Concept of Volume Spread Analysis

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Concept of Volume Spread Analysis -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

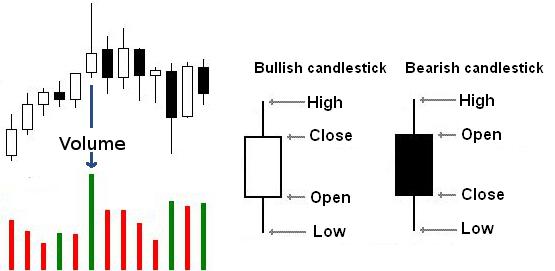

Concept of Volume Spread Analysis Dear forex trader ko pata hota hai k market supply or demand ki ratio sy chalti hai. Jb market ma buyer zayada ho jaty hain to us pair ya commodity ki price barh jati hai or resultly market up trend ma move kar jati hai. Ese tarha market ma jb seller ki ratio barh jati hai to pair ya commodity ki demand kam ho jati hai or wo market ko bear ma move karwany ma kamyab ho jaty hain. So hamy es sy ye pata chala k market ma uptrend us waqat hota hai jb market ma buyer ki ratio seller ki ratio sy zayada hoti hai. Uptrend k lae buy k order ka zayada hona zaruri hai balky seller k orders ka kam hona zaruri hai. Volume Spread Analysis Working Strategy VSA hamy sekhata hai k market ki power bearish candle sy show hoti hai or bullish candle sy b but market ki weaknes hamesa bullish candlestick ki sorat ma show hoti hai. Ek sorat loss sy bachny ki ye b hai k hamesa us taraf trade open karni chahe jis side par kam trader hon. VSA supply or demand k difference ko measure karny k lae use hota hai. Forex trading ma supply or demand k difference ko find karny k lae VSA 3 vairable ka forex chart par interaction compare karta hai. 1. Price bar k uper volume ki quantity ketni hai. 2. Ye price variation yani market ka high or low point ko b es purpose k lae use karta hai. 3. Third factor jo vsa measure karta hai wo ha closing price. Technical Point of View Volume Spread Analysis ma ham market ma kisi pair ki supply or demand ko observe karty hain. Rates high ho jaty hain jb market ma demand barh jati hai or ese tarha rate kam ho jaty hain jb market ma supply barh jati hai. Supply or demand k difference ko measure karny k lae vsa bhot sary factors ko use karta hai. Pehle step ma ya dekha jata hai k candlestick ma volume ki ratio ketni hai. Second step ma eski high or low range ko measure kiya jata hai or last ma closing price ko value ko judgr kiya jata hai. Es principle k bena par jb market ma buyinf selling sy zayada hoti hai to market up chali jati hai or jb market ma selling buying sy zayada hoti hai to market fall kar jati hai. Kuch cases ma trader ko majority sy dor rehna chahe. Kiu k aksar ye b dakhny ma aya hai k market us side par ni jati jis taraf majority of trader hoty hain. So trader ko hamesa apna experince sarh use kar k he decision making karni chahe. Advice for Traders Is basic information ko use karny sy experience trader market k bary ma prediction hasil karny ma kamyab ho jaty hain k market ab kis trend ma jany wali hai or wo eski base par kesy trade ko open or manage karyn gy. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamu Alaikum Dosto!

Volume Spread Analysis (VSA)

Forex trading mein kamiyabi hasil karne ke liye, supply aur demand ke dynamics ko samajhna behad zaroori hai. Volume Spread Analysis (VSA) ek khaas market analysis method hai jo trading volume aur price movements ke darmiyan taluqat ko explore karta hai. Tom Williams ne Richard D. Wyckoff ke kaam ko extend karke VSA ko develop kia, jo major market players ki actions ke bare mein maool insights deta hai aur market mein effectively dakhil hone ke liye signals faraham karta hai.

VSA (Volume Spread Analysis) ek exclusive market analysis method hai jo opening/closing price range aur trading volume ke darmiyan taluqat par nazar dalta hai. VSA ko forex market mein bar/candle ki high aur low ke darmiyan fasla aur total trading volume ke darmiyan mushabahat karne ka bhi zikar kia ja sakta hai.

Is tarah, ek trader ko market ke major players (professional traders, institutions, banks, aur doosre market makers) ke dwara paida kiye jane wale supply aur demand ke farq ko nikalne ka koshish karna chahiye. Agar aap unke amalat ko durust taur par interpret karne mein mahir hain, to ye aapko market mein dakhil hone ke liye achi signals dega.

VSA Richard D. Wyckoff ke kaam ka ek tajaweezi extension hai, jo ne 1888 mein stocks trading shuru ki thi. 20th century ke akhir mein, Tom Williams ne Wyckoff ke research par sudhar kia aur apni methodology develop ki.

Livermore ne pehla shakhs tha jo volume data ko bulls aur bears ke mood ko analyze karne ke liye istemaal kia. Lekin, is trading method ka woh koi moqfi nahi tha. Is ka asal hissa doosre trader, Wyckoff ne diya.

Wyckoff ne trading ke liye apne academic approach se sab se alag kiya. Unho ne khud mukhlis traders se mulaqat ki aur unke sath interview kiya. Aise hi ek interviewee Livermore tha jinhon ne volumes ke bare mein apne khayalat bayan kie, jin se Wyckoff ne VSA concept ke basic usoolon ko derive kia.

Lekin na hi Livermore ne VSA ka istemaal kia, aur na hi Wyckoff ne Volume Spread Analysis ka combination istemaal kia. Is method ke liye ism "VSA" ke term ko introduce karne wale Williams thay. Williams ki books aur computer software ne VSA ko forex traders ke darmiyan market volumes ko analyze karne ke liye ek taqatwar tool ke taur par promote kia aur is concept ko classic analysis variants ke liye alternative banaya.

Volume Spread Analysis (VSA) Kya Show Karti Hai

Supply aur demand ke darmiyan balance maloom karne ke liye, VSA forex chart par teen variables ke interaction ko dekhta hai takay supply/demand balance maloom ho sake aur market ke short-term direction ko pehchana ja sake.

Yeh variables hain:- Candle/price bar volume

- Session ke liye total price change (highs aur lows)

- Closing price

In teeno pieces of information ka istemal kar ke, ek mahir trader forex mein behtareen dakhil points dhoondhega. Volume ki ahmiyat aur ehmiyat ko zyadatar novice traders ke darmiyan behtar se samjha nahi jata, lekin ye technical chart analysis ka ek bohot zaroori hissa hai.

Wall Street ko pasand hai ke price chart ko volume ke baghair ek petrol tank ke tarah samjha jaye. Volume eksoo mei adhi information deta hai, aur baqi ki milta hai price difference ko mutalia karke.

VSA Kaise Kaam Karti Hai

Har market supply aur demand ke mutabiq chalta hai jo professional players ne paida kia hai. Agar demand supply se zyada hai, to market chadhta hai. Agar supply demand se zyada hai, to market neeche jata hai. Ye simple lagta hai, lekin amali tor par, financial markets ko hissab lagana asaan nahi hota. Supply aur demand financial markets mein alag taur par kaam karte hain.

VSA sikhata hai ke market ki tamam taqat ek bearish candle mein parhi ja sakti hai, ulta, market ki kamzori ek bullish candle mein parhi ja sakti hai. Professional aur institutional investors forex mein aksar aur bari miqdaar mein trade karte hain.

Unki khareed o farokht chart par ek bada range wale bullish aur bearish candles se darust hoti hai. Closing price, overall price range, aur trading volume ko mawafiqat karke, traders tay karte hain ke bulls/bears ne support/resistance lines ko tor diya hai aur kya is momentum mein tezi ke liye kafi quwat hai.

VSA Ko Kahan Use Kiya Ja Sakta Hai

VSA price aur volume par tawajju dene wala hota hai aur professionals ke actions ko track karne ka tend karta hai. Is liye, har market jahan acha turnover aur market makers hain, VSA trading concept valid rehta hai.

Lagbhag tamam financial markets is requirement ko naqli tor par poora karte hain. Lekin, forex market mein volume ek mushkil miqdaar hai. Traders is par bohot debate karte hain ke kya VSA ko forex market mein istemaal kiya ja sakta hai.

Wajah ye hai ke foreign exchange market decentralized hai, stock market ki tarah nahi. Is natije mein, asal volumes available nahi hoti. Lekin hum asani se har bar aur candlestick ki volumes ko analyse kar sakte hain. Ye forex trading mein kaafi achha kaam karta hai.

VSA Concept

VSA ya Volume Spread Analysis ek trading soch ki ek school hai jo ke volumes ki ahmiyat par zor deti hai trading ke dauran qeemat ki harkaton ko samajhne mein.

Isi tarah, VSA ke paanch bunyadi concepts aate hain:- Technical Analysis self-sufficient Nahi Hai:

Technical analysis ke favor mein ye dalil hoti hai ke qeemat pehle hi sab kuch ko shamil kar leti hai. Lekin, sirf qeemat se market ko parhna kaafi nahi hota. Market asal mein supply aur demand par depend karti hai, is liye volume analysis ek acha tareeqa hai samajhne ka ke supply aur demand qeematon par kis tarah asar dal rahi hain. - Sab Kuch Mehsoos Kiye Jane Wale Qeemat Par Munhasir Hai:

Bunyadi analysis ka kehna hai ke hum hamesha kisi asal asset ki asal qeemat ko samajh sakte hain jab ke ek financial instrument jese ke stocks, currencies, commodities ka asal value dekhte hain. Lekin, volume traders ka kehna hai ke humein samajhne ke liye shuruwat mehsoos kiye jane wale qeemat se karni chahiye. Asal value nahi, balki yeh ke bears aur bulls ab isay kaise dekh rahe hain. Kyunki traders hamesha companies ko unki book value se zyada qeemat dena pasand karte hain, is liye fundamental analysis ke alawa aur bhi tarah ke analysis ko mad-e-nazar rakhna zaroori hai. - Price Aur Volume Mutabaqat Rakhte Hain:

Guzishta qeematayn financial markets ki harkaton ko samajhne ka aham pehlu hain. Lekin sirf qeemat ka analysis kaafi nahi hai. VSA ke supporters ka kehna hai ke ye zaroori hai ke hum samajhein ke paise ab kahan hain aur humein ab inki zarurat hai. Volume market ki "bhook" ya "saturation" ko tay karta hai, jo ke qeemat ke impulses ki taqat aur raaste par asar andaz hota hai. - Har Movement Ka Asal Maqsad Volume Hai:

Humne pehle hi fundamental aur technical analysis ko financial markets ki harkaton ka waazeh karanah maan liya hai. VSA ye sujhata hai ke price movement ko volume ke sath dekha jaye jese ke asal factor. Misal ke liye, chahe market ya koi individual issuer jitna bhi acha nazar aaye, agar trading volumes lambay waqt tak peak par rahe hain, to hume aane wale slack ya reversal ka intezar karna chahiye. - Forex Mein Alag Alag Traders Ka Alag Maqam Hai:

Is concept ki bunyad ye hai ke alag tarah ke traders alag tarah ki malumat le kar ate hain, aur hum apni trading strategy is idea par bana sakte hain.- Retail Traders: Ye woh hote hain jo chhote accounts rakhte hain aur casual taur par trade karte hain.

- Commercial Traders: Ye investment banks hote hain jin ka kaam market mein orders place karna hota hai takay unke customers ke needs ko pura kiya ja sake.

- Professional Traders: Ye qualified investors hote hain jo jeetna chahte hain aur hamesha market se thoda sa peechay rehna chahte hain taake steady trend mein ja sakein. Jab ek trader ye calculate karta hai ke ab kis type ka trader market ko control kar raha hai, to wo forex mein future price movements ko ziada sahi tarah se predict kar sakta hai.

VSA Trading Ke Advantages & Disadvantages- VSA Ke Advantages:

- Versatility: VSA har market ke liye munasib hai, jese ke commodity, stocks, forex, waghera.

- Efficiency: Ye approach behavioral research mein haqdaar hai aur is se classical fundamental aur technical analysis ki hadon ko paar kia ja sakta hai.

- Accuracy: Volumes future trend ke na sirf raaste ko samajhne mein madad karti hain balki uske hoslay aur rukh ko bhi samajhne mein madad karti hain.

- VSA Ke Disadvantages:

- Lack of clarity: Is theory mein wazeh qawaid nahi hain. Market ki taqat aur kamzori ka concept to hai lekin sab kuch kaafi ghair-wazeh hai. Yeh beginners ke liye aik waziha nuksan hai. Isay samajhne ke liye demo account par waqt guzarna zaroori hai.

- High-Frequency Trading Ke Liye Bad Hai: Short time frames mein, classic technical analysis zyada effective hoti hai.

Assalamu Alaikum Dosto!

VSA Trading Ke Signals- Upthrust Reversal Pattern:

Upthrust pattern is concept ka istemaal karne ka aasaar hai. Ek uptrend pattern candlestick chart par aise dikhai dega jese ke ek bada uptrend candlestick super high volume ke sath, jiska baad mein ek neeche ki taraf ki harkat hoti hai. Aise anormal candlesticks forex mein mamool hai aur ye aggressive trading ka aamal hai. Ye situations important news ke broadcast hone ke baad aksar aati hain. Uptrend movement ka pattern dikhai dene se bahut se traders ko ye signal milta hai ke reversal movement shuru ho raha hai. - Shakeout:

Shakeout ka lafz do words - Shake aur Out se mil kar bana hai. Is term ki koi wazeh tafseel nahi hoti. Ye candlestick formations ke peeche hone wale amal ko darust karti hai. Bade forex players aksar Shakeout ka istemaal karte hain taake kamzor players ko promising bull market se bahar nikala ja sake. Leverage ke sath margin par trade karte waqt, unke patli deposits simply resulting ripples ke drawdown se bardasht nahi kar sakti. - Level Attack:

Price chart par level attack ek pattern ko darust karti hai jise powerful candles ya bars with high volume se represent kiya gaya hai, jo current price patterns ko "break" karte hain. For example, agar aap sideways movement ke doran isko dekhte hain, to aap keh sakte hain ke consolidation period khatam hone wala hai. Mool baat: candle ko sach mein ek bohot hi strong level ko break karna chahiye. Levels ko puri tarah se shakl dena chahiye. - Stopping Volume:

Yeh woh pehchan hai jo trend change hone wale hai ke aane wale isharay ki khabar sunata hai. Aksar tezi ke background mein liquidity mein tezi se izafah hota hai, jo ke jald hi uncertainty aur volumes mein kami ke saath aane wale price movements ke liye harbinger ban jata hai. Ye forecast ke liye ahem hai. Beginners ka ek bara ghalati hota hai ke wo trend ki galat istemal ko dekhte hain, consolidation ko reversal samajhte hain. Baray players is trick se market ko manipulate kar sakte hain, mass mein stop-losses ko girane mein madad karte hain aur trading volume ko badal dete hain. Savdhan rahein. - Demand/Supply Testing:

Isay kisi bhi trading instrument aur time frame par dekha ja sakta hai. Ye ek kaafi reliable indicator hai jo forex mein current halat ko dikhata hai. Is tarah ke cases mein hum dekhte hain ke uptrend ek hidden resistance level se takraata hai, jise ke jahan bahut se sell orders attach hote hain. A simple "squeeze" nahi kaam karta, is liye market accumulation stage mein chali jati hai.

VSA Istemaal Ke Tips

VSA analysis ki khaas bat ye hai ke forex mein exact volume data nahi milta. Lekin hum aapko iske liye kuch tips de sakte hain:- Kuch brokers se price readings ko compare karen. Wo forex market ke liye average ke neeche nahi hona chahiye.

- Average volumes ke doran VSA ko carefuly istemaal karen. Consolidation periods mein accuracy peaks ke doran se kam hoti hai.

- Hamesha ek clear confirmation ka intezaar karen. Price ko alag alag volume se alag analyse karen.

- Yeh bhi yaad rahe ke VSA stock market mein zyada applicable hai, jabke forex market mein iski effectiveness alag alag instruments par alag hoti hai.

- Isliye, traders ko apne trading strategies mein VSA principles ko shaamil karne ke liye, aur alag instruments ke mukhtalif khasoosiyat ko mad-e-nazar rakhte hue, volume analysis ke taqat ka istemaal karne ke liye tayyar rehna chahiye.

Conclusion

Volume Spread Analysis (VSA) forex trading mein volume aur iske correlation ke ahmiyat par zor dene ke zariye ek khaas nazar pesh karta hai. Volume, candlestick patterns, aur price changes ko analyse kar ke, traders market ki taqat ko samajh sakte hain, reversal points ko pehchan sakte hain, aur informe trading decisions le sakte hain. Jabke VSA ke apne faiday hain jese ke versatility aur accuracy, iske nuances ko samajhne ke liye waqt aur tajribat ki zaroorat hai. Traders ko average volumes ke doran savdhan rehna chahiye aur reliable results ke liye confirmation talash karna chahiye. VSA stock market mein majboot istemal paata hai, lekin iski forex market mein kaaragarat alag hoti hai. VSA ke principles ko apni trading strategies mein shaamil kar ke aur mukhtalif instruments ki khaas khasoosiyat ko mad-e-nazar rakhte hue, traders volume analysis ki taqat ka istemaal kar ke apne forex trading ko behtar bana sakte hain.

-

#4 Collapse

Volume Spread Analysis (VSA) forex trading mein aik ahem tajziya ka tareeqa hai jo volume aur price movement ke darmiyan taluqat par tawajju deta hai. VSA ka maqsad market dynamics ko samajhna hai taake traders ko behtar faislay karne aur trading opportunities ko pehchanne mein madad mile.

VSA ke bunyadi concept par amal karte hue, traders market mein volume aur price ke darmiyan taluqat ko dekhte hain. Agar price badh rahi hai aur volume bhi barh raha hai, to yeh bullish trend ki nishani hai. Jabke agar price gir raha hai aur volume bhi kam ho raha hai, to yeh bearish trend ki nishani hai.

Volume Spread Analysis (VSA) ka ek zaroori hissa hai "spread" ya pharak hai, jo bid aur ask ke darmiyan ka farq hota hai. Agar spread kam hota hai, to yeh market ki active trading aur tawajju ki nishani hai. Jabke agar spread barh raha hai, to yeh market ki liquidity aur interest mein kami ki alamat hai.

VSA ke zariye traders market ke signals ko samajhne aur market trends ko pehchanne mein madad lete hain. Yeh unhe market ke asal movements aur investor sentiment ka behtar andaza dete hain, jo unhe trading decisions mein faida pohnchane mein madad karte hain.

Is tajziye ka faida uthane ke liye, traders ko volume, price action, aur spread ko sahi taur par samajhna zaroori hai. Yeh unhe market ke nuances aur price movement ke peeche chhipe patterns ko pehchanne mein madad karta hai, jisse woh behtar trading opportunities ko pehchan sakte hain.

-

#5 Collapse

Concept of Volume Spread Analysis

Volume Spread Analysis ka concept stock market mein ek ahem role ada karta hai. Ye ek technical analysis ka tareeqa hai jo traders aur investors istemal karte hain taake market trends aur price movements ko samajh sakein. Volume Spread Analysis (VSA) ki bunyadi idea hai ke trading volume aur price spread ki analysis se market ki future movement ko predict kiya ja sakta hai.

Is tareeqe ka pehla maqsad hai market manipulation aur institutional activity ko pehchan'na. VSA ke mutabiq, agar trading volume barh raha hai aur price bhi barh rahi hai, to ye bullish sentiment ko darust karti hai. Isi tarah, agar trading volume kam hai aur price barh rahi hai, to ye bearish signal hai. Is tareeqe se traders ko market ke asal movement ka andaza hota hai, jo ke unhein trading decisions mein madad deta hai.

VSA ke zariye, traders aur investors market mein hidden patterns aur trends ko explore kar sakte hain jo ke traditional technical analysis se nazar andaz hojate hain. Is tareeqe mein volume aur price ki correlation ko samjha jata hai taake accurate predictions ki ja sakein.

Ek aur ahem concept jo VSA mein istemal hota hai, wo hai "Smart Money". Smart Money market ke bade players ko ya institutions ko refer karta hai jo large volumes mein trade karte hain. VSA ke mutabiq, agar Smart Money ek particular stock ko kharid rahi hai aur uski price bhi barh rahi hai, to ye bullish signal hai. Isi tarah, agar Smart Money kisi stock ko bech rahi hai aur uski price bhi gir rahi hai, to ye bearish signal hai.

VSA ke zariye traders ko market ke dynamics ko samajhne mein madad milti hai aur unhein better trading decisions lene mein help hoti hai. Is tareeqe ka istemal karke, traders aur investors market ke complex nature ko samajhte hain aur isse profit kamane ke liye strategies develop karte hain.

Ek chuninda tool jo VSA mein istemal hota hai, wo hai "Volume Bars". Volume bars ko istemal karke traders volume ke fluctuations ko observe karte hain aur isse market sentiment ko samajhte hain. Agar volume bars mein sudden spikes hote hain, to ye indicate karta hai ke market mein interest hai aur price movement ki expectation hai.

VSA ke zariye, traders ko market mein hone wale changes ka pata lagane mein asani hoti hai aur isse unka confidence bhi barhta hai. Is tareeqe ka istemal karke, traders apne trading strategies ko refine karte hain aur market ke mukhtalif scenarios mein behtar tareeqe se deal karte hain.

Overall, Volume Spread Analysis ek powerful tool hai jo traders aur investors ko market ke intricacies ko samajhne mein madad deta hai. Is tareeqe ka istemal karke, traders apne trading decisions ko improve karte hain aur market ke volatility ka behtar andaza lagate hain.

Firangi.com ❣️ -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Concept of Volume Spread AnalysisVolume Spread Analysis (VSA) ek trading methodology hai jo price action aur volume analysis par adharit hai. Is technique mein traders price movement aur volume ke relationship ko analyze karte hain, jisse unhe market direction aur future price movements ke baare mein insights milte hain..

Neeche VSA ke kuch key concepts hain:- Volume Analysis: VSA mein volume ka bahut bada mahatva hai. Traders volume bars ko analyze karte hain taki unhe pata chale ki market mein kya ho raha hai. High volume price moves ko confirm karta hai, jabki low volume moves ko weak aur unreliable samjha jata hai.

- Spread Analysis: Spread yani bid aur ask prices ke beech ka difference hai. VSA mein spread ko bhi analyze kiya jata hai taki traders ko pata chale ki market mein liquidity kya hai aur big players kya kar rahe hain.

- Price Action: VSA mein price action ka bhi mahatva hai. Traders price patterns aur candlestick formations ko dekhte hain taki unhe pata chale ki market mein kis taraf ka sentiment hai.

- Smart Money Activity: VSA traders ko "smart money" ya institutional traders ke activity ko track karne mein madad karta hai. Volume aur price action analysis se unhe pata chalta hai ki bade khiladi kis taraf ki movement kar rahe hain.

- Market Manipulation: VSA traders ko market manipulation aur price manipulation ko detect karne mein bhi madad karta hai. Volume aur spread ke abnormal changes ko dekhkar, traders market manipulation ko identify kar sakte hain.

Overall, VSA ek comprehensive approach hai trading mein, jisme price action, volume, aur spread analysis ka combination istemal kiya jata hai. Ye technique traders ko market dynamics aur institutional activity ke baare mein insights pradan karta hai, jisse unhe trading decisions lene mein madad milti hai.

-

#7 Collapse

Volume Spread Analysis (VSA) ka Tassavur:

Volume Spread Analysis Kya Hai?:

Volume Spread Analysis (VSA) ek trading approach hai jo market ke price aur volume data ka istemal karta hai taake price movements aur market trends ko samajh sake. Ismein volume aur price ke relationship ko analyze kiya jata hai taake trading decisions li ja sakein.

Volume aur Spread Kya Hote Hain?:

Volume ka matlab hai trading activity ka volume, yaani kitne contracts ya shares trade hote hain ek specific time period mein. Spread ka matlab hai price range ya difference between high aur low prices ek specific time period mein.

Price aur Volume ka Relationship:

Volume Spread Analysis mein maana jata hai ke jab price aur volume dono ek direction mein move karte hain, toh yeh ek confirmatory signal hai ke trend strong hai. Agar volume badh raha hai jab prices bhi badh rahe hain, toh ye bullish trend ko confirm karta hai, aur agar volume ghat raha hai jab prices bhi ghat rahe hain, toh ye bearish trend ko indicate karta hai.

Chhart Analysis:

VSA mein traders price aur volume data ko chhart analysis ke zariye samajhte hain. Ismein volume bars aur price bars ko dekha jata hai sath mein, taake price movements aur volume fluctuations ka pattern samajha ja sake.

Signs of Strength aur Weakness:

Volume Spread Analysis traders ko market mein strength aur weakness ke signals provide karta hai. Jaise ki agar price ek uptrend mein hai aur volume bhi badh raha hai, toh ye ek sign of strength hai. Lekin agar price badh raha hai lekin volume ghat raha hai, toh ye ek sign of weakness ho sakta hai.

Trading Strategy:

VSA ke saath, traders apni trading strategies develop karte hain. Wo volume aur price ke patterns ko interpret karte hain aur trading decisions lene se pehle confirmatory signals ka wait karte hain.

Volume Spread Analysis ek powerful tool hai jo traders ko market trends aur price movements ko samajhne mein madad karta hai. Iske zariye, traders apne trading decisions ko improve kar sakte hain aur better entry aur exit points tay kar sakte hain.

-

#8 Collapse

Concept of Volume Spread Analysis

Volume Spread Analysis (VSA) ek technical analysis ka tarika hai, jo price action, volume aur spread ke bich ke sambandh ka istemal karke trend, market phase aur sambhavit trading opportunity ki pahchan karta hai. VSA is baat per aadharit hai ki smart money (bade institutional traders) market ko chalate hain, aur unki kharid aur bikri ki gatividhi ko volume aur spread mein badlav ke madhyam se dekha ja sakta hai.

VSA ke kuchh pramukh siddhant asa hain:- Volume supply aur demand ko darshata hai. jab volume badhta hai, to iska matlab hai ki market mein zyada log shamil hain, aur isase price mein badlav hone ki sambhavna zyada hoti hai. jab volume kam hota hai, to iska matlab hai ki market mein kam log shamil hain, aur isase price mein badlav hone ki sambhavna kam hoti hai.

- Spread price ki volatility ko darshata hai. jab spread badhta hai, to iska matlab hai ki market mein zyada volatility hai, aur isase price mein bada badlav hone ki sambhavna zyada hoti hai. jab spread kam hota hai, to iska matlab hai ki market mein kam volatility hai, aur isase price mein bada badlav hone ki sambhavna kam hoti hai.

- Price action supply aur demand ke bich ke sangharsh ko darshata hai. jab price badhta hai, to iska matlab hai ki kharidar vikretaon se zyada hain. jab price girta hai, to iska matlab hai ki vikreta kharidar se zyada hain.

VSA ka istemal karke, trader market ki disha, trend ki takat aur sambhavit reversal ki pahchan kar sakte hain. VSA ka istemal karne ke kuchh tarike is prakar hain:- Trend ki pahchan karne ke liye volume aur spread ka istemal karen. jab volume badhta hai aur spread kam hota hai, to iska matlab hai ki trend majbut hai. jab volume kam hota hai aur spread badhta hai, to iska matlab hai ki trend kamjor hai.

- Reversal ki pahchan karne ke liye volume aur spread ka istemal karen. jab volume badhta hai aur spread badhta hai, to iska matlab hai ki reversal hone ki sambhavna hai. jab volume kam hota hai aur spread kam hota hai, to iska matlab hai ki trend jari rahane ki sambhavna hai.

- Trading opportunity ki pahchan karne ke liye volume aur spread ka istemal karen. jab volume badhta hai aur spread kam hota hai, to iska matlab hai ki kharidari ka avsar hone ki sambhavna hai. jab volume kam hota hai aur spread badhta hai, to iska matlab hai ki bikri ka avsar hone ki sambhavna hai.

VSA ek shaktishali upkaran hai jiska istemal trader market ki behtar samajh prapt karne aur adhik suchit trading nirnay lene ke liye kar sakte hain. halanki, yah yad rakhna mahatvpurn hai ki VSA ek perfect system nahin hai, aur iska istemal karne se hamesha safalta ki guarantee nahin hoti hai.

Yahan kuchh sansadhan diye gaye hain jo aapko VSA ke bare mein adhik janne mein madad kar sakte hain:- The Wyckoff Method: URL The Wyckoff Method, by Richard D. Wyckoff

- Mastering Volume Spread Analysis: URL Mastering Volume Spread Analysis, by Tom Williams

- Volume Spread Analysis: A Complete Guide to Identifying Market Trends: URL Volume Spread Analysis: A Complete Guide to Identifying Market Trends, by Anna Coulling

mujhe ummid hai ki yah madad karta hai!

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Concept of Volume Spread Analysis

Volume Spread Analysis (VSA) ek technical analysis ka tareeqa hai jo share market mein istemal hota hai. Ye tareeqa share market ki trading activity, volume aur price movement ko analyze karne ka hai. VSA ki bunyadi idea ye hai ke market ke price aur volume ke darmiyan taalluqat ko samajh kar trading decisions liye ja sakte hain.

VSA ka mool tareeqa hai ke agar kisi stock ka price barh raha hai aur uski trading volume bhi barh rahi hai, to iska matlab hai ke buying pressure hai aur ye stock strong hai. Jabke agar price barh raha hai lekin volume kam ho rahi hai, to iska matlab hai ke buying interest kam hai aur ye stock weak ho sakta hai. Isi tarah agar price gir raha hai aur volume bhi gir rahi hai, to iska matlab hai ke selling pressure hai aur ye stock aur bhi weak ho sakta hai.

Ek asan tareeqa VSA ko samajhne ka ye hai ke jab price aur volume dono barh rahe hain, to market mein interest hai aur trend strong hai. Lekin agar price aur volume ka taalluq ulta hai, yaani price barh raha hai lekin volume gir rahi hai, ya price gir raha hai lekin volume barh rahi hai, to iska matlab hai ke trend weak ho sakta hai aur reversal hone ki possibility hai.

VSA ke istemal se traders market ki buying aur selling pressure ko samajh sakte hain aur is ke mutabiq trading strategies tay kar sakte hain. Is tareeqe ka istemal kar ke traders market mein hone wale mukhtalif situations ko samajhte hain aur apni trades ko improve karne ke liye volume aur price movement ko dhyan mein rakhte hain.

Samanya bhasha mein, VSA traders ko market ke undercurrents ko samajhne aur trading decisions ko behatar banane mein madad karta hai. Is tareeqe ka istemal kar ke traders market ke trends aur reversals ko samajhte hain aur apni trading strategies ko optimize karte hain. -

#10 Collapse

Concept of Volume Spread Analysis

Volume Spread Analysis (VSA) ek technical analysis technique hai jo market activity aur price movements ke understanding mein madad karta hai. Is technique ka istemal volume aur price action ke relationship ko analyze karne ke liye kiya jata hai. Chaliye, VSA ke concept par ghoor karte hain:

1. Volume Spread Analysis ki Bunyadiat:- VSA ka concept Charles Dow ke principles par mabni hai jo ke kehte hain ke price aur volume ke relationship se market ke movements ka andaza lagaya ja sakta hai.

- Is technique mein traders volume analysis aur price spread (range) ko combine karte hain taake market ke hidden trends aur patterns ko samajh sakein.

2. Volume Analysis:- Volume market mein traded shares ya contracts ka measure hai. VSA mein, volume ki analysis ki jati hai taake pata chale ke kitna activity market mein ho raha hai aur traders ka sentiment kya hai.

- Agar price upar ja raha hai aur volume bhi badh raha hai, to ye indicate karta hai ke uptrend strong hai aur traders ke confidence hai.

- Agar price upar ja raha hai lekin volume decrease ho raha hai, to ye indicate karta hai ke uptrend weak ho sakta hai aur price reversal hone ka potential hai.

3. Price Spread (Range) Analysis:- Price spread ya range market mein price ke movement ka measure hai. VSA mein, traders price spread ko analyze karte hain taake pata chale ke market ke participants ke behavior kya hai.

- Agar price spread bada hai aur volume bhi badh raha hai, to ye indicate karta hai ke market mein strong buying or selling pressure hai.

- Agar price spread narrow hai aur volume bhi kam hai, to ye indicate karta hai ke market mein activity kam hai aur traders ke interest bhi kam hai.

4. Interpretation and Trading Strategies:- VSA ka interpretation market ke activity aur price action ko samajh kar kiya jata hai. Traders is technique ka istemal karke entry aur exit points ko determine karte hain.

- Agar volume badh raha hai aur price bhi upar ja raha hai, to ye bullish signal hai aur traders long positions lete hain.

- Agar volume aur price dono hi decrease ho rahe hain, to ye indicate karta hai ke market mein uncertainty hai aur traders cautious rehte hain.

5. Conclusion:

Volume Spread Analysis (VSA) ek powerful technique hai jo market activity aur price movements ko samajhne mein madad karta hai. Is technique ka istemal karke traders market ke trends aur patterns ko identify karke behtar trading decisions le sakte hain. Lekin, VSA ko samajhne aur sahi tareeqe se interpret karne ke liye practice aur experience ki zaroorat hoti hai.

-

#11 Collapse

Volume Spread Analysis VSAVolume Spread Analysis (VSA) ek technical analysis ka tarika hai jo stock market mein istemal hota hai. Iska maqsad market trends aur price movements ko analyze karna hai, especially trading volume aur price spread par focus karke. Chaliye shuru karte hain:

Introduction:

Volume Spread Analysis (VSA) market trends aur price movements ko analyze karne ka ek powerful tool hai. Is technique mein trading volume aur price spread ko study kiya jata hai taake market direction aur future price movements ka pata lagaya ja sake.

Calculation:

VSA ke calculation mein primarily trading volume aur price spread ka istemal hota hai. Volume, yani ki kitni shares ya contracts exchange hoti hain, aur spread, yani ki price range between high and low, dono hi key components hain. In dono ke variations ko analyze karke traders market sentiment aur strength ko assess karte hain.

Setting:

VSA ka setting market aur trader preference par depend karta hai. Traders apne trading platform par VSA indicators ko set karke volume aur price spread ko monitor karte hain. Setting mein traders ko customize karne ki flexibility hoti hai, jaise ki specific time frames, volume thresholds, aur price spread ranges ko define karna.

Istemal aur Explanation:

.VSA ko istemal karne ke liye traders trading volume aur price spread ki variations par dhyan dete hain. Agar price ek uptrend mein hai aur volume bhi badh raha hai, toh yeh ek bullish sign ho sakta hai, indicating ki uptrend continue hone wala hai. VSA indicators ki madad se traders market sentiment aur demand-supply dynamics ko samajhte hain, jo unhe better trading decisions lene mein madad karta hai.

Trading Strategy:

VSA ke through traders different trading strategies istemal karte hain. Kuch popular VSA strategies mein shamil hain:- Upthrusts aur Springs: Jab price ek resistance level ko briefly cross karke phir se niche aata hai (upthrust), ya fir support level se briefly niche jaata hai aur phir se upar aata hai (spring), toh yeh VSA strategies ka istemal hota hai.

- No Demand aur No Supply: Jab price ek specific level par rahti hai aur volume kam hota hai, ya fir jab price mein koi significant movement hoti hai aur volume bhi kam hota hai, toh yeh indicators no demand aur no supply ko darshate hain, jo reversals ka indication ho sakta hai.

- Climax Bars: Jab ek sudden aur abnormal volume ke sath price mein ek sharp movement hota hai, toh yeh climax bar ko darshata hai, jo trend reversal ka indication ho sakta hai.

Benefits:

VSA ke kuch benefits niche diye gaye hain:- Better Market Understanding: VSA traders ko market sentiment aur demand-supply dynamics ko samajhne mein madad karta hai.

- Enhanced Trading Decisions: VSA ke istemal se traders ko better trading decisions lene mein help milti hai, jaise ki entry aur exit points ko identify karna.

- Early Trend Reversal Identification: VSA indicators ke through traders early trend reversals ko identify kar sakte hain, jo unhe losses se bachane mein madad karta hai.

- Customizable: VSA indicators ko traders apne trading style aur preferences ke hisab se customize kar sakte hain, jo unki trading accuracy ko improve karta hai.

VSA ek powerful tool hai jo traders ko market dynamics ko samajhne aur better trading decisions lene mein madad karta hai.

-

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Define and details

Forex mein Volume Spread Analysis ke concept ko samajhne ke liye, sabse pehle humein VSA ke component ko samajhna hoga. VSA mein 3 components hote hain - Price, Volume aur Spread. Price se humein pata chalta hai ke market kis direction mein ja raha hai. Volume se humein pata chalta hai ke kitne log market mein trade kar rahe hain aur Spread se humein pata chalta hai ke kitna gap hai bid aur ask price ke beech mein.in 3no ko wja sy apko pory pattern ki smjh aa jaye gi k market me kia chl rha h.

Combine components

Agar hum in components ko combine karenge to humein market ke trend aur strength ka pata chalega. Agar price aur volume dono up ja rahe hain to yeh bullish trend ka indication hai. Agar price up ja raha hai aur volume down ja raha hai to yeh fake breakout ho sakta hai. Agar price down ja raha hai aur volume up ja raha hai to yeh bearish trend ka indication hai.

Ye b aik indication show krti h.

VSA

Iske alawa, VSA ka use humein market ke reversal aur continuation signals bhi provide karta hai. Agar market mein high volume aur narrow spread hai to yeh strong buying ya selling ka indication hai. Agar market mein low volume aur wide spread hai to yeh market mein confusion aur uncertainty ka indication hai.

Conclusion

In sabhi indications aur signals ka use karke, VSA traders market ke trends aur movements ko predict karte hain aur profitable trades execute karte hen.aur signal ka b ishara dti h. -

#13 Collapse

write artical on Concept of Volume Spread Analysis

Forex trading is a complex world where various strategies and techniques are employed to analyze the market and make profitable trades. One such method that has gained popularity among traders is Volume Spread Analysis (VSA), or "Hajm Phailao Tajziya" in Roman Urdu.

Hajm Phailao Tajziya is a methodology that focuses on analyzing the relationship between price movements and trading volume. It was developed by Richard Wyckoff, a renowned trader and market analyst, and later refined by Tom Williams. The central idea behind VSA is that changes in volume can provide valuable insights into the strength or weakness of price movements.

In simple terms, VSA suggests that if the price of a currency is rising and accompanied by increasing volume, it indicates strong buying interest and suggests a bullish market sentiment. Conversely, if the price is falling with rising volume, it suggests strong selling pressure and indicates a bearish market sentiment.

One of the key concepts in VSA is the analysis of volume patterns. Traders look for specific volume patterns, such as high volume on up days and low volume on down days, or vice versa. These patterns can provide clues about the underlying market dynamics and help traders anticipate future price movements.

Another important aspect of VSA is the analysis of price spread. Price spread refers to the difference between the high and low prices of a currency during a particular time period. By analyzing price spread in conjunction with volume, traders can assess the strength of price movements and identify potential trading opportunities.

Moreover, VSA emphasizes the importance of analyzing price bars, particularly those with high volume. Traders look for price bars that exhibit wide spreads and closing prices near the high or low of the bar, indicating strong buying or selling pressure, respectively.

Additionally, VSA incorporates the concept of market manipulation. According to VSA theory, large institutional players and market makers often manipulate the market to trap retail traders. By analyzing volume and price movements, traders can detect signs of manipulation and avoid falling into traps set by these market participants.

It's important to note that VSA is not a standalone trading strategy but rather a tool that can be used in conjunction with other analysis techniques. Traders often combine VSA with technical analysis, such as trend analysis and support and resistance levels, to confirm trading signals and increase the probability of success.

In conclusion, Volume Spread Analysis, or Hajm Phailao Tajziya, is a powerful methodology for analyzing the Forex market. By studying the relationship between price movements and trading volume, traders can gain valuable insights into market dynamics and make more informed trading decisions. However, like any trading strategy, VSA requires practice, patience, and disciplined execution to achieve consistent profitability.

-

#14 Collapse

Volume Spread Analysis (VSA): A Comprehensive Guide

Volume Spread Analysis (VSA) ek trading technique hai jo traders ko market ke price aur volume movements ko analyze karne mein madad karta hai. Yeh technique Richard Wyckoff ke principles par aadharit hai aur market ke supply aur demand dynamics ko samajhne mein madad karta hai. Iss guide mein, hum VSA ke fundamentals, uske components aur uske forex trading mein istemal ke fayde ko explore karenge.

1. Fundamentals of Volume Spread Analysis:

Price-Volume Relationship: VSA ka mool mantra hai ki price aur volume ke beech strong relationship hota hai. Jab price aur volume ek saath badhte hain, toh yeh ek strong trend ka indication deta hai.

Demand and Supply: VSA traders market mein demand aur supply ke imbalance ko identify karne ki koshish karte hain. High volume aur price bar ke sath agar market upar ja raha hai, toh yeh demand ke strong sign hai. Vahi agar price down ja raha hai aur volume bhi down hai, toh yeh supply ke strong sign hai.

2. Components of Volume Spread Analysis:

Price Bars Analysis:VSA mein traders price bars ko detail se analyze karte hain, jaise ki high, low, open, aur close prices, along with volume information.

Volume Analysis: Volume ki analysis market ke movements aur trends ko samajhne mein madad karta hai. High volume bars typically indicate strong participation and potential trend continuation.

Spread Analysis:Spread, ya difference between high and low prices, bhi ek important factor hai VSA mein. Wide spread bars often indicate strong market momentum.

3. Advantages of Volume Spread Analysis in Forex Trading:

Identification of Market Manipulation: VSA traders often use the analysis of volume and spread to identify market manipulation and false breakouts.

Confirmation of Trends: VSA can help confirm the strength of trends by analyzing volume and price movements in the market.

Enhanced Trade Timing:

By using VSA techniques, traders can improve their timing for trade entries and exits, leading to better profitability.

4. Implementation of Volume Spread Analysis in Forex Trading.

Tick Volume vs. Real Volume:In forex trading, since there is no centralized exchange, traders often rely on tick volume or volume indicators derived from price movements.

Use of VSA Principles with Other Indicators:

Traders often combine VSA principles with other technical indicators such as moving averages, trend lines, and support/resistance levels for enhanced analysis.

Practice and Patience:** Implementing VSA requires practice and patience. Traders need to spend time studying price and volume relationships and gaining experience in interpreting market signals.Volume Spread Analysis (VSA) ek powerful technique hai jo traders ko market ke price aur volume movements ko analyze karne mein madad karta hai. By understanding the fundamentals of VSA, traders can gain valuable insights into market trends, identify potential trade opportunities, and improve their overall trading performance in the forex market.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Volume Spread Analysis (VSA) ek trading technique hai jo market analysis aur price action ko samajhne ke liye istemal hoti hai. VSA ke zariye traders volume aur price movement ke correlation ko study karte hain taki woh market ke underlying supply aur demand dynamics ko samajh sakein.

Yeh kuch key concepts hain Volume Spread Analysis ke bare mein:

Volume

Volume VSA ka ek mukhya component hai. Yeh batata hai ke kitna trading activity market mein ho raha hai. Agar price ek uptrend mein hai aur volume bhi badh raha hai, toh yeh indicate karta hai ke uptrend strong ho sakta hai. VSA mein, high volume price movements ke confirmation ke liye use hota hai.

Spread

Spread ka matlab hota hai price range ya difference. VSA mein spread ko price bars ke high aur low ke difference ke roop mein dekha jata hai. Spread ki analysis se traders supply aur demand ke bich ke tasadum ko samajhte hain. Agar spread narrow ho raha hai toh yeh indicate karta hai ke market mein consolidation ho rahi hai.

Analysis of Price and Volume Relationship

VSA mein, traders price aur volume ke relationship ko study karte hain. Agar price badh rahi hai aur volume bhi badh raha hai, toh yeh indicate karta hai ke uptrend strong hai. Lekin, agar price badh rahi hai lekin volume gir raha hai, toh yeh indicate karta hai ke uptrend weak ho sakta hai.

Candlestick Analysis

VSA mein candlestick patterns aur formations ka bhi istemal hota hai. Traders candlestick patterns aur volume ke combination ko analyze karte hain taki woh entry aur exit points ka faisla kar sakein.

Wyckoff Principles

VSA ke development mein Richard Wyckoff ke principles ka bhi bada role raha hai. Wyckoff ke principles supply aur demand ke dynamics ko analyze karne aur market trends ko predict karne ke liye use kiye jate hain.

dear friends

Overall, Volume Spread Analysis ek holistic approach hai market analysis mein jo price, volume, aur price movement ke dynamics ko samajhne ke liye istemal hota hai. Is technique ka istemal karke traders market trends ko samajh sakte hain aur unhe better trading decisions lene mein madad milti hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 11:58 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим