What are candles in Forex trading

`

X

new posts

-

#1 Collapseٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

What are candles in Forex trading What are candles in Forex trading Candlestick forex trading mein qeemat ki malomat zahir karne ka aik maqbool tareeqa hai. mom batian aik waqt ke douran qeemat ki naqal o harkat ki basri numindagi hain, aam tor par aik din ya aik ghantay. woh aik mustateel jism aur jism ke oopar aur neechay se phailay hue do" vicks" ya" saaye" par mushtamil hotay hain . candles batian taajiron ko qeemti maloomat faraham karti hain, jaisay ke iftitahi aur ikhtitami qeematein, muddat ki buland tareen aur kam tareen qeematein, aur qeemat ki naqal o harkat ki simt. woh taajiron ko rujhanaat aur mumkina tabdeelion ke sath sath himayat aur muzahmat ki sthon ki nishandahi karne mein madad kar satke hain . sirloin patteren, jaisay doji, hammer, aur shooting star, market ke jazbaat aur mumkina qeemat ki naqal o harkat ke baray mein izafi maloomat bhi faraham kar satke hain . khulasa yeh ke, candles forex traders ke liye aik zaroori tool hain. mom btyon ke namonon aur taskeelat ka mutalea karkay, tajir market ke ravayye ke baray mein baseerat haasil kar satke hain aur mazeed bakhabar tijarti faislay kar satke hain . Types of candles in Forex trading Forex trading mein istemaal honay wali candlestick ki kayi aqsam hain, har aik currency jore ki qeemat ke amal ke baray mein mukhtalif maloomat faraham karti hai. mom btyon ki kuch aam kasmain yeh hain: Bull candlestick : je qisam ki candlestick ka jism lamba hota hai aur yeh ishara karta hai ke trading ke douran currency pear ki qeemat mein izafah sun-hwa. body like oopri hissa ikhtitami qeemat ki numaindagi karti hai, aur neechay ki qeemat iftitahi qeemat ki numaindagi karti hai . Bear candlestick : je qisam ki candlestick ki body bhi lambi hoti hai, lekin yeh je baat ki nishandahi karti hai ke trading ke douran currency pear ki qeemat mein kami waqay hui. jism ka oopri hissa iftitahi qeemat ki numaindagi karta hai, aur neechay ikhtitami qeemat ki numaindagi karta hai . Doji candle stick : is qisam ki candle stick ki body choti hoti hai aur yeh batati hai ke trading ke douran currency pear ki ibtidayi aur band honay wali qeematein taqreeban aik jaisi theen. yeh market mein Adam faisla ki nishandahi karta hai aur mumkina rujhan ko tabdeel karne ka ishara day sakta hai . Hammer candlestick : je qisam ki candlestick ka jism chhota aur nichli batii lambi hoti hai. is se zahir hota hai ke farokht knndgan ne tijarti muddat ke douran qeemat ko kam kar diya, lekin kharidaron ne qadam barha kar qeemat ko wapas barha diya. yeh mumkina rujhan ko tabdeel karne ka mahswara den sakta hai . Shooting star candlestick : is qisam ki candle stick ka jism chhota aur oopri vÙk lambi hoti hai. is se zahir hota hai ke kharidaron ne trading ke douran qeemat ziyada kar di, lekin baichnay walay agay barhay aur qeemat ko wapas neechay dhakel diya. yeh mumkina rujhan ko tabdeel karne ki tajweez bhi den sakta hai . Yeh ghair mulki currency ki tijarat mein istemaal honay wali mom batii ki aqsam ki sirf chand misalein hain. patteren aur mumkina tijarti mawaqay ki nishandahi karne ke liye tajir aksar aik sath mutadid mom batian istemaal karte hain . -

#3 Collapse

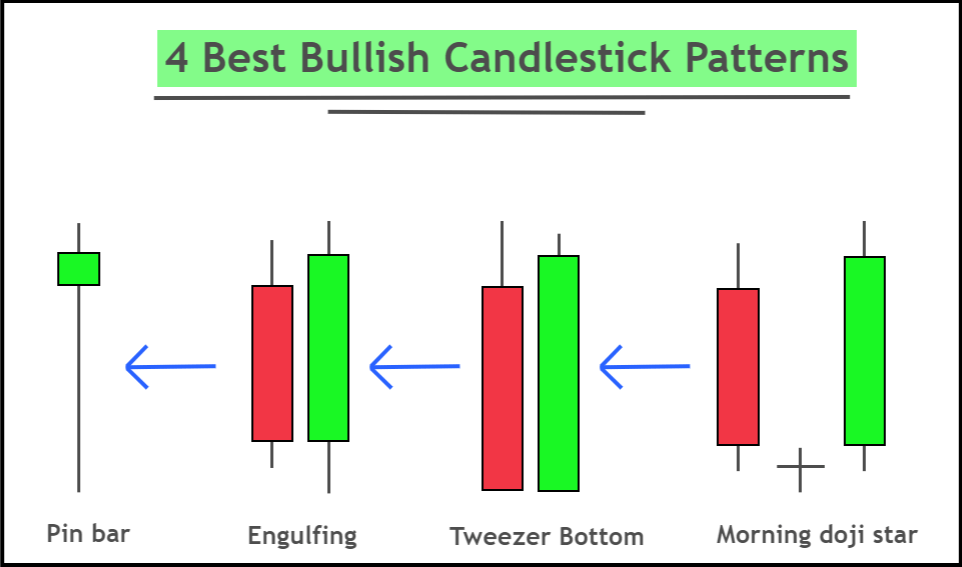

Introduction: Forex trading woh market hai jahan traders mukhtalif tools aur indicators ka istemal kar ke samjhte hain konsi trading decisions behtar ho sakti hain. Ek aisa tool jo Forex trading mein wafadar istemal hota hai wo "candles" hoti hain. Is post mein hum samjheinge ke candles kya hote hain aur unka Forex trading mein istemal kaise hota hai. Forex Trading Mein Candles Kya Hote Hain? Candles, jo ke candlesticks bhi kaha jate hain, Forex trading mein price movements ki visual representation hoti hain. Ye traders ko mukhtalif maloomat faraham karte hain jaise ke kisi time period mein opening, closing, highest aur lowest prices. Har candle mein aik body aur do wicks hote hain, jinhe shadows ya tails bhi kaha jata hai. Candlestick Components Samajhna: Candles ko Forex trading mein puri tarah samajhne ke liye, hum inke components ko samjhte hain: 1. Body: Rectangle-shaped body opening aur closing prices ke beech ki price range ko represent karti hai, jo kisi time period mein hoti hai. Agar closing price opening price se ziada hoti hai, to body typically filled ya colored hoti hai, jo ke bullish (upward) movement ko indicate karti hai. Waise hi, agar closing price opening price se kam hoti hai, to body aksar hollow ya different color ki hoti hai, jo ke bearish (downward) movement ko suggest karti hai. 2. Wicks (Shadows ya Tails): Body ke upar aur neeche patli lines wicks, shadows ya tails kahlati hain. Upper wick highest price ko represent karti hai, jabkay lower wick lowest price ko represent karti hai. Wicks ki lambai market ki volatility aur trading range ke bare mein mazeed maloomat faraham karti hai. 3. Candlestick Patterns Ki Tashreeh: Candles Forex trading mein ahem kirdar ada karte hain kyun ke wo traders ko price movements aur market sentiment ki patterns aur trends ki pehchan karne mein madad karte hain. Yahan kuch aam candlestick patterns aur unki tashreeh di gayi hai: 4. Doji: Doji candle jab hoti hai jab opening aur closing prices aik dosre ke qareeb hoti hain. Iska matlab hota hai market mein uncertainty aur aksar isse reversal ya significant price movement se pehle paaya jata hai. 5. Engulfing: Engulfing pattern jab hota hai jab aik bada candle puri tarah se pehle wale candle ko cover kar leta hai. Isse market sentiment ki tabdeeli ka andaza hota hai aur ye potential trend reversal ko indicate kar sakta hai. 6. Hammer: Hammer candle mein chhoti body aur lambi lower wick hoti hai. Ye suggest karta hai ke downtrend ke baad buyers market mein dakhil ho rahe hain aur ye bullish reversal ki possibility ho sakti hai. -

#4 Collapse

candles in Forex trading:- Forex Trading mein Candles ki Ahmiyat:

- Forex Trading mein Candles aur Unke Charts:

- Bullish Candles ke Tareeqe Forex Trading mein:

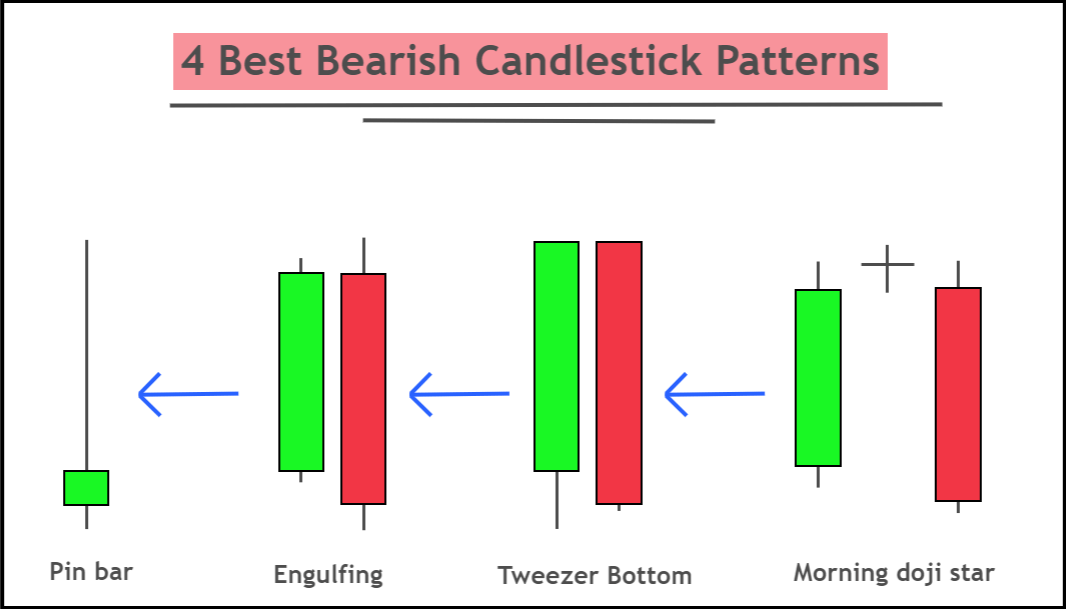

- Bearish Candles ke Tareeqe Forex Trading mein:

- Candles ki Tashreeh aur Samajh Forex Trading mein:

- Candles ke Istemaal se Reversal Trades ka Pata Lagana Forex Trading mein:

- Candles ke Istemaal se Continuation Trades ka Pata Lagana Forex Trading mein:

- Forex Trading mein Strategy Banane ke Liye Candles ka Istemaal:

- Candlestick Patterns: Study karein aur samjhein ki bullish aur bearish candlestick patterns kaise dikhte hain. Isse aap price reversals aur trend continuation ke signals ko samajh sakte hain. Kuch prasiddh patterns hain, jaise ki Doji, Hammer, Shooting Star, Engulfing, etc.

- Multiple Time Frames: Different time frames mein candles ke patterns aur formations ko analyze karein. Ek candle pattern ek time frame mein confirm ho sakta hai, lekin agar dusre time frames par bhi ye pattern confirm ho raha hai, toh aapki trading decision ko validate karne mein madad milegi.

- Support aur Resistance Levels: Candles ke patterns aur formations ko support aur resistance levels ke saath combine karein. Agar aap bullish candle pattern aur support level ke beech ek confluence point dekh rahe hain, toh ye aapke buy entry ke liye ek strong signal ho sakta hai.

- Trend Identification: Candles ki madad se trend direction ko identify karein. Agar aap uptrend mein hain, toh bullish candle patterns ke saath entry points ko dhundein. Vaise hi, downtrend mein bearish candle patterns ke saath entry points ko dhundein.

- Stop Loss aur Take Profit Levels: Candles ke patterns aur price action ko dekhkar stop loss aur take profit levels ko set karein. Agar aap long position le rahe hain, toh aap stop loss order ko bearish candle ke neeche set kar sakte hain. Take profit level ko bullish candle ke near ya resistance level ke paas set karein.

- Risk Management: Apni trading strategy mein risk management ka dhyan rakhein. Candles ke patterns aur formations ke saath risk-reward ratio ko calculate karein aur apne trades ko manage karein.

- conclusion Candles, Forex Trading mein bahut ahmiyat rakhte hain. Unke patterns, formations, aur price action analysis se traders price movement, trend direction, aur market sentiment ko samajh sakte hain. Candlestick charts, jo candles ko graphical form mein darshate hain, traders ko price data ko samajhne aur interpret karne mein madad karte hain. Bullish aur bearish candle patterns, reversal aur continuation trades ke signals provide karte hain. Candles ko strategy banane mein istemal karke traders entry aur exit points, stop loss, aur take profit levels ko set kar sakte hain. Risk management ko dhyan mein rakhte hue, candles ke saath practice aur experience ka nirantar prayas karna chahiye. Is tarah se, candles ka istemal karke traders apni Forex Trading strategy ko strengthen kar sakte hain.

-

#5 Collapse

Presentation: Forex exchanging woh market hai jahan brokers mukhtalif devices aur pointers ka istemal kar ke samjhte hain konsi exchanging choices behtar ho sakti hain. Ek aisa instrument jo Forex exchanging mein wafadar istemal hota hai wo "candles" hoti hain. Is post mein murmur samjheinge ke candles kya hote hain aur unka Forex exchanging mein istemal kaise hota hai.Forex Exchanging Mein Candles Kya Hote Hain? Candles, jo ke candles bhi kaha jate hain, Forex exchanging mein cost developments ki visual portrayal hoti hain. Ye dealers ko mukhtalif maloomat faraham karte hain jaise ke kisi time span mein opening, shutting, most elevated aur least costs. Har light mein aik body aur do wicks hote hain, jinhe shadows ya tails bhi kaha jata hai. \ Candle Parts Samajhna: Candles ko Forex exchanging mein puri tarah samajhne ke liye, murmur inke parts ko samjhte hain:

1. Body: Square shape formed body opening aur shutting costs ke beech ki cost range ko address karti hai, jo kisi time span mein hoti hai. Agar shutting cost opening cost se ziada hoti hai, to body commonly filled ya shaded hoti hai, jo ke bullish (up) development ko show karti hai. Waise greetings, agar shutting cost opening cost se kam hoti hai, to body aksar empty ya different variety ki hoti hai, jo ke negative (descending) development ko recommend karti hai. 2. Wicks (Shadows ya Tails): Body ke upar aur neeche patli lines wicks, shadows ya tails kahlati hain. Upper wick greatest cost ko address karti hai, jabkay lower wick most reduced cost ko address karti hai. Wicks ki lambai market ki instability aur exchanging range ke uncovered mein mazeed maloomat faraham karti hai. 3. Candle Examples Ki Tashreeh: Candles Forex exchanging mein ahem kirdar ada karte hain kyun ke wo dealers ko cost developments aur market feeling ki designs aur patterns ki pehchan karne mein madad karte hain. Yahan kuch aam candle designs aur unki tashreeh di gayi hai: 4. Doji: Doji flame hit hoti hai hit opening aur shutting costs aik dosre ke qareeb hoti hain. Iska matlab hota hai market mein vulnerability aur aksar isse inversion ya critical cost development se pehle paaya jata hai. 5. Overwhelming: Overwhelming example punch hota hai hit aik bada candle puri tarah se pehle ridge flame ko cover kar leta hai. Isse market feeling ki tabdeeli ka andaza hota hai aur ye potential pattern inversion ko demonstrate kar sakta hai. 6. Hammer:Hammer light mein chhoti body aur lambi lower wick hoti hai. Ye recommend karta hai ke downtrend ke baad purchasers market mein dakhil ho rahe hain aur ye bullish inversion ki plausibility ho sakti hai.

-

#6 Collapse

What are candles in Forex exchangingShow: Forex trading woh market hai jahan merchants mukhtalif gadgets aur pointers ka istemal kar ke samjhte hain konsi trading decisions behtar ho sakti hain. Ek aisa instrument jo Forex trading mein wafadar istemal hota hai wo "candles" hoti hain. Is post mein mumble samjheinge ke candles kya hote hain aur unka Forex trading mein istemal kaise hota hai.Forex Trading Mein Candles Kya Hote Hain?Candles, jo ke candles bhi kaha jate hain, Forex trading mein cost advancements ki visual depiction hoti hain. Ye sellers ko mukhtalif maloomat faraham karte hain jaise ke kisi period of time mein opening, closing, most raised aur smallest expenses. Har light mein aik body aur do wicks hote hain, jinhe shadows ya tails bhi kaha jata hai.\ Flame Parts Samajhna: Candles ko Forex trading mein puri tarah samajhne ke liye, mumble inke parts ko samjhte hain: 1. Body: Square shape framed body opening aur closing expenses ke beech ki cost range ko address karti hai, jo kisi time frame mein hoti hai. Agar closing expense opening expense se ziada hoti hai, to body regularly filled ya concealed hoti hai, jo ke bullish (up) improvement ko show karti hai. Waise good tidings, agar closing expense opening expense se kam hoti hai, to body aksar void ya different assortment ki hoti hai, jo ke negative (sliding) advancement ko suggest karti hai. 2. Wicks (Shadows ya Tails): Body ke upar aur neeche patli lines wicks, shadows ya tails kahlati hain. Upper wick most noteworthy expense ko address karti hai, jabkay lower wick most decreased cost ko address karti hai. Wicks ki lambai market ki shakiness aur trading range ke revealed mein mazeed maloomat faraham karti hai. 3. Light Models Ki Tashreeh: Candles Forex trading mein ahem kirdar ada karte hain kyun ke wo sellers ko cost improvements aur market feeling ki plans aur designs ki pehchan karne mein madad karte hain. Yahan kuch aam flame plans aur unki tashreeh di gayi hai: 4. Doji: Doji fire hit hoti hai hit opening aur closing expenses aik dosre ke qareeb hoti hain. Iska matlab hota hai market mein weakness aur aksar isse reversal ya basic expense advancement se pehle paaya jata hai. 5. Overpowering: Overpowering model punch hota hai hit aik bada candle puri tarah se pehle edge fire ko cover kar leta hai. Isse market feeling ki tabdeeli ka andaza hota hai aur ye potential example reversal ko show kar sakta hai. 6. Hammer :Hammer light mein chhoti body aur lambi lower wick hoti hai. Ye suggest karta hai ke downtrend ke baad buyers market mein dakhil ho rahe hain aur ye bullish reversal ki credibility ho sakti hai -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#7 Collapse

Show: Forex trading woh market hai jahan representatives mukhtalif gadgets aur pointers ka istemal kar ke samjhte hain konsi trading decisions behtar ho sakti hain. Ek aisa instrument jo Forex trading mein wafadar istemal hota hai wo "candles" hoti hain. Is post mein mumble samjheinge ke candles kya hote hain aur unka Forex trading mein istemal kaise hota hai.Forex Trading Mein Candles Kya Hote Hain? Candles, jo ke candles bhi kaha jate hain, Forex trading mein cost improvements ki visual depiction hoti hain. Ye vendors ko mukhtalif maloomat faraham karte hain jaise ke kisi period of time mein opening, closing, most raised aur smallest expenses. Har light mein aik body aur do wicks hote hain, jinhe shadows ya tails bhi kaha jata hai. \Candle Parts Samajhna: Candles ko Forex trading mein puri tarah samajhne ke liye, mumble inke parts ko samjhte hain: 1. Body: Square shape fram ed body opening aur closing expenses ke beech ki cost range ko address karti hai, jo kisi time frame mein hoti hai. Agar closing expense opening expense se ziada hoti hai, to body usually filled ya concealed hoti hai, jo ke bullish (up) advancement ko show karti hai. Waise good tidings, agar closing expense opening expense se kam hoti hai, to body aksar void ya different assortment ki hoti hai, jo ke negative (sliding) advancement ko suggest karti hai. 2. Wicks (Shadows ya Tails): Body ke upar aur neeche patli lines wicks, shadows ya tails kahlati hain. Upper wick most noteworthy expense ko address karti hai, jabkay lower wick most diminished cost ko address karti hai. Wicks ki lambai market ki shakiness aur trading range ke revealed mein mazeed maloomat faraham karti hai. 3. Flame Models Ki Tashreeh: Candles Forex trading mein ahem kirdar ada karte hain kyun ke wo vendors ko cost advancements aur market feeling ki plans aur designs ki pehchan karne mein madad karte hain. Yahan kuch aam light plans aur unki tashreeh di gayi hai:4. Doji: Doji fire hit hoti hai hit opening aur closing expenses aik dosre ke qareeb hoti hain. Iska matlab hota hai market mein weakness aur aksar isse reversal ya basic expense advancement se pehle paaya jata hai. 5. Overpowering: Overpowering model punch hota hai hit aik bada light puri tarah se pehle edge fire ko cover kar leta hai. Isse market feeling ki tabdeeli ka andaza hota hai aur ye potential example reversal ko exhibit kar sakta hai. 6. Hammer: Hammer light mein chhoti body aur lambi lower wick hoti hai. Ye suggest karta hai ke downtrend ke baad buyers market mein dakhil ho rahe hain aur ye bullish reversal ki believability ho sakti hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 08:33 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим