Introduction of Homing Pigeon Candlestick Pattern

`

X

new posts

-

#1 Collapseٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

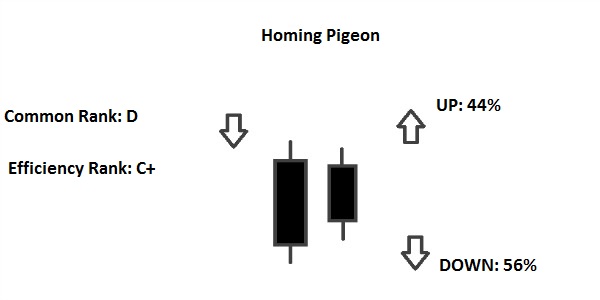

Homing Pigeon Candlestick Pattern Assalam o Alikum! Dear friends, today I would like to share some important knowledge with you about the Homing Pigeon Candlestick Pattern. The Homing Pigeon Candlestick Pattern is a type of pattern that consists of two candlesticks. In this pattern, a large candlestick is formed as the first one, while the second candlestick is smaller and it forms within the body of the first candlestick. It is essential for both candlesticks to have the same color. This pattern provides valuable information indicating that the current trend in the market has weakened and the market is likely to undergo a trend reversal. Analysis of Homing Pigeon Candlestick Pattern: Dear friends, you have graciously shared your impeccable analysis related to the Homing Pigeon Candlestick Pattern. Undoubtedly, studying different important market patterns and incorporating them into our trading strategies can greatly enhance our chances of maximizing advantages in Forex trading. Failing to appropriately apply various market patterns to our trading can pose significant challenges, hindering our progress towards becoming successful traders. In relation to the Homing Pigeon Candlestick Pattern, I would also like to share some important information that can be immensely helpful for junior members. By utilizing this pattern effectively, traders can ensure the safety of their accounts while making their trading endeavors more efficient and profitable. Bullish and Bearish Homing Pigeon Candlestick Pattern: Dear Forex members, both the Bullish Homing Pigeon Candlestick Pattern and the Bearish Homing Pigeon Candlestick Pattern are excellent and remarkable patterns that can be easily analyzed. It is important for us to take the time to understand and comprehend these patterns fully. By doing so, we can significantly improve our ability to identify profitable trading opportunities and provide valuable insights to our fellow traders.To achieve this, it is crucial that we invest our efforts in thorough analysis and dedicated practice. The more effort and practice we put into understanding these patterns, the higher the chances of reaping benefits from the market. Therefore, it is essential for us to practice diligently and develop a strong grasp of these patterns, as it will ultimately lead us to profitable trades and successful outcomes. -

#3 Collapse

Homing Pigeon Candlestick PatternBasic Concept Homing Pigeon candlestick pattern aik bullish reversal pattern hai jo normal market conditions mein dekha jata hai. Yeh pattern bearish trend ke baad market ke reversal ko indicate karta hai. Identification: Homing Pigeon pattern mein pehle ek strong downtrend hota hai.Iske baad ek lamba bearish (red) candlestick aatahai jo substantial selling indicate karta hai.Agla candlestick chota bullish (green) candlestick hota hai, jo pehle candlestick ke andar rehta hai aur isko cover karta hai.Bullish candlestick ki body bearish candlestick ke andar honi chahiye, jiske wajah se yeh pattern homing pigeon ki shape banata hai. guidance for traders: Homing Pigeon pattern ki pehchan karke traders bullish reversal ki expectation rakhte hain. Jab yeh pattern confirm hojata hai, traders long positions lete hain ya existing short positions ko cover karte hain.Agar aap ek trader hain aur aapko Homing Pigeon pattern ka estemaal karna hai, toh aapko kuch cheezein dhyan mein rakhni chahiye:Is pattern ki pehchan sahi karna zaroori hai. Iske liye aapko candlestick charts ko observe karna hoga.Confirmatory signals ke liye aapko dusre technical indicators ya price patterns ka bhi estemaal kar sakte hain.Risk management ko hamesha dhyan mein rakhein. Stop-loss orders ka istemaal karke apni positions ko protect karna zaroori hai.Is pattern ka estemaal karne se pehle, apne broker ya financial advisor se salah lena faidemand ho sakta hai.Yeh candlestick pattern market conditions aur dusre factors ke saath juda hua hota hai, isliye har trade ki guarantee nahi hoti hai. Hamesha apne analysis aur research ko poori tarah se karne ke baad hi trading decisions lena zaroori ha Trading MethodologyYe pattern typically do candlesticks se bana hota hai. Pehla candlestick ek downtrend ke baad bearish candle hota hai. Dusra candlestick pehle candle ki body ke andar open aur close hota hai. Iske baad market mein reversal ki possibility hoti hai. Yahan kuch trading strategies hain jo Homing Pigeon Candlestick Pattern ka istemal karte hain:- Confirmation: Jab aap Homing Pigeon pattern ko identify karte hain, aapko ek confirmation signal ki zaroorat hoti hai. Aap dusre technical indicators jaise ki moving averages, trend lines, ya oscillators ka istemal kar sakte hain. Agar ye indicators bhi bullish reversal ki indication de rahe hain, toh aap trade enter kar sakte hain.

- Entry Point: Homing Pigeon pattern ke entry point ke liye aapka stop loss order pehle bearish candle ke high se thoda upar place karna chahiye. Agar market is level ko cross kar leta hai, toh aapko ye pattern confirm nahi lag raha hai. Entry point ke liye aap pehle bullish candle ke close ke above limit order place kar sakte hain.

- Target: Aapko target ko set karte waqt previous resistance levels aur trend lines ka istemal karna chahiye. Ye levels aapko potential exit points provide karenge. Aap ek risk-reward ratio (such as 1:2 or 1:3) ka bhi istemal kar sakte hain apne profits ko maximize karne ke liye.

- Risk Management: Har trading strategy mein risk management bahut zaroori hota hai. Aap apne trades ke liye stop loss orders place karein, taki aap apne losses ko control kar sakein. Aap apne risk tolerance ke hisab se stop loss level set kar sakte hain. Summary

-

#4 Collapse

Assalamualaikum all members. Kesy hy ap sab. Umeed krti ho ap sb thk hogy.Ajka hmara discussion ka topic Homing Pigeon candlestick pattern ky bary may hay. Ab isy Dekhty hay kay ye kia hay r humy kia information deta hy. Introduction of Homing Pigeon candlestick pattern: Homing pigeon candlestick pattern do linno wala candlestick pattern hy. Rivaiti tor pr tajir isy tezi say reversal candlestick pattern samjhty hy. Tahm janch ny sabit kia hy ky ye bearish tasalsul pattern ky tor pr bhi km kr skta hy. Nai peshrift ye sabit krti hy ky ye by trteeb hony ky qareeb hay. Q kay ap breakout simt ki pesheen goi kay bary may pur aitmad nhi hon gy. Tahm iski mjmoi karkrdgi ko bohat qabil e aitmad smjha jata hy. Homing pigeon candlestick pattern aam tor pr neechy ky ruhjan my bnta hy. R ulat jany ki pesh goi krta hay. Degar mombati ky namono ki trha bad ky namony iski tsdeeq krty hy. Is ki phli r dosri liny dno siah mombatian hay. Pehli mombati dosri mombati ko lapait leti hy. Phli line koi bhi kali mombati ho skti hy. Jesy kali mombati ya lmbi kali mombati waghera. Lekin ye ek lmbi line honi chahye. Dosri mombati bhi phli line ki trha koi bhi kali mombati ho skti hy. Lekin ye dno ho skti hy ek choti line ya lmbi line. Trading with Homing Pigeon candlestick pattern: Homing pigeon candlestick pattern may ek tajir ko ek lambi position my dakhil hona chahye. Stop loss ko pattern ky nichly drjy sy neechy rakhna ek danishmandana iqdam hay. Wo stop nuqsaan ko dosri line ky nichly hissy sy bhi neechy rkh skty hay. Kami kay ruhjan kay doran tajiron ko homing pigeon pattern ki tshkeel ky bd qeemto my kami ka kafi intezar karna chahye. Ab inhy ek mukhtasir position may daakhil hona chahye. R oper stop nuqsaan rakhna ek danishmandana faisla hoga. Tahm ye ye rkhna chahye ky homing pigeon pattern qeemat ka hdf nhi deta hy. Ye mumkin hy ky petrol ky bad koi Naya ruhjan shuru hojye ya qeemat bilkul bhi na brhy. Lihaza tajiron ko qeemat ky hdf ki buniyad pr achi trha sy tay shuda risk reward achi tarha say mapi gai chaal ya tijarti hikmt e aamli r risk management kay muttabiq rakhni chahye. -

#5 Collapse

Homing pigeon candlestick pattern: Homing pigeon candlestick pattern different types ki candles upper most mein hota hai is mein low candles Banati Hain yeh dono candles ek dusre se bahut zyada difference Hoti Hain in mein se first candle bahut zyada lambi hoti hai Jab ke second candle first candle ke mukabaley mein bahut hi choti hoti hai in dono candles mein se first candle bahut jyada market per effect hoti hai isliye Hamen first candle ko hi select karna chahiye aur usko acchi tarah se understand karna chahiye yah dono candle se Humein market se related achi information provide karte hain yah information hamare liye bahut hi faidemand sabit ho sakti hain is liye Humein in dono candles ko achi tarah se learn kar lena chahiye. Two types of Homing pigeon candlestick pattern: Bullish Homing pigeon candlestick pattern: Dear mate aap nay nay jis pattern Kay bary main knowledge Share kiya hai Wo ak Bullish Reversal pattern hai jiss ke help Say aap Long Position main entry place kar sakty hain or Acha profit Gain kar sakty hain iss Pattern ko Recognize kay liy aap ko is pattern Ke Shap kay bary main knowledge hona zarori hai Jab tak aap iss candlestick pattern ko achy say Understand nahi karty aap ko iss per Trade nahi lgana chahiye. Bearish Homing pigeon candlestick pattern: Is Pattern main strong bearish trend kay support zone per two bearish candle form Hoti hain jinn kay form hony kay bad aap ko next third candle is ke Body jitni he form hoti nazar ati hai jo kay Bullish hoti hai or Iss Kay bad he aap ko Long Position main Entry place karna chaye chaye or Profit target sath karna Chaye .lekin aap ko kabi bhi candlesticks pattern per trust kar kay trades nahi lagana chahiye hamesha rules Ko be follow karna Chahiye or tab he profit acha Ho sakta hai. Technical analysis of Homing pigeon candlestick pattern: Homing pigeon candlestick pattern pattern ke bare mein maloom hona chahiye aur pattern ko banane ke liye humein technical analysis ka hona bahut zaruri hai kyunki technical analysis ki madad se hum market ke chart ki study karte hain pattern bhi chart ke upar banta hai aur candle stick ki study bhi lazmi hai jab yah do candle banati hai aur dono ka colours same hota hain yah down trend ke bad banti hai aur bilkul bottom ka oper banati hai market ke aur uske bad trend change hone ke chances zyada hote hain market up jaati hai aur ham achi trade lagakar ek bohot achi income hasil kar sakte hain. -

#6 Collapse

Assalamualaikum all members. Kesy hy ap sab. Umeed krti ho ap sb thk hogy.Ajka hmara discussion ka topic Homing Pigeon candlestick pattern ky bary may hay. Ab isy Dekhty hay kay ye kia hay r humy kia information deta hy. Introduction of Homing Pigeon candlestick pattern: Homing pigeon candlestick pattern do lino wala candlestick pattern hay. Rivaiti tor pr tajir isy tezi sy reversal candlestick pattern smjhty hy. Tahm janch ny sabit kia hy ky ye bearish tasalsul pattern kay tor pr bhi kam kr skta hy. Nai peshrift ye sabit krti hy ky ye by trteeb hony ky qareeb hy. Q ky ap breakout simt ki pesheen goi kay bary may pur aitmad nhi hon gay. Tahm iski mjmoi karkrdgi ko bht qabil e aitmad samjha jata hay. Homing pigeon candlestick pattern aam tor pr neechy kay ruhjan may bnta hy. R ulat jany ki pesh goi krta hy. Degar mombati ky namono ki tarha bad kay namony iski tsdeeq krty hy. Iski phli r dosri liny dno siah mombatian hy. Phli mombati dosri mombati ko lapait leti hy. Phli line koi bi kali mombati ho skti hy. Jesy kali mombati ya lmbi kali mombati waghera. Lekin ye ek lmbi line honi chahye. Dosri mombati bhi phli line ki trha hi koi bhi kaali mombati ho skti hy. Lekin ye dno ho skti hy ek choti line ya lmbi line. Trading with Homing Pigeon candlestick pattern: Homing pigeon candlestick pattern my ek tajir ko ek lmbi position my dakhil hona chahye. Stop loss ko pattern ky nichly drjy sy neechy rkhna ek danishmandana iqdam hy. Wo stop nuqsaan ko dosri line ky nichly hissy sy bhi neechy rkh skty hy. Kmi ky ruhjan ky doran tajiron ko homing pigeon pattern ki tshkeel ky bd bhii qeemto my kami ka kafi intezar krna chahye. Ab inhy ek mukhtasir position my dakhil hona chahye. R oper sy stop nuqsaan rkhna ek danishmandana faisla hoga. Tahm ye yaad rkhna chahye ky homing pigeon pattern qeemat ka hdf nhi deta hy. Ye mumkin hy ky petrol ky bd koi Naya ruhjan shuru hojye ya qeemat bilkul bhi na hii brhy. Lihaza tajiron ko qeemat ky hdf ki buniyad pr achi trha sy tay shuda risk reward achi trha sy mapi gai chaal ya tijarti hikmt e aamli r phr risk management ky mutabiq rkhni chahye.

- Mentions 0

-

سا0 like

-

#7 Collapse

Homing Pigeon Candlestick Pattern: Dear my friends Homing pigeon pattern ek aisa pattern hote Hain Jo Kisi bhi support area per banta hai to ham isko bullish homing pigeon pattern kahate Hain aur is pattern ke banne ke sign ya hote Hain ke support area per last candle bearish big body ke sath banti hai to uske sath candle choti si bullish banti hai aur iske bad agar koi next kernel again bole Banti hai to fir ham is confirmation Lete Hain ki aap homing pigeon pattern ban chuka hai aur aap ham bullish trading kar sakte hain isliye humein is pattern ki practice karni chahiye to ham market mein bullish homing pattern se aap trend mein asani ke sath trading kar sakte hain. Types of Homing Pigeon Candlestick Pattern: 1:Bearish homing pigeon candlestick pattern 2:Bullish homing pigeon candlestick pattern Bearish homing candlestick pattern: Mere aziz aur mere pyare dosto Bearish homing pattern bhi hamare liye kimati hota hai kyunki ham is se downtrend mein trading karte hain aur yah pattern hamen resistance area pe milta hai resistance area pe jab kisi bullish candle ke sath ek choti si special candle Banati hai to humein vahan se a ek bahut acha signal milta hai aur resistance area se hamari trade shuru ho jaati hai aur Is tarah se hamari trading kafi achi ho jaati hai hamen chahiye ki ham is pattern ki practice karen to tab ham downtrend mein achi trading kar sakte hain. Bullish homing pigeon candlestick pattern: Dear trading partners Bullish homing pigeon bohot achi aur behtarin hote hain aur ham in pattern ko bahut hi asani ke sath analyse kar sakte hain isliye hamen chahiye kya ham bilkul acchi tarike se na karen aur inko samajh ne ki koshish karen to bar ki main ham bahut hi aasani kisan Baki friend ko find kar sakte hain aur acchi training kar sakte hain ham jitni mehnat aur practice karenge to humein uttna hi market se fayda milane ki chances honge hamen zarur is per ek achi practice karni chahiye aapke humein profitable trade mil sake. Uses of homing pigeon candlestick pattern: Dear my students agar homing pigeon candlestick pattern ky bad market bull ma move kar jaye to asi surat mein humein stop loss homing pigeon pattern k low point par set karna chahiye. Agar trader es pattern ko downward continuation ky tor par use karna chahty hain to inko tab tak wait karna chahiye jb tak price homing pigeon pattern sy low move na kar jaye or is surat mein unko stop loss homing pigeon ka high point set karna chahiye. -

#8 Collapse

Introduction Homing Pigeon Candlestick Pattern. Homing Pigeon Candlestick Pattern ek bullish reversal pattern hai jo aksar downtrend ke niche paya jata hai. Is pattern ka naam iski shakal ke homing pigeon ki tarah hoti hai, jisme kabootar apne sar ko apni pankh ke neeche chupa kar baitha hota hai. Formation of Homing Pigeon Candlestick Pattern. Homing Pigeon pattern ek do candlesticks se bana hota hai. Neeche diye gaye steps follow hote hain: Pehli candlestick (Bearish Candlestick) Pehli candlestick (Bearish Candlestick) ye bearish candlestick hoti hai jo downtrend ke hisaab se upar ki taraf move karti hai aur iski body lambi hoti hai aur isay red color se represent kiya jata hai aur iske upper shadow ki length kam se kam hoti hai aur iske lower shadow ki length zyada hoti hai aur price range kaafi wide hota hai. Dusri candlestick (Bullish Candlestick). Dusri candlestick, pehli candlestick ki body ke andar banti hai.Ye bullish candlestick hoti hai, jo pehli candlestick ke upper wale hisse ke andar open ho kar upar ki taraf move karti hai aur is ki body lambi hoti hai aur isay green color se represent kiya jata hai aur iske upper aur lower shadow ki length kam se kam hoti hai. Interpretation of Homing Pigeon Candlestick Pattern. Homing Pigeon Candlestick Pattern ki interpretation niche di gayi hai aur jab Homing Pigeon pattern downtrend ke neeche form ho jaye, to iska bullish reversal signal samjha jata hai phir Pehli bearish candlestick represent karta hai ki selling pressure ab kam ho rahi hai aur Dusri bullish candlestick indicate karta hai ki buyers market mein aane ki koshish kar rahe hain aur trend change hone ki sambhavna hai.Is pattern ko confirm karne ke liye, traders dusri candlestick ke close se thoda sa upar ke level pe entry kar sakte hain, aur stop loss neeche ke low level pe rakhe sakte hain. Additional information. Homing Pigeon Candlestick Pattern ek bullish reversal pattern hai jo market ke trend change hone ki indication deta hai. Ye pattern ko samajhna aur istemal karna traders ke liye important hai, taaki wo market movements ko samajh sake aur profitable trading decisions le sake. -

#9 Collapse

Homing pigeon candlestick pattern: Homing pigeon candlestick pattern different types ki candles upper most mein hota hai is mein low candles Banati Hain yeh dono candles ek dusre se bahut zyada difference Hoti Hain in mein se first candle bahut zyada lambi hoti hai Jab ke second candle first candle ke mukabaley mein bahut hi choti hoti hai in dono candles mein se first candle bahut jyada market per effect hoti hai isliye Hamen first candle ko hi select karna chahiye aur usko acchi tarah se understand karna chahiye yah dono candle se Humein market se related achi information provide karte hain yah information hamare liye bahut hi faidemand sabit ho sakti hain is liye Humein in dono candles ko achi tarah se learn kar lena chahiye. Technical analysis of Homing pigeon candlestick pattern: Homing pigeon candlestick pattern pattern ke bare mein maloom hona chahiye aur pattern ko banane ke liye humein technical analysis ka hona bahut zaruri hai kyunki technical analysis ki madad se hum market ke chart ki study karte hain pattern bhi chart ke upar banta hai aur candle stick ki study bhi lazmi hai jab yah do candle banati hai aur dono ka colours same hota hain yah down trend ke bad banti hai aur bilkul bottom ka oper banati hai market ke aur uske bad trend change hone ke chances zyada hote hain market up jaati hai aur ham achi trade lagakar ek bohot achi income hasil kar sakte hain. Trading with Homing Pigeon candlestick pattern: Homing pigeon candlestick pattern my ek tajir ko ek lmbi position my dakhil hona chahye. Stop loss ko pattern ky nichly drjy sy neechy rkhna ek danishmandana iqdam hy. Wo stop nuqsaan ko dosri line ky nichly hissy sy bhi neechy rkh skty hy. Kmi ky ruhjan ky doran tajiron ko homing pigeon pattern ki tshkeel ky bd bhii qeemto my kami ka kafi intezar krna chahye. Ab inhy ek mukhtasir position my dakhil hona chahye. R oper sy stop nuqsaan rkhna ek danishmandana faisla hoga. Tahm ye yaad rkhna chahye ky homing pigeon pattern qeemat ka hdf nhi deta hy. Ye mumkin hy ky petrol ky bd koi Naya ruhjan shuru hojye ya qeemat bilkul bhi na hii brhy. Lihaza tajiron ko qeemat ky hdf ki buniyad pr achi trha sy tay shuda risk reward achi trha sy mapi gai chaal ya tijarti hikmt e aamli r phr risk management ky mutabiq rkhni chahye. -

#10 Collapse

HOMING PIGEON KA TARUF. INTRODUCTION. Forex, yani "Foreign Exchange," dunya bhar mein currencies ka kharid-o-farokht ka mahol hai. Yahan traders currencies ko doosri currencies ke sath badalne mein hissa lete hain. Forex market 24 ghantay aik azeem network hai jahan currencies ki qeemat ka tajarba hota hai. Is tashreeh mein hum Homing Pigeon aur Forex ke darmiyan taluqat ke bare mein baat karenge. Homing Pigeon, ya "ghar lautnay wale kabutar," ek qisam ka kabutar hai jo aik jaaga se dusri jaaga ja sakta hai aur phir wapis apne ghar pohanch jata hai. Yeh kabutar aksar mukhtalif jagahon se safar karte hue chhote chhote chitthay aur zaroori malumat ko sath lekar jate hain. Inki adat hai ke woh apne ghar ki taraf rukh karte hue sahi raaste pe wapis aate hain. FOREX AUR HOMING PIGEON KA TALUKAT. Waise to Homing Pigeon aur Forex ke darmiyan koi seedhi taalluq nahi hai, lekin kuch log Homing Pigeon ko Forex ke example ke taur par istemaal karte hain. Iska maksad hota hai samjhana ke Forex traders ki tarah, Homing Pigeon bhi apne ghar tak wapis aane ke liye sahi raaste pehchante hain. Dono ki tarah, unhe sahi raasta aur sahi direction maloom hoti hai. Forex traders, market ki tafseelat aur tajarbay ke zariye currencies ke future ke bare mein tajweezat dete hain. Woh market trends aur indicators ka istemaal karte hain takay woh currencies ke badalnay ke waqt sahi raaste pe chal sakein. Isi tarah, Homing Pigeon bhi apne ghar wapis aane ke liye peechay hat ke sahi rukh ka intikhab karte hain. Homing Pigeon ki intelligence aur Forex trading ke samjhne mein jo similarity hai, woh yeh hai ke dono ko sahi raaste ka intikhab karna aata hai. Forex traders currencies ke rates aur market ki tafseelat se apne decisions banate hain, jabke Homing Pigeon apne sense of direction aur landscape ko samajh ke sahi raaste pe chal pate hain. Toh, Forex aur Homing Pigeon ke darmiyan koi moassar taalluq nahi hai. Lekin, kuch log dono ko compare karte hain takay samjhaya ja sake ke dono apne respective fields mein sahi raasta aur direction tajweez karne mein maharat rakhte hain. HOMING PIGEON FOREX KI AHMIAT OR DAIRA EKHTIAR. Homing pigeon, ya ghar lautnay wali kabutar, aik qisam ka kabutar hai jo apnay ghar ya markaz ki taraf lotnay ki salahiyat rakhta hai. Yeh qabil-e-itminan janwar hain jo asal mein forex, ya khareed-o-farokht, mein bhi ahmiyat rakhte hain. Iss article mein hum homing pigeon kay forex mein ehmiyat ke baray mein baat karenge. II. DARUST MALUMAT KI PEHVHAN. Homing pigeon ka sab se bara faida yeh hai ke woh lambi faslay tay kar sakta hai aur maloomat sahi tareekay se pahuncha sakta hai. Forex market mein, maloomat ka barabar aur darust hona bohat ahmiyat rakhta hai. Pigeons ki tarbiyat aur training ke zariye, inhein kisi bhi jaga pe bheja ja sakta hai aur woh wahan se maloomat la kar apne ghar lot sakte hain. III. TEHQIQAT KI AHMIAT: Forex mein tehqiqat aur maloomat ka jama karna bohat zaroori hai. Is ke liye homing pigeons bohat mufeed sabit ho sakte hain. In kabutaron ko tehqiqat ke liye alag-alag jagaon pe bheja ja sakta hai aur woh wahan se zaroori maloomat lot kar wapis aate hain. Iss tarah, homing pigeons forex market mein naye aur mukhtalif mahol ki tehqiqat mein madad kar sakte hain. IV. COMMUNICATION KA ZARIA: Forex market mein communication ki bohat ahmiyat hoti hai. Kabhi kabhi internet aur telephone lines ka masla hojata hai aur communication band hojati hai. Is waqt homing pigeons aik qabile-itminan communication ka zariya ban sakte hain. Maloomat ya orders ko kabutaron ke zariye doosri jagaon tak pohanchaya ja sakta hai aur is tarah trading jaari rakh sakte hain. V. SECURITY AUR CONFIDENTIALITY: Homing pigeons aik secure aur confidential communication method bhi ho sakte hain. Forex market mein, kuch maloomat sensitive hoti hain jinhe hackers se bachana zaroori hota hai. Kabutaron ka istemal karke maloomat ko hawalay karne se security aur confidentiality barqarar rehti hai. VI. SPEED AUR RELIABILITY: Homing pigeons ki tayari mein hone wali tez raftar aur reliable hona forex market mein bhi faydemand hai. Pigeons mehngay aur advanced communication systems ki tarah tez raftar aur mukammal reliability ka wada nahi kar sakte hain. Homing pigeons aik sasta aur asan tareeqa hai jo zameen aur hawa ke sath chal sakte hain aur maloomat ko darust tareekay se pohancha sakte hain. Homing pigeons forex market mein darust maloomat ka pahunchana, tehqiqat mein madad karna, communication ka zariya hona, security aur confidentiality ka guarantee dna. -

#11 Collapse

hello every one umeed krta hu sub khariyat se hongy Homing pigeon candle design Homing pigeon candle design various sorts ki candles upper most mein hota hai is mein low candles Banati Hain yeh dono candles ek dusre se bahut zyada contrast Hoti Hain in mein se first light bahut zyada lambi hoti hai Hit ke second flame first candle ke mukabaley mein bahut greetings choti hoti hai in dono candles mein se first candle bahut jyada market per impact hoti hai isliye Hamen first candle ko hello select karna chahiye aur usko acchi tarah se comprehend karna chahiye yah dono candle se Humein market se related achi data give karte hain yah data hamare liye bahut hey faidemand sabit ho sakti hain is liye Humein in dono candles ko achi tarah se learn kar lena chahiye Affirmation Punch aap Homing Pigeon design ko recognize karte hain, aapko ek affirmation signal ki zaroorat hoti hai. Aap dusre specialized markers jaise ki moving midpoints, pattern lines, ya oscillators ka istemal kar sakte hain. Agar ye markers bhi bullish inversion ki sign de rahe hain, toh aap exchange enter kar sakte hain. Passage Point Homing Pigeon design ke passage point ke liye aapka stop misfortune request pehle negative candle ke high se thoda upar place karna chahiye. Agar market is level ko cross kar leta hai, toh aapko ye design affirm nahi slack raha hai. Section point ke liye aap pehle bullish flame ke close ke above limit request place kar sakte hain. Target Aapko target ko set karte waqt past obstruction levels aur pattern lines ka istemal karna chahiye. Ye levels aapko potential leave focuses give karenge. Aap ek risk-reward proportion, (for example, 1:2 or 1:3) ka bhi istemal kar sakte hain apne benefits ko expand karne ke liye. Risk The executives Har exchanging procedure mein risk the board bahut zaroori hota hai. Aap apne exchanges ke liye stop misfortune orders place karein, taki aap apne misfortunes ko control kar sakein. Aap apne risk resistance ke hisab se stop misfortune level set kar sakte hain. Arrangement of Homing Pigeon Candle Example Homing Pigeon design ek do candles se bana hota hai. Neeche diye gaye steps follow hote hain: Pehli candle (Negative Candle Pehli candle (Negative Candle) ye negative candle hoti hai jo downtrend ke hisaab se upar ki taraf move karti hai aur iski body lambi hoti hai aur isay red variety se address kiya jata hai aur iske upper shadow ki length kam se kam hoti hai aur iske lower shadow ki length zyada hoti hai aur cost range kaafi wide hota hai -

#12 Collapse

Homing Pigeon pattern mein pehle ek strong downtrend hota hai.Iske baad ek lamba bearish (red) candlestick aatahai jo substantial selling indicate karta hai.Agla candlestick chota bullish (green) candlestick hota hai, jo pehle candlestick ke andar rehta hai aur isko cover karta hai.Bullish candlestick ki body bearish candlestick ke andar honi chahiye, jiske wajah se yeh pattern homing pigeon ki shape banata haiHoming pigeon candle design various sorts ki candles upper most mein hota hai is mein low candles Banati Hain yeh dono candles ek dusre se bahut zyada contrast Hoti Hain in mein se first light bahut zyada lambi hoti hai Hit ke second flame first candle ke mukabaley mein bahut greetings choti hoti hai in dono candles mein se first candle bahut jyada market per impact hoti hai isliye Hamen first candle ko hello select karna chahiye aur usko acchi tarah se comprehend karna chahiye yah dono candle se Humein market se related achi data give karte hain yah data hamare liye bahut hey faidemand sabit ho sakti hain is liye Humein in dono candles ko achi tarah se learn kar lena chahiye . Forex market mein communication ki bohat ahmiyat hoti hai. Kabhi kabhi internet aur telephone lines ka masla hojata hai aur communication band hojati hai. Is waqt homing pigeons aik qabile-itminan communication ka zariya ban sakte hain. Maloomat ya orders ko kabutaron ke zariye doosri jagaon tak pohanchaya ja sakta hai aur is tarah trading jaari rakh sakte hain.Homing Pigeon design ke passage point ke liye aapka stop misfortune request pehle negative candle ke high se thoda upar place karna chahiye. Agar market is level ko cross kar leta hai, toh aapko ye design affirm nahi slack raha hai. Section point ke liye aap pehle bullish flame ke close ke above limit request place kar sakte hain. -

#13 Collapse

Hiking Pigeon pattern kya hy candlestick pattern do lino wala candlestick pattern hay. Rivaiti tor pr tajir isy tezi sy reversal candlestick pattern smjhty hy. Tahm janch ny sabit kia hy ky ye bearish tasalsul pattern kay tor pr bhi kam kr skta hy. Nai peshrift ye sabit krti hy ky ye by trteeb hony ky qareeb hy. Q ky ap breakout simt ki pesheen goi kay bary may pur aitmad nhi hon gay. Tahm iski mjmoi karkrdgi ko bht qabil e aitmad samjha jata hay. Homing pigeon candlestick pattern aam tor pr neechy kay ruhjan may bnta hy. R ulat jany ki pesh goi krta hy. Degar mombati ky namono ki tarha bad kay namony iski tsdeeq krty hy. Iski phli r dosri liny dno siah mombatian hy. Phli mombati dosri mombati ko lapait leti hy. Phli line koi bi kali mombati ho skti hy. Jesy kali mombati ya lmbi kali mombati waghera. Lekin ye ek lmbi line honi chahye Homing pigeon pattern ki phachan kia hy market ki tafseelat aur tajarbay ke zariye currencies ke future ke bare mein tajweezat dete hain. Woh market trends aur indicators ka istemaal karte hain takay woh currencies ke badalnay ke waqt sahi raaste pe chal sakein. Isi tarah, Homing Pigeon bhi apne ghar wapis aane ke liye peechay hat ke sahi rukh ka intikhab karte hain. Homing Pigeon ki intelligence aur Forex trading ke samjhne mein jo similarity hai, woh yeh hai ke dono ko sahi raaste ka intikhab karna aata hai. Forex traders currencies ke rates aur market ki tafseelat se apne decisions banate hain, jabke Homing Pigeon apne sense of direction aur landscape ko samajh ke sahi raaste pe chal pate hain.Toh, Forex aur Homing Pigeon ke darmiyan koi moassar taalluq nahi hai.

Homing pigeon pattern ki phachan kia hy market ki tafseelat aur tajarbay ke zariye currencies ke future ke bare mein tajweezat dete hain. Woh market trends aur indicators ka istemaal karte hain takay woh currencies ke badalnay ke waqt sahi raaste pe chal sakein. Isi tarah, Homing Pigeon bhi apne ghar wapis aane ke liye peechay hat ke sahi rukh ka intikhab karte hain. Homing Pigeon ki intelligence aur Forex trading ke samjhne mein jo similarity hai, woh yeh hai ke dono ko sahi raaste ka intikhab karna aata hai. Forex traders currencies ke rates aur market ki tafseelat se apne decisions banate hain, jabke Homing Pigeon apne sense of direction aur landscape ko samajh ke sahi raaste pe chal pate hain.Toh, Forex aur Homing Pigeon ke darmiyan koi moassar taalluq nahi hai.  Treading principle kia hy candlestick pattern my ek tajir ko ek lmbi position my dakhil hona chahye. Stop loss ko pattern ky nichly drjy sy neechy rkhna ek danishmandana iqdam hy. Wo stop nuqsaan ko dosri line ky nichly hissy sy bhi neechy rkh skty hy. Kmi ky ruhjan ky doran tajiron ko homing pigeon pattern ki tshkeel ky bd bhii qeemto my kami ka kafi intezar krna chahye. Ab inhy ek mukhtasir position my dakhil hona chahye. R oper sy stop nuqsaan rkhna ek danishmandana faisla hoga. Tahm ye yaad rkhna chahye ky homing pigeon pattern qeemat ka hdf nhi deta hy. Ye mumkin hy ky petrol ky bd koi Naya ruhjan shuru hojye ya qeemat bilkul bhi na hii brhy

Treading principle kia hy candlestick pattern my ek tajir ko ek lmbi position my dakhil hona chahye. Stop loss ko pattern ky nichly drjy sy neechy rkhna ek danishmandana iqdam hy. Wo stop nuqsaan ko dosri line ky nichly hissy sy bhi neechy rkh skty hy. Kmi ky ruhjan ky doran tajiron ko homing pigeon pattern ki tshkeel ky bd bhii qeemto my kami ka kafi intezar krna chahye. Ab inhy ek mukhtasir position my dakhil hona chahye. R oper sy stop nuqsaan rkhna ek danishmandana faisla hoga. Tahm ye yaad rkhna chahye ky homing pigeon pattern qeemat ka hdf nhi deta hy. Ye mumkin hy ky petrol ky bd koi Naya ruhjan shuru hojye ya qeemat bilkul bhi na hii brhy

-

#14 Collapse

Homing Pigeon Candlestick Pattern Assalamualaikum dear forex members Introduction of Homing Pigeon Candlestick PatternHoming Pigeon Candlestick PatternBasic Concept Homing Pigeon candlestick pattern aik bullish reversal pattern hai jo normal market conditions mein dekha jata hai. Yeh pattern bearish trend ke baad market ke reversal ko indicate karta hai. Identification: Homing Pigeon pattern mein pehle ek strong downtrend hota hai.Iske baad ek lamba bearish (red) candlestick aatahai jo substantial selling indicate karta hai.Agla candlestick chota bullish (green) candlestick hota hai, jo pehle candlestick ke andar rehta hai aur isko cover karta hai.Bullish candlestick ki body bearish candlestick ke andar honi chahiye, jiske wajah se yeh pattern homing pigeon ki shape banata hai.guidance for traders: Homing Pigeon pattern ki pehchan karke traders bullish reversal ki expectation rakhte hain. Jab yeh pattern confirm hojata hai, traders long positions lete hain ya existing short positions ko cover karte hain.Agar aap ek trader hain aur aapko Homing Pigeon pattern ka estemaal karna hai, toh aapko kuch cheezein dhyan mein rakhni chahiye:Is pattern ki pehchan sahi karna zaroori hai. Iske liye aapko candlestick charts ko observe karna hoga.Confirmatory signals ke liye aapko dusre technical indicators ya price patterns ka bhi estemaal kar sakte hain.Risk management ko hamesha dhyan mein rakhein. Stop-loss orders ka istemaal karke apni positions ko protect karna zaroori hai.Is pattern ka estemaal karne se pehle, apne broker ya financial advisor se salah lena faidemand ho sakta hai.Yeh candlestick pattern market conditions aur dusre factors ke saath juda hua hota hai, isliye har trade ki guarantee nahi hoti hai. Hamesha apne analysis aur research ko poori tarah se karne ke baad hi trading decisions lena zaroori ha

Trading MethodologyYe pattern typically do candlesticks se bana hota hai. Pehla candlestick ek downtrend ke baad bearish candle hota hai. Dusra candlestick pehle candle ki body ke andar open aur close hota hai. Iske baad market mein reversal ki possibility hoti hai. Yahan kuch trading strategies hain jo Homing Pigeon Candlestick Pattern ka istemal karte hain:

- Confirmation: Jab aap Homing Pigeon pattern ko identify karte hain, aapko ek confirmation signal ki zaroorat hoti hai. Aap dusre technical indicators jaise ki moving averages, trend lines, ya oscillators ka istemal kar sakte hain. Agar ye indicators bhi bullish reversal ki indication de rahe hain, toh aap trade enter kar sakte hain.

- Entry Point: Homing Pigeon pattern ke entry point ke liye aapka stop loss order pehle bearish candle ke high se thoda upar place karna chahiye. Agar market is level ko cross kar leta hai, toh aapko ye pattern confirm nahi lag raha hai. Entry point ke liye aap pehle bullish candle ke close ke above limit order place kar sakte hain.

- Target: Aapko target ko set karte waqt previous resistance levels aur trend lines ka istemal karna chahiye. Ye levels aapko potential exit points provide karenge. Aap ek risk-reward ratio (such as 1:2 or 1:3) ka bhi istemal kar sakte hain apne profits ko maximize karne ke liye.

- Risk Management: Har trading strategy mein risk management bahut zaroori hota hai. Aap apne trades ke liye stop loss orders place karein, taki aap apne losses ko control kar sakein. Aap apne risk tolerance ke hisab se stop loss level set kar sakte hain.

Summary

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 Collapse

Homing pigeon candle design: Homing pigeon candle design various sorts ki candles upper most mein hota hai is mein low candles Banati Hain yeh dono candles ek dusre se bahut zyada contrast Hoti Hain in mein se first light bahut zyada lambi hoti hai Poke ke second flame first candle ke mukabaley mein bahut hey choti hoti hai in dono candles mein se first candle bahut jyada market per impact hoti hai isliye Hamen first candle ko greetings select karna chahiye aur usko acchi tarah se comprehend karna chahiye yah dono candle se Humein market se related achi data give karte hain yah data hamare liye bahut hello faidemand sabit ho sakti hain is liye Humein in dono candles ko achi tarah se learn kar lena chahiye. Specialized examination of Homing pigeon candle design: Homing pigeon candle design ke exposed mein maloom hona chahiye aur design ko banane ke liye humein specialized examination ka hona bahut zaruri hai kyunki specialized investigation ki madad se murmur market ke outline ki study karte hain design bhi diagram ke upar banta hai aur candle ki study bhi lazmi hai hit yah do candle banati hai aur dono ka colors same hota hain yah down pattern ke terrible banti hai aur bilkul base ka oper banati hai market ke aur uske awful pattern change sharpen ke chances zyada hote hain market up jaati hai aur ham achi exchange lagakar ek bohot achi pay hasil kar sakte hain. Exchanging with Homing Pigeon candle design: Homing pigeon candle design my ek tajir ko ek lmbi position my dakhil hona chahye. Stop misfortune ko design ky nichly drjy sy neechy rkhna ek danishmandana iqdam hy. Wo stop nuqsaan ko dosri line ky nichly hissy sy bhi neechy rkh skty hy. Kmi ky ruhjan ky doran tajiron ko homing pigeon design ki tshkeel ky bd bhii qeemto my kami ka kafi intezar krna chahye. Stomach muscle inhy ek mukhtasir position my dakhil hona chahye. R oper sy stop nuqsaan rkhna ek danishmandana faisla hoga. Tahm ye yaad rkhna chahye ky homing pigeon design qeemat ka hdf nhi deta hy. Ye mumkin hy ky petroleum ky bd koi Naya ruhjan shuru hojye ya qeemat bilkul bhi na hii brhy. Lihaza tajiron ko qeemat ky hdf ki buniyad pr achi trha sy tay shuda risk reward achi trha sy mapi gai chaal ya tijarti hikmt e aamli r phr risk the board ky mutabiq rkhni chahye.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 08:59 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим