How to trade hanging man candlestick pattern?

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

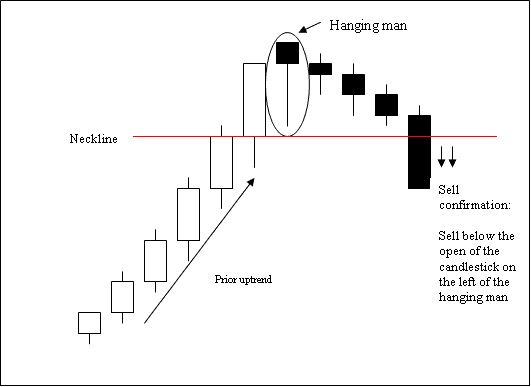

Assalamualaikum! Dear member umeed krta hon ap sab khariat sy hon gy dosto aj ko Haram topic h vo hanging man candlestick pattern per h hanging man aik single candlestick pattern hota h ye hamesha uptrend mn dekhai deta h dosto aj hm ko mokamal details k sath jane gy k ye market mn kia Kam krta h our is per hm kasy trade ly sakty hn. Hanging Man candlestick pattern Kia hota h? Hanging Man,Latka Hua Aadmi" kehte hain, ek candlestick pattern hai jo technical analysis mein istemaal kiya jaata hai. Candlestick patterns market ke price movements aur future trend ke bare mein hamain samajhne mein madad karte hain. Hanging Man pattern bearish trend ke reversal ke signals provide karta hai.Hanging Man pattern ek single candlestick pattern hai aur usually uptrend ke baad dikhta hai. Is pattern ko recognize karne ke liye kuch important elements hote hain. Ek Hanging Man candlestick pattern mein price open aur close ke beech mein horizontal line hoti hai. Iske neeche ki taraf ek long lower shadow hoti hai, jo usually double ya triple length ki hoti hai as compared to the body of the candle. Upper shadow bahut choti hoti hai ya bilkul nahi hoti. Hanging Man candlestick pattern mein body bearish (downward) color mein hoti ha. How to trade hanging man candlestick pattern? Hanging Man pattern ka interpretation yeh hai ki market ke bullish trend ke baad selling pressure increase ho rahi hai aur bears (sellers) control mein aa rahe hain. Hanging Man pattern bullish trend ke reversal ke potential signals provide karta hai aur traders ko selling opportunities suggest karta hai. Jab ye pattern confirm ho jaata hai, toh traders selling positions enter kar sakte hain.Agar Hanging Man pattern confirm hota hai, toh traders ko iska confirmation wait karna chahiye. Confirmation ke liye, next candle ki price action ka observation karna zaroori hai. Agar next candle bearish (downward) trend mein open hoti hai aur Hanging Man candle ke neeche close hoti hai, toh confirmation ho jata hai aur traders selling positions enter kar sakte hain. Stop loss level ko set karte hue, traders apni positions manage kar sakte hain.Hanging Man pattern ke saath kuch additional indicators aur tools ka bhi istemaal kiya ja sakta hai, jaise ki trend lines, moving averages, aur oscillators, taaki traders ko is pattern ki validity aur accuracy ka better idea mil sake.Hanging Man pattern ka use karne se pehle, traders ko market ke overall context aur other technical indicators ka bhi dhyaan dena chahiye. Ek pattern ke akele se rely karne se pehle, iska confirmation aur validation important hai. Traders ko is pattern ke saath risk management ka bhi dhyaan rakhna chahiye. Traders ko Hanging Man pattern aur dusre candlestick patterns ka study karna chahiye taaki unko market ke movements aur trends ka better understanding ho sake. Technical analysis mein candlestick patterns valuable tools hote hain, lekin unka sahi tareeke se istemaal karna aur market ke overall context ko samajhna zaroori hai. Thanks for Attention -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Introduction: Hanging Man Candlestick Pattern, jo technical analysis mein aam taur par dekhi jaati hai, ek bearish reversal pattern hai, jis se traders ko aham maaloomaat mil sakti hain. Is post mein hum dekheinge ke hanging man candlestick pattern ko kaise safal tareeqe se trade kiya ja sakta hai. Understanding the Hanging Man Candlestick Pattern Hanging man candlestick pattern ko samajhna trading mein kaafi zaroori hai. Ye pattern typically uptrend ke baad dikhai deta hai aur bearish reversal ki indication deta hai. Is pattern ko recognize karne ke liye kuch key elements hain: 1.Shape: Hanging man candlestick pattern ek single candle se banta hai. Iski body upper wick se choti hoti hai aur lower wick bari hoti hai. Iski body ko preferably red (bearish) color mein depict kiya jata hai. 2.Upper Shadow: Hanging man candlestick pattern mein upper shadow ki length body ke kareeb ya usse zyada hoti hai. Ye upper wick ko represent karta hai, jo price ki high level ko show karta hai. 3.Lower Shadow: Hanging man pattern mein lower shadow ki length short hoti hai ya woh bilkul na ho. Ye lower wick ko represent karta hai, jo price ki low level ko show karta hai. Trading Strategies for the Hanging Man Candlestick Pattern Hanging man candlestick pattern ko trade karne ke liye kuch strategies hain, jinhe aap istemaal kar sakte hain: 1.Confirmation: Hanging man candlestick pattern ek potential reversal signal hai, lekin iski confirmation ke liye aapko aur factors ka istemaal karna chahiye. Iski confirmation ke liye aap price action, support and resistance levels, trend lines, ya dusre technical indicators ka istemaal kar sakte hain. 2.Entry and Exit Points: Hanging man candlestick pattern ke entry point ko confirm karne ke baad, aap apne trade ke entry aur exit points decide kar sakte hain. Entry point ke liye aap stop loss aur target price ko set kar sakte hain, jisse aap apne risk ko manage kar sakte hain. Risk Management: Hanging man candlestick pattern ko trade karte waqt risk management ka dhyaan rakhna zaroori hai. Apne trades ko monitor karein aur stop loss ka istemaal karke apne losses ko limit karein. Conclusion: Hanging man candlestick pattern bearish reversal signal hai, jo traders ko market trends aur price movements ke baare mein important information provide karta hai. Is pattern ko samajhna aur sahi tareeqe se trade karna trading skills ko improve kar sakta hai. Apne trades ko manage karne ke liye hamesha risk management techniques ka istemaal karein. Practice aur experience ke saath, aap hanging man candlestick pattern ko successfully trade kar sakte hain. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#4 Collapse

Hanging man pattern ka Introduction kya hy ek candlestick pattern hai jo technical analysis mein istemaal kiya jaata hai. Candlestick patterns market ke price movements aur future trend ke bare mein hamain samajhne mein madad karte hain. Hanging Man pattern bearish trend ke reversal ke signals provide karta hai.Hanging Man pattern ek single candlestick pattern hai aur usually uptrend ke baad dikhta hai. Is pattern ko recognize karne ke liye kuch important elements hote hain. Ek Hanging Man candlestick pattern mein price open aur close ke beech mein horizontal line hoti hai. Iske neeche ki taraf ek long lower shadow hoti hai, jo usually double ya triple length ki hoti hai as compared to the body of the candle. Upper shadow bahut choti hoti hai ya bilkul nahi hoti. Hanging Man Pattern ki Identification kya hy pattern ka interpretation yeh hai ki market ke bullish trend ke baad selling pressure increase ho rahi hai aur bears (sellers) control mein aa rahe hain. Hanging Man pattern bullish trend ke reversal ke potential signals provide karta hai aur traders ko selling opportunities suggest karta hai. Jab ye pattern confirm ho jaata hai, toh traders selling positions enter kar sakte hain.Agar Hanging Man pattern confirm hota hai, toh traders ko iska confirmation wait karna chahiye. Confirmation ke liye, next candle ki price action ka observation karna zaroori hai. Agar next candle bearish (downward) trend mein open hoti hai aur Hanging Man candle ke neeche close hoti hai.

Hanging Man Pattern ki Identification kya hy pattern ka interpretation yeh hai ki market ke bullish trend ke baad selling pressure increase ho rahi hai aur bears (sellers) control mein aa rahe hain. Hanging Man pattern bullish trend ke reversal ke potential signals provide karta hai aur traders ko selling opportunities suggest karta hai. Jab ye pattern confirm ho jaata hai, toh traders selling positions enter kar sakte hain.Agar Hanging Man pattern confirm hota hai, toh traders ko iska confirmation wait karna chahiye. Confirmation ke liye, next candle ki price action ka observation karna zaroori hai. Agar next candle bearish (downward) trend mein open hoti hai aur Hanging Man candle ke neeche close hoti hai.  Treading Principle kya hy traders selling positions enter kar sakte hain. Stop loss level ko set karte hue, traders apni positions manage kar sakte hain.Hanging Man pattern ke saath kuch additional indicators aur tools ka bhi istemaal kiya ja sakta hai, jaise ki trend lines, moving averages, aur oscillators, taaki traders ko is pattern ki validity aur accuracy ka better idea mil sake.Hanging Man pattern ka use karne se pehle, traders ko market ke overall context aur other technical indicators ka bhi dhyaan dena chahiye. Ek pattern ke akele se rely karne se pehle, iska confirmation aur validation important hai. Traders ko is pattern ke saath risk management ka bhi dhyaan rakhna chahiye.Traders ko Hanging Man pattern aur dusre candlestick patterns ka study karna chahiye taaki unko market ke movements aur trends ka better understanding ho sake. Technical analysis mein candlestick patterns valuable tools hote hain,

Treading Principle kya hy traders selling positions enter kar sakte hain. Stop loss level ko set karte hue, traders apni positions manage kar sakte hain.Hanging Man pattern ke saath kuch additional indicators aur tools ka bhi istemaal kiya ja sakta hai, jaise ki trend lines, moving averages, aur oscillators, taaki traders ko is pattern ki validity aur accuracy ka better idea mil sake.Hanging Man pattern ka use karne se pehle, traders ko market ke overall context aur other technical indicators ka bhi dhyaan dena chahiye. Ek pattern ke akele se rely karne se pehle, iska confirmation aur validation important hai. Traders ko is pattern ke saath risk management ka bhi dhyaan rakhna chahiye.Traders ko Hanging Man pattern aur dusre candlestick patterns ka study karna chahiye taaki unko market ke movements aur trends ka better understanding ho sake. Technical analysis mein candlestick patterns valuable tools hote hain,

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 11:42 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим