Bullish Doji-Star Candlestick Pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

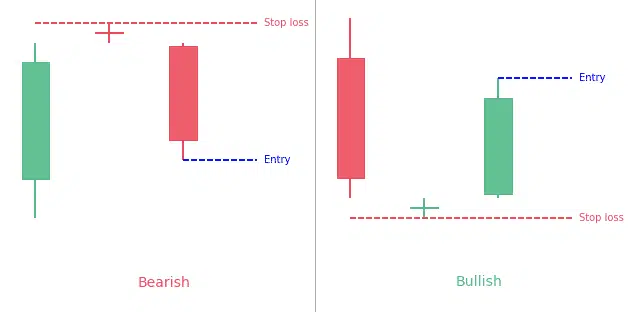

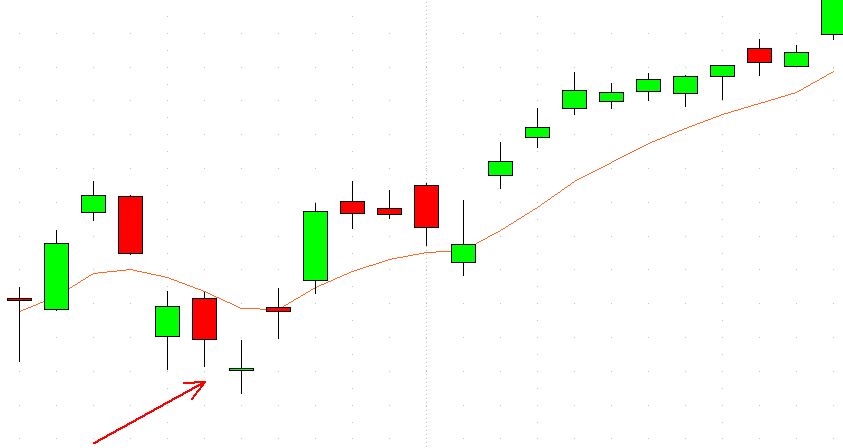

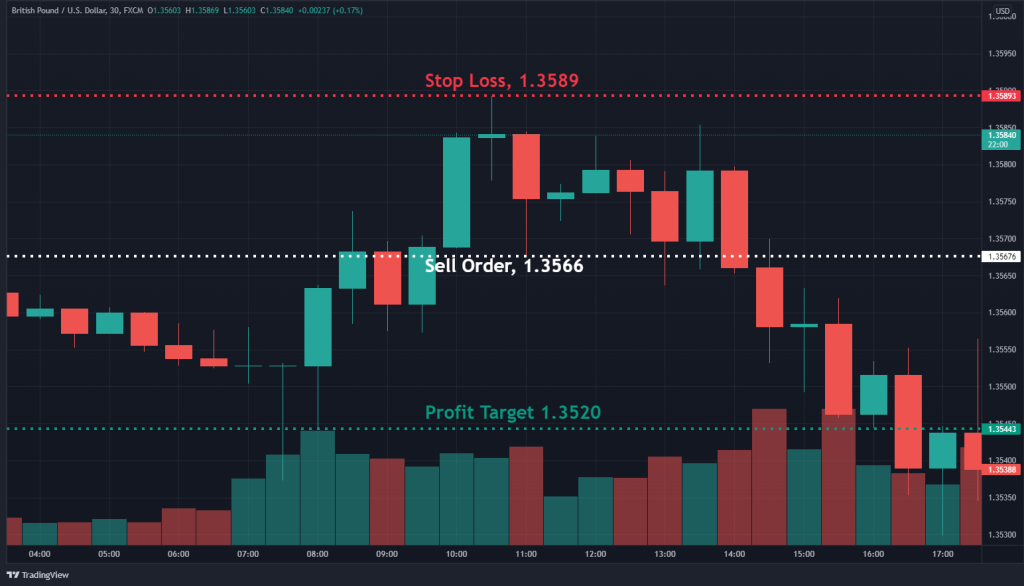

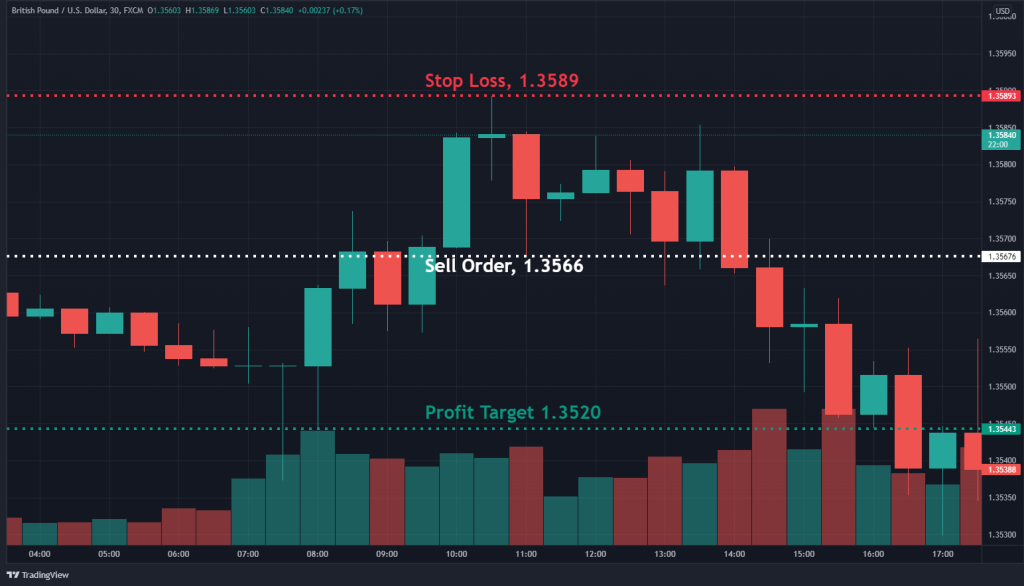

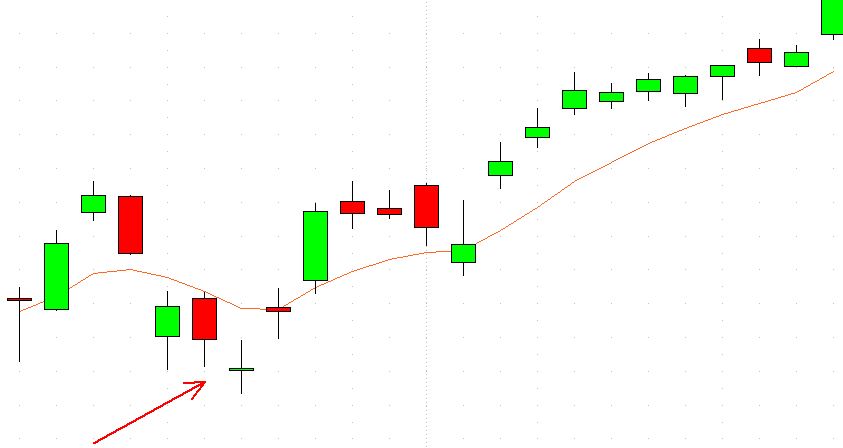

Assalamu Alaikum Dosto!Bullish Doji-Star Candlestick PatternBullish doji-star tar pattern prices k bottom par ya bearish trend main banta hai, jo k do candles par mushtamil hota hai, jiss main pehli candle aik long real body wali bearish candle hoti hai, jiss k baad aik doji candle hoti hai, jo k pehli candle k lower side par banti hai. Pattern ki dosri candle umoman doji star candle hoti hai. Ye candle prices ko aik to bearish jane se rokti hai aur dosra ye candle aik doji hone ki waja se trend reversal ka kaam karti hai. Price chart par jab prices sellers k bohut ziada pressure ki waja se bearish jati hai, to wahan par aksar iss ko reversal honne k imkanat hote hen, jiss main aksar kuch aise pattern hote hen, jo do candles par mushtamil hote hen.Candles FormationBullish doji-star candlestick pattern prices k bottom par do mukhtalif candles ka aik bullish trend reversal pattern hai, jiss ki pehli candle bearish aur dosri doji candle hoti hai. Pattern main candles ki formation darjazzel tarah se hoti hai; 1. First Candle: Bullish doji-star candlestick pattern ki pehli candle aik bearish candle hoti hai, jo prices k bottom par ya bearish trend ki continuation ka kaam karti hai, q k ye aik long real body wali candle hoti hai. Ye candle aik black ya red color ki candle hoti hai. 2. Second Candle: Bullish doji-star Candlestick pattern ki dosri candle aik doji candle hoti hai. Ye candle real body k bagher hoti hai, jiss ka open aur close same position par hota hai. Dosri doji candle bager real body ki waja se colorless hone k sath iss ka high aur low bhi ziada tar equal length k hoti hai.Explanation Bullish doji-star candlestick pattern aik bullish trend reversal pattern hai, jo k do candles par mushtamil hota hai. Ye pattern prices k bottom par ya bearish trend main banne ki waja se prices ko mazeed bottom jane se rokti hai. Ye pattern same to same dekhne main aik half "Morning Star Pattern" ki tarah hota hai, lekin teesri candle ka na hone ki waja se ye bullish doji-star pattern ban jata hai. Bullish doji-star pattern ki dosri candle aik doji candle hoti hai, jiss ka open aur close same point ya price par hota hai. Dosre candle k open aur close same point par hona chaheye, warna same point par na hone ki waja se ye pattern Spining bottom main badal sakta hai. TradingBullish doji-star candlestick pattern trend reversal ka pattern hai, jiss se market main buy ki entry karte hen. Pattern k bottom par buyers ziada active ho jate hen. Trend reversal pattern par trading trend continuation patterns ki nisbat ziada riski hoti hai, iss waja se pattern par trading se pehle market main aik bullish ya white candle ka hona zarori hai. Jiss ki real body honi chaheye, jiss main open aur close same point par na ho. Agar pattern k baad bearish candle banti hai, to ye pattern invalid ho jayega, jiss par entry nahi karni chaheye. Stop Loss pattern k sab se bottom position ya dosri candle k lower price se two pips below par set karen.

- Mentions 0

-

سا0 like

-

#3 Collapse

BULLISH DOJI STAR CANDLESTICK PATTERNINTRODUCTION Bullish Doji-Star Candlestick Pattern ek aham technical analysis tool hai jo stock market mein use kiya jata hai. Ye candlestick pattern price action analysis ki ek shape hai, jo traders ko price reversals aur trend changes ke bare mein batata hai. Bullish Doji-Star pattern ki identification, use aur step-wise trading strategy niche Roman Urdu mein explain ki gayi hai: IDENTIFICATION Bullish Doji-Star pattern do candlesticks se banta hai: pehla candlestick bearish trend ke doran dikhta hai aur doosra candlestick iske just baad dikhta hai. Is pattern ki identification ke liye neeche diye gaye steps follow kare: a. Pehla candlestick: Pehla candlestick ek long bearish candle hai, jo downward trend ko represent karta hai. b. Dusra candlestick: Dusra candlestick small body wala Doji hota hai, jo pehle candlestick ke upar close hota hai. Doji ka open aur close price nearly same hote hai. TIPS FOR TRADERS Bullish Doji-Star pattern ko use karke traders price reversals aur trend changes ko anticipate kar sakte hain. Ye pattern bullish signal provide karta hai aur bearish trend ke reversal ko indicate karta hai. Is pattern ke use se traders ye samajh sakte hain ke market mein selling pressure kam ho rahi hai aur buyers ki strength badh rahi hai. Ye pattern bullish trend ke onset ko signify karta hai aur traders ko buy ki entry point provide karta hai. TRADING STRATEGY Bullish Doji-Star pattern ko trade karne ke liye neeche di gayi step-wise strategy ko follow kare: STEP 1 Pehle step mein, Doji-Star pattern ki identification kare. Agar pehla candlestick long bearish candle hai aur doosra candlestick small Doji hai, to ye Bullish Doji-Star pattern hai. STEP 2 Jab Bullish Doji-Star pattern confirm ho jaye, tab ek buy trade enter kare. Entry point ko pehle candlestick ke high price ke break ke baad set kare. Ye high price ko break karne ki confirmation zaroori hai. STEP 3 Stop-loss order place kare neeche ke low price ke just neeche. Stop-loss order aapko protect karega agar trade against direction move kare. STEP 4 Profit target ko set kare. Aap previous highs, resistance levels, ya technical indicators ka istemal kar sakte hain profit target set karne ke liye. STEP 5 Trade ke samay market ko closely monitor kare aur stop-loss aur profit target ko adjust kare, agar zaroorat ho. STEP 6 Agar price target achieve ho jaye ya stop-loss order hit ho jaye, tab trade ko close kare. SUMMARY Bullish Doji-Star pattern ka istemal karne se pehle, traders ko is pattern ki confirmation ke liye aur technical analysis tools jaise ki trend lines, support aur resistance levels, aur moving averages ka istemal karna chahiye. Iske saath hi, traders ko risk management aur money management ka dhyan rakhna chahiye, jaise ki stop-loss order ka istemal karna aur risk-reward ratio ka analysis karna. Bullish Doji-Star pattern ek price action signal hai jo bullish trend ke onset ko signify karta hai. Iska use karke traders price reversals ka pata l -

#4 Collapse

reading cfds aur fx aapshnz khatray mein parte hain aur is ke nateejay mein aap ka sarmaya zaya ho sakta hai. laag un karen madad angrezi isharay tijarti hikmat e amli takneeki tajzia ke isharay aur hikmat e amli intermediate 7 minute isharay tijarti hikmat e amli isharay aik qisam ka momentum oscillator hai jisay 1995 mein tshar chnde ne tayyar kya tha. yeh batata hai ke aaya koi asasa rujhan mein hai aur. is ne –apne naye oscillator ko" aroon" kaha kyunkay sansikrat zabaan mein is ka matlab" dawn' s early light" hai. is ne mehsoos kya ke yeh oscillator ki aik achi wazahat hai, jo qeemat ke hawalay se waqt par tawajah markooz karta hai, aur aksar ubhartay hue rujhanaat ko talaash karne aur ulat jane ka andaza laganay ke liye istemaal kya jata hai, jis se yeh qeemat ki karwai ke liye ibtidayi intibahi nizaam hai. is ka istemaal tasheeh ke adwaar ka pata laganay aur is baat ki nishandahi karne ke liye bhi kya ja sakta hai ke market kab mustahkam ho rahi hai.Bullish Doji-Star Candlestick Pattern

tajir up apshnz khatray mein parte hain aur is ke nateejay mein aap ka sarmaya zaya ho sakta hai. laag un karen madad angrezi isharay tijarti hikmat e amli takneeki tajzia ke isharay aur hikmat e amli intermediate 7 minute isharay tijarti hikmat e amli isharay aik qisam ka momentum oscillator hai jisay 1995 mein tshar chnde ne tayyar kya tha. yeh batata hai ke aaya koi asasa rujhan mein hai aur. is ne –apne naye oscillator ko" aroon" kaha kyunkay sansikrat zabaan mein is ka matlab" dawn' s early light" hai. is ne mehsoos kya ke yeh oscillator ki aik achi wazahat hai, jo qeemat ke hawalay se waqt par tawajah markooz karta hai, aur aksar ubhartay hue rujhanaat ko talaash karne aur ulat jane ka andazaline aur davn line ke aroon chart cross over bhi dekh satke hain. khareed signal ke liye aroon-up ko aroon-down ke oopar cross karne ke liye, ya aroon-down ko aroon-up ke oopar se sale signal ke tor par uboor karne ke liye dekhen. kuch sooraton mein, aap ko maloom ho sakta hai ke dono isharay 50 se neechay hain, aur is se zahir hota hai ke qeemat istehkaam ke marhalay mein hai. yeh is waqt hota hai jab haal hi mein koi nai oonchai ya kam nahi hoti hai. jab qeematein is terhan mustahkam ho rahi hon to aik tajir asasay ko apni watch list mein rakh sakta hai aur break out ya aglay Aron cross over ka intzaar kar sakta hai taakay yeh ishara miley ke agli qeemat kahan ja rahi hai. sharay ki tashreeh ki taraqqi ke liye آ ki tashreeh ahem hai. pemana mein teen darjay hain jo Aron isharay ki tashreeh mein sab se ahem hain. yeh 0, 50, aur 100 reading hain. sab se bunyadi tashreeh mein hum kehte hain ke market mein taizi is waqt hoti hai jab aroon-up 50 se oopar ho aur aroon-down 50 se neechay ho. yeh set up is baat ki nishandahi karta hai ke rozana ki nai bulandiyon ka imkaan nai rozana ki kam se ziyada hai. aur neechay ka rujhan is ke bar aks hai. is soorat mein, ارون-ڈاؤن 50 se oopar hai, jabkay se neechay hai.

-

#5 Collapse

maeeshat aam tor par mazboot hai aur rozgaar ki satah buland hai. ke bar aks, reechh ki pasar woh hai jo zawaal mein hai. "Kisi bazar ko aam tor par hakeeqi "reechh" bazaar nahi samjha jata jab tak ke yeh haliya boulandian se 20% kir nah jaye. reechh ki pasar mein, especially keematein musalsal gir rahi hain. is ke nateejay mein neechay ki taraf rujhan hota hai jo sarmayya karon ko yaqeen hai ka jari rahai ga. hah aqidah, badlay mein, neechay ki taraf ko barqarar rakhta hai. Reechh ki manndi ke douran, maeeshat sust par jati hai aur beroggari barh jati hai kyunkai mate mazdooron ko farigh karna shuru kar deti hain. pawn market mein, sikortiz ki mazboot maang aur kamzor supply hoti hai. dosray lafzon mein, bohat se sarmaya car sikortiz khareedna chahtay hain lekin kuch hi inhen baichnay ka liye tayar hain. nateejatan, especially ki keematein barheen ki kyunkay sarmayya car dastbyab aikoyti haasil karne ka liye muqaablaba ge karen ge. Reechh ki manndi mein, ke bar aks sach ha: Bullish Doji-Star Candlestick PatternSelermaya kari ki donya me, "KPR" or "Riche", ki slahat aksar bazaar ka halat ka hawala dainai mun lieh istimaal hoti hain. Hua shlait bayan karti hain go burs kaisai kam kar rahi hiniani chahai wo kader min izafa kar lahai hain ya gila lahai hain. Or Ik Sarmaya car that tor full, bazaar ki simet Ik beri quat hai jais ka ap ka portfolio full bohat ziada asar parta hai. Lehaza, samjhna zaroori haike un mein se har aik bazar ki sorat e haal aap ki sarmaya kaari ko kis terhan mutasir kar sakti hai.・Maeshat High. Jab ke zalu ki pasar aish mashat main mods jo gat ways hai ·Yes. Agarchai kuch salmaya ka 'mandi ka shikar' ho saktai hain, ama salmaya kalon ki mast am thor per 'taiji' hoti hai. Pasar, majimoi tul per, tavir ase ei ka ofek per, mesbet wamsi post karne ka rojan rakti hai. Lich ki pasar main salmaya kali karna zida hatrnak ho saktai, kyunkai bohat si kimaat ko dti hai ur kamatin mu saksa ho jati・hin. Chanki market ka nikale hise ai min wakt lagana mashkil hai, li salmaya kah rich, bazaar se apna paisa nikar satke hain all wakt tak nakad par naib satke hain jab tak karjan tabdale na ho ji, ol kamatin labd kam ho ji.

-

#6 Collapse

perusing cfds aur fx aapshnz khatray mein parte hain aur is ke nateejay mein aap ka sarmaya zaya ho sakta hai. laag un karen madad angrezi isharay tijarti hikmat e amli takneeki tajzia ke isharay aur hikmat e amli middle of the road 7 moment isharay tijarti hikmat e amli isharay aik qisam ka force oscillator hai jisay 1995 mein tshar chnde ne tayyar kya tha. yeh batata hai ke aaya koi asasa rujhan mein hai aur. is ne - apne naye oscillator ko" aroon" kaha kyunkay sansikrat zabaan mein is ka matlab" day break' s early light" hai. is ne mehsoos kya ke yeh oscillator ki aik achi wazahat hai, jo qeemat ke hawalay se waqt standard tawajah markooz karta hai, aur aksar ubhartay tint rujhanaat ko talaash karne aur ulat jane ka andaza laganay ke liye istemaal kya jata hai, jis se yeh qeemat ki karwai ke liye ibtidayi intibahi nizaam hai. is ka istemaal tasheeh ke adwaar ka pata laganay aur is baat ki nishandahi karne ke liye bhi kya ja sakta hai ke market kab mustahkam ho rahi hai.Bullish Doji-Star Candle Example tajir up apshnz khatray mein parte hain aur is ke nateejay mein aap ka sarmaya zaya ho sakta hai. laag un karen madad angrezi isharay tijarti hikmat e amli takneeki tajzia ke isharay aur hikmat e amli middle of the road 7 moment isharay tijarti hikmat e amli isharay aik qisam ka force oscillator hai jisay 1995 mein tshar chnde ne tayyar kya tha. yeh batata hai ke aaya koi asasa rujhan mein hai aur. is ne - apne naye oscillator ko" aroon" kaha kyunkay sansikrat zabaan mein is ka matlab" day break' s early light" hai. is ne mehsoos kya ke yeh oscillator ki aik achi wazahat hai, jo qeemat ke hawalay se waqt standard tawajah markooz karta hai, aur aksar ubhartay tint rujhanaat ko talaash karne aur ulat jane ka andazaline aur davn line ke aroon graph get over bhi dekh satke hain. khareed signal ke liye aroon-up ko aroon-down ke oopar cross karne ke liye, ya aroon-down ko aroon-up ke oopar se deal signal ke peak standard uboor karne ke liye dekhen. kuch sooraton mein, aap ko maloom ho sakta hai ke dono isharay 50 se neechay hain, aur is se zahir hota hai ke qeemat istehkaam ke marhalay mein hai. yeh is waqt hota hai hit haal greetings mein koi nai oonchai ya kam nahi hoti hai. hit qeematein is terhan mustahkam ho rahi hon to aik tajir asasay ko apni watch list mein rakh sakta hai aur break out ya aglay Aron get over ka intzaar kar sakta hai taakay yeh ishara miley ke agli qeemat kahan ja rahi hai. sharay ki tashreeh ki taraqqi ke liye آ ki tashreeh ahem hai. pemana mein youngster darjay hain jo Aron isharay ki tashreeh mein sab se ahem hain. yeh 0, 50, aur 100 perusing hain. sab se bunyadi tashreeh mein murmur kehte hain ke market mein taizi is waqt hoti hai punch aroon-up 50 se oopar ho aur aroon-down 50 se neechay ho. yeh set up is baat ki nishandahi karta hai ke rozana ki nai bulandiyon ka imkaan nai rozana ki kam se ziyada hai. aur neechay ka rujhan is ke bar aks hai. is soorat mein, ارون-ڈاؤن 50 se oopar hai, jabkay se neechay hai.

-

#7 Collapse

Bullish Doji-Star Candle Example examining cfds aur fx aapshnz khatray mein parte hain aur is ke nateejay mein aap ka sarmaya zaya ho sakta hai. laag un karen madad angrezi isharay tijarti hikmat e amli takneeki tajzia ke isharay aur hikmat e amli widely appealing 7 second isharay tijarti hikmat e amli isharay aik qisam ka force oscillator hai jisay 1995 mein tshar chnde ne tayyar kya tha. yeh batata hai ke aaya koi asasa rujhan mein hai aur. is ne - apne naye oscillator ko" aroon" kaha kyunkay sansikrat zabaan mein is ka matlab" dawn' s early light" hai. is ne mehsoos kya ke yeh oscillator ki aik achi wazahat hai, jo qeemat ke hawalay se waqt standard tawajah markooz karta hai, aur aksar ubhartay color rujhanaat ko talaash karne aur ulat jane ka andaza laganay ke liye istemaal kya jata hai, jis se yeh qeemat ki karwai ke liye ibtidayi intibahi nizaam hai. is ka istemaal tasheeh ke adwaar ka pata laganay aur is baat ki nishandahi karne ke liye bhi kya ja sakta hai ke market kab mustahkam ho rahi hai. Bullish Doji-Star Flame Model tajir up apshnz khatray mein parte hain aur is ke nateejay mein aap ka sarmaya zaya ho sakta hai. laag un karen madad angrezi isharay tijarti hikmat e amli takneeki tajzia ke isharay aur hikmat e amli widely appealing 7 second isharay tijarti hikmat e amli isharay aik qisam ka force oscillator hai jisay 1995 mein tshar chnde ne tayyar kya tha. yeh batata hai ke aaya koi asasa rujhan mein hai aur. is ne - apne naye oscillator ko" aroon" kaha kyunkay sansikrat zabaan mein is ka matlab" dawn' s early light" hai. is ne mehsoos kya ke yeh oscillator ki aik achi wazahat hai, jo qeemat ke hawalay se waqt standard tawajah markooz karta hai, aur aksar ubhartay color rujhanaat ko talaash karne aur ulat jane ka andazaline aur davn line ke aroon diagram move past bhi dekh satke hain. khareed signal ke liye aroon-up ko aroon-down ke oopar cross karne ke liye, ya aroon-down ko aroon-up ke oopar se bargain signal ke top standard uboor karne ke liye dekhen. kuch sooraton mein, aap ko maloom ho sakta hai ke dono isharay 50 se neechay hain, aur is se zahir hota hai ke qeemat istehkaam ke marhalay mein hai. yeh is waqt hota hai hit haal good tidings mein koi nai oonchai ya kam nahi hoti hai. hit qeematein is terhan mustahkam ho rahi hon to aik tajir asasay ko apni watch list mein rakh sakta hai aur break out ya aglay Aron move past ka intzaar kar sakta hai taakay yeh ishara miley ke agli qeemat kahan ja rahi hai. sharay ki tashreeh ki taraqqi ke liye آ ki tashreeh ahem hai. pemana mein adolescent darjay hain jo Aron isharay ki tashreeh mein sab se ahem hain. yeh 0, 50, aur 100 examining hain. sab se bunyadi tashreeh mein mumble kehte hain ke market mein taizi is waqt hoti hai punch aroon-up 50 se oopar ho aur aroon-down 50 se neechay ho. yeh set up is baat ki nishandahi karta hai ke rozana ki nai bulandiyon ka imkaan nai rozana ki kam se ziyada hai. aur neechay ka rujhan is ke bar aks hai. is soorat mein, ارون-ڈاؤن 50 se oopar hai, jabkay se neechay hai. -

#8 Collapse

Assalamo Alaekum friends. Kasy hain ap sabMain umed karta hon ap sab bilkul thek thak hon gay. Aj ka jo topic zer e behs hay uska nam bullish doji star candlestick patterns hay . Yeh hamen kia btayega r kia information deta hay yeh dekhty hain. Yeh hamen kia kuch btaya hay yeh ab ham agy mazeed dekhty hain. Bullish Star doji Candlistic Pattern Bullish Doji-Star Candlestick Pattern forex trading mein ek mukhtasar aur ahem candlestick pattern hai. Is pattern ko dekh kar traders price reversal ki tashkeel samajhte hain. Is pattern mein do main candlesticks hote hain.Pehla candlestick bearish ya girawat ki taraf hota hai aur doosra candlestick Doji pattern ka hota hai, jismein open aur close price barabar ya qareebi barabar hoti hai. Doji ki wajah se is pattern ko Doji-Star kaha jata hai.Jab market downtrend mein hota hai aur Bullish Doji-Star pattern ban jata hai, to yeh market mein bullish bullish trend ki nishandahi kar sakta hai. Doji-Star candlestick pattern ke baad market mein price reversal ya uptrend ki mumkinat hoti hai.Bullish Doji-Star pattern ko samajhne ke liye, traders ko iski tasdeeq ki zaroorat hoti hai. Agar next candlestick, Doji-Star ki high price ko break karke upar jaata hai, to isko ek bullish signal samjha jata hai. Traders is signal par trading decisions lete hain, jaise ki buy orders place karna ya mojoda sell positions ko close karna.Hamesha yeh yaad rakhein ki candlestick patterns ke saath dusre technical indicators aur analysis tools ka istemal karna zaroori hai, taakay aap sahi trading decisions le sakein. Candlestick patterns ke sath trend lines, support aur resistance levels, aur dusre price indicators ka istemal karke trading strategy ko muntakhib karna chahiye. Trend of Doji Candlistic Pattern Bullish Doji-Star Candlestick Pattern ki kuch limitations hain. Yeh limitations traders ko is pattern ko samajhne aur is par inhasar karne se pehle dhyan mein rakhne chahiye.Yahan kuch aham limitations diye gaye hain Confirmation ki zaroorat hai.Bullish Doji-Star pattern ko dekh kar traders ko tasdeeq ki zaroorat hoti hai. Agar next candlestick Doji-Star ki high price ko break karke upar jaata hai, tabhi yeh pattern bullish signal samjha jata hai.Tasdeeq ke bina, yeh pattern blkl sahi nahi ho sakta.Galat isharay bhe miltay hain.Bullish Doji-Star pattern galat signals bhi peda kar sakta hai. Kabhi kabhi price reversal ki jagah yeh pattern sirf arzi tor pr Retracements ya consolidation phase ko ishara kar sakta hai. Isliye, traders ko dusre technical indicators aur price analysis tools ka istemal karna chahiye pattern ki shanakht ko tasdeeq karne ke liye.Market context. Bullish Doji-Star pattern ko samajhne ke liye market context ka dhyan dena zaroori hai. Agar market strong downtrend mein hai aur tamam tar ehsasat bearish hai, to ek Bullish Doji-Star pattern kam behtreen ho sakta hai. Market trend aur market conditions ka tajziya karna zaruri hai. Kabhi-kabhi Doji candlestick pattern ke andar price ki movement itni kam hoti hai ki Doji ko shanakht karna mushkil ho jata hai. Aise cases mein, Bullish Doji-Star pattern ki validity kam ho jati hai.Candlestick patterns, jin main Bullish Doji-Star hoty hain woh timeframe par inhasar karte hain. Iska matlab hai ki pattern ka timeframe par inhasar karti hai. Pattern ko ek timeframe se dusre timeframe par transfer karte waqt ehtyat ki zaroorat hoti hai.Isliye, Bullish Doji-Star pattern ko samajhne se pehle traders ko in limitations ko dhyan mein rakhna chahiye. Technical analysis aur price action ke saath, traders ko aur bhi indicators aur tools ka istemal karna chahiye, jisse woh sahi trading decisions le sakein. -

#9 Collapse

Bullish Doji Star pattern doji-star tar pattern prices k bottom par ya bearish trend main banta hai, jo k do candles par mushtamil hota hai, jiss main pehli candle aik long real body wali bearish candle hoti hai, jiss k baad aik doji candle hoti hai, jo k pehli candle k lower side par banti hai. Pattern ki dosri candle umoman doji star candle hoti hai. Ye candle prices ko aik to bearish jane se rokti hai aur dosra ye candle aik doji hone ki waja se trend reversal ka kaam karti hai. Price chart par jab prices sellers k bohut ziada pressure ki waja se bearish jati hai, to wahan par aksar iss ko reversal honne k imkanat hote hen, jiss main aksar kuch aise pattern hote hen. Is pattern ko dekh kar traders price reversal ki tashkeel samajhte hain. Is pattern mein do main candlesticks hote hain.Pehla candlestick bearish ya girawat ki taraf hota hai aur doosra candlestick Doji pattern ka hota hai, jismein open aur close price barabar ya qareebi barabar hoti hai. Doji ki wajah se is pattern ko Doji-Star kaha jata hai.Jab market downtrend mein hota hai aur Bullish Doji-Star pattern ban jata hai, to yeh market mein bullish bullish trend ki nishandahi kar sakta hai. Doji-Star candlestick pattern ke baad market mein price reversal ya uptrend ki mumkinat hoti hai.Bullish Doji-Star pattern ko samajhne ke liye, traders ko iski tasdeeq ki zaroorat hoti hai. Explanation aur Identification Method Bullish doji-star candlestick pattern ki pehli candle aik bearish candle hoti hai, jo prices k bottom par ya bearish trend ki continuation ka kaam karti hai, q k ye aik long real body wali candle hoti hai. Ye candle aik black ya red color ki candle hoti hai.Bullish doji-star Candlestick pattern ki dosri candle aik doji candle hoti hai. Ye candle real body k bagher hoti hai, jiss ka open aur close same position par hota hai. Dosri doji candle bager real body ki waja se colorless hone k sath iss ka high aur low bhi ziada tar equal length k hoti hai.Bullish doji-star candlestick pattern aik bullish trend reversal pattern hai, jo k do candles par mushtamil hota hai. Ye pattern prices k bottom par ya bearish trend main banne ki waja se prices ko mazeed bottom jane se rokti hai. Ye pattern same to same dekhne main aik half "Morning Star Pattern" ki tarah hota hai, lekin teesri candle ka na hone ki waja se ye bullish doji-star pattern ban jata hai. Bullish doji-star pattern ki dosri candle aik doji candle hoti hai, jiss ka open aur close same point ya price par hota hai. Dosre candle k open aur close same point par hona chaheye

Explanation aur Identification Method Bullish doji-star candlestick pattern ki pehli candle aik bearish candle hoti hai, jo prices k bottom par ya bearish trend ki continuation ka kaam karti hai, q k ye aik long real body wali candle hoti hai. Ye candle aik black ya red color ki candle hoti hai.Bullish doji-star Candlestick pattern ki dosri candle aik doji candle hoti hai. Ye candle real body k bagher hoti hai, jiss ka open aur close same position par hota hai. Dosri doji candle bager real body ki waja se colorless hone k sath iss ka high aur low bhi ziada tar equal length k hoti hai.Bullish doji-star candlestick pattern aik bullish trend reversal pattern hai, jo k do candles par mushtamil hota hai. Ye pattern prices k bottom par ya bearish trend main banne ki waja se prices ko mazeed bottom jane se rokti hai. Ye pattern same to same dekhne main aik half "Morning Star Pattern" ki tarah hota hai, lekin teesri candle ka na hone ki waja se ye bullish doji-star pattern ban jata hai. Bullish doji-star pattern ki dosri candle aik doji candle hoti hai, jiss ka open aur close same point ya price par hota hai. Dosre candle k open aur close same point par hona chaheye Treading in Doji Star Patterndoji-star candlestick pattern trend reversal ka pattern hai, jiss se market main buy ki entry karte hen. Pattern k bottom par buyers ziada active ho jate hen. Trend reversal pattern par trading trend continuation patterns ki nisbat ziada riski hoti hai, iss waja se pattern par trading se pehle market main aik bullish ya white candle ka hona zarori hai. Jiss ki real body honi chaheye, jiss main open aur close same point par na ho. Agar pattern k baad bearish candle banti hai, to ye pattern invalid ho jayega, jiss par entry nahi karni chaheye

Treading in Doji Star Patterndoji-star candlestick pattern trend reversal ka pattern hai, jiss se market main buy ki entry karte hen. Pattern k bottom par buyers ziada active ho jate hen. Trend reversal pattern par trading trend continuation patterns ki nisbat ziada riski hoti hai, iss waja se pattern par trading se pehle market main aik bullish ya white candle ka hona zarori hai. Jiss ki real body honi chaheye, jiss main open aur close same point par na ho. Agar pattern k baad bearish candle banti hai, to ye pattern invalid ho jayega, jiss par entry nahi karni chaheye

-

#10 Collapse

candle aik long real body wali bearish candle hoti hai, jiss k baad aik doji candle hoti hai, jo k pehli candle k lower side par banti hai. Pattern ki dosri candle umoman doji star candle hoti hai. Ye candle prices ko aik to bearish jane se rokti hai aur dosra ye candle aik doji hone ki waja se trend reversal ka kaam karti hai. Price chart par jab prices sellers k bohut ziada pressure ki waja se bearish jati hai, to wahan par aksar iss ko reversal honne k imkanat hote hen, jiss main aksar kuch aise pattern hote hen, jo do candles par mushtamil hote hen.Candles FormationBullish doji-star candlestick pattern prices k bottom par do mukhtalif candles ka aik bullish trend reversal pattern hai, jiss ki pehli candle bearish aur dosri doji candle hoti hai. Pattern main candles ki formation darjazzel tarah se hoti hai;1. First Candle: Bullish doji-star candlestick pattern ki pehli candle aik bearish candle hoti hai, jo prices k bottom par ya bearish trend ki continuation ka kaam karti hai, q k ye aik long real body wali candle hoti hai. Ye candle aik black ya red color ki candle hoti hai. 2. Second Candle: Bullish doji-star Candlestick pattern ki dosri candle aik doji candle hoti hai. Ye candle real body k bagher hoti hai, jiss ka open aur close same position par hota hai. Dosri doji candle bager real body ki waja se colorless hone k sath iss ka high aur low bhi ziada tar equal length k hoti hai.

Explanation Bullish doji-star candlestick pattern aik bullish trend reversal pattern hai, jo k do candles par mushtamil hota hai. Ye pattern prices k bottom par ya bearish trend main banne ki waja se prices ko mazeed bottom jane se rokti hai. Ye pattern same to same dekhne main aik half "Morning Star Pattern" ki tarah hota hai, lekin teesri candle ka na hone ki waja se ye bullish doji-star pattern ban jata hai. Bullish doji-star pattern ki dosri candle aik doji candle hoti hai, jiss ka open aur close same point ya price par hota hai. Dosre candle k open aur close same point par hona chaheye, warna same point par na hone ki waja se ye pattern Spining bottom main badal sakta hai.Treading in Doji Star Pattern doji-star candlestick pattern trend reversal ka pattern hai, jiss se market main buy ki entry karte hen. Pattern k bottom par buyers ziada active ho jate hen. Trend reversal pattern par trading trend continuation patterns ki nisbat ziada riski hoti hai, iss waja se pattern par trading se pehle market main aik bullish ya white candle ka hona zarori hai. Jiss ki real body honi chaheye, jiss main open aur close same point par na ho. Agar pattern k baad bearish candle banti hai, to ye pattern invalid ho jayega, jiss par entry nahi karni chaheye

-

#11 Collapse

Pattern ki dosri candle umoman doji star candle hoti hai. Ye candle prices ko aik to bearish jane se rokti hai aur dosra ye candle aik doji hone ki waja se trend reversal ka kaam karti hai. Price chart par jab prices sellers k bohut ziada pressure ki waja se bearish jati hai, to wahan par aksar iss ko reversal honne k imkanat hote hen, jiss main aksar kuch aise pattern hote hen, jo do candles par mushtamil hote hen.IDENTIFICATION Pehla candlestick ek long bearish candle hai, jo downward trend ko represent karta hai. b. Dusra candlestick: Dusra candlestick small body wala Doji hota hai, jo pehle candlestick ke upar close hota hai. Doji ka open aur close price nearly same hote hai. Bullish Doji-Star pattern ka istemal karne se pehle, traders ko is pattern ki confirmation ke liye aur technical analysis tools jaise ki trend lines, support aur resistance levels, aur moving averages ka istemal karna chahiye. Iske saath hi, traders ko risk management aur money management ka dhyan rakhna chahiye, jaise ki stop-loss order ka istemal karna aur risk-reward ratio ka analysis karna. Bullish Doji-Star pattern ek price action signal hai jo bullish trend ke onset ko signify karta hai. Iska use karke traders price reversals ka pata l

Reechh ki manndi ke douran, maeeshat sust par jati hai aur beroggari barh jati hai kyunkai mate mazdooron ko farigh karna shuru kar deti hain. pawn market mein, sikortiz ki mazboot maang aur kamzor supply hoti hai. dosray lafzon mein, bohat se sarmaya car sikortiz khareedna chahtay hain lekin kuch hi inhen baichnay ka liye tayar hain. nateejatan, especially ki keematein barheen ki kyunkay sarmayya car dastbyab aikoyti haasil karne ka liye muqaablaba ge karen ge. Reechh ki manndi mein, ke bar aks sach ha

-

#12 Collapse

ai. Ye hamy market kay bary mother bhot zayada information deti hain or ye bi batati hain kay market kis side standard move karny wali hai. En plan ki base standard he ham market ko anticipate karty hain or apni trades ki the leaders karty hain. En plan ki waja sy hamy es bat kaforex trading ka busniess ek kamyab busniess hain forex trading essential best learning karna must hota hain agar troublesome work k sath kaam hota hain tu best learning k sath kaamkarna must hain Negative Mat-Hold Flame Model major learning serious solid areas for ko Negative Mat-Hold Light Model chief learning ko incress kare jaaab tak Negative Mat-Hold Candle Model essential learning strong nhe hain tu mishap mil skta hain Negative Mat-Hold Candle Model essential learning kare common pratice kare Negative Mat-Hold Candle Model crucial learning ko incress karna must hota hain Negative Mat-Hold Candle Model ek benefit dene rib busniess hain troublesome work kare pratice kare Negative Mat-Hold Candle Model essential demo account essential learning ko incress kare troublesome work karne grain dealers forex trading essential kamyabi hasil kar skte hain jisne learning nhe ki vo kabi b benefit hasil nhe ka answer bi mel jata hai kay market es side standard kiu move kar rahi hai. Regardless, plans ko use kar kay bi kahe bar hamy market ko anticipate karna mushkil ho jata hai kiu kay mar

- Mentions 0

-

سا0 like

-

#13 Collapse

BULLISH STAR CANDLESTICK PATTERN SE KEA MURAAD HA TAFSEEL BEYAAN KIJIYE ??? ULLISH STAR CANDLESTICK PATTERN OVERVIEW:- Analyzing cfds aur fx aapshnz khatray mein parte hain aur is ke nateejay mein aap ka sarmaya zaya ho sakta hai. Laag un karen madad angrezi isharay tijarti hikmat e amli takneeki tajzia ke isharay aur hikmat e amli intermediate 7 minute isharay tijarti hikmat e amli isharay aik qisam ka momentum oscillator hai jisay 1995 mein tshar chnde ne tayyar kya tha. Yeh batata hai ke aaya koi asasa rujhan mein hai aur. Is ne –apne naye oscillator ko" aroon" kaha kyunkay sansikrat zabaan mein is ka matlab" sunrise' s early mild" hai. Is ne mehsoos kya ke yeh oscillator ki aik achi wazahat hai, jo qeemat ke hawalay se waqt par tawajah markooz karta hai, aur aksar ubhartay hue rujhanaat ko talaash karne aur ulat jane ka andaza laganay ke liye istemaal kya jata hai, jis se yeh qeemat ki karwai ke liye ibtidayi intibahi nizaam hai. Is ka istemaal tasheeh ke adwaar ka pata laganay aur is baat ki nishandahi karne ke liye bhi kya ja sakta hai ke market kab mustahkam ho rahi hai.Tajir up apshnz khatray mein parte hain aur is ke nateejay mein aap ka sarmaya zaya ho sakta hai. Laag un karen madad angrezi isharay tijarti hikmat e amli takneeki tajzia ke isharay aur hikmat e amli intermediate 7 minute isharay tijarti hikmat e amli isharay aik qisam ka momentum oscillator hai jisay 1995 mein tshar chnde ne tayyar kya tha. Yeh batata hai ke aaya koi asasa rujhan mein hai aur. Is ne –apne naye oscillator ko" aroon" kaha kyunkay sansikrat zabaan mein is ka matlab" sunrise' s early mild" hai. Is ne mehsoos kya ke yeh oscillator ki aik achi wazahat hai, jo qeemat ke hawalay se waqt par tawajah markooz karta hai, aur aksar ubhartay hue rujhanaat ko talaash karne aur ulat jane ka andazaline aur davn line ke aroon chart go with the flow over bhi dekh satke hain. Khareed signal ke liye aroon-up ko aroon-down ke oopar flow into karne ke liye, ya aroon-down ko aroon-up ke oopar se sale signal ke tor par uboor karne ke liye dekhen. Kuch sooraton mein, aap ko maloom ho sakta hai ke dono isharay 50 se neechay hain, aur is se zahir hota hai ke qeemat istehkaam ke marhalay mein hai. Yeh is waqt hota hai jab haal unique day mein koi nai oonchai ya kam nahi hoti hai. Jab qeematein is terhan mustahkam ho rahi hon to aik tajir asasay ko apni watch listing mein rakh sakta hai aur break out ya aglay Aron pass over ka intzaar kar sakta hai taakay yeh ishara miley ke agli qeemat kahan ja rahi hai. Sharay ki tashreeh ki taraqqi ke liye ki tashreeh ahem hai. Pemana mein teenager darjay hain jo Aron isharay ki tashreeh mein sab se ahem hain. Yeh zero, 50, aur a hundred studying hain. Sab se bunyadi tashreeh mein hum kehte hain ke market mein taizi is waqt hoti hai jab aroon-up 50 se oopar ho aur aroon-down 50 se neechay ho. Yeh set up is baat ki nishandahi karta hai ke rozana ki nai bulandiyon ka imkaan nai rozana ki kam se ziyada hai. Aur neechay ka rujhan is ke bar aks hai. Is soorat mein 50 se oopar hai, jabkay ye os se neechay hai. Trend of Doji Candlistic Pattern ULLISH STAR CANDLESTICK PATTERN ME TIJAARAT:- Bullish Doji-Star Candlestick Pattern ki kuch obstacles hain. Yeh barriers clients ko is sample ko samajhne aur is par inhasar karne se pehle dhyan mein rakhne chahiye.Yahan kuch aham barriers diye gaye hain Confirmation ki zaroorat hai.Bullish Doji-Star sample ko dekh kar clients ko tasdeeq ki zaroorat hoti hai. Agar next candlestick Doji-Star ki excessive fee ko harm karke upar jaata hai, tabhi yeh pattern bullish sign samjha jata hai.Tasdeeq ke bina, yeh pattern blkl sahi nahi ho sakta.Galat isharay bhe miltay hain.Bullish Doji-Star pattern galat signs and symptoms and signs and symptoms bhi peda kar sakta hai. Kabhi kabhi price reversal ki jagah yeh sample sirf arzi tor pr Retracements ya consolidation segment ko ishara kar sakta hai. Isliye, clients ko dusre technical signs and signs and signs and symptoms and signs and symptoms and signs and signs and signs and symptoms and symptoms and signs and signs and symptoms and symptoms and signs and signs and signs and symptoms and signs and signs and signs and symptoms and signs and symptoms and signs and symptoms and symptoms aur price evaluation tool ka istemal karna chahiye pattern ki shanakht ko tasdeeq karne ke liye.Market context. Bullish Doji-Star pattern ko samajhne ke liye market context ka dhyan dena zaroori hai. Agar marketplace strong downtrend mein hai aur tamam tar ehsasat bearish hai, to ek Bullish Doji-Star sample kam behtreen ho sakta hai. Market fashion aur market situations ka tajziya karna zaruri hai. Kabhi-kabhi Doji candlestick pattern ke andar charge ki motion itni kam hoti hai ki Doji ko shanakht karna mushkil ho jata hai. Aise times mein, Bullish Doji-Star pattern ki validity kam ho jati hai.Candlestick styles, jin maximum crucial Bullish Doji-Star hoty hain woh time-body par inhasar karte hain. Iska matlab hai ki pattern ka time frame par inhasar karti hai. Pattern ko ek time frame se dusre time frame par transfer karte waqt ehtyat ki zaroorat hoti hai.Isliye, Bullish Doji-Star pattern ko samajhne se pehle customers ko in obstacles ko dhyan mein rakhna chahiye. Technical evaluation aur price movement ke saath, customers ko aur bhi signs and signs and symptoms and signs and symptoms and signs and symptoms and symptoms aur device ka istemal karna chahiye, jisse woh sahi seeking out and promoting alternatives le sakty hein. -

#14 Collapse

perusing cfds aur fx aapshnz khatray mein parte hain aur is ke nateejay mein aap ka sarmaya zaya ho sakta hai. laag un karen madad angrezi isharay tijarti hikmat e amli takneeki tajzia ke isharay aur hikmat e amli halfway 7 moment isharay tijarti hikmat e amli isharay aik qisam ka force oscillator hai jisay 1995 mein tshar chnde ne tayyar kya tha. yeh batata hai ke aaya koi asasa rujhan mein hai aur. is ne - apne naye oscillator ko" aroon" kaha kyunkay sansikrat zabaan mein is ka matlab" day break' s early light" hai. is ne mehsoos kya ke yeh oscillator ki aik achi wazahat hai, jo qeemat ke hawalay se waqt standard tawajah markooz karta hai, aur aksar ubhartay shade rujhanaat ko talaash karne aur ulat jane ka andaza laganay ke liye istemaal kya jata hai, jis se yeh qeemat ki karwai ke liye ibtidayi intibahi nizaam hai. is ka istemaal tasheeh ke adwaar ka pata laganay aur is baat ki nishandahi karne ke liye bhi kya ja sakta hai ke market kab mustahkam ho rahi hai. Bullish Doji-Star Candle Example tajir up apshnz khatray mein parte hain aur is ke nateejay mein aap ka sarmaya zaya ho sakta hai. laag un karen madad angrezi isharay tijarti hikmat e amli takneeki tajzia ke isharay aur hikmat e amli halfway 7 moment isharay tijarti hikmat e amli isharay aik qisam ka force oscillator hai jisay 1995 mein tshar chnde ne tayyar kya tha. yeh batata hai ke aaya koi asasa rujhan mein hai aur. is ne - apne naye oscillator ko" aroon" kaha kyunkay sansikrat zabaan mein is ka matlab" day break' s early light" hai. is ne mehsoos kya ke yeh oscillator ki aik achi wazahat hai, jo qeemat ke hawalay se waqt standard tawajah markooz karta hai, aur aksar ubhartay shade rujhanaat ko talaash karne aur ulat jane ka andazaline aur davn line ke aroon graph get over bhi dekh satke hain. khareed signal ke liye aroon-up ko aroon-down ke oopar cross karne ke liye, ya aroon-down ko aroon-up ke oopar se deal signal ke pinnacle standard uboor karne ke liye dekhen. kuch sooraton mein, aap ko maloom ho sakta hai ke dono isharay 50 se neechay hain, aur is se zahir hota hai ke qeemat istehkaam ke marhalay mein hai. yeh is waqt hota hai punch haal hello mein koi nai oonchai ya kam nahi hoti hai. punch qeematein is terhan mustahkam ho rahi hon to aik tajir asasay ko apni watch list mein rakh sakta hai aur break out ya aglay Aron get over ka intzaar kar sakta hai taakay yeh ishara miley ke agli qeemat kahan ja rahi hai. sharay ki tashreeh ki taraqqi ke liye آ ki tashreeh ahem hai. pemana mein youngster darjay hain jo Aron isharay ki tashreeh mein sab se ahem hain. yeh 0, 50, aur 100 perusing hain. sab se bunyadi tashreeh mein murmur kehte hain ke market mein taizi is waqt hoti hai poke aroon-up 50 se oopar ho aur aroon-down 50 se neechay ho. yeh set up is baat ki nishandahi karta hai ke rozana ki nai bulandiyon ka imkaan nai rozana ki kam se ziyada hai. aur neechay ka rujhan is ke bar aks hai. is soorat mein, ارون-ڈاؤن 50 se oopar hai, jabkay se neechay hai. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 Collapse

"Bullish Doji-Star Candlestick Pattern"- Introduction:

Bullish Doji-Star Pattern ki Pehchan:

- Pehla din bearish candlestick se represented hota hai, jo downward movement ko indicate karta hai.

- Dusra din ek Doji candlestick hoti hai, jismein open aur close prices qareeb qareeb hote hain.

- Teesra din ek bullish candlestick hoti hai, jismein price gap up hota hai aur upward movement shuru hoti hai.

Bullish Doji-Star Pattern ketypes:

- Bullish Dragonfly Doji: Is variation mein Doji candlestick mein lower shadow nahi hota, sirf upper shadow hoti hai.

- Bullish Gravestone Doji: Is variation mein Doji candlestick mein upper shadow nahi hota, sirf lower shadow hoti hai.

Bullish Doji-Star Pattern ke Istemal:

- Reversal Signal: Yeh pattern market trend ki potential reversal ko indicate karta hai, bearish trend se bullish trend ki taraf badalne ka sanket dete hue.

- Entry Point: Bullish Doji-Star Pattern traders ko entry point provide karta hai. Jab yeh pattern ke baad ek bullish candlestick ban jaye, traders long position le sakte hain.

- Stop Loss Placement: Yeh pattern traders ko stop loss order place karne ke liye reference point deta hai. Traders apna stop loss is pattern ke neeche set kar sakte hain, apna risk control karne ke liye.

Bullish Doji-Star Pattern ke Istemal se Trading Strategy:

- Pattern Confirmation: Traders sab se pehle Bullish Doji-Star Pattern ki confirmation ka intezaar karte hain. Woh dusri bullish candlestick ki tafseel dekhte hain, jismein price gap up hota hai.

- Entry: Jab dusri bullish candlestick ban jaye, traders long position lete hain. Entry point Doji candlestick ki high price se thoda upar set kiya jata hai.

- Stop Loss: Traders apna stop loss order Bullish Doji-Star Pattern ke neeche place karte hain. Yeh unko unka risk manage karne aur potential loss ko limit karne mein madad karta hai.

- [*=center]

Conclusion:Bullish Doji-Star Candlestick Pattern aik bullish reversal pattern hai jo traders ko trend reversal aur market mein entry opportunities ki signals deta hai. Halaanki, sirf is pattern par bharosa karke trading decisions lene se pehle, dusre technical indicators ko bhi madde nazar rakhte hue thorough analysis zaroor karni chahiye.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 11:46 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим