacy ko khatre mein daal sakta hai. graph design ki arrangement, long time period mein sharpen ke chances zyada hote hain. Is design ko distinguish karne ke liye, brokers ko graph ko cautiously break down karna chahiye aur various time periods standard iski legitimacy ko affirm karna chahiye. Thank YOU

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 04:05 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим