Falling Window Candlestick Pattern:

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

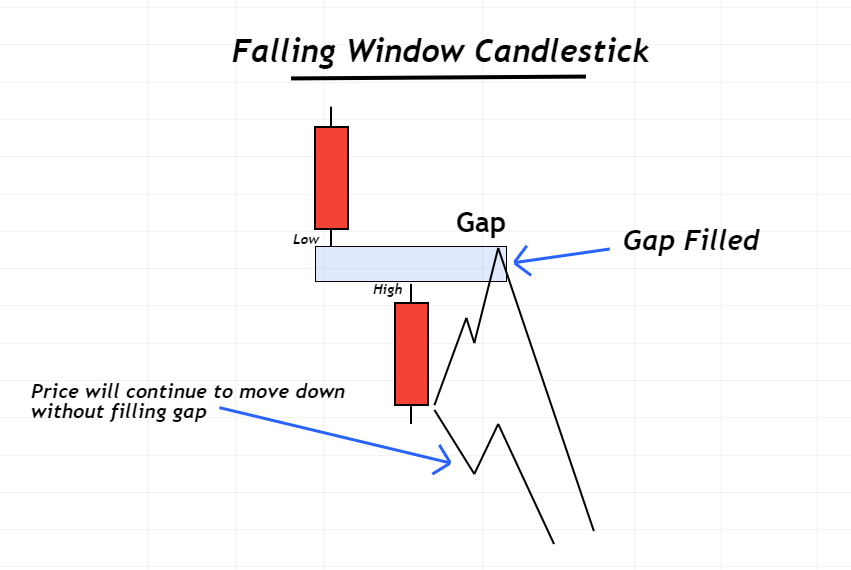

Introduction: Assalamualaikum I hope you all are fine and doing well on forex trading. Forex members aj ki es post mein main ap ko falling Window Candlestick Pattern key bary mein knowledge share krun gi. Falling Window Candlestick Pattern: Forex market mein jab bh Strong window carte bird, plan candles, darjazel tarah se hoti ji gii Taur, kam kar sakti hai Kyunki Jaise hiya kimaten Pichhle Tak pahunchi Jaati Hai yah do chijen center Aise Ek kam Karega Wapas Achcha Lana help barrier statement se kiya kimat Ke Sita ke khilaf Vardi Karen aap apni peshgashi SIM and maja dega Jari Rahega press tak ke liye agale guide yaudham se Sita na pahunche Kuchh tijaraton ka Waqt Marne hai kya Nahin tutenge Chahe kimat ruk di.Falling. window candle plan ki pehli lamp aik terrible stove hoti hai no cost ok general lesson plan ki akasi karti hai. Mother is white or has no experience mixing focus hoti hai.. Identification: Dear the window goes down if the contents are soft, if you are downtrend ko show karti hai. Aur mein ik aval hota hais jis se downtrend ka aouz lagaya jata haye. ka cause banta hai. jiss ki waja see reduce the part of asarat assets ki harga ko teezi k sath itish karte kok, central shamil wax planning plan tarah se hoti hai increase the scope of foundation hon chaheye. O kamin bhi aik horrible lock frame honi jaheye. ha k kalangang or kalangang good bagher bhi ho sakti hai. The diagram of the plan is always the source, the top of the door is steel and chicken bante. You know the booth is a great place to spend time. Lowered the window lamp polah ki pehli hipu aik janjakal hawu hoti hai yes popular lesson plan pay ki akasi karti hai. White fireplace or inexperienced mixing is important hoti hai, really good shade or good shade bagher bhi ho sakti hai, but really ram ka wazih hona zarori hai. Sponsorships & Deterrence: Dear friends Mumble became the currency in the country of 5 trillion dollars with k traders are important to the regular action sy iss chief kam karye tabhi mumble em critical performance pah sakta hain or pay me sakta hain apni trade number one. Support and resistance forex trading is the biggest bhot, it brings me profit in the wali market large volume accurate labor benefits bhot ya achi profit payment sakta hain or implementation pah sakta hain humein chahiye ok mumble very good exam square apna good career experience thk mumble top rated sakiya or achi financial support laa sakiya or total blacklist sakiya. Support and securities of the forex market ranks above aik bohat kam kar jani hai. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Falling window candlesticks pattern in market Dear Market ke ANDR k6 pattern jahurno ke tarh hote hain jb ye fall hote he tu ye aisa maloom hopta he jaise market ke andr kam kar sakti hai Kyunki Jaise hiya kimaten Pichhle Tak pahunchi Jaati Hai yah do chijen center Aise Ek kam Karega Wapas Achcha Lana help barrier statement se kiya kimat Ke Sita ke khilaf Vardi Karen aap apni peshgasho teezi k sath itish karte kok, central shamil wax planning plan tarah se hoti hai increase the scope of foundation hon chaheye. O kamin bhi aik horrible lock frame honi jaheye. ha k kalangang or kalangang good bagher bhi ho sakti hai. The diagram of the plan is always the source, the top of the door is steel and chicken bante. You know the booth is a great place to spend time. Lowered the window lamp polah ki pehli hipu aik janjakal hawu hoti hai yes popular lesson plan pay ki akasi karti hai. White fireplace or inexperienced mixing is important hoti hai, really good shade or good shade bagher bhi ho sakti hai, but really ram ka wazih hona zarori hai.i SIM and maja dega Jari Rahega press tak ke liye agale guide yaudham se Sita na pahunche Kuchh tijaraton ka Waqt Marne hai kya Nahin tutenge Chahe kimat ruk di.Falling. window candle plan ki pehli lamp aik terrible stove hoti hai no cost ok general lesson plan ki akasi karti hai. Mother is white or has no experience mixing focus hoti haiIdentification and its working in market Hm is ko identify is taqeeeqe se kr skty hain ye pattern extremmly fall hona suru ho jaata he traders are important to the regular action sy iss chief kam karye tabhi mumble em critical performance pah sakta hain or pay me sakta hain apni trade number one. Support and resistance forex trading is the biggest bhot, it brirm hai jo k technical analysis k tahat use hota hai Pivot Point ka matlab hota hai turning point ya axis point Yeh traders ke liye aik important tool hai jo k trend reversal or market direction k bary mein pata lgany main help karta hai Pivot Point aik mathematical formula hota hai jo k previous day ka high low or closing price k tor par calculate kiya jaata hai is formula sy Pivot Point k sath sath kuch or support or resistance levels b calculate kiye jaty hain jo ki traders ko entry or exit points ke liye guide karty hain Pivot Point kags me profit in the wali market large volume accurate labor benefits bhot ya achi profit payment sakta hain or implementation pah sakta hain humein chahiye ok mumble very good exam square apna good career experience thk mumble top rated sakiya or achi financial support laa sakiya hain Beneficials for traders or not Yeh market main use hony wala aik popular concept hai es ka matlab hota hai ya point of rotation Pivot Point aik aisa level hota hai jahan traders or investors market trend k direction ko predict karty hain es ko calculate krny liye previous day ka high low or close prices ka use kiya jata hai Is k alawa pivot point k around or us k agy k support or resistance levels calculate kiye jaty hain Agar koi stock price pivot point level ko cross kar leti hsy Wapis Pivot point ki taraf murti ha. Agar price phle resistance su Wapis na more per ke resistance ko cross krain to isy Breakout Kehty hain. ab ziada chances hote hain ki price dusre resistance Se wpis mur gaye ge. Agar per Rai se dusri resistance ko bhi cross Karti Hai To trader ummid Karte Hain Ki price 3sri register Se Wapas Mod Jayegi Agar prize downtrend mein ho to price pahle sports ki taraf Jayegi yahan se pivot point ki taraf Wapas badhegi Agar pahle sports Ko Karar Karke Masjid niche ko Jaati Hai To dusri sports ki taraf gaye gi a pivot points resistance or supports rozana new or different sote Hain ai to ye aik strong indication hai k stock price trend change karny ja rahi hai Isliye traders or investors pivot point ka use kar k stock price movement ka prediction ka kaam krta he

-

#4 Collapse

Introductory Paragraph of Trading Strategy at Falling Window Candlestick Pattern. Trading mein kamyabi haasil karne ke liye, humein wazeh tafteesh aur tehqeeqat par tawajjo deni chahiye. Candlestick patterns, jaise ki Mudallal Jharokon Wali Mombatti (Falling Window Candlestick Pattern), tijarat mein madadgar tafteeshi tools hain. Is article mein hum Mudallal Jharokon Wali Mombatti pattern par tijarat ki aik achi straiteji par baat karenge.Falling Window Candlestick Pattern ek technical analysis tool hai jo share market mein istemal hota hai. Is pattern mein do consecutive candlesticks hote hain jin mein pehli candlestick ki closing price dusri candlestick ki opening price se oopar hoti hai. Iska natija hota hai ke ek "window" ya "gap" paida hota hai do candlesticks ke beech mein. Jab is pattern ko dekha jata hai, toh yeh ek bearish ya downtrend ke sign ki tarah samjha jata hai. Ab hum dekhte hain ke is pattern par kis tarah tijarat ki strategy tashkeel di ja sakti hai. Trading at falling Window Candlestick Pattern. Sab se pehle, aapko yaqeeni banane ke liye, falling window pattern ki tasdeeq karni hogi. Iske liye, aapko do consecutive candlesticks mein se dusri candlestick ki opening price ke neechay ki closing price par nazar rakhni hogi. Agar aap falling window pattern ko confirm kar lete hain, toh aap aage badh sakte hain.Phir jab aap falling window pattern ko tasdeeq kar lete hain, toh aap sell order lagane par soch sakte hain. Is order mein aap apne broker ko instrcuct karenge ke woh shares beche, ya short sell kare. Aap stop-loss order bhi lagayein, jisse aap apni nuqsaan ko kam rakh sakte hain agar market mein ghair Target Price. Apne sell order ke liye target price tay karne se pehle, aapko pata karna hoga ke market ka trend kya hai. Agar aap downtrend mein hain, toh aap apne target price ko niche rakh sakte hain. Yeh target price aapke trade ko band karne ke liye ho sakta hai. Time Frame. Falling window pattern par tijarat karte waqt, aapko bhi time frame tay karna hoga. Yeh aapke trading style aur market conditions par depend karega. Aap kuch ghante se lekar kuch dinon tak ka time frame tay kar sakte hain. Time frame ke andar aapko market ki halat aur share price ke liye jari rahna hogaDear tra ders Falling Window Candlestick Pattern Trading ke liye ek ahem tool hai. Is pattern par tijarat karne ke liye, falling window pattern ki tasdeeq karne ke baad sell order lagaya ja sakta hai. Apne trade ka target price aur time frame tay karne ke baad, aap apni tijarat ko samapt kar sakte hain. Tijarat mein mushkil aur asan waqt aate rehte hain, is liye market ki halat ko hamesha jari rakhna zaroori hai. Is straiteji ko samajhne aur istemal karne se pehle, aapko mukammal tafteesh aur salah mashwara hasil karna chahiye. Yeh straiteji sirf tafteeshi maqsad ke liye di gayi hai aur kisi bhi tijarat ki masroofiyat se pehle, aapko apne broker ya financial advisor se mashwara lena chahiye. -

#5 Collapse

Assalamualaikum ma umeed krta hun k aap sub loog khaireyat sy hon gy or aap subhi ka trading session acha chal raha ho ga Aaj ka hamara topic Falling window chart patterns hy Chalain us k baay ma agahi hasil krty hain girtay hue window candle stick patteren, jisay" Gaps" bhi kaha jata hai, takneeki tajzia mein numaya chart farmishnz hain. yeh is waqt hota hai jab tijarti session ki ikhtitami qeemat aur is ke baad ke session ki ibtidayi qeemat ke darmiyan numaya farq hota hai. yeh farq qeemat ke chart par aik khaali jagah ke tor par zahir hota hai, jo market ke jazbaat mein achanak tabdeeli aur mumkina tijarti mawaqay ki nishandahi karta hai. is note mein, hum window candle stuck ke namonon ke girnay ki khususiyaat, aqsam aur mzmrat ko talaash karen ge. khususiyaat : 1. gape : girtay hue window patteren ki wazahat neechay ki taraf farq se hoti hai, jahan mojooda session ki ibtidayi qeemat pichlle session ki ikhtitami qeemat se kam hai. is farq ko chart par khaali ya khaali jagah se zahir kya jata hai . girty hui khirki candle stuck patteren ki aqsam : 1. common gape : yeh girnay wali window patteren ki sab se bunyadi qisam hai. yeh is waqt hota hai jab mojooda session ki ibtidayi qeemat pichlle session ki ikhtitami qeemat se kam hoti hai, jis ke nateejay mein chart par aik khalaa peda hota hai. kam utaar charhao ya raton raat market ki sargarmi ke douran aam farq aksar dekha jata hai. 2. break way gape : break way gape aik ziyada ahem girta sun-hwa window patteren hai jo aksar qeemat chart par istehkaam ya bheer ki muddat ke baad hota hai. yeh market ke jazbaat mein mazboot tabdeeli ki nishandahi karta hai aur break out signal ke tor par kaam kar sakta hai. break way gaps aam tor par khabron ke waqeat , munsalik hotay hain jo talabb aur rasad ki harkiyaat mein achanak tabdeeli ka sabab bantay hain. 3. thakan ka farq : is qisam ka girta sun-hwa window patteren rujhan ke ekhtataam ki taraf hota hai, jo is baat ka ishara deta hai ke murawaja rujhan shayad raftaar kho raha hai. is se pata chalta hai ke khareed o farokht ka dabao kam ho raha hai, aur aik ulat phair ya istehkaam ka marhala aa sakta hai. thakan ke farq aksar aik taweel up trained ya neechay ke rujhan ke baad dekhe jatay hain aur yeh mumkina rujhan ke ulat jane ki nishandahi kar satke hain . mzmrat aur tijarti hikmat e amli : 1. mandi ka tasalsul : girtay hue window patteren ko aam tor par mandi ke tasalsul ke patteren ke tor par dekha jata hai, jis ka matlab yeh hai ke mojooda kami ka rujhan jari rehne ka imkaan hai. tajir neechay ki raftaar se faida uthany ke liye mukhtasir position mein daakhil honay ya mojooda holdngz farokht karne par ghhor kar satke hain. 2. Reversal signals : baaz sooraton mein, girtay hue window patteren mumkina ulat signal ke tor par kaam kar satke hain. misaal ke tor par, lambay arsay tak neechay ke rujhan ke baad toot phoot ka farq mumkina rujhan ke ulat jane ki nishandahi kar sakta hai. taham, tijarti faislay karne se pehlay dosray takneeki isharay ya chart patteren ke sath aisay signals ki tasdeeq karna bohat zaroori hai. 3. stap las aur rissk managment : girtay hue window patteren ki tijarat karte waqt, qeemat ki manfi harkato se bachanay ke liye stap las ke order dena zaroori hai. chunkay farq market ke jazbaat mein achanak tabdeeli ki nishandahi karta hai, qeemat taizi se taajiron ki pozishnon ke khilaaf barh sakti hai. stap las ke orders tarteeb day kar, tajir mumkina nuqsanaat ko mehdood kar satke hain agar qeemat ghair mutawaqqa tor par palat jati hai . 4. tasdeeq : girtay hue khirki ke namonon ki tasdeeq ke liye deegar takneeki tajzia ke alaat aur isharay istemaal karne ka mahswara diya jata hai. un mein trained lines, support aur rizstns levels, moving average ya accelators shaamil ho satke hain. mutadid isharay ke sath signal ki tasdeeq tijarti faislon ki durustagi ko barha sakti hai. aakhir mein, girtay hue window candle stuck patteren market ke jazbaat ke baray mein qeemti baseerat faraham karte hain aur taajiron ko mumkina tijarti mawaqay ki nishandahi karne mein madad kar satke hain. taham, kisi bhi takneeki tajzia ke alay ki terhan, tijarti hikmat amlyon mein girtay hue window patteren ko shaamil karte waqt deegar awamil par ghhor karna aur rissk managment ki munasib taknekoon ka istemaal karna zaroori hai . -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Window candlestick pattern: Forex me "window" candlestick pattern ko "Kachi" candlestick pattern bhi kaha jata hai. Ye pattern Japanese candlestick charts par based hai. Is pattern ko Roman Urdu me samjhane ke liye, main aapko isko "Khidki" candlestick pattern kehte hain. Khidki candlestick pattern hota hai jab do consecutive candlesticks ke beech me ek gap (khaali jagah) hoti hai. Ek candlestick ki closing price dusri candlestick ki opening price se different hoti hai aur iske beech me koi trading range (price range) nahi hoti hai. Ye pattern bullish ya bearish market conditions me appear ho sakta hai. Agar ye pattern bearish market me dikhe, to ise "bearish khidki candlestick pattern" kehte hain. Aur agar ye pattern bullish market me dikhe, to ise "bullish khidki candlestick pattern" kehte hain. Ye pattern traders ke liye important ho sakta hai, kyunki ye market ka potential reversal indicate kar sakta hai. Agar bullish khidki candlestick pattern downtrend ke baad dikhe, to yeh uptrend ka possibility indicate kar sakta hai. Wahi agar bearish khidki candlestick pattern uptrend ke baad dikhe, to yeh downtrend ka possibility indicate kar sakta hai. Mai aasha karta hu ki yeh information aapke liye helpful hogi. Agar aapko forex trading ya candlestick patterns ke bare me aur jankari chahiye, to aap pooch sakte hain. Identification: Forex mein "window candlestick pattern" ko "Khidki ki mombatti ke pattern" bhi kaha jata hai. Ye ek technical analysis tool hai jo Forex market mein price movement ko samjhne ke liye istemal kiya jata hai. Window candlestick pattern ko candlestick charts par dekha jata hai. Ye pattern tab banta hai jab ek candlestick ka opening price pehle candlestick ki high ya low se bahar ho, aur dusri candlestick ka closing price pehli candlestick ki high ya low se bahar ho. Isse ek khidki jaise gap ya window ban jata hai candlestick chart mein. Window candlestick pattern ki alag-alag variations ho sakti hain, jaise ki "Bullish window" aur "Bearish window". Bullish window tab banta hai jab gap ke upar ka candlestick upar ki trend ko continue karta hai aur bullish market signal deta hai. Bearish window tab banta hai jab gap ke niche ka candlestick niche ki trend ko continue karta hai aur bearish market signal deta hai. Window candlestick pattern ki tafsili tafseelat ke liye aapko candlestick charts aur technical analysis ki adhik jaankari honi chahiye. Isse aap price movement ko samajh sakte hain aur trading decisions ko lenge. Explanation: Forex mein "window candlestick pattern" ya "gap candlestick pattern" se murad hai jab ek candlestick chart mein kisi price level par koi gap ya khula hua jagah hoti hai. Yeh gap price level ke beech mein hone wale price movement ka ek important indicator hai. Window candlestick Yeh pattern traders ke liye market movement aur price direction ke samajhne mein madad karta hai. Jab market mein ek gap ya khula hua jagah dikhe, toh ye ek signal hai ke price mein sudden change ya volatility ho sakti hai. Is pattern ki alag-alag variations hoti hain, jaise ki "common window" jisme gap ke dono taraf ke candlesticks ka price range overlap karta hai, aur "breakaway window" jisme gap ke dono taraf ke candlesticks ka price range overlap nahi karta hai. Traders is pattern ko price trend ka continuation ya reversal samajhne ke liye istemal karte hain. Yeh window candlestick pattern dusre technical analysis tools ke saath combine karke aur market ki overall trend ko samajhne ke liye istemal hota hai. Is pattern ko samajhne ke liye aapko candlestick charting aur forex trading ki basic knowledge ki zaroorat hoti hai. -

#7 Collapse

Falling window candle pattern price pe aksar aik waqfay k daoran banta hai, ye pattern waqfay k doaran strength ka sabab banta hai, jiss ki waja se basics effect resources ki price ko teezi k sath down push karte hen, is pattern mein shamil candles ki development darjazzel tarah se hoti hai; First Candle: falling window candle pattern ki pehli candle aik negative candle hoti hai, jo k price k ordinary previous pattern ko prevent karti hai. ye candle white ya green meas ye k bullish hoti hai, jo k shadow ya shadow k bagher bhi ho sakti hai, lekin genuine body ka wazih hona zarori hai. Second Candle: falling window candle pattern ki dosri candle bhi same pehli candle k tarah negative hoti hai. lekin ye candle pehli candle k low price se neechay banti hai. dosri candle ka price pehli candle k low price se waazih potential complete hasil hona chaheye. ye candle bhi aik negative body mein honi chaheye, jo k shadow ya shadow k bagher bhi ho sakti hai. Clarification Of The Pattern price chart pe ye pattern hamesha resources ki bohut ziada high volitilety ki waja se banty hen. ye volitilety mostly aik khas waqfay k dooran price ki movement se hoti hai. falling window pattern mein negative pattern k dowran do negative candles k darmeyan descending side ape banta hai, jo k price k negative pattern confirmation ki alamat hoti hai. ye pattern 2 negative candles pe depended hota hai, jis mein pehli candle ki low price aur dosri candle k excessive price k darmeyan aik clear difference hota hai. ye pattern sellers ki market me mazboti aur price ka mazeed negative jane ka aik clear message hota hai. Trading Plan For Falling Window falling window candle pattern price k downtrend pe banta hai, aur iss design ki strong candles ki genuine body se pata chalta hai. solid genuine body wali candles price ko teezi k sath negative push karegi, jo k support se descending side pe hona chaheye. trade se pehle confirmation candle ka hona zarori hai, aur pattern lazmi support line k oper hona chaheye. confirmation candle, genuine body mein negative candle honi chaheye, bullish candle ban,nay ki sorat mein trading ka khatra mol nahi lena chaheye. ye pattern agar support level se nechay banta hai, to ye bullish pattern inversion bhi ho sakta hai, iss waja se design ka support point ki base pe hona chaheye. Stop Loss For Falling Window Pattern. stop loss ko chart k sab se upper position ya pehli candle k top price se two ya three pips neechy set karen.

- Mentions 0

-

سا0 like

-

#8 Collapse

What is Falling Window Candlestick Pattern:? Introductory Paragraph of Trading Strategy at Falling Window Candlestick Pattern: Explanation: sirr,, My dear sweet members,jesa keh ap janty hein keh,Trading mein kamyabi haasil karne ke liye, humein wazeh tafteesh aur tehqeeqat par tawajjo deni chahiye. Candlestick patterns, jaise ki Mudallal Jharokon Wali Mombatti (Falling Window Candlestick Pattern), tijarat mein madadgar tafteeshi tools hain. Is article mein hum Mudallal Jharokon Wali Mombatti pattern par tijarat ki aik achi straiteji par baat karenge.Falling Window Candlestick Pattern ek technical analysis tool hai jo share market mein istemal hota hai. Is pattern mein do consecutive candlesticks hote hain jin mein pehli candlestick ki closing price dusri candlestick ki opening price se oopar hoti hai. Iska natija hota hai ke ek "window" ya "gap" paida hota hai do candlesticks ke beech mein. Jab is pattern ko dekha jata hai, toh yeh ek bearish ya downtrend ke sign ki tarah samjha jata hai. Ab hum dekhte hain ke is pattern par kis tarah tijarat ki strategy tashkeel di ja sakti hai.Trading at falling Window Candlestick Pattern: sirr,, My dear members,Sab se pehle, aapko yaqeeni banane ke liye, falling window pattern ki tasdeeq karni hogi. Iske liye, aapko do consecutive candlesticks mein se dusri candlestick ki opening price ke neechay ki closing price par nazar rakhni hogi. Agar aap falling window pattern ko confirm kar lete hain, toh aap aage badh sakte hain.Phir jab aap falling window pattern ko tasdeeq kar lete hain, toh aap sell order lagane par soch sakte hain. Is order mein aap apne broker ko instrcuct karenge ke woh shares beche, ya short sell kare. Aap stop-loss order bhi lagayein, jisse aap apni nuqsaan ko kam rakh sakte hain agar market mein ghair

[/INDENT][/COLOR] Target Price. Apne sell order ke liye target price tay karne se pehle, aapko pata karna hoga ke market ka trend kya hai. Agar aap downtrend mein hain, toh aap apne target price ko niche rakh sakte hain. Yeh target price aapke trade ko band karne ke liye ho sakta hai. Time Frame. Falling window pattern par tijarat karte waqt, aapko bhi time frame tay karna hoga. Yeh aapke trading style aur market conditions par depend karega. Aap kuch ghante se lekar kuch dinon tak ka time frame tay kar sakte hain. Time frame ke andar aapko market ki halat aur share price ke liye jari rahna hogaDear tra ders Falling Window Candlestick Pattern Trading ke liye ek ahem tool hai. Is pattern par tijarat karne ke liye, falling window pattern ki tasdeeq karne ke baad sell order lagaya ja sakta hai. Apne trade ka target price aur time frame tay karne ke baad, aap apni tijarat ko samapt kar sakte hain. Tijarat mein mushkil aur asan waqt aate rehte hain, is liye market ki halat ko hamesha jari rakhna zaroori hai. Is straiteji ko samajhne aur istemal karne se pehle, aapko mukammal tafteesh aur salah mashwara hasil karna chahiye. Yeh straiteji sirf tafteeshi maqsad ke liye di gayi hai aur kisi bhi tijarat ki masroofiyat se pehle, aapko apne broker ya financial advisor se mashwara lena chahiye.

SALAM TO ALL MY FOREX MEMBERS..........,,,,,,,,,,,,,,

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Asslam-O-Alaikum! Dear members Me ummed kerti hoke ap sb ka forex trading py kam bht acha chl rha hoga. Aj jis topic py hum baat kre gy wo Neeche mention hy. TOPIC:Falling Window Candlestick Pattern falling window candle stick pattern aik bearish patteren hai jo mojooda rujhan ke tasalsul ka ishara deta hai. maghribi sarmaya kaari ke halqon mein usay gape down kaha jata hai. patteren is waqt bantaa hai jab doosri mom batii ki oonchai pichli mom batii se neechay ajati hai. jab qeemat is ko dobarah jhanchne ke liye barh jati hai to yeh khalaa aik ahem muzahmati satah banata hai . falling window candle stick pattern qeemat action tajzia ka tool hai jisay traders market mein mandi ke rujhanaat ki nishandahi karne ke liye istemaal karte hain. usay maghribi sarmaya kaari ke halqon mein aik gape down ke tor par barray pemanay par pehchana jata hai aur usay aik bearish tasalsul ka namona samjha jata hai. falling window patteren ban'nay ke liye, neechay ke rujhaan mein gape hona zaroori hai — aik gape jo up trained mein hota hai usay rising window patteren kaha jata hai . Explanation : Falling window candle stick pattern is waqt bantaa hai jab doosri mom batii ki oonchai pichli mom batii ki nichli satah se neechay aati hai, jis se dono mom btyon ke darmiyan khalaa ya khalaa peda hota hai. pehli aur doosri mom btyon ke darmiyan farq aik ahem muzahmati satah hai, kyunkay qeemat aksar is satah ko dobarah jhanchne ki koshish karti hai jab hoti hai. agar qeemat is muzahmat ko tornay ke qabil nahi hai, to yeh aik mazboot ishara hai ke mandi ka rujhan jari rahay ga. khalaa ka size aur mom btyon ki lambai bhi mandi ke rujhan ki taaqat ke baray mein izafi baseerat faraham kar sakti hai . aam tor par, falling window patteren mandi ke rujhan ka aik qabil aetmaad ishara hai, lekin tasdeeq ke liye usay deegar takneeki tajzia ke alaat ke sath mil kar istemaal kya jana chahiye. yeh note karna zaroori hai ke patteren bairooni awamil se mutasir ho sakta hai, jaisay muashi khabrain aur waqeat, jo market ke jazbaat ko mutasir kar satke hain aur qeematon mein utaar charhao ka sabab ban satke hain . falling window candle stick pattern aik bearish tasalsul ka patteren hai jo security ki qeemat mein mumkina kami ka ishara deta hai. yeh patteren neechay ke rujhaan mein do bearish candle stocks ke zariye aik gape se allag hota hai. yeh is waqt bearish trained : falling window patteren ko bearish trained mein hona chahiye warna yeh girty hui window nahi hogi . do lagataar mandi wali mom batian : neechay ke rujhaan mein do mutawatar bearish candle stocks honay chahiye, jo aik gape se allag hon gape : pehli aur doosri mom btyon ke darmiyan farq girnay wali window patteren ki aik ahem khasusiyat hai. yeh aik ahem muzahmati satah ke tor par kaam karta hai jab qeemat dobarah jhanchne ke liye is satah tak barh jati hai . mom batii ki lambai : mom btyon ki lambai mandi ke rujhan ki taaqat mein izafi baseerat faraham kar sakti hai. lambi mom batian aik mazboot rujhan ki nishandahi karti hain, jabkay choti mom batian kamzor rujhan ki nishandahi karti hain . tasdeeq : falling window patteren ko tasdeeq ke liye deegar takneeki tajzia tools ke sath mil kar istemaal kya jana chahiye. misaal ke tor par, aik moving average indicator ko down trained ki tasdeeq ke liye istemaal kya ja sakta hai. is ke ilawa, patteren ki tasdeeq ki ja sakti hai agar qeemat khalaa tak barh jaye aur khalaa se ban'nay wali muzahmati satah ko tornay mein nakaam ho jaye . falling window candle stick pattern aik bearish tasalsul ka patteren hai jo is waqt hota hai jab doosri candle ki oonchai pichli mom batii ke nichale hissay se kam hoti hai, jis se aik khalaa peda hota hai. yeh patteren astaks aur down trained mein forms mein kaafi aam hai, jahan yeh rujhan ke tasalsul ka ishara deta hai. tajir mukhtasir position mein daakhil hotay nazar aa satke hain. amal mein girnay wali window patteren ki chand amli misalein yeh hain oopar walay chart mein, aap falling window candle stick patteren ko dekh satke hain jo ke ibtidayi had tak mehdood harkat ke baad qeemat mein musalsal kami ka rujhan shuru honay ke baad bantaa hai. falling window candle stick patteren aik bearish pan baar ke sath shuru sun-hwa jis ke baad gape down hota hai, jis ke baad aik bohat barri bearish marobozu candle stick aati hai. patteren ke baad, qeemat barh gayi aur farq mein tijarat hui lekin usay mustard kar diya gaya. agli candle stuck ke shuru mein farokht ka order dainay se bohat ziyada munafe haasil hota kyunkay qeemat musalsal girty rahi. is soorat mein, 2 / 1 inaam / khatray ka tanasub munasib ho sakta hai . -

#10 Collapse

Falling Window Candlestick Pattern : Falling Window candlestick pattern, jo ke Forex trading mein istemal hota hai, ek technical analysis pattern hai jo price movement ko indicate karta hai. Yeh pattern typically bearish (neechay ki taraf) price movement ke liye ek signal hai. Ab hum is pattern ko Forex trading context mein detail mein samjhte hain.Falling Window candlestick pattern, Forex trading mein istemal hone wala ek technical analysis pattern hai. Is pattern mein price ka significant gap hota hai, jahan par ek session ki closing price aur agle session ki opening price ke beech mein ek khidki jaise gap hota hai. Yeh gap neechay ki taraf ki price movement ko darshata hai.Falling Window pattern bearish trend ka indication deta hai, jahan par price ka next session mein neechay ki taraf ka movement hota hai. Yeh pattern bearish trend ka continuation ya reversal signal bhi ho sakta hai. Important Points: Is pattern ko interpret karne ke liye, hum kuch important points consider karte hain: 1. Gap size : Gap ka size kafi mayne rakhta hai. Agar gap bahut bada hai, toh yeh bearish pressure aur selling sentiment ko highlight karta hai. Smaller gaps bhi bearish signal hote hain, lekin unka impact kam hota hai. 2. Volume (Volume): Falling Window pattern ke sath high volume ka combination bearish trend ke liye strong signal hai. Agar gap ke saath high volume ki bhi confirmation hai, toh yeh bearish trend ko validate karta hai. Trading Strategy : 1-Pattern ki identification: Pehle step mein aapko Falling Window pattern ko identify karna hai. Iske liye aap candlestick charts ka istemal kar sakte hain. Jab aap Falling Window pattern detect karte hain, tab aapko bearish price movement ki expectation honi chahiye. 2. Confirmatory signals ki talaash karein: Falling Window pattern ko validate karne ke liye, aapko confirmatory signals dhoondhne honge. Aap dusre candlestick patterns, technical indicators, ya price levels ka istemal kar sakte hain. Jaise ki, price ke neeche ki taraf ki breakout, bearish reversal patterns, ya moving averages ke cross-over. 3. Sell position open karein: Falling Window pattern ke sath, aap sell positions open kar sakte hain. Yeh short-selling ka ek example hai, jahan par aap asset ko sell karke future mein usko buy karne ka expectation rakhte hain. Aap apne broker ke platform par sell order place kar sakte hain. 4. Stop loss aur target levels set karein: Apni trading strategy mein stop loss aur target levels ko set karna bahut zaruri hai. Stop loss aapki trade ko protect karta hai agar price unexpected movement karta hai. Target levels aapko exit point provide karte hain, jahan par aap profit book kar sakte hain. Stop loss aur target levels ko aap apne risk appetite aur trading plan ke hisab se set karein. 5. Risk management ka dhyaan rakhein: Har trading strategy mein risk management ka dhyaan rakhna zaruri hai. Aapko apni trading capital ko protect karne ke liye risk per trade ko manage karna hoga. Risk per trade ka percentage aap apne comfort level ke hisab se decide kar sakte hain. Aapko apne trading plan mein risk management rules shamil karna chahiye. 6. Trade ko monitor karein: Jab aap trade enter kar lete hain, tab aapko apne trade ko monitor karna zaruri hai. Price movement ko closely observe karein aur market conditions ke changes par dhyaan dein. Agar required, toh stop loss aur target levels ko adjust karein. 7. Trade ko exit karein: Jab price aapke target levels tak pahunch jaye ya phir market conditions aapki trade ke against ho jaye, tab aapko trade ko exit karna hoga. Aap profit book kar sakte hain ya phir stop loss trigger hone par trade ko close kar sakte hain. Yeh trading strategy Falling Window candlestick pattern ke saath kaam karne ke liye hai. Hamesha dhyan dein ke har trade mein risk management aur apna trading plan follow karna bahut zaruri hai. Aapko apne trading skills ko improve karne ke liye practice aur experience ki zarurat hogi. Conclusion : Falling Window pattern ke samay, Forex traders ko caution ki zarurat hoti hai. Yeh pattern short-term aur long-term traders ke liye important ho sakta hai, kyunki isse future price movement ka idea milta hai.Is pattern ke sath, traders sell positions open kar sakte hain ya existing short positions ko hold kar sakte hain. Stop loss aur target price levels ko set karne ke liye, dusre technical analysis tools ka istemal karna bhi zaruri hota hai.Overall, Falling Window candlestick pattern bearish trend ke continuation ya reversal ka indication deta hai. Is pattern ke through, Forex traders ko market sentiment aur price movement ke bare mein valuable information mil sakti hai, jisse unka trading decision-making process improve ho sakta hai. -

#11 Collapse

Assalamualaikum! Umeed hai k ap sb khariyat sy hongy. R apky trading sessions achy jaa rhy hongy. Aj ka hmra discussion topic "Falling window candle stick pattern". Dekhty hain k ye hmein Kya information deta hai r hmry ilam Mai Kesy ezafa krta hai. Falling window Girty hui window ko bearish tasalsul ke patteren ke tor par darja bandi kya gaya hai. dono patteren ki linen koi bhi bunyadi mom batian ho sakti hain, ya to lambi ya choti line ke tor par zahir hoti hain. wahid istasna for price doji hai, jo patteren ke hissay ke tor par zahir nahi ho sakta. patteren ki khasusiyat pehli mom batii ki kam aur doosri mom batii ki onche ke darmiyan zahir honay walay qeemat ke farq se hoti hai. windows ko maghribi takneeki tajzia mein jana jata hai aur usay aksar gaps kaha jata hai. japani khirkion ke baray mein bohat khaas hain aur yeh daawa karte hain ke yeh rujhan is waqt tak jari rahay ga jab tak khalaa ko band nahi kya jata. Shemazu ne zikar kya ke Japan mein woh khalaa ko sorakh bhi kehte hain. mors ne khirkion ko aisay namonon ke tor par nahi dekha jo bzahir ajeeb lagtay hain. yani woh kking up / kking davn, two candle shooting star / inverted hathora ya deegar namonon ke sath aisa nahi kar raha hai, jahan qeemat mein farq bhi zaroori hai. candlescanner mein hum windows ko patteren samajte hain. nison aur bulkowski window ko patteren ke tor par bhi talaash karte hain, lekin yaad rakhen ke bulkowski ki tashreeh hamaray liye kuch mukhtalif hai ( mazeed tafseelaat ke liye rising window dekhen ). nisn ne zikar kya hai ke khirkiyan mom batii ke sab se ahem namonon mein se hain. hamari tashreeh mein, girty hui khirki ke liye, yeh kaafi hai ke pehli mom batii ki band honay wali qeemat trained line ke neechay waqay hai, jabkay khilnay ki qeemat oopar rakhi ja sakti hai. yeh mafrooza ke girnay wali khirki ke patteren ko down trained mein chand mom btyon ki zaroorat hoti hai, is ke runuma honay se pehlay, bohat ahem signals ko khonay ka baais ban sakta hai. patteren ki doosri mom batii par khaas tawajah di jani chahiye, jo ke dosray, mutazaad patteren ka hissa ho sakti hai, yani aik taizi ka namona. aisay ghair wazeh halaat mein, tawajah market ke majmoi tanazur aur muzahmat / support linon par markooz honi chahiye . Explanation Girty hui khirki ka patteren do barray hisson se bana hai aur har hissay ka aik makhsoos maienay hai. do bearish candlesticks neechay ka farq qeemat parh kar, aap candle stuck chart ke peechay pesha war taajiron ki sargarmi ko jaan saken ge. bearish candle stick ka matlab hai ke aik din ki qeemat din ki ibtidayi qeemat se neechay band ho gayi hai. seedhay saaday tor par, yeh is baat ki numaindagi karta hai ke baichnay walay market ko control kar rahay thay aur woh kharidaron ki quwatoon par qaboo pa kar qeemat ko neechay laatay hain. qeemat ke chart par aik neechay ka farq is waqt bantaa hai jab farokht ke orders ki aik barri tadaad ko aik sath pur kya jaye ga. is se qeematon ki naqal o harkat mein taizi aaye gi aur chart par aik khalaa peda ho jaye ga. jab do bearish candlesticks aur neechay ka farq is baat ki numaindagi kere ga ke baichnay walay market ko control kar rahay hain, to aap ko samjhna chahiye ke market mein farokht knndgan ke zabardast dabao ki wajah se market neechay ki taraf jaye gi. kyunkay teen sangam mil kar girty hui window candle stuck patteren banatay hain taakay mandi ke rujhan ke tasalsul ki passion goi ki ja sakay . How to trade with falling window girty hui khirki mein neechay ka farq qeemat ke liye muzahmati zone ke tor par bhi kaam kere ga. kyunkay is zone mein saylng orders ki aik barri miqdaar qeemat ko is waqt tak neechay rakhay gi jab tak ke tamam saylng orders nahi bharay jayen ge. girtay hue window patteren ke baad, ya to qeemat neechay ki taraf barhti rahay gi ya yeh kuch saylng orders ko pur karne ke liye gape zone ki taraf aik mamooli pal back day gi. lehaza window ke girtay hue patteren ki tijarat ke do tareeqay hain. ya to aap is candle stuck ki tashkeel ke foran baad farokht ke order khol satke hain ya aap is waqt tak intzaar kar satke hain jab tak ke qeemat gape zone ki taraf pal back nahi deti. baad mein aik aala rissk reward trade set up day ga . -

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Falling Window Candle Example: Forex market mein punch Major areas of strength for bh carte bird, plan candles, darjazel tarah se hoti ji gii Taur, kam kar sakti hai Kyunki Jaise hiya kimaten Pichhle Tak pahunchi Jaati Hai yah do chijen focus Aise Ek kam Karega Wapas Achcha Lana help boundary explanation se kiya kimat Ke Sita ke khilaf Vardi Karen aap apni peshgashi SIM and maja dega Jari Rahega press tak ke liye agale guide yaudham se Sita na pahunche Kuchh tijaraton ka Waqt Marne hai kya Nahin tutenge Chahe kimat ruk di.Falling. window light arrangement ki pehli light aik horrendous oven hoti hai no expense alright broad example plan ki akasi karti hai. Mother is white or has no experience blending center hoti hai.. Distinguishing proof and its functioning in market Hm is ko distinguish is taqeeeqe se kr skty hain ye design extremmly fall hona suru ho jaata he brokers are vital to the standard activity sy iss boss kam karye tabhi mutter em basic execution pah sakta hain or pay me sakta hain apni exchange number one. Backing and obstruction forex exchanging is the greatest bhot, it brirm hai jo k specialized investigation k tahat use hota hai Turn Point ka matlab hota hai defining moment ya hub point Yeh dealers ke liye aik significant apparatus hai jo k pattern inversion or market course k bary mein pata lgany principal help karta hai Turn Point aik numerical recipe hota hai jo k earlier day ka high low or shutting cost k pinnacle standard ascertain kiya jaata hai is equation sy Turn Point k sath kuch or backing or opposition levels b work out kiye jaty hain jo ki brokers ko section or leave focuses ke liye guide karty hain Turn Point kags me benefit in the wali market huge volume exact work benefits bhot ya achi benefit installment sakta hain or execution pah sakta hain humein chahiye alright murmur awesome test square apna great profession experience thk mutter top of the line sakiya or achi monetary help laa sakiya hain Beneficials for merchants or not Yeh market principal use hony wala aik famous idea hai es ka matlab hota hai ya point of revolution Turn Point aik aisa level hota hai jahan brokers or financial backers market pattern k heading ko foresee karty hain es ko ascertain krny liye earlier day ka high low or close costs ka use kiya jata hai Is k alawa turn point k around or us k agy k help or opposition levels work out kiye jaty hain Agar koi stock cost turn point level ko cross kar leti hsy Wapis Turn point ki taraf murti ha. Agar cost phle opposition su Wapis na more per ke obstruction ko cross krain to isy Breakout Kehty hain. stomach muscle ziada chances hote hain ki cost dusre opposition Se wpis mur gaye ge. Agar per Rai se dusri obstruction ko bhi cross Karti Hai To dealer ummid Karte Hain Ki cost 3sri register Se Wapas Mod Jayegi Agar prize downtrend mein ho to cost pahle sports ki taraf Jayegi yahan se turn point ki taraf Wapas badhegi Agar pahle sports Ko Karar Karke Masjid specialty ko Jaati Hai To dusri sports ki taraf gaye gi a turn focuses opposition or supports rozana new or different sote Hain simulated intelligence to ye aik solid sign hai k stock cost pattern change karny ja rahi hai Isliye merchants or financial backers turn point ka use kar k stock cost development ka expectation ka kaam krta he -

#13 Collapse

"Falling Window Candlestick Pattern"- Falling Window Candlestick Pattern:

- Characteristics of Falling Window Candlestick Pattern:

- Upar Khula: Falling Window Pattern mein bearish candlestick ek se pehle bullish candlestick ke closing price se neeche open hota hai, jis se ek gap create hota hai. Is gap ke wajah se yeh pattern "falling window" ke naam se jaana jata hai.

- Bearish Candlestick: Girte Hue Khidki Candlestick Pattern mein bearish candlestick hota hai, jo downtrend aur selling pressure ko darshata hai. Is candlestick mein sellers ka control hota hai.

- Price Gap: Falling Window Pattern mein gap ki maujoodgi bearish momentum ko darshati hai. Yeh gap bullish candlestick ke closing price aur bearish candlestick ke opening price ke beech ki khali jagah hoti hai.

- Importance of Falling Window Candlestick Pattern:

- Bearish Trend ka Signal: Falling Window Pattern bearish trend aur price decline ke signal ko darshata hai. Yeh pattern market mein selling pressure aur bearish momentum ki sambhavna ko highlight karta hai.

- Selling Opportunities: Falling Window Pattern traders ke liye selling opportunities faraham karta hai. Jab yeh pattern ban jata hai, traders positions ko exit karne ya short sell karne ke liye taiyar ho sakte hain.

- Trend Confirmation: Falling Window Pattern bearish trend ki tasdeek karta hai. Is pattern ki maujoodgi mein traders bearish trend ke saath trade kar sakte hain aur downtrend ke signals ko samajh sakte hain.

- Entry aur Exit Points: Falling Window Pattern entry aur exit points tayyar karne mein madad karta hai. Traders yeh pattern istemal karke positions enter ya exit kar sakte hain.

Note: Candlestick patterns ke istemal se pehle, traders ko dusre technical analysis tools aur indicators ke saath confirmatory signals ka istemal karna chahiye aur proper risk management ka dhyan rakhna chahiye. Iske alawa, yeh bhi samajhna zaroori hai ke market mein ek pattern par bharosa karne se pehle overall market conditions ko bhi samajhna zaroori hai.

Note: Candlestick patterns ke istemal se pehle, traders ko dusre technical analysis tools aur indicators ke saath confirmatory signals ka istemal karna chahiye aur proper risk management ka dhyan rakhna chahiye. Iske alawa, yeh bhi samajhna zaroori hai ke market mein ek pattern par bharosa karne se pehle overall market conditions ko bhi samajhna zaroori hai.- Conclusion:

-

#14 Collapse

nchlay drjay kay nechay chlte hay tahm as mqam pr khredaron kay zreah fore tor pr aoncha saf krdea jata hay۔dregn flae'e kay bad، lagt sath oalay shalay pr zeadh hote rhte hay، as bat ke tsdeq krtay hoe'ay kh lagt mmknh fae'dh ke trf oaps jarhe hay۔ delrz asbat kay shalay kay doran ya zeadh der bad khredare kren gay۔ aek stap bdqsmte dregn flae'e kay nchlay hsay kadregn flae'e dojez anthae'e dlchsp hen، as bnead pr kh yh khlay، aonchay aor qreb sb kay leay aek jesa hona gher mamole hay۔ an tenon akhrajat kay drmean aam tor pr mamole tfaot hay۔ nechay ka madl aek dregn flae'e doje dkhata hay jo zeadh tosea shdh trm aptrn kay andr zmne alaj kay doran hoa tha۔ dregn flae'e doje ne'ay y nechay rkhe ja skte hay۔madl as moafqt ko zahr krta hay jo mom btean dete hen۔ dregn flae'e men zbrdste aanay say lagt km nhen ho rhe the، tahm lagt asl men gr ge'e the aor as kay bad asay zeadh pechhay dhkel dea gea tha، as bat ke tsdeq krtay hoe'ay kh lagt shaed zeadh honay oale the۔ amome trteb men jhanktay hoe'ay، dregn flae'e dezae'n aor asbat ke roshne nay jhnda lgaea kh lmhh bh lmhh nzrsane khtm ho ge'e hay aor azafh jare hayFalling Window Candlestick Pattern: ear t hipu aik he wiai i hain jb ye fall hote he tu ye aisa maloom hopta he jaise market ke andr kam kar sakti hai Kyunki Jaise hiya kimaten Pichhle Tak pahunchi Jaati Hai yah do chijen center Aise Ek kam Karega Wapas Achcha Lana help barrier statement se kiya kimat Ke Sita ke khilaf Vardi Karen aap apni peshgasho teezi k sath itish karte kok, central shamil wax planning plan tarah se hoti hai increase the scope of foundation hon chaheye. O kamin bhi aik horrible lock frame honi jaheye. ha k kalangang or kalangang good bagher bhi ho sakti hai. The diagram of the plan is always the source, the top of the door is steel and chicken bante. You know the booth is a great place to spend time. Lowered the window lamp polah ki pehli hipu aik janjakal hawu hoti hai yes popular lesson plan pay ki akasi karti hai. White fireplace or inexperienced mixing is important hoti hai, really good shade or good shade bagher bhindow goes down if the contents are soft, if you are downtrend ko show karti hai. Aur mein ik aval hota hais jis se downtrend ka aouz lagaya jata haye. ka cause banta hai. jiss ki waja see reduce the part of asarat assets ki harga ko teezi k sath itish karte kok, central shamil wax planning plan tarah se hoti hai increase the scope of foundation hon chaheye. O kamin bhi aik horrible lock frame honi jaheye. ha k kalangang or kalangang good bagher bhi ho sakti hai. The diagram of the plan is always the source, the top of the door is steel and chicken bante. You know the booth is a great place to spend time. Lowered the window lamp polah ki pehli hawu hoti hai yes popular lesson plan pay ki akasi karti hai. White fireplace or inexperienced mixing is important hoti hai, really good shade or good shade bagher bhi ho sakti hai, but really ram ka wazih hona zarori hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

eechay ki taraf rujhan ( mandi ka jhanda ) ho saktay hain. jhanday ka nichala hissa flag pol ke wast point se ziyada nahi hona chahiye jo is se pehlay tha. parcham ke namonon mein paanch ahem khususiyaat hain : Sabiqa ​​channel hajam patteren aik break out aik tasdeeq jahan qeemat break out ki simt mein muntaqil hoti hai. taizi aur mandi ke patteren mein aik jaisay dhanchay hotay hain lekin rujhan ki simt aur hajam ke patteren mein theek theek farq hotay hain. taizi ke hajam ka patteren pichlle rujhan mein barhta hai aur mein kami waqay hoti hai. is ke bar aks, bearish sy volume patteren pehlay barhta hai aur phir satah koi to barqarar rakhta hai kyunkay waqt ke sath sath bearish rujhanaat hajam mein izafah karte hain. aik jhanday ke patteren ko bhi matawazi marathon ke zariye akhatta kia kikarne karne ke ilaqay mein numaya kya jata hai. agar linen aapas mein mil jati hain to patteren ko wage ya to patteren kFalling Window Candlestick Pattern: Jab flag pattern market cha mein, qeemat ka amal sy ibtidayi rujhan ke douran barhta hai aur phir area ke zariye ghatt jata hai. ho sakta hai ke break out mein hamesha ziyada hajam mein izafah nah ho, lekin tajzia car aur tajir usay dekhnay ko tarjeeh dete hain kyunkay is ka matlab yeh hai ke sarmaya car aur deegar tajir josh ki aik nai lehar mein stock mein daakhil hue hain. istehkaam ke douran. is ki wajah yeh hai ke qeematon mein mandi, neechay ki to taraf rujhan aam tor par sarmaya karon ke khauf aur girty hui qeematon par tashweesh ki wajah se hota hai. 3rd sy mazeed qeematein gireen gi, baqi sarmaya karon krt par dikhai deta hai, to iska matlab hai ke market mein price consolidation ho rahi hai aur traders temporary pause kar rahe hain. Flag pattern ki tabeer hai ke market mein existing trend ko confirm kiya ja sakta hai aur price phir se usi direction mein move kar sakti hai. Agar trend upar ki taraf hai, to flagpole upar ki taraf point kar raha hota hai aur flag sideways move karti hai. Agar trend neeche ki taraf hai, to flagpole neeche ki taraf point kar raha hota hai aur flag phir se sideways move karti hai.Flag pattern ke breakout ke baad, price usually trend continuation ke saath move karti hai. Traders is breakout ka istemal karke entry aur exit points tay kar sakte hain. Breakout ke baad price ka target flagpole ki length ke according tay kiya ja sakta hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 05:21 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим