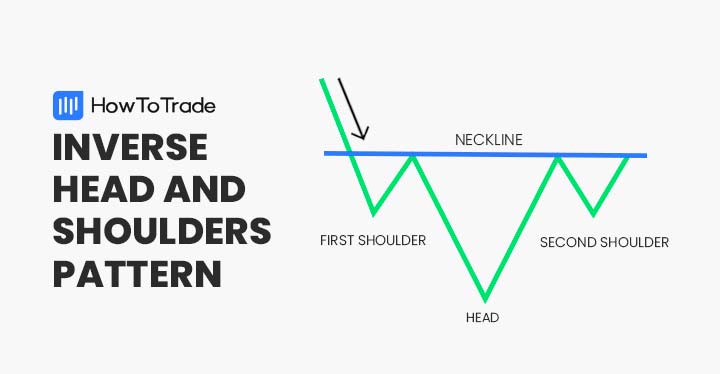

Inverse head and shoulder pattern

`

X

new posts

-

#1 Collapseٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

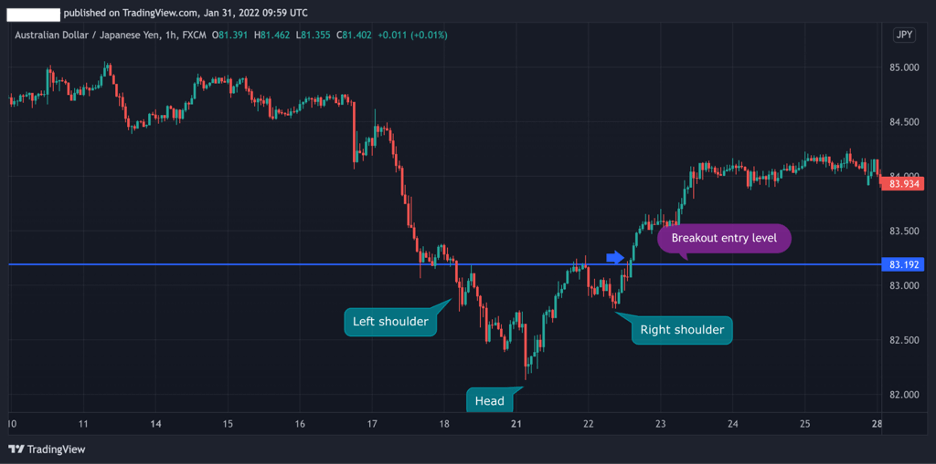

Assalamualaikum! Dear friend main umeed krta hon ap khariat sy hon gy our forex market mn acha Kam kr rhy hon gy dosto aj ka jo hmara topic h vo inverse head and shoulder pattern aj main apko is pattern ki mokamal information dun ga ye market mn kasy banta h. What is Inverse head and shoulder pattern? Inverse Head and Shoulder pattern ek technical analysis ka pattern hai jo stock market mein use hota hai. Ye pattern usually price reversal ke liye indicate karta hai, yaani ki stock ke price ki downward trend ke baad ek upward trend ka signal deta hai. Is pattern ko Inverse Head and Shoulder kaha jata hai kyun ki iska shape ek human shoulder, head, aur doosre shoulder ki tarah hota hai.Ye pattern generally bearish trend ke baad dekha jata hai aur ek bullish trend ke shuru hone ke indication ke taur par interpret kiya jata hai. Important components of head and shoulder: Shoulder: Ye pattern ke dono shoulders bearish trend mein price ke decline ke samay ban jate hain. Jab stock ki price pehle se niche ja rahi hoti hai aur phir se ek bottom banati hai, tab shoulders ban jate hain. Generally, dono shoulders ka height aur width similar hoti hai. Head: Head, shoulders ke beech mein hota hai aur shoulders se jyada height tak pahunchta hai. Yeh bullish ya bearish trend ke dauran form ho sakta hai. Head bearish trend ke baad form hone par ye bullish reversal ka indication deta hai. Pattern ka formation: Inverse Head and Shoulder pattern ko identify karne ke liye, aapko kuch steps follow karne hote hain: Left Shoulder: Stock ka price pehle se down trend mein hota hai aur bottom banata hai. Isse left shoulder ban jata hai. Head: Price dobara se niche jata hai aur ek bottom banata hai jo left shoulder se kam hota hai. Isse head ban jata hai. Head usually left shoulder se niche hota hai. Right Shoulder: Price phir se up move karta hai aur ek bottom banata hai jo head se kam hota hai. Isse right shoulder ban jata hai. Right shoulder left shoulder se jyada niche hota hai. Neckline: Neckline, left shoulder aur right shoulder ke bottoms ko join karke banayi jati hai. Neckline horizontal ya sloping ho sakti hai. Agar neckline sloping hoti hai, toh pattern ki strength jyada hoti hai. Confirmation: Pattern ki validity ke liye, ek confirmation ki zarurat hoti hai. Jab price neckline ko upar ki taraf break karke chala jata hai aur ek specific level ko cross karta hai, tab pattern confirm hota hai. Is level ko breakout level ya neckline breakout level kaha jata hai. Target aur stop loss: Inverse Head and Shoulder pattern ke breakout ke baad, stock usually target ko achieve karne ki koshish karta hai. Target ko calculate karne ke liye, neckline ke height ko left shoulder ke bottom se measure kar sakte hain aur usko breakout level mein add kar sakte hain.Stop loss, yani ki ek level jahan par aap apne trade ko close kar denge, pattern ke formation aur market conditions par depend karta hai. Generally, stop loss neckline ke neeche rakha jata hai, taki agar pattern invalid ho jaye toh loss control kiya ja sake. Inverse Head and Shoulder pattern ek important technical analysis tool hai jo bullish reversal ke indication deta hai. Main umeed krta hon k aj Jo kuch mainy apko is pattern k bary mn btaya vo ap k knowledge our experience mn zaror izafa kry ga. Thanks for All -

#3 Collapse

Asslam o Alaikum forex trading pr ap logo ka kam Acha chl rha hoga aj jis mozo pr hum bt krain ga wo nicha hain TOPIC :INVERSE HEAD AND SHOULDER PATTERN Inverse head and shoulder pattern ka namona isharay ke tor par istemaal hota hai. yeh namona qeemat mein neechay ki taraf rujhan ke ulat jane se wabasta hai. yeh ziyada aam ulat isharay mein se aik hai . jaisay jaisay price neechay ki taraf peechay hathta hai, yeh aik kam nuqta ( aik geherai ) se tkrata hai aur phir sehat yab hona shuru hota hai aur oopar ki taraf jhoolna shuru hota hai. market muzahmat phir usay aik aur geherai mein wapas dhkilti hai . qeemat is maqam par girty hai jahan market kam qeematon ki himayat nahi kar sakti, aur qeemat dobarah barhna shuru ho jati hai. aik baar phir, market muzahmat qeemat ko wapas karne par majboor karti hai, aur qeemat aik aakhri baar gir jati hai. agar market kam qeemat ki himayat nahi kar sakti hai to, yeh pehlay ki kam qeemat tak nahi pahunchti hai. qeematon mein dobarah izafay se pehlay is se ziyada kam hota hai. yeh harkat teen giraaten, ya kam points banati hai : baen kandhay, sir aur dayen kandhay . sir aur kaandhon ka ulta namona neechay ke rujhan ke douran hota hai aur is ke ekhtataam ko nishaan zad karta hai. chart patteren teen kam dekhata hai, darmiyan mein do retracements ke sath. patteren mukammal karta hai aur aik mumkina khareed nuqta faraham karta hai jab qeemat gardan ya doosri retracement aala ke oopar rilyon . EXPLANATION : aap riwayati tor par stop nuqsaan ka istemaal karen ge aur usay dayen kandhay ke bilkul neechay qeemat den ge aur break out qeemat mein shaamil patteren ki oonchai ki bunyaad par aik hadaf qaim karen ge. misali tor par, tijarat ko 2 : 1 inaam se khatrah tanasub se behtar faraham karna chahiye. agar aisa nahi hota hai to, namona ab bhi mufeed maloomat faraham karta hai, jo neechay ki taraf rujhan se oopar ki taraf rujhan mein muntaqili ko zahir karta hai . aik aisa ilaqa jahan bohat saaray tajir ghalat ho jatay hain woh yeh soch raha hai ke dosray kandhay ki tashkeel ke sath hi patteren ki tasdeeq hojati hai. agarchay patteren is marhalay par shakal ikhtiyar karna shuru kar deta hai, lekin is ki tasdeeq is waqt tak nahi hoti jab tak ke market gardan ki muzahmat se oopar band nah ho jaye . -

#4 Collapse

Assalamualaikum all members. Kesy hy ap sab. Umeed krti ho ap sb thk hogy. Ajka hmara discussion ka topic Inverse Head and Shoulder Pattern kay bary may hy. Ab issy Dekhty hay kay ye kia hay r hmy kia information deta hy. Inverse Head and Shoulder Pattern: Inverse head and shoulder ek aisa pattern hy Jo neechy ky ruhjan my zahir hota hay. Ye mndi say tezi kay ulat jany ka ishara hay. Head and shoulder pattern ki tarha reverse head and shoulder bhi har waqt kay framo my zahir hoty hy r asani say nazr aty hay. Ek reverse head and shoulder pattern bnta hy jb ksi asasy ki qeemat girt par girti hay. Phr brhti hy dosri bar girti hy. Lekin is bar gir out pehly say ziada Tez hay. Qeemat dobara brh jati hy r akhri bar girti hay. Is ki formation ek bail market ka ishara deti hy. R formation mukamal hony kay bad Tajir ek lmbi position my dakhil hojaty hy. Explanation: Phli grit mojoda ruhjan my nai nichli sitha ko tashkeel deti hy. Market ohr muzahimat ki sitha pr torny kay lye dobara uthti hay. Dosri grit ek nai neechi bnati hy. Jo phly wly say km hay. Tesra nichla hissa dosry nichly hissy ky oper khtm hota hy. Right shoulder bnata hy. Jab right shoulder gardan ki lakeer sy tot jata hay to tashkeel mukamal ho jati hy. Neckline high ek r do ko jorny wali lakeer hy. Ulat jany ku tasdeeq ky lye volume ahm hy. Ek bar muzahimati line tot jany kay bad ye nai support bn jati hy. Pattern us wqt to mukamal nhi hota jb tk trendline neckline ko nhi tor deti. Trading in Inverse Head and Shoulder Pattern: Head and shoulder pattern my tijart krny ky ek say ziada tareeky hay. Jch jarhana tijarti khreedny sy phly moqy par chalang lgaye gay. Jab trend line reverse pattern ki neckline ky bilkul oper stop buy rakh kar muzahimat ko tor dy gi. Jab kay qadamt pasand trading may traders pattern ky mukamal hony ka intezar kr skty hay. R jab qeemat gardan ky oper bnd hojati hy to reversal ki tauseeq kr skty hay. Isky natijy my qeemat ki wapsi ki ksi bhi moqy ko khtm kia ja skta hy. -

#5 Collapse

Assalamualaikum all members. Kesy hy ap sab. Umeed krti ho ap sb thk hogy. Ajka hmara discussion ka topic Inverse Head and Shoulder Pattern kay bary may hay. Ab isy Dekhty hay kay ye kia hay r hmy kia information deta hy. Inverse Head and Shoulder Pattern: Inverse head and shoulder ekk aisa pattern hay Jo kay neechy kay ruhjan may zahir hota hy. Ye mndi say tezi kay ulat jany ka ishara hay. Head and shoulder pattern ki tarha reverse head and shoulder bhi har wqt ky framo my zahir hoty hy r asani sy nazar aty hay. Ekk reverse head and shoulder pattern bnta hy jb ksi asasy ki qeemat girt par girti hay. Phr brhti hy dosri bar girti hay. Lekin is bar gir out pehly say ziada Tez hay. Qeemat dobara brh jati hay r akhri bar girti hy. Iski formation ek bail market ka bhi ishara deti hy. R formation mukamal hony ky bd Tajir ek lmbi position my dakhil hojaty hy. Explanation: Phli grit mojoda ruhjan my nai nichli sitha ko tashkeel deti hy. Market phr muzahimat ki sitha pr torny ky lye dobara uthti hy. Dosri grit ek nai neechi bnati hy. Jo phly wly sy kam hay. Tesra nichla hissa dosry nichly hissy ky oper khtm hota hy. Right shoulder bnata hy. Jab right shoulder gardan ki lakeer sy tot jata hay to tashkeel mukamal ho jati hay. Neckline high ekk r do ko jorny wali lakeer hy. Ulat jany ku tasdeeq ky lye volume ahm hy. Ek bar muzahimati line tot jany kay bad ye nai support bn jati hy. Pattern us wqt to mukamal nhi hota jb tk trendline neckline ko nhi tor deti. Trading in Inverse Head and Shoulder Pattern: Head and shoulder pattern my tijart krny ky ek say ziada tareeky hay. Kch jarhana tijarti khreedny sy phly moqy par chalang lgaye gay. Jab ky trend line reverse pattern ki neckline ky bilkul oper stop buy rkh kar muzahimat ko tor day gi. Jab kay qadamt pasand trading may traders pattern kay bhi mukamal hony ka intezar kr skty hay. R jab qeemat gardan kay oper band hojati hy to reversal ki tauseeq kr skty hy. Isky natijy my qeemat ki wapsi ki ksi bhi moqy ko khtm kia ja skta hy. -

#6 Collapse

1.Identification - Inverse Head and Shoulders pattern, jo forex market mein istemal hota hai, bullish (mehengai badhne ki taraf) trend ke pehchan karne ke liye istemal kiya jata hai. - Is pattern mein, price chart par teen prominent peaks hote hain, jinhe "head" aur "shoulders" kaha jata hai. 2. Head - Head, pattern ka sabse prominent peak hota hai aur price chart par highest point ko represent karta hai. - Yeh peak market mein bearish trend se turn karne ki indication deta hai. - Normally, is peak ke aas paas price kam ho jati hai. 3. Shoulders - Shoulders, head ke dono taraf hote hain aur slightly kam height ke hote hain as compared to the head. - Left shoulder (baen kandha) head se pehle hota hai aur right shoulder (daen kandha) head ke baad hota hai. - Dono shoulders ki heights aur symmetry similar honi chahiye. 4. Neckline - Neckline, inverse head and shoulders pattern ka ek important component hota hai. - Yeh ek horizontal line hoti hai, jo shoulders ke bottoms ko connect karti hai. - Neckline ka break (tutna), pattern ke completion aur bullish trend ke confirmation ka indication deta hai. 5. Volume - Volume pattern ke saath closely dekha jana chahiye. - Generally, pattern ke left shoulder se right shoulder tak volume decrease hona chahiye. - Jab neckline ko break karta hai, volume increase hona chahiye, indicating a strong bullish move. 6. Entry Point - Jab neckline break ho jaye, woh point entry point ke taur par consider kiya jata hai. - Traders is point par long position lete hain, expecting further upward movement in price. 7. Target - Pattern ke completion ke baad, price usually head ke height tak move karti hai. - Isi level ko target point ke taur par consider kiya jata hai. 8. Stop Loss - Har trading strategy mein, stop loss ka istemal zaruri hota hai, taaki unexpected market movements se nuksan se bacha ja sake. - Stop loss, entry point se neeche rakha jata hai, pattern ke samjhne aur risk management ke principles ko follow karte hue. Inverse Head and Shoulders pattern ki samajh aur istemal karne se traders ko bullish reversals ke opportunities mil sakte hain. Lekin is pattern ke sahi tareeqe se samajhne ke liye aur confirmation ke liye, technical analysis aur price action ke concepts ka istemal kiya jana chahiye. -

#7 Collapse

bhot he nice and learning wali post ki hainapne forex trading main har person ko good learning krna must hain agar ek traders good elarning k sath forex trading main kaaam karta hain tu tu traders best earning kar skte hain forex trading amin demo account main hard work karna must hota hain jaab tak demo account main pratice nhe hoti hain vo traders kamyab nhe hote hain demo account main har person ko apni learning ko strong krna must hain agar fofrex ko koin kiya hain tu fofrex main learning kare praitce kare market ki move ko samjhy jaab tak learning and pratice nhe hoti hain vo traders kamyabi nhe pate hain forex main learning he best hain forex kimove ko samjhna parta hain agar ek trades move earning karne k liye pratice kare ga tu kamyabi hasil kare ga forex main analysis kare and move main trend ko find kare How to trade on Inverse head and shoulder pattern: forex trading ka busniess ek risk wala busniess hain forex trading main hard work k sath kaaam karna parta hain jaaba tak ek trades learning ko strong kar k kaaam nhe karta hain vo traders kabi b kamyab nhe hota hain har traders ko apni learning ko strong krna must hain agar ek traders best learning k sath kaam kare ga tu kamyabi b hasil kare ga forex main pratice kare forex trading main learning kare forex trading ki move ko samjhy forex main trend ko samjhy forex main har dwork k sath kaam kare pratice k sath kaam kare achi tara learning kare good learning kare best benefit mil skta hain forex main analysis kare agar learning strong nhe hain tu kabi b benfeit mil lnhe skta hain forex main ttrend ko follow kare

- Mentions 0

-

سا0 like

-

#8 Collapse

forex trading main agar ek traderse bina learning k kaam kare ga tu kamyabi hasil kare fa forex trading main pratice kare forex ki move ko samjhy forex main analysis kare forex trading main pratice k bina kamyabi nhe hain forex main regular pratice krna must hota hain forex ek kamyab busniess hain jaab tak learning s trong nhe hoti hain o traders kamyabi nhe pate hain fofrex main analysis kare jaaab tak learning strong hoti hain vo traders forex main easy earning kar skte hain earning karne wale traders benfit ahsol kar skte hainGullalai

- Mentions 0

-

سا0 like

-

#9 Collapse

Invers Head aur Shoulder kis hy Head and Shoulder pattern ek technical analysis ka pattern hai jo stock market mein use hota hai. Ye pattern usually price reversal ke liye indicate karta hai, yaani ki stock ke price ki downward trend ke baad ek upward trend ka signal deta hai. Is pattern ko Inverse Head and Shoulder kaha jata hai kyun ki iska shape ek human shoulder, head, aur doosre shoulder ki tarah hota hai.Ye pattern generally bearish trend ke baad dekha jata hai Ye mndi say tezi kay ulat jany ka ishara hay. Head and shoulder pattern ki tarha reverse head and shoulder bhi har wqt ky framo my zahir hoty hy r asani sy nazar aty hay. Ekk reverse head and shoulder pattern bnta hy jb ksi asasy ki qeemat girt par girti hay. Phr brhti hy dosri bar girti hay. Lekin is bar gir out pehly say ziada Tez hay. Inverse Head aur Shoulder ki Identification aur Important kia hy mojoda ruhjan my nai nichli sitha ko tashkeel deti hy. Market phr muzahimat ki sitha pr torny ky lye dobara uthti hy. Dosri grit ek nai neechi bnati hy. Jo phly wly sy kam hay. Tesra nichla hissa dosry nichly hissy ky oper khtm hota hy. Right shoulder bnata hy. Jab right shoulder gardan ki lakeer sy tot jata hay to tashkeel mukamal ho jati hay. Neckline high ekk r do ko jorny wali lakeer hy. Ulat jany ku tasdeeq ky lye volume ahm hy. Ek bar muzahimati line tot jany kay bad ye nai support bn jati hy.

Inverse Head aur Shoulder ki Identification aur Important kia hy mojoda ruhjan my nai nichli sitha ko tashkeel deti hy. Market phr muzahimat ki sitha pr torny ky lye dobara uthti hy. Dosri grit ek nai neechi bnati hy. Jo phly wly sy kam hay. Tesra nichla hissa dosry nichly hissy ky oper khtm hota hy. Right shoulder bnata hy. Jab right shoulder gardan ki lakeer sy tot jata hay to tashkeel mukamal ho jati hay. Neckline high ekk r do ko jorny wali lakeer hy. Ulat jany ku tasdeeq ky lye volume ahm hy. Ek bar muzahimati line tot jany kay bad ye nai support bn jati hy.  Treading Principle kya hy tijart krny ky ek say ziada tareeky hay. Kch jarhana tijarti khreedny sy phly moqy par chalang lgaye gay. Jab ky trend line reverse pattern ki neckline ky bilkul oper stop buy rkh kar muzahimat ko tor day gi. Jab kay qadamt pasand trading may traders pattern kay bhi mukamal hony ka intezar kr skty hay. R jab qeemat gardan kay oper band hojati hy to reversal ki tauseeq kr skty hy. Isky natijy my qeemat ki wapsi ki ksi bhi moqy ko khtm kia ja skta hy.Head and Shoulder pattern ke breakout ke baad, stock usually target ko achieve karne ki koshish karta hai. Target ko calculate karne ke liye, neckline ke height ko left shoulder ke bottom se measure kar sakte hain aur usko breakout level mein add kar sakte hain.Stop loss, yani ki ek level jahan par aap apne trade ko close kar denge, pattern ke formation aur market conditions par depend karta hai. Generally, stop loss neckline ke neeche rakha jata ha

Treading Principle kya hy tijart krny ky ek say ziada tareeky hay. Kch jarhana tijarti khreedny sy phly moqy par chalang lgaye gay. Jab ky trend line reverse pattern ki neckline ky bilkul oper stop buy rkh kar muzahimat ko tor day gi. Jab kay qadamt pasand trading may traders pattern kay bhi mukamal hony ka intezar kr skty hay. R jab qeemat gardan kay oper band hojati hy to reversal ki tauseeq kr skty hy. Isky natijy my qeemat ki wapsi ki ksi bhi moqy ko khtm kia ja skta hy.Head and Shoulder pattern ke breakout ke baad, stock usually target ko achieve karne ki koshish karta hai. Target ko calculate karne ke liye, neckline ke height ko left shoulder ke bottom se measure kar sakte hain aur usko breakout level mein add kar sakte hain.Stop loss, yani ki ek level jahan par aap apne trade ko close kar denge, pattern ke formation aur market conditions par depend karta hai. Generally, stop loss neckline ke neeche rakha jata ha

- Mentions 0

-

سا0 like

-

#10 Collapse

Forex market crucial trading karnay k liye juvenile intermediaries experts shippers say is baat ka brilliant data hasil kartay ha k kab market essential kitna risk laitay huway area lainay head sahi faida hasil kiya ja sakta ha market ki sahi section aur leave k liye agar design ki confirmationa ka andaza astonishing ho jaye to sellers ka market ko samjhna aur is chief gamble laina asaan ho jata ha designs ko smajhnay k liye kuch aisay rules ko notice karna hota hai jin say is mushkil ko asaan banaya ja sakta hai. trneds ko fined karnay aur isay follow karnay k sath agar vendors basically news ko bhi sath follow kartay hain to tab bhi unki is mushkil ka plan asaani say nikal sakta ha aj ki is post major ham kuch trendline trading starategy k baray essential analyze karty ha jisko follow karnay say market frame ko samjhnay head asaani bhi hoge falling wedge hojaye toh aapke PC standard put away information ko nuqsaan ho sakta hai. Ismein aapki tejarti tareekh sara information systems, pointers, aur bht aham information shaamil ho sakte hain. Is tarah ka information misfortune aapke tejarti karkardagi aur records standard asar kar sakta hai.Trading principal nuqsana falling wedge say crash aapke exchanging exercises ko bhi mutasir kar sakta hai. Agar aap kisi exchange ke beech mein hai aur aapka framework crash hojaye, toh aap exchange execute karne mein paryshan ho sakte hain. Isse aapko byhad nuqsan yaa faiday se mehroom kar sakta hai.Time or mawaqay ke munasibat Agar aap live market mein exchange kar rahe hain aur falling wedge crash hota hai, toh aap bahut waqat aur mauke kho sakte hain. Poke aap apne framework ko phir se chalu karenge, aapko economic situations aur exchange ke mawaqay ko dobara tajziya karna hoga, jisse aap faidamand exchanging time aur mauke kho sakte hain.Tachniqu tajziya Disturbance Forex brokers aksar technici tajziya ka istemal karte ha Long term trading mein traders usually monthly, quarterly, ya yearly charts ka istemal karte hain aur trade positions ko kuch hafte se lekar kai mahino tak hold kar sakte hain. Ismein traders economic indicators, monetary policy decisions, geopolitical events, aur long term trends ka dhyan rakhte hain.Long term trading ke fayde mein shaamil hote hain:Kam transactional cost: Long term trading mein traders kam se kam transaction karte hain, jisse unko brokerage aur spread ke charges par kam pressure hota hai.Chhote noise aur volatility: Long term trading mein short term price fluctuations ki wajah se trading decisions par kam asar hota hai, kyunki traders bade time frame par focus karte hain. Isse noise aur volatility kam hoti hai.Fundamentals ka focus: Long term trading mein economic indicators, monetary policy, aur market fundamentals ka important role hota hai. Traders ko in factors ko analyze karke trading decisions lena hota hai.Long term trading mein bhi risks hote hain, aur traders ko market conditions aur risk management techniques par dhyan dena chahiye. Ismein patience aur discipline ki zaroorat hoti hai, kyunki trades ko kai hafte ya mahine tak hold karna padta hai.Forex trading mein long term trading karne se pehle, aapko market ko samajhne ke liye study karna chahiye, technical aur fundamental analysis ke concepts ko samajhna chahiye,Get away from ho satke hain kyunkay tamam representatives yaksaa help aur rizstns degree ko nahi pehchanen ge ya istemaal nahi karen ge .Departure mumkina tijarti mawaqay faraham karte hain. Oopar ki taraf break out taajiron ko lambi position haasil karne ya supd tijarat mein daakhil hona hai jaisay great day there qeemat apni had se bahar honay ka intizam karti hai. Tajir mazboot raftaar ki talaash mein hain aur asal get away from position mein daakhil honay ka ishara hai aur is ke baad honay wali market ki harkat se munafe hai .Port stage se oopar hoti hai, mumkina top popular kuch waqt ke liye. Muzahmat ya help stage rait mein aik lakeer blacklist jata hai jisay bohat se tajir entry centers set karne ya nuqsaan ki satah ko roknay ke liye istemaal karte hain. Hit qeemat help ya rizstns level se blare jati hai to agents get away from jump un ka intzaar karte hain, aur woh log jo nahi chahtay thay ke qeemat move away ho taakay barray nuqsanaat smukhtasir position haasil karne ka ishara deta hai.jisay bohat se tajir entry centers set karne ya nuqsaan ki satah ko roknay ke liye istemaal karte hain. Hit qeemat help ya rizstns level se blare jati hai to merchants get away from bounce un ka intzaar karte hain, aur woh log jo nahi chahtay thay ke qeemat move away ho taakay barray nuqsanaat smukhtasir position haasil karne ka ishara deta hai. Manfi pehlu ka break out taajiron ko mumkina zenith stylish mukhtasir honay ya lambi pozishnin farokht karne ka ishara deta hai .Nisbatan ziyada hajam ke sath escape yaqeen aur dilchaspi zahir karte hain -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#11 Collapse

Inverse head and shoulder pattern

Assalam o Alaikum Dear Friends and Fellows Inverse head & shoulder pattern is waqat creat hota hy jab market continuously downtrend me movement ker rehi ho aur kuch time ky liay kuch pips reverse movement ker ky aik small resistance creat kerny ky bahd dobara downtrend me movement kerty hue previous support ko break kery aur bari movement kerny ky bahd reverse ho ker pehly wali resistance per dobara ponch ker reverse ho jaey aur phir downtrend me small move kerny ky bahd uptrend me small resistance tak ponch jaey tou same inverse head and shoulder pattern complete ho chuka hota hy ky three downward movement ky sath center big downward movement sy head aur two small downward movements both sides per snider ko creat ker rehi hoti hein tou isterha sy inverse head and shoulders pattern create hota hy.forex trading me inverse head and shoulder market k continuously down trend ki wjah se banta hy jis me market ki movement basiaclly hoti tu down trend me hota hy jis me wo apni move,ent me kuch time k liye hume market uptrend me milta hy jis ki wjah se market me yah pattern banta hy tu hme es patern ko follow karny k liye market me es ki confirmation milny par he tarde leni chahye q k aghr hum es pattern ko follow karty hein tu hme break out par trade elni chahye jis se hum achi tarde lay skty hein or apny profit k liy bhi neck line ko follow karna chahye jis se hum forex me achi tarde kar skty hein jis se hme faida bhi hota hy es liye hme chahye k hum es bat ko hmaisha he mind me rakh kar forex market ko follow karen ayse hme loss hony k cheinces kam se kam hoty hein.

Importance of Inverse head and shoulder pattern

Hello dosto forex trading me Inverse head and shoulder pattern boht importance rakhta he is liye is pattern ko samjhna bhi bohut zaruri hota he.Forex trading ma inverse head or shoulder pattern ko samajna bhot zaruri hota hy. Forex market ma aksar asa chart dakhny ko melta hy k market continuously down ah rahi ho or phr wo kuch time k lae break le or wapas ik temperory resistance ko create kar ley. Es situation ma market ny shoulder pattern bana leya hota hy asi sorat ma hamy sell ki trade again resistance k pass sy open karni chahe. 90 percent cheinces ye he hoty hein k market pehle sy zayada down fall karti hy or shoulder pattern k sath ik head pattern sequence ma bana leti hy. Asi situation ma hamari sell ki trade bhot kar amed sabit hoti hy. Forex trading ma es head pattern k sath market again ik shoulder pattern banati hy. Es shoulder pattern ko hamy deeply observe karna chahe or yaha sy buy ki trade ko open karny k lae achy point ko talash karna chahe. Forex trading ma zayada tar asa he hota hy k market shoulder or head pattern k bad wapas apni previous state ma wapas chali jati hy. Forex k demo acct ma hamy ye sb techniques ko deeply observe karna chahe. Jo trader real acct ma asi techniques ko sekhny ki khosis karta hy wo kbi kamyab ni ho pata kiu k real acct ma loss knowledge or practical experience k bawajood bhot zayada hota hy agr bena knowledge k yaha serf try ya tooky marny ki khosis karyn gy to apka account insecure ho jae ga or wash hony sy esko bacheina bhot mushkil ho jae ga.trading me inverse Head and shoulder pattern expected moment bahut lazmi hy agar aap koi bhi trading kar rahe hein to uski chahat ko dekhna bhi bahut lazmi hy jab bhi Anwar sad aur shoulder Patna expected moment karte hein to market downward hoti hy aur yah takriban 90% per aate Hein to market foreign hi hony ki koshish karti hy aur upper chali jaati hy jab bhi 90% pahunch jaaye to aap bi wali trade open karne aur bhy par lagane se aapko bahut jyada faida hogayah use time paida hote Hein jab market downward hoti hy aur don't want hokar takriban 90% boyati hy to uski fauran baat bhy wala indicator indicates hota hy harbor side per sender create hota hy to isase University aur shoulder pattern jab bhi market me Downward create hota hy tu yah 90% downward Ho ke reverse Ho jaati hy hospital lagal unchy are accepted moment se faida hasil karna chahie doston aap jitna market ke mat per nazar rakhenge itna hi aapko faida hoga.

Normal vs Inverse Head and Shoulder pattern- Normal Head and Shoulder Pattern:

- Inverse Head and Shoulder Pattern:

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 10:39 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим