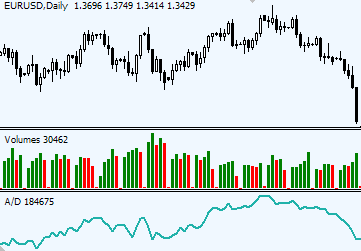

bahut Sare Hain Jo bhojan ki buniyad per kam karte hain ine Shahrukh takniki karo ko yah mushayara karne madad ki hai ki market mein kya ho raha hai aur kya hone wala trading aur Market ke takniki taji hai main bahut time hai bahut Sare Isharon net volume indicator Ek Sath Aisa per kam Karta Hai jaise ki ab tak volume aur Iske dont take volume Ke Darmiyan Park Hai yah Sare Ka kam karne wala asur hai net volume security ka update volume security card don't take volume indicator volume indicator batata hai ki market Mein Mandi ya Teri Ishare Hain aamtaur kimat ke chart Ke Niche khalispur dikhata hai Jab Ke Bajar chart per plant is Hasil karne per ke liye apni kadardaay Karte Hain  How to use net volume in trade: Ye indicator traders ko market ke trend ke baray mein maloomat faraham karta hai. Agar net volume positive hai, toh iska matlab hai ke buyers dominate kar rahay hain aur market mein bullish trend hai. Jab net volume negative hai, toh iska matlab hai ke sellers dominate kar rahay hain aur market mein bearish trend hai.Net volume indicator, trading decisions mein madad kar sakta hai, lekin iska istemal kisi bhi trading strategy ke sath karne se pehle mukammal tajurba aur samajh hona chahiye.Forex me "Net Volume Indicator" ek aisa technical indicator hai jo market mein trade hote hue total buy aur sell volumes ka antar (difference) dikhata hai. Is indicator ki madad se aap market sentiment aur price movement ko samajh sakte hain.Net Volume Indicator ka upyog karke traders volume ke basis par trading decisions lete hain. Agar net volume positive hai, yani buy volumes sell volumes se adhik hain, toh iska matlab hai ki market mein uptrend ho sakta hai aur traders buy positions le sakte hain. Vaise hi, agar net volume negative hai, yani sell volumes buy volumes se adhik hain, toh iska matlab hai ki market mein downtrend ho sakta hai aur traders sell positions le sakte hain.

How to use net volume in trade: Ye indicator traders ko market ke trend ke baray mein maloomat faraham karta hai. Agar net volume positive hai, toh iska matlab hai ke buyers dominate kar rahay hain aur market mein bullish trend hai. Jab net volume negative hai, toh iska matlab hai ke sellers dominate kar rahay hain aur market mein bearish trend hai.Net volume indicator, trading decisions mein madad kar sakta hai, lekin iska istemal kisi bhi trading strategy ke sath karne se pehle mukammal tajurba aur samajh hona chahiye.Forex me "Net Volume Indicator" ek aisa technical indicator hai jo market mein trade hote hue total buy aur sell volumes ka antar (difference) dikhata hai. Is indicator ki madad se aap market sentiment aur price movement ko samajh sakte hain.Net Volume Indicator ka upyog karke traders volume ke basis par trading decisions lete hain. Agar net volume positive hai, yani buy volumes sell volumes se adhik hain, toh iska matlab hai ki market mein uptrend ho sakta hai aur traders buy positions le sakte hain. Vaise hi, agar net volume negative hai, yani sell volumes buy volumes se adhik hain, toh iska matlab hai ki market mein downtrend ho sakta hai aur traders sell positions le sakte hain.

Video song Ek snap shot view indicator Hai candle stick Badariya candlest Aam kya kar sakte hain kya ruzan badhta hai to Jyada jayaj Rahega lekin kya yah Aisi chijen Nahin Hai Jiska aap kimat Jaat se Najar Laga sakte hain matlab Khali Sujan aapko start ke ruzan ya zero Altaf break out ke Asal Niyat ki chunav karne mein madad karta hai agar Kuchh Bhi Hai To kimat ki karyvahi ki to Sikh karne ke liye Khali film ko Piche Rahane wale Sare Ke Taur per istemal Kiya Ja sakta hai isliye agar aap break aur dekhte hain aur kha lete Upar ki taraf jyada hai to yah aapko yakin karne ka hai FIR Jaan Jari Rahega kam ka Ishara kis bhi Tarah Se aapko yah Nahin bataega star Krishna Kisi Tarah Jyada kharida Jyada Sahyog To Aaya Jara ko Talash kar rahe hain

تبصرہ

Расширенный режим Обычный режим