What is Mat Hold Candle Stick Pattern

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

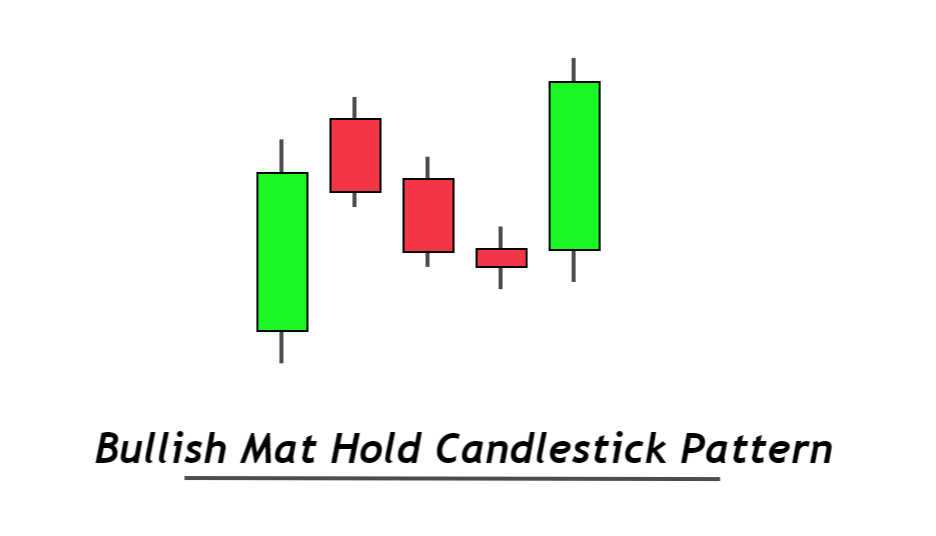

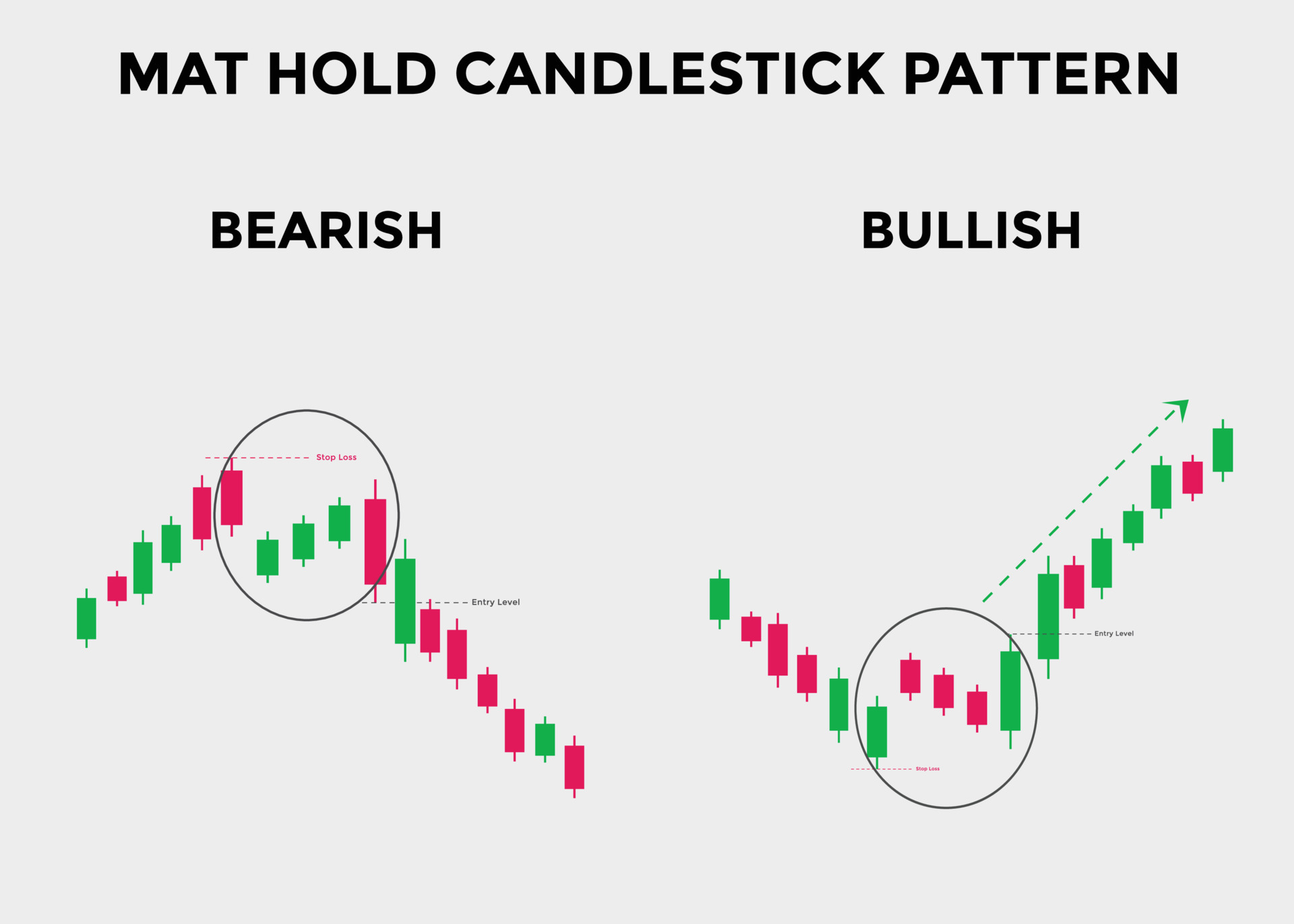

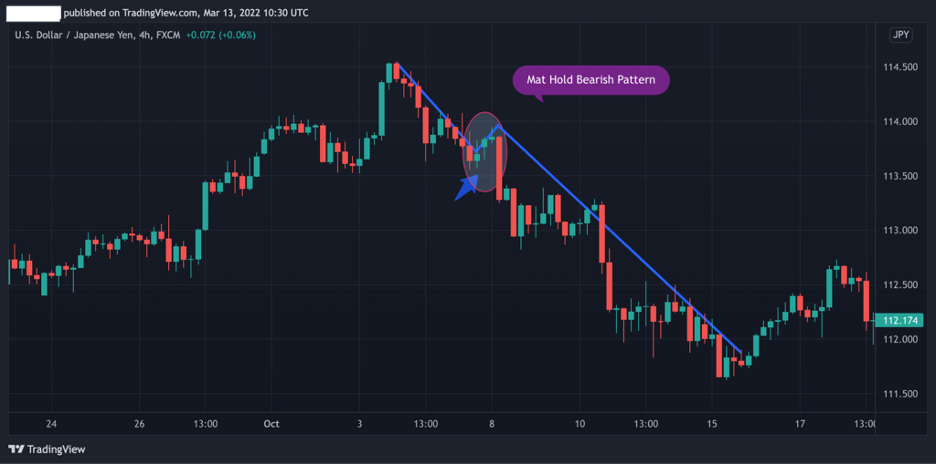

Hello, I hope you're all doing well in the forex market. Wish you all best of luck. It is really a fantastic forum to discuss on important points.Today, I want to talk about an important topic called the "Mat Hold" candlestick pattern. When you're trading in the forex market, you need to do different kinds of analysis to make your trades. If you pay close attention to candlestick patterns, you can gain more benefits. The Mat Hold pattern is a continuation pattern that occurs after a bullish or bearish trend. It helps to keep the price moving in the same direction. In this pattern, the first candle has a long real body, followed by three small real body candles. Finally, there is another long real body candle. When this last candle appears, it indicates that the pattern is formed, and it can lead to a strong movement in its direction. This is when we can make a good trade. Trading Strategy:In the forex market, the Mat Hold pattern is used for trend continuation. If it appears during a bullish trend, we can take a buying position, and if it appears during a bearish trend, we can take a selling position when the pattern is complete. The pattern keeps the price within its boundaries for some time, but it doesn't change the direction of the trend. That's why the last candle is important as it confirms the pattern. Setting a stop-loss is crucial, and it should be placed at the high or low point of the pattern, depending on our entry. This way, we can make good trades.The Mat Hold pattern is formed near the top or bottom of the price, which is why it's considered a reversal pattern. It consists of the first candle with a long real body that represents the current trend. The second, third, and fourth candles have small real bodies and can go against the trend. The fifth candle is another long real body candle, indicating a continuation of the previous trend. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Introduction: Candlestick patterns play a vital role in technical analysis and can provide valuable insights into market trends and potential price movements. One such pattern is the "Mat Hold" candlestick pattern. In this guide, we will explore the Mat Hold pattern, its characteristics, and how traders can interpret and utilize it effectively. Mat Hold Candlestick Pattern Kya Hai? Mat Hold candlestick pattern ek bullish continuation pattern hai, jo uptrend ke dauran dekha jata hai. Is pattern mein, ek lambi green (bullish) candlestick ko doji candlestick aur phir ek lambi green candlestick follow karti hai. Doji candlestick pehli candlestick ke niche ya near mein form hoti hai. Mat Hold pattern mein ye important hai ke doji candlestick pehli candlestick ke upper body mein form ho. Is pattern ko mat hold kaha jata hai kyunke doji candlestick pehli candlestick ko jaise "hold" karti hai aur phir market mein bullish trend continue hota hai. Mat Hold Pattern Ki Tafsiliyat aur Interpretation Mat Hold pattern ko samajhna aur interpret karna traders ke liye zaroori hai. Is pattern ki tafsiliyat neechay diye gaye points par mabni hai: 1.Uptrend ki Presence: Mat Hold pattern ek bullish continuation pattern hai, isliye isko uptrend ke dauran dekha jata hai. Agar market mein strong uptrend hai aur price action bullish hai, to Mat Hold pattern ki possibility zyada hoti hai. 2.Confirmation: Mat Hold pattern ko confirm karne ke liye, doji candlestick pehli candlestick ke upper body mein form honi chahiye. Isse indicate hota hai ke uptrend mein buying pressure barqarar hai aur bullish trend continue ho sakti hai. 3.Volume Analysis: Volume analysis bhi Mat Hold pattern ki confirmation mein madadgar ho sakti hai. Agar doji candlestick ke samay volume kam hai aur phir next bullish candlestick ke samay volume increase hota hai, to ye pattern ki validity ko confirm karta hai. 4.Price Targets: Mat Hold pattern ke price targets ko identify karna bhi zaroori hai. Traders support aur resistance levels aur technical analysis ke saath mila kar price targets tay kar sakte hain. Conclusion: Mat Hold candlestick pattern ek useful tool hai jise traders apni technical analysis mein istemal kar sakte hain. Is pattern ki samajh aur interpretation market trends aur potential price movements ko samajhne mein madadgar ho sakti hai. Traders ko is pattern ko samajhna, confirm karna aur phir apne trading strategies mein incorporate karna zaroori hai. Hamesha risk management ka dhyaan rakhe aur apne trades ko monitor karte hue apni strategy ko refine karte rahe. -

#4 Collapse

"Mat Hold Candle Stick Pattern"- Mat Hold Candlestick Pattern Introduction:

:max_bytes(150000):strip_icc()/matholdpattern-d2036e7c83eb4fae94047ec844bfa39d.jpg) Characteristics of the Mat Hold Pattern :

Characteristics of the Mat Hold Pattern :

- Pehle candlestick ek uptrend mein dikhta hai.

- Uptrend ke baad ek long white candlestick aati hai.

- Long white candlestick ke baad small size ki bearish candlestick aati hai.

- Bearish candlestick ke baad firse ek long white candlestick aati hai jo pehle wali white candlestick ko cover karti hai.

- Mat Hold Pattern mein gap usually nahi hota hai.

- Formation of the Mat Hold Pattern:

- Components of the Mat Hold Pattern:

- Pehla long white candlestick

- Small size ki bearish candlestick

- Dusra long white candlestick jo pehle wali white candlestick ko cover karti hai

- Interpretation of the Mat Hold Pattern:

- Bullish Mat Hold Pattern:

- Bearish Mat Hold Pattern:

- Importance of Confirmation in Mat Hold Patterns:

- Trading Strategies Using Mat Hold Patterns:

- Bullish Mat Hold Pattern ko buy signal ke roop mein interpret karke long position lena.

- Bearish Mat Hold Pattern ko sell signal ke roop mein interpret karke short position lena.

- Stop-loss aur target levels ko set karna taki risk management ka dhyan rakha ja sake.

- Limitations of the Mat Hold Pattern :

- Ye pattern alone reliable nahi hota aur confirmation ki zarurat hoti hai.

- False signals generate ho sakte hain, isliye dusre technical tools ka istemal zaruri hai.

- Market conditions aur trend ke against ye pattern kaam nahi karta hai.

- Conclusion and Summary:

-

#5 Collapse

Assalamualaikum! Umeed hai k ap sb khariyat sy hongy. R apky trading sessions achy jaa rhy hongy.Aj ka hmra or discussion topic "Mat hold candlestick pattern ". Dekhty hain k ye hmein Kya information deta hai r hmry ilam Mai Kesy ezafa krta hai. Definition aik chitaai hold patteren aik candle stuck ki tashkeel hai jo paishgi harkat ke tasalsul ki nishandahi karti hai . Explanation bearish ya blush meet hold patteren ho satke hain. aik or taizi ka namona aik barri oopar ki mom batii se shuru hota hai jis ke baad aik faasla ouncha hota hai aur teen choti mom batian jo neechay chalti hain. yeh mom batian pehli mom batii ke nichale hissay se oopar rahen. panchwin es mom batii aik barri mom batii hai jo dobarah oopar ki taraf chalti hai. patteren majmoi tor par up trained mein hota hai. bearish version yaksaa hai, siwaye aik aur paanch to mom batian barri neechay candles hain, aur candles do se chaar choti hain aur oopar ki taraf jati hain. yeh mom to batian pehli mom batii ki oonchai se neechay rahen. 3rd patteren neechay ki taraf aik lambi mom batii ke sath koi mukammal hota hai, candle five. yeh neechay ke rujhan ke andar waqay hona chahiye . keysteps meet hold patteren taizi ya mandi ka ho sakta hai. taizi ka patteren oopar ke rujhan mein hota hai aur mandi ka koi to patteren neechay ke rujhan mein hota hai. blush version es aik barri up candle hai, jis ke baad teen choti mom to mein batian, aur phir aik barri up candle ke baad aik gape ziyada hai. bearish version aik barri davn candle hai, aik gape nichala hai jis ke baad teen choti oopar candles, aur phir aik barri neechay candle hai . Example chitaai hold patteren nayaab hai. lehaza, tajir patteren ko mein chhootey inhiraf ki ijazat day satke hain jab tak ke koi patteren ki majmoi bunyaad tadbeer mein rehti hai. alphabet ankarporishn ( goog ) mein darj zail patteren ka aaghaz majmoi tor par oopar ki janib aik mazboot mom batii ke sath hota hai. is ke baad chaar mom batian aati hain jo pehli ki kam se oopar rehti hain. blush patteren koi totmein mein aam tor par sirf teen mom batian hoti hain jo koi to neechay ki taraf jati hain. patteren ke baad oopar ki taraf mazeed izafah hota hai, halaank is muamlay mein yeh qaleel almudati hai. mamool se inhiraf ke bawajood - paanch ki bajaye chay mom batian - majmoi patteren qeemat mein zabardast izafah, aik pal back, aur phir to patteren ke aakhir mein rujhan saazi ki simt mein koi bhe zabardast izafay ko zahir karta hai. -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Mat Hold Candle Stick pattern ko Mat Hold Doji bhi kaha jata hai, aur is mein do candles shamil hoti hain jinke bodies chhoti hoti hain aur lambi wicks hoti hain. Pehli candle, jo ke Mat candle kehlata hai, uski body chhoti hoti hai aur ek lambi lower wick hoti hai. Dusri candle, jo ke Hold candle kehlata hai, uski body chhoti hoti hai aur ek lambi upper wick hoti hai. Dono candles ki wicks ki lambai lagbhag barabar hoti hai, jo ke market mein uncertainty ko darust karti hai.

Significance of Candlestick Pattern

Mat Hold Candle Stick pattern ko is liye reversal pattern kaha jata hai kyun ke ye ishara karta hai ke market indecision mein hai aur jald hi apni rah ko palat sakta hai. Mat candle khareedne ka mouqa darust karta hai, jahan buyers ne price ko ooper dhakela hai lekin bechne wale dabao ke bais band position ko close nahi kar sake. Hold candle bechne ka mouqa darust karta hai, jahan sellers ne price ko neeche dhakela hai lekin khareedne wale dabao ke bais position ko close nahi kar sake.

Mat Hold Candle Stick pattern ahem hai kyun ke ye ishara karta hai ke market mein khareedne wale aur bechne wale barabar hain, jo ke aik mawafiqi halat utpann karta hai. Ye mawafiqi halat mamoolan short-lived hoti hai, kyun ke market ka koi aik hissa dominance hasil karke apni rah par price ko dhakel sakta hai. Traders ko ye maloom hona chahiye ke ye pattern kisi bhi time frame par ho sakta hai, daily charts se le kar intraday charts tak.

Indications of the Mat Hold Candle Stick Pattern

Mat Hold Candle Stick pattern mukhtalif currency pairs par mil sakta hai, jaise ke EUR/USD, GBP/USD, USD/JPY, aur USD/CHF. Ye kisi bhi din ke waqt ho sakta hai, lekin ye low volatility ya consolidation ke doran zyada hota hai. Traders ko ye bhi note karna chahiye ke ye pattern tab zyada ahem hota hai jab ye kisi lambi trend ke baad ya kisi ahem support ya resistance level ke nazdeek hota hai.

Mat Hold Candle Stick pattern par trade karne ke liye traders ko kuch steps follow karne chahiye:- Identify the Mat Hold Candle Stick pattern: Do candles ko dhoonden jinke bodies chhoti hain aur lambi wicks hain jo lagbhag barabar lambi hain. Pehli candle ki lower wick lambi honi chahiye, jabke dusri candle ki upper wick lambi honi chahiye.

- Confirm the pattern: Is pattern par trade karne se pehle, traders ko ye tasdeeq karna chahiye ke ye sach mein aik reversal pattern hai. Iske liye wo support ya resistance levels, trend lines, ya moving averages jaise doosre indicators dekhein. Traders ko economic news releases ya central bank meetings jaise doosre factors ko bhi mad e nazar rakhein jo currency pair ki price movement ko asar andaaz kar sakte hain.

- Determine the direction: Reversal pattern aur doosre indicators ki tasdeeq ke badle, traders ko ye tay karna chahiye ke unhe currency pair ko khareedna hai ya bechna hai. Agar unka khayal hai ke khareedne wale bechne wale se zyada taqatwar hain, to wo currency pair ko khareed sakte hain. Agar unka khayal hai ke bechne wale khareedne wale se zyada taqatwar hain, to wo currency pair ko bech sakte hain.

- Set stop-loss and take-profit orders: Traders ko apne nuksan ko had mein rakhne ke liye stop-loss orders set karna chahiye aur apne munafa ko mehfooz karne ke liye take-profit orders set karna chahiye. Wo ye bhi ghor karein ke price unke faavor mein chal raha hai to trailing stop-loss orders set karke apne stop-loss orders ko adjust karna bhi consider karein.

- Manage risk: Traders ko hamesha apna risk sahi tariko se manage karna chahiye, jaise ke har trade ke liye unke trading capital ka aik hissa alag rakhna aur stop-loss orders ka istemal karke apne nuksan ko had mein rakhna. Wo ye bhi sochein ke kya wo risk management tools jaise ke hedging ya positions ko minimize karne ke liye use kar sakte hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

- 0.8738 USDCHF

- Mentions 0

-

سا0 like

-

#7 Collapse

What is Mat Hold Candle Stick Pattern

"Mat Hold" Candlestick Pattern ek technical analysis concept hai jo financial markets mein istemal hota hai. Ye pattern price charts par dekha ja sakta hai aur traders isay market direction ka indication samajhne ke liye istemal karte hain.

Mat Hold pattern ka basic idea ye hai ke ek uptrend (price barh raha hai) ke baad, ek specific candlestick pattern aata hai jo indicate karta hai ke market mein consolidation ho rahi hai aur phir trend continue ho sakta hai.

Mat Hold pattern mein, pehle ek bullish (upward movement) candle hoti hai, jo ki uptrend ko represent karti hai. Iske baad, ek small bearish (downward movement) candle hoti hai jo uptrend ke opposite direction mein hoti hai lekin iska range pehle wale bullish candle ke andar rehta hai. Iske baad, ek series of small bullish candles aati hai jo indicate karte hain ke market mein strong selling pressure nahi hai aur uptrend continue ho sakta hai.

Ye pattern market sentiment ko reflect karta hai aur traders ise trend reversal ya trend continuation ke signals ke liye use karte hain.

Is pattern ka mukhtalif variations bhi ho sakte hain, isliye traders ko isay properly identify karne mein practice aur experience ki zarurat hoti hai.

Mat Hold pattern mein kuch key features hote hain:- Pehli Candlestick: Uptrend ke doran, ek lambi bullish candle hoti hai.

- Dusri Candlestick: Dusri candle bhi bullish hoti hai, lekin iski body pehli candle ki body ke andar rehti hai. Iska matlab hai ke dusri candle pehli candle ko cover nahi karti, lekin woh uske andar rehti hai.

- Isolation: Dusri candle ke baad ek ya kuch small-sized candles aati hain jo ke market mein uncertainty ko darust karti hain.

- Confirmation: Uptrend continue hota hai jab ek aur lambi bullish candle aati hai, jo ke dusri candle ki body ke andar rehti hai.

Mat Hold pattern ko dekhte hue traders expect karte hain ke uptrend jari rahega. Yeh pattern market mein bullish momentum ko darust karta hai.

-

#8 Collapse

What is mat hold candle stick pattern

Mat hold, jo ke ek candlestick pattern hai, yeh trend continuation pattern ko represent karta hai. Yeh pattern aksar bullish trends mein dekha jata hai.

Mat Hold, ek bullish candlestick pattern hai jo market mein tezi ke doran paida hota hai. Is pattern mein kuch candles aise hote hain jo ek uptrend ke dauran dikhte hain. Yeh pattern doosre bullish patterns se thoda alag hota hai.

Mat Hold pattern ko pehchane ke liye, aapko kuch steps follow karne padte hain:

Pehla Candle (Candle A):

Ek strong bullish candle hoti hai, jo ke uptrend ko represent karti hai.

Dusra Candle (Candle B):

Isme bhi ek bullish candle hoti hai, jo pehle candle ki body ke andar close hoti hai. Iska matlab hai ke uptrend mein aur bhi buying pressure hai.

Teesra Candle (Candle C):

Yeh candle bhi bullish hoti hai, lekin iska close pehle do candles ke close ke beech hota hai. Is candle ka close pehle do candles ke darmiyan rehna "mat hold" kehlaney ka reason hai.

Chouthi Candle (Candle D):

Yeh ek aur bullish candle hoti hai, jo trend ko confirm karta hai. Is candle ka close teesri candle ke close se ooper hota hai, jo ke ek aur bullish indication hai.

Mat Hold pattern ka matlab hai ke uptrend mein hone wali tezi ko confirm karte hue market mein buying interest strong hai aur trend continue ho sakta hai.

Yeh pattern market analysis mein istemal hota hai taake traders ko future price movement ke bare mein anuman lagane mein madad mile.

- CL

- Mentions 0

-

سا0 like

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Mat hold candlestick pattern, ya "mat hold" pattern, ek technical analysis mein istemal hone wala candlestick pattern hai jo market ke trends ko analyze karne ke liye istemal hota hai. Yeh pattern bullish aur bearish markets mein dono situations mein dekha ja sakta hai.

Candlestick Chart

Candlestick charts, technical analysis mein ek popular tool hain jo market trends ko visualize karne ke liye istemal hoti hai. Har candlestick chart ek specific time period ko represent karta hai, jaise 1 din, 1 ghanta, ya 15 minute.

Har candlestick chart mein, har candlestick ek rectangle shape mein hota hai jise "body" kehte hain aur do lines hoti hain jo body se bahar extend hoti hain, inhein "shadows" ya "wicks" kehte hain. Har candlestick ke body ka color bhi important hota hai, jaise green candle bullish trend ko represent karta hai jabke red candle bearish trend ko indicate karta hai.

Mat Hold Candlestick Pattern

Mat hold candlestick pattern, ek bullish continuation pattern hai jo ek uptrend ke doran develop hota hai. Is pattern mein, ek strong uptrend ke baad market mein kuch consolidation hoti hai, lekin price mein significant decline nahi hota.

Mat hold pattern ko identify karne ke liye kuch key characteristics hain:- Uptrend: Mat hold pattern, pehle ek strong uptrend ki presence mein develop hota hai.

- Consolidation: Uptrend ke baad, market mein consolidation hoti hai jahan price mein koi significant decline nahi hota. Yeh consolidation phase, price mein thoda sa movement hota hai lekin overall trend bullish rehta hai.

- Doji Candlestick: Mat hold pattern ke doran, ek ya multiple doji candles dikhai dete hain. Doji candles mein open aur close price aapas mein bohot qareeb hoti hain aur body ki length chhoti hoti hai.

- Price Stability: Consolidation phase ke doran, price mein stability hoti hai aur koi major price decline nahi hota.

- Volume: Volume bhi ek important factor hota hai mat hold pattern ko identify karne mein. Generally, volume consolidation phase ke doran decrease hota hai, indicating ke market mein activity kam hoti hai.

Mat Hold Pattern ke Types

Mat hold pattern ke do types hote hain:- Bullish Mat Hold: Jab mat hold pattern ek uptrend ke baad develop hota hai, to ise bullish mat hold kehte hain. Yeh pattern bullish trend ko confirm karta hai aur traders ko indicate karta hai ke uptrend jari reh sakta hai.

- Bearish Mat Hold: Kabhi kabhi, mat hold pattern ek downtrend ke baad develop hota hai, jise bearish mat hold kehte hain. Yeh pattern downtrend ko confirm karta hai aur traders ko indicate karta hai ke downtrend jari reh sakta hai.

Trading Strategy

Mat hold pattern ko trade karne ke liye, traders ko kuch important steps follow karne chahiye:- Identify the Trend: Pehle toh traders ko current trend ko identify karna zaroori hai. Mat hold pattern bullish ya bearish trend ke baad develop hota hai, isliye trend ka pata hona zaroori hai.

- Identify the Mat Hold Pattern: Trader Traders ji candles ke sath-sath price stability aur volume ko bhi observe karna chahiye, taake wo mat hold pattern ko identify kar sakein.

- Confirmation: Mat hold pattern ko confirm karne ke liye, traders ko next candlestick ka reaction bhi dekhna chahiye. Agar next candlestick bullish hai aur uptrend continue hota hai, toh mat hold pattern confirm hota hai.

- Entry aur Exit Points: Traders ko entry aur exit points ko determine karna zaroori hai. Entry point ko usually doji candle ke close ke neeche aur stop loss ko doji candle ke low ke neeche rakha jata hai.

- Risk Management: Har trading strategy mein risk management zaroori hai. Traders ko apne trades ke liye stop loss aur take profit levels set karna chahiye.

-

#10 Collapse

MAT HOLD CANDLE STICK PATTERN:-

Forex market mein mat hold pattern ko special importance dety hein. Ess pattern ka maqsad hai prove karna ke market mein uptrend strong hai aur continue ho sakta hai. Har new candle first four candles ki range ke andar close hoti hai, jis ki wajah sey strong uptrend ko confirm karta hai. Ess pattern ka istemal karte waqt traders ko strong uptrend mein entry lene ka chance milta hai. Yeh pattern aksar long trading positions key liye traders first option hota hay.

IDENTIFICATION:-

Market mein available other patterns ki tarh ess ki identification bi traders kay leye trading requirements ko complete kerti hay. Ess pattern ki first candlestick uptrend ya downtrend ke center mein ati hai, aur is ki length normal hoti hai. Second candlestick bhi uptrend ya downtrend mein hoti hai, jab kay is ki body first candlestick ki body se zyada lengthy hoti hai. Ess ke badle mein is ki closing price first candlestick ki opening price ke nazdeek hoti hai. Second candlestick kay baad market mein association hoti hai, jis mein prices tezi sey change nahi hoti hain aur volume bhi normal hota hai. Third candlestick ek long candle hoti hai, jo first candlestick ki taraf move karti hai. Ess ki lambai, consolidation ke doran aayi average lambi candlesticks sey zyada hoti hai. Ess tarah yeh formation complete ho jati hay.

RECOMMENDATIONS:-

Trading mein traders ko chehye kay candles ke sath price stability aur volume ko bhi observe karna chahiye, taa kay woh mat hold pattern ko efficiently identify kar sakein. Mat hold pattern ko confirm karne ke liye, traders ko next candlestick ka reaction bhi dekhna chahiye. Agar next candlestick bullish hai aur uptrend continue hota hai, toh mat hold pattern confirm hota hai. Traders mat hold pattern ko dekhte hain jab un ko lagta hai ke market mein uptrend hai aur yeh pattern confirm karta hai kay trend continue hone wala hai. Ess pattern ki completion kay baad traders apne buy trading positions ko reinforce kar sakte hain.aur as aresult required positive results gain ker sakty hein.

-

#11 Collapse

What is Mat Hold Candle Stick Pattern.

Mat Hold ek bullish continuation pattern hai jo Japanese candlestick charting mein dekha jaata hai. Yeh pattern ek uptrend ke doran develop hota hai aur ek chhoti si retracement ke baad hota hai jab market mein bullish momentum phir se shuru hota hai. Is pattern mein pehla candle bullish hota hai, phir ek chhoti si retracement ke baad doosra candle aata hai jo pehle candle ke range ke andar rehta hai, lekin ise exceed nahi karta. Iske baad agle kuch candles mein price firse upward movement karta hai, jo ki uptrend ko confirm karta hai.

Mat Hold Candle Stick Pattern tips.

Mat Hold Candlestick Pattern ko trade karte waqt kuch tips yaad rakhein.

1.Confirmation ke liye wait karein.

Mat Hold pattern ko trade karne se pehle ek confirmation candle ka wait karein. Yeh candle price ke further upward movement ko validate karta hai.

2.Stop-loss aur target levels set karein.

Har trade mein stop-loss aur target levels set karna zaroori hai. Stop-loss lagana aapko loss se bachata hai, jabki target levels aapko profit booking karne mein madad karte hain.

3.Volume ko monitor karein.

Volume ko bhi consider karein Mat Hold pattern ko trade karte waqt. Agar volume pattern ke saath increase ho raha hai, toh yeh bullish momentum ko confirm karta hai.

4.Dusre technical indicators ke saath confirm karein.

Mat Hold pattern ko confirm karne ke liye, dusre technical indicators jaise ki moving averages, RSI, ya MACD ka istemal karein.

5.Risk management ka dhyaan rakhein.

Har trade mein apna risk manage karein. Overleveraging se bachne ke liye apni position size ko control karein aur apna risk tolerance level samjhein.

6.Practice karein.

Mat Hold pattern ko pehle demo account mein practice karein ya phir small position sizes mein trade karein, takay aap is pattern ko samajh sakein aur apni trading skills improve kar sakein.

Mat Hold Candle Stick Pattern trading strategy.

Mat Hold Candlestick Pattern ko trade karne ke liye ek trading strategy kaafi effective ho sakti hai. Yahan ek basic Mat Hold pattern trading strategy di gayi hai.

Step 1. Identify Mat Hold Candlestick Pattern.

Market mein ek uptrend ke dauran, ek chhoti si retracement ke baad Mat Hold pattern ko identify karein. Is pattern mein pehla candle bullish hota hai aur doosra candle pehle candle ke range ke andar rehta hai, lekin ise exceed nahi karta.

Step 2. Wait for Confirmation.

Mat Hold pattern ko confirm karne ke liye, ek confirmation candle ka wait karein jo price ke further upward movement ko validate karta hai.

Step 3. Entry Point.

Confirmation candle ke closing price ke above ek buy entry point set karein. Isse ensure karein ki uptrend ke momentum ke sath sath aapki entry bhi strong ho.

Step 4. Stop-loss Placement.

Stop-loss apni risk tolerance aur market volatility ke according set karein. Ek common approach hai ki stop-loss ko confirmation candle ke low ke just neeche rakhna.

Step 5. Take Profit Targets.

Take profit levels ko set karein jahan aapko comfortable feel ho ya phir technical analysis ke through determine karein. Previous swing high ya resistance levels ko take profit targets ke roop mein consider kiya ja sakta hai.

Step 6. Risk Management.

Har trade mein apna risk manage karein. Position size ko control karein aur stop-loss levels ka dhyan rakhein.

Step 7. Monitor the Trade.

Trade ko monitor karte rahein aur price ke movements ko observe karte rahein. Agar market conditions change hote hain, toh apne positions ko adjust karein ya phir exit karein.

Summary.

Yeh strategy basic hai aur aap ise apne trading style aur preferences ke according customize kar sakte hain. Always remember to backtest any strategy before implementing it in live trading, and use proper risk management techniques. -

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What is Mat Hold Candle Stick Pattern in Forex?

Answer:

Mat Hold Candlestick Pattern Kya Hai:

Mat Hold Candlestick Pattern ek continuation pattern hai jo forex trading mein istemal hota hai. Ye pattern ek strong uptrend ke doran dekha jata hai aur iska matlab hota hai ke price ek strong uptrend mein hai aur iske baad ek temporary consolidation phase aata hai jise mat hold pattern kehte hain.

Kis Tarah Kaam Karta Hai:

1. Banawat:

Mat Hold Pattern mein ek series of bullish candlesticks hoti hai jo ek uptrend ko represent karti hai. Iske baad ek bearish candlestick aati hai jo ek temporary consolidation ya pullback phase ko indicate karta hai, lekin ye consolidation phase pehle ke bullish trend ke continuity ko darust rakhta hai.

2. Volume Analysis:

Is pattern ke confirmation ke liye, traders volume analysis ka istemal karte hain. Agar consolidation phase ke doran volume decrease hota hai aur phir price fir se upar move karta hai, toh yeh pattern confirm hota hai.

Tabeer aur Trading:

1. Continuation Signal:

Mat Hold Pattern ko dekh kar traders ko signal milta hai ke current uptrend jari hai aur consolidation phase ke baad price ka uptrend continue hone ka potential hai.

2. Entry Aur Exit Points:

Traders is pattern ke completion ke baad entry aur exit points tay karte hain. Agar pattern confirm ho jata hai, toh traders uptrend ke direction mein positions enter karte hain.

Trading Strategy:

1. Confirmation Ki Zarurat:

Mat Hold Pattern ke signals ko confirm karne ke liye, traders doosre technical indicators aur price action ka istemal karte hain. Confirmatory signals ke bina trading avoid kiya jana chahiye.

2. Risk Management:

Har trading strategy mein risk management ka ek crucial hissa hota hai. Mat Hold Pattern ke signals ke saath, stop-loss aur take-profit levels tay karna zaroori hai.

Nateeja:

Mat Hold Candlestick Pattern, forex traders ke liye trend continuation ko confirm karne mein madadgar hota hai. Lekin, hamesha market context aur doosre confirmatory indicators ko bhi tajziya karna zaroori hai trading decisions ke liye.

-

#13 Collapse

Mat Hold Candle Stick Pattern

Introduction

Mat Hold Candle Stick Pattern ek mumtaz technical analysis tool hai jo share market mein istemal hota hai. Is pattern ka maqsad price movement ko analyze karna hota hai taake traders ko future price direction ka andaza lagaya ja sake.Mat Hold Candle Stick Pattern mein, pehle ek bullish candle hoti hai jo ek uptrend ko darust karta hai. Isko "mother candle" kehte hain. Phir, agle kuch chhote bullish aur bearish candles aati hain jo "mat hold zone" mein rehti hain. Mat hold zone, mother candle ki range ke andar hoti hai, lekin in candles ki wick mother candle ke range se bahar nahi hoti. Iske baad, ek lambi bullish candle ati hai jo mother candle ke range se bahar nikalti hai aur uptrend ko jari rakhti hai.

Candle Stick Pattern Identity

Mat Hold Candle Stick Pattern ki pehchan ke liye, traders ko kuch pointon par tawajjo deni hoti hai.- Pehli baat to yeh hai ke mother candle ki range ko theek tareeqe se define kiya jaye. Iske baad, mat hold zone mein aane wale chhote candles ko dekha jata hai. Agar yeh candles mother candle ke range mein rehte hain aur wick mother candle se bahar nahi jaati, to yeh mat hold pattern ka hissa hai.

- Iske baad, jab ek lambi bullish candle mother candle ke range se bahar nikalti hai, to yeh confirmatory signal hota hai. Is candle ki length bhi important hoti hai, jisay zyada lamba hona behtar hai.

- Agar yeh pattern uptrend ke dauran nazar aaye, to yeh bullish continuation signal hai. Jabki agar downtrend ke dauran yeh pattern nazar aaye, to yeh bullish reversal signal hai.

Istemal aur Ahmiyat

Mat Hold Candle Stick Pattern ka istemal traders aur investors ke liye ahem hota hai kyun ke iske zariye woh market ki movement ko predict kar sakte hain. Yeh pattern market trends ko samajhne mein madadgar hota hai aur trading strategies ko banane mein istemal kiya ja sakta hai. Iske zariye, traders ko potential buying ya selling points ka andaza lagane mein madad milti hai. Is pattern ki sahi tashkeel se faida uthane ke liye, traders ko market ke technical aur fundamental aspects ko mila kar samajhna zaroori hai.

-

#14 Collapse

What is Mat Hold Candle Stick Pattern kai hy

Mat Hold Candlestick Pattern (میٹ ہولڈ کینڈلسٹک پیٹرن):

Mat Hold Candlestick Pattern ek continuation pattern hai jo market charts par dikhai deta hai. Ye pattern uptrend ke doran aata hai aur indicate karta hai ke current trend continue ho sakta hai.

Formation:- Uptrend: Pehle, market mein ek uptrend hona chahiye jisme prices consistently upar jaati hain.

- Long White Candle: Uptrend ke doran ek lambi white (bullish) candle aati hai, jo indicate karta hai ke buyers control mein hain.

- Small Candle: Iske baad ek small-sized candle aata hai, jo preferably white ho, lekin ye bhi zaroori nahi hai.

- Third Candle: Teesri candle lambi white candle ke neeche open hoti hai, lekin low level pe pehli candle ki close ke bohot kareeb hoti hai. Is candle ka size bhi bada hota hai.

- Continuation: Mat Hold pattern ke baad prices continue karte hain aur uptrend maintain hota hai.

Characteristics:- Mat Hold pattern ka primary characteristic hai ke despite small retracement, uptrend continue hota hai.

- Third candle ke closing level pehli candle ke close ke bohat kareeb hota hai, indicating strong support.

Interpretation:- Mat Hold pattern ka interpretation ye hai ke despite minor profit-taking ya retracement, overall bullish sentiment maintain ho rahi hai.

- Third candle ke closing level pehli candle ke close ke bohat kareeb hona strong support ko darust karta hai.

Trading Strategy:- Traders Mat Hold pattern ko dekh kar uptrend ke continuation ke liye confirmation ka wait karte hain.

- Agar next few candles bhi bullish hote hain aur uptrend confirm hota hai, to traders long positions (buy positions) par focus karte hain.

- Stop-loss orders ka istemal important hai taki in case of unexpected market movements, trader ka risk minimized ho sake.

Zaroori Hidayat:- Jaise har ek technical pattern, Mat Hold pattern ko confirmatory signals aur doosre technical tools ke saath combine karna important hai.

- Market conditions aur overall trend ka analysis bhi karna crucial hai.

Conclusion: Mat Hold Candlestick Pattern ek strong bullish continuation signal hai, lekin hamesha cautious approach aur thorough analysis ke saath istemal karna chahiye.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What is Mat Hold Candle Stick Pattern.

Mat Hold Candlestick Pattern ek bullish continuation pattern hai jo technical analysis mein istemal hota hai. Ye pattern market mein uptrend ke dauran dikhta hai aur isse samajhaya jata hai ke current uptrend continue hone ka zor ho sakta hai. Is pattern ko dekh kar traders ko ye indication milti hai ke bullish momentum barqarar hai aur price mein mazeed izafa hone ki sambhavna hai.

Mat Hold Pattern ka hona zaruri components hain:- Uptrend Hona: Mat Hold pattern tabhi effective hota hai jab market mein already uptrend chal raha ho. Is pattern ko confirm karne ke liye pehle ek strong uptrend ka hona zaruri hai.

- Large Bullish Candle (Continuation Candle): Pehla candle large bullish candle hota hai jo uptrend ko represent karta hai. Is candle ka size aur strength, trend continuation ke liye zaruri hai.

- Small Bearish Candle (Mat Hold Candle): Doosra candle bearish hota hai lekin iska size chhota hota hai compared to the previous bullish candle. Ye candle typically uptrend mein hone wale temporary pullback ko darust karta hai.

- Third Candle (Bullish Candle): Teesra candle dobara se bullish hota hai aur pehle wale large bullish candle ke saath similar ya usse bada hota hai. Ye candle uptrend ko confirm karta hai aur ye dikhata hai ke bears ki koshishon ke baawajood bulls ka control barqarar hai.

- Fourth Candle (Bullish Candle): Mat Hold pattern ko complete karne ke liye, ek aur bullish candle aati hai jiska size pehle wale large bullish candle ke barabar ya usse bada hota hai.

Mat Hold Pattern ka ye structure dikhaata hai ke uptrend ke dauran short-term selling ke attempts ko market ne absorb kiya hai, aur bulls phir se control mein hain. Traders is pattern ko dekh kar anticipate karte hain ke uptrend mein mazid izafa hone ki sambhavna hai, aur iske mutabiq trading decisions lete hain. Hamesha yaad rakhein ke technical patterns ke istemal mein risk management ka bhi ahem kirdar hota hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 02:56 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим