Spinning top candle stick pattern Kia h??

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

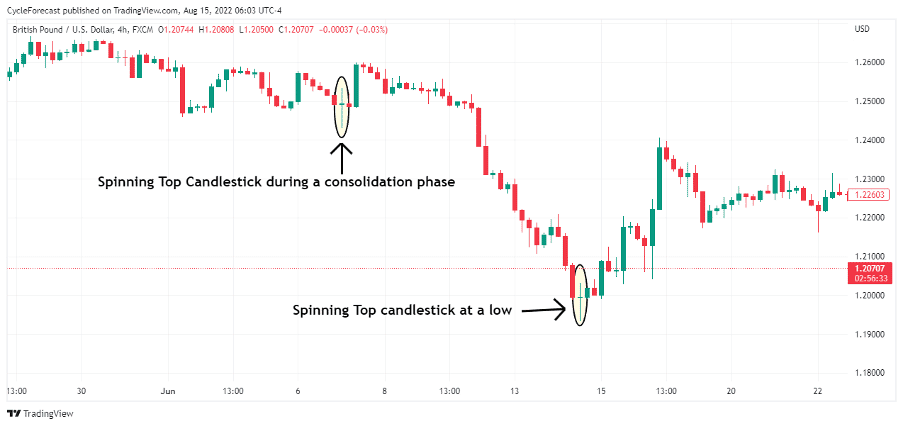

Assalam alaikum dear forum members!umeed karta hun aap sb khairiat se hn gy or apki trading achi jaa rahi ho ge. dear members trading karty hovy hmara hr waqt candlesticks se taluq hota ha or hum inko dkh kr price read karty hain. ye candle sticks price k ilawa or b bahut kuch btati hain jesa k tredn k bary main support resitance k bary main or reversal k bary main bhi btati hain. esi silsly main aj hum aik important candle ko read karen gy jisy k spinning top candle stick kaha jata ha. What is spinning top candlestick pattern?dear members spinning top candle ki short real body hoti ha jo k opr or nechy shadow k drmyan hoti ha ye body bearish ya bullish ho skti ha. spinning top market main indecission ko zahir karti ha mtlb k buyer or sellers equal force main thy or market main koe faisla ni ho ska. Jb market opr hai to seller ny sell kia or opr ki trf wick ya shadow bn gya or jb market nechy gai to buyers ny buy kia jski waja se nechy se wick bn gai or darmyan main choti c body bni ha. agr ye pattern strong support ya resistance py bny or es se agli candle eski confirmation kar dy to ye trend reversal ka sign ho skta ha. Importance of spinning top candlestick pattern: Yeh candlestick pattern us time banta ha jab buyers aik given time k doran price ko down push kr deta ha. Liken closing price open k bht qareeb close hojati ha. Strong price mein izafa ya kami k baad, spinning top potential price reversal ka signals dy sakti ha. Spinning top above open k oper ya below close ho sakti ha. Liken dono prices hamesha aik dusry k qareeb hoti hein. Spinning top aik candlestick pattern ha jis ki short real body hoti ha jo long upper aur lower shadows k darmeyan hota ha. Is ki real body choti honi chaiye jo open aur close prices mein thora farq dekhata hai. Kyun k buyers aur sellers dono ny price ko agy barhaya liken usy maintain nae rakh saky. Pattern indecision ko show karta ha aur us k sath sath mazid sideways movement bhi ho sakti hai. Umeed ha k aj ka topic ap sab doston ko zarur samjh aye ga ta k ap trading k doran is candle ko pehchan saken aur us k baad he apni trade ko active karen ta k ap loss sy bach saken. Bullish reversal spinning top candlestick pattern:Dear members ye pattern bearish trend k end main support py banta ha or ye reversal ki nishani hota ha es k bad market bullish ho jati ha. laikin es se phly eski confirmation lazmi ha. eski confirmation ye ha k support muqam py phly spinning top candle bny bullish body k sth or phr us k bad usi time frame main next candle spinning top ki closing price se opr close ho.Bearish reversal spinning top candlestick pattern:Dear memebrs ye pattern bullish trend k end main resistance muqam py bnta ha. Resistance py aikspinning top candle banti ha bearish body k sth or eski confirmation k lye next bearish candle ko spinning top candle k low k nechy close hona chahye. Es k bad market ka trend reverse hota ha or market bearish move karti ha -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Spinning top, yaani ghoomta top, forex mein ek masha-hoor candlestick pattern hai. Ye pattern market sentiment aur price action ke baare mein hamain kuch maaloomat deta hai. Neechay Roman Urdu mein is pattern ki tafseel hai: 1. Introduction : - Ghoomta top pattern ek single candlestick pattern hai. - Ye pattern market ke reversals ya trend ke changes ki indication deta hai. 2. Appearance : - Ghoomta top ek chhota sa candle hota hai jiske upper aur lower shadows hote hain. - Candle ka body bahut chhota hota hai, almost doosre patterns jaise doji ya harami ki tarah. 3. Upper Shadow : - Uper wala shadow candle ke body se bahar extend hota hai. - Iska presence bullish ya bearish market ke hisaab se interpret kiya jata hai. 4. Lower Shadow : - Neeche wala shadow bhi candle ke body se bahar extend hota hai. - Iski length bullish ya bearish market ke hisaab se samjhi jati hai. 5. Interpretation : - Agar ghoomta top candle uptrend mein form hua hai, toh ye reversal signal ho sakta hai. - Agar ghoomta top candle downtrend mein form hua hai, toh ye bhi reversal signal ho sakta hai. - Ghoomta top ka presence indecision ya price consolidation indicate karta hai. 6. Market Sentiment : - Ghoomta top bullish market sentiment ko weaken kar sakta hai aur bearish sentiment ko strengthen kar sakta hai. - Agar ghoomta top downtrend mein form hua hai, toh ye bullish reversal ki indication ho sakti hai. 7. Confirmation : - Ghoomta top pattern ko confirm karne ke liye, traders dusre technical indicators aur price patterns ka istemaal karte hain. - Volume, support aur resistance levels, aur trend lines ki confirmation ka istemaal kiya ja sakta hai. Ghoomta top candlestick pattern forex traders ke liye important hai kyunki isse market trends aur reversals ko identify kiya ja sakta hai. Traders is pattern ki madad se apne trading strategies aur decision-making process ko improve kar sakte hain. -

#4 Collapse

What is spinning top candlestick pattern : Spinning Top candlestick pattern aisa pattern hy jo Bullish trend ko show kerta hy , spinning topasi candle stick hoti hai jo up trend k peak par ya down trend k bottom par or trend k middle mab ho aksar nazar ati hai. Ye candle bearish or bullish 2no kisam ki ho sakti hai. Ye candle smallbody par mushtamil hoti hai jis k opening point or closing point ik dosray k kareeb hoty hain. Yepattern us sorat ma banta hai.spinning tops candles main jab hum charts main thore sespinning ate hae to yeh is tarah se view dete bhe hain or kam bhe esa he karte hain is ke liyehamen cahiye ke hum is main mehnat kara karen hum jitna zayada sahe or ache tarah se ismain kam ko kar jate hain hum is main kuch na kuch gain karte he hain to bas candles mian aikhamare pas bearisk candle hote hae or aik hamare bas bullish candle hote hae jitna zayada humsahe tarah se un ko use kar lete hain. (a) Bullish Spinning top candlestick pattern: Bullish Spinning top pattern ko technical analysis mein istemaal hota hai. Ye pattern tab banta hai jab opening aur closing prices aik doosre ke qareeb hotay hain, lekin price kisi ahem range mein ghoomti rehti hai. (b) Bearish Spinning top candlestick pattern: Bearish Spinning Top pattern ek technical analysis tool hai jo market mein potential reversal ya indecision ko indicate kar sakta hai. Yeh pattern tab banta hai jab candlestick chart par ek spinning top shape ban jati hai aur price action bearish trend ke sath closely related hota hai.Is pattern mein candlestick ki body chhoti hoti hai aur shadow (wick) dono taraf lambi hoti hai. Opening aur closing prices aik doosre ke qareeb hote hain, jisse spinning top ki shape ban jati hai. Is pattern mein price action kisi specific range ke andar ghoomti rehti hai, jiski wajah se market sentiment indecisive ho jati hai.Bearish Spinning Top pattern bearish trend ka indication deta hai, yani ke market ki downward momentum ka zor kamzor ho raha hai aur sellers aur buyers ke darmiyan tawazun ban raha hai. Is pattern ko dekh kar traders ko caution ki zarurat hoti hai kyunki yeh ek potential reversal signal bhi ho sakta hai.Agar Bearish Spinning Top pattern kisi strong support level ya trendline ke qareeb ban raha hai, toh yeh bearish trend ki mazbooti ko darshata hai aur selling pressure ko indicate karta hai. Is situation mein traders selling positions ko consider kar sakte hain.Bearish Spinning Top pattern ki validity aur confirmation ke liye, traders ko market ke upcoming price action aur kisi aur technical indicator ki tafseelati tajurbe ki zarurat hoti hai. Pattern ki confirmation ke liye, next candlestick ki price action aur volume ko closely monitor karna zaroori hota hai. Agar price next candlestick mein downward move karta hai aur selling pressure zyada hoti hai, toh Bearish Spinning Top pattern ki validity aur reliability barh jati hai.Yeh pattern market ke overall context, trend, aur additional indicators ke saath combine karke analyze karna zaroori hai taaki accurate trading decisions liye ja saken. Identification of Spinnind top candlestick pattern : spinning tops candles main jab hum charts main thore se spinning ate hae to yeh is tarah seview dete bhe hain or kam bhe esa he karte hain is ke liye hamen cahiye ke hum is main mehnatkara karen hum jitna zayada sahe or ache tarah se is main kam ko kar jate hain hum is mainkuch na kuch gain karte he hain to bas candles mian aik hamare pas bearisk candle hote hae oraik hamare bas bullish candle hote hae jitna zayada hum sahe tarah se un ko use kar lete hain Lekin jab Kisi pattern ke top per bearish spinning top ban jaati hai to iska matlabhota hai ki short term ke liye market mein train reversal ho sakti hai aur aap selling opportunitiesle sakte ho Apne assets ko sell kar sakte ho aur aur accha profit banaa sakte ho. trading marketmein hamen straight chij ke sath kam karna hai aur opportunity to Dekh Kar unko kaise karnahai Forex trading market mein hamen management ke sath safety step lekar Apne capital kosev rakhte hue ham karna hota hai . Trading strategy : spinning top candlestick ko kaise pahchan sakte hain to uska aasan tarika yah hai ki iski body johai vah chhoti hoti hai aur iske shadows Jo stick hoti hain. Spinning top candlestick Ek Aisicandlestick hoti hai jo aapko market Mein reversal train se related information provide kar rahihoti hai dear jab aap market Mein is candlestick ko observe karte hain to ismein aapko bahutjyada profit milane ke chance hote. spining top potential price reversal ka signal daiti ha, jbspining top candle uptrend k top par bnti ha to ye is cheez ka signal jota ha k bulls control loosekar rahay hain aur trend down honay wala ha, isi tarah jb ye down trend k bottom ma bnti ha toye uptrend ka signal hota ha .Jab market uptrend main continue movement ker rehi hoti haidifferent candles create ho rehi hoti hai lekin agar market kisi time per fast movement ker rehiho kisi aik point per market kuch time ky liay stay kerti hai ky wahan sy market both directionsmain movement kerny ky bahd small body candle create kerti hai lekin both sides per long wickban jati hai tou same candle spinning top bearish candle create hony per market main trendreversal ki confirmation hoti hai ky same time per market ka uptrend reverse ho ker downtrendshoru ho jata hai isi terha agar market continue downtrend main movement ker rehi hoti hai aurmarket kisi aik point per kuch stay kerti hai ky candle open hony ky bahd both directions mainbig movement kerti hai lekin jab close hoti hai woh small body ky sath bullish candle create kertihai aesi candle ko bullish spinning top candle kehty hain jo downtrend ki reversal ki confirmationprovide kerti hai aur same time per bearish trend change ho ker bullish trend start ho jata hai. -

#5 Collapse

Asslam-O-Alaikum! Dear members Me ummed kerti hoke ap sb ka forex trading py kam bht acha chl rha hoga. Aj jis topic py hum baat kre gy wo Neeche mention hy. TOPIC:Spinning top candle stick pattern Spinning Top candle stick aik namona hai jis ka jism aik oopri aur nichli lambi batii ke darmiyan hota hai. aspnng taap aik aisay manzar naame ki akkaasi karta hai jahan nah baichnay walay aur nah hi khredar ko faida sun-hwa hai. is ke nateejay mein khilnay aur band honay wali qeematon ki akayyan barabar hoti hain . Spinning Top candle stick ki tashkeel qeemat ke ulat jane ke imkaan ka taayun karne mein madad karti hai khaas tor par agar yeh qeemat mein kami ke baad hoti hai. market ke rujhan mein chhootey tagayuraat ki wajah se, candle stick ko tasalsul ka namona kaha jata hai . EXPLAINATION: candle stick ki tashkeel kharidaron aur farokht knndgan ke darmiyan Adam faisla ki satah ki nishandahi karti hai, jo qeemat ke ulat phair ko zahir karti hai, is liye aik ghair janabdaar namona banata hai. mom batii band honay par, ghoomnay wala taap bearish ya taizi wala ho sakta hai. taham, candle stick ka pattern ziyada tar aik oopri rujhan, neechay ke rujhan, aur aik taraf ki harkat mein paaya jata hai, jo mumkina ulat jane ki nishandahi karta hai. taizi ka rujhan qeemat ko mazeed berhata hai, jab ke mandi ka rujhan qeemat ko is waqt tak kam karta hai jab tak ke majmoi qeemat jahan khuli thi band nah ho jaye . Spinning Top asasa mein Adam faisla ki alamat hain. lambay oopri aur nichale saaye is baat ki nishandahi karte hain ke khulay aur band ke darmiyan qeemat mein koi maienay khaiz tabdeeli nahi hui. belon ne qeemat taizi se ziyada bhaije aur reachi ne qeemat taizi se kam bhaije, lekin aakhir mein, qeemat jahan khuli thi is ke qareeb hi band hogayi. yeh ghair faisla kin harkat ziyada side way ka ishara day sakta hai, khaas tor par agar ghoomnay wala taap aik qaim range ke andar hota hai. yeh mumkina qeemat ke ulat jane ka bhi ishara day sakta hai agar yeh qeemat ki paishgi ya kami ke baad waqay hoti hai . baaz auqaat aspnng tops aik ahem rujhan ki tabdeeli ka ishara day satke hain. aik ghoomta sun-hwa taap jo oopri rujhan ke oopar hota hai is baat ki alamat ho sakti hai ke bail apna control kho rahay hain aur rujhan palat sakta hai. isi terhan, down trained ke neechay ghoomnay wala taap is baat ka ishara day sakta hai ke reechh control kho rahay hain aur bail lagaam le satke hain . kisi bhi soorat mein, tasdeeq se yeh wazeh karne mein madad millti hai ke aspnng taap kya keh raha hai. tasdeeq agli mom batii se aati hai. agar kisi tajir ka khayaal hai ke oopar ke rujhan ke baad ghoomnay wala taap neechay ki taraf palat sakta hai, to mom batii jo aspnng taap ke peechay aati hai usay qeematon mein kami nazar aani chahiye. agar aisa nahi hota hai to, ulat jane ki tasdeeq nahi hoti hai aur tajir ko dosray tijarti signal ka intzaar karna parre ga. agar aspnng taap aik range ke andar waqay hota hai, to yeh is baat ki nishandahi karta hai ke Adam faisla abhi bhi mojood hai aur range jari rehne ka imkaan hai. is ke baad anay wali mom batii ko tasdeeq karni chahiye, yani yeh qaim shuda side ways channel ke andar rehti hai . chart ki misaal kayi Spinning Top ko dukhati hai. pehla, baen taraf, qeemat mein thori kami ke baad hota hai. is ke baad neechay candle aati hai, jo qeemat mein mazeed kami ka ishara deti hai. qeemat qadray kam hoti hai lekin phir oopar ki taraf palat jati hai. agar mom batii ki bunyaad par tijarat karte hain, to yeh candle stuck ke baad mansoobah bandi aur khatray ka intizam karne ki ahmiyat ko ujagar karta hai . dosra aspnng taap aik range ke andar hota hai. yeh market ki mojooda ghair faisla kin sorat e haal ki tasdeeq karta hai, kyunkay qeemat agay barh rahi hai . teesra ghoomnay wala taap is ke ird gird mojood mom btyon ke muqablay mein ghair mamooli tor par bara hai. yeh aik paish qadmi ke baad sun-hwa aur is ke baad aik barri neechay candle thi. yeh aik ulat mom batii ban kar khatam sun-hwa, jaisa ke qeemat kam hoti gayi . jaisay jaisay qeemat gir rahi thi, aik aur aspnng taap ban gaya. yeh aik mukhtasir waqfa ke tor par khatam hota hai, kyunkay agli mom batii neechay ki taraf gayi aur musalsal girty rahi . misalein tasdeeq aur sayaq o Sabaq ki ahmiyat ko ujagar karti hain. range ke andar ghoomnay walay tops aam tor par range aur market ke ghair faisla kin honay ki tasdeeq karne mein madad karte hain. rujhanaat ke andar ghoomnay walay tops reversal signal ho satke hain, lekin is ke baad anay wali candle ko tasdeeq karne ki zaroorat hai . -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalam o Alaikum! Spinning top candle stick pattern Kia h?? Spinning top patteren mein aik wahid mom batii shaamil hoti hai jo market mein ghair yakeeni sorat e haal ki nishandahi karti hai. candle stick ki tareef khud aik mukhtasir jism se hoti hai jis ke charon taraf lambi VICKS ( taqreeban aik hi lambai ) dono taraf hoti hain. aspnng taap candle ke qareeb ya to taizi ya mandi ka ho sakta hai. yeh candle stuck patteren aksar up trained, down trained aur / ya consolidation ( side way movement ) ke andar waqay hota hai jo mumkina ulat phair ki nishandahi karta hai . Explanation Spinning top candle ke andar qeemat ki harkat kharidaron aur farokht knndgan ki numaindagi karti hai jo aik dosray ko chore dete hain jis ke nateejay mein qeemat ki satah aik jaisi khuli aur qareeb hoti hai. tijarti hikmat e amli mein aspnng taap candle stuck patteren ko shaamil karne ka faida yeh hai ke kam se kam waqti sarmaya kaari ke sath is ki shanakht karna aasaan hai. aspnng taap ki tashkeel ke douran market mein dukhaay jane walay Adam faisla ke peechay mantaq saada hai - jab mom batii ban rahi thi, taajiron ne chart ki poori muddat ke douran qeematein ziyada aur kam dono taraf muntaqil kee. is ke nateejay mein ikhtitami qeemat wapas lout rahi hai / ibtidayi qeemat ke bohat qareeb hai. aspnng taap patteren isi bunyadi dhanchay aur mantaq ki pairwi karta hai jaisa ke doji taham, aspnng taap aik wasee candle body dekhata hai jo candle ki muddat ke douran qeemat mein ziyada numaya harkat dekhata hai . Spinning top candle ke sath tijarat mein yeh samjhna shaamil hai ke yeh kaisay banti hai aur market ke majmoi rujhan ke silsilay mein yeh kahan bithti hai. neechay di gayi misaal aspnng taap ka istemaal karte hue aik amli forex trade ki shanakht, tasdeeq aur is par amal daraamad se guzarti hai. eur / nzd aspnng taap candle stuck oopar walay eur / nzd chart mein, aspnng taap candle ( bearish ) oopri rujhan ke oopar dikhayi deti hai – jis ko gold trained line se numaya kya gaya hai. kharidaron aur farokht knndgan ki taraf se Adam faisla wazeh hai aur rujhan ki simt mein ulat phair ka baais bantaa hai. zindah taajiron ko aspnng taap ban'nay ke foran baad tijarat mein daakhil honay ki taraf nahi dekhna chahiye, balkay tasdeeq ka intzaar karne ke liye tijarat mein takheer karna chahiye. tasdeeq takneeki isharay, bunyadi awamil ya oscillators se hosakti hai jaisa ke statistic accelerator ka istemaal karte hue dekha jata hai. Statistics aik mukhtasir indraaj ki dobarah tasdeeq karta hai jaisa ke neelay dairay se ishara kya gaya hai. rujhan ke ulat jane ki tasdeeq karne ke liye takneeki taajiron ke zareya istemaal kya jane wala sab se aam tareeqa baad mein anay wali candle ki tashkeel ka intzaar kar raha hai. oopar di gayi misaal ko istemaal karte hue, anay wali mom batii ko aspnng taap ki vÙk se neechay band hona chahiye. is tasdeeq ke baghair, rujhan ki tabdeeli ka ishara qaim nahi ho sakta, aur market mein ghair yakeeni sorat e haal barqarar hai. aspnng taap candle stuck patteren ki tijarat ke liye ahem rastay : mom batii ko aik mukhtasir jism aur dono atraaf par lambi vicks ke sath talaash karen. rujhan linon ya takneeki isharay istemaal karkay market ke rujhan ki shanakht karen. tijarat mein daakhil honay se pehlay tasdeeq ka intzaar karen. agar tasdeeq ho jaye to tijarat ko matlooba simt mein karen. aakhir mein, spinning top candle kharidaron aur farokht knndgan ke darmiyan market ki ghair faisla kin sorat e haal ko zahir karti hai jo qeemat mein tabdeeli ki nishandahi kar sakti hai. market mein aspnng taap ki pozishnng ko pehchanana zaroori hai - rujhan ke andar ya support aur muzahmat ki kaleedi qeemat ki sthon par. aspnng taap candle stuck ka patteren un makhsoos maqamat par sab se ziyada mo-asar hai . -

#7 Collapse

Spinning top candlestick pattern kia hia. dear members trading karty hovy hmara hr waqt candlesticks se taluq hota ha or hum inko dkh kr price read karty hain. ye candle sticks price k ilawa or b bahut kuch btati hain jesa k tredn k bary main support resitance k bary main or reversal k bary main bhi btati hain. esi silsly main aj hum aik important candle ko read karen gy jisy k spinning top candle stick kaha jata ha.Spinning Top candle stick aik namona hai jis ka jism aik oopri aur nichli lambi batii ke darmiyan hota hai. aspnng taap aik aisay manzar naame ki akkaasi karta hai jahan nah baichnay walay aur nah hi khredar ko faida sun-hwa hai. is ke nateejay mein khilnay aur band honay wali qeematon ki akayyan barabar hoti hain .Spinning Top candle stick ki tashkeel qeemat ke ulat jane ke imkaan ka taayun karne mein madad karti hai khaas tor par agar yeh qeemat mein kami ke baad hoti hai. market ke rujhan mein chhootey tagayuraat ki wajah se, candle stick ko tasalsul ka namona kaha jata hai . Spinning top candlestick pattern ke details. Spinning Top asasa mein Adam faisla ki alamat hain. lambay oopri aur nichale saaye is baat ki nishandahi karte hain ke khulay aur band ke darmiyan qeemat mein koi maienay khaiz tabdeeli nahi hui. belon ne qeemat taizi se ziyada bhaije aur reachi ne qeemat taizi se kam bhaije, lekin aakhir mein, qeemat jahan khuli thi is ke qareeb hi band hogayi. yeh ghair faisla kin harkat ziyada side way ka ishara day sakta hai, khaas tor par agar ghoomnay wala taap aik qaim range ke andar hota hai. yeh mumkina qeemat ke ulat jane ka bhi ishara day sakta hai agar yeh qeemat ki paishgi ya kami ke baad waqay hoti hai .kisi bhi soorat mein, tasdeeq se yeh wazeh karne mein madad millti hai ke aspnng taap kya keh raha hai. tasdeeq agli mom batii se aati hai. agar kisi tajir ka khayaal hai ke oopar ke rujhan ke baad ghoomnay wala taap neechay ki taraf palat sakta hai, to mom batii jo aspnng taap ke peechay aati hai usay qeematon mein kami nazar aani chahiye. agar aisa nahi hota hai to, ulat jane ki tasdeeq nahi hoti hai aur tajir ko dosray tijarti signal ka intzaar karna parre ga. agar aspnng taap aik range ke andar waqay hota hai, to yeh is baat ki nishandahi karta hai ke Adam faisla abhi bhi mojood hai aur range jari rehne ka imkaan hai. is ke baad anay wali mom batii ko tasdeeq karni chahiye, yani yeh qaim shuda side ways channel ke andar rehti hai . Spinning top candlestick pattern ke pachan . spinning tops candles main jab hum charts main thore se spinning ate hae to yeh is tarah seview dete bhe hain or kam bhe esa he karte hain is ke liye hamen cahiye ke hum is main mehnatkara karen hum jitna zayada sahe or ache tarah se is main kam ko kar jate hain hum is mainkuch na kuch gain karte he hain to bas candles mian aik hamare pas bearisk candle hote hae oraik hamare bas bullish candle hote hae jitna zayada hum sahe tarah se un ko use kar lete hain Lekin jab Kisi pattern ke top per bearish spinning top ban jaati hai to iska matlabhota hai ki short term ke liye market mein train reversal ho sakti hai aur aap selling opportunitiesle sakte ho Apne assets ko sell kar sakte ho aur aur accha profit banaa sakte ho. trading marketmein hamen straight chij ke sath kam karna hai aur opportunity to Dekh Kar unko kaise karnahai Forex trading market mein hamen management ke sath safety step lekar Apne capital kosev rakhte hue ham karna hota hai . -

#8 Collapse

Good afternoon! Friends spinning tops candles main jab hum charts main zayada tar thore se spinning ate hae to yeh is tarah seview dete hain or is kay sath sath kam bhe aisa hi karte hain is ke liye hamen cahiye ke jab bhi is main mehnatkara karen hum jitna zayada sahe is k ilawa bhi ache tarah se is main kam ko kar jate hain jun he hum is mainkuch na kuch gain karte he hain sath he bas candles mian aik hamare pas bearisk candle hote hein ab agar hamare pas bullish candle hote show ho rhi hai to jitna zayada hum sahe tarah se un ko use kar lete hain Lekin yaad rahe agar ham Kisi pattern ke top per bearish spinning top ban jaati hai to iska matlabhota hai jee han dosto ki short term ke liye market mein train reversal ho sakti hai albata ham sab selling opportunitiesle sakte ho Apne assets ko sell kar sakte hain is k sath aur accha profit bhi bana sakte hein. Agar dekha jaye tou candle stick ki tashkeel kharidaron aur farokht knndgan ke darmiyan zayada Adam faisla ki satah ki nishandahi karti hai, Ham sab ko pata hai kejo qeemat ke ulat phair ko zahir karti hai. Agar ghar mein maa bati band honay par, aur ghoomnay wala taap bearish ya taizi wala ho sakta hai. taham, isi tarha is candle stick ka pattern ziyada tar aik oopri rujhan, hamen neechay ke rujhan, agar ye siraf aik taraf ki harkat mein paaya jata hai, aur jo bhi mumkina ulat jane ki nishandahi karta hai. Agar ye sab taizi ka rujhan qeemat ko zayada barhata hai. -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Spining top pattern ki Explanation Top candlestick pattern aisa pattern hy jo Bullish trend ko show kerta hy , spinning topasi candle stick hoti hai jo up trend k peak par ya down trend k bottom par or trend k middle mab ho aksar nazar ati hai. Ye candle bearish or bullish 2no kisam ki ho sakti hai. Ye candle smallbody par mushtamil hoti hai jis k opening point or closing point ik dosray k kareeb hoty hain. Yepattern us sorat ma banta hai.spinning tops candles main jab hum charts main thore sespinning ate hae to yeh is tarah se view dete bhe hain or kam bhe esa he karte hain is ke liyehamen cahiye ke hum is main mehnat kara karen hum jitna zayada sahe or ache tarah se ismain kam ko kar jate hain hum is main kuch na kuch gain karte he hain to bas candles mian aikhamare pas bearisk candle hote ha Bullish aur Barish Spinning Top pattern Spinning Top pattern ek technical analysis tool hai jo market mein potential reversal ya indecision ko indicate kar sakta hai. Yeh pattern tab banta hai jab candlestick chart par ek spinning top shape ban jati hai aur price action bearish trend ke sath closely related hota hai.Is pattern mein candlestick ki body chhoti hoti hai aur shadow (wick) dono taraf lambi hoti hai. Opening aur closing prices aik doosre ke qareeb hote hain, jisse spinning top ki shape ban jati hai. Is pattern mein price action kisi specific range ke andar ghoomti rehti hai, jiski wajah se market sentiment indecisive ho jati hai.Bearish Spinning Top pattern bearish trend ka indication deta hai, yani ke market ki downward momentum ka zor kamzor ho raha hai aur sellers aur buyers ke darmiyan tawazun ban raha hai. Is pattern ko dekh kar traders ko caution ki zarurat hoti hai kyunki yeh ek potential reversal signal bhi ho sakta hai.Agar Bearish Spinning Top pattern kisi strong support level ya trendline ke qareeb ban raha hai, toh yeh bearish trend ki mazbooti ko darshata hai aur selling pressure ko indicate karta hai. Is situation mein traders selling positions ko consider kar sakte hain.Bearish Spinning Top pattern ki validity aur confirmation ke liye, traders ko market ke upcoming price action aur kisi aur technical indicator ki tafseelati tajurbe ki zarurat hoti hai. Pattern ki confirmation ke liye, next candlestick ki price action aur volume ko closely monitor karna zaroori hota hai. Agar price next candlestick mein downward move karta hai aur selling pressure zyada hoti hai, toh Bearish Spinning Top pattern ki validity aur reliability barh jati hai. tops candles main jab hum charts main thore se spinning ate hae to yeh is tarah seview dete bhe hain or kam bhe esa he karte hain is ke liye hamen cahiye ke hum is main mehnatkara karen hum jitna zayada sahe or ache tarah se is main kam ko kar jate hain hum is mainkuch na kuch gain karte he hain to bas candles mian aik hamare pas bearisk candle hote hae oraik hamare bas bullish candle hote hae jitna zayada hum sahe tarah se un ko use kar lete hain Lekin jab Kisi pattern ke top per bearish spinning top ban jaati hai to iska matlabhota hai ki short term ke liye market mein train reversal ho sakti hai aur aap selling opportunitiesle sakte ho Apne assets ko sell kar sakte ho aur aur accha profit banaa sakte ho. trading marketmein hamen straight chij ke sath kam karna ha SPining Top Pattern min Treading pattern tops candles main jab hum charts main thore se spinning ate hae to yeh is tarah seview dete bhe hain or kam bhe esa he karte hain is ke liye hamen cahiye ke hum is main mehnatkara karen hum jitna zayada sahe or ache tarah se is main kam ko kar jate hain hum is mainkuch na kuch gain karte he hain to bas candles mian aik hamare pas bearisk candle hote hae oraik hamare bas bullish candle hote hae jitna zayada hum sahe tarah se un ko use kar lete hain Lekin jab Kisi pattern ke top per bearish spinning top ban jaati hai to iska matlabhota hai ki short term ke liye market mein train reversal ho sakti hai aur aap selling opportunitiesle sakte ho Apne assets ko sell kar sakte ho aur aur accha profit banaa sakte ho. trading marketmein hamen straight chij ke sath kam karna ha

SPining Top Pattern min Treading pattern tops candles main jab hum charts main thore se spinning ate hae to yeh is tarah seview dete bhe hain or kam bhe esa he karte hain is ke liye hamen cahiye ke hum is main mehnatkara karen hum jitna zayada sahe or ache tarah se is main kam ko kar jate hain hum is mainkuch na kuch gain karte he hain to bas candles mian aik hamare pas bearisk candle hote hae oraik hamare bas bullish candle hote hae jitna zayada hum sahe tarah se un ko use kar lete hain Lekin jab Kisi pattern ke top per bearish spinning top ban jaati hai to iska matlabhota hai ki short term ke liye market mein train reversal ho sakti hai aur aap selling opportunitiesle sakte ho Apne assets ko sell kar sakte ho aur aur accha profit banaa sakte ho. trading marketmein hamen straight chij ke sath kam karna ha

-

#10 Collapse

Assalam alaikum dear gathering members!umeed karta hun aap sb khairiat se hn gy or apki exchanging achi jaa rahi ho ge.dear individuals exchanging karty hovy hmara hr waqt candles se taluq hota ha or murmur inko dkh kr cost read karty hain.ye candles cost k ilawa or b bahut kuch btati hain jesa k tredn k bary principal support resitance k bary fundamental or inversion k bary primary bhi btati hain.esi silsly primary aj murmur aik significant candle ko read karen gy jisy k turning top candle kaha jata ha. What is spinning top candle design? dear individuals turning top flame ki short genuine body hoti ha jo k opr or nechy shadow k drmyan hoti ha ye body negative ya bullish ho skti ha.turning top market primary indecission ko zahir karti ha mtlb k purchaser or venders equivalent power fundamental thy or market principal koe faisla ni ho ska.Jb market opr hai to dealer ny sell kia or opr ki trf wick ya shadow bn gyaor then again jb market nechy gai to purchasers ny purchase kia jski waja se nechy se wick bn gai or darmyan primary choti c body bni ha.agr ye design solid help ya opposition py bny or es se agli flame eski affirmation kar dy to ye pattern inversion ka sign ho skta ha. Significance of spinning top candle design: Yeh candle design us time banta ha hit purchasers aik given time k doran cost ko down push kr deta ha. Compare shutting cost open k bht qareeb close hojati ha. Solid cost mein izafa ya kami k baad, turning top potential cost inversion ka signals dy sakti ha. Turning top above open k oper ya beneath close ho sakti ha. Compare dono costs hamesha aik dusry k qareeb hoti hein.Turning top aik candle design ha jis ki short genuine body hoti ha jo long upper aur lower shadows k darmeyan hota ha. Is ki genuine body choti honi chaiye jo open aur close costs mein thora farq dekhata hai. Kyun k purchasers aur dealers dono ny cost ko agy barhaya compare usy keep up with nae rakh saky. Design hesitation ko show karta ha aur us k sath mazid sideways development bhi ho sakti hai. Umeed ha k aj ka subject ap sab doston ko zarur samjh yes ga ta k ap exchanging k doran is candle ko pehchan saken aur us k baad he apni exchange ko dynamic karen ta k ap misfortune sy bach saken.

Significance of spinning top candle design: Yeh candle design us time banta ha hit purchasers aik given time k doran cost ko down push kr deta ha. Compare shutting cost open k bht qareeb close hojati ha. Solid cost mein izafa ya kami k baad, turning top potential cost inversion ka signals dy sakti ha. Turning top above open k oper ya beneath close ho sakti ha. Compare dono costs hamesha aik dusry k qareeb hoti hein.Turning top aik candle design ha jis ki short genuine body hoti ha jo long upper aur lower shadows k darmeyan hota ha. Is ki genuine body choti honi chaiye jo open aur close costs mein thora farq dekhata hai. Kyun k purchasers aur dealers dono ny cost ko agy barhaya compare usy keep up with nae rakh saky. Design hesitation ko show karta ha aur us k sath mazid sideways development bhi ho sakti hai. Umeed ha k aj ka subject ap sab doston ko zarur samjh yes ga ta k ap exchanging k doran is candle ko pehchan saken aur us k baad he apni exchange ko dynamic karen ta k ap misfortune sy bach saken. Bullish inversion spinning top candle design: Dear individuals ye design negative pattern k end fundamental help py banta ha or ye inversion ki nishani hota ha es k terrible market bullish ho jati ha.laikin es se phly eski affirmation lazmi ha.eski affirmation ye ha k help muqam py phly turning top flame bny bullish body k sth or phr us k awful usi time period primary next candle turning top ki shutting cost se opr close ho.

Negative inversion spinning top candle design: Dear memebrs ye design bullish pattern k end principal opposition muqam py bnta ha. Obstruction py aikspinning top flame banti ha negative body k sth or eski affirmation k lye next negative candle ko turning top candle k low k nechy close hona chahye. Es k awful market ka pattern turn around hota ha or market negative move karti ha

-

#11 Collapse

What is spinning top candlestick pattern : Spin Top candlestick structure hy jo Bullish trends ko display kerta hy, spinning topasi candle stick hoti hai jo up trend k peak par ya down trend k bottom par or movement k mid mab ho aksar nazar ati hai. Bearish or bullish candle kisam ki ho sakti hai. Ye candle smallbody par mushtamil hoti hai jis k opening point ik dosray k kareeb hoty hain. Us sorat ma banta hai yepattern.To bas candles, aikhamare pas bearisk candle hote hae or aik hamare bas bullish candle hote hae jitna zayada humsahe tarah se un ko use kar lete hain. Bullish aur Barish Spinning Top pattern Spinning Top pattern is a technical analysis technique that indicates possible market reversal or hesitation. Yeh pattern tab banta hai, ek spinning top shape ban jati hai aur price action bearish trend ke sath closely connected hota hai.Is pattern mein candlestick ki body chhoti hoti hai aur dono taraf lambi hoti hai. Opening and closing prices are the same, but the form of the spinning top is different. Is pattern mein price action kisi specified range ke andar ghoomti rehti hai, if market mood is undecided.Bearish Spinning Top pattern deta hai, yani ke market ki downward momentum ka zor kamzor ho raha hai aur sellers aur buyers ke darmiyan tawazun ban raha hai. Is pattern ko dekh kar traders ko zarurat hoti hai, kyunki yeh ek possible reversal signal bhi ho sakta hai?If the Bearish Spinning Top pattern has a strong support level and a trendline, then the bearish trend has a mazbooti and selling pressure has been indicated. In this case, traders should consider selling holdings.Bearish Spinning Top pattern ke liye, traders ko market ke future price action aur kisi aur technical indicator ki tafseelati tajurbe ki zarurat hoti hai. If the pattern is confirmed, the next candlestick's price movement and volume should be actively monitored. If the price moves lower in the next candlestick and there is selling pressure, the Bearish Spinning Top pattern has validity and dependability. To bas candles, aik hamare pas bearisk candle hote hae or aik hamare bas bullish candle hote hae jitna zayada hum sahe tarah se un ko use kar lete hain. Sell your possessions and make a profit. Trading marketmein hamen ke sath kam karna ha

Bullish aur Barish Spinning Top pattern Spinning Top pattern is a technical analysis technique that indicates possible market reversal or hesitation. Yeh pattern tab banta hai, ek spinning top shape ban jati hai aur price action bearish trend ke sath closely connected hota hai.Is pattern mein candlestick ki body chhoti hoti hai aur dono taraf lambi hoti hai. Opening and closing prices are the same, but the form of the spinning top is different. Is pattern mein price action kisi specified range ke andar ghoomti rehti hai, if market mood is undecided.Bearish Spinning Top pattern deta hai, yani ke market ki downward momentum ka zor kamzor ho raha hai aur sellers aur buyers ke darmiyan tawazun ban raha hai. Is pattern ko dekh kar traders ko zarurat hoti hai, kyunki yeh ek possible reversal signal bhi ho sakta hai?If the Bearish Spinning Top pattern has a strong support level and a trendline, then the bearish trend has a mazbooti and selling pressure has been indicated. In this case, traders should consider selling holdings.Bearish Spinning Top pattern ke liye, traders ko market ke future price action aur kisi aur technical indicator ki tafseelati tajurbe ki zarurat hoti hai. If the pattern is confirmed, the next candlestick's price movement and volume should be actively monitored. If the price moves lower in the next candlestick and there is selling pressure, the Bearish Spinning Top pattern has validity and dependability. To bas candles, aik hamare pas bearisk candle hote hae or aik hamare bas bullish candle hote hae jitna zayada hum sahe tarah se un ko use kar lete hain. Sell your possessions and make a profit. Trading marketmein hamen ke sath kam karna ha Significance of spinning top candle design: Yeh candle design kr deta ha hit buyers aik provided time k doran cost kr deta ha. Compare the cost of closing open k bht qareeb close hojati ha. Turning top probable cost inversion ka signals dy sakti ha, solid cost mein izafa ya kami k baad. Turning top above open k oper and bottom below close ho sakti ha. Cost comparison hamesha aik dusry k qareeb hoti hein.Turning top aik candle design ha jo lengthy upper aur lower shadows k darmeyan hota ha. Is ki authentic body choti honi chaiye jo open thora farq dekhata hai. When buyers and sellers compare prices, it is difficult to keep up with nae rakh saky. Design hesitancy ko display karta hai, aur mazid sideways development bhi ho sakti hai. Yes ga ta k ap exchanging k doran is candle ko pehchan saken aur us k baad he apni exchange ko dynamic karen ta k ap misfortune sy bach saken.

Significance of spinning top candle design: Yeh candle design kr deta ha hit buyers aik provided time k doran cost kr deta ha. Compare the cost of closing open k bht qareeb close hojati ha. Turning top probable cost inversion ka signals dy sakti ha, solid cost mein izafa ya kami k baad. Turning top above open k oper and bottom below close ho sakti ha. Cost comparison hamesha aik dusry k qareeb hoti hein.Turning top aik candle design ha jo lengthy upper aur lower shadows k darmeyan hota ha. Is ki authentic body choti honi chaiye jo open thora farq dekhata hai. When buyers and sellers compare prices, it is difficult to keep up with nae rakh saky. Design hesitancy ko display karta hai, aur mazid sideways development bhi ho sakti hai. Yes ga ta k ap exchanging k doran is candle ko pehchan saken aur us k baad he apni exchange ko dynamic karen ta k ap misfortune sy bach saken.

-

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

INTRODUCTION OF SPINING TOP CANDLESTICKS PATTERN..&& Spinning Top candlestick sample aisa pattern hy jo Bullish fashion ko show kerta hy , spinning topasi candle stick hoti hai jo up trend okay top par ya down fashion okay bottom par or fashion okay center mab ho aksar nazar ati hai. Ye candle bearish or bullish 2no kisam ki ho sakti hai. Ye candle smallbody par mushtamil hoti hai jis k beginning point or final point ik dosray ok kareeb hoty hain. Yepattern us sorat ma banta hai.Spinning tops candles major jab hum charts essential thore sespinning ate hae to yeh is tarah se view dete bhe hain or kam bhe esa he karte hain is ke liyehamen cahiye ke hum is essential mehnat kara karen hum jitna zayada sahe or pain tarah se ismain kam ko kar jate hain hum is main kuch na kuch gain karte he hain to bas candles mian aikhamare pas bearisk candle hote hae or aik hamare bas bullish candle hote hae jitna zayada humsahe tarah se un ko use kar lete hai BULLESH SPINING TOP CANDLESTICKS PATTERN..&& Bullish Spinning pinnacle sample ko technical analysis mein istemaal hota hai. Ye pattern tab banta hai jab opening aur closing charges aik doosre ke qareeb hotay hain, lekin rate kisi ahem variety mein ghoomti rehti hai. BEARISH SPINING TOP CANDLESTICKS PATTERN..&& Bearish Spinning Top pattern ek technical evaluation device hai jo marketplace mein capacity reversal ya indecision ko imply kar sakta hai. Yeh pattern tab banta hai jab candlestick chart par ek spinning pinnacle shape ban jati hai aur rate action bearish trend ke sath closely related hota hai.Is sample mein candlestick ki body chhoti hoti hai aur shadow (wick) dono taraf lambi hoti hai. Opening aur last charges aik doosre ke qareeb hote hain, jisse spinning top ki form ban jati hai. Is pattern mein charge motion kisi unique range ke andar ghoomti rehti hai, jiski wajah se market sentiment indecisive ho jati hai.Bearish Spinning Top sample bearish fashion ka indication deta hai, yani ke market ki downward momentum ka zor kamzor ho raha hai aur sellers aur consumers ke darmiyan tawazun ban raha hai. Is sample ko dekh kar buyers ko warning ki zarurat hoti hai kyunki yeh ek capability reversal signal bhi ho sakta hai.Agar Bearish Spinning Top sample kisi sturdy aid level ya trendline ke qareeb ban raha hai, toh yeh bearish trend ki mazbooti ko darshata hai aur selling strain ko indicate karta hai. Is scenario mein traders promoting positions ko consider kar sakte hain.Bearish Spinning Top pattern ki validity aur confirmation ke liye, traders ko marketplace ke upcoming charge motion aur kisi aur technical indicator ki tafseelati tajurbe ki zarurat hoti hai. Pattern ki confirmation ke liye, next candlestick ki fee action aur volume ko carefully monitor karna zaroori hota hai. Agar rate subsequent candlestick mein downward pass karta hai aur selling strain zyada hoti hai, toh Bearish Spinning Top sample ki validity aur reliability barh jati hai.Yeh sample market ke overall context, trend, aur additional signs ke saath integrate karke examine karna zaroori hai taaki accurate buying and selling choices liye ja saken IDENTIFICATION OF SPINING TOP CANDLESTICKS PATTERN spinning tops candles foremost jab hum charts important thore se spinning ate hae to yeh is tarah seview dete bhe hain or kam bhe esa he karte hain is ke liye hamen cahiye ke hum is primary mehnatkara karen hum jitna zayada sahe or pain tarah se is main kam ko kar jate hain hum is mainkuch na kuch gain karte he hain to bas candles mian aik hamare pas bearisk candle hote hae oraik hamare bas bullish candle hote hae jitna zayada hum sahe tarah se un ko use kar lete hain Lekin jab Kisi pattern ke top in keeping with bearish spinning top ban jaati hai to iska matlabhota hai ki quick term ke liye market mein educate reversal ho sakti hai aur aap selling opportunitiesle sakte ho Apne assets ko promote kar sakte ho aur aur accha income banaa sakte ho. Buying and selling marketmein hamen immediately chij ke sath kam karna hai aur opportunity to Dekh Kar unko kaise karnahai the Forex market trading market mein hamen management ke sath protection step lekar Apne capital kosev rakhte hue ham karna hota hai TRADING STRATEGY..&&spinning top candlestick ko kaise pahchan sakte hain to uska aasan tarika yah hai ki iski body johai vah chhoti hoti hai aur iske shadows Jo stick hoti hain. Spinning pinnacle candlestick Ek Aisicandlestick hoti hai jo aapko market Mein reversal educate se associated information provide kar rahihoti hai dear jab aap marketplace Mein is candlestick ko have a look at karte hain to ismein aapko bahutjyada earnings milane ke risk hote. Spining top ability rate reversal ka sign daiti ha, jbspining top candle uptrend k top par bnti ha to ye is cheez ka sign jota ha ok bulls manage loosekar rahay hain aur trend down honay wala ha, isi tarah jb ye down fashion k bottom ma bnti ha toye uptrend ka sign hota ha .Jab marketplace uptrend principal keep motion ker rehi hoti haidifferent candles create ho rehi hoti hai lekin agar marketplace kisi time consistent with speedy movement ker rehiho kisi aik factor per market kuch time ky liay stay kerti hai ky wahan sy market both directionsmain movement kerny ky bahd small frame candle create kerti hai lekin each aspects in step with long wickban jati hai tou same candle spinning top bearish candle create hony in keeping with market primary trendreversal ki confirmation hoti hai ky same time per market ka uptrend opposite ho ker downtrendshoru ho jata hai isi terha agar marketplace hold downtrend essential movement ker rehi hoti hai aurmarket kisi aik point according to kuch live kerti hai ky candle open hony ky bahd each instructions mainbig movement kerti hai lekin jab near hoti hai woh small body ky sath bullish candle create kertihai aesi candle ko bullish spinning top candle kehty hain jo downtrend ki reversal ki confirmationprovide kerti hai aur identical time in line with bearish trend exchange ho ker bullish fashion begin ho jata hai.

-

#13 Collapse

What Is a Spinning Top Candlestick? Spinning top aik candlestick patteren hai jis mein aik mukhtasir haqeeqi jism hai jo amoodi tor par taweel oopri aur kam saaye ke darmiyan markooz hai. candlestick patteren asasa ki mustaqbil ki simt ke baray mein be hisi ki numaindagi karta hai. is ka matlab yeh hai ke nah khredar aur nah baichnay walay oopri haath haasil kar saktay hain . traders ko aik muqarara waqt ki muddat ke douran qeemat ko dhaka jab aik mom batii patteren form, aur baichnay walay aik hi waqt ki muddat ke douran qeemat ko dhaka, lekin bil akhir band qeemat khulay ke qareeb khatam ho gaya. aik mazboot qeemat paishgi ya kami ke baad, spinning top mumkina qeemat ke ulat ko signal kar satke hain agar mom batii jo tasdeeq karta hai. aik spinning top ya khulay se neechay aik qareebi ho sakta hai, lekin do qeematein hamesha aik dosray ke sath qareeb hain . Spinning top candle ke andar qeemat ki harkat kharidaron aur farokht knndgan ki numaindagi karti hai jo aik dosray ko chore dete hain jis ke nateejay mein qeemat ki satah aik jaisi khuli aur qareeb hoti hai. tijarti hikmat e amli mein aspnng taap candle stuck patteren ko shaamil karne ka faida yeh hai ke kam se kam waqti sarmaya kaari ke sath is ki shanakht karna aasaan hai. Bullish Spinning top pattern ko technical analysis mein istemaal hota hai. Ye pattern tab banta hai jab opening aur closing prices aik doosre ke qareeb hotay hain, lekin price kisi ahem range mein ghoomti rehti hai. ye pattern bullish trend k end main resistance muqam py bnta ha. Resistance py aikspinning top candle banti ha bearish body k sth or eski confirmation k lye next bearish candle ko spinning top candle k low k nechy close hona chahye. Es k bad market ka trend reverse hota ha or market bearish move karti ha -

#14 Collapse

Significance of turning top candle design: Yeh candle design us time banta ha poke purchasers aik given time k doran cost ko down push kr deta ha. Compare shutting cost open k bht qareeb close hojati ha. Solid cost mein izafa ya kami k baad, turning top potential cost inversion ka signals dy sakti ha. Turning top above open k oper ya beneath close ho sakti ha. Compare dono costs hamesha aik dusry k qareeb hoti hein.Turning top aik candle design ha jis ki short genuine body hoti ha jo long upper aur lower shadows k darmeyan hota ha. Is ki genuine body choti honi chaiye jo open aur close costs mein thora farq dekhata hai. Kyun k purchasers aur venders dono ny cost ko agy barhaya compare usy keep up with nae rakh saky. Design uncertainty ko show karta ha aur us k sath mazid sideways development bhi ho sakti hai. Umeed ha k aj ka theme ap sab doston ko zarur samjh affirmative ga ta k ap exchanging k doran is light ko pehchan saken aur us k baad he apni exchange ko dynamic karen ta k ap misfortune sy bach saken.Bullish inversion turning top candle pattern:Dear individuals ye design negative pattern k end primary help py banta ha or ye inversion ki nishani hota ha es k terrible market bullish ho jati ha.laikin es se phly eski affirmation lazmi ha. eski affirmation ye ha k help muqam py phly turning top light bny bullish body k sth or phr us k terrible usi time period fundamental next candle turning top ki shutting cost se opr close ho Negative inversion turning top candle pattern:Dear memebrs ye design bullish pattern k end principal obstruction muqam py bnta ha. Obstruction py aikspinning top candle banti ha negative body k sth or eski affirmation k lye next negative candle ko turning top flame k low k nechy close hona chahye. Es k awful market ka pattern invert hota ha or market negative move karti ha -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

yani yeh is muddat ki mojoodgi ki pishin goi karta hai hit kisi khaas security ki qeemat neechay ki taraf bherne ki tawaqqa ki jati hai. yeh is waqt zahir hota hai punch do linon ke zariye - aik nichli oonchaiyon ki series mein shaamil ho hoti hai doosri ufuqi prepared line jo neechay ki aik series ko judte hai. is ki shakal ki wajah se usay baaz auqaat dayen zavia masalas bhi kaha jata hai. utartay tint masalas sy graph ka patteren is baat ka ishara hai ke deals side sy bhe brokers jarehana ho rahay hain aur security ki qeemat ki raftaar ko control kar len ge. aam peak standard, merchants is waqt tak intzaar karte hain hit tak ke support ke nichale rujhan mein kharabi nah ho aur phir mukhtasir pozishnin len, or aakhir-kaar security ki qeemat ko kam kar sanctum. yeh candle stuck patteren taajiron mein kaafi maqbool hai kyunkay yeh is baat ki nishandahi karta hai ke capital business sectors mein security ki maang kamzor standard rahi hai. utarti hui masalas aik tajir ko mukhtasir waqt mein khatir khuwa faida haasil karne ka mauqa faraham karti hai . Bullish aur Barish Spinning Top pattern ona samjha jata hai. is ka kr deta ha. Compare the cost of closing open k bht qareeb close hojati ha. Turning top probable cost inversion ka signals dy sakti ha, solid cost mein izafa ya kami k baad. Turning top above open k oper and bottom below close ho sakti ha. Cost comparison hamesha aik dusry k qareeb hoti hein.Turning top aik candle design ha jo lengthy upper aur lower shadows k darmeyan hota ha. Is ki authentic body choti honi chaiye jo open thora farq dekhata hai. When buyers and sellers compare prices, it is difficult to keep up with nae rakh saky. Design hesitancy ko display karta hai, aur mazid sideways development bhi ho sakti hai. Yes ga ta k ap exchanging k doran is candle ko pehchan saken yeh hai ke koi Sa patteren ahem rehta hai agar yeh neechay ke rujhan sy aur oopar ke rujhan dono mein hota hai. masalas se break out honay ke baad, tajir is simt standard munhasir hai jis mein hasas ki qeemat pehli baar shuru hui thi, jarehana pinnacle standard asason ko baichnay ya kharidne mein jaldi karte hain. third sy barhta sun-hwa hajam is baat ki tasdeeq karne mein madad karta hai ke aaya qeemat honk gayi hai ya nahi. Or on the other hand hajam jitna ziyada barhta hai qeemat mein itni howdy dilchaspi patteren se bahar hoti hai. aik charhtay tone masalas ki koi markazi prepared lines bananay ke liye, kam az kam do hon soyng lovs aur do soyng higher zaroori hain. taham, aik dosray ko chone ke liye ziyada tadaad mein prepared lines ziyada qabil aetmaad tijarti nataij ki nishandahi karti hain. chunkay dono prepared material aik dosray mein tabdeel ho to rahi hain, agar hasas ki qeemat is masalas ke andar kayi jhoolon ke liye chalti rehti hai, to is ki qeemat ka amal sy mazeed marboot ho jaye ga, jo bil akhir maz

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 01:15 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим