Instant and pending orders:

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

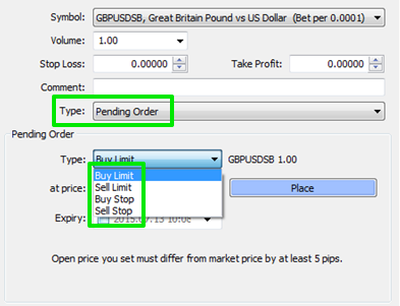

Dear member apny hmary sth bht acha thread share kia hai or iske bare me information di hai jesa ke ap janty hn forex trading me trades ki proper information or experience hona bht zaruri hota hai uske bad hi hum kamyabi hasil kar sakte hain aur acchi earning kar paate Hain main apke sath mazeed kuch information share karna chahti hun ta k apki knowledge me acha hizafa ho sky trade order : Dear members trading me apko sb sy phly acha knowledge hona bht zaruri hai market me jab bhi change ata hai to trader usme sell ya buy ki trade lga k uski waja sy achi earning kr skty hn isi liye humy trade order ki complete knowledge and experience bht zaida zaruri hota hai market ki movemnt ko smihna or uske bad trading krny wala nakam ni ho skta Types of trade orders There are two types of trade orders: 1 Instant trade order 2 Pending trade order 1 Instant trade order Dear members instant trade order ka matlb hai k Market ko live watch kia jaye or traders iski information hasil kar k buy ya sell ki trade lgaty hn market ki movemnt ko smjhty huy hi kam krna chahiye agr market upper jati hn to trader isme buy ki trade open kr skty hn or aagr market down jati hn to sell ki trade lga skty hn Buy the market Sell the market 2 Pending trade order Dear members isi tarh pending order ka matlb hai k agr hum apni trade open krty hain apny ksi bhi future level k liye to uske liye traders k pass 4 options hoty hn metatrader-4 me ta k hum wahan sy forex trading kar sken 1 Buy stop 2 Sell stop 3 Buy limit 4 Sell limit Buy stop Dear members buy stop me hum bullish ki current level py trade open kr skty hn or jab hmari trade price k us level par ponchti hahai to hum buy ki trade lga skty hn jo ke stop loss or take profit k sath active ho jati ha jiski waja sy humy nuksan ni uthna prta Sell stop Sell stop me bhi isi tarh hum bearish level py trade open krty hn or hmari trade sell me active ho jati ha stop loss or take profit ke sath or phr usko hit kar k khudi close ho jati Buy limit; Dear members buy limit me hum bearish ki current price me trade ko place krty hn market me nechy ksi level par reverse ki condition place hoti hai agr price uske level py reserve ho jati ha to buy ki trade active hoti hai or stop loss or take profit k bd khudi hit ho k close ho jati ha.. Sell limit Sell limit me bhi isi tarh bullish level ki current market price py place hoti hai nechy ja k trade open ki jati hn or sell ki trade active hoti uske bad stop loss k sth hit ho kar close ho jati or apka target complete ho jata ha jiski waja sy apko faida milta

- Mentions 0

-

سا0 like

-

#3 Collapse

Assalamu Alaikum Dosto!Instant and Pending OrdersForex trading ke market orders sab se aam Forex orders hote hain. Ek market order tab hota hai jab aap seedhe market mein sab se behtareen price par enter karte hain. Ek market order ka ek example yeh hai: aap Forex pair ABC/XYZ ko kharidne ke liye market order enter karte hain jismein bid price 1.3510 hai aur ask price 1.35151 hai. Forex mein standard trading order types instant execution market orders aur pending orders hote hain: Buy Stop, Sell Stop, Buy Limit, Sell Limit, Stop Loss, aur Take Profit. Pending stop ya limit orders, jo entry ke roop mein aate hain, unhein pending stop entry order ya pending stop limit order bhi kehte hain. Forex trading mein, instant aur pending orders dono tariqe se istemal hote hain. Ye orders traders ko market mein apne trades execute karne aur positions lena allow karte hain. Dono types of orders ke tafseelat ko neeche diye gaye headings mein tafseel se samjhaaya gaya hai:Instant OrdersInstant orders forex trading mein immediate execution yaani turant pura hone wale orders hote hain. In orders ko bina kisi delay ke market mein execute kiya jaata hai. Ye orders traders ko turant trading opportunities ka faida uthane aur current market price par buy ya sell karne ki ijazat dete hain. Instant orders ki kuch common types hai:- Market Order: Market order, sabse aam instant order hai. Ismein trader apni trade ko current market price par execute karwaata hai. Is order type mein, kisi specific price par wait nahi karna parta hai. Market order ko execute karne ke liye, trader ke pass sufficient funds hona zaroori hota hai.

- Stop Order: Stop order, market price ke upar ya niche ek specific level par execute hota hai. Stop order, existing position ko protect karne ya phir new position enter karne ke liye istemal kiya jaata hai. Is order type mein, trader apni desired level ko set karta hai aur jab market us level ko touch karti hai, order execute ho jaata hai.

Pending OrdersPending orders, forex trading mein future mein execute hone wale orders hote hain. Ye orders tab execute hote hain jab market mein specific price level ko touch karti hai. Traders pending orders ka istemal karte hain jab wo market ki movement ko closely monitor kar rahe hote hain aur unhein specific price levels par trades lena hota hai. Pending orders ki kuch common types hai:- Buy Limit: Buy limit order, market price se thodi kam price par execute hota hai. Jab market price desired level tak pohnchti hai, to buy limit order automatically execute ho jaata hai. Ye order type generally market price ke niche entry points par use kiya jaata hai.

- Sell Limit: Sell limit order, market price se thodi zyada price par execute hota hai. Jab market price desired level tak pohnchti hai, to sell limit order automatically execute ho jaata hai. Ye order type generally market price ke upar entry points par use kiya jaata hai.

- Buy Stop: Buy stop order, market price se thodi zyada price par execute hota hai. Jab market price desired level tak pohnchti hai, to buy stop order automatically execute ho jaata hai. Ye order type generally market price ke upar trend continuation ke liye use kiya jaata hai.

- Sell Stop: Sell stop order, market price se thodi kam price par execute hota hai. Jab market price desired level tak pohnchti hai, to sell stop order automatically execute ho jaata hai. Ye order type generally market price ke niche trend continuation ke liye use kiya jaata hai.

-

#4 Collapse

Introduce of Instant and Pending OrdersForex buying and selling ke marketplace orders sab se aam Forex orders hote hain. Ek market order tab hota hai jab aap seedhe marketplace mein sab se behtareen price par input karte hain. Ek market order ka ek example yeh hai: aap Forex pair ABC/XYZ ko kharidne ke liye market order enter karte hain jismein bid charge 1.3510 hai aur ask charge 1.35151 hai. Forex mein wellknown trading order sorts on the spot execution marketplace orders aur pending orders hote hain: Buy Stop, Sell Stop, Buy Limit, Sell Limit, Stop Loss, aur Take Profit. Pending prevent ya limit orders, jo access ke roop mein aate hain, unhein pending prevent access order ya pending stop restrict order bhi kehte hain. The Forex market buying and selling mein, immediately aur pending orders dono tariqe se istemal hote hain. Ye orders traders ko marketplace mein apne trades execute karne aur positions lena permit karte hain. Dono kinds of orders ke tafseelat ko neeche diye gaye headings mein tafseel se samjhaaya gaya Formation of Instant Orders

Instant orders forex trading mein instantaneous execution yaani turant pura hone wale orders hote hain. In orders ko bina kisi put off ke market mein execute kiya jaata hai. Ye orders buyers ko turant buying and selling opportunities ka faida uthane aur contemporary marketplace rate par purchase ya sell karne ki ijazat dete hain. Instant orders ki kuch commonplace types hai: Market Order Overview Market order, sabse aam instant order hai. Ismein dealer apni exchange ko present day marketplace price par execute karwaata hai. Is order kind mein, kisi specific charge par wait nahi karna parta hai. Market order ko execute karne ke liye, trader ke skip sufficient finances hona zaroori hota hai. Stop Order Overview Stop order, market rate ke upar ya niche ek specific stage par execute hota hai. Stop order, present position ko defend karne ya phir new role input karne ke liye istemal kiya jaata hai. Is order type mein, dealer apni desired level ko set karta hai aur jab marketplace us degree ko touch karti hai, order execute ho jaata hai. Pending Orders overview

Pending orders, forex buying and selling mein future mein execute hone wale orders hote hain. Ye orders tab execute hote hain jab market mein specific fee stage ko touch karti hai. Traders pending orders ka istemal karte hain jab wo market ki movement ko intently display kar rahe hote hain aur unhein particular fee levels par trades lena hota hai.Pending orders ki kuch not unusual types hai: Buy Limit Overview Buy limit order, market rate se thodi kam charge par execute hota hai. Jab marketplace price favored level tak pohnchti hai, to buy restriction order routinely execute ho jaata hai. Ye order type usually market rate ke area of interest access factors par use kiya jaata hai. Sell Limit Order Sell restrict order, marketplace fee se thodi zyada rate par execute hota hai. Jab marketplace fee favored stage tak pohnchti hai, to promote limit order automatically execute ho jaata hai. Ye order type normally market rate ke upar access points par use kiya jaata hai. Buy Stop order Buy prevent order, market fee se thodi zyada charge par execute hota hai. Jab marketplace price preferred degree tak pohnchti hai, to buy forestall order automatically execute ho jaata hai. Ye order kind normally market price ke upar trend continuation ke liye use kiya jaata hai. Sell Stop order Sell forestall order, marketplace rate se thodi kam rate par execute hota hai. Jab market rate preferred stage tak pohnchti hai, to sell forestall order routinely execute ho jaata hai. Ye order kind commonly marketplace price ke area of interest fashion continuation ke liye use kiya jaata hai.

-

#5 Collapse

Present of Moment and Forthcoming Orders Forex trading ke commercial center requests sab se aam Forex orders hote hain. Ek market request tab hota hai punch aap seedhe commercial center mein sab se behtareen cost standard information karte hain. Ek market request ka ek model yeh hai: aap Forex pair ABC/XYZ ko kharidne ke liye market request enter karte hain jismein bid charge 1.3510 hai aur ask charge 1.35151 hai. Forex mein wellknown exchanging request sorts on the spot execution commercial center requests aur forthcoming orders hote hain: Purchase Stop, Sell Stop, Purchase Cutoff, Sell Breaking point, Stop Misfortune, aur Take Benefit. Forthcoming forestall ya limit orders, jo access ke roop mein aate hain, unhein forthcoming forestall access request ya forthcoming stop confine request bhi kehte hain. The Forex market trading mein, promptly aur forthcoming orders dono tariqe se istemal hote hain. Ye orders dealers ko commercial center mein apne exchanges execute karne aur positions lena grant karte hain. Dono sorts of requests ke tafseelat ko neeche diye gaye headings mein tafseel se samjhaaya gaya Development of Moment Orders Moment orders forex exchanging mein immediate execution yaani turant pura sharpen rib orders hote hain. In orders ko bina kisi put off ke market mein execute kiya jaata hai. Ye orders purchasers ko turant trading potential open doors ka faida uthane aur contemporary commercial center rate standard buy ya sell karne ki ijazat dete hain. Moment orders ki kuch ordinary sorts hai: Market Request Outline Market request, sabse aam moment request hai. Ismein vendor apni trade ko present day commercial center cost standard execute karwaata hai. Is organization kind mein, kisi explicit charge standard stand by nahi karna parta hai. Market request ko execute karne ke liye, merchant ke avoid adequate funds hona zaroori hota hai. Stop Request Outline Stop request, market rate ke upar ya specialty ek explicit stage standard execute hota hai. Stop request, present position ko shield karne ya phir new job input karne ke liye istemal kiya jaata hai. Is organization type mein, vendor apni wanted level ko set karta hai aur poke commercial center us degree ko contact karti hai, request execute ho jaata hai. Forthcoming Orders outline Forthcoming orders, forex trading mein future mein execute sharpen grain orders hote hain. Ye orders tab execute hote hain hit market mein explicit expense stage ko contact karti hai. Merchants forthcoming orders ka istemal karte hain punch wo market ki development ko eagerly show kar rahe hote hain aur unhein specific charge levels standard exchanges lena hota hai.Pending orders ki kuch to be expected sorts hai: Purchase Cutoff OutlinePurchase limit request, market rate se thodi kam charge standard execute hota hai. Poke commercial center cost leaned toward level tak pohnchti hai, to purchase limitation request regularly execute ho jaata hai. Ye request type ordinarily market rate ke area of premium access factors standard use kiya jaata hai. Sell Cutoff Request Sell confine request, commercial center expense se thodi zyada rate standard execute hota hai. Hit commercial center expense leaned toward stage tak pohnchti hai, as far as possible request consequently execute ho jaata hai. Ye request type ordinarily market rate ke upar passages standard use kiya jaata hai. Purchase Stop request Purchase forestall request, market expense se thodi zyada charge standard execute hota hai. Poke commercial center cost favored degree tak pohnchti hai, to purchase prevent request naturally execute ho jaata hai. Ye request kind regularly market cost ke upar pattern continuation ke liye use kiya jaata hai. Sell Stop request Sell thwart request, commercial center rate se thodi kam rate standard execute hota hai. Poke market rate favored stage tak pohnchti hai, to sell prevent request regularly execute ho jaata hai. Ye request kind generally commercial center cost ke area of interest design continuation ke liye use kiya jaata hai.

-

#6 Collapse

Re: Moment and forthcoming orders: Present of Moment and Forthcoming OrdersForex trading ke commercial center requests sab se aam Forex orders hote hain. Ek market request tab hota hai hit aap seedhe commercial center mein sab se behtareen cost standard information karte hain. Ek market request ka ek model yeh hai: aap Forex pair ABC/XYZ ko kharidne ke liye market request enter karte hain jismein bid charge 1.3510 hai aur ask charge 1.35151 hai. Forex mein wellknown exchanging request sorts on the spot execution commercial center requests aur forthcoming orders hote hain: Purchase Stop, Sell Stop, Purchase Cutoff, Sell Breaking point, Stop Misfortune, aur Take Benefit. Forthcoming forestall ya limit orders, jo access ke roop mein aate hain, unhein forthcoming forestall access request ya forthcoming stop confine request bhi kehte hain. The Forex market trading mein, quickly aur forthcoming orders dono tariqe se istemal hote hain. Ye orders brokers ko commercial center mein apne exchanges execute karne aur positions lena grant karte hain. Dono sorts of requests ke tafseelat ko neeche diye gaye headings mein tafseel se samjhaaya gaya Development of Momen======Moment orders forex exchanging mein prompt execution yaani turant pura sharpen grain orders hote hain. In orders ko bina kisi put off ke market mein execute kiya jaata hai. Ye orders purchasers ko turant trading valuable open doors ka faida uthane aur contemporary commercial center rate standard buy ya sell karne ki ijazat dete hain. Moment orders ki kuch typical sorts hai:Market Request Outline Market request, sabse aam moment request hai. Ismein vendor apni trade ko present day commercial center cost standard execute karwaata hai. Is organization kind mein, kisi explicit charge standard stand by nahi karna parta hai. Market request ko execute karne ke liye, dealer ke avoid adequate funds hona zaroori hota hai. Stop Request Outline Stop request, market rate ke upar ya specialty ek explicit stage standard execute hota hai. Stop request, present position ko guard karne ya phir new job input karne ke liye istemal kiya jaata hai. Is organization type mein, vendor apni wanted level ko set karta hai aur poke commercial center us degree ko contact karti hai, request execute ho jaata hai. Forthcoming Orders outline Forthcoming orders, forex trading mein future mein execute sharpen rib orders hote hain. Ye orders tab execute hote hain poke market mein explicit charge stage ko contact karti hai. Brokers forthcoming orders ka istemal karte hain poke wo market ki development ko eagerly show kar rahe hote hain aur unhein specific expense levels standard exchanges lena hota hai.Pending orders ki kuch to be expected sorts hai:Purchase Cutoff OutlinePurchase limit request, market rate se thodi kam charge standard execute hota hai. Hit commercial center cost leaned toward level tak pohnchti hai, to purchase limitation request regularly execute ho jaata hai. Ye request type as a rule market rate ke area of premium access factors standard use kiya jaata hai. Sell Cutoff Request Sell confine request, commercial center expense se thodi zyada rate standard execute hota hai. Hit commercial center expense leaned toward stage tak pohnchti hai, as far as possible request naturally execute ho jaata hai. Ye request type regularly market rate ke upar passageways standard use kiya jaata hai. Purchase Stop request Purchase forestall request, market expense se thodi zyada charge standard execute hota hai. Poke commercial center cost favored degree tak pohnchti hai, to purchase hinder request consequently execute ho jaata hai. Ye request kind typically market cost ke upar pattern continuation ke liye use kiya jaata hai. Sell Stop request Sell prevent request, commercial center rate se thodi kam rate standard execute hota hai. Punch market rate favored stage tak pohnchti hai, to sell prevent request regularly execute ho jaata hai. Ye request kind normally commercial center cost ke area of interest design continuation ke liye use kiya jaata hai.

-

#7 Collapse

trading mein, instant aur pending orders dono tariqe se istemal hote hain. Ye orders traders ko market mein apne trades execute karne aur positions lena allow karte hain. Dono types of orders ke tafseelat ko neeche diye gaye headings mein tafseel se samjhaaya gaya hai:Instant OrdersInstant orders forex trading mein immediate execution yaani turant pura hone wale orders hote hain. In orders ko bina kisi delay ke market mein execute kiya jaata hai. Ye orders traders ko turant trading opportunities ka faida uthane aur current market price par buy ya sell karne ki ijazat dete hain. Instant orders ki kuch common types hai:- Market Order: Market order, sabse aam instant order hai. Ismein trader apni trade ko current market price par execute karwaata hai. Is order type mein, kisi specific price par wait nahi karna parta hai. Market order ko execute karne ke liye, trader ke pass sufficient funds hona zaroori hota hai.

- Stop Order: Stop order, market price ke upar ya niche ek specific level par execute hota hai. Stop order, existing position ko protect karne ya phir new position enter karne ke liye istemal kiya jaata hai. Is order type mein, trader apni desired level ko set karta hai aur jab market us level ko touch karti hai, order execute ho jaata hai.

Pending OrdersPending orders, forex trading mein future mein execute hone wale orders hote hain. Ye orders tab execute hote hain jab market mein specific price level ko touch karti hai. Traders pending orders ka istemal karte hain jab wo market ki movement ko closely monitor kar rahe hote hain aur unhein specific price levels par trades lena hota hai.- Buy Limit: Buy limit order, market price se thodi kam price par execute hota hai. Jab market price desired level tak pohnchti hai, to buy limit order automatically execute ho jaata hai. Ye order type generally market price ke niche entry points par use kiya jaata hai.

- Sell Limit: Sell limit order, market price se thodi zyada price par execute hota hai. Jab market price desired level tak pohnchti hai, to sell limit order automatically execute ho jaata hai. Ye order type generally market price ke upar entry points par use kiya jaata hai.

- Buy Stop: Buy stop order, market price se thodi zyada price par execute hota hai. Jab market price desired level tak pohnchti hai, to buy stop order automatically execute ho jaata hai. Ye order type generally market price ke upar trend continuation ke liye use kiya jaata hai.

- Sell Stop: Sell stop order, market price se thodi kam price par execute hota hai. Jab market price desired level tak pohnchti hai, to sell stop order automatically execute ho jaata hai. Ye order type generally market price ke niche trend continuation ke liye use kiya jaata hai.

-

#8 Collapse

Introduction: Forex mein "instant orders" aur "pending orders" dono tareeqe hotay hain jin se aap apne trades execute kar saktay hain.Instant order: Instant orders ko "market orders" bhi kaha jata hai. Jab aap instant order use karte hain, to aap turant hi current market price pe trade execute kar saktay hain. Yani, aap order place kar detay hain aur woh foran execute ho jata hai, jaisay hi aap order place karte hhai Pending order: Pending orders ko aap "limit orders" ya "stop orders" bhi keh saktay hain. Jab aap pending order use karte hain, to aap ek specific price level pe trade execute karne ke liye order place karte hain. Aap apne pending order ko kisi specific price level pe set kar saktay hain, aur jab market uss price level pe pohanchti hai, to aapka order execute ho jata hai.Limit orders: Limit orders mein aap apne trade ko buy ya sell karne ke liye specific price level set karte hain. Agar market uss price level pe pohanchti hai, to aapka order execute ho jata hai. Limit orders do tarah ke hote hain: Types of limit orders:Buy Limit Order: Agar aapko lagta hai ke market neechay ja kar upar wapis aayega aur aap uss neechay wali price pe buy karna chahte hain, to aap buy limit order place kar saktay hain.Sell Limit Order: Agar aapko lagta hai ke market upar ja kar neechay wapis aayega aur aap uss upar wali price pe sell karna chahte hain, to aap sell limit order place kar saktay hain.Stop orders mein aap apne trade ko buy ya sell karne ke liye specific price level set karte hain, jahan aapko market ke movement ki confirmation chahiye hoti hai. Jab market uss price level pe pohanchti hai, to aapka order execute ho jata hai. Stop orders bhi do tarah ke hote hain:Buy Stop Order: Agar aapko lagta hai ke market upar ja kar aur zyada upar jayega aur aap uss upar wali price pe buy karna chahte hain, to aap buy stop order place kar saktay hain.Sell Stop Order: Agar aapko lagta hai ke market neechay ja kar aur zyada neechay jayega aur aap uss neechay wali price pe sell karna chahte hain, to aap sell stop order place kar saktay hain.Details: Ye tareeqay aapko market mein flexibility detay hain aur aap apne trades ko apne desired price levels pe execute kar saktay hain.Forex market mein instant aur pending orders dono tarah ke hote hain. Yeh orders trading platform par lagaye jaate hain aur trading ko automate karney k liay use hoty hain.Instant orders ko "market orders" bhi kaha jata hai. Jab aap instant order lagate hain, toh aapki trade turant execute hoti hai. Aap bid (sell) ya ask (buy) price par order lagate hain, aur market ki current price par aapki trade execute hojati hai. Instant orders ki khasiyat hai ki aapko turant entry miljati hai, lekin execution price mein kuch variation ho sakti hai, kyunki market ki volatility ya liquidity ke karan execution price mein minor changes ho sakte hain.Pending orders aise orders hote hain jo future mein execute honge, jab market aapki specified price level tak pahunchti hai. Pending orders aap "buy stop", "sell stop", "buy limit" aur "sell limit" mein lagaye jaate hain:Buy Stop: Agar aap market ke breakout par entry lena chahte hain, toh aap higher price par "buy stop" order lagate hain. Jab market aapki specified price se upar jati hai, toh aapki trade execute hoti hai.Sell Stop: Agar aap market ke breakout par sell karna chahte hain, toh aap lower price par "sell stop" order lagate hain. Jab market aapki specified price se niche jati hai, toh aapki trade execute hoti hai.Buy Limit: Agar aap market ke pullback par entry lena chahte hain, toh aap lower price par "buy limit" order lagate hain. Jab market aapki specified price se niche jati hai aur phir se upar aati hai, toh aapki trade execute hoti hai.Sell Limit: Agar aap market ke pullback par sell karna chahte hain, toh aap higher price par "sell limit" order lagate hain. Jab market aapki specified price se upar jati hai aur phir se niche aati hai, toh aapki trade execute hoti hai.Yeh the instant aur pending orders ki basic jaankari Forex market mein. Aap in orders ko apne trading strategy ke hisab se istemal kar sakte hain. -

#9 Collapse

Re: Moment and forthcoming orders:Present of Moment and Forthcoming Order sForex trading ke commercial center requests sab se aam Forex orders hote hain. Ek market request tab hota hai punch aap seedhe commercial center mein sab se behtareen cost standard information karte hain. Ek market request ka ek model yeh hai: aap Forex pair ABC/XYZ ko kharidne ke liye market request enter karte hain jismein bid charge 1.3510 hai aur ask charge 1.35151 hai. Forex mein wellknown exchanging request sorts on the spot execution commercial center requests aur forthcoming orders hote hain: Purchase Stop, Sell Stop, Purchase Breaking point, Sell Cutoff, Stop Misfortune, aur Take Benefit. Forthcoming forestall ya limit orders, jo access ke roop mein aate hain, unhein forthcoming forestall access request ya forthcoming stop confine request bhi kehte hain. The Forex market trading mein, promptly aur forthcoming orders dono tariqe se istemal hote hain. Ye orders merchants ko commercial center mein apne exchanges execute karne aur positions lena license karte hain. Dono sorts of requests ke tafseelat ko neeche diye gaye headings mein tafseel se samjhaaya gaya Development of Moment Orders Moment orders forex exchanging mein quick execution yaani turant pura sharpen ridge orders hote hain. In orders ko bina kisi put off ke market mein execute kiya jaata hai. Ye orders purchasers ko turant trading open doors ka faida uthane aur contemporary commercial center rate standard buy ya sell karne ki ijazat dete hain. Moment orders ki kuch typical sorts hai: Market Request Outline

Market request, sabse aam moment request hai. Ismein vendor apni trade ko present day commercial center cost standard execute karwaata hai. Is structure kind mein, kisi explicit charge standard stand by nahi karna parta hai. Market request ko execute karne ke liye, dealer ke avoid adequate funds hona zaroori hota hai. Stop Request Outline Stop request, market rate ke upar ya specialty ek explicit stage standard execute hota hai. Stop request, present position ko guard karne ya phir new job input karne ke liye istemal kiya jaata hai. Is structure type mein, vendor apni wanted level ko set karta hai aur punch commercial center us degree ko contact karti hai, request execute ho jaata hai. Forthcoming Orders outline Forthcoming orders, forex trading mein future mein execute sharpen grain orders hote hain. Ye orders tab execute hote hain hit market mein explicit expense stage ko contact karti hai. Merchants forthcoming orders ka istemal karte hain punch wo market ki development ko eagerly show kar rahe hote hain aur unhein specific expense levels standard exchanges lena hota hai.Pending orders ki kuch to be expected sorts hai: Purchase Cutoff Outline Purchase limit request, market rate se thodi kam charge standard execute hota hai. Hit commercial center cost inclined toward level tak pohnchti hai, to purchase limitation request regularly execute ho jaata hai. Ye request type as a rule market rate ke area of premium access factors standard use kiya jaata hai. Sell Breaking point Request Sell confine request, commercial center expense se thodi zyada rate standard execute hota hai. Punch commercial center expense leaned toward stage tak pohnchti hai, as far as possible request naturally execute ho jaata hai. Ye request type ordinarily market rate ke upar passageways standard use kiya jaata hai. Purchase Stop request Purchase forestall request, market expense se thodi zyada charge standard execute hota hai. Punch commercial center cost favored degree tak pohnchti hai, to purchase prevent request consequently execute ho jaata hai. Ye request kind regularly market cost ke upar pattern continuation ke liye use kiya jaata hai. Sell Stop request Sell prevent request, commercial center rate se thodi kam rate standard execute hota

-

#10 Collapse

Instant orders forex trading mein immediate execution yaani turant pura hone wale orders hote hain. In orders ko bina kisi delay ke market mein execute kiya jaata hai. Ye orders traders ko turant trading opportunities ka faida uthane aur current market price par buy ya sell karne ki ijazat dete hain. Instant orders ki kuch common types hai: Moment orders forex exchanging mein immediate execution yaani turant pura sharpen rib orders hote hain. In orders ko bina kisi put off ke market mein execute kiya jaata hai. Ye orders purchasers ko turant trading potential open doors ka faida uthane aur contemporary commercial center rate standard buy ya sell karne ki ijazat dete hain. Moment orders ki kuch ordinary sorts hai: Pending orders, forex trading mein future mein execute hone wale orders hote hain. Ye orders tab execute hote hain jab market mein specific price level ko touch karti hai. Traders pending orders ka istemal karte hain jab wo market ki movement ko closely monitor kar rahe hote hain aur unhein specific price levels par trades lena hota hai.Agar aapko lagta hai ke market neechay ja kar upar wapis aayega aur aap uss neechay wali price pe buy karna chahte hain, to aap buy limit order place kar saktay hain.Sell Limit Order: Agar aapko lagta hai ke market upar ja kar neechay wapis aayega aur aap uss upar wali price pe sell karna chahte hain, to aap sell limit order place kar saktay hain.Stop orders mein aap apne trade ko buy ya sell karne ke liye specific price level set karte hain, jahan aapko market ke movement ki confirmation chahiye hoti hai. Jab market uss price level pe pohanchti hai, to aapka order execute ho jata hai. Stop orders bhi do tarah ke hote hain:Buy Stop Order: Agar aapko lagta hai ke market upar ja kar aur zyada upar jayega aur aap uss upar wali price pe buy karna chahte hain, to aap buy stop order place kar saktay hain.Sell Stop Order: Agar aapko lagta hai ke market neechay ja kar aur zyada neechay jayega aur aap uss neechay wali price pe sell karna chahte hain, to aap sell stop order place kar saktay hain -

#11 Collapse

Assalamualaikum dear forex members Instant and pending orders:Dear member apny hmary sth bht acha thread share kia hai or iske bare me information di hai jesa ke ap janty hn forex trading me trades ki proper information or experience hona bht zaruri hota hai uske bad hi hum kamyabi hasil kar sakte hain aur acchi earning kar paate Hain main apke sath mazeed kuch information share karna chahti hun ta k apki knowledge me acha hizafa ho sky trade order : Dear members trading me apko sb sy phly acha knowledge hona bht zaruri hai market me jab bhi change ata hai to trader usme sell ya buy ki trade lga k uski waja sy achi earning kr skty hn isi liye humy trade order ki complete knowledge and experience bht zaida zaruri hota hai market ki movemnt ko smihna or uske bad trading krny wala nakam ni ho skta Types of trade orders There are two types of trade orders:

Instant and pending orders:Dear member apny hmary sth bht acha thread share kia hai or iske bare me information di hai jesa ke ap janty hn forex trading me trades ki proper information or experience hona bht zaruri hota hai uske bad hi hum kamyabi hasil kar sakte hain aur acchi earning kar paate Hain main apke sath mazeed kuch information share karna chahti hun ta k apki knowledge me acha hizafa ho sky trade order : Dear members trading me apko sb sy phly acha knowledge hona bht zaruri hai market me jab bhi change ata hai to trader usme sell ya buy ki trade lga k uski waja sy achi earning kr skty hn isi liye humy trade order ki complete knowledge and experience bht zaida zaruri hota hai market ki movemnt ko smihna or uske bad trading krny wala nakam ni ho skta Types of trade orders There are two types of trade orders:1 Instant trade order 2 Pending trade order 1 Instant trade order Dear members instant trade order ka matlb hai k Market ko live watch kia jaye or traders iski information hasil kar k buy ya sell ki trade lgaty hn market ki movemnt ko smjhty huy hi kam krna chahiye agr market upper jati hn to trader isme buy ki trade open kr skty hn or aagr market down jati hn to sell ki trade lga skty hn

Buy the market Sell the market 2 Pending trade order Dear members isi tarh pending order ka matlb hai k agr hum apni trade open krty hain apny ksi bhi future level k liye to uske liye traders k pass 4 options hoty hn metatrader-4 me ta k hum wahan sy forex trading kar sken 1 Buy stop 2 Sell stop 3 Buy limit 4 Sell limit Buy stop Dear members buy stop me hum bullish ki current level py trade open kr skty hn or jab hmari trade price k us level par ponchti hahai to hum buy ki trade lga skty hn jo ke stop loss or take profit k sath active ho jati ha jiski waja sy humy nuksan ni uthna prta

Sell stop Sell stop me bhi isi tarh hum bearish level py trade open krty hn or hmari trade sell me active ho jati ha stop loss or take profit ke sath or phr usko hit kar k khudi close ho jati Buy limit; Dear members buy limit me hum bearish ki current price me trade ko place krty hn market me nechy ksi level par reverse ki condition place hoti hai agr price uske level py reserve ho jati ha to buy ki trade active hoti hai or stop loss or take profit k bd khudi hit ho k close ho jati ha.. Sell limit Sell limit me bhi isi tarh bullish level ki current market price py place hoti hai nechy ja k trade open ki jati hn or sell ki trade active hoti uske bad stop loss k sth hit ho kar close ho jati or apka target complete ho jata ha jiski waja sy apko faida milta

-

#12 Collapse

IMPORTANCE OF INSTANT ORDERS IN MARKET; Aoa omeed hy ap kaise he bilkul thik hoon gy Forex exchanging Marketing main instant order ko book karny ky liye ordar senior member sey rehnomai lety hein trade order ka matlb hai k Market ko live watch kia jaye or traders iski information hasil kar k buy ya sell ki trade lgaty hn market ki movemnt ko smjhty huy hi kam krna chahiye agr market upper jati hn to trader isme buy ki trade open kr skty hn or aagr market down jati hn to sell ki trade lga skty hn Instant orders forex trading mein immediate execution yaani turant pura hone wale orders hote hain. In orders ko bina kisi delay ke market mein execute kiya jaata Ye orders traders ko turant trading opportunities ka faida uthane aur current market price par buy ya sell karne ki ijazat dete hain. Instant orders ki kuch common types hai Market sabse aam instant order hai. Ismein trader apni trade ko current market price par execute karwaata hai. Is order type mein, kisi specific price par wait nahi karna parta Market order ko execute karne ke liye, trader ke pass sufficient funds hona zaroori samjhaty hei our preference dety hein signal ky liye Traders hazraat Tradings karty howy signal provided dety hein.EXPLANATIONS OF PENDING ORDERED IN MARKET: Dear friends Forex trading Marketing price orders sab se aam Forex orders hote hain. Ek market order tab hota hai jab aap seedhe market mein sab se behtareen price par enter karte hain. Ek market order ka ek example yeh hai: aap Forex pair ko kharidne ke liye market order enter karte hain jismein bid price 1.3510 hai aur ask price 1.35151 hai. Forex mein standard trading order types instant execution market orders aur pending orders hote Buy Take Profit. Pending stop ya limit orders, jo entry ke roop mein samjha jata Heiunhein pending stop entry order ya pending stop limit order bhi kehte hain. Forex trading mein, instant aur pending orders dono tariqe se istemal hote hain. Ye orders traders ko market mein apne trades execute karne aur positions lena allow karte hain. Dono types of orders ke tafseelat ko neeche diye gaye headings mein tafseel se samjhaty hei aap ky kitny Trader's ko follow up karty hen our successful in the forex trading marketing mein ho sakty hen our es wakt price 1.4563 kartyy our Resistance level uptrend karty hen.

-

#13 Collapse

Forex market mein trading karte waqt traders ko instant orders aur pending orders ka istemal karna hota hai. Instant orders jinhe market orders bhi kehte hain traders ke throught immediate execution ke liye bheje jaate hain. Wahi pending orders traders ke through future mein execute hone ke liye set kiye jaate hain jab market mein specific conditions fulfill hote hain. Instant Orders: Instant orders jaisa ki naam se pata chalta hai foran execute hone wale orders hote hain. Traders jab instant order place karte hain toh unka trade market mein available liquidity ke hisab se immediately execute ho jata hai. Yeh orders traders ko immediate buying ya selling opportunity dete hain kyunki yeh trades current market price (CMP) par execute hote hain. Instant orders ka ek main fayda yeh hai ki traders ko current market price par trading karne ka mauka milta hai. Jab traders ko current market price par entry ya exit karna hota hai tab instant orders bahut useful hote hain. Traders ko CMP par trade karne ki flexibility milti hai aur isse price fluctuations ke liye exposure kam hota hai. Instant orders mein kuch main orders hote hain: Market Buy/Sell Orders: Yeh orders market price par buy ya sell karne ke liye place kiye jate hain. Traders ko apne trading platform par market order select karna hota hai, quantity enter karna hota hai, aur order execute karna hota hai. Market orders immediate execution ke liye liquidity ke saath match ho jate hain. Buy Stop/Sell Stop Orders: Stop orders traders ke dwara set kiye jaate hain, jab market price specific level (stop price) ko touch karti hai. Buy stop order ko traders tab place karte hain, jab woh expect karte hain ki price upar jayegi aur unhe buy karna hai. Sell stop order ko traders tab place karte hain, jab woh expect karte hain ki price niche jayegi aur unhe sell karna hai. Jab market price stop price ko touch karti hai, tab stop orders market orders mein convert ho jate hain aur immediate execution ho jati hai. Buy Limit/Sell Limit Orders: Limit orders traders ke dwara set kiye jaate hain, jab market price specific level (limit price) tak pahunchti hai. Buy limit order ko traders tab place karte hain, jab woh expect karte hain ki price niche jayegi aur unhe buy karna hai. Sell limit order ko traders tab place karte hain, jab woh expect karte hain ki price upar jayegi aur unhe sell karna hai. Jab market price limit price tak pahunchti hai, tab limit orders market orders mein convert ho jate hain aur immediate execution ho jati hai. Pending Orders: Pending orders jaise ki naam se pata chalta hai future mein execute hone wale orders hote hain. Traders pending orders set karte hain jab woh specific market conditions ki expectation rakhte hain. Jab market mein woh specific conditions fulfill hoti hain tab pending orders execute ho jate hain aur trades automatically place ho jate hain. Pending orders ko lago karne ke kuch faide hain: Pre-Defined Entry and Exit Points: Traders ko specific entry aur exit points set karne ki flexibility milti hai. Jab market price woh specific level touch karti hai, tab pending orders execute ho jate hain aur traders ke desired entry aur exit points par trades place ho jate hain. Trading Strategies Ko Implement Karne Ka Mouka: Traders apne trading strategies ke mutabiq pending orders set kar sakte hain. Agar kisi trading strategy mein specific market conditions ko identify kiya gaya hai, toh pending orders uss strategy ko implement karne ka mouka dete hain. Trading Automation: Pending orders ka istemal karke traders apne trading process ko automate kar sakte hain. Jab market conditions traders ke desired levels tak pahunchti hain, tab pending orders execute ho jate hain aur trades automatically place ho jate hain. Isse traders ko manually trades place karne ki zarurat nahi hoti hai.

Pending Orders: Pending orders jaise ki naam se pata chalta hai future mein execute hone wale orders hote hain. Traders pending orders set karte hain jab woh specific market conditions ki expectation rakhte hain. Jab market mein woh specific conditions fulfill hoti hain tab pending orders execute ho jate hain aur trades automatically place ho jate hain. Pending orders ko lago karne ke kuch faide hain: Pre-Defined Entry and Exit Points: Traders ko specific entry aur exit points set karne ki flexibility milti hai. Jab market price woh specific level touch karti hai, tab pending orders execute ho jate hain aur traders ke desired entry aur exit points par trades place ho jate hain. Trading Strategies Ko Implement Karne Ka Mouka: Traders apne trading strategies ke mutabiq pending orders set kar sakte hain. Agar kisi trading strategy mein specific market conditions ko identify kiya gaya hai, toh pending orders uss strategy ko implement karne ka mouka dete hain. Trading Automation: Pending orders ka istemal karke traders apne trading process ko automate kar sakte hain. Jab market conditions traders ke desired levels tak pahunchti hain, tab pending orders execute ho jate hain aur trades automatically place ho jate hain. Isse traders ko manually trades place karne ki zarurat nahi hoti hai.  Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#14 Collapse

heoo Forex mein standard exchanging request types moment execution market orders aur forthcoming orders hote hain: Purchase Stop, Sell Stop, Purchase Breaking point, Sell Cutoff, Stop Misfortune, aur Take Benefit. Forthcoming stop ya limit orders, jo passage ke roop mein aate hain, unhein forthcoming stop section request ya forthcoming stop limit request bhi kehte hain. Forex exchanging mein, moment aur forthcoming orders dono tariqe se istemal hote hain. Ye orders dealers ko market mein apne exchanges execute karne aur positions lena permit karte hain. Dono kinds of orders ke tafseelat ko neeche diye gaye headings mein tafseel se samjhaaya gaya hai: Moment Orders Moment orders forex exchanging mein prompt execution yaani turant pura sharpen rib orders hote hain. In orders ko bina kisi delay ke market mein execute kiya jaata hai. Ye orders merchants ko turant exchanging potential open doors ka faida uthane aur current market cost standard purchase ya sell karne ki ijazat dete hain. Moment orders ki kuch normal sorts hai:Market Request Market request, sabse aam moment request hai. Ismein dealer apni exchange ko current market cost standard execute karwaata hai. Is structure type mein, kisi explicit cost standard stand by nahi karna parta hai. Market request ko execute karne ke liye, broker ke pass adequate assets hona zaroori hota hai. Stop Request Stop request, market cost ke upar ya specialty ek explicit level standard execute hota hai. Stop request, existing position ko safeguard karne ya phir new position enter karne ke liye istemal kiya jaata hai. Is organization type mein, broker apni wanted level ko set karta hai aur punch market us level ko contact karti hai, request execute ho jaata hai. Forthcoming Orders Forthcoming orders, forex exchanging mein future mein execute sharpen grain orders hote hain. Ye orders tab execute hote hain poke market mein explicit cost level ko contact karti hai. Dealers forthcoming orders ka istemal karte hain hit wo market ki development ko intently screen kar rahe hote hain aur unhein explicit cost levels standard exchanges lena hota hai.4 exchange request Dear individuals exchanging me apko sb sy phly acha information hona bht zaruri hai market me poke bhi change ata hai to dealer usme sell ya purchase ki exchange lga k uski waja sy achi acquiring kr skty hn isi liye humy exchange request ki complete information and experience bht zaida zaruri hota hai market ki movemnt ko smihna or uske awful exchanging krny wala nakam ni ho skt -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 Collapse

Aslamoalekum members kesay hain ap sab. Mujhay umed hay sah thek thak hon gay. Aj ka hamara disscussion ka jo topic hay qoh instant aur pending order kay bary hain. Isy dekhty hain kay yeh kia hay r hamen kia information deta hay. Instant and pending order Forex trading mein instant aur pending dono types ke orders hote hain. Dono he bohat ehmiyat kay hamil hotay hain.jin ki bohat zeada ehmiyat kay hamil hay. Agy ja ky mein apko inky bunyadi tajziya se bunyadi malomat faraham r mazed dsri batem btaungi. In orders ko lgany sy phly apko bht ehtyat bhe krni hoti hay taky koi bhe nuqsan na ho. Sab sy pehlay ham instant order ky bary mein bt krengy. Instant Order ka matlab hota hai ki aap b apna order foran execute karna chahte hain to jaise hi aap usko place karte hain. Instant order 2 iqsam ke hote hain aik Market Order or yeah jo bh market order lagane par, aap foran aur sabse aasani sey mily mojoda hazir market price par trade kar sakte hain. Aap khareed ya frokht ka order place kar sakte hain aur aapka order foran execute ho jayega. types of orders Stop Order jo bhe Stop order ko lagane se, aap market mein tab trade kar sakte hain jab price ek makhsos level tak pahunch jaye. Stop order do iqsam key b hote hain. Buy Stop Order jesay ky Buy stop order lagane par, aap tab trade karenge jab market price upar jayegi aur aapko lagta hai ki upar jate hi price aur bhi upar say jayegi. Sell Stop Order jesay ky Sell stop order lagane par, aap tab trade karenge jab market price niche jayegi aur aapko lagta hai ki niche jate hi price aur bhi waqt niche jayegi. Jiskay zariye bht say faiday hasil kiye ja sakty hein lekin sab sy zarori bt yeah hy ky isky bary mein pori pori malomat honi chahiyen. Taky issy sab say zeada jo chez zehan mein rakhni hti hy wh muqsan say bchao hota hy uskary mein sab say pehlay sochen. Pending order types Pending Order wh order hein in ka Pending order ka matlab hota hai ki aap apna order mustaqbil mein execute hona chahte hain, jab market price aapke khahish ki satah tak pahunchegi. Pending order 4 iksam ke hote hain. Buy Limit jo bhe Buy limit order lagane par, aap tab trade karenge jab market price niche jayegi aur wsy aapko lagta hai ki niche jate hi price badh jayegi. Sell Limit jo ky Sell limit order lagane parr to ap tab trade karenge jab market price upar jayegi aur aapko lagta hai ki upar jate hi price gir jayegi. Buy Stop yeah order Buy stop order lagane par, aap tab trade karenge jab market price upar jayegi aur aapko lagta hai ki upar jatey hi price aur bhi upar jayegi. Sell Stop yaeh order jo Sell stop order lagane par, aap tab trade karenge jab market price niche jayegi aur aapko lagta hai ki nichey jatey hi price aur bhi niche jayegi.Ye tha ek jana mana tajurba hy . Forex trading platform par aapko alag-alag order ky iksam aur unke istalahat milenge, isliye aapko apne broker ya trading platform ki rehnumai ki bhi perwi karn.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 01:07 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим