what is the symmetical triangle pattern

`

X

new posts

-

#1 Collapseٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

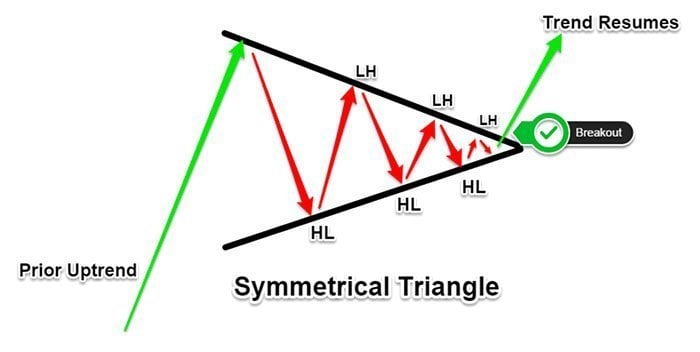

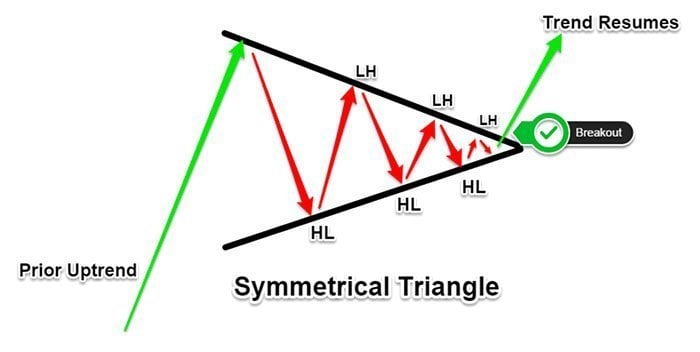

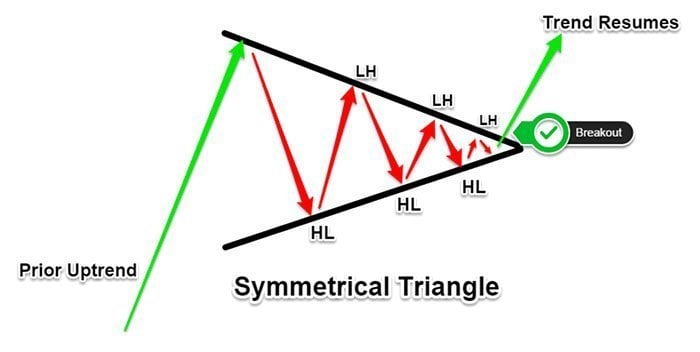

Introduction Aoa dears member i hope you are all fined and gain lot of profit in forex trading with experience skrill today my question gives you lot of information and knowledge aboit the trading . My question is what is symmetical triangle pattern how it is used in firex trading and earn lot of profit. What is symmetical triangle aik sadool masalas aik chart patteren hai jis ki khasusiyat do convergencetrained linon se hoti hai jo silsila waar chotyon aur greating ki aik series ko judte hai. yeh trained lines taqreeban masawi dhalwan par mut-tasil honi chahiye. rujhan ki lakerain jo ghair masawi dhlwanon par aapas mein mil rahi hain un ko barhta sun-hwa pachar, girta sun-hwa pachar, charhata sun-hwa masalas, ya utartaa sun-hwa masalas kaha jata hai. Important take ways sadool masalas is waqt peda hotay hain jab security ki qeemat is terhan mazboot ho rahi hoti hai jo aik jaisi dhlwanon ke sath do convergence trained lines banati hai. sadool masalas ke break out ya break down ahdaaf break out ya break down point par laago ibtidayi aala aur kam ke darmiyan faaslay ke barabar hain. bohat se tajir takneeki tajzia ki doosri shaklon ke sath mil kar sadool masalas ka istemaal karte hain Working and undarstanding jo tasdeeq ke tor par kaam karte hain. sadool masalas ki wazahat aik matawazi masalas chart patteren qeemat ko break out ya kharabi par majboor karne se pehlay istehkaam ki muddat ki numaindagi karta hai. nichli trained line se break down aik naye bearish trained ke aaghaz ki nishandahi karta hai, jabkay oopri trained line se break out aik naye taizi ke rujhan ke aaghaz ki nishandahi karta hai. patteren ko wage chart patteren ke naam se bhi jana jata hai .

- Mentions 0

-

سا0 like

-

#3 Collapse

Introduction: Forex trading mein, technical analysis aik ahem hissa hai jis ki madad se traders market trends aur price patterns ko samajhne ki koshish karte hain. Symmetrical triangle pattern, ya sammiya shaqqat patla, ek aesa price pattern hai jis ko traders istemal karte hain trend ka pata lagane ke liye. Is article mein hum Roman Urdu mein Symmetrical Triangle pattern ki tafseelat pesh karenge. 1. Symmetrical Triangle: Symmetrical Triangle, ya sammiya shaqqat patla, aik chart pattern hai jo technical analysis mein istemal hota hai. Is pattern mein price highs aur lows, aik triangle ke andar mehsoos hotay hain. Ye triangle hota hai aesa jismay price levels symmetrically barhte aur ghatte hain, jis ki wajah se isay "symmetrical" triangle kehte hain. 2. Pattern Banane ka Tareeka: Symmetrical Triangle pattern banane ke liye price highs aur lows ko connect karte hain. Is pattern mein traders do trend lines istemal karte hain: a. Upper Trend Line: Ye trend line price highs ko connect karti hai, jisay resistance line bhi kehte hain. b. Lower Trend Line: Ye trend line price lows ko connect karti hai, jisay support line bhi kehte hain Jab ye trend lines connect hoti hain, triangle ban jata hai jisay Symmetrical Triangle pattern kehte hain. 3. Symmetrical Triangle Ka Tashkhis Karna: Symmetrical Triangle pattern ko tashkhis karne ke liye traders ko kuch baatein tawajjo mein rakhni hoti hain: a. Price Contraction: Symmetrical triangle pattern mein price range kafi kam hota hai aur highs aur lows ke darmiyan gap chota hota hai. Ye contraction price ke future direction ka indication deta hai. b. Volume: Volume bhi ahem factor hota hai Symmetrical Triangle pattern ki tashkhis mein. Price contraction ke sath sath volume bhi generally kam ho jata hai, jo traders ko breakout ki taraf ishara deta hai. c. Breakout: Symmetrical Triangle pattern mein breakout ek ahem event hota hai. Jab price triangle ke upper ya lower side se bahir nikalta hai, toh breakout samjha jata hai. Breakout ke baad price aksar tezi se ya mandi se chalta hai. 4. Trading Strategy: Symmetrical Triangle pattern ki trading strategy mein traders breakout ke direction mein trade karte hain. Agar price upper side se breakout karta hai, toh traders buy positions lete hain. Jab price lower side se breakout karta hai, toh traders sell positions lete hain. Stop loss aur take profit levels ko bhi determine kiya jata hai taaki trading risk manage kiya ja sake. 5. Real-Life Examples: Symmetrical Triangle pattern forex market mein frequently dekha jata hai. Is pattern ki samsarasin aksar currency pairs, jaise EUR/USD, GBP/USD, USD/JPY, etc., mein nazar aati hain. Real-time charts aur technical analysis tools istemal karke traders is pattern ko tashkhis kar sakte hain. Conclusion: mein istemal hone wala ahem price pattern hai. Is pattern ki madad se traders market trends aur price movement ke bare mein samajh pate hain. Symmetrical Triangle pattern ki tashkhis karke traders trading strategies bana sakte hain aur breakout ke direction mein trade kar sakte hain. -

#4 Collapse

Asslam-O-Alaikum! Dear members Me ummed kerti hoke ap sb ka forex trading py kam bht acha chl rha hoga. Aj jis topic py hum baat kre gy wo Neeche mention hy. Topic : What is Symmetrical Triangle Pattern? The symmetrical triangle , jisay coil bhi kaha ja sakta hai, aam tor par rujhan ke douran tasalsul ke patteren ke tor par bantaa hai. patteren mein kam az kam do nichli uchaiyaan aur do onche kmyan shaamil hain. jab yeh points aapas mein jurey hotay hain to lakerain aapas mein mil jati hain jaisay jaisay un ko badhaya jata hai aur sadool masalas ki shakal ikhtiyar kar layte hai. aap usay wage ke tor par bhi soch satke hain, shuru mein chaura aur waqt ke sath tang hota hai . Explanation: agarchay aisi misalein mojood hain jab hum ahangi masalas ahem rujhan ke ulat jane ko nishaan zad karte hain, woh aksar mojooda rujhan ke tasalsul ko nishaan zad karte hain. patteren, tasalsul ya ulat jane ki noiyat se qata nazar, aglay barray iqdaam ki simt ka taayun durust break out ke baad hi kya ja sakta hai. hum hum ahangi masalas ke har hissay ka infiradi tor par jaiza len ge, aur phir conseco ke sath aik misaal faraham karen ge . tasalsul ke namoonay ke tor par ahal honay ke liye, aik qaim shuda rujhan ( kam az kam chand mah purana ) mojood hona chahiye. sadool masalas break out ke baad jari rakhnay se pehlay aik mazbooti ki muddat ko nishaan zad karta hai . trained line bananay ke liye kam az kam 2 points ki zaroorat hoti hai aur aik hum aahang masalas bananay ke liye 2 trained lines ki zaroorat hoti hai. lehaza, tashkeel ko aik hum aahang masalas ke tor par samajhney ke liye kam az kam 4 points ki zaroorat hai. doosri onche ( 2 ) pehli ( 1 ) se neechay honi chahiye aur oopri line neechay ki taraf dhalwan honi chahiye. doosri nichli ( 2 ) pehli ( 1 ) se onche honi chahiye aur nichli line ko oopar ki taraf dhalwan hona chahiye. misali tor par, break out honay se pehlay patteren 6 points ( har taraf 3 ) ke sath banay ga . The symmetrical triangle is waqt peda hotay hain jab security ki qeemat is terhan se mustahkam ho rahi hoti hai jo aik jaisi dhlwanon ke sath do trained lines peda karti hai . sadool masalas ke break out ya break down ahdaaf break out ya break down point par laago ibtidayi aala aur kam ke darmiyan faaslay ke barabar hain . bohat se tajir takneeki tajzia ki doosri shaklon ke sath hum aahang masalas ka istemaal karte hain jo tasdeeq ke tor par kaam karte hain sadool masalas chart patteren qeemat ko break out ya break down par majboor karne se pehlay istehkaam ki muddat ki numaindagi karta hai. nichli trained line se break down aik naye bearish trained ke aaghaz ki nishandahi karta hai, jabkay oopri trained line se break out aik naye taizi ke rujhan ke aaghaz ki nishandahi karta hai. patteren ko wage chart patteren ke naam se bhi jana jata hai . hum ahangi The symmetrical triangle charhtay hue masalas aur nazooli masalas se mukhtalif hain ke oopri aur zaireen rujhan linen dono aik markaz nuqta ki taraf dhal rahi hain. is ke bar aks, charhtay hue masalas mein ufuqi oopri trained line hoti hai, jo mumkina break out ziyada honay ki passion goi karti hai, aur nazooli masalas mein ufuqi nichli trained line hoti hai, jo mumkina kharabi kam honay ki paish goi karti hai. sadool masalas bhi kuch tareeqon se aur jhndon se mlitay jaltay hain, lekin mein rujhan linon ko tabdeel karne ke bajaye oopar ki taraf dhalwan rujhanaat hotay hain . is misaal mein, north west aik hum The symmetrical triangle bana raha hai jo break out se pehlay ho sakta hai. break out ke liye qeemat ka hadaf $ 19. 40, ya $ 17. 40 - $ 15. 20 = $ 2. 20, phir + $ 17. 20 = $ 19. 40 hoga. stap las break down ke liye $ 16. 40 ya break out ke liye $ 17. 20 hoga -

#5 Collapse

Aslamoalekum members kesay hain ap sab. Mujhay umed hay sah thek thak hon gay. Aj ka hamara disscussion ka jo topic hay wh symmetrical triangle pattern kay bary hain. Isy dekhty hain kay yeh kia hay r hamen kia information deta hay. Symmetrical triangle pattern Symmetrical triangle pattern, jo Hamwar Tircha Tara kehte hain, ek Forex trading chart pattern hai. Yeh pattern am tor par price consolidation phase ko zahir karta hai, jahan price higher highs aur lower lows ke beech mein sideways ke harkaat karta hai.Hamwar Tircha Ta'ara ke shakal triangle jaisa hota hai, jahan price ke lye high points ek trend line se jora hote hain aur low points dusri trend line se joray hote hain. Dono trend lines ek dusre se lagbhag barabar angle par hoti hain, isliye ise symmetrical triangle kaha jata hai.Jab price triangle ke andar consolidate hota hai, toh volume am tor pr kam ho jata hai aur traders intzar karte hain ki price ka breakout ho aur ek simat mein harkat kare. Breakout hone ke baad, price am tor pr triangle ke mukhalif simit mein harkat karta hai aur breakout ke simat mein trend jari hota hai. identification Symmetrical triangle pattern trading mein ek amm se strategy hai. Jab price triangle ke andar consolidate ho, toh traders support aur resistance levels ke breakout ka intezar karte hain. Agar price triangle ke upper trend line se breakout karta hai, toh yeh buy signal ko gor kiya jata hai. Aur agar price triangle ke lower trend line se breakout karta hai, toh yeh sell signal samjha jata hai.Yeh pattern traders ke liye entry aur exit points ko shanakht karne mein madad karta hai, jisse unhey waqt pr trading kay mokay mil sakti hain. Lekin trading mein nuqsan say bchao aur behtreen tajziya bahut zaroori hai, isliye traders ko is pattern ko samajhne ke liye bh khas ilam or zeada sy zeada tajarba kar hona chahiye. -

#6 Collapse

Assalamualaikum! Umeed hai k ap sb khariyat sy hongy. R apky trading sessions achy jaa rhy hongy.Aj ka hmra or discussion topic "Symmetrical triangle chart pattern". Dekhty hain k ye hmein Kya information deta hai r hmry ilam Mai Kesy ezafa krta hai. Introduction aik sadool masalas chart patteren bunyadi tor par market mein utaar charhao ki alamat hai. dosray lafzon mein, es market ka utaar charhao aahista aahista suker raha hai aur jald hi toot sakta hai ya toot sakta hai. is patteren ka mushahida is waqt hota hai jab kisi hasas ki qeemat is sy andaaz mein mustahkam ho rahi hoti hai jo qareeb se bhe munsalik dhlwanon ke sath do trained lines peda karti hai. yeh chart patteren khud hasas ki qeemat ke istehkaam ki aik jari muddat ko zahir karta hai is se pehlay ke usay koi to totnay ya totnay par majboor kya jaye. agar nichli sy trained line kharabi ka tajurbah karti hai, to yeh aik naye bearish trained ki shuruvaat ki nishandahi karta hai. Or es mutabadil tor par, agar oopri trained line ko break out ka saamna karna parta hai, to is ka matlab aik nai taizi ki koi tehreek ka aaghaz hai. Trading with symmetrical triangle chart pattern hum aahang masalas takneeki tajzia mukhtalif chart ka koi patteren ke tajziyon ke sath mil kar behtareen kaam karta hai. matawazi masalas ke namonon ka istemaal sy karte hue, tajir aam tor par hasas ki qeemat mein ziyada hajam ki naqal o harkat ki talaash mein hotay hain taakay woh is ke break out ki tasdeeq kar saken. deegar isharay is break out ki muddat ka andaza laganay mein madad kar satke hain. misaal ke tor par, rsi ya' rishta daar taaqat ka asharih' aam tor par hum aahang masalas ke takneeki ho tajzia ke sath is baat ka andaza laganay ke liye istemaal kya jata hai ke kab security is ke break out ke baad sy bhe zaroorat se ziyada kharidi gayi hai. tajir –apne stap sy koi nuqsaan ko karne ke liye aik hum aahang masalas chart patteren ke sath mil kar harkat pazeeri ost ka bhi istemaal karte hain. stop nuqsaan ki taknik istemaal karne ke ilawa, traders aksar qeemat projikshn taknik ka istemaal karte ho hain jab takneeki isharay ka istemaal karte hain jaisay ke hum aahang masalas. yahan hai ke qeemat ka koi bhe takhmeenah kaisay kaam karta hai. sab se pehlay, hum aahang masalas patteren ke sab se kam nuqta aur sab se ziyada nuqta ke darmiyan faaslay ka hisaab lagayen. yeh is ki choraai hai. break out point par is choraai ko' copy sy paste' karen. ab aap qeemat projikshn level par apni tijarat se bahar nikal satke hain . Ascending Triangle chart pattern aik charhtay hue masalas ko aam tor par tasalsul ka koi bhe namona samjha jata hai. is ka matlab yeh hai ke koi Sa patteren ahem rehta hai agar yeh neechay ke rujhan sy aur oopar ke rujhan dono mein hota hai. masalas se break out honay ke baad, tajir is simt par munhasir hai jis mein hasas ki qeemat pehli baar shuru hui thi, jarehana tor par asason ko baichnay ya kharidne mein jaldi karte hain. 3rd sy barhta sun-hwa hajam is baat ki tasdeeq karne mein madad karta hai ke aaya qeemat toot gayi hai ya nahi. Or hajam jitna ziyada barhta hai qeemat mein itni hi dilchaspi patteren se bahar hoti hai. aik charhtay hue masalas ki koi markazi trained lines bananay ke liye, kam az kam do hon soyng lovs aur do soyng higher zaroori hain. taham, aik dosray ko chone ke liye ziyada tadaad mein trained lines ziyada qabil aetmaad tijarti nataij ki nishandahi karti hain. chunkay dono trained linen aik dosray mein tabdeel ho to rahi hain, agar hasas ki qeemat is masalas ke andar kayi jhoolon ke liye chalti rehti hai, to is ki qeemat ka amal sy mazeed marboot ho jaye ga, jo bil akhir mazboot break out ka baais banay ga . Descending Triangle chart pattern utarti hui masalas aik bearish candle stuck patteren hai – yani yeh is muddat ki mojoodgi ki pishin goi karta hai jab kisi khaas security ki qeemat neechay ki taraf bherne ki tawaqqa ki jati hai. yeh is waqt zahir hota hai jab do linon ke zariye - aik nichli oonchaiyon ki series mein shaamil ho hoti hai doosri ufuqi trained line jo neechay ki aik series ko judte hai. is ki shakal ki wajah se usay baaz auqaat dayen zavia masalas bhi kaha jata hai. utartay hue masalas sy chart ka patteren is baat ka ishara hai ke sales side sy bhe traders jarehana ho rahay hain aur security ki qeemat ki raftaar ko control kar len ge. aam tor par, traders is waqt tak intzaar karte hain jab tak ke support ke nichale rujhan mein kharabi nah ho aur phir mukhtasir pozishnin len, or aakhir-kaar security ki qeemat ko kam kar den. yeh candle stuck patteren taajiron mein kaafi maqbool hai kyunkay yeh is baat ki nishandahi karta hai ke capital markets mein security ki maang kamzor par rahi hai. utarti hui masalas aik tajir ko mukhtasir waqt mein khatir khuwa faida haasil karne ka mauqa faraham karti hai . -

#7 Collapse

Assalamualaikum! Umeed hai k ap sb khariyat sy hongy. R apky trading sessions achy jaa rhy hongy. Aj ka hmra discussion topic "What is symmetrical triangle pattern" Dekhty hain k ye hmein Kya information deta hai r hmry ilam Mai Kesy ezafa krta hai. Symmetrical triangle pattern Aik sadool masalas aik chart patteren hai jis ki khasusiyat do converging trained linon se hoti hai jo silsila waar chotyon aur girton ki aik series ko judte hai. yeh trained lines taqreeban masawi dhalwan par mut-tasil honi chahiye. rujhan ki lakerain jo ghair masawi dhlwanon par aapas mein mil rahi hain un ko barhta sun-hwa triangle , girta sun-hwa triangle , charhata sun-hwa masalas, ya utartaa sun-hwa masalas kaha jata hai . Explanation Aik sadool masalas chart pattern qeemat ko break out ya break down par majboor karne se pehlay istehkaam ki muddat ki numaindagi karta hai. nichli trained line se break down aik naye bearish trained ke aaghaz ki nishandahi karta hai, jabkay oopri trained line se break out aik naye taizi ke rujhan ke aaghaz ki nishandahi karta hai. patteren ko wage chart patteren ke naam se bhi jana jata hai. aik matawazi masalas se break out ya break down ke liye qeemat ka hadaf break out price point par laago patteren ke ibtidayi hissay ke ounchay aur nichale hissay se faaslay ke barabar hai. misaal ke tor par, aik matawazi masalas patteren $ 10 ki kam se shuru ho sakta hai aur qeemat ki had waqt ke sath kam honay se pehlay $ 15 tak barh sakta hai. $ 12 se aik break out $ 17, ya $ 15 - $ 10 = $ 5, phir + $ 12 = $ 17 ki qeemat ka hadaf zahir kere ga. sadool masalas patteren ke liye stop las aksar break out point ke bilkul neechay hota hai. misaal ke tor par, agar mazkoorah security ziyada hajam par $ 12 se toot jati hai, to tajir aksar $ 12 se neechay ka stap las den ge. hum ahangi masalas charhtay hue masalas aur nazooli masalas se mukhtalif hain ke oopri aur zaireen rujhan linen dono aik markaz nuqta ki taraf dhal rahi hain. is ke bar aks, charhtay hue masalas mein ufuqi oopri trained line hoti hai, jo mumkina break out ziyada honay ki passion goi karti hai, aur nazooli masalas mein ufuqi nichli trained line hoti hai, jo mumkina kharabi kam honay ki paish goi karti hai. sadool masalas bhi kuch tareeqon se aur jhndon se mlitay jaltay hain, lekin iss mein rujhan linon ko tabdeel karne ke bajaye oopar ki taraf dhalwan rujhanaat hotay hain. jaisa ke takneeki tajzia ki ziyada tar shaklon ke sath, sadool masalas patteren dosray takneeki isharay aur chart patteren ke sath mil kar behtareen kaam karte hain. Trading with symmetrical triangle Tajir aksar break out ki tasdeeq ke tor par ziyada hajam ke iqdaam ki talaash karte hain aur yeh taayun karne ke liye deegar takneeki isharay istemaal kar satke hain ke break out kitni der tak chal sakta hai. misaal ke tor par, rishta daar taaqat index ( rsi ) ka istemaal is baat ka taayun karne ke liye kya ja sakta hai ke break out ke baad security kab ziyada kharidi gayi hai . Qeematein baaz auqaat break out ki simt mein dobarah shuru honay se pehlay rad-e-amal ki harkat par break out point par wapas ajati hain. yeh wapsi khatray ke tanasub se behtar inaam ke sath hissa lainay ka dosra mauqa faraham kar sakti hai. pemaiesh aur matawazi trained line extension ke zareya milnay walay mumkina inaami qeemat ke ahdaaf ka maqsad sirf kisi had tak rehnuma khutoot ke tor par kaam karna hai. takneeki tajzia mutharrak hai aur musalsal tashkhees ki zaroorat hai. mandarja baala pehli misaal mein, sunw ne chand mahino mein apna hadaf ( 42 ) poora kar liya ho ga, lekin stock ne anay walay mahino mein sust honay aur 100 se oopar jane ka koi ishara nahi diya . -

#8 Collapse

WHAT IS THE SYMMETRICAL TRIANGLE PATTERN DEFINITION Ek symmetrical Triangle ek chart pattern Hota Hai Jas ki characterized two converging trend line se hoti hai trend ki lines Jo UN equal slopes per aapas Mein mil rahi hai unko rising wedge, falling wedge ascending triangle yeah descending triangle Kaha jata hai Ek symmatrical triangle chart pattern price ko break out ya break down per Majboor karne se pahle consolidation ki. Ki represent karta hai nichli trend Line se break down Ek new bearish trend ke start ki maloomat karta hai pattern ko wedge pattern ke naam se bhi Jana jata hai symmtrical Triangle price ka target break out price point per applied pattern ke ebtadai part ke unche aur nichle part se distance ke barabar hai Stop loss Breakout point ke bilkul niche Hota Hai SYMMETRICAL TRIANGLE FALLING WEDGE ASCENDING Technical analysis ki zyadatar forms ke sath symmetrical triangle pattern dusre technical indicators ke sath Milkar best work Karte Hain iska determine karne ke liye technical indicator ka istemal kar sakte hain traders break out ki confirmation ke bad zyada volume ke setup Ki Talash Karte Hain buniyadi tar per market mein volatility primarily symbolizes ki alamat hai yah pattern Khud shares ki term ko zahar karta hai bahut se trading expert Tasleem Karte Hain Ki symmetrical Triangle Forex form ke liye ek Achcha tool Hota Hai is message per Hamen focus karna chahie Jo Hamen market bhej raha hai Kyunki buyers and seller triangle symmatricals ko torne ki koshish kar rahe hain aap tryangle ko torne ke liye price ki action ka wait kar sakte hain aap Dobara test per trading mein enter hone ka mauka dekh sakte hain limit option ka fayda yah Hai Ke market apni control Kho rahi hai Jiska mean hai ke take profit window tang ho gai hai Jab Ke Pips ki amount barh gai hai aapko risk hai

SYMMETRICAL TRIANGLE FALLING WEDGE ASCENDING Technical analysis ki zyadatar forms ke sath symmetrical triangle pattern dusre technical indicators ke sath Milkar best work Karte Hain iska determine karne ke liye technical indicator ka istemal kar sakte hain traders break out ki confirmation ke bad zyada volume ke setup Ki Talash Karte Hain buniyadi tar per market mein volatility primarily symbolizes ki alamat hai yah pattern Khud shares ki term ko zahar karta hai bahut se trading expert Tasleem Karte Hain Ki symmetrical Triangle Forex form ke liye ek Achcha tool Hota Hai is message per Hamen focus karna chahie Jo Hamen market bhej raha hai Kyunki buyers and seller triangle symmatricals ko torne ki koshish kar rahe hain aap tryangle ko torne ke liye price ki action ka wait kar sakte hain aap Dobara test per trading mein enter hone ka mauka dekh sakte hain limit option ka fayda yah Hai Ke market apni control Kho rahi hai Jiska mean hai ke take profit window tang ho gai hai Jab Ke Pips ki amount barh gai hai aapko risk hai  SYMMETRICAL TRIANGLE OF WORK Symmetrical triangle trading ke liye important Hota Hai trend line price high ko connect karti hai Jise resistance lines Kahate Hain moving average ke volume Mein level Upar hoti hai

SYMMETRICAL TRIANGLE OF WORK Symmetrical triangle trading ke liye important Hota Hai trend line price high ko connect karti hai Jise resistance lines Kahate Hain moving average ke volume Mein level Upar hoti hai

-

#9 Collapse

Assalamualaikum ma umeed krta hun k aap sub loog khaireyat sy hon gy or aap subhi ka trading session acha chal raha ho ga. Aaj ka hamara topic hy Symmetrical triangle candle stick patteren Chalain us k baay ma agahi hasil krty hain Symmetrical triangle candle stick pattern takneeki tajzia mein aik maqbool candle stick patteren hai, jo maliyati mandiyon mein qeemat ke amal ka tajzia karne ke liye istemaal hota hai. yeh aik tasalsul ka namona samjha jata hai, jo is baat ki nishandahi karta hai ke market mazbooti ki muddat ke baad –apne Sabiqa rujhan ko dobarah shuru karne ka imkaan hai. is note mein, symmetrical triangle candle stick patteren ki khususiyaat, tashkeel, aur tashreeh ko talaash karen ge. khususiyaat : 1. shakal : matawazi masalas ka namona converging trained lines par mushtamil hota hai jo qeemat ke chart par aik masalas ki shakal banati hai. oopri trained line nichli oonchaiyon ki aik series ko judte hai, jab ke nichli trained line oonchai ki aik series ko judte hai. yeh trained linen masalas ka namona banati hain, un ke darmiyan qeemat dohrati hai. 2. dorania : patteren ka dorania mukhtalif ho sakta hai, chand hafton se le kar kayi mahino tak. jitni der tak patteren tayyar hota hai, itna hi ahem samjha jata hai. tashkeel : symmetrical triangle ka namona do trained linon ke convergen se bantaa hai, jis ke liye kam az kam do ree action highs aur do ree action lovs ki zaroorat hoti hai. tajir un points ko oopri aur nichli trained lines bananay ke liye jorhte hain, masalas banatay hain. yeh note karna zaroori hai ke rujhan ki lakerain ziyada khari nahi honi chahiye, kyunkay yeh aik mukhtalif patteren ki nishandahi kar sakti hai, jaisay ke barhta sun-hwa ya girna. Tashreeh : 1. tasalsul ka namona : symmetrical triangle ko bunyadi tor par tasalsul ke namoonay se tabeer kya jata hai, jo tajweez karta hai ke market –apne Sabiqa rujhan ko jari rakhay gi. agar Sabiqa rujhan taizi ka tha, to masalas se break out ke ultay honay ki tawaqqa hai. is ke bar aks, agar Sabiqa rujhan mandi ka tha, to break out ke manfi pehlu honay ki tawaqqa hai. 2. utaar charhao : jaisay jaisay symmetrical triangle ka namona agay barhta hai, radd amal ki bulandi aur neechi ke darmiyan ki had kam hoti jati hai. yeh utaar charhao mein sankchan ki nishandahi karta hai kyunkay market istehkaam ke marhalay mein daakhil hoti hai. tajir aksar is sanckhan ko aik asaan break out ke signal ke tor par istemaal karte hain. 3. break out ki tasdeeq : symmetrical triangle patteren mukammal nahi hota jab tak ke break out nah ho. break out is waqt hota hai jab qeemat faisla kin tor par trained lines mein se kisi aik se oopar ya neechay jati hai, jo market ke jazbaat mein tabdeeli ki nishandahi karti hai. patteren ki toseeq karne ke liye tajir aam tor par break out ki tasdeeq talaash karte hain, jaisay ke break out ke sath volume mein numaya izafah. 4. qeemat ka hadaf : break out ke baad mumkina qeemat ke hadaf ka andaza laganay ke liye, tajir aksar pemaiesh shuda iqdaam ka tareeqa istemaal karte hain. is mein masalas ki oonchai ko is ke choray nuqta par naapna aur break out point se is faaslay ko paish karna shaamil hai. misaal ke tor par, agar masalas ka chaura hissa $ 10 hai aur break out $ 50 par hota hai, to qeemat ka hadaf $ 60 ( $ 50 + $ 10 ) hoga. Tijarti hikmat e amli : break out trading : break out honay ke baad traders tijarat mein daakhil ho satke hain, break out point ke neechay stap loss order rakh kar. is hikmat e amli ka maqsad break out ke baad ibtidayi raftaar ko haasil karna aur rujhan ke dobarah shuru honay se faida uthana hai. Intzaar karo aur dekho nuqta nazar : kuch tajir tijarat mein daakhil honay se pehlay break out ki tasdeeq ka intzaar karne ko tarjeeh dete hain. yeh nuqta nazar ziyada yaqeen faraham karta hai lekin is ke nateejay mein qeemat ki muntaqili ke ibtidayi marahil gayab ho satke hain. Ghalat break out managment : ghalat break out ho satke hain, jahan qeemat mukhtasir tor par trained line se agay barh jati hai lekin taizi se patteren mein wapas aa jati hai. taajiron ko jhutay break out se mohtaat rehna chahiye aur tijarat karne se pehlay tasdeeq ka intzaar karna chahiye. aakhir mein, hum aahang masalas candle stuck patteren takneeki tajzia mein aik taaqatwar tool hai, jo ke istehkaam ki muddat aur Sabiqa rujhan ke hatmi tasalsul ka ishara deta hai. tajir mumkina break out ka andaza laganay aur is ke mutabiq apni tijarti hikmat amlyon ki mansoobah bandi karne ke liye is tarz ka istemaal kar satke hain. taham, kisi bhi takneeki tajzia ke alay ki terhan, tijarti faislay karte waqt deegar awamil par ghhor karna aur rissk managment ki munasib taknik istemaal karna zaroori hai . -

#10 Collapse

Assalamualaikum ma umeed krta hun k aap sub loog khaireyat sy hon gy or aap subhi ka trading session acha chal raha ho ga. Aaj ka hamara topic hy Symmetrical triangle candle stick patteren Chalain us k baay ma agahi hasil krty hain Symmetrical triangle candle stick pattern takneeki tajzia mein aik maqbool candle stick patteren hai, jo maliyati mandiyon mein qeemat ke amal ka tajzia karne ke liye istemaal hota hai. yeh aik tasalsul ka namona samjha jata hai, jo is baat ki nishandahi karta hai ke market mazbooti ki muddat ke baad –apne Sabiqa rujhan ko dobarah shuru karne ka imkaan hai. is note mein, hum hum aahang masalas candle stuck patteren ki khususiyaat, tashkeel, aur tashreeh ko talaash karen ge. khususiyaat : 1. shakal : matawazi masalas ka namona converging trained lines par mushtamil hota hai jo qeemat ke chart par aik masalas ki shakal banati hai. oopri trained line nichli oonchaiyon ki aik series ko judte hai, jab ke nichli trained line oonchai ki aik series ko judte hai. yeh trained linen masalas ka namona banati hain, un ke darmiyan qeemat dohrati hai. 2. dorania : patteren ka dorania mukhtalif ho sakta hai, chand hafton se le kar kayi mahino tak. jitni der tak patteren tayyar hota hai, itna hi ahem samjha jata hai. tashkeel : sadool masalas ka namona do trained linon ke convergen se bantaa hai, jis ke liye kam az kam do ree action highs aur do ree action lovs ki zaroorat hoti hai. tajir un points ko oopri aur nichli trained lines bananay ke liye jorhte hain, masalas banatay hain. yeh note karna zaroori hai ke rujhan ki lakerain ziyada khari nahi honi chahiye, kyunkay yeh aik mukhtalif patteren ki nishandahi kar sakti hai, jaisay ke barhta sun-hwa ya girna. Tashreeh : 1. tasalsul ka namona : symmetrical triangle ko bunyadi tor par tasalsul ke namoonay se tabeer kya jata hai, jo tajweez karta hai ke market –apne Sabiqa rujhan ko jari rakhay gi. agar Sabiqa rujhan taizi ka tha, to masalas se break out ke ultay honay ki tawaqqa hai. is ke bar aks, agar Sabiqa rujhan mandi ka tha, to break out ke manfi pehlu honay ki tawaqqa hai. 2. utaar charhao : jaisay jaisay symmetrical triangle ka namona agay barhta hai, radd amal ki bulandi aur neechi ke darmiyan ki had kam hoti jati hai. yeh utaar charhao mein sankchan ki nishandahi karta hai kyunkay market istehkaam ke marhalay mein daakhil hoti hai. tajir aksar is sanckhan ko aik asaan break out ke signal ke tor par istemaal karte hain. 3. break out ki tasdeeq : symmetrical triangle patteren mukammal nahi hota jab tak ke break out nah ho. break out is waqt hota hai jab qeemat faisla kin tor par trained lines mein se kisi aik se oopar ya neechay jati hai, jo market ke jazbaat mein tabdeeli ki nishandahi karti hai. patteren ki toseeq karne ke liye tajir aam tor par break out ki tasdeeq talaash karte hain, jaisay ke break out ke sath volume mein numaya izafah. 4. qeemat ka hadaf : break out ke baad mumkina qeemat ke hadaf ka andaza laganay ke liye, tajir aksar pemaiesh shuda iqdaam ka tareeqa istemaal karte hain. is mein masalas ki oonchai ko is ke choray nuqta par naapna aur break out point se is faaslay ko paish karna shaamil hai. misaal ke tor par, agar masalas ka chaura hissa $ 10 hai aur break out $ 50 par hota hai, to qeemat ka hadaf $ 60 ( $ 50 + $ 10 ) hoga. Tijarti hikmat e amli : break out trading : break out honay ke baad traders tijarat mein daakhil ho satke hain, break out point ke neechay stap loss order rakh kar. is hikmat e amli ka maqsad break out ke baad ibtidayi raftaar ko haasil karna aur rujhan ke dobarah shuru honay se faida uthana hai. Intzaar karo aur dekho nuqta nazar : kuch tajir tijarat mein daakhil honay se pehlay break out ki tasdeeq ka intzaar karne ko tarjeeh dete hain. yeh nuqta nazar ziyada yaqeen faraham karta hai lekin is ke nateejay mein qeemat ki muntaqili ke ibtidayi marahil gayab ho satke hain. Ghalat break out managment : ghalat break out ho satke hain, jahan qeemat mukhtasir tor par trained line se agay barh jati hai lekin taizi se patteren mein wapas aa jati hai. taajiron ko jhutay break out se mohtaat rehna chahiye aur tijarat karne se pehlay tasdeeq ka intzaar karna chahiye. aakhir mein, hum aahang masalas candle stuck patteren takneeki tajzia mein aik taaqatwar tool hai, jo ke istehkaam ki muddat aur Sabiqa rujhan ke hatmi tasalsul ka ishara deta hai. tajir mumkina break out ka andaza laganay aur is ke mutabiq apni tijarti hikmat amlyon ki mansoobah bandi karne ke liye is tarz ka istemaal kar satke hain. taham, kisi bhi takneeki tajzia ke alay ki terhan, tijarti faislay karte waqt deegar awamil par ghhor karna aur rissk managment ki munasib taknik istemaal karna zaroori hai . -

#11 Collapse

candle stick patteren Chalain us k baay ma agahi hasil krty hain Symmetrical triangle candle stick pattern takneeki tajzia mein aik maqbool candle stick patteren hai, jo maliyati mandiyon mein qeemat ke amal ka tajzia karne ke liye istemaal hota hai. yeh aik tasalsul ka namona samjha jata hai, jo is baat ki nishandahi karta hai ke market mazbooti ki muddat ke baad –apne Sabiqa rujhan ko dobarah shuru karne ka imkaan hai. is note mein, hum hum aahang masalas candle stuck patteren ki khususiyaat, tashkeel, aur tashreeh ko talaash karen ge.khususiyaat : 1. shakal : matawazi masalas ka namona converging trained lines par mushtamil hota hai jo qeemat ke chart par aik masalas ki shakal banati hai. oopri trained line nichli oonchaiyon ki aik series ko judte hai, jab ke nichli trained line oonchai ki aik series ko judte hai. yeh trained linen masalas ka namona banati hain, un ke darmiyan qeemat dohrati hai. 2. dorania : patteren ka dorania mukhtalif ho sakta hai, chand hafton se le kar kayi mahino tak. jitni der tak patteren tayyar hota hai, itna hi ahem samjha jata hai. tashkeel : sadool masalas ka namona do trained linon ke convergen se bantaa hai, jis ke liye kam az kam do ree action highs aur do ree action lovs ki zaroorat hoti hai. tajir un points ko oopri aur nichli trained lines bananay ke liye jorhte hain, masalas banatay hain. yeh note karna zaroori hai ke rujhan ki lakerain ziyada khari nahi honi chahiye, kyunkay yeh aik mukhtalif patteren ki nishandahi kar sakti hai, jaisay ke barhta sun-hwa ya girna. Tashreeh : 1. tasalsul ka namona : symmetrical triangle ko bunyadi tor par tasalsul ke namoonay se tabeer kya jata hai, jo tajweez karta hai ke market –apne Sabiqa rujhan ko jari rakhay gi. agar Sabiqa rujhan taizi ka tha, to masalas se break out ke ultay honay ki tawaqqa hai. is ke bar aks, agar Sabiqa rujhan mandi ka tha, to break out ke manfi pehlu honay ki tawaqqa hai. 2. utaar charhao : jaisay jaisay symmetrical triangle ka namona agay barhta hai, radd amal ki bulandi aur neechi ke darmiyan ki had kam hoti jati hai. yeh utaar charhao mein sankchan ki nishandahi karta hai kyunkay market istehkaam ke marhalay mein daakhil hoti hai. tajir aksar is sanckhan ko aik asaan break out ke signal ke tor par istemaal karte hain. 3. break out ki tasdeeq : symmetrical triangle patteren mukammal nahi hota jab tak ke break out nah ho. break out is waqt hota hai jab qeemat faisla kin tor par trained lines mein se kisi aik se oopar ya neechay jati hai, jo market ke jazbaat mein tabdeeli ki nishandahi karti hai. patteren ki toseeq karne ke liye tajir aam tor par break out ki tasdeeq talaash karte hain, jaisay ke break out ke sath volume mein numaya izafah. 4. qeemat ka hadaf : break out ke baad mumkina qeemat ke hadaf ka andaza laganay ke liye, tajir aksar pemaiesh shuda iqdaam ka tareeqa istemaal karte hain. is mein masalas ki oonchai ko is ke choray nuqta par naapna aur break out point se is faaslay ko paish karna shaamil hai. misaal ke tor par, agar masalas ka chaura hissa $ 10 hai aur break out $ 50 par hota hai, to qeemat ka hadaf $ 60 ( $ 50 + $ 10 ) hoga. Tijarti hikmat e amli :Forex form ke liye ek Achcha tool Hota Hai is message per Hamen focus karna chahie Jo Hamen market bhej raha hai Kyunki buyers and seller triangle symmatricals ko torne ki koshish kar rahe hain aap tryangle ko torne ke liye price ki action ka wait kar sakte hain aap Dobara test per trading mein enter hone ka mauka dekh sakte hain limit option ka fayda yah Hai Ke market apni control Kho rahi hai Jiska mean hai ke take profit window tang ho gai hai Jab Ke Pips ki amount barh gai hai aapko risk hai

​break out trading : break out honay ke baad traders tijarat mein daakhil ho satke hain, break out point ke neechay stap loss order rakh kar. is hikmat e amli ka maqsad break out ke baad ibtidayi raftaar ko haasil karna aur rujhan ke dobarah shuru honay se faida uthana hai. Intzaar karo aur dekho nuqta nazar : kuch tajir tijarat mein daakhil honay se pehlay break out ki tasdeeq ka intzaar karne ko tarjeeh dete hain. yeh nuqta nazar ziyada yaqeen faraham karta hai tajir mumkina break out ka andaza laganay aur is ke mutabiq apni tijarti hikmat amlyon ki mansoobah bandi karne ke liye is tarz ka istemaal kar satke hain. taham, kisi bhi takneeki tajzia ke alay ki terhan, tijarti faislay karte waqt deegar awamil par ghhor karna aur rissk managment ki munasib taknik istemaal karna zaroori hai .

​break out trading : break out honay ke baad traders tijarat mein daakhil ho satke hain, break out point ke neechay stap loss order rakh kar. is hikmat e amli ka maqsad break out ke baad ibtidayi raftaar ko haasil karna aur rujhan ke dobarah shuru honay se faida uthana hai. Intzaar karo aur dekho nuqta nazar : kuch tajir tijarat mein daakhil honay se pehlay break out ki tasdeeq ka intzaar karne ko tarjeeh dete hain. yeh nuqta nazar ziyada yaqeen faraham karta hai tajir mumkina break out ka andaza laganay aur is ke mutabiq apni tijarti hikmat amlyon ki mansoobah bandi karne ke liye is tarz ka istemaal kar satke hain. taham, kisi bhi takneeki tajzia ke alay ki terhan, tijarti faislay karte waqt deegar awamil par ghhor karna aur rissk managment ki munasib taknik istemaal karna zaroori hai .

- Mentions 0

-

سا0 like

-

#12 Collapse

Symmetrical Triangle, ya sammiya shaqqat patla, aik chart pattern hai jo technical analysis mein istemal hota hai. Is pattern mein price highs aur lows, aik triangle ke andar mehsoos hotay hain. Ye triangle hota hai aesa jismay price levels symmetrically barhte aur ghatte hain, jis ki wajah se isay "symmetrical" triangle kehte hain. agarchay aisi misalein mojood hain jab hum ahangi masalas ahem rujhan ke ulat jane ko nishaan zad karte hain, woh aksar mojooda rujhan ke tasalsul ko nishaan zad karte hain. patteren, tasalsul ya ulat jane ki noiyat se qata nazar, aglay barray iqdaam ki simt ka taayun durust break out ke baad hi kya ja sakta hai. hum hum ahangi masalas ke har hissay ka infiradi tor par jaiza len ge, aur phir conseco ke sath aik misaal faraham karen ge Symmetrical triangle pattern trading mein ek amm se strategy hai. Jab price triangle ke andar consolidate ho, toh traders support aur resistance levels ke breakout ka intezar karte hain. Agar price triangle ke upper trend line se breakout karta hai, toh yeh buy signal ko gor kiya jata hai. trained line bananay ke liye kam az kam 2 points ki zaroorat hoti hai aur aik hum aahang masalas bananay ke liye 2 trained lines ki zaroorat hoti hai. lehaza, tashkeel ko aik hum aahang masalas ke tor par samajhney ke liye kam az kam 4 points ki zaroorat hai. doosri onche ( 2 ) pehli ( 1 ) se neechay honi chahiye aur oopri line neechay ki taraf dhalwan honi chahiye. doosri nichli ( 2 ) pehli ( 1 ) se onche honi chahiye aur nichli line ko oopar ki taraf dhalwan hona chahiye. misali tor par, break out honay se pehlay patteren 6 points ( har taraf 3 ) ke sath banay ga . mein istemal hone wala ahem price pattern hai. Is pattern ki madad se traders market trends aur price movement ke bare mein samajh pate hain. Symmetrical Triangle pattern ki tashkhis karke traders trading strategies bana sakte hain aur breakout ke direction mein trade kar sakte hain. -

#13 Collapse

what is the symmetical triangle designPresentationAoa dears part I really want to believe that you are undeniably fined and gain parcel of benefit in forex exchanging with experience skrill today my inquiry gives you part of data and information aboit the exchanging . My inquiry is symmetical triangle design the way things are utilized in firex exchanging and procure parcel of benefit.What is symmetical triangleaik sadool masalas aik graph patteren hai jis ki khasusiyat do convergencetrained linon se hoti hai jo silsila waar chotyon aur greating ki aik series ko judte hai. yeh prepared lines taqreeban masawi dhalwan standard mut-tasil honi chahiye. rujhan ki lakerain jo ghair masawi dhlwanon standard aapas mein mil rahi hain un ko barhta sun-hwa pachar, girta sun-hwa pachar, charhata sun-hwa masalas, ya utartaa sun-hwa masalas kaha jata hai. Significant take ways sadool masalas is waqt peda hotay hain punch security ki qeemat is terhan mazboot ho rahi hoti hai jo aik jaisi dhlwanon ke sath do intermingling prepared lines banati hai. sadool masalas ke separate out ya break ahdaaf separate out ya break point standard laago ibtidayi aala aur kam ke darmiyan faaslay ke barabar hain. bohat se tajir takneeki tajzia ki doosri shaklon ke sath mil kar sadool masalas ka istemaal karte hainWorking and undarstandingjo tasdeeq ke peak standard kaam karte hain. sadool masalas ki wazahat aik matawazi masalas diagram patteren qeemat ko break out ya kharabi standard majboor karne se pehlay istehkaam ki muddat ki numaindagi karta hai. nichli prepared line se separate aik naye negative prepared ke aaghaz ki nishandahi karta hai, jabkay oopri prepared line se break out aik naye taizi ke rujhan ke aaghaz ki nishandahi karta hai. patteren ko wage outline patteren ke naam se bhi jana jata hai . what is the symmetical triangle design

Presentation:Forex exchanging mein, specialized examination aik ahem hissa hai jis ki madad se merchants market patterns aur cost designs ko samajhne ki koshish karte hain. Even triangle design, ya sammiya shaqqat patla, ek aesa cost design hai jis ko merchants istemal karte hain pattern ka pata lagane ke liye. Is article mein murmur Roman Urdu mein Balanced Triangle design ki tafseelat pesh karenge.1. Balanced Triangle:Balanced Triangle, ya sammiya shaqqat patla, aik diagram design hai jo specialized examination mein istemal hota hai. Is design mein cost highs aur lows, aik triangle ke andar mehsoos hotay hain. Ye triangle hota hai aesa jismay cost levels evenly barhte aur ghatte hain, jis ki wajah se isay "balanced" triangle kehte hain.2. Design Banane ka Tareeka:Balanced Triangle design banane ke liye cost highs aur lows ko associate karte hain. Is design mein dealers in all actuality do drift lines istemal karte hain:a. Upper Pattern Line:Ye pattern line cost highs ko interface karti hai, jisay obstruction line bhi kehte hain.b. Lower Pattern Line:Ye pattern line cost lows ko interface karti hai, jisay support line bhi kehte hainPunch ye pattern lines associate hoti hain, triangle boycott jata hai jisay Even Triangle design kehte hain.3. Balanced Triangle Ka Tashkhis Karna:Balanced Triangle design ko tashkhis karne ke liye brokers ko kuch baatein tawajjo mein rakhni hoti hain: a. Value Compression: Even triangle design mein cost range kafi kam hota hai aur highs aur lows ke darmiyan hole chota hota hai. Ye constriction cost ke future bearing ka sign deta hai.b. Volume:Volume bhi ahem factor hota hai Balanced Triangle design ki tashkhis mein. Cost compression ke sath volume bhi by and large kam ho jata hai, jo brokers ko breakout ki taraf ishara deta hai.c. Breakout:Balanced Triangle design mein breakout ek ahem occasion hota hai. Poke cost triangle ke upper ya lower side se bahir nikalta hai, toh breakout samjha jata hai. Breakout ke baad cost aksar tezi se ya mandi se chalta hai.4. Exchanging Technique:Balanced Triangle design ki exchanging technique mein merchants breakout ke heading mein exchange karte hain. Agar cost upper side se breakout karta hai, toh dealers purchase positions lete hain. Hit cost lower side se breakout karta hai, toh brokers sell positions lete hain. Stop misfortune aur take benefit levels ko bhi decide kiya jata hai taaki exchanging risk oversee kiya ja purpose.5. Genuine Models:Balanced Triangle design forex market mein often dekha jata hai. Is design ki samsarasin aksar money matches, jaise EUR/USD, GBP/USD, USD/JPY, and so on, mein nazar aati hain. Constant diagrams aur specialized investigation apparatuses istemal karke merchants is design ko tashkhis kar sakte hain.End:mein istemal sharpen wala ahem cost design hai. Is design ki madad se merchants market patterns aur cost development ke exposed mein samajh pate hain. Even Triangle design ki tashkhis karke brokers exchanging procedures bana sakte hain aur breakout ke heading mein exchange kar sakte hain.

-

#14 Collapse

trading mein, technical analysis aik ahem hissa hai jis ki madad se traders market trends aur price patterns ko samajhne ki koshish karte hain. Symmetrical triangle pattern, ya sammiya shaqqat patla, ek aesa price pattern hai jis ko traders istemal karte hain trend ka pata lagane ke liye. Is article mein hum Roman Urdu mein Symmetrical Triangle pattern ki tafseelat pesh karenge. 1. Symmetrical Triangle: Symmetrical Triangle, ya sammiya shaqqat patla, aik chart pattern hai jo technical analysis mein istemal hota hai. Is pattern mein price highs aur lows, aik triangle ke andar mehsoos hotay hain. Ye triangle hota hai aesa jismay price levels symmetrically barhte aur ghatte hain, jis ki wajah se isay "symmetrical" triangle kehte hain.2. Pattern Banane ka Tareeka: Symmetrical Triangle pattern banane ke liye price highs aur lows ko connect karte hain. Is pattern mein traders do trend lines istemal karte hain: a. Upper Trend Line: Ye trend line price highs ko connect karti hai, jisay resistance line bhi kehte hain. b. Lower Trend Line: Ye trend line price lows ko connect karti hai, jisay support line bhi kehte hain

Jab ye trend lines connect hoti hain, triangle ban jata hai jisay Symmetrical Triangle pattern kehte hain. 3. Symmetrical Triangle Ka Tashkhis Karna: Symmetrical Triangle pattern ko tashkhis karne ke liye traders ko kuch baatein tawajjo mein rakhni hoti hain: a. Price Contraction: Symmetrical triangle pattern mein price range kafi kam hota hai aur highs aur lows ke darmiyan gap chota hota hai. Ye contraction price ke future direction ka indication deta hai. b. Volume:Volume bhi ahem factor hota hai Symmetrical Triangle pattern ki tashkhis mein. Price contraction ke sath sath volume bhi generally kam ho jata hai, jo traders ko breakout ki taraf ishara deta hai. c. Breakout: Symmetrical Triangle pattern mein breakout ek ahem event hota hai. Jab price triangle ke upper ya lower side se bahir nikalta hai, toh breakout samjha jata hai. Breakout ke baad price aksar tezi se ya mandi se chalta hai.

4. Trading Strategy: Symmetrical Triangle pattern ki trading strategy mein traders breakout ke direction mein trade karte hain. Agar price upper side se breakout karta hai, toh traders buy positions lete hain. Jab price lower side se breakout karta hai, toh traders sell positions lete hain. Stop loss aur take profit levels ko bhi determine kiya jata hai taaki trading risk manage kiya ja sake. 5. Real-Life Examples: Symmetrical Triangle pattern forex market mein frequently dekha jata hai. Is pattern ki samsarasin aksar currency pairs, jaise EUR/USD, GBP/USD, USD/JPY, etc., mein nazar aati hain. Real-time charts aur technical analysis tools istemal karke traders is pattern ko tashkhis kar sakte hain. Conclusion: mein istemal hone wala ahem price pattern hai. Is pattern ki madad se traders market trends aur price movement ke bare mein samajh pate hain. Symmetrical Triangle pattern ki tashkhis karke traders trading strategies bana sakte hain aur breakout ke direction mein trade kar sakte hain.break out ka andaza laganay aur is ke mutabiq apni tijarti hikmat amlyon ki mansoobah bandi karne ke liye is tarz ka istemaal kar satke hain. taham, kisi bhi takneeki tajzia ke alay ki terhan, tijarti faislay karte waqt deegar awamil par ghhor karna aur rissk managment ki munasib taknik istemaal karna zaroori hai .

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 Collapse

Assalamualaikum! Umeed hai k ap sb khariyat sy hongy. R apky exchanging meetings throbbing jaa rhy hongy.Aj ka hmra or conversation theme "Even triangle diagram design". Dekhty hain k ye hmein Kya data deta hai r hmry ilam Mai Kesy ezafa krta hai. Presentation aik sadool masalas graph patteren bunyadi peak standard market mein utaar charhao ki alamat hai. dosray lafzon mein, es market ka utaar charhao aahista suker raha hai aur jald greetings honk sakta hai ya honk sakta hai. is patteren ka mushahida is waqt hota hai punch kisi hasas ki qeemat is sy andaaz mein mustahkam ho rahi hoti hai jo qareeb se bhe munsalik dhlwanon ke sath do prepared lines peda karti hai. yeh graph patteren khud hasas ki qeemat ke istehkaam ki aik jari muddat ko zahir karta hai is se pehlay ke usay koi to totnay ya totnay standard majboor kya jaye. agar nichli sy prepared line kharabi ka tajurbah karti hai, to yeh aik naye negative prepared ki shuruvaat ki nishandahi karta hai. Or on the other hand es mutabadil pinnacle standard, agar oopri prepared line ko break out ka saamna karna parta hai, to is ka matlab aik nai taizi ki koi tehreek ka aaghaz hai. ​ Exchanging with balanced triangle diagram design murmur aahang masalas takneeki tajzia mukhtalif graph ka koi patteren ke tajziyon ke sath mil kar behtareen kaam karta hai. matawazi masalas ke namonon ka istemaal sy karte tone, tajir aam peak standard hasas ki qeemat mein ziyada hajam ki naqal o harkat ki talaash mein hotay hain taakay woh is ke break out ki tasdeeq kar saken. deegar isharay is break out ki muddat ka andaza laganay mein madad kar satke hain. misaal ke pinnacle standard, rsi ya' rishta daar taaqat ka asharih' aam peak standard murmur aahang masalas ke takneeki ho tajzia ke sath is baat ka andaza laganay ke liye istemaal kya jata hai ke kab security is ke break out ke baad sy bhe zaroorat se ziyada kharidi gayi hai. tajir - apne stap sy koi nuqsaan ko karne ke liye aik murmur aahang masalas graph patteren ke sath mil kar harkat pazeeri ost ka bhi istemaal karte hain. stop nuqsaan ki taknik istemaal karne ke ilawa, merchants aksar qeemat projikshn taknik ka istemaal karte ho hain hit takneeki isharay ka istemaal karte hain jaisay ke murmur aahang masalas. yahan hai ke qeemat ka koi bhe takhmeenah kaisay kaam karta hai. sab se pehlay, murmur aahang masalas patteren ke sab se kam nuqta aur sab se ziyada nuqta ke darmiyan faaslay ka hisaab lagayen. yeh is ki choraai hai. break out point standard is choraai ko' duplicate sy glue' karen. stomach muscle aap qeemat projikshn level standard apni tijarat se bahar nikal satke hain .

​ Exchanging with balanced triangle diagram design murmur aahang masalas takneeki tajzia mukhtalif graph ka koi patteren ke tajziyon ke sath mil kar behtareen kaam karta hai. matawazi masalas ke namonon ka istemaal sy karte tone, tajir aam peak standard hasas ki qeemat mein ziyada hajam ki naqal o harkat ki talaash mein hotay hain taakay woh is ke break out ki tasdeeq kar saken. deegar isharay is break out ki muddat ka andaza laganay mein madad kar satke hain. misaal ke pinnacle standard, rsi ya' rishta daar taaqat ka asharih' aam peak standard murmur aahang masalas ke takneeki ho tajzia ke sath is baat ka andaza laganay ke liye istemaal kya jata hai ke kab security is ke break out ke baad sy bhe zaroorat se ziyada kharidi gayi hai. tajir - apne stap sy koi nuqsaan ko karne ke liye aik murmur aahang masalas graph patteren ke sath mil kar harkat pazeeri ost ka bhi istemaal karte hain. stop nuqsaan ki taknik istemaal karne ke ilawa, merchants aksar qeemat projikshn taknik ka istemaal karte ho hain hit takneeki isharay ka istemaal karte hain jaisay ke murmur aahang masalas. yahan hai ke qeemat ka koi bhe takhmeenah kaisay kaam karta hai. sab se pehlay, murmur aahang masalas patteren ke sab se kam nuqta aur sab se ziyada nuqta ke darmiyan faaslay ka hisaab lagayen. yeh is ki choraai hai. break out point standard is choraai ko' duplicate sy glue' karen. stomach muscle aap qeemat projikshn level standard apni tijarat se bahar nikal satke hain . Rising Triangle diagram design aik charhtay tone masalas ko aam peak standard tasalsul ka koi bhe namona samjha jata hai. is ka matlab yeh hai ke koi Sa patteren ahem rehta hai agar yeh neechay ke rujhan sy aur oopar ke rujhan dono mein hota hai. masalas se break out honay ke baad, tajir is simt standard munhasir hai jis mein hasas ki qeemat pehli baar shuru hui thi, jarehana pinnacle standard asason ko baichnay ya kharidne mein jaldi karte hain. third sy barhta sun-hwa hajam is baat ki tasdeeq karne mein madad karta hai ke aaya qeemat honk gayi hai ya nahi. Or on the other hand hajam jitna ziyada barhta hai qeemat mein itni howdy dilchaspi patteren se bahar hoti hai. aik charhtay tone masalas ki koi markazi prepared lines bananay ke liye, kam az kam do hon soyng lovs aur do soyng higher zaroori hain. taham, aik dosray ko chone ke liye ziyada tadaad mein prepared lines ziyada qabil aetmaad tijarti nataij ki nishandahi karti hain. chunkay dono prepared material aik dosray mein tabdeel ho to rahi hain, agar hasas ki qeemat is masalas ke andar kayi jhoolon ke liye chalti rehti hai, to is ki qeemat ka amal sy mazeed marboot ho jaye ga, jo bil akhir mazboot break out ka baais banay ga .

Slipping Triangle diagram design utarti hui masalas aik negative candle stuck patteren hai - yani yeh is muddat ki mojoodgi ki pishin goi karta hai hit kisi khaas security ki qeemat neechay ki taraf bherne ki tawaqqa ki jati hai. yeh is waqt zahir hota hai punch do linon ke zariye - aik nichli oonchaiyon ki series mein shaamil ho hoti hai doosri ufuqi prepared line jo neechay ki aik series ko judte hai. is ki shakal ki wajah se usay baaz auqaat dayen zavia masalas bhi kaha jata hai. utartay tint masalas sy graph ka patteren is baat ka ishara hai ke deals side sy bhe brokers jarehana ho rahay hain aur security ki qeemat ki raftaar ko control kar len ge. aam peak standard, merchants is waqt tak intzaar karte hain hit tak ke support ke nichale rujhan mein kharabi nah ho aur phir mukhtasir pozishnin len, or aakhir-kaar security ki qeemat ko kam kar sanctum. yeh candle stuck patteren taajiron mein kaafi maqbool hai kyunkay yeh is baat ki nishandahi karta hai ke capital business sectors mein security ki maang kamzor standard rahi hai. utarti hui masalas aik tajir ko mukhtasir waqt mein khatir khuwa faida haasil karne ka mauqa faraham karti hai .

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 02:55 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим