Bollinger Band Indicator detail discussion...

`

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔ٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

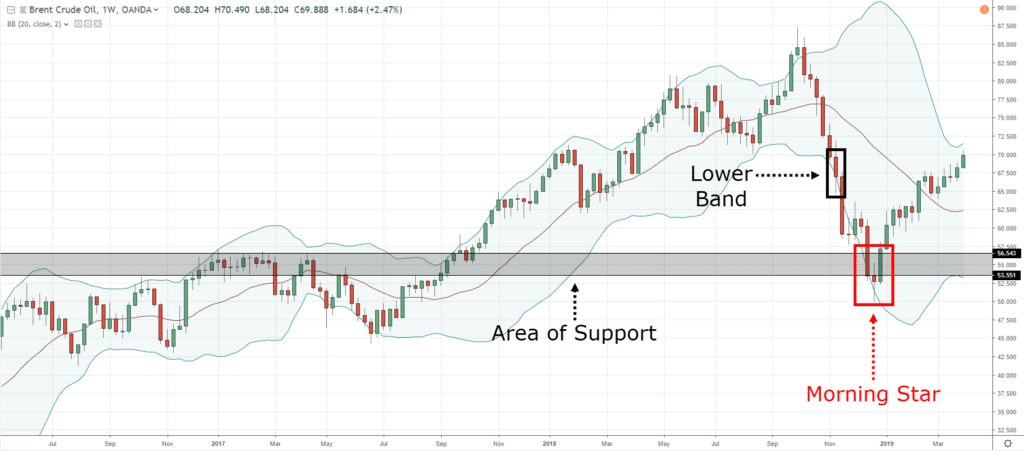

Assalamu Alaikum dear friend ummid Karti hun aap sab khairiyat se honge aur forex trading business Mein achi working quality ke sath market Se achcha profit hasil kar rahe ho Business mein kam karte Hain To hamen market Mein inter aur exit hone se pahle market ko acchi tarike se karna hota hai ki market ki movement Ke side per expected hai to use surat Mein hamen acchi decision making karne aur Market Se achcha profit hasil karne ka mauka milta Hai aur different types of indicator hamen market ko analysis karne mein madad dete Hain dear Ham apni aaj ki post mein baat karenge Bollinger band indicator ke baare mein aur Main ummid Karti Hun ki yah information aapko bahut jyada madad degi.Bollinger Band Indicator:Dear Bollinger bend jaise indicator price ke zareye analysis karne aur trading ko behtar banane mein aapko bahut jyada help out karte Hain is indicator ka istemal aapko trend direction ko samajhne mein bahut jyada madad deta hai aur agar trend khatm ho jaaye to yah entry point ka pata lagane waqt risk ko kam kar sakta hai aur aapko stock karne ke liye ek acche exit time aur break out ki Nishan dahi karne ke liye signal provide karta hai. Agar Ham acchi tarike se ine signals ko samajhne ke bad market mein apni working karte Hain to hamen uske acche advantages available ho sakti hain.Bollinger bend indicator market mein ups and downs ya utality jyada ya kam hone ki surat mein overbought or over sold ki condition mein aapko bahut acchi information provide karta hai yah indicator Ek simple moving average hai jisko amomen 20 periods per set Kiya jata hai.Kunky jab market votality jyada Hoti hai to blinger band expand hote Hain aur jab band close ho jaate Hain to utaar chadhav Kam hota hai aamtaur per Kisi aise overboard samjha jata hai jab price billinger band tak pahunchti hai to use waqt price phir dobara oversold ki taraf chalna start karti hai. Kyunki price Jab upper band ko touch karti hai to use time uski reversal movement start ho jaati hai aur iske sath Jab price lower band ko touch karti hai to use waqt Bhi uska trend change ho jata hai aur uski reversal munh Mein start ho jaati Hai.Explaination and Trading Strategy:Dear billonger band indicator Ek bahut popular indicator hai yah market ki movement ke bare mein signals ke liye isko istemal karne ke different methods hain lekin bahut se dusre tools ki Tarah yah future ki direction ya prediction Nahin deta isiliye time frame jitna long Hoga signal itne hi jyada acche sabit honge Kyunki yah hamen trend ki direction ke bare mein information deta hai isiliye agr dosry indicators ke sath milakar istemal kiya jaaye to uske advantages ko increase Kiya ja sakta hai lity ke signals ke liye istemal Kiya jata hai yah pichhali bands ki nisbatya kam hone ki behtar prediction deta hai jiski vajah se is band ki madad se market ke movement ko samajhna hamare liye bahut aasan ho jata hai forex market votality ke dauran Bollinger band close ho jaate Hain aur line Ek dusre ke bahut kareeb a Rahi hoti hai to use waqt aapko yah samajhna chahie ki Kisi bhi time mein break out ke liye taiyari rakhen kyunki yah break out hone ki bahut badi nishani deta hai aur jab prices ke aur chadhav ke dauran isko istemal kiya jaaye to Ek Sath jab yah kam hote hain to aap break out ke liye taiyar rahen ke price bullish rahegi aur yah market mein buy ka ek achcha time hota hai Is Tarah agar rice bottom band se niche break ho jaati hai to yah is baat ki production Hoti hai jis per market mein sell ki entry li ja sakti hai Kyunki price Jab iske upar yaar lower back ko touch karti hai to use waqt uski reversal moment strongly expected hoti hai to use waqt entry lekar aap market se maximum profit hasil kar sakte hain. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamu Alaikum Dosto!Bollinger Band IndicatorBollinger Band indicator ka istemal price volatility aur trend ki samajhne ke liye kiya jata hai. Yeh indicator John Bollinger dwara banaya gaya tha aur iske naam unhi ke naam par rakha gaya hai. Bollinger Bands traders ke beech mein bahut hi mashhoor hai aur iska istemal market trends aur price movements ke analyze karne ke liye kiya jata hai. Bollinger Bands ek price envelope hai jo price ke aas-pass ek upper band, lower band, aur middle band se bana hota hai. Middle band usually simple moving average (SMA) ka istemal karke calculate kiya jata hai. Upper aur lower bands ko middle band se ek standard deviation distance par plot kiya jata hai. Standard deviation volatility ka measure karta hai aur iske istemal se price ke aas-pass ki volatility ka pata lagaya ja sakta hai.Bollinger Band Indicator - ComponentsBollinger Bands indicator mein kuch important components hote hain, jinhe traders ko samajhna zaruri hota hai.- Middle Band: Middle band, jo ki usually simple moving average (SMA) hota hai, price ke trend ka measure karta hai. Middle band market trend ke liye reference point ke roop mein kaam karta hai.

- Upper Band: Upper band price ke aas-pass ki volatility ko darshata hai. Yeh middle band ke upar ek standard deviation distance par plot kiya jata hai. Jab price upper band ke pass ata hai, toh yeh ek possible overbought condition darshata hai aur price ka reversal hone ka indication ho sakta hai.

- Lower Band: Lower band bhi price ke aas-pass ki volatility ko darshata hai. Yeh middle band ke neeche ek standard deviation distance par plot kiya jata hai. Jab price lower band ke pass ata hai, toh yeh ek possible oversold condition darshata hai aur price ka reversal hone ka indication ho sakta hai.

- Band Width: Band width, upper band aur lower band ke beech ki distance ko measure karta hai. Band width ki kam value low volatility ko darshati hai, jabki zyada value high volatility ko darshati hai. Band width ki help se traders volatility ke changes ko monitor kar sakte hain.

Bollinger Band Indicator - InterpretationBollinger Bands ka istemal karke traders market conditions aur price movements ka interpretation kar sakte hain.- Volatility: Bollinger Bands ki width volatility ke changes ko darshati hai. Jab bands zyada wide hote hain, tab volatility zyada hoti hai, aur jab bands narrow hote hain, tab volatility kam hoti hai. Volatility ke changes ke basis par traders apne trading strategies aur risk management ko adjust kar sakte hain.

- Overbought/Oversold Conditions: Jab price upper band ke pass ata hai, toh yeh ek overbought condition darshata hai, aur jab price lower band ke pass ata hai, toh yeh ek oversold condition darshata hai. Overbought conditions mein price ka reversal downward ho sakta hai aur oversold conditions mein price ka reversal upward ho sakta hai.

- Trend Reversals: Bollinger Bands ka istemal trend reversals ko identify karne ke liye kiya jata hai. Jab price upper band se bahar nikal kar wapas middle band ke pass ata hai, toh yeh ek possible downtrend reversal indication ho sakta hai. Vaise hi, jab price lower band se bahar nikal kar wapas middle band ke pass ata hai, toh yeh ek possible uptrend reversal indication ho sakta hai.

Bollinger Band Indicator - Trading StrategiesBollinger Bands ka istemal karke traders alag-alag trading strategies follow kar sakte hain.- Bollinger Squeeze: Jab bands narrow hote hain aur band width kam ho jata hai, tab yeh bollinger squeeze condition darshata hai. Is condition mein market mein volatility kam hoti hai aur ek breakout ki possibility hoti hai. Traders bollinger squeeze ke baad ki breakout direction ka wait karte hain aur uske anusaar trade karte hain.

- Bounce Strategy: Bollinger Bands ke pass se price bounce karna ek popular strategy hai. Jab price upper band touch karta hai, toh yeh ek possible selling opportunity ho sakti hai, aur jab price lower band touch karta hai, toh yeh ek possible buying opportunity ho sakti hai. Traders ko bounce strategy mein price ke bounce point par entry aur exit points set karne hote hain.

- Trend-Following Strategy: Bollinger Bands ko trend-following strategy mein bhi istemal kiya jata hai. Agar price upper band ke pass up-trending hai aur lower band ke pass down-trending hai, toh traders trend-following strategy ko follow karke trades execute karte hain. Price ke upper band touch par long position lete hain aur price ke lower band touch par short position lete hain.

ConclusionBollinger Band Indicator forex trading mein ek powerful tool hai jo price volatility, trend reversals, aur trading opportunities ko identify karne mein madad karta hai. Traders ko is indicator ka istemal karne se pehle uski tafseel aur components ko samajhna zaruri hota hai. Saath hi, traders ko is indicator ke interpretation aur trading strategies par bhi dhyan dena chahiye. Bollinger Bands ke sahi istemal se traders apne trading decisions ko improve kar sakte hain aur trading performance ko enhance kar sakte hain. -

#4 Collapse

Asslam o Alaikum forex trading pr ap logo ka kam Acha chl rha hoga aj jis mozo pr hum bt krain ga wo nicha hain TOPIC :BOLLINGER BAND INDICATOR DETAIL DESCRIPTION Bollinger Band indicator ko 1980 ki dahai ke awail mein jaan Bollinger ne tayyar kya tha. aik aam tasawwur ke bawajood ke utaar charhao jaamad hai, mister Bollinger ka khayaal tha ke yeh mutharrak hai. usay aik aisay alay ki zaroorat thi jo tijarti baind aur utaar charhao ko apane. agarchay yeh indicator sikyortiz tajzia ke l- created tayyar kya gaya tha, lekin tajir usay mukhtalif marketon mein wasee pemanay par istemaal karte hain, Bashmole forex, stock, ijnaas isharay teen linon par mushtamil hai. middle Bollinger baind aik saada harkat Pazeer ost hai, jabkay oopri aur nichale baind market mein utaar charhao ke liye kharray hain aur harkat Pazeer ost aur mayaari inhiraf ki bunyaad par shumaar kiye jatay hain. inhiraf is baat ka taayun karta hai ke qeemat ki qeemat is ki ost se kitni daur hai . EXPLANATION : chart mein indicator ko laago karte waqt, taajiron ko do parameters muqarrar kar satke hain – muddat aur mayaari inhiraf. Sabiqa is baat ka taayun karta hai ke isharay ke hisaab ke liye kitney adwaar par ghhor kya jata hai, jabkay moakhar az zikr baind ke darmiyan faaslay ke liye khara hai . jab baind kam utaar charhao ki muddat ke douran sakht ho jatay hain to, is se kisi bhi simt mein taiz qeemat ki harkat ka imkaan barh jata hai. yeh aik rujhan saazi iqdaam shuru kar sakta hai. mukhalif simt mein ghalat iqdaam par nigah rakhen jo munasib rujhan shuru honay se pehlay ulat jata hai . jab baind ghair mamooli barri miqdaar se allag ho jatay hain to, utaar charhao barhta hai aur koi bhi mojooda rujhan khatam ho sakta hai . qeematon mein baind ke lifafay ke andar uchalnay ka rujhan hota hai, aik baind ko chone ke baad dosray baind mein muntaqil hota hai. aap un jhoolon ko mumkina munafe ke ahdaaf ki shanakht mein madad ke liye istemaal kar satke hain. misaal ke tor par, agar qeemat nichale baind se uchalti hai aur phir chalti ost se oopar uboor karti hai to, oopri baind phir munafe ka hadaf ban jata hai . qeemat mazboot rujhanaat ke douran taweel arsay tak baind lifafay se ziyada ya gilaay lag sakti hai. aik momentum axcelator ke sath inhiraf par, aap is baat ka taayun karne ke liye izafi tehqeeq karna chahain ge ke aaya izafi munafe lena aap ke liye munasib hai .

- Mentions 0

-

سا0 like

-

#5 Collapse

BOLLINGER BAND INDICATOR DEFINITION: Bollinger Band Indicator ka matlab hota hai Bollinger Bands ke istemaal se kisi bhi security ya stock ke price movements ko analyze karna. Ye indicator volatility, trend, aur potential reversals ko samajhne ke liye istemaal hota hai. Bollinger Bands ko develop kiya gaya tha John Bollinger ne aur ye ek popular technical analysis tool hai.Bollinger Bands, price chart par ek set of lines hote hain jo price ke around banaye jate hain. Ye lines usually three hote hain: upper band, middle band (simple moving average), aur lower band. Upper band price ke volatility aur trend ke upper limit ko represent karta hai, jabki lower band volatility aur trend ke lower limit ko represent karta hai. SIMPLE MOVING AVERAGES (SMA): Bollinger Bands ka middle band usually Simple Moving Average (SMA) hota hai. SMA ko calculate karne ke liye past kuch specific time periods ke price add karke unka average nikala jata hai. Is tarah se SMA current price ko smooth karke trend ko highlight karta hai. STANDARD DEVIATION WITH UPER AND LOWER BANDS: Bollinger Bands ke upper aur lower bands ko calculate karne ke liye standard deviation ka istemaal hota hai. Standard deviation volatility ko measure karta hai. Higher standard deviation, higher volatility ko indicate karta hai. UPPER AND LOWER BANDS: Bollinger Bands ke upper band aur lower band price ke around volatility ke basis par set kiye jate hain. Usually, 20-day simple moving average (SMA) ke around 2 standard deviations upar aur neeche ke bands banaye jate hain. Bollinger Bands ki interpretation price movements aur volatility par depend karti hai. Jab price upper band ke near hota hai, to ye indicate karta hai ki security overbought ho sakti hai aur price reversal ka possibility hai. Jab price lower band ke near hota hai, to ye indicate karta hai ki security oversold ho sakti hai aur price reversal ka possibility hai. Bollinger Bands ke squeeze pattern mein upper aur lower bands aapas mein bahut close hote hain, jo indicate karta hai ki security volatility ke kam phase mein hai. Squeeze pattern usually kam volatility ke baad bada price movement ka signal hai. BOLLINGER BAND INDICATOR PRICE MOVEMENTS. Bollinger Bands ke breakout pattern mein price bands se bahar nikal jata hai. Jab price upper band se bahar nikalta hai, to ye bullish breakout hai aur price ka further up move possible hai. Jab price lower band se bahar nikalta hai, to ye bearish breakout hai aur price ka further down move possible hai. Bollinger Band Indicator price movements ko analyze karne mein madad karta hai aur traders aur investors ko entry aur exit points identify karne mein help karta hai. Ye ek popular tool hai jo market volatility aur trends ko samajhne ke liye istemaal kiya jata hai. -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Bollinger Band Indicator main analysis kare makret main trend ko follow kare agar trend ko follow kiya jata hain tu kamyabi mil jati hainforex trading main pratice kare Bollinger Band Indicator main analysis kare har traders big loss kar dete hain forex main hard work krne wale traders kamyabi easy pate hainjisne learning nhe ki makret kimove ko nhe samjha vo traders kabi b kamyab nhe ho skte hain is liye learning koincress kare forex mainanalysis kare market main trend ko follow kare agar trend ko follow nhe kiya jata hai t u ek traders big loss kar deta hain forex trading main trend ko follow krna must hain forex tradingmain analysis kare makret main trend ko follow krna must hota hain agar trend ko follow nhe kiya tu loss hain is liyye trend he ek traderka friend hain forex mainbenefit mil skta hain How to trade on Bollinger Band Indicator: forex trading main Bollinger Band Indicator main kafi best benefit de skta hainBollinger Band Indicator main regular pratice kare qk jaaab tak ek traders Bollinger Band Indicator main pratice nhe karta hain tu big loss kar deta hain forex mainpratice kare Bollinger Band Indicator main regular hardwork k sath kaam kare Bollinger Band Indicator main learning ko strong kare Bollinger Band Indicator main analysis kare makretmain trend ko follow kare Bollinger Band Indicator main rules ko agar follow nhe kiya tu big loss ho jata hain Bollinger Band Indicator main analysis kare jaab tak learning strong nhe hain tu big loss ho jata hain l;earning karna must hain hard work karna must hain makret main trend ko follow karna must hain Bollinger Band Indicator main analysis kare -

#7 Collapse

hree black crows ki aik typical appearance mein bulls session start karen gey jis ki price previous close k muqably mein zada open hojaye gi liken pury session mein price kam hojati hai In end price bears k pressure mein session low k qareeb band hojaye gi aur is trading action ka result boht short hoga Traders aksar is downtrend pressure ki interpret karty hein jo k three sessions mein start rehny waly bearish downtrend ka start hai Umeed hai k tamam members ko aj ka topic easily samjh aya hoga Agar is pattern ko ap mind k andar rakh kar trade karty hein tou acha earn kar skty hain just apko aesy time ka wait kerna hota hai ky jab three black crows pattern complete ho jaey tab trade open ker ky continue ker leni chahiayGullalai -

#8 Collapse

Bollinger bend jaise indicator price ke zareye analysis karne aur trading ko behtar banane mein aapko bahut jyada help out karte Hain is indicator ka istemal aapko trend direction ko samajhne mein bahut jyada madad deta hai aur agar trend khatm ho jaaye to yah entry point ka pata lagane waqt risk ko kam kar sakta hai aur aapko stock karne ke liye ek acche exit time aur break out ki Nishan dahi karne ke liye signal provide karta hai.Bollinger Band indicator ka istemal price volatility aur trend ki samajhne ke liye kiya jata hai. Yeh indicator John Bollinger dwara banaya gaya tha aur iske naam unhi ke naam par rakha gaya hai. Bollinger Bands traders ke beech mein bahut hi mashhoor hai aur iska istemal market trends aur price movements ke analyze karne ke liye kiya jata hai. Bollinger Band Indicator main kafi best benefit de skta hainBollinger Band Indicator main regular pratice kare qk jaaab tak ek traders Bollinger Band Indicator main pratice nhe karta hain tu big loss kar deta hain forex mainpratice kare Bollinger Band Indicator main regular hardwork k sath kaam kare Bollinger Band Indicator main learning ko strong kare Bollinger Band Indicator main analysis kare makretmain trend ko follow kare Bollinger Band Indicator main rules ko agar follow nhe kiya tu big loss ho jata hain Bollinger Band Indicator main analysis kare jaab tak learning strong nhe hain tu big loss ho jata hain l;earning karna must hain hard work karna must hain makret main trend ko follow karna must hain Bollinger Band Indicator main analysis kareBollinger Bands ke breakout pattern mein price bands se bahar nikal jata hai. Jab price upper band se bahar nikalta hai, to ye bullish breakout hai aur price ka further up move possible hai. Jab price lower band se bahar nikalta hai, to ye bearish breakout hai aur price ka further down move possible hai. Bollinger Band Indicator price movements ko analyze karne mein madad karta hai aur traders aur investors ko entry aur exit points identify karne mein help karta hai. Ye ek popular tool hai jo market volatility aur trends ko samajhne ke liye istemaal kiya jata hai. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Bollinger Band Indicator ka Introduction signals ko samajhne ke bad market mein apni working karte Hain to hamen uske acche advantages available ho sakti hain.Bollinger bend indicator market mein ups and downs ya utality jyada ya kam hone ki surat mein overbought or over sold ki condition mein aapko bahut acchi information provide karta hai yah indicator Ek simple moving average hai jisko amomen 20 periods per set Kiya jata hai.Kunky jab market votality jyada Hoti hai to blinger band expand hote Hain aur jab band close ho jaate Hain to utaar chadhav Kam hota hai aamtaur per Kisi aise overboard samjha jata hai jab price billinger band tak pahunchti hai to use waqt price phir dobara oversold ki taraf chalna start karti hai. Kyunki price Jab upper band ko touch karti hai to use time uski reversal movement start ho jaati hai aur iske sath Jab price lower band ko touch karti hai to use waqt Bhi uska trend change ho jata hai Working Principle Ek bahut popular indicator hai yah market ki movement ke bare mein signals ke liye isko istemal karne ke different methods hain lekin bahut se dusre tools ki Tarah yah future ki direction ya prediction Nahin deta isiliye time frame jitna long Hoga signal itne hi jyada acche sabit honge Kyunki yah hamen trend ki direction ke bare mein information deta hai isiliye agr dosry indicators ke sath milakar istemal kiya jaaye to uske advantages ko increase Kiya ja sakta hai lity ke signals ke liye istemal Kiya jata hai yah pichhali bands ki nisbatya kam hone ki behtar prediction deta hai jiski vajah se is band ki madad se market ke movement ko samajhna hamare liye bahut aasan ho jata hai forex market votality ke dauran Bollinger band close ho jaate Hain aur line Ek dusre ke bahut kareeb a Rahi hoti hai to use waqt aapko yah samajhna chahie ki Kisi bhi time mein break out ke liye taiyari rakhen kyunki yah break out hone ki bahut badi nishani deta hai aur jab prices ke aur chadhav ke dauran isko istemal kiya jaaye to Ek Sath jab yah kam hote hain to aap break out ke liye taiyar rahen ke price bullish rahegi aur yah market mein buy ka ek achcha time hota hai Is Tarah agar rice bottom band se niche break ho jaati hai to yah is baat ki production Hoti hai jis per market mein sell ki entry li ja sakti ha

Working Principle Ek bahut popular indicator hai yah market ki movement ke bare mein signals ke liye isko istemal karne ke different methods hain lekin bahut se dusre tools ki Tarah yah future ki direction ya prediction Nahin deta isiliye time frame jitna long Hoga signal itne hi jyada acche sabit honge Kyunki yah hamen trend ki direction ke bare mein information deta hai isiliye agr dosry indicators ke sath milakar istemal kiya jaaye to uske advantages ko increase Kiya ja sakta hai lity ke signals ke liye istemal Kiya jata hai yah pichhali bands ki nisbatya kam hone ki behtar prediction deta hai jiski vajah se is band ki madad se market ke movement ko samajhna hamare liye bahut aasan ho jata hai forex market votality ke dauran Bollinger band close ho jaate Hain aur line Ek dusre ke bahut kareeb a Rahi hoti hai to use waqt aapko yah samajhna chahie ki Kisi bhi time mein break out ke liye taiyari rakhen kyunki yah break out hone ki bahut badi nishani deta hai aur jab prices ke aur chadhav ke dauran isko istemal kiya jaaye to Ek Sath jab yah kam hote hain to aap break out ke liye taiyar rahen ke price bullish rahegi aur yah market mein buy ka ek achcha time hota hai Is Tarah agar rice bottom band se niche break ho jaati hai to yah is baat ki production Hoti hai jis per market mein sell ki entry li ja sakti ha  Bollinger Band ki Treading Information kia hy Bollinger Band Indicator main kafi best benefit de skta hainBollinger Band Indicator main regular pratice kare qk jaaab tak ek traders Bollinger Band Indicator main pratice nhe karta hain tu big loss kar deta hain forex mainpratice kare Bollinger Band Indicator main regular hardwork k sath kaam kare Bollinger Band Indicator main learning ko strong kare Bollinger Band Indicator main analysis kare makretmain trend ko follow kare Bollinger Band Indicator main rules ko agar follow nhe kiya tu big loss ho jata hain Bollinger Band Indicator main analysis kare jaab tak learning strong nhe hain tu big loss ho jata hain

Bollinger Band ki Treading Information kia hy Bollinger Band Indicator main kafi best benefit de skta hainBollinger Band Indicator main regular pratice kare qk jaaab tak ek traders Bollinger Band Indicator main pratice nhe karta hain tu big loss kar deta hain forex mainpratice kare Bollinger Band Indicator main regular hardwork k sath kaam kare Bollinger Band Indicator main learning ko strong kare Bollinger Band Indicator main analysis kare makretmain trend ko follow kare Bollinger Band Indicator main rules ko agar follow nhe kiya tu big loss ho jata hain Bollinger Band Indicator main analysis kare jaab tak learning strong nhe hain tu big loss ho jata hain

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 07:26 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим