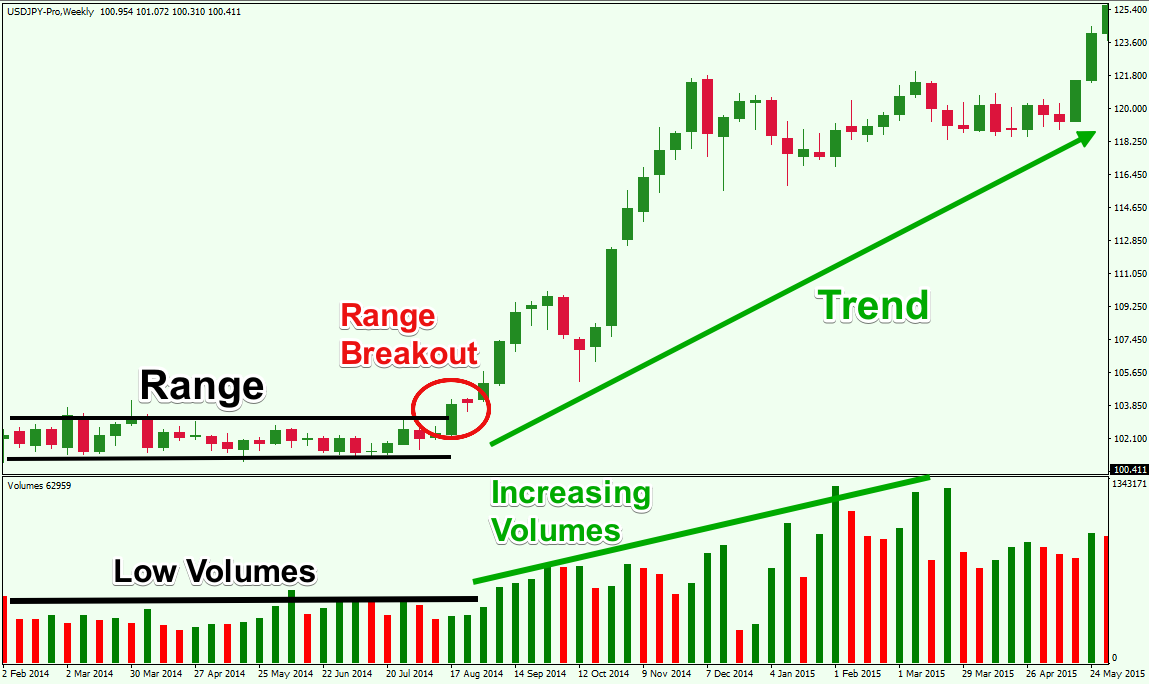

Range breakout

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Range breakoutrange breakout strategy ki baat kren to ye ham asi situation ko kehty hen jo pehlay 30 minutes tak market ki moment rahi ho chahay wo up ho ya down, 5 minutes charts 5 EMA aur 20 EMA k sath trading decisions liay jatay hain, 20 EMA system ma use honay wala aik important technical indicator ha, lihaza is ma entry point pehlay 5 minutes ki candle ki opening range sa outside par hota ha, is strategy k liay MACD aur Stochastic indicators kafi useful hotay hain, is strategy k liay hmain market k different sessions k closing time ko mind ma rakhna chaiay ta k un k open honay par trades set karnay ma asani ho aur hm achi entering oppertunity miss na karain, lihaza hmain market ma entry k liay pairs ki moment aur routine ko b mind ma rakhna chaiay aur apni learning ko use kar k acha entry point select karain, tp aur sl ka proper use karain ta k agr market koi unpredicted moment b karay to hmain ziada loss na ho aur hmara capital safe range breakout trading framework kay sath ap kay pass aam top standard gathering 3 mint kay ley hota hi trail batay hein keh aik bar jab ap kay pass meeting ka high ya low ho jata hi or es kay converse ho jata hi to ap kay pass negative pehlo ka opening ho jata hi or aam zenith baqi kay days es ko low nahi daikh saktay hein to aap aam top standard baqi days bhe es say low nahi kar torture gay ager ap kay pass negative pehlo ka opening nahi helloes ke importance ke wajah say advancement kay imkan open or khas top standard opening ke limit or trading framework kay kafi chance talash hote helloexchanging mein opening reach karna trading cheezon ko asan karna hota hi or raston ka bhe tayon karna hota hi apnay stop ko kahan standard rakhna he es kay ley koi district hota hiTradingrange breakout trading strategy kay sath sath ap kay pass aam tor par session 3 mint kay ley hota hey trail batay hein keh aik bar jab ap kay pass session ka high ya low ho jata hey or es kay opposite ho jata hey to ap kay pass negative pehlo ka gap ho jata hey or aam tor baqi kay days es ko low nahi daikh saktay hein to aap aam tor par baqi days bhe es say low nahi kar pain gay ager ap kay pass negative pehlo ka gap nahi heyes ke importance ke wajah say movement kay imkan open or khas tor par opening ke limit or trading strategy kay kafi chance talash hote hey.echnically Market Movement ki jo maximum range limit hoti hai mean resistance ya minimum range limit hoti hai mean support tou kabhi kabhi aesa time bhi ata hai ky same support ya resistance break bhi ho jati hain tou ham in ko range breakout kehty hain ky jab market maximum support ya resistance ko break kerti hai tou woh first time hota hai ky kisi bhi pair main market ki price minimum ya maximum limit ko break ker chuki hai tou ham aesy time per trade open ker ky bara risk lety hain ky hamain further market ki movement ka koi idea nehi hota ky support aur resistance already break ho chuki hoti hai tou hamain aesy time per wait kerna chahiay ky jab market reverse order main move kerna shuru ker dy tab ham trade open ker ky continue ker sakain. -

#3 Collapse

ar Friends, Forex me Maximum range breakout strategy ki baat kren to ye ham asi situation ko kehty hen jo pehlay 30 minutes tak market ki moment rahi ho chahay wo up ho ya down, 5 minutes charts 5 EMA aur 20 EMA k sath trading decisions liay jatay hain, 20 EMA system ma use honay wala aik important technical indicator ha, lihaza is ma entry point pehlay 5 minutes ki candle ki opening range sa outside par hota ha, is strategy k liay MACD aur Stochastic indicators kafi useful hotay hain, is strategy k liay hmain market k different sessions k closing time ko mind ma rakhna chaiay ta k un k open honay par trades set karnay ma asani ho aur hm achi entering oppertunity miss na karain, lihaza hmain market ma entry k liay pairs ki moment aur routine ko b mind ma rakhna chaiay aur apni learning ko use kar k acha entry point select karain, tp aur sl ka proper use karain ta k agr market koi unpredicted moment b karay to hmain ziada loss na ho aur hmara capital safe rahay.Jab bhi market kisi direction main movement ker rehi hoti hai tou woh aik specific range ky darmian hi movement ker rehi hoti hai ky price minimum aur price maximum limits hoti hain jin ky darmian hi market by kabhi minimum ki taraf movement kerna hoti hai aur kabhi maximum ki taraf tou ham same time main same direction main trade open ker ky acha profit bana sakty hain lekin forex market ki language main same minimum price limit ko support kehty hain jabky maximum price limit ko resistance kehty hain tou ham forex market main in support aur resistance ko follow kerty huey hi apni trade sell aur buy main enter kerty hain tou hamain open trade main profit ya loss hota hai ky ham kisi aik point sy trade enter ker ky market ki maximum range tak same direction main trade ko continue rakhty hain jabky reverse direction main market ki movement per loss aur forward direction main range limit tak market ki movement sy hamain profit hasil hota hai -

#4 Collapse

Range breakout: Forex market mein range breakout ka matlab hota hai, jab kisi currency pair ka price ek defined range ke bahar nikalta hai. Ye range typically support aur resistance levels ke beech hoti hai. Range breakout tab hota hai jab price ek specific level ko break karke uske upar ya niche move karta hai. Range breakout trading strategy mein traders ye try karte hain ki price range se bahar nikalne ke baad ek strong trend shuru kare. Agar price range ke bahar move karne ke baad strong upward trend show kar raha hai, toh traders long positions lete hain. Aur agar price range ke bahar move karne ke baad strong downward trend show kar raha hai, toh traders short positions lete hain. Traders range breakout ko identify karne ke liye technical analysis tools jaise ki support aur resistance levels, trend lines, chart patterns, aur indicators ka istemal karte hain. Range breakout trade karne se pehle, traders stop-loss aur take-profit levels set karte hain, taki unhe pata rahe ki trade unfavorable direction mein chalne par kab exit karna hai. Range breakout trading strategy mein, traders ko price ke movement ke liye careful observation karna hota hai, aur sahi entry aur exit points identify karne ke liye market analysis karna hota hai. Ismein patience aur discipline bahut important hote hain, kyunki range breakout hone ke baad bhi false breakouts ho sakte hain. Ye strategy samajhne ke liye, traders ko forex trading aur technical analysis concepts ko study aur practice karna chahiye. Advantages of range breakout: Range breakout forex trading mein ek tarika hai jahan par traders price range se bahar nikalne par focus karte hain. Jab market kuch samay tak ek range mein trade kar rahi hoti hai, jaise ki specific high aur low levels ke beech, toh traders breakout ki possibility par dhyan dete hain. Jab price range se bahar nikal jata hai, yani ki upper level ko cross karke upar jaata hai ya phir lower level ko cross karke neeche jaata hai, toh woh breakout kaha jata hai. Range breakout traders is breakout ko trading opportunity ke roop mein dekhte hain, kyun ki isse market mein volatility aur price movement ka chance hota hai. Range breakout ki trading strategy mein traders generally ek stop loss aur target level set karte hain. Jab price range se bahar nikalta hai, traders entry karte hain aur stop loss level ko set karte hain, jo unki risk tolerance aur market conditions par depend karta hai. Target level price movement ke liye set kiya jata hai, jahan par traders apne profits ko book kar sakte hain. Range breakout strategy mein technical indicators, jaise ki Bollinger Bands, ATR (Average True Range), aur momentum oscillators, jaise ki RSI (Relative Strength Index) aur Stochastic, ka istemal kiya ja sakta hai. In indicators ki madad se traders range breakout ki possibility ko identify kar sakte hain. Yeh strategy traders ke liye suitable ho sakti hai jab market mein consolidation phase ho aur price range bound movement kar raha ho. Range breakout mein entry points aur stop loss levels ko carefully determine karna zaroori hai, aur iske liye technical analysis aur risk management ke acche understanding ki zaroorat hoti hai. Disclaimer: Forex trading mein risk hota hai aur ismein loss ho sakta hai. Main aapko salah deta hoon ki aap trading decisions lene se pehle apne risk tolerance aur financial situation ko dhyan mein rakhein aur ek financial advisor ki madad lein. Explanation of range breakout: Forex me range breakout ka matlab hota hai jab currency pair ya kisi bhi financial instrument ka price ek specific range se bahar nikalta hai. Range breakout trading strategy ko traders use karte hain, jisme wo price ke breakout ke baad trading opportunities dhundte hain. Range breakout strategy me traders usually ek specific price range define karte hain, jisme price kuch samay tak ghoomta rehta hai. Jab price us range se bahar nikalta hai, wo ek potential breakout signal hai. Breakout direction pe depend karta hai ki price range ke upar ya niche se bahar nikalta hai. Is strategy me traders price range ko closely monitor karte hain aur jab breakout signal milta hai, wo trading positions lete hain. Breakout ke baad price me volatility increase hoti hai, jisse traders profit generate kar sakte hain. Range breakout strategy me stop-loss aur target levels properly define karna important hota hai, taki excessive losses se bacha ja sake. Technical analysis tools jaise ki support aur resistance levels, chart patterns, aur indicators range breakout opportunities identify karne me madad karte hain. Yad rahe, forex trading me risk involved hota hai, isliye proper risk management aur knowledge hona zaruri hai. Trading strategies pe depend karke, traders ko market ko closely monitor karna hota hai aur market conditions ko analyze karte huye decisions lena hota hai. -

#5 Collapse

Pairs for Range Breakout Strategy Is strategy ky leay pair ki baat ki jay to ye strategy mostly eurousd k leay hai aur ye is ky ilawa eurpean major k leay bhi effectively use ki ja sakti hai. Jesa k forex market 24 hrs open rehti hai but friday evening ma is pair ki movement consistent ni rehti. Trading the eurpean open range has three steps. 1. Half an hour london session k open hony sy pehle hamy market ma high or low ko identify karna hota hai. 2. Es step ma hamy Average True Range k zaryae plus minus 10 pip break out ko dakhna hota hai. Ye attempt market ki direction ko mahloom karny k lae ki jati hai. 3. Final step ma ham bullish or bearish trade ko attempt karty hain. Ye ham 5 minute time frame ko judge kar k kar sakty hain. aur is ma mazeed improvement k lae ham rsi ko bhi use kar sakty hain. Resistance of Maximum Range Technically Market Movement ki jo maximum range limit hoti hai mean resistance ya minimum range limit hoti hai mean support tou kabhi kabhi aesa time bhi ata hai ky same support ya resistance break bhi ho jati hain tou ham in ko range breakout kehty hain ky jab market maximum support ya resistance ko break kerti hai tou woh first time hota hai ky kisi bhi pair main market ki price minimum ya maximum limit ko break ker chuki hai tou ham aesy time per trade open ker ky bara risk lety hain ky hamain further market ki movement ka koi idea nehi hota ky support aur resistance already break ho chuki hoti hai tou hamain aesy time per wait kerna chahiay ky jab market reverse order main move kerna shuru ker dy tab ham trade open ker ky continue ker sakain. -

#6 Collapse

Maximum Range break out hikmat e amli aik maqbool tijarti hikmat e amli hai jisay tajir market mein mumkina break out ki shanakht ke liye istemaal karte hain. hikmat e amli mein aik khaas muddat ke douran kisi asasa ya security ki ziyada se ziyada had ki nishandahi karna aur phir tijarat shuru karne ke liye is had ke oopar ya neechay break out ka intzaar karna shaamil hai . Maximum Range break out hikmat e amli ko nafiz karne ke liye yeh iqdamaat hain : Identify the maximum range of an asset or security over a certain period : Aisa karne ke liye, aap aik chart istemaal kar satke hain aur aik makhsoos muddat ke douran asasa ki qeemat ke sab se ziyada aur kam tareen points ko talaash kar satke hain. muddat aap ke trading ke andaaz aur asasa ke lehaaz se mukhtalif ho sakti hai jo aap trade kar rahay hain . Wait for a breakout : Aik baar jab aap ne ziyada se ziyada had ki nishandahi kar li hai, to asasa ki qeemat is had se oopar ya neechay anay ka intzaar karen. break out ki durustagi ki tasdeeq ke liye is break out ke sath high volume hona chahiye . Initiate a trade : Break out ki tasdeeq honay ke baad, is baat par munhasir hai ke aaya break out ziyada se ziyada had se oopar hai ya neechay . Place stop-loss orders : Khatray ka intizam karne ke liye, break out point ke bilkul neechay stap loss orders den. break out ghalat signal honay ki soorat mein yeh aap ke nuqsanaat ko mehdood kar day ga . Take profits : Apne rissk inaam ke tanasub ki bunyaad par apne munafe ka hadaf muqarrar karen. aap –apne munafe ke hadaf ka taayun karne ke liye takneeki tajzia ke tools jaisay ke support aur rizstns levels ya fibonacci retracement levels istemaal kar satke hain . Yeh note karna zaroori hai ke agarchay ziyada se ziyada range break out hikmat e amli mumkina break out ki nishandahi karne mein kargar ho sakti hai, lekin yeh faul proof nahi hai. ghalat break out ho satke hain, aur yeh zaroori hai ke stap loss orders aur munasib position ka size istemaal kar ke apne khatray ka intizam karen. mazeed bar-aan, taajiron ko tijarat mein daakhil honay se pehlay hamesha apni tehqeeq aur tajzia karna chahiye . -

#7 Collapse

Assalamualaikum! Umeed hai k ap sb khariyat sy hongy. R apky trading sessions achy jaa rhy hongy.Aj ka hmra or discussion topic "Range bound trading". Dekhty hain k ye hmein Kya information deta hai r hmry ilam Mai Kesy ezafa krta hai. Introduction range bound trading aik tijarti hikmat e amli hai jo sikyortiz ki shanakht aur is se faida uthana chahti hai, jaisay stock, price channels mein trading. ahem support aur rizstns levels talaash karne aur inhen ufuqi trained lines se jornay ke baad, aik tridr lower trained line support ( channel ke neechay ) par security khareed sakta hai aur usay oopri trained line rizstns ( channel ke oopar ) par farokht kar sakta hai . keysteps range se munsalik tijarti hikmat e amli se morad woh yehn tareeqa hai jis mein tajir support trained line par kharedtay hain aur diye gaye stock ya option ke liye muzahmati ho to trained line ki satah par farokht karte hain. aala hajam ke break out se bhaari nuqsaan se bachney ke liye tajir oopri aur nichli trained linon ke bilkul oopar stop las points sy to rakhtay hain. aam tor par, tajir apni kamyabi ke imkanaat ko badhaane ke liye dosray isharay, jaisay hajam ke sath mil kar range bound trading ka istemaal karte hain . Trading Range strategies support aur rizstns : agar koi security achi terhan se qaim trading range mein hai, to traders is waqt khareed satke hain jab qeemat support ke qareeb pahonch jaye aur koi muzahmat tak pounchanay par farokht kar sakay. takneeki isharay, jaisay ke rishta daar taaqat ka asharih ( rsi ), or to , aur commodity channel index ( cci ), ka istemaal ziyada sy kharidi hui aur ziyada farokht honay wali sharait ki tasdeeq ke liye kya ja sakta hai jab qeemat tijarti had ke andar barh jati hai. misaal ke tor par, aik tajir is waqt lambi position mein daakhil ho sakta hai jab stock ki qeemat support par trade kar rahi ho aur rsi 30 se ​​nechey over sealed reading deta hai. mutabadil ke tor par, tajir is waqt aik mukhtasir position kholnay ka faisla kar sakta hai jab rsi 70 se oopar ke over boat ilaqay mein chala jata hai. khatray ko kam karne ke liye stap las ka order trading range se bilkul bhe bahar rakha jana chahiye. break out aur break down : or to traders trading range se break out ya break down ki simt mein daakhil ho satke hain. is iqdaam ke durust honay ki tasdeeq karne ke liye, taajiron ko deegar asharie istemaal karne chahiye, jaisay ke hajam aur qeemat ki karwai. Or he misaal ke tor par, ibtidayi break out ya break down par koi hajam mein numaya izafah hona chahiye, sath hi tijarti ho range se bahar kayi bndyan. qeemat ka peecha karne ke bajaye, tajir tijarat mein daakhil honay se pehlay dobarah haasil karne ka intzaar karna chahtay hain. misaal ke tor par, khareed ki had ka order trading range ke bilkul oopar rakha ja sakta hai, jo ab support level ke tor par kaam sy karta hai. aik stap las order trading range ke mukhalif simt mein aik nakaam break out se bachanay ke liye baith Kar sakta hai . -

#8 Collapse

Range breakoutWhen using the range breakout method, the market's moment will change in 30 minutes, going either up or down. 5 minutes charts 5 EMA aur 20 EMA k sath trading decisions liay jatay hain, 20 EMA system ma use honay wala aik important technical indicator ha, lihaza is ma entry indicate pehlay 5 minutes ki candle ki opening range sa outside par hota ha, is strategy k liay the MACD value aur Stochastic indicators kafi useful hotay hain, is plan k liay hmain market k different sessions k closing time ko mind ma rakhna chaiay ta k un k open honay par trades set karnay ma asani ho aur hm achi entering oppertunity miss na karain, lihaza hmain market ma entry k liay connects ki right now aur habit ko b awareness ma rakhna chaiay aur apni learning ko use kar k acha entry point select karain, tp aur sl ka proper use karain ta k agr sale koi unpredicted moment b karay to hmain ziada loss na ho aur hmara capital safe range breakout trading framework kay sath ap kay pass aam top standard gathering 3 mint kay ley hota hi trail batay hein keh aik bar jab ap kay pass meeting ka high ya minimal ho jata hi or es kay converse ho jata hi to ap kay pass negative pehlo ka opening ho jata hi or aam zenith baqi kay days es ko low nahi daikh saktay hein to aap aam top standard baqi days bhe es say low nahi kar torture gay ager ap kay pass negative pehlo ka opening nahi helloes ke importance ke wajah say advancement kay imkan open or khas top standard opening ke limit or trading framework kay kafi chance talash hote helloexchanging mein opening reach karna trading cheezon ko asan karna hota hi or raston ka bhe tayon karna hota hi apnay stop ko kahan standard rakhna he es kay ley koi district hota hi Trading Range strategies The market's moment will shift in 30 minutes when employing the range breakout strategy, either moving up or down. 5 minutes charts 5 EMA aur 20 EMA k sath trading decisions liay jatay hain, 20 EMA system ma use honay wala aik important technical indicator ha, lihaza is ma entry indicate pehlay 5 minutes ki candle ki opening range sa outside par hota ha, is strategy k liay the MACD value aur Stochastic indicators kafi advantageous hotay hain, is establish k liay hmain marketplace k different discussions k closing time ko mind ma rakhna chaiay ta k un k open honay par trades set karnay ma asani ho aur hm achi entering oppertunity miss na karain, lihaza hmain market ma access k liay connects ki right now aur habit ko b awareness ma rakhna chaiay aur apni learning ko use kar k acha entry point select karain, tp aur sl ka proper use karain ta k agr sale koi unpredicted moment b karay to hmain ziada loss na ho aur hmara funding safe range breakout trading framework kay sath ap kay pass aam top standard gathering 3 mint kay ley hota hi trail batay hein keh aik bar jab ap kay pass reaching ka high ya minimal ho jata hi or es kay converse ho jata hi to ap kay pass negative pehlo ka opening ho jata hi or aam zenith baqi kay days es ko low nahi daikh saktay hein to aap aam top standard baqi days bhe es say low nahi kar torture gay ager ap kay pass negative pehlo ka opening nahi helloes ke importance ke wajah say advancement kay imkan open or khas top standard opening ke limit or trading framework kay kafi chance talash hote helloexchanging mein opening reach karna trading cheezon ko asan karna hota hi or raston ka bhe tayon karna hota hi apnay stop ko kahan standard rakhna he es kay ley koi district hota hi

Trading Range strategies The market's moment will shift in 30 minutes when employing the range breakout strategy, either moving up or down. 5 minutes charts 5 EMA aur 20 EMA k sath trading decisions liay jatay hain, 20 EMA system ma use honay wala aik important technical indicator ha, lihaza is ma entry indicate pehlay 5 minutes ki candle ki opening range sa outside par hota ha, is strategy k liay the MACD value aur Stochastic indicators kafi advantageous hotay hain, is establish k liay hmain marketplace k different discussions k closing time ko mind ma rakhna chaiay ta k un k open honay par trades set karnay ma asani ho aur hm achi entering oppertunity miss na karain, lihaza hmain market ma access k liay connects ki right now aur habit ko b awareness ma rakhna chaiay aur apni learning ko use kar k acha entry point select karain, tp aur sl ka proper use karain ta k agr sale koi unpredicted moment b karay to hmain ziada loss na ho aur hmara funding safe range breakout trading framework kay sath ap kay pass aam top standard gathering 3 mint kay ley hota hi trail batay hein keh aik bar jab ap kay pass reaching ka high ya minimal ho jata hi or es kay converse ho jata hi to ap kay pass negative pehlo ka opening ho jata hi or aam zenith baqi kay days es ko low nahi daikh saktay hein to aap aam top standard baqi days bhe es say low nahi kar torture gay ager ap kay pass negative pehlo ka opening nahi helloes ke importance ke wajah say advancement kay imkan open or khas top standard opening ke limit or trading framework kay kafi chance talash hote helloexchanging mein opening reach karna trading cheezon ko asan karna hota hi or raston ka bhe tayon karna hota hi apnay stop ko kahan standard rakhna he es kay ley koi district hota hi

-

#9 Collapse

Assalam Alykum me umeed krti hoon ap sb log kheriyat se ho gay or ap logo ka trading seesion bhi acha chal Raha ho ga .Aj hmara topic hai Range breakout chale os k baray mein kuch maloomat hasil krtay Hain. Explanation:Range break out aik takneeki tajziye ki tijarti hikmat e amli hai jo qeematon ki ahem naqal o harkat ki shanakht aur faida uthany ki koshish karti hai jo is waqt hoti hai jab kisi asasa ki qeemat aik mutayyan tijarti had se nikal jati hai. Tijarti had se morad woh muddat hai jis ke douran kisi asasay ki qeemat mustahkam hoti hai aur nisbatan tang qeemat ki had ke andar muntaqil hoti hai, aksar ufuqi support aur muzahmati sthon ki khasusiyat hoti hai. Jab range break out hota hai, to yeh market ke jazbaat mein mumkina tabdeeli aur khareed o farokht ke dabao mein izafay ki nishandahi karta hai. Range break out hikmat amlyon ko istemaal karne walay taajiron ka maqsad qeemat ki anay wali raftaar aur is ke nateejay mein qeemat ki tehreek se munafe haasil karna hai. range break out trading mein shaamil kaleedi anasir aur tahaffuzaat yeh hain : 1. Trading range ki shanakht : Range break out trading ka pehla marhala trading range ki shanakht karna hai. tajir aam tor par pichlle jhoolon ki oonchaiyon ki bunyaad par range ki oopri aur nichli hudood ko nishaan zad karne ke liye ufuqi lakerain khenchte hain. range mein qeemat ki salakhon ya mom btyon ki kaafi tadaad ko shaamil karna chahiye taakay is ki darostiyat ko qaim kya ja sakay. 2. Break out ki tasdeeq : Tajir oopri baondri ( muzahmat ) ke oopar ya trading range ki nichli baondri ( support ) ke neechay wazeh aur faisla kin break out ka intzaar karte hain. break out mazboot tijarti hajam ke sath hona chahiye aur tarjeehi tor par ikhtitami bunyaad par hona chahiye .3. Stop lost placement : Khatray ka intizam karne ke liye, traders aam tor par stap loss orders trading range ke bilkul bahar, break out point se bahar set karte hain. is se mumkina nuqsanaat ko mehdood karne mein madad millti hai agar break out ghalat signal niklay ya agar market taizi se palat jaye. 4. Qeemat ke hadaf ka taayun : Tajir tijarti had ki oonchai ki pemaiesh karkay aur usay break out ki simt mein paish karkay qeemat ka hadaf qaim karte hain. yeh break out ke baad qeemat ke mumkina iqdaam ka takhmeenah faraham karta hai. mazeed bar-aan, tajir deegar takneeki asharion ya chart ke namonon par ghhor kar satke hain taakay support ya muzahmat ke ilaqon ki nishandahi ki ja sakay jo izafi qeemat ke ahdaaf ke tor par kaam kar satke hain. 5. Dakhlay aur bahar niklny ki hikmat e amli :Break out ki tasdeeq honay ke baad, tajir muzahmati satah se oopar khareed order ya support level se neechay farokht ke order ke sath tijarat mein daakhil hotay hain. bahar niklny ki hikmat e amli tajir ki tarjeehat aur market ke makhsoos halaat ke lehaaz se mukhtalif ho sakti hai. kuch tajir pehlay se mutayyan munafe ka hadaf istemaal kar satke hain, jabkay deegar qeematon ki barri naqal o harkat ko pakarney ke liye trailing stop las orders istemaal kar satke hain. yeh note karna zaroori hai ke range break out ki hikmat e amli faul proof nahi hain, aur ghalat break out ho satke hain. is hikmat e amli ko nafiz karte waqt taajiron ko ahthyat brtni chahiye aur izafi awamil par ghhor karna chahiye jaisay ke market mein utaar charhao, rujhan ki taaqat, aur market ke majmoi halaat. mazeed bar-aan, range break out hikmat e amli makhsoos marketon ya time frame tak mehdood nahi hai. un ka itlaq mukhtalif maliyati alaat par kya ja sakta hai, Bashmole stock, ashya, krnsyon, aur crypto currencies, aur un ka istemaal intra day trading, soyng trading, ya taweel mudti sarmaya kaari mein kya ja sakta hai. Kamyaab range break out trading ke liye takneeki tajzia ki mharton, rissk managment taknikoon , aur market ki harkiyaat ki samajh ke imtezaaj ki zaroorat hoti hai. Break out ki toseeq karne aur kamyaab tijarat ke imkaan ko badhaane ke liye tajir aksar izafi isharay istemaal karte hain, jaisay moving average, ascletreous , ya chart patteren. Kisi bhi tijarti hikmat e amli ki terhan, live trading mein laago karne se pehlay tareekhi qeemat ke adaad o shumaar ka istemaal karte hue range break out hikmat e amli ko back test aur behtar karne ki sifarish ki jati hai. Is se taajiron ko hikmat e amli par aetmaad haasil karne aur mumkina taqaton aur kamzoriyon ki nishandahi karne mein madad millti hai. Mazeed bar-aan, taajiron ko hamesha market ki khabron aur waqeat ke baray mein bakhabar rehna chahiye jo asasa ki tijarat ko mutasir kar satke hain, kyunkay ghair mutawaqqa paish Raft range break out hikmat amlyon ki taseer ko mutasir kar sakti hai . -

#10 Collapse

RANGE BREAKOUT IN TRADINGIntroduction Range breakout trading mein aik important concept hai. Jab ek security ya financial instrument, jaise stocks ya currencies, ek specific range mein trade kar rahi hoti hai aur phir us range ko tor kar upar ya neechay move karti hai, toh usay range breakout kaha jata hai. Yeh movement traders ke liye ek trading opportunity create karti hai. Details Range breakout ka importance trading mein bahut hota hai. Yeh traders ko market trends aur price movements ki samajh mein madad karta hai. Jab ek security ek range mein trade karti hai, toh us range ko identify karna traders ke liye useful hota hai. Range ko samajhne se, traders ko pata chalta hai ke security ki trading activity kis range mein limited hai aur kis range ke bahar jaa sakti hai. Range breakout trading strategies istemal kar ke traders market ke potential turning points aur reversals ko identify kar sakte hain. Jab ek security range ke bahar move karti hai, toh yeh ek price reversal ya trend change ka indication ho sakta hai. Range breakout traders is opportunity ko pakar, security ko buy ya sell kar ke profit earn kar sakte hain. Yeh concept especially trend-following traders ke liye important hota hai. Agar koi trader ek uptrend ya downtrend mein trade karna chahta hai, toh woh range breakout ka istemal kar sakta hai. Jab security range ko tor kar trend direction mein move karti hai, toh woh trader us trend ko follow kar ke trade karta hai. Tips for traders Range breakout ka use karne ke liye, traders ko kuch factors consider karna zaruri hota hai. Pehle toh traders ko range ko identify karna hota hai. Iske liye woh high aur low price levels ko dekhte hain jin mein security trade kar rahi hai. Range ko identify karne ke baad, traders ko breakout point ko determine karna hota hai. Breakout point woh level hota hai jahan security range ko tor kar move karti hai. Is point ko identify karne ke liye, traders price patterns, technical indicators, aur market volume ka istemal karte hain. Range breakout trading mein stop-loss aur take-profit levels ka istemal karna zaruri hota hai. Stop-loss level ko define karne se, traders apne trades ko protect kar sakte hain agar price opposite direction mein move kare. Take-profit level ko set kar ke traders apne profits secure kar sakte hain. Precaution Range breakout trading ka istemal karte waqt, traders ko fake breakouts se bhi deal karna hota hai. Fake breakouts, yani jab price range ko tor kar move karta hai, lekin phir se range mein re-enter kar jata hai. Isse bachne ke liye, traders ko breakout confirmation ka wait karna hota hai. Woh security ka price action aur volume analysis karte hain taake sahi breakout ki confirmation mile. Summary Range breakout trading, trading mein aik important concept hai. Iska use kar ke traders market trends aur reversals ko identify kar sakte hain aur trading opportunities create kar sakte hain. Range breakout trading strategies ke istemal se traders apne profits ko maximize kar sakte hain. Lekin, ismein risk management aur fake breakouts ko samajhna zaruri hota hai. Range breakout trading mein successful hone ke liye, traders ko market ko closely observe karna aur technical analysis ka sahi istemal karna chahiye. -

#11 Collapse

Matches for Reach Breakout System Is methodology ky leay pair ki baat ki jay to ye technique for the most part eurousd k leay hai aur ye is ky ilawa eurpean significant k leay bhi really use ki ja sakti hai. Jesa k forex market 24 hrs open rehti hai yet friday night mama is pair ki development predictable ni rehti. Exchanging the eurpean open reach has three stages. 1. Thirty minutes london meeting k open hony sy pehle hamy market mama high or low ko recognize karna hota hai. 2. Es step mama hamy Normal Genuine Reach k zaryae in addition to short 10 pip break out ko dakhna hota hai. Ye endeavor market ki bearing ko mahloom karny k lae ki jati hai. 3. Last step mama ham bullish or negative exchange ko endeavor karty hain. Ye ham brief time span ko judge kar k kar sakty hain. aur is mama mazeed improvement k lae ham rsi ko bhi use kar sakty hain. Range breakout range breakout technique ki baat kren to ye ham asi circumstance ko kehty hen jo pehlay 30 minutes tak market ki second rahi ho chahay wo up ho ya down, 5 minutes diagrams 5 EMA aur 20 EMA k sath exchanging choices liay jatay hain, 20 EMA framework mama use honay wala aik significant specialized marker ha, lihaza is mama section point pehlay 5 minutes ki candle ki opening reach sa outside standard hota ha, is procedure k liay MACD aur Stochastic pointers kafi valuable hotay hain, is methodology k liay hmain market k various meetings k shutting time ko mind mama rakhna chaiay ta k un k open honay standard exchanges set karnay mama asani ho aur hm achi entering oppertunity miss na karain, lihaza hmain market mama passage k liay matches ki second aur routine ko b mind mama rakhna chaiay aur apni learning ko use kar k acha passage point select karain, tp aur sl ka legitimate use karain ta k agr market koi unpredicted second b karay to hmain ziada misfortune na ho aur hmara capital safe reach breakout exchanging system kay sath ap kay pass aam top standard social affair 3 mint kay ley hota greetings trail batay hein keh aik bar hit ap kay pass meeting ka high ya low ho jata hey or es kay chat ho jata hey to ap kay pass negative pehlo ka opening ho jata hey or aam pinnacle baqi kay days es ko low nahi daikh saktay hein to aap aam top standard baqi days bhe es say low nahi kar torment gay ager ap kay pass negative pehlo ka opening nahi helloes ke significance ke wajah say progression kay imkan open or khas top standard opening ke cutoff or exchanging structure kay kafi chance talash hote helloexchanging mein opening reach karna exchanging cheezon ko asan karna hota hey or raston ka bhe tayon karna hota hey apnay stop ko kahan standard rakhna he es kay ley koi region hota hey Exchanging range breakout exchanging system kay sath ap kay pass aam pinnacle standard meeting 3 mint kay ley hota hello trail batay hein keh aik bar poke ap kay pass meeting ka high ya low ho jata hello or es kay inverse ho jata hello to ap kay pass negative pehlo ka hole ho jata hello or aam peak baqi kay days es ko low nahi daikh saktay hein to aap aam pinnacle standard baqi days bhe es say low nahi kar torment gay ager ap kay pass negative pehlo ka hole nahi heyes ke significance ke wajah say development kay imkan open or khas peak standard opening ke cutoff or exchanging technique kay kafi chance talash hote hey.echnically Market Development ki jo greatest reach limit hoti hai mean opposition ya least reach limit hoti hai mean help tou kabhi aesa time bhi ata hai ky same help ya obstruction break bhi ho jati hain tou ham in ko range breakout kehty hain ky punch market most extreme help ya opposition ko break kerti hai tou woh first time hota hai ky kisi bhi pair fundamental market ki cost least ya greatest cutoff ko break ker chuki hai tou ham aesy time per exchange open ker ky bara risk lety hain ky hamain further market ki development ka koi thought nehi hota ky support aur opposition as of now break ho chuki hoti hai tou hamain aesy time per stand by kerna chahiay ky hit market switch request primary move kerna shuru ker dy tab ham exchange open ker ky proceed ker sakain. -

#12 Collapse

DETAILS OF RANGE BREAKOUTS...&& Dear friends I know ap sab khariyat sy hoon gy Forex exchanging Marketing main range breakouts ki bunyad pay tradings kar rahy hoon gey our apna profile mutwatir hasil kar rahy hoon gey our tradings ky manzar ko strategy ki baat kren to ye ham asi situation ko kehty hen jo pehlay 30 minutes tak market ki moment rahi ho chahay wo up ho ya down, 5 minutes charts k sath trading decisions liay system ma use honay wala aik important technical indicator ha, lihaza is ma entry point pehlay 5 minutes ki candle ki opening range sa outside par Hei our indicators kafi useful hotay hain, is strategy k liay hmain market k different sessions k closing time ko mind ma rakhna chaiay ta k un k open honay par trades set karnay ma asani ho aur hm achi entering oppertunity miss na karain, lihaza hmain market ma entry k liay pairs ki moment aur routine ko b mind ma rakhna chaiay aur apni learning ko use kar k acha entry point select karain, tp aur sl ka proper use karain ta k agr market Mei Tradings ky liye hard work karna zoriri hota Hai our yeh hamary liye comfortable hota Hai.... KEY TAKEAWAYES...&& Dear members forex tradings marketing and Mei Hmain range breakouts Mei ziada loss na ho aur hmara capital safe range breakout trading framework kay sath ap kay pass aam top standard gathering 3 mint kay ley hota hi trail batay hein keh aik bar jab ap kay pass meeting ka high ya low ho jata hi or es kay converse ho jata hi to ap kay pass negative pehlo ka opening ho jata hi or aam zenith baqi kay days es ko low nahi daikh saktay hein to aap aam top standard baqi days bhe es say low nahi kar torture gay ager ap kay pass negative pehlo ka opening nahi helloes ke importance ke wajah say advancement kay imkan open or khas top standard opening ke limit or trading framework kay kafi chance talash hote helloexchanging mein opening reach karna trading cheezon ko asan karna hota hi or raston ka bhe tayon karna hota hi apnay stop ko kahan standard hota Hai... TRADINGS STRATEGY'S...!!Dear friends Forex Mei RANGE OF BULLISH BREAKOUTS TRADING STRATEGY'S ap kay pass aam tor par session 3 mint kay ley hota hey trail batay hein keh aik bar jab ap kay pass session ka high ya low ho jata hey or es kay opposite ho jata hey to ap kay pass negative pehlo ka gap ho jata hey or aam tor baqi kay days es ko low nahi daikh saktay hein to aap aam tor par baqi days bhe es say low nahi kar pain gay ager ap kay pass negative pehlo ka gap nahi heyes ke importance ke wajah say movement kay imkan open or khas tor par opening ke limit or trading strategy kay kafi chance talash hote hey.echnically Market Movement ki jo maximum range limit hoti hai mean resistance ya minimum range limit hoti hai mean support tou kabhi kabhi aesa time bhi ata hai ky same support ya resistance break bhi ho jati hain tou ham in ko range breakout kehty hain ky jab market maximum support ya resistance level khud hi uptrend our Trendiness ko stop loss par loss recovery karty hen... -

#13 Collapse

trading strategies istemal kar ke traders market ke potential turning points aur reversals ko identify kar sakte hain. Jab ek security range ke bahar move karti hai, toh yeh ek price reversal ya trend change ka indication ho sakta hai. Range breakout traders is opportunity ko pakar, security ko buy ya sell kar ke profit earn kar sakte hain.Yeh concept especially trend-following traders ke liye important hota hai. Agar koi trader ek uptrend ya downtrend mein trade karna chahta hai, toh woh range breakout ka istemal kar sakta hai. Jab security range ko tor kar trend direction mein move karti hai, toh woh trader us trend ko follow kar ke trade karta hai. Tips for traders Range breakout ka use karne ke liye, traders ko kuch factors consider karna zaruri hota hai. Pehle toh traders ko range ko identify karna hota hai. Iske liye woh high aur low price levels ko dekhte hain jin mein security trade kar rahi hai. Range ko identify karne ke baad, traders ko breakout point ko determine karna hota hai. Breakout point woh level hota hai jahan security range ko tor kar move karti hai. Is point ko identify karne ke liye, traders price patterns, technical indicators, aur market volume ka istemal karte hain.

Range breakout trading mein stop-loss aur take-profit levels ka istemal karna zaruri hota hai. Stop-loss level ko define karne se, traders apne trades ko protect kar sakte hain agar price opposite direction mein move kare. Take-profit level ko set kar ke traders apne profits secure kar sakte hain. Precaution Range breakout trading ka istemal karte waqt, traders ko fake breakouts se bhi deal karna hota hai. Fake breakouts, yani jab price range ko tor kar move karta hai, lekin phir se range mein re-enter kar jata hai. Isse bachne ke liye, traders ko breakout confirmation ka wait karna hota hai. Woh security ka price action aur volume analysis karte hain taake sahi breakout ki confirmation mile.

- Mentions 0

-

سا0 like

-

#14 Collapse

Forex trading mein "range breakout" ek trading strategy hai jo traders istemaal karte hain jab market mein ek price range se bahar nikalne ka expectation hota hai. Ye strategy market volatility aur price movement ke based par kaam karti hai. Range breakout ki tafsiri hoti hai jab price kisi resistance ya support level ko paar karke ek naya trend banata hai. Range breakout strategy ka istemal karne ke liye traderon ko price range tay karna hota hai. Price range ek specific price band hota hai jahan par price kafi samay tak ghoom rahi hoti hai. Jab price range identify ho jata hai, to traders ek breakout ka wait karte hain jab price range se bahar nikalne ka signal milta hai. Jab price resistance level ko paar karke upar nikalta hai ya support level ko paar karke neeche jaata hai, to range breakout ka signal samjha jata hai. Range breakout strategy ke liye traders lagbhag do tareekon se tay karte hain. Ek tareeka hai "buy breakout" aur dusra tareeka hai "sell breakout". Buy breakout mein trader price range se upar nikalne ka signal pakar kar long position lete hain. Isme stop loss order price range ke neeche lagaya jata hai. Jab price range se bahar nikalta hai, to trader profit target ke liye exit point tay karta hai.Sell breakout mein trader price range se neeche jaane ka signal pakar kar short position lete hain. Isme stop loss order price range ke upar lagaya jata hai. Jab price range se bahar nikalta hai, to trader profit target ke liye exit point tay karta hai. Range breakout strategy ka istemal karne se traders range-bound market conditions se nikal sakte hain aur strong trending markets mein entry kar sakte hain. Ye strategy market volatility aur price momentum ke samay acche results deta hai.Range breakout strategy ka istemal karne ke liye traderon ko price range ko sahi tareekay se identify karna aur breakout signal ko confirm karna zaroori hai. Iske saath hi sahi risk management, stop loss aur profit targets ka dhyan rakhna bhi zaroori hai. In conclusion, range breakout forex trading mein ek prasiddh strategy hai jisme traders price range se bahar nikalne ka expectation rakhte hain. Range breakout strategy ko istemal karne ke liye traders ko price range tay karna hota hai aur jab price range se bahar nikalta hai, to unko entry aur exit points tay karna hota hai. Range breakout strategy range-bound market conditions se nikalne aur trending markets mein entry karne mein madadgar sabit ho sakti hai. Is strategy ka istemal karne se pehle, traders ko sahi risk management aur money management ka dhyan rakhna zaroori hai.

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 Collapse

Dear friends I know ap sab khariyat sy hoon gy Forex exchanging Marketing main range breakouts ki bunyad pay tradings kar rahy hoon gey our apna profile mutwatir hasil kar rahy hoon gey our tradings ky manzar ko strategy ki baat kren to ye ham asi situation ko kehty hen jo pehlay 30 minutes tak market ki moment rahi ho chahay wo up ho ya down, 5 minutes charts k sath trading decisions liay system ma use honay wala aik important technical indicator ha, lihaza is ma entry point pehlay 5 minutes ki candle ki opening range sa outside par Hei our indicators kafi useful hotay hain, is strategy k liay hmain market k different sessions k closing time ko mind ma rakhna chaiay ta k un k open honay par trades set karnay ma asani ho aur hm achi entering oppertunity miss na karain, lihaza hmain market ma entry k liay pairs ki moment aur routine ko b mind ma rakhna chaiay aur apni learning ko use kar k acha entry point select karain, tp aur sl ka proper use karain ta k agr market Mei Tradings ky liye hard work karna zoriri hota Hai our yeh hamary liye comfortable hota Hai....Advantages of range breakout: Forex me range breakout ka matlab hota hai jab currency pair ya kisi bhi financial instrument ka price ek specific range se bahar nikalta hai. Range breakout trading strategy ko traders use karte hain, jisme wo price ke breakout ke baad trading opportunities dhundte hain. Range breakout strategy me traders usually ek specific price range define karte hain, jisme price kuch samay tak ghoomta rehta hai. Jab price us range se bahar nikalta hai, wo ek potential breakout signal hai. Breakout direction pe depend karta hai ki price range ke upar ya niche se bahar nikalta hai. Is strategy me traders price range ko closely monitor karte hain aur jab breakout signal milta hai, wo trading positions lete hain. Breakout ke baad price me volatility increase hoti hai, jisse traders profit generate kar sakte hain. Range breakout strategy me stop-loss aur target levels properly define karna important hota hai, taki excessive losses se bacha ja sake. Technical analysis tools jaise ki support aur resistance levels, chart patterns, aur indicators range breakout opportunities identify karne me madad karte hain. Yad rahe, forex trading me risk involved hota hai, isliye proper risk management aur knowledge hona zaruri hai. Trading strategies pe depend karke, traders ko market ko closely monitor karna hota hai aur market conditions ko analyze karte huye decisions lena hota hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 09:49 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим