Bearish Mat-Hold Candles..!!!

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

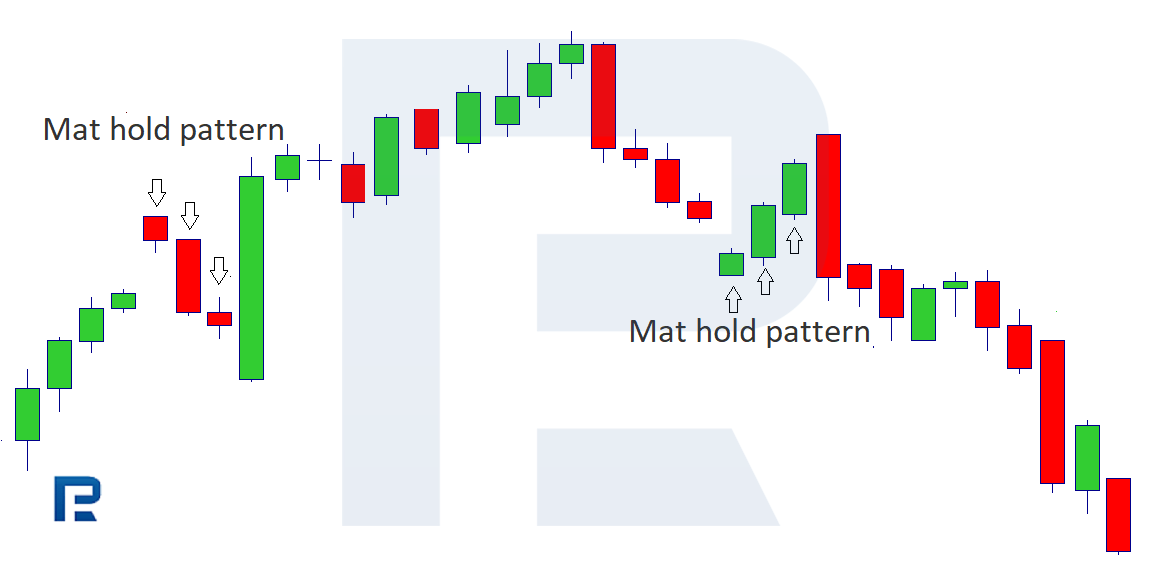

Small dosri bullpattern dekhne main "Rising Three Methods Pattern" aur Three line strike pattern se melta julta pattern hai, jo bearish trend main banta hai, jo trend continuation k leye jana jata hai. Ye pattern panch candles par mushtamil hota hai, jiss main pehli candle aik long real body wali bearish candle hota hai, jiss k baad small real body main teen bullish candles hote hen.ish candles pehli candle ki real body main open ho kar uss k real body main close hoti hai. Jab k teesri aur chothi small candles open aur close pehli candle ki real body main hoti haicandle aik long real body main hoti hai. Pattern ki agli teen candles small real body main bullish hoti hai, jiss main pattern ki dosri pehli bearish candle k lower side par gap main open hoti hai, lekin close ussi k real body main hoti hai. Pattern ki teesri aur chothi candles pehli candle k real body main aur close dono hote hen. Pattern ki small real body wali candles se prices bearish side par mazeed nechay jane se thore se rok jati hai. Jab k last candle wapis bearish trend karwati q k ye aik long real body wali bearish candle hoti hai.Identification of Bearish Mat-Hold CandlestickHamy he to pata hai kay candlestick market data ko display karny ka bhot easy or effective way hai. Ye hamy market kay bary ma bhot zayada information deti hain or ye bi batati hain kay market kis side par move karny wali hai. En pattern ki base par he ham market ko predict karty hain or apni trades ki management karty hain. En pattern ki waja sy hamy es bat kaforex trading ka busniess ek kamyab busniess hain forex trading main best learning karna must hota hain agar hard work k sath kaam hota hain tu best learning k sath kaamkarna must hain Bearish Mat-Hold Candlestick Pattern main learning ko strong kare Bearish Mat-Hold Candlestick Pattern main learning ko incress kare jaaab tak Bearish Mat-Hold Candlestick Pattern main learning strong nhe hain tu loss mil skta hain Bearish Mat-Hold Candlestick Pattern main learning kare regular pratice kare Bearish Mat-Hold Candlestick Pattern main learning ko incress karna must hota hain Bearish Mat-Hold Candlestick Pattern ek benefit dene wale busniess hain hard work kare pratice kare Bearish Mat-Hold Candlestick Pattern main demo account main learning ko incress kare hard work karne wale traders forex trading main kamyabi hasil kar skte hain jisne learning nhe ki vo kabi b benefit hasil nhe ka answer bi mel jata hai kay market es side par kiu move kar rahi hai. But patterns ko use kar kay bi kahe bar hamy market ko predict karna mushkil ho jata hai kiu kay market ki movement bhot sary other factors par bi depend karti hai. En factors ma news, disease or war wagera shamil hain. So hamy en pattern kay es weak point ka khawal rakhna hota hai or es weakness ko khatam karny kay laye hamy filters or technical tools ka sahara lena hota hai. Jo hamari trader ko perfect banany ma hamari help karty hain. Ham agr serf patterns par iktafa karyn gy to ye bhot khatarnak ho sakta hai.

-

#3 Collapse

Little dosri bullpattern dekhne principal "Rising Three Techniques Example" aur Three line strike design se melta julta design hai, jo negative pattern fundamental banta hai, jo pattern continuation k leye jana jata hai. Ye design panch candles standard mushtamil hota hai, jiss fundamental pehli light aik long genuine body wali negative flame hota hai, jiss k baad little genuine body principal adolescent bullish candles hote hen.ish candles pehli candle ki genuine body primary open ho kar uss k genuine body fundamental close hoti hai. Punch k teesri aur chothi little candles open aur close pehli flame ki genuine body fundamental hoti haicandle aik long genuine body primary hoti hai. Design ki agli adolescent candles little genuine body fundamental bullish hoti hai, jiss primary example ki dosri pehli negative candle k lower side standard hole principal open hoti hai, lekin close ussi k genuine body principal hoti hai. Design ki teesri aur chothi candles pehli candle k genuine body principal aur close dono hote hen. Design ki little genuine body wali candles se costs negative side standard mazeed nechay jane se thore se rok jati hai. Poke k last flame wapis negative pattern karwati q k ye aik long genuine body wali negative candle hoti hai. Distinguishing proof of Negative Mat-Hold Candle Hamy he to pata hai kay candle market information ko show karny ka bhot simple or successful way hai. Ye hamy market kay bary mama bhot zayada data deti hain or ye bi batati hain kay market kis side standard move karny wali hai. En design ki base standard he ham market ko foresee karty hain or apni exchanges ki the executives karty hain. En design ki waja sy hamy es bat kaforex exchanging ka busniess ek kamyab busniess hain forex exchanging primary best learning karna must hota hain agar difficult work k sath kaam hota hain tu best learning k sath kaamkarna must hain Negative Mat-Hold Candle Example fundamental learning serious areas of strength for ko Negative Mat-Hold Candle Example principal learning ko incress kare jaaab tak Negative Mat-Hold Candle Example primary learning solid nhe hain tu misfortune mil skta hain Negative Mat-Hold Candle Example primary learning kare ordinary pratice kare Negative Mat-Hold Candle Example fundamental learning ko incress karna must hota hain Negative Mat-Hold Candle Example ek benefit dene rib busniess hain difficult work kare pratice kare Negative Mat-Hold Candle Example primary demo account primary learning ko incress kare difficult work karne grain merchants forex exchanging primary kamyabi hasil kar skte hain jisne learning nhe ki vo kabi b benefit hasil nhe ka answer bi mel jata hai kay market es side standard kiu move kar rahi hai. In any case, designs ko use kar kay bi kahe bar hamy market ko foresee karna mushkil ho jata hai kiu kay market ki development bhot sary different elements standard bi depend karti hai. En factors mama news, infection or war wagera shamil hain. So hamy en design kay es flimsy spot ka khawal rakhna hota hai or es shortcoming ko khatam karny kay laye hamy channels or specialized instruments ka sahara lena hota hai. Jo hamari dealer ko wonderful banany mama hamari help karty hain. Ham agr serf designs standard iktafa karyn gy to ye bhot khatarnak ho sakta hai. -

#4 Collapse

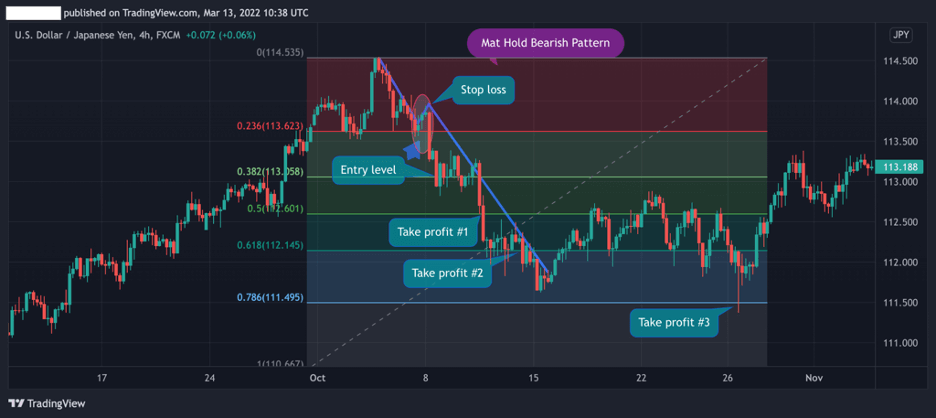

[CENTER] Assalamu Alaikum Dosto![CENTER]Bearish Mat-Hold PatternBearish mat-hold price chart par prices k downtrend main continuation k kaam karta hai, jo k low prices ya bearish trend k baad banta hai. Bearish mat-hold panch candles par mushtamil aik Bearish trend continuation pattern hai, jiss main shamil pehli candle aik strong bearish candle hoti hai, jo aik long real body main banti hai. Pehli candle k baad teen small real body wali bullish candles hoti hai, jiss ka open aur close dono pehli candle k andar hoti hai. Ye teeno candles pehli candle k open aur close price se bahir nahi nekate hen. Teeno bullish candles prices ko waqti tawar par mazeed bearish jane main rukawat dalti hai. Pattern k last par aik aur long real body wali candle hoti hai, jo k prices ko sabeqa trend main continue karwati hai.Candles FormationBearish mat-hold pattern trend Bearish continuation pattern ki waja se prices k downtrend ya newly Bearish breakout trend main banta hai. Ye pattern panch candles par mushtamil hota hai, jiss main candles ki formation darjazzel tarah se hote hen; 1. First Candle: Bearish mat-hold pattern ki pehli candle aik Bearish candle hoti hai. Ye candle aik long real body main banti hai, jiss k upper aur lower side k wicks ya shadow real body se kam hone chaheye. Ye candle Bearish trend ki alamat hoti hai, jo k black ya red color main banti hai. 2. Second Candle: Bearish mat-hold pattern ki dosri candle aik bullish candle hoti hai, jiss ki real body bohut small hoti hai. Ye candle pehli candle k real body main bottom par banti hai, yanni candle ka open aur close pehli candle k andar hota hai. 3. Third Candle: Bearish mat-hold pattern ki teesri candle bhi aik real body wali bullish candle hoti hai, aur same dosri candle ki tarah small bhi hoti hai, jiss ka open aur close pehli candle k andar hota hai. Ye candle dosri candle k above aur pehli candle k real body main banti hai. 4. Fourth Candle: Bearish mat-hold pattern ki forth candle bhi dosri aur teesri candle ki tarah bullish bhi hoti hai aur small real body main hoti hai. Ye candle teesri candle k baad upper banti hai lekin ye candle bhi same dosri aur teesri bullish candles ki tarah pehli candle k andar hota hai. 5. Fifth Candle: Bearish mat-hold pattern ki last candle Bearish hoti hai, jo k pehli candle ki taqreeban parallel main banti hai, lekin open forth candle k baad hoti hai, jab lower side par ja kar close hoti hai. Ye candle black ya red color main hoti hai, jo k Bearish trend continuation ka kaam karti hai.Explanation Bearish mat-hold pattern main dekhne main same "Falling Three Methods" ya bullish trend par banne wala "Bearish Three Line Strike Pattern" se melta julta pattern hai, jo k downtrend k leye istemal hota hai. Ye pattern panch candles par mushtamil hota hai, jiss ki pehli candle aik strong bearish candle hoti hai, jo k downtrend ki alamat hoti hai. Pehli candle k baad teen small real body wali bearish candles hoti hai, jo k open aur close pehli candle k andar hoti hai. Ye small candles prices ko temporary tawar par bearish jane se rokti hai, jiss se prices k dowran waqti tawar par pause a jata hai. Lekin baad main aik bari real body wali bearish candle banti hai jo k prices ko downtrend main continue karwati hai. TradingBearish mat-hold pattern main small candles downward trend main aik pause create karti hai, jiss k baad prices wapis apni sabeqa trend par chal parti hai. Ye pattern panch candles ka aik majmoa hai, jiss main pehli candle aik Bearish candle hoti hai, jab k baad wali teen candles small real body wali bullish candles hoti hai, bullish candles dar asal market main analyst ki prices k bare main agli faisala ka time hota hai, k aya prices ne downward jani hai, k nahi, lekin last par aik long bearish candle k banne se ye wapis pane porane trade par chal parta hai. Pattern par trades open karne se pehle aik agli bearish candle ka intezar zaror karen jo k buy k entry k leye hona chaheye. Stop Loss pattern k upper side ya pehli bearish candle k open price se two pips above set karen. -

#5 Collapse

BEARISH MAT HOLD CANDLES DEFINITION bearish mat hold Ek candle stick ki tashkel hoti hai bearish version same hota hai jo prior move ke tasalsul ki maloomat Karti Hai Ek Bullish ka pattern Ek large Upar ki candle se start Hota Hai Jiske bad Ek Fasla Uncha Hota Hai aur three Samall candles Jo niche Chalti Hain pattern overal tar per Upar ke Trends Mein Hota Hai traders five candles[ large Upar Wali candle] ke near buy ka choose kar sakte hain Ek Stop loss aamtaur per five candles Ke Niche Rakha jata hai candle stick market ki price ka analyze karne ke Kuchh popular tarike Hote Hain Jo market ke Hamare analysis main Hamari help kar sakti hain zyadatar market ke share ka point negative hai new trading strategies ke liye Idea Hasil karne ke liye ham kud market data ka thora sa expose Karte Hai BEARISH MAT HOLD VS FALLING THREE METHODS Aap mein se jin Logon Ne falling three methods Ke pattern ke bare mein suna hai vah Ab Bhi little confused Ka Shikar ho sakte hain Jab donon pattern bahut Milte julate Hain To usmein Ek important Fark Hota Hai Jab Pehli Baar candle range se bahar Nikalti Hai to bearish mat hold per apply Nahin Hoti hai iska Ehsas hone per market ke shares Aane Wale pullll back ki participant mein sell order Jari karna close kar dete Hain ab market Mein three positive candles Paida Karne mein Kamyab ho gaye hain Ke Market niche ki taraf ja rahi hai Agar signals weak hote hain to aap best trade nahi kar sakte isliye pahle signal ko dekhna chahie Uske bad apni trade ko open karna chahie bulls and bears market Mein control Hote Hain

BEARISH MAT HOLD VS FALLING THREE METHODS Aap mein se jin Logon Ne falling three methods Ke pattern ke bare mein suna hai vah Ab Bhi little confused Ka Shikar ho sakte hain Jab donon pattern bahut Milte julate Hain To usmein Ek important Fark Hota Hai Jab Pehli Baar candle range se bahar Nikalti Hai to bearish mat hold per apply Nahin Hoti hai iska Ehsas hone per market ke shares Aane Wale pullll back ki participant mein sell order Jari karna close kar dete Hain ab market Mein three positive candles Paida Karne mein Kamyab ho gaye hain Ke Market niche ki taraf ja rahi hai Agar signals weak hote hain to aap best trade nahi kar sakte isliye pahle signal ko dekhna chahie Uske bad apni trade ko open karna chahie bulls and bears market Mein control Hote Hain  MAT HOLD OF UNDERSTAND mat hold trading ke liye ek best tool Hota Hai isliye investor investment karne ke bad indicators ko dekhte hain jyadatar pattern izaafi filters aur Sharat ke bagair Itna good work nahi karte hain pahle aapko time frame per focus karne ki zarurat hoti hai Pahli candle red colours ki hoti hai aur iska bodies long Hota Hai

MAT HOLD OF UNDERSTAND mat hold trading ke liye ek best tool Hota Hai isliye investor investment karne ke bad indicators ko dekhte hain jyadatar pattern izaafi filters aur Sharat ke bagair Itna good work nahi karte hain pahle aapko time frame per focus karne ki zarurat hoti hai Pahli candle red colours ki hoti hai aur iska bodies long Hota Hai

-

#6 Collapse

Identification of Bearish Mat-Hold Candlestick Hamy he to pata hai kay candlestick market data ko display karny ka bhot easy or effective way hai. Ye hamy market kay bary ma bhot zayada information deti hain or ye bi batati hain kay market kis side par move karny wali hai. En pattern ki base par he ham market ko predict karty hain or apni trades ki management karty hain. En pattern ki waja sy hamy es bat kaforex trading ka busniess ek kamyab busniess hain forex trading main best learning karna must hota hain agar hard work k sath kaam hota hain tu best learning k sath kaamkarna must hain Bearish Mat-Hold Candlestick Pattern main learning ko strong kare Bearish Mat-Hold Candlestick Pattern main learning ko incress kare jaaab tak Bearish Mat-Hold Candlestick Pattern main learning strong nhe hain tu loss mil skta hain Bearish Mat-Hold Candlestick Pattern main learning kare regular pratice kare Bearish Mat-Hold Candlestick Pattern main learning ko incress karna must hota hain Bearish Mat-Hold Candlestick Pattern ek benefit dene wale busniess hain hard work kare pratice kare Bearish Mat-Hold Candlestick Pattern main demo account main learning ko incress kare hard work karne wale traders forex trading main kamyabi hasil kar skte hain jisne learning nhe ki vo kabi b benefit hasil nhe ka answer bi mel jata hai kay market es side par kiu move kar rahi hai. But patterns ko use kar kay bi kahe bar hamy market ko predict karna mushkil ho jata hai kiu kay market ki movement bhot sary other factors par bi depend karti hai. En factors ma news, disease or war wagera shamil hain. So hamy en pattern kay es weak point ka khawal rakhna hota hai or es weakness ko khatam karny kay laye hamy filters or technical tools ka sahara lena hota hai. Jo hamari trader ko perfect banany ma hamari help karty hain. Ham agr serf patterns par iktafa karyn gy to ye bhot khatarnak ho sakta hai. Distinguishing proof of Negative Mat-Hold Candle Hamy he to pata hai kay candle market information ko show karny ka bhot simple or successful way hai. Ye hamy market kay bary mama bhot zayada data deti hain or ye bi batati hain kay market kis side standard move karny wali hai. En design ki base standard he ham market ko foresee karty hain or apni exchanges ki the executives karty hain. En design ki waja sy hamy es bat kaforex exchanging ka busniess ek kamyab busniess hain forex exchanging primary best learning karna must hota hain agar difficult work k sath kaam hota hain tu best learning k sath kaamkarna must hain Negative Mat-Hold Candle Example fundamental learning serious areas of strength for ko Negative Mat-Hold Candle Example principal learning ko incress kare jaaab tak Negative Mat-Hold Candle Example primary learning solid nhe hain tu misfortune mil skta hain Negative Mat-Hold Candle Example primary learning kare ordinary pratice kare Negative Mat-Hold Candle Example fundamental learning ko incress karna must hota hain Negative Mat-Hold Candle Example ek benefit dene rib busniess hain difficult work kare pratice kare Negative Mat-Hold Candle Example primary demo account primary learning ko incress kare difficult work karne grain merchants forex exchanging primary kamyabi hasil kar skte hain jisne learning nhe ki vo kabi b benefit hasil nhe ka answer bi mel jata hai kay market es side standard kiu move kar rahi hai. In any case, designs ko use kar kay bi kahe bar hamy market ko foresee karna mushkil ho jata hai kiu kay market ki development bhot sary different elements standard bi depend karti hai. En factors mama news, infection or war wagera shamil hain. So hamy en design kay es flimsy spot ka khawal rakhna hota hai or es shortcoming ko khatam karny kay laye hamy channels or specialized instruments ka sahara lena hota hai. Jo hamari dealer ko wonderful banany mama hamari help karty hain. Ham agr serf designs standard iktafa karyn gy to ye bhot khatarnak ho sakta hai. Explanation Bearish mat-hold pattern main dekhne main same "Falling Three Methods" ya bullish trend par banne wala "Bearish Three Line Strike Pattern" se melta julta pattern hai, jo k downtrend k leye istemal hota hai. Ye pattern panch candles par mushtamil hota hai, jiss ki pehli candle aik strong bearish candle hoti hai, jo k downtrend ki alamat hoti hai. Pehli candle k baad teen small real body wali bearish candles hoti hai, jo k open aur close pehli candle k andar hoti hai. Ye small candles prices ko temporary tawar par bearish jane se rokti hai, jiss se prices k dowran waqti tawar par pause a jata hai. Lekin baad main aik bari real body wali bearish candle banti hai jo k prices ko downtrend main continue karwati hai. -

#7 Collapse

Bearish Mat_Hold pattern kia hy prices k downtrend main continuation k kaam karta hai, jo k low prices ya bearish trend k baad banta hai. Bearish mat-hold panch candles par mushtamil aik Bearish trend continuation pattern hai, jiss main shamil pehli candle aik strong bearish candle hoti hai, jo aik long real body main banti hai. Pehli candle k baad teen small real body wali bullish candles hoti hai, jiss ka open aur close dono pehli candle k andar hoti hai. Ye teeno candles pehli candle k open aur close price se bahir nahi nekate hen. Teeno bullish candles prices ko waqti tawar par mazeed bearish jane main rukawat dalti hai. Bearish Mat_Hold pattern ki Phachan aur Working principle kia hy Bearish mat-hold pattern ki pehli candle aik Bearish candle hoti hai. Ye candle aik long real body main banti hai, jiss k upper aur lower side k wicks ya shadow real body se kam hone chaheye. Ye candle Bearish trend ki alamat hoti hai, jo k black ya red color main banti hai. Bearish mat-hold pattern ki dosri candle aik bullish candle hoti hai, jiss ki real body bohut small hoti hai. Ye candle pehli candle k real body main bottom par banti hai, yanni candle ka open aur close pehli candle k andar hota hai. Bearish mat-hold pattern ki teesri candle bhi aik real body wali bullish candle hoti hai, aur same dosri candle ki tarah small bhi hoti hai, jiss ka open aur close pehli candle k andar hota hai. Ye candle dosri candle k above aur pehli candle k real body main banti hai. Bearish mat-hold pattern ki forth candle bhi dosri aur teesri candle ki tarah bullish bhi hoti hai aur small real body main hoti hai. Ye candle teesri candle k baad upper banti hai lekin ye candle bhi same dosri aur teesri bullish candles ki tarah pehli candle k andar hota hai. Bearish mat-hold pattern ki last candle Bearish hoti hai, jo k pehli candle ki taqreeban parallel main banti hai, lekin open forth candle k baad hoti hai, jab lower side par ja kar close hoti hai. Ye candle black ya red color main hoti hai,ya bullish trend par banne wala "Bearish Three Line Strike Pattern" se melta julta pattern hai, jo k downtrend k leye istemal hota hai. Ye pattern panch candles par mushtamil hota hai, jiss ki pehli candle aik strong bearish candle hoti hai, jo k downtrend ki alamat hoti hai. Pehli candle k baad teen small real body wali bearish candles hoti hai, jo k open aur close pehli candle k andar hoti hai

Bearish Mat_Hold pattern ki Phachan aur Working principle kia hy Bearish mat-hold pattern ki pehli candle aik Bearish candle hoti hai. Ye candle aik long real body main banti hai, jiss k upper aur lower side k wicks ya shadow real body se kam hone chaheye. Ye candle Bearish trend ki alamat hoti hai, jo k black ya red color main banti hai. Bearish mat-hold pattern ki dosri candle aik bullish candle hoti hai, jiss ki real body bohut small hoti hai. Ye candle pehli candle k real body main bottom par banti hai, yanni candle ka open aur close pehli candle k andar hota hai. Bearish mat-hold pattern ki teesri candle bhi aik real body wali bullish candle hoti hai, aur same dosri candle ki tarah small bhi hoti hai, jiss ka open aur close pehli candle k andar hota hai. Ye candle dosri candle k above aur pehli candle k real body main banti hai. Bearish mat-hold pattern ki forth candle bhi dosri aur teesri candle ki tarah bullish bhi hoti hai aur small real body main hoti hai. Ye candle teesri candle k baad upper banti hai lekin ye candle bhi same dosri aur teesri bullish candles ki tarah pehli candle k andar hota hai. Bearish mat-hold pattern ki last candle Bearish hoti hai, jo k pehli candle ki taqreeban parallel main banti hai, lekin open forth candle k baad hoti hai, jab lower side par ja kar close hoti hai. Ye candle black ya red color main hoti hai,ya bullish trend par banne wala "Bearish Three Line Strike Pattern" se melta julta pattern hai, jo k downtrend k leye istemal hota hai. Ye pattern panch candles par mushtamil hota hai, jiss ki pehli candle aik strong bearish candle hoti hai, jo k downtrend ki alamat hoti hai. Pehli candle k baad teen small real body wali bearish candles hoti hai, jo k open aur close pehli candle k andar hoti hai  Treading Pattern aur Tools mat-hold pattern main small candles downward trend main aik pause create karti hai, jiss k baad prices wapis apni sabeqa trend par chal parti hai. Ye pattern panch candles ka aik majmoa hai, jiss main pehli candle aik Bearish candle hoti hai, jab k baad wali teen candles small real body wali bullish candles hoti hai, bullish candles dar asal market main analyst ki prices k bare main agli faisala ka time hota hai, k aya prices ne downward jani hai, k nahi, lekin last par aik long bearish candle k banne se ye wapis pane porane trade par chal parta hai. Pattern par trades open karne se pehle aik agli bearish candle ka intezar zaror karen jo k buy k entry k leye hona chaheye.

Treading Pattern aur Tools mat-hold pattern main small candles downward trend main aik pause create karti hai, jiss k baad prices wapis apni sabeqa trend par chal parti hai. Ye pattern panch candles ka aik majmoa hai, jiss main pehli candle aik Bearish candle hoti hai, jab k baad wali teen candles small real body wali bullish candles hoti hai, bullish candles dar asal market main analyst ki prices k bare main agli faisala ka time hota hai, k aya prices ne downward jani hai, k nahi, lekin last par aik long bearish candle k banne se ye wapis pane porane trade par chal parta hai. Pattern par trades open karne se pehle aik agli bearish candle ka intezar zaror karen jo k buy k entry k leye hona chaheye.

- Mentions 0

-

سا0 like

-

#8 Collapse

Recognizable proof of Negative Mat-Hold Candle Hamy he to pata hai kay candle market information ko show karny ka bhot simple or powerful way hai. Ye hamy market kay bary mama bhot zayada data deti hain or ye bi batati hain kay market kis side standard move karny wali hai. En design ki base standard he ham market ko anticipate karty hain or apni exchanges ki the executives karty hain. En design ki waja sy hamy es bat kaforex exchanging ka busniess ek kamyab busniess hain forex exchanging primary best learning karna must hota hain agar difficult work k sath kaam hota hain tu best learning k sath kaamkarna must hain Negative Mat-Hold Candle Example principal learning serious areas of strength for ko Negative Mat-Hold Candle Example fundamental learning ko incress kare jaaab tak Negative Mat-Hold Candle Example primary learning solid nhe hain tu misfortune mil skta hain Negative Mat-Hold Candle Example primary learning kare standard pratice kare Negative Mat-Hold Candle Example principal learning ko incress karna must hota hain Negative Mat-Hold Candle Example ek benefit dene ridge busniess hain difficult work kare pratice kare Negative Mat-Hold Candle Example principal demo account fundamental learning ko incress kare difficult work karne rib dealers forex exchanging fundamental kamyabi hasil kar skte hain jisne learning nhe ki vo kabi b benefit hasil nhe ka answer bi mel jata hai kay market es side standard kiu move kar rahi hai. Be that as it may, designs ko use kar kay bi kahe bar hamy market ko foresee karna mushkil ho jata hai kiu kay market ki development bhot sary different variables standard bi depend karti hai. En factors mama news, infection or war wagera shamil hain. So hamy en design kay es flimsy spot ka khawal rakhna hota hai or es shortcoming ko khatam karny kay laye hamy channels or specialized apparatuses ka sahara lena hota hai. Jo hamari merchant ko wonderful banany mama hamari help karty hain. Ham agr serf designs standard iktafa karyn gy to ye bhot khatarnak ho sakta hai. Recognizing confirmation of Negative Mat-Hold Light Hamy he to pata hai kay flame market data ko show karny ka bhot basic or effective way hai. Ye hamy market kay bary mother bhot zayada information deti hain or ye bi batati hain kay market kis side standard move karny wali hai. En plan ki base standard he ham market ko anticipate karty hain or apni trades ki the leaders karty hain. En plan ki waja sy hamy es bat kaforex trading ka busniess ek kamyab busniess hain forex trading essential best learning karna must hota hain agar troublesome work k sath kaam hota hain tu best learning k sath kaamkarna must hain Negative Mat-Hold Flame Model key learning serious solid areas for ko Negative Mat-Hold Light Model chief learning ko incress kare jaaab tak Negative Mat-Hold Candle Model essential learning strong nhe hain tu disaster mil skta hain Negative Mat-Hold Candle Model essential learning kare customary pratice kare Negative Mat-Hold Candle Model crucial learning ko incress karna must hota hain Negative Mat-Hold Candle Model ek benefit dene rib busniess hain troublesome work kare pratice kare Negative Mat-Hold Candle Model essential demo account essential learning ko incress kare troublesome work karne grain dealers forex trading essential kamyabi hasil kar skte hain jisne learning nhe ki vo kabi b benefit hasil nhe ka answer bi mel jata hai kay market es side standard kiu move kar rahi hai. Anyway, plans ko use kar kay bi kahe bar hamy market ko predict karna mushkil ho jata hai kiu kay market ki advancement bhot sary various components standard bi depend karti hai. En factors mother news, contamination or war wagera shamil hain. So hamy en plan kay es unstable spot ka khawal rakhna hota hai or es inadequacy ko khatam karny kay laye hamy channels or concentrated instruments ka sahara lena hota hai. Jo hamari vendor ko great banany mom hamari help karty hain. Ham agr serf plans standard iktafa karyn gy to ye bhot khatarnak ho sakta hai. Clarification Negative mat-hold design fundamental dekhne principal same "Falling Three Strategies" ya bullish pattern standard banne wala "Negative Three Line Strike Example" se melta julta design hai, jo k downtrend k leye istemal hota hai. Ye design panch candles standard mushtamil hota hai, jiss ki pehli light areas of strength for aik candle hoti hai, jo k downtrend ki alamat hoti hai. Pehli light k baad youngster little genuine body wali negative candles hoti hai, jo k open aur close pehli candle k andar hoti hai. Ye little candles costs ko transitory tawar standard negative jane se rokti hai, jiss se costs k dowran waqti tawar standard delay a jata hai. Lekin baad fundamental aik bari genuine body wali negative light banti hai jo k costs ko downtrend primary proceed karwati hai -

#9 Collapse

Small dosri bullpattern dekhne main "Rising Three Methods Pattern" aur Three line strike pattern se melta julta pattern hai, jo bearish trend main banta hai, jo trend continuation k leye jana jata hai. Ye pattern panch candles par mushtamil hota hai, jiss main pehli candle aik long real body wali bearish candle hota hai, jiss k baad small real body main teen bullish candles hote hen.ish candles pehli candle ki real body main open ho kar uss k real body main close hoti hai. Jab k teesri aur chothi small candles open aur close pehli candle ki real body main hoti haicandle aik long real body main hoti hai. Pattern ki agli teen candles small real body main bullish hoti hai, jiss main pattern ki dosri pehli bearish candle k lower side par gap main open hoti hai, lekin close ussi k real body main hoti hai. Pattern ki teesri aur chothi candles pehli candle k real body main aur close dono hote hen. Pattern ki small real body wali candles se prices bearish side par mazeed nechay jane se thore se rok jati hai. Jab k last candle wapis bearish trend karwati q k ye aik long real body wali bearish candle hoti hai.Identification of Bearish Mat-Hold Candlestick Hamy he to pata hai kay candlestick market data ko display karny ka bhot easy or effective way hai. Ye hamy market kay bary ma bhot zayada information deti hain or ye bi batati hain kay market kis side par move karny wali hai. En pattern ki base par he ham market ko predict karty hain or apni trades ki management karty hain. En pattern ki waja sy hamy es bat kaforex trading ka busniess ek kamyab busniess hain forex trading main best learning karna must hota hain agar hard work k sath kaam hota hain tu best learning k sath kaamkarna must hain Bearish Mat-Hold Candlestick Pattern main learning ko strong kare Bearish Mat-Hold Candlestick Pattern main learning ko incress kare jaaab tak Bearish Mat-Hold Candlestick Pattern main learning strong nhe hain tu loss mil skta hain Bearish Mat-Hold Candlestick Pattern main learning kare regular pratice kare Bearish Mat-Hold Candlestick Pattern main learning ko incress karna must hota hain Bearish Mat-Hold Candlestick Pattern ek benefit dene wale busniess hain hard work kare pratice kare Bearish Mat-Hold Candlestick Pattern main demo account main learning ko incress kare hard work karne wale traders forex trading main kamyabi hasil kar skte hain jisne learning nhe ki vo kabi b benefit hasil nhe ka answer bi mel jata hai kay market es side par kiu move kar rahi hai. But patterns ko use kar kay bi kahe bar hamy market ko predict karna mushkil ho jata hai kiu kay market ki movement bhot sary other factors par bi depend karti hai. En factors ma news, disease or war wagera shamil hain. So hamy en pattern kay es weak point ka khawal rakhna hota hai or es weakness ko khatam karny kay laye hamy filters or technical tools ka sahara lena hota hai. Jo hamari trader ko perfect banany ma hamari help karty hain. Ham agr serf patterns par iktafa karyn gy to ye bhot khatarnak ho sakta hai.

-

#10 Collapse

When a bearish mat hold pattern occurs within a downtrend, it indicates the downtrend is likely resuming and prices will continue to fall. Traders may opt to sell or short near the close of the fifth or on the following candle. A stop loss on short positions is placed above the high of the fifth candle.Small dosri bullpattern dekhne main "Rising Three Methods Pattern" aur Three line strike pattern se melta julta pattern hai, jo bearish trend main banta hai, jo trend continuation k leye jana jata hai. Ye pattern panch candles par mushtamil hota hai, jiss main pehli candle aik long real body wali bearish candle hota hai, jiss k baad small real body main teen bullish candles hote hen.ish candles pehli candle ki real body main open ho kar uss k real body main close hoti hai. Jab k teesri aur chothi small candles open aur close pehli candle ki real body main hoti haicandle aik long real body main hoti hai. Pattern ki agli teen candles small real body main bullish hoti hai, jiss main pattern ki dosri pehli bearish candle k lower side par gap main open hoti hai, lekin close ussi k real body main hoti hai. Pattern ki teesri aur chothi candles pehli candle k real body main aur close dono hote hen. Pattern ki small real body wali candles se prices bearish side par mazeed nechay jane se thore se rok jati hai. Jab k last candle wapis bearish trend karwati q k ye aik long real body wali bearish candle hoti hai. mat-hold pattern main small candles downward trend main aik pause create karti hai, jiss k baad prices wapis apni sabeqa trend par chal parti hai. Ye pattern panch candles ka aik majmoa hai, jiss main pehli candle aik Bearish candle hoti hai, jab k baad wali teen candles small real body wali bullish candles hoti hai, bullish candles dar asal market main analyst ki prices k bare main agli faisala ka time hota hai, k aya prices ne downward jani hai, k nahi, lekin last par aik long bearish candle k banne se ye wapis pane porane trade par chal parta hai. Pattern par trades open karne se pehle aik agli bearish candle ka intezar zaror karen jo k buy k entry k leye hona chaheye. -

#11 Collapse

Small dosri bullpattern dekhne main "Rising Three Methods Pattern" aur Three line strike pattern se melta julta pattern hai, jo bearish trend main banta hai, jo trend continuation k leye jana jata hai. Ye pattern panch candles par mushtamil hota hai, jiss main pehli candle aik long real body wali bearish candle hota hai, jiss k baad small real body main teen bullish candles hote hen.ish candles pehli candle ki real body main open ho kar uss k real body main close hoti hai. Jab k teesri aur chothi small candles open aur close pehli candle ki real body main hoti haicandle aik long real body main hoti hai. Pattern ki agli teen candles small real body main bullish hoti hai, jiss main pattern ki dosri pehli bearish candle k lower side par gap main open hoti hai, lekin close ussi k real body main hoti hai. Pattern ki teesri aur chothi candles pehli candle k real body main aur close dono hote hen. Pattern ki small real body wali candles se prices bearish side par mazeed nechay jane se thore se rok jati hai. Jab k last candle wapis bearish trend karwati q k ye aik long real body wali bearish candle hoti hai.Identification of Bearish Mat-Hold Candlestick Hamy he to pata hai kay candlestick market data ko display karny ka bhot easy or effective way hai. Ye hamy market kay bary ma bhot zayada information deti hain or ye bi batati hain kay market kis side par move karny wali hai. En pattern ki base par he ham market ko predict karty hain or apni trades ki management karty hain. En pattern ki waja sy hamy es bat kaforex trading ka busniess ek kamyab busniess hain forex trading main best learning karna must hota hain agar hard work k sath kaam hota hain tu best learning k sath kaamkarna must hain Bearish Mat-Hold Candlestick Pattern main learning ko strong kare Bearish Mat-Hold Candlestick Pattern main learning ko incress kare jaaab tak Bearish Mat-Hold Candlestick Pattern main learning strong nhe hain tu loss mil skta hain Bearish Mat-Hold Candlestick Pattern main learning kare regular pratice kare Bearish Mat-Hold Candlestick Pattern main learning ko incress karna must hota hain Bearish Mat-Hold Candlestick Pattern ek benefit dene wale busniess hain hard work kare pratice kare Bearish Mat-Hold Candlestick Pattern main demo account main learning ko incress kare hard work karne wale traders forex trading main kamyabi hasil kar skte hain jisne learning nhe ki vo kabi b benefit hasil nhe ka answer bi mel jata hai kay market es side par kiu move kar rahi hai. But patterns ko use kar kay bi kahe bar hamy market ko predict karna mushkil ho jata hai kiu kay market ki movement bhot sary other factors par bi depend karti hai. En factors ma news, disease or war wagera shamil hain. So hamy en pattern kay es weak point ka khawal rakhna hota hai or es weakness ko khatam karny kay laye hamy filters or technical tools ka sahara lena hota hai. Jo hamari trader ko perfect banany ma hamari help karty hain. Ham agr serf patterns par iktafa karyn gy to ye bhot khatarnak ho sakta hai.

-

#12 Collapse

Introduction Yeh pattern hamain downward trend k bary main information detta h or yeh btata h keh market fall karny k bary main information detta h or hamain btata h keh market ki situation downward trend ki trf ja rahii h or hamain is position par apni trade ko sell Karna chahye or yeh reversal pattern hotta h jo five candlesticks par consists karta h or yeh inform out karta h keh ub bearish market control leny lagii h or bullish market stop hony ko h How to identify valid bearish mat candlestick pattern Yeh candlestick pattern 5 candlestick pattern par consists out karta h jis main jis main pehli stick bearish market ko indicate kar to h or ko next three hotti hein who bullish market k bary main btati h or last main bearish stick candle ko complete karti h is k bad phr reversal trend start hotta h or ham market main entry ly k bearish market s fayda ly skty hein Parameters that make Bearish mat candlestick pattern different from other patterns Kuch aesy parameters hotty hein jo Bearish market ko dosty candlestick pattern s different bnaty hein or hamain is parameters ko achy tariky s understand Karna chahye or kuch un main s neechy dieye gye hein • Length Bearish mat candlestick pattern or dosry pattern ki length main but ziada difference hotta h jis s difference Kia ja skta h • size of candles Bearish mat candlestick pattern main first or last candles long hotti h or mids main jo banti hein who small hotti h or hamain bht ziada profit hotta h unko understand kar k Advantages of Bearish mat candlestick pattern Is pattern main mid main jo three bullish candlestick banti hein who market main temporary pause k bary main btati hein jo downward ja raha hotta h or yeh hamain ya trader ko lower risk entry point k bary main btata h or trader is ko daikh wait kar skty hein market ko fully confirm kar skty hein Disadvantages of Bearish mat candlestick pattern Is ka disadvantage yeh h keh limited profit potential k bary main btata h or dosra Or is main false breakout risk hotta h or sometimes aesa hotta h keh is pattern ko identify karny main difficulty hotti h -

#13 Collapse

ke aik munfarid shakal hai lekin tijarti mawaqay faraham karti hai. jaisa ke naam se pata chalta hai, yeh prepared line mein aik chouti banata hai jahan qeemat ibtidayi had mein wapas anay se pehlay aik ahem harkat karti hai. Spike light stuck ki tareef usay market k ke hisab se market aise greetings move Karti Hai jaise ki all over Banta Hai Uska size bolate Hain market ki proportion ykatam Upar Chali Jaaye yah Jackson specialty a Jaaye jo bhi Udhar candistic banti hai usko spike bolate HForex market mein spike ke bht c reasons ho skti hain lekin jb all over world mein large startling koi occasion hota hy to es ke Wja sy market ke development shaky ho jati Hy. Market up ya down breakout kr jati Hy. Es k elawa different banked ya monetary organizations ka information or deliveries b spike ke wja sy bnti hy. Non formal, payrolls, shopper cost record, business, GDP, information and so forth es ke wja sy bnty hain.Ese liye hmain sb factors ko mind mein rkhna chaheay or us k bd he exchange dynamic krni chaheay. UnforeseeBearish Mat-Hold Candles. Assalamu alaikum dear Pakistan Forex forum members dear forex market Mein hum jab kaam kar rahe hote Hain To ismein Ham dekhte hain ke Forex ko aap acchi tarike se time denge aur aap ismein mehnat karenge to isase aapko bahut jyada advantages aur iske benefits mil sakte hain dear forex market Mein learning karna aur knowledge Hasil karna aapke liye bahut jyada jaruri hote hain aap jitne jyada study karenge aur Market ke bare mein knowledge Hasil Karke kam karenge to aapko fayda Hoga different types of charts ko dekhkar ine per banne wale patterns ko maddenajar rakhte hue aapko kam karna hota hai isliye aapke sath mein apni information share karna chadear technical analysis ke dauran agar aap technical analysis ka istemal karenge to ismein aapko divergence dekhne ko milati Hain divergence isko kahate Hain ki jab market mein kisi bhi trend mein move kar rahi hoti hain market kuchh mein jab aap dekhte hain to ismein aap vah police bhi move ho sakte hain aur bear is indicator ya is later aapko Uske against trend show karta hai jaisa ki aap ismein dekh sakte hain ki agar market ka trend upward ja raha hai aur iske sath aapko indicator ya osilator aapko down trend show karte Hain to yah ek hidan divergence kahate Hain isko aap indicators ki madad se market mein find karte hain aur aap trading perform kar sadear forex market mein aapke pass chart aur indicators ki madad se aapko different types ki divergence dekhne ko milati Hain jinke mutabik aap trade kar sakte hain ismein aapke pass Tu type ki divergence hoti hain E

-

#14 Collapse

Assalamo Alaekum friends. Kasy hain ap sabMain umed karta hon ap sab bilkul thek thak hon gay. Aj ka jo topic zer e behs hay uska nam bearish mat hold patterns hay . Yeh hamen kia btayega r kia information deta hay yeh dekhty hain. Yeh hamen kia kuch btaya hay yeh ab ham agy mazeed dekhty hain. Bearish Mat hold Pattern Forex trading mein mat hold pattern ek kisam ka candlestick pattern hai, jise techneqe tajzeya mein istemal kiya jata hai. Ye pattern ahissta ahista uptrend ya downtrend ke dauran dekha ja sakta hai aur ek bullish kay tasalasl kay pattern hai, yaani uptrend ke baad aage ki bullish ke harkaat ki perwi karta hai.Mat hold pattern mein ek barhi hoi sabaz bullish candle ke baad do ya zyada choti green candles jo ki halki retracement hai aur phir ek aur barhi hoi sabaz candle aati hai. Is pattern mein do retracement candles ke dauran price ek had tak niche jaa sakti hai, lekin sara trend bullish rehta hai.Mat hold pattern ko samajhne ke liye, yeh zarori hai ki aap price action aur candlestick patterns ke bunyadi baten samjhein. Technici tajziya ki madad se is pattern ko pehchanne par aap forex trading mein price ke harkat aur trends ko samajhne mein madad mil sakti hai.forex trading mein mat hold pattern ya kisi bhi technical analysis tool ka istemal karne se pehle, aapko acche se samajhna chahiye ki kaise ye patterns kaam karte hain aur unki sahi tafseel kya hoti hai. Iske liye aap forex education, books, tutorials, aur practice accounts ka istemal kar sakte hain, taki aapki trading decisions me samjh karne mein aasani ho.forex trading mein bohat zeada nuqsan ka khatra bhi hota hai, isliye hamesha apne financial goals, bardasht ke sabar aur achay khasy ilam ko dhyan mein rakhte hue trading karein.Ye pattern, traders ko market ke mustaqbil ke keemat ke harkaat ke bare mein neshandahi muhaya karne mein madad karta hai. Is pattern ki khas importance hai, kyunki isse price trends aur market ke simat ke bare mein samajhne mein madad milti hai. Trading Mat Hold Pattern, ek bullish continuation pattern hai, jo uptrend ke baad ke harkat ko zahir karta hai. Is pattern ke do ya zyada chote green candles aur phir ek aur candle aate hain. Ye pattern, bullish trend mein market sentiment aur buyer momentum ka continuation dekhata hai.Mat Hold Pattern ki samajh aapko kisi uptrend ke continuation ka hint hay. Isky zariye aap market mein sahi waqat par entry aur exit points ka pata laga sakte hain. Agar aap is pattern ko sahi dhang se pehchan lete hain, toh aap apne trading strategy ko uske baki trend taiyar kar sakte hain aur Price ke harkaat ka sahi pata laga sakte hain.Is pattern ka sahi istemal karne se aap risk ko kam kar sakte hain aur trading decisions ko behter kar sakte hain. Ye pattern aapko market mein ek edge karta hai aur aapko ek tarah se confirmation deta hai ki uptrend jaari hai aur bullish momentum banaye rakhna chahiye.historical price charts ka istemal kar sakte hain aur demo trading account par ye pattern ko pehchanne ki practice kar sakte hain. Dhyan rahe, technical analysis ke saath sath bunyadi tajziya aur risk management ko bhi samjhein, taki aap apne trading decisions ko sahi tarah se support kar sakein. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 Collapse

ke aik munfarid shakal hai lekin tijarti mawaqay faraham karti hai. jaisa ke naam se pata chalta hai, yeh arranged line mein aik chouti banata hai jahan qeemat ibtidayi had mein wapas anay se pehlay aik ahem harkat karti hai. Spike light stuck ki tareef usay market k ke hisab se market aise good tidings move Karti Hai jaise ki all over Banta Hai Uska size bolate Hain market ki extent ykatam Upar Chali Jaaye yah Jackson specialty a Jaaye jo bhi Udhar candistic banti hai usko spike bolate HForex market mein spike ke bht c reasons ho skti hain lekin jb all over world mein huge frightening koi event hota hy to es ke Wja sy market ke improvement temperamental ho jati Hy. Market up ya down breakout kr jati Hy. Es k elawa different banked ya money related associations ka data or conveyances b spike ke wja sy bnti hy. Non formal, payrolls, customer cost record, business, Gross domestic product, data, etc es ke wja sy bnty hain.Ese liye hmain sb factors ko mind mein rkhna chaheay or us k bd he trade dynamic krni chaheay. UnforeseeNegative Mat-Hold Candles. Assalamu alaikum dear Pakistan Forex gathering individuals dear forex market Mein murmur punch kaam kar rahe hote Hain To ismein Ham dekhte hain ke Forex ko aap acchi tarike se time denge aur aap ismein mehnat karenge to isase aapko bahut jyada benefits aur iske benefits mil sakte hain dear forex market Mein learning karna aur information Hasil karna aapke liye bahut jyada jaruri hote hain aap jitne jyada study karenge aur Market ke uncovered mein information Hasil Karke kam karenge to aapko fayda Hoga various sorts of graphs ko dekhkar ine per banne ridge designs ko maddenajar rakhte shade aapko kam karna hota hai isliye aapke sath mein apni data share karna chadear specialized examination ke dauran agar aap specialized investigation ka istemal karenge to ismein aapko disparity dekhne ko milati Hain uniqueness isko kahate Hain ki poke market mein kisi bhi pattern mein move kar rahi hoti hain market kuchh mein hit aap dekhte hain to ismein aap vah police bhi move ho sakte hain aur bear is marker ya is later aapko Uske against pattern show karta hai jaisa ki aap ismein dekh sakte hain ki agar market ka move vertically ja raha hai aur iske sath aapko pointer ya osilator aapko down pattern show karte Hain to yah ek hidan dissimilarity kahate Hain isko aap pointers ki madad se market mein find karte hain aur aap exchanging perform kar sadear forex market mein aapke pass outline aur markers ki madad se aapko various sorts ki difference dekhne ko milati Hain jinke mutabik aap exchange kar sakte hain ismein aapke pass Tu type ki uniqueness hoti hain

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 03:27 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим