Piercing Line Candlestick Pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

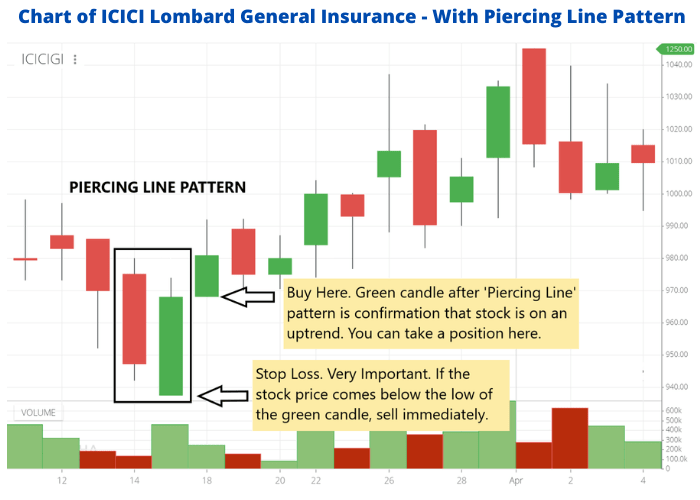

Assalamu Alaikum Dosto!Piercing Line PatternPiercing two days candlestick pattern hai, jo prices k downtrend k baad bantta hai. Pattern ki pehlee candle aik bearish trend k tasalsul ko zahir karne wali candle hotti hai. Jo k aik long real body main banti hai. Dosrre number par banne wali candle bhi aik real body wali strong candle hotti hai, lekin ye candle aik bullish candle hotti hai. Piercing line pattern dekhne main "Meeting Line Pattern" jaisa hibdekhaye detta hai, lekin bullish candle k bearish candle k midpoint se upper close honne par us se mukhtalif ho jatta hai.Candles FormationPiercing line pattern bearishbtrend k baad bantta hai, is wajja se pattern ki pehlee candle trend k muttabiq bearish candle honi chaheye jiss k baad aik long real body wali bullish candle bantti hai, jiss ki tafseel darjazzel hai; 1. First Candle: Piercing Line Pattern ki pehlee candle aik strong bearish candle hotti hai, jo k pehle se harkat main a rahe bearish trend ko zahir kartti hai. Ye candle normal real body main hotti hai, jisbk wick body k muqabele main kam hotta hai. 2. Second Candle: Piercing Line Pattern ki dosree candle aik strong real body wali bullish candle bantti hai, jo open to pehlee candle k closing point se nechay gap main hai, lekin close pehlee candle k real body k 50% area se upper pe hotti hai.ExplainationPiercing Line Pattern bearish trend ya prices k bohut low area main bannte hen, jahan se ye bullish trend reversal ka sabbab bannte hen. Piercing Line Pattern aur "Meeting Line Pattern" candles ki formation main aik jaise hotte hen, lekin is pattern main dosree candle pehlee candle k real body se main 50% area se upper par ja k clise hotti hai, jab k meeting line main pehlee aur dosree candle ki closing point same hotta hai. Pattern ki pehlee candle bearish trend k mutabiq black hotti hai, jab k dosree din ki candle reversal pattern k mutabiq bullish hotti hai.TradingPiercing Line Pattern k leye downtrend ka hona zarori hai, q k candlestick pattern top ya downtrend main behtar result dete hen. Pattern ki dosri candle k leye zarori hai k wo pehlee candle k mid point main lazmi close bhi ho aur ye point 50% se upper ka area honna chaheye. Piercing Line Pattern pe trading se pehle prices ka downtrend k elawa trend confirmation bhi hona zarrori hai, is waja se pattern k baad teesrri candle ka bullish banna bohut aham hai, aur candle ki real body bhi honi chaheye. Aggar confirmation candle pehlee candle se upper side pe close ho jatti hai, to ye aik strong buy ka signal hogga. Stop Loss pattern k sab se lower area ya dosri bullish candle k open price se aik ya do pips down side pe set karen. -

#3 Collapse

Piercing Line pattern (Yaani Taar Kash Line) Forex trading mein ek significant bullish reversal pattern hai. Iss pattern ki samajh Forex traders ke liye zaroori hai, kyunki issay identify karne se traders ko potential buying opportunities milti hain. Piercing Line pattern do candlesticks se banta hai aur kisi downtrend ke baad bullish reversal signal provide karta hai. Iss pattern ko samajhne ke liye neeche diye gaye steps ko follow karein: 1. Pehla candlestick: Piercing Line pattern ki formation ki shuruaat pehle candlestick ke saath hoti hai, jo downtrend ke dauran form hota hai. Yeh candlestick typically red (bearish) hota hai. 2. Doosra candlestick: Downtrend ke baad, doosra candlestick form hota hai, jo pehle candlestick ko partially cover karta hai. Yeh candlestick typically green (bullish) hota hai. 3. Open price: Doosre candlestick ka open price pehle candlestick ke close price ke neeche hota hai, indicating a gap down opening. 4. Close price: Doosre candlestick ka close price pehle candlestick ke middle se upar tak jaata hai. Ideally, iska close price pehle candlestick ke 50% se zyada hota hai. 5. Confirmation: Jab Piercing Line pattern confirm ho jaata hai, tab traders ko bullish reversal ki possibility samajhni chahiye. Iska matlab hai ki traders ko buy position lena chahiye. 6. Stop loss: Traders ko hamesha stop loss order lagana chahiye, jisse unko potential losses control karne mein madad mile. Stop loss order typically pehle candlestick ke low price ke neeche lagaya jaata hai. Piercing Line pattern ki samajh se traders ko bullish reversal ki signal milti hai. Yeh pattern kaafi reliable hai, lekin traders ko hamesha market trends aur other technical indicators ko consider karna chahiye. Isse traders apne trading decisions ko validate kar sakte hain. Note: Roman Urdu translation may not accurately represent technical terms in forex trading. -

#4 Collapse

candlestick pattern hai, jo prices k downtrend k baad bantta hai. Pattern ki pehlee candle aik bearish trend k tasalsul ko zahir karne wali candle hotti hai. Jo k aik long real body main banti hai. Dosrre number par banne wali candle bhi aik real body wali strong candle hotti hai, lekin ye candle aik bullish candle hotti hai. Piercing line pattern dekhne main "Meeting Line Pattern" jaisa hibdekhaye detta hai, lekin bullish candle k bearish candle k midpoint se upper close honne par us se mukhtalif ho jatta hai.Candles FormationPiercing line pattern bearishbtrend k baad bantta hai, is wajja se pattern ki pehlee candle trend k muttabiq bearish candle honi chaheye jiss k baad aik long real body wali bullish candle bantti hai, jiss ki tafseel darjazzel hai;1. First Candle: Piercing Line Pattern ki pehlee candle aik strong bearish candle hotti hai, jo k pehle se harkat main a rahe bearish trend ko zahir kartti hai. Ye candle normal real body main hotti hai, jisbk wick body k muqabele main kam hotta hai. 2. Second Candle: Piercing Line Pattern ki dosree candle aik strong real body wali bullish candle bantti hai, jo open to pehlee candle k closing point se nechay gap main hai, lekin close pehlee candle k real body k 50% area se upper pe hotti hai.

ExplainationPiercing Line Pattern bearish trend ya prices k bohut low area main bannte hen, jahan se ye bullish trend reversal ka sabbab bannte hen. Piercing Line Pattern aur "Meeting Line Pattern" candles ki formation main aik jaise hotte hen, lekin is pattern main dosree candle pehlee candle k real body se main 50% area se upper par ja k clise hotti hai, jab k meeting line main pehlee aur dosree candle ki closing point same hotta hai. Pattern ki pehlee candle bearish trend k mutabiq black hotti hai, jab k dosree din ki candle reversal pattern k mutabiq bullish hotti hai.TradingPiercing Line Pattern k leye downtrend ka hona zarori hai, q k candlestick pattern top ya downtrend main behtar result dete hen. Pattern ki dosri candle k leye zarori hai k wo pehlee candle k mid point main lazmi close bhi ho aur ye point 50% se upper ka area honna chaheye. Piercing Line Pattern pe trading se pehle prices ka downtrend k elawa trend confirmation bhi hona zarrori hai, is waja se pattern k baad teesrri candle ka bullish banna bohut aham hai, aur candle ki real body bhi honi chaheye. Aggar confirmation candle pehlee candle se upper side pe close ho jatti hai, to ye aik strong buy ka signal hogga. pattern k sab se lower area ya dosri bullish candle k open price se aik ya do pips down side pe set karen. -

#5 Collapse

INTRODUCTION ABOUT PIERCING LINE CANDLESTICK PATTERN IN FOREX TRAIDING Piercing Line Candlestick Pattern, ek mumtaz aur aham technical analysis tool hai jo candlestick charts par istemal hota hai. Is pattern ki tashkeel do candlesticks se hoti hai aur yeh aksar trend reversal ki tashkhees karne ke liye istemal hota hai. Piercing Line, ya "chhedh karne wala line", ek bullish candlestick pattern hai jo downtrend ke baad trend reversal ka sanket deta hai. Yeh pattern uptrend ke shuruaat ka bhi sanket kar sakta hai. Piercing Line pattern do candlesticks se tashkeel paye ga. Neeche diye gaye hain dono candlesticks ki tashreehat:Piercing Line Candlestick Pattern ko samajhna aur uska sahi istemal karne ke liye, traders aur investors ko candlestick charting techniques aur technical analysis ki acchi samajh honi chahiye. TYPES OF PIERCING LINE CANDLESTICK PATTERN. BEARISH PIERCING LINE CANDLESTICK - Lambi aur ghatte wali ek bearish (girawat ki taraf jane wali) candle hai. - Iski opening price pehle candlestick ki high se niche hoti hai. - Iski closing price pehle candlestick ki middle tak ya usse upper hoti hai. BULLISH PIERCING LINE CANDLESTICK - Lambi aur ghatte wali ek bullish (badhne ki taraf jane wali) candle hai. - Iski opening price pehle candlestick ki closing price se equal ya usse niche hoti hai. - Iski closing price pehle candlestick ki middle tak ya usse upper hoti hai. PIERCING LINE CANDLESTICK PATTERN STRATEGY Piercing Line pattern bullish trend reversal ka potential indicate karta hai. Is pattern ke baad, market mein bearish momentum kam ho jata hai aur bulls (kharidari wale) control mein aate hain. Yeh pattern uptrend ke shuruaat ka bhi signal de sakta hai.Piercing Line pattern ki tasdeeq aur validity ke liye, traders aur investors dusre technical indicators, jaise ki moving averages, trendlines, aur volume analysis ka istemal karte hain. Iske saath, price action ko confirm karne ke liye dusri candlestick patterns aur chart patterns bhi dekhe ja sakte hain. Traders Piercing Line pattern ko istemal karke entry point aur stop loss level tay kar sakte hain. Stop loss level pehli candlestick ki low se niche set kiya jata hai. Targets (lakshya) previous highs, moving averages, ya chart patterns ke support aur resistance levels par rakhe ja sakte hain. -

#6 Collapse

Piercing Line pattern pattern kya hy chart pattern par banne wala aik bullish trend reversal pattern hai, jo uss waqat market main banta hai, jab sellers market par control hasil karne ki koshash karte hen. Price action main candles timeframes k mutabiq kisi assets ki high aur kam value ko zahir karti hai, aur jab bhi ye value intehaye kam ya ziada ho jati hen, to uss waqat trend reversal hone ka indication melta hai. Ye indication aksar price chart par mukhtalif candles se mel kar banta hai, jo k aik ya aik se ziada candles par mushtamil hota hai. Piercing line candlestick pattern do din k mukhtalif formate k candles par mushtamil aik trend reversal pattern hai... Piercing Line Pattern ki Phachan aour Working Principle candlestick pattern k leye zarori hai, k prices chart par bearish ya lower area main trade kar rahi ho. Ye pattern prices k bottom main bearish trend ka khatema karke bullish trend reversal ka sabab banti hai. Pattern do candles par mushtamil hota hai, jiss ki pehli candle aik real body wali bearish candle hoti hai, niss main candle ka close price open price se kam hota hai. Pattern ki dosri candle aik bullish candle hoti hai, jo pehli candle se lower gap main open ho kar ussi k darmeyan se thora sa above close hoti hai. Dosri candle ka close price open price se high hota hai,

Piercing Line Pattern ki Phachan aour Working Principle candlestick pattern k leye zarori hai, k prices chart par bearish ya lower area main trade kar rahi ho. Ye pattern prices k bottom main bearish trend ka khatema karke bullish trend reversal ka sabab banti hai. Pattern do candles par mushtamil hota hai, jiss ki pehli candle aik real body wali bearish candle hoti hai, niss main candle ka close price open price se kam hota hai. Pattern ki dosri candle aik bullish candle hoti hai, jo pehli candle se lower gap main open ho kar ussi k darmeyan se thora sa above close hoti hai. Dosri candle ka close price open price se high hota hai,  Treading pattern of Piercing line pattern trading k leye zarorri hai, k prices long timeframes main downtrend main ho. Ye pattern buyers k leye market main khareedari ki opportunity deti hai, jo k aik confirmation candle k baad mumkin hota hai. Pattern k baad confirmation candle bullish real body main honi chaheye, jo k dosri candle k top par close bhi honi chaheye. Lekin agar ye candle bearish banti hai to uss waqat pattern par trading se parhez karen. Pattern ki confirmation indicator se bhi ki ja sakti hai, jo k CCI, RSI indicator aur stochastic oscillator par value oversold zone main honi chaheye.

Treading pattern of Piercing line pattern trading k leye zarorri hai, k prices long timeframes main downtrend main ho. Ye pattern buyers k leye market main khareedari ki opportunity deti hai, jo k aik confirmation candle k baad mumkin hota hai. Pattern k baad confirmation candle bullish real body main honi chaheye, jo k dosri candle k top par close bhi honi chaheye. Lekin agar ye candle bearish banti hai to uss waqat pattern par trading se parhez karen. Pattern ki confirmation indicator se bhi ki ja sakti hai, jo k CCI, RSI indicator aur stochastic oscillator par value oversold zone main honi chaheye.

-

#7 Collapse

What is Piercing line candle pattern? piercing line ka patteren do commotion candles ka stuck price ka patteren hai jo disadvantage se le kar upper side ki taraf move karta hai. Importance Of The Pattern Piercing line ka pattern two candles ka combination design hai jo down se upperside pe move krnay ki expectation provide karta hai. yeh candle design aik aisa design most part a few days design ki continuety ka signal deta ha. es patteren ki (Three) qualities hain jis mein se pehlay neechay ki taraf pattern then aik hole aur patteren mein second candle ki against development incorporate ha . The most effective method to Identify Piercing Line Pattern: Piercing line design ki distinguished karnay k kuch rules hain jinko agar ham observe kartay hain to ham is design k sath market principle great trading kar skatay hain... i ....Piercing line design ko perceive karnay k liye market fundamental pattern down ka hona chaye ii ...first large candle ki body cost ko drawback run karty huw nazar ani chaye iii ... first aur second candles ki bodies cost principle hole aur inversion ka show kar rahi hon iv ... Bullish aur Bearish candles ki bodies ka large hona bhi zaruri hai agar traders chart ko aisay price design ka base say down start daikhain to ham outline pay isay penetrating line design ka name daitay huway exchanges kr skty hain... Trading Planing For This Pattern... apni trading ko kamyab bananay ke liye hamesha aise different sort ke designs ko follow Karte rehna chahie jitna jyada hamen aise designs ko samajhne aur in per kam karne ka mauka Milega to ham apni trde ko kamyab bana sakte hain agar apne trading capacity aur abilities ko improve karna chahte hain to hamesha candle ke different type ke pattrens ko follow karte Raha karen aur unko samajhne ke liye markers ka use Kiya Karen Jitna zyada point ko use karte ek arranging ke sath apni trading ko perform karenge to aapko in candle design se acha result milega aur ap apni trade ko bahut aasani ke sath Kamyab bana sakte hain..... -

#8 Collapse

helloevery one candle design hai, jo costs k downtrend k baad bantta hai. Design ki pehlee light aik negative pattern k tasalsul ko zahir karne wali flame hotti hai. Jo k aik long genuine body principal banti hai. Dosrre number standard banne wali flame bhi aik genuine body serious areas of strength for wali hotti hai, lekin ye candle aik bullish candle hotti hai. Puncturing line design dekhne primary "Meeting Line Example" jaisa hibdekhaye detta hai, lekin bullish flame k negative candle k midpoint se upper close honne standard us se mukhtalif ho jatta hai. Candles Arrangement Puncturing line design bearishbtrend k baad bantta hai, is wajja se design ki pehlee flame pattern k muttabiq negative light honi chaheye jiss k baad aik long genuine body wali bullish candle bantti hai, jiss ki tafseel darjazzel hai; 1. First Candle: Penetrating Line Example ki pehlee candle areas of strength for aik candle hotti hai, jo k pehle se harkat fundamental a rahe negative pattern ko zahir kartti hai. Ye flame ordinary genuine body primary hotti hai, jisbk wick body k muqabele principal kam hotta hai.2. Second Light: Puncturing Line Example ki dosree flame major areas of strength for aik body wali bullish candle bantti hai, jo open to pehlee candle k shutting point se nechay hole principal hai, lekin close pehlee candle k genuine body k half region se upper pe hotti hai. Explaination Puncturing Line Example negative pattern ya costs k bohut low region fundamental bannte hen, jahan se ye bullish pattern inversion ka sabbab bannte hen. Penetrating Line Example aur "Meeting Line Example" candles ki development fundamental aik jaise hotte hen, lekin is design primary dosree candle pehlee candle k genuine body se principal half region se upper standard ja k clise hotti hai, hit k gathering line primary pehlee aur dosree light ki shutting point same hotta hai. Design ki pehlee flame negative pattern k mutabiq dark hotti hai, hit k dosree noise ki light inversion design k mutabiq bullish hotti hai. Exchanging Penetrating Line Example k leye downtrend ka hona zarori hai, q k candle design top ya downtrend fundamental behtar result dete hen. Design ki dosri flame k leye zarori hai k wo pehlee candle k mid point primary lazmi close bhi ho aur ye point half se upper ka region honna chaheye. Puncturing Line Example pe exchanging se pehle costs ka downtrend k elawa pattern affirmation bhi hona zarrori hai, is waja se design k baad teesrri flame ka bullish banna bohut aham hai, aur candle ki genuine body bhi honi chaheye. Aggar affirmation candle pehlee candle se upper side pe close ho jatti hai, to ye aik solid purchase ka signal hogga. design k sab se lower region ya dosri bullish candle k open cost se aik ya do pips disadvantage pe set karen. -

#9 Collapse

Assalamo Alaekum friends. Kasy hain ap sabMain umed karta hon ap sab bilkul thek thak hon gay. Aj ka jo topic zer e behs hay uska nam piercing line candlestick patterns hay . Yeh hamen kia btayega r kia information deta hay yeh dekhty hain. Yeh hamen kia kuch btaya hay yeh ab ham agy mazeed dekhty hain. Piercing line Candlistic Pattern Piercing Line candlestick pattern forex trading mein ek bullish reversal pattern hai. Yeah pattern amm tor par downtrend ke baad dikhta hai aur price ko uper ki simat mein reverse karne ka ishara deta hai. Importance of Piercing line Candlistic Pattern Piercing Line pattern mein do mustaqil tor par candlesticks hote hain. Pehla candlestick bearish nichay ke trend mein hota hai aur doosra candlestick uske upar open hota hai. Doosre candlestick ka open pehle candlestick ke neeche band karta hai lekin uske upar close hota hai.Piercing Line pattern ki pehli candlestick bearish nichay ke traf trend ki neshandahi karta hai. Isme sellers galib karte hain aur price nichay jaata hai. Doosri candlestick, jo ki bullish upar ke traf trend ki ishara hain first candlestick ke neeche open hota hai lekin uske upar close hota hai. Iska matlab hai ki buyers ne control le liya hai aur price upar ke simat mein harkat kar raha hai.Yeah pattern confirmation ke liye aur strong banane ke liye kuch mazeed halat say bhi hoti hain. Mesal kay tor pr doosri candlestick ka size pehli candlestick ke size se bada hona chahiye. Isse pattern ki Paicheda aur mazboti badhti hai.Piercing Line pattern ka istemal karke traders ko potential trend reversal points aur buying kay mawaqay mil sakti hain. Is pattern ko confirm karne ke liye traders ko aur bhi techniqi ishary aur price action analysis ka istemal karna chahiye.Forex trading mein candlestick patterns keemat ke harkat aur trend analysis ka important pehlo hote hain. Traders ko in patterns aur ishary ko samajhna aur tajziya karna zaruri hota hai taki wo malomat Kay zariye tejarti zariyee say ley sake. -

#10 Collapse

What is Piercing line Candlestick Pattern? Piercing Line" ek candlestick pattern hai jo technical analysis mein istemal kiya jata hai. Ye pattern bullish trend ki indication deta hai, jahan market ke downward movement ke baad ek reversal signal hota hai. Piercing Line pattern mein do consecutive candles hote hain, ek bearish candle aur dusri bullish candle. How to confirm piercing line pattern? Piercing Line pattern ko recognize karne ke liye, hume kuch conditions ko check karna hota hai. Pehle candle bearish (downward) trend ke saath chalti hai, jabki dusri candle uske neeche open ho kar upar ki taraf move karti hai aur pehli candle ki kuch had tak cover karti hai. Iska matlab hota hai ki bullish momentum bearish trend ko overcome kar raha hai aur price ka reversal ho sakta hai.Ye pattern market psychology ko reflect karta hai. Jab bearish trend chal raha hota hai, log selling pressure create karte hain aur price neeche jaane ki ummeed rakhte hain. Lekin piercing line pattern ke appearance se, buyers market mein enter hote hain aur price ko upar le jaate hain, jisse trend change ho sakta hai. Explanation Piercing Line pattern ko samajhne ke liye, iski structure aur formation ko detail se analyze karna zaroori hai. Pehle bearish candle ki body green (bullish) candle se badi honi chahiye, indicating strong selling pressure. Dusri candle ki opening price pehli candle ki body ke neeche honi chahiye. Agar ye condition satisfy hoti hai, toh ye ek potential piercing line pattern ho sakta hai.Is pattern ke interpretation aur validity ko samajhna bhi zaroori hai. Jab piercing line pattern ban jata hai, traders ko price ka reversal expect karna chahiye. Lekin ye ek confirmation signal nahi hota, isliye dusre technical indicators aur price action patterns ke saath isko confirm karna zaroori hota hai. Traders ko volume, support and resistance levels, aur trend lines ka bhi analysis karna chahiye, taki ek sahi entry ya exit point decide kar sake.Piercing Line pattern ka use trading strategies mein kiya ja sakta hai. Agar ye pattern downtrend ke baad appear karta hai, toh traders long (buy) positions le sakte hain. Stop loss order neeche set kiya jata hai, taki agar price phir se neeche jaata hai toh trader ko loss na ho. Profit target ko resistance levels ke paas set kiya ja sakta hai, jahan price ka bounce back hone ka possibility hota hai.Piercing Line pattern ka ek variation bhi hai, jise Bullish Piercing pattern kehte hain. Is pattern mein pehli bearish candle ke neeche ki jagah, doosri bullish candle pehli candle ki middle mein open hoti hai. Yeh bhi bullish trend ka indication deta hai, lekin piercing line pattern se thoda alag hota hai. Conclusion: Piercing line candlestick pattern bearish trend ke reversal ka potential signal hai. Ye pattern traders ko bullish momentum aur price ka reversal anticipate karne mein help karta hai. Lekin isko confirm karne ke liye dusre technical analysis tools ka bhi istemal zaroori hota hai. Isliye, piercing line pattern ko samajhna aur sahi tarah se interpret karna traders ke liye important hai. Thanks -

#11 Collapse

Piercing Line Pattern bearish trend ya prices k bohut low area main bannte hen, jahan se ye bullish trend reversal ka sabbab bannte hen. Piercing Line Pattern aur "Meeting Line Pattern" candles ki formation main aik jaise hotte hen, lekin is pattern main dosree candle pehlee candle k real body se main 50% area se upper par ja k clise hotti hai, jab k meeting line main pehlee aur dosree candle ki closing point same hotta hai. Pattern ki pehlee candle bearish trend k mutabiq black hotti hai, jab k dosree din ki candle reversal pattern k mutabiq bullish hotti hai.Piercing line candlestick pattern bearish trend ke reversal ka potential signal hai. Ye pattern traders ko bullish momentum aur price ka reversal anticipate karne mein help karta hai. Lekin isko confirm karne ke liye dusre technical analysis tools ka bhi istemal zaroori hota hai. Isliye, piercing line pattern ko samajhna aur sahi tarah se interpret karna traders ke liye important hai. candlestick pattern k leye zarori hai, k prices chart par bearish ya lower area main trade kar rahi ho. Ye pattern prices k bottom main bearish trend ka khatema karke bullish trend reversal ka sabab banti hai. Pattern do candles par mushtamil hota hai, jiss ki pehli candle aik real body wali bearish candle hoti hai, niss main candle ka close price open price se kam hota hai. Pattern ki dosri candle aik bullish candle hoti hai, jo pehli candle se lower gap main open ho kar ussi k darmeyan se thora sa above close hoti hai. Dosri candle ka close price open price se high hota hai, -

#12 Collapse

INTRODUCTION OF PIERCING LINE PATTERN: Dear fellow traders Forex market mein jab hum trading ko perform Karte Hain To Hamen apni trading ko Kamyab banane ke liye bahut sari cheazon ko dekhna padta hay. bahut Sare pattern ko follow karte hue candlestick ki movement ko judge karna padta hay, Jab Bhi aap Kisi country ki market open Karte Hain yah Kisi product per trading karna chahte hain to aapko market ke bare mein technical analysis kerny ky leye different type ke candlestick patterns ko follow karna padta hay.ess pattern ko market mein continuously observe kerty rehna chahiay specially jab market continuously downward trend main movement ker rehi ho tou aesy time per Jesy hi market support per ponch chuki ho aur aesa pattern creat hony per hamain buy ki trade open ker leni chahiay isi terha trade ker ky ham bahot achi earning ker sakty hain.yeh pattren Hamein market ke bare mein support deta hai just hum Piercing Pattren bolty han ye pattern Hamesha support level per Banega Jab market mein ek strong down Trend ke bad market up jati hai aur Buy ka trend create hota hai aur ismein aap market ko analysis ker lene ke baad buy Mein Apni trade ko perform kar sakte hain.jis sy profit earning easy ho jati hy. DESCRIPTION OF PIERCING LINE PATTERN: G Friends Trading market mein jab hum ess pattern ko explain kerty hein tu hamein pata chalta hy yeh pattern Hamesha bearish trend per banta hai aur aur jab aap is ko observe karna chahte hain to aapko yah Pata Hona chahie ki Hamesha yah pattern support level per Banega..ess pattern ki ki pehli candle market k current trend ky according aik bearish trend hoti hai, jiss ka close price open price k se nechay hota hai. Bearish candle shadow samet ya uss k bagher ho sakti hai, jo k real body main hoti hai.jab ky dosri candle aik bullish candle hoti hai. Ye candle pehli candle k bottom par gap main open ho kar ussi k real body k centre se above par close hoti hai. second candle lazmi real body mein honi chaheye aur first candle k open point se pehle close honi chaheye.ees tarah yeh pattern complete ho jata hy aur trading ky leye yeh ideal time hota hy.jis sy immediately faida uthana chehye. TRADING PARANETERS: Dear community traders,Forex market mein trade lagany sy pehly kisi bi pattern ka technical analysis aur oss ki history of effectivity ko lazmi calculate ker lena chehye.Jab market Mein Ek strong downtrend ke baad aik buy wali candle create hoti hai jo last bearish candle ka according uska 50 percent sa big aur us kay hundred percent Chhoti hoti hai to ismein aapko Idea laga lena chahie ki yah pattern ban raha hai.Priecing line pattern ky liay market ko continuously observe kerty rehna chahiay specially jab market continuously downward trend main movement ker rehi ho tou aesy time per Jesy hi market support per ponch chuki ho aur aesa pattern creat hony per hamain buy ki trade open ker leni chahiay.ess ky alava market ke trend ko dekhna padta hai aur phir different type ke indicators ko follow karte hue Ham apni trading ko successful banate hain. isi terha trade ker ky ham bahot achi earning ker sakty hain.dear yaad rakhn ky ess pattern mein always Priecing line pattern ky liay market ko continuously observe kerty rehna chahiay specially jab market continuously downward trend main movement ker rehi ho tou aesy time per Jesy hi market support per ponch chuki ho aur aesa pattern create hony per hamain buy ki trade open ker leni chahiay. ess terha trade ker ky ham bahot achi earning ker sakty hain. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#13 Collapse

light plan hai, jo costs k downtrend k baad bantta hai. Plan ki pehlee light aik negative example k tasalsul ko zahir karne wali fire hotti hai. Jo k aik long real body head banti hai. Dosrre number standard banne wali fire bhi aik certifiable body serious solid areas for wali hotti hai, lekin ye flame aik bullish light hotti hai. Penetrating line plan dekhne essential "Meeting Line Model" jaisa hibdekhaye detta hai, lekin bullish fire k negative candle k midpoint se upper close honne standard us se mukhtalif ho jatta hai. Candles Game plan Penetrating line plan bearishbtrend k baad bantta hai, is wajja se plan ki pehlee fire design k muttabiq negative light honi chaheye jiss k baad aik long real body wali bullish flame bantti hai, jiss ki tafseel darjazzel hai; 1. First Light: Entering Line Model ki pehlee flame solid areas for aik candle hotti hai, jo k pehle se harkat essential a rahe negative example ko zahir kartti hai. Ye fire customary certifiable body essential hotti hai, jisbk wick body k muqabele head kam hotta hai.2. Second Light: Penetrating Line Model ki dosree fire significant solid areas for aik body wali bullish candle bantti hai, jo open to pehlee flame k closing point se nechay opening head hai, lekin close pehlee candle k authentic body k half district se upper pe hotti hai. Explaination Penetrating Line Model negative example ya costs k bohut low district central bannte hen, jahan se ye bullish example reversal ka sabbab bannte hen. Infiltrating Line Model aur "Meeting Line Model" candles ki improvement essential aik jaise hotte hen, lekin is plan essential dosree candle pehlee flame k certified body se head half district se upper standard ja k clise hotti hai, hit k social event line essential pehlee aur dosree light ki closing point same hotta hai. Plan ki pehlee fire negative example k mutabiq dull hotti hai, hit k dosree commotion ki light reversal plan k mutabiq bullish hotti hai. Trading Entering Line Model k leye downtrend ka hona zarori hai, q k light plan top ya downtrend essential behtar result dete hen. Plan ki dosri fire k leye zarori hai k wo pehlee flame k mid point essential lazmi close bhi ho aur ye point half se upper ka district honna chaheye. Penetrating Line Model pe trading se pehle costs ka downtrend k elawa design insistence bhi hona zarrori hai, is waja se plan k baad teesrri fire ka bullish banna bohut aham hai, aur candle ki real body bhi honi chaheye. Aggar assertion candle pehlee candle se upper side pe close ho jatti hai, to ye aik strong buy ka signal hogga. plan k sab se lower district ya dosri bullish flame k open expense se aik ya do pips weakness pe set karen.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 04:45 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим