what is chart & candle stick pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

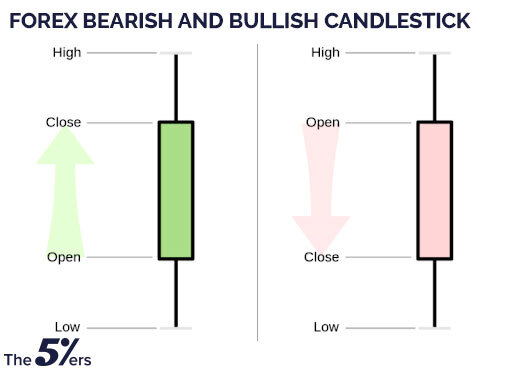

Assalam o Alikum Dears Pakistan the Forex market Fourm Members Umeed karta hun ap sab loog khair Khariyat sy hungy oor enjoy kr rhy hungy apni training life ko dosto chart bht jagha istmal hota ha jo okay one of a kind time period or se associated values ko 1 shakal fundamental dekhata ha.Aisy hello foreign exchange fundamental charge chart istmal hota ha js ok x-axis py hamen buying and selling pair ki charge display ki jati ha jb okay Y-axis py time period display kia jata ha jo okay hum apni mrzi se change kar skty hain.Es trha hamen exclusive durations ki costs dkhny or unko evaluate karny ok lye bht zada facts ni dkhna parta bl k aik chart ki madad se hum ye kam thory se wqt important kar skty hain. Dosto the Forex market trading mai Candlestick chart sample ek technical tool ha.Ye baki charts se mukhtalif hota ha es essential ksi buying and selling pair ki charge k bary major entire malomat hoti ha.Es chart primary kisi commodity ki fee motion ko 1 bar kind candle ki shkl foremost display kia jata ha. Candle hamen latest charge movement bhi btati ha or es ok sth sth hamen ultimate or commencing rate okay bary foremost bhi btati ha.Ye chart zada tr technical evaluation primary istmal hota ha or ye kafi beneficial ha.Or es ok sth sth jo candles es important hoti hain us k bhi alg alg patterns or meanings hoty hain jo ok buying and selling primary assist karty hain.Es chart ka important detail candle hoti hai or Candles ki bhi 2 types hoti hain.Jo k nechy di gai hain. Bullish Candlestick Dosto Bullish candle jesa okay nam se b zahir ha ye purchase ki candle hoti ha or ye chart essential charge ok boom hony ko indicate karti ha.Es ka color ap apni mrzi se choose kar skty hain. Jb ok commoly eska shade inexperienced or white hota ha. Dosto Bearish candle market essential expenses ok km hony ko imply karti ha or eska color usually black ya purple use hota ha laikin ap apni mrzi se koe bhi coloration istmal kar skty hain.Agr akely candle ko dekha jy to candle k bhi 2parts hoty hain jo ok beginning ultimate fees or charge movement ko display karty hain.Nechy candle k 2 elements ko precise speak kia gia ha or ap photo bhi dkh skty hain. Dosto Candle ki frame colored hoti hai or ye btati ha k price kis course essential gai ha or commencing price lia thi candle okay near hony tk kia charge thi.Agr frame bullish ho to fees boom hovi hoti hain or agr bearish ho to orices lower hovi hoti hain.Candlestick technical analysis ki base han agr hum candle sticks ko smjh kr marketplace ko analyse karen to hum apni buying and selling ko profitable bna skty hain. -

#3 Collapse

Chart patterns vs. candlesticks

Hajaron aur hajaron Alfaaz Mein tahrir boutique takniki tajiya do unwanth Hamesha kasrat se Baap aap hote hain chart aur mombatti aur Jaat Ke namune taajir Hain Gair Mulki market aur Digar malyaati mandiyon ka tajiya karne ke liye behtarin tools Agar Kuchh tajuran donon ko istemal karte hain lekin vah donon ke मां-बहन Fark Nahin Jante is Guide Mein Ham Mukabala mombatti ke donon ke man bahan Fark ko gahrai se Byan karne ja rahe hain

What is a candlestick pattern?

Theek hai mombattiyon ka ek group Ek Kahani sunana hai aur uski aakashi karta hai ki kharidar aur Bechne wale kya kar rahe hain use Waqt kimat kya kar rahi hai aur Iske bad Kya Hoga mombatti Ki Kintu main badlav ke kari hai tasvir Di Jaati Hai To Upar aur niche Jaate Hain Agar Ja Kintu main utaar chadhav Najar a sakte hain lekin vah Aise Na Mujhe kam kar sakte hain Forex reach our village mombatti task kil Di gai hai pattern aapko is mahsus Waqt per kya ho raha hai Iske bare mein bahut Kuchh bataya Gaya Hai yah Matlab Ki liya Ja sakta hai farj Karen aap 1 ghante ke time frame per Hain uska matlab yah Hai Ki Har ghante Mein Har kshma Ka namuna taskil Diya Jaega agar aap ek Hafte ke time frame per Aaya To Kya Hoga Ham aapko apne aap ko jawab dene ke liye live Chhod Denge Sidhe Alfaaz Mein Ek Samadhan ka namuna kimat chart padhne ka ek Tarika hai

What are chart patterns?

Ab Jab aap mombatti ke namunon ke bare mein jante ho chat pattern BA Muqabla mombatti ke Namo Namo ko samajhne ke liye aaiae Char Damon mein muntakil ho jaen chart ka namuna Kintu ki nakal Harkat ki ek graphical hota hai chart pattern Aise Mazar Hain jismein insani Swaroop samet mukhya Baju se mutasir Mali Asa Sa ki kimat mein tabdiliyon Ke Nishan day ki gai hai

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#4 Collapse

Trading mein chart aur candlestick patterns ek important role play karte hain jo traders aur investors ko market trends ko samajhne aur apne trading decisions ko optimize karne mein madad karte hain. Chart aur candlestick patterns technical analysis ke fundamental tools hain jo price action aur market sentiment ko visualise karne mein help karte hain. Trading mein chart ek graphical representation hai jo asset ke price movement ko ek specific time period ke liye dikhata hai. Charts traders ko market trends, patterns, aur price movements ko visually analyze karne ka ek tool provide karte hain. Charts ke through traders historical price data ko dekh sakte hain aur future price movements ke predictions kar sakte hain.

Types of Charts- Line Chart: Line chart sabse basic type ka chart hota hai jo price data ko ek continuous line ke through represent karta hai. Yeh chart price ke closing prices ko connect karta hai, aur market ke overall trend ko dekhne mein madad karta hai. Line chart simple aur easy to read hota hai, lekin yeh intraday price movements aur volatility ko accurately reflect nahi karta.

- Bar Chart: Bar chart price data ko vertical bars ke through represent karta hai. Har bar ek specific time period (jaise ek din, ek ghanta, etc.) ka price action dikhata hai. Bar chart ke har bar ki do main components hote hain: open aur close price, aur bar ke do ends high aur low price ko show karte hain. Bar chart zyada detailed information provide karta hai aur price volatility ko dekhne mein madad karta hai.

- Candlestick Chart: Candlestick chart price action ko candlesticks ke form mein represent karta hai. Har candlestick ek specific time period ka price action dikhata hai aur ek rectangular body aur upper aur lower wicks (shadows) se milkar banta hai. Candlestick chart traders ko market sentiment aur trend reversal signals ko dekhne mein help karta hai aur yeh bar chart se zyada detailed aur visually appealing hota hai.

Candlestick pattern ek specific formation hota hai jo multiple candlesticks ke combination se banta hai aur market ki future price movements ka indication deta hai. Candlestick patterns price action ke historical data ko analyze karke traders ko buy or sell signals provide karte hain. Candlestick patterns market ke psychological aspects ko reflect karte hain aur traders ko market ke behavior ko samajhne mein madad karte hain.

Key Components of a Candlestick- Body: Candlestick ka body price ke open aur close prices ke beech ka range dikhata hai. Agar body hollow hai (white or green), to iska matlab hai ke close price open price se zyada hai aur candle bullish hai. Agar body filled hai (black or red), to iska matlab hai ke close price open price se kam hai aur candle bearish hai.

- Wicks (Shadows): Wicks candlestick ke body ke upar aur neeche ki lines hoti hain jo price ke high aur low ko represent karti hain. Upper wick high price ko dikhata hai aur lower wick low price ko dikhata hai. Wicks market ke volatility aur price fluctuations ko reflect karte hain.

- Open Price: Yeh price woh point hai jahan se candlestick formation start hoti hai. Agar open price body ke neeche hota hai, to yeh bullish candle hota hai aur agar open price body ke upar hota hai, to yeh bearish candle hota hai.

- Close Price: Yeh price woh point hai jahan candlestick ka formation end hota hai. Close price market ke sentiment aur price movement ka indication hota hai. Agar close price open price se zyada hota hai, to candle bullish hoti hai aur agar close price open price se kam hota hai, to candle bearish hoti hai.

Candlestick patterns ko samajhne ke liye kuch popular aur commonly used patterns ko explore karte hain. Har pattern market ke specific scenarios aur price movements ko represent karta hai:- Doji: Doji candlestick pattern ek neutral pattern hota hai jahan open aur close price almost same hote hain. Doji ki body chhoti hoti hai aur wicks long hoti hain. Doji pattern market ki indecision aur uncertainty ko indicate karta hai. Jab Doji pattern ek uptrend ya downtrend ke baad aata hai, to yeh potential trend reversal ka signal ho sakta hai.

- Hammer: Hammer candlestick pattern ek bullish reversal pattern hota hai jo downtrend ke baad banta hai. Is pattern mein ek chhoti body hoti hai jo candle ke upper end par hoti hai aur long lower wick hoti hai. Hammer pattern buyers ke strength ko indicate karta hai aur market mein bullish momentum ka signal hota hai.

- Hanging Man: Hanging Man pattern bearish reversal pattern hota hai jo uptrend ke baad banta hai. Is pattern mein ek chhoti body hoti hai jo candle ke lower end par hoti hai aur long lower wick hoti hai. Hanging Man pattern market ke potential top aur bearish reversal ka indication deta hai.

- Engulfing Pattern: Engulfing pattern do candlesticks se mil kar banta hai. Bullish engulfing pattern ek bearish candle ke baad banta hai jahan next candle ek large bullish candle hoti hai jo previous candle ke body ko completely engulf karti hai. Bearish engulfing pattern bhi do candlesticks se mil kar banta hai jahan ek large bearish candle previous bullish candle ke body ko engulf karti hai. Yeh patterns trend reversal aur market sentiment ka indication dete hain.

- Morning Star: Morning Star pattern ek bullish reversal pattern hota hai jo downtrend ke baad banta hai. Is pattern mein teen candlesticks hote hain: ek bearish candle, ek small bodied candle (Doji ya Spinning Top), aur ek large bullish candle. Morning Star pattern market ke bullish reversal aur buying opportunity ka indication deta hai.

- Evening Star: Evening Star pattern bearish reversal pattern hota hai jo uptrend ke baad banta hai. Is pattern mein bhi teen candlesticks hote hain: ek bullish candle, ek small bodied candle (Doji ya Spinning Top), aur ek large bearish candle. Evening Star pattern market ke bearish reversal aur selling opportunity ka signal hota hai.

- Shooting Star: Shooting Star pattern ek bearish reversal pattern hota hai jo uptrend ke baad banta hai. Is pattern mein ek small body hoti hai jo candle ke lower end par hoti hai aur long upper wick hoti hai. Shooting Star pattern market ke potential top aur bearish reversal ka indication deta hai.

- Three White Soldiers: Three White Soldiers pattern ek bullish reversal pattern hota hai jo downtrend ke baad banta hai. Is pattern mein teen consecutive long bullish candles hoti hain jinka close price previous candle se upar hota hai. Three White Soldiers pattern market ke bullish momentum aur buying pressure ko indicate karta hai.

- Three Black Crows: Three Black Crows pattern bearish reversal pattern hota hai jo uptrend ke baad banta hai. Is pattern mein teen consecutive long bearish candles hoti hain jinka close price previous candle se neeche hota hai. Three Black Crows pattern market ke bearish momentum aur selling pressure ka indication deta hai.

Candlestick patterns ka use trading mein market trends aur price movements ko samajhne aur accurate trading decisions lene mein madad karta hai. Candlestick patterns ko use karke traders various strategies adopt kar sakte hain:- Trend Reversal Identification: Candlestick patterns trend reversals ko identify karne mein madad karte hain. Patterns jaise Hammer, Hanging Man, Morning Star, aur Evening Star trend reversal ke signals dete hain aur traders ko market ke top aur bottom ko identify karne mein help karte hain.

- Entry and Exit Points: Candlestick patterns traders ko entry aur exit points identify karne mein madad karte hain. Patterns ke signals ko dekh kar traders buying ya selling decisions le sakte hain aur market ke favorable points par apni positions open ya close kar sakte hain.

- Confirmation Signals: Candlestick patterns ke signals ko confirmation ke liye additional indicators ke saath combine kiya jata hai. Volume, moving averages, aur RSI jaise indicators candlestick patterns ko confirm karte hain aur trading decisions ko zyada accurate banate hain.

- Risk Management: Candlestick patterns ko use karke traders apne risk ko manage kar sakte hain. Patterns ke signals ke basis par stop-loss aur target levels ko set kiya jata hai, jo risk-reward ratio ko optimize karte hain aur trading risk ko manage karte hain.

Candlestick Patterns Ki Limitations

Candlestick patterns ki kuch limitations bhi hoti hain jo traders ko dhyan mein rakhni chahiye:- False Signals: Candlestick patterns kabhi-kabhi false signals bhi generate kar sakte hain. Pattern ke signals ke basis par market ka movement predict karna risky ho sakta hai, isliye additional confirmation signals ka use karna zaroori hota hai.

- Pattern Reliability: Har candlestick pattern har market condition mein reliable nahi hota. Market ke different phases aur conditions mein patterns ka effectiveness vary kar sakta hai. Isliye, pattern ko analyze karte waqt market context aur broader trend ko consider karna chahiye.

- Over-Reliance on Patterns: Candlestick patterns ke signals par over-reliance bhi risky ho sakti hai. Patterns ko technical indicators aur fundamental analysis ke sath combine karna chahiye taake trading decisions zyada accurate aur reliable ho.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 12:46 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим