Complete Guide About Doji Candlestick Pattern.

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

The Doji Candlestick Pattern. market mai doji candlestick pattern se indication aor direction mai change ho raha ho to aus time ye pata chal jata ha to aus waja se market mai jab ye candlestick pattern banta ha to aus mai reversal ki indication hoti ha aisy candlestick pattern ko dekh k hum ais market mai trade laga sakty hain kun k ye patterns reverasal ka signal dy rahy hoty ha aor aisy patterns ko find karna bahot asan hota ha aisy candle ko asani k sath wick dekh k hum find kar sakty hain ais ki differnet types ha jin ko hum dekh k ais market mai trade kar sakty hain doji candlestick ak asi candle hoti ha jiski open aur close price ak he price level per hoti ha ye candlestick buyers aur sellers k dermiyan indecision ko batati ha es candle k banna k bad market trend k change hona k 90% chance hota han. Doji Candlestick Pattern. Doji candlestick proper pattern k tor per work kerti ha jab doji candlestick pattern ki bat hoti ha to es man doji candle k bad next candle ko b trader new trend k start hona ki confirmation k liye watch kerta ha doji candlestick long bullish trend k top per resistance level k qareeb banta ha ya bearish trend k bottom per support level k qareeb banta ha. Trading With Doji Candlestick Pattern. Doji candlestick Pattern per trading k liye trader doji candle k bad next candle k close hona ka wait kerta ha ager doji candlestick pattern long bullish trend k top per resistance level per bana to es pattern man doji candle k bad next ka close bearish man hona bhot zarori ha ager next candle bearish man close de to new candle k open per sell ki trade active kerni chaheye stoploss ko doji candlestick k high sa 6 pips oper place karen aur take profit ko next support levels per Tp-1, Tp-2 aur Tp-3 ker k place karen. Doji Candlestick Pattern Long Bearish. Long bearish trend k bottom per support level per banna to es pattern man doji candle k bad next candle bullish man close ho to new candle per buy ki trade active kerni chaheye stoploss ko doji candlestick k low sa 6 pips nicha place karen aur Take Profit ko next resistance levels per Tp-1, Tp-2 aur Tp-3 ker k place karen. Doji Candlestick Pattern K Sath Trader. Relative strength Index (RSI) indicator ko use kara to trade ki mazeed confimation ho jae gi jab doji candlestick pattern bullish trend k top per resistance level per bana to us waqt RSI overbought ka signal de rahe ho aur jab trade entry le raha hon to us waqt RSI 70 k level ko cross down kar rahe ho es terha ager doji candlestick pattern long bearish trend k bottom per banta ha to eski formation k doran RSI oversold area man honi chaheye. aur jab trader trade active ker raha ho to us waqt RSI 30 k level ko cross above ker rahe ho. Importance Of Candlestick Patterns. Forex trading man trader price ki movement ko smajhna k liye price chart ko read kerta ha price chart pattern man tabdeeli, momentum aur price k trend man tabdeeli ko accuracy k sath identify kerta ha price chart man trade entry aur trade exit find kerna k liye use hona wala technical tools man candlestick pattern bhot importance rukhta han es aj man apka sath doji candlesticks pattern k bara man apna knowledge share kerta hon. -

#3 Collapse

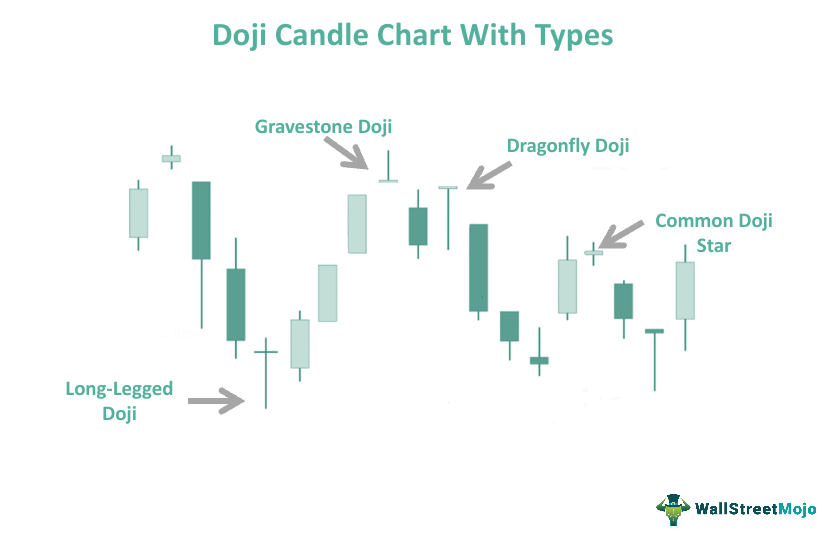

Assalamu Alaikum Dosto!Doji CandleDoji Candlesticks ek aisi technical analysis tool hai jo traders ko market indecision aur potential change in direction ki indication deta hai. Doji Candlesticks trading me popular hai kyunke ye candles identify karne me easy hote hain aur inke wicks traders ko stop loss placement ke liye excellent guidelines provide karte hain. Doji Candlesticks ka matlab hota hai ki market me buyers aur sellers ke beech me balance hai aur koi clear trend nahi hai. Doji Candlesticks me open aur close price virtually equal hote hain.Different types of Doji CandlesticksDoji Candlesticks ke different types hote hain jaise ki Standard Doji, Long-Legged Doji, Dragonfly Doji, aur Gravestone Doji. In sabhi types ke Doji Candlesticks me open aur close price virtually equal hote hain, lekin inke wicks aur bodies different hote hain. Har ek type ke Doji Candlesticks ki apni alag significance hoti hai aur traders inhe different market conditions me use karte hain. Doji Candlesticks ke mukhtalif types ki tafseel darjazel hen:- Standard Doji Standard Doji ek aisa Doji Candlestick hai jisme open aur close price virtually equal hote hain. Ye Doji Candlestick market me indecision ki indication deta hai aur traders ko market trend ke bare me koi clear indication nahi deta hai. Standard Doji ka use traders apni trading strategy ko improve karne ke liye karte hain.

- Long-Legged Doji Long-Legged Doji ek aisa Doji Candlestick hai jisme open aur close price virtually equal hote hain, lekin iske wicks bahut lambi hoti hain. Ye Doji Candlestick market me indecision ki indication deta hai aur traders ko market trend ke bare me koi clear indication nahi deta hai. Long-Legged Doji ka use traders apni trading strategy ko improve karne ke liye karte hain.

- Dragonfly Doji Dragonfly Doji ek aisa Doji Candlestick hai jisme open price, high price aur close price virtually equal hote hain, lekin iske low price bahut kam hoti hai. Ye Doji Candlestick market me bullish reversal ki indication deta hai aur traders ko market trend ke bare me clear indication deta hai. Dragonfly Doji ka use traders apni trading strategy ko improve karne ke liye karte hain.

- Gravestone Doji Gravestone Doji ek aisa Doji Candlestick hai jisme open price, low price aur close price virtually equal hote hain, lekin iske high price bahut kam hoti hai. Ye Doji Candlestick market me bearish reversal ki indication deta hai aur traders ko market trend ke bare me clear indication deta hai. Gravestone Doji ka use traders apni trading strategy ko improve karne ke liye karte hain.

Doji Candlesticks ka IstemalDoji Candlesticks ka use karne ke liye, traders ko apni trading platform me candlestick chart ko analyze karna hota hai aur phir Doji Candlesticks ko identify karna hota hai. Doji Candlesticks ki value ko analyze karne ke liye, traders ko market volatility aur risk tolerance ko consider karna chahiye. Doji Candlesticks ka use karne se pehle, traders ko apni trading strategy ko properly define karna chahiye aur phir apni position ko monitor karte rehna chahiye. Doji Candlesticks ki sabse badi advantage ye hai ki ye traders ko market indecision aur potential change in direction ki indication deta hai. Doji Candlesticks ki madad se traders apni trading strategy ko improve kar sakte hain aur apni profits ko increase kar sakte hain. Lekin, Doji Candlesticks ki kuch disadvantages bhi hain. Agar market me zyada volatility hai, to Doji Candlesticks ki value zyada fluctuate ho sakti hai aur traders ko zyada losses ho sakte hain. Isliye, traders ko apni trading strategy ke hisab se Doji Candlesticks ka use karna chahiye.

- Mentions 0

-

سا0 like

-

#4 Collapse

umeeed karti ho k sath thek hongy forex trading main maze k sath kaam kar rahy hongy forex trading main learning ko achi tara strong kare agar ek traders best learning k sath kaam karta hain forex k rules ko follow kar khe kaaam karta hain tu vo traders achi kamyabi hasil kar lete hain Doji Candlestick Pattern main market main trendline ko follow karna must hain qk jaaab tak trend ko follow nhe iya 3rd touch pay follow nhe kiya tu loss ho jata hain learning ko strong karna hain tu rules ko follow kare best benefit hasil karna hain tu forex main Doji Candlestick Pattern main trade lenee say phly market main learning ko strong kare market main trend he ek best friend hota hain jisne learning nhe ki vo loss kar deta hain loss ko recover karne k liye smal lot size Doji Candlestick Pattern main benefit hain How to trade on Doji Candlestick Pattern: forex trading main doji candle main kaaam karna hain tu anlaysis kare supply and demand main kaamkarna hain tu forex ki makret main chert ko achi tara analysis kare qk jaaab tak cehrt analysis nhe hota hain vo trades forex main loss he karta hain loss and profit forex trading ka hissa hota hain loss ko recover karna hain tu trend ko follow kare trend ko follow karne wale traders best benefit hasil kar skte hain forex ki learning ko strong krna parta hain Doji Candlestick Pattern main rules ko follow krna must hain rules ko break kiya tu loss kiya loss and profit forex trading ka hissa hota hain Doji Candlestick Pattern main rules he benefit deta h ain -

#5 Collapse

forex market mein hum technical analysis ka estamal kar saktay hein nechay de gay mesal mein zoom out kay manzar namay ko bhe daikh saktay hein nechay deya geya chart dekha sakta hey keh kes tarah new takhleeq kardah price up janay say pehlay wapes aa sakte hey Lose ko jornay wala zone support ke taraf eshara kar sakta hey or prices oper janay say pehlay wapes aa jate hein hammer candlestick pattern aik strong signal frahm karta hey jo keh buy ke taraf trend ko start kartay hein support zone kay nechay stp rakhay ja saktay hein jab keh target resistane ke anay wale level par he set keya ja sakta h trader ki apni strategy hoti ha ka us na market main kasy trading karni ha ab yahan par bat ho rahi ha swing trading ki to ye asi trading ha jis main market ki movement swing main hoti ha market kabhe bhe seedha move nhe karti ka ye kisi 1 he side pa chali jaye asy nhe hota ha balky market zigzag maon move karti ha or ye swing karti up ya down jati ha to is main ham swing trading kart skty han or ye asi trading ha jo ka long term ka lye hoti ha agar ap na swing par koi trade open ki ha to ye long hold par hopti ha kun ka is main ap kopata hota ka market na swing karty upar he jana ha ya nechy he ana hlagataar teen bearish candles par mushtamil hota hai, jin mein se har aik pichlle se kam qareeb hota hai. yeh patteren market ke jazbaat mein taizi se mandi ki taraf aik mazboot tabdeeli ki tajweez karta hai aur is baat ki nishandahi karta hai ke farokht ka dabao barh raha hai. yeh note karna zaroori hai ke agarchay turn down candle stuck patteren mumkina rujhan ke ulat jane ke baray mein qeemti maloomat faraham kar satke hain, lekin inhen tanhai mein nahi samjha jana chahiye. traders aur sarmaya karon ko hamesha un ka istemaal dosray takneeki isharay, jaisay trained lines, support aur rizstns levels, aur hajam ke tajziye ke sath karna chahiye, taakay patteren ki durusti ki tasdeeq ki ja sakay aur mazeed bakhabar tijarti faislay kare forex trading main praitce kare jaaab tak learning strong hotihain vo traders kamyabi pate hain agar learning strong nhe hoti hain tu loss hojata hain forex ki move ko samjhne k liye Marubozu candlestick pattern ek kamyab pattren hain learning ko strong and incress kare hard work k sath kaam kare pratice kare rules ko break kiya tu loss kiya rules ko follow kiya tu kamyabi hasil ki forex ki move ko samjhna parta hain Marubozu candlestick pattern main forex makret main newx main b big move ho jati hain Marubozu candlestick pattern main newx k time small lot use kare jaaab tak lot size big hoti hain forex market mein pattern kam prices ko reject karta hey or yeh forex market kay doewn trend mein paya jata hey yeh candlestick pattern es bat ko identify karta hey keh trend bullish reversal janay walla hey or yeh forex market mein selling pressure kay end ke taraf eshara karta hey yeh aik side pe trade karna start kar dayta hey or reversal trend chala jata hey woh trader jen majodah short position hote hey woh hammer candle stick ko es bat ke taraf eshara day skty hein keh forex market mein seller pressure kam ho raha hey forex market mein es bat ke taraf eshara day saktay he -

#6 Collapse

Doji candles ki Analysis kasy krty hy technical analysis tool hai jo traders ko market indecision aur potential change in direction ki indication deta hai. Doji Candlesticks trading me popular hai kyunke ye candles identify karne me easy hote hain aur inke wicks traders ko stop loss placement ke liye excellent guidelines provide karte hain. Doji Candlesticks ka matlab hota hai ki market me buyers aur sellers ke beech me balance hai aur koi clear trend nahi hai. Doji Candlesticks me open aur close price virtually equal hote hain. candlestick pattern se indication aor direction mai change ho raha ho to aus time ye pata chal jata ha to aus waja se market mai jab ye candlestick pattern banta ha to aus mai reversal ki indication hoti ha aisy candlestick pattern ko dekh k hum ais market mai trade laga sakty hain kun k ye patterns reverasal ka signal dy rahy hoty ha aor aisy patterns ko find karna bahot asan hota ha aisy candle ko asani k sath wick dekh k hum find kar sakty hain ais ki differnet types ha jin ko hum dekh k ais market mai trade kar sakty hain doji candlestick ak asi candle hoti ha jiski open aur close price ak he price level per hoti ha ye candlestick buyers aur sellers k dermiyan indecision ko batati ha Doji candle ki Types ki Information aur Identification 1) Doji Candlestick hai jisme open aur close price virtually equal hote hain. Ye Doji Candlestick market me indecision ki indication deta hai aur traders ko market trend ke bare me koi clear indication nahi deta hai. Standard Doji ka use traders apni trading strategy ko improve karne ke liye karte hain. 2)Doji Candlestick hai jisme open aur close price virtually equal hote hain, lekin iske wicks bahut lambi hoti hain. Ye Doji Candlestick market me indecision ki indication deta hai aur traders ko market trend ke bare me koi clear indication nahi deta hai. Long-Legged Doji ka use traders apni trading strategy ko improve karne ke liye karte hain. 3)Doji Candlestick hai jisme open price, high price aur close price virtually equal hote hain, lekin iske low price bahut kam hoti hai. Ye Doji Candlestick market me bullish reversal ki indication deta hai aur traders ko market trend ke bare me clear indication deta hai. Dragonfly Doji ka use traders apni trading strategy ko improve karne ke liye karte hain 4) Candlestick hai jisme open price, low price aur close price virtually equal hote hain, lekin iske high price bahut kam hoti hai. Ye Doji Candlestick market me bearish reversal ki indication deta hai aur traders ko market trend ke bare me clear indication deta hai. Gravestone Doji khty hy

Doji candle ki Types ki Information aur Identification 1) Doji Candlestick hai jisme open aur close price virtually equal hote hain. Ye Doji Candlestick market me indecision ki indication deta hai aur traders ko market trend ke bare me koi clear indication nahi deta hai. Standard Doji ka use traders apni trading strategy ko improve karne ke liye karte hain. 2)Doji Candlestick hai jisme open aur close price virtually equal hote hain, lekin iske wicks bahut lambi hoti hain. Ye Doji Candlestick market me indecision ki indication deta hai aur traders ko market trend ke bare me koi clear indication nahi deta hai. Long-Legged Doji ka use traders apni trading strategy ko improve karne ke liye karte hain. 3)Doji Candlestick hai jisme open price, high price aur close price virtually equal hote hain, lekin iske low price bahut kam hoti hai. Ye Doji Candlestick market me bullish reversal ki indication deta hai aur traders ko market trend ke bare me clear indication deta hai. Dragonfly Doji ka use traders apni trading strategy ko improve karne ke liye karte hain 4) Candlestick hai jisme open price, low price aur close price virtually equal hote hain, lekin iske high price bahut kam hoti hai. Ye Doji Candlestick market me bearish reversal ki indication deta hai aur traders ko market trend ke bare me clear indication deta hai. Gravestone Doji khty hy  Treading principles kia hy traders ko apni trading platform me candlestick chart ko analyze karna hota hai aur phir Doji Candlesticks ko identify karna hota hai. Doji Candlesticks ki value ko analyze karne ke liye, traders ko market volatility aur risk tolerance ko consider karna chahiye. Doji Candlesticks ka use karne se pehle, traders ko apni trading strategy ko properly define karna chahiye aur phir apni position ko monitor karte rehna chahiye. Doji Candlesticks ki sabse badi advantage ye hai ki ye traders ko market indecision aur potential change in direction ki indication deta hai. Doji Candlesticks ki madad se traders apni trading strategy ko improve kar sakte hain aur apni profits ko increase kar sakte hain. Lekin, Doji Candlesticks ki kuch disadvantages bhi hain. Agar market me zyada volatility hai, to Doji Candlesticks ki value zyada fluctuate ho sakti hai aur traders ko zyada losses ho sakte hain.

Treading principles kia hy traders ko apni trading platform me candlestick chart ko analyze karna hota hai aur phir Doji Candlesticks ko identify karna hota hai. Doji Candlesticks ki value ko analyze karne ke liye, traders ko market volatility aur risk tolerance ko consider karna chahiye. Doji Candlesticks ka use karne se pehle, traders ko apni trading strategy ko properly define karna chahiye aur phir apni position ko monitor karte rehna chahiye. Doji Candlesticks ki sabse badi advantage ye hai ki ye traders ko market indecision aur potential change in direction ki indication deta hai. Doji Candlesticks ki madad se traders apni trading strategy ko improve kar sakte hain aur apni profits ko increase kar sakte hain. Lekin, Doji Candlesticks ki kuch disadvantages bhi hain. Agar market me zyada volatility hai, to Doji Candlesticks ki value zyada fluctuate ho sakti hai aur traders ko zyada losses ho sakte hain.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#7 Collapse

Doji candlestick ki sabse pehchanne wali cheez hai uski shape. Doji barik vertical line ya "wick" ke saath dikhti hai, jo high aur low price ko represent karti hai. Wick dono taraf extend ho sakti hai, iska matlab hai ke doji candlestick ke during price ne ek range mein fluctuation kiya hai. Open aur close price barabar ya phir kareebi barabar hote hain, jiski wajah se candlestick ka body bohot patla hota hai ya phir nazar bhi nahi aata. Introduction Dear friends Doji pattern aik indecision pattern hota hai es liye humen price action ya dusry technical indicators ki madad sy confirmation karni chahiye Agar doji k saath saath price action negative hai jesy k bearish candlesticks hain to ye selling opportunity ho sakti hai or agar doji k saath price action positive hai jesy k bullish candlesticks ye buying opportunity hoti hai Trading mein risk management boht zaroori hai. how to trade with doji candlestick Doji k sath trade karty waqt apny stop loss order ko set karna na bhoolen es ka use lazmi kren Ye humen apny loss ko control karny mein madad karta hai stop-loss order ko hum doji k high ya low k just theek nichy ya upar set kar sakty hain jis sy humen market k against jany par nuksan kam hog Doji ke sath trade karny k liye hum dusry technical indicators ka istmal b kar sakty hain Jesy RSI MACD ya bollinger bands Ye indicators humen trend reversal k bary main malomat deta hai Volume bhi aik parameter hai doji k sath trade karty waqt Agar doji k sath volume kam hai toh ye market ki low condition k bary main aik ishara hota hai Lekin agar doji ke sath volume tezi sy barh raha hai toh ye aik strong reversal signal ho sakta hai Doji pattern ko alagalag timeframes par dekha ja sakta hai Chotiy timeframes jesy k 15 minute ya 30 minute charts par doji k signals zyada frequent hoty hain lekin unki reliability kam hoti hai Bary timeframes jesy k daily ya weekly charts par doji k signals kam hoty hain lekin un ki reliability hoti hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 10:29 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим