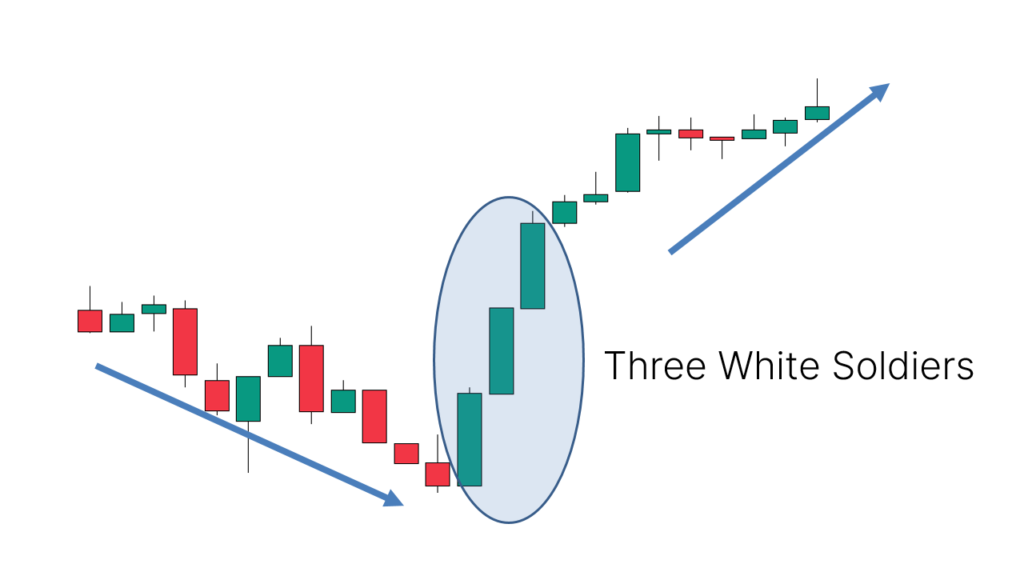

Three white candlestick soldiers

`

X

new posts

-

#1 Collapseٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Three white candlestick soldiers Explanation three white sipahi aik blush candle stuck patteren hai jo qeematon ke chart mein mojooda kami ke rujhan ke ulat jane ki paish goi karne ke liye istemaal kya jata hai. patteren mein teen lagataar lambay jism wali shammen shaamil hain jo pichli mom batii ke asli jism ke andar khulti hain aur aik band jo pichli mom batii ki oonchai se ziyada hai. un mom btyon mein bohat lambay saaye nahi honay chahiye aur misali tor par patteren mein Sabiqa ​​موم batii ke asli body ke andar khilna chahiye . jab dosray takneeki isharay jaisay rishta daar taaqat index ( rsi ) se tasdeeq ki jati hai to teen safaid sipahiyon ko aik qabil aetmaad ulat patteren samjha jata hai. mom btyon ka size aur saaye ki lambai ka istemaal is baat ka faisla karne ke liye kya jata hai ke aaya wapsi ka khatrah hai. teen safaid sipahiyon ka ulat patteren teen kalay kaway hain, jo oopri rujhan ke ulat jane ki nishandahi karta hai . What does three white soldier Tell You teen safaid sipahi candle stuck patteren chart par qeemat ke amal ko bananay walay stock, commodity ya jore ke lehaaz se market ke jazbaat mein zabardast tabdeeli ka mahswara dete hain. jab aik mom batii chhootey ya baghair saaye ke sath band ho rahi hai, to yeh batata hai ke bail session ke liye qeemat ko range ke oopri hissay par rakhnay mein kamyaab ho gaye hain. bunyadi tor par, bail poooray session mein really ko sambhaal letay hain aur lagataar teen sishnon tak din ki oonchai ke qareeb pahonch jatay hain. is ke ilawa, patteren se pehlay deegar mom batii ke patteren ho saktay hain jo ulat jane ki tajweez karte hain, jaisay doji van aik fallen angel high yield band exchange fund ke liye qeematon ke chart mein zahir honay walay teen safaid sipahiyon ki aik misaal yeh hai . Example of how to trade three white soldier chunkay teen safaid sipahi aik taiz basri namona hai, is liye usay dakhlay ya kharji nuqta ke tor par istemaal kya jata hai. jin taajiron ke paas security ki kami hai woh bahar nikaltay hue nazar atay hain aur woh tajir jo taizi se position lainay ka intzaar kar rahay hain teen safaid faam fojion ko dakhlay ke mauqa ke tor par dekhte hain. teen safaid sipahiyon ke patteren ki tijarat karte waqt, yeh note karna zaroori hai ke ziyada mazboot harkatein earzi had se ziyada kharidari ke halaat peda kar sakti hain. rishta daar taaqat index ( rsi ), misaal ke tor par, ho sakta hai 70. 0 ki satah se oopar chala gaya ho. kuch mamlaat mein, teen sipahiyon ke patteren ke baad mazbooti ki mukhtasir muddat hoti hai, lekin qaleel aur darmiyani muddat ka taasub badastoor taiz rehta hai. ahem iqdaam aala muzahmati sthon tak bhi pahonch sakta hai jahan stock bulandi ko jari rakhnay se pehlay istehkaam ka tajurbah karsaktha h -

#3 Collapse

Assalamu Alaikum Dosto!

Three White Soldiers Pattern

Jaise experience traders ko maloom hai, tamam candlestick patterns entry point faraham nahi karte aur na hi woh market reversal ka ishara dete hain. Inmein se kuch trend continuation patterns bhi hote hain, jo haalat-e-haal market ka andaza lagane ke liye istemaal hote hain, aur unhon ne market mein dakhil hone ka koi signal nahi diya hota. Teen white soldier candlesticks ka pattern is category mein shamil hai. Ye forex aur stock market dono ke liye munasib hai, is liye ise zaroor apne hathiyar mein shaamil karen.

Teen white soldiers pattern trend ki tawliyat ka ishara dene wale patterns mein shamil hai. Kabhi-kabhi soldiers ke banne ke baad reversal bhi hota hai (jo ke ek naye trend mein badal jata hai), lekin aisi situations kam hoti hain.

Three white soldier candlestick formation teen bullish candles se banti hai:- Shadows body ke size ke mawafiq bay-had chhoti hoti hain. Bari upper shadows ki na hona bulls ki taqat ke favo mein hai, aur izafah bila mushaqqat hota hai;

- Har candlestick par peechli High ko update kiya jata hai;

- Koi impulse movement nahi hoti. Agar kisi candle ki size doosri candles se kai martaba zyada hoti hai, to three white soldiers pattern ki itminaniyat mein kami aati hai.

Time frame ke hawale se, behtar hai ke aap kam se kam H1, aur behtar hai H4 ya us se zyada ke time frames mein kaam karen. Inke zariye hum market ki halat ka andaza lagate hain, low time frames mein aisi tashreefat be maayne hoti hain - ittifaqan chart ki harkatien pattern ki qeemat ko sifar kar deti hain.

Three white soldiers tab sab se zyada taqatwar hote hain jab chart flat zone se bahar nikalta hai ya jab correctional movement khatam ho jata hai. Ek naye urooj ki taraf ki tezi ka dor shuru hota hai. Agar aap teesre candle ko dekhte hain aur ye current trend ka maximum hai, to pattern bhi bura nahi hai, lekin chalne ki mumkinat kuch kam hoti hai.

Forex market mein three white soldiers ko kya ho raha hai, isay is context mein dekhte hain. Agar teesre candle ke baad hi uptrend ka maximum form hota hai, to mazeed urooj ki mumkinat ka taluq muzmon hai.

Three White Soldiers Pattern Identification

Three White Soldiers candlestick pattern ko pehchane ke liye, aapko candlestick chart mein khaas khasoosiyat dekhni hoti hain:- Zahiri Surat: Three White Soldiers pattern teen musalsal bullish (hara ya safed) candlesticks ka silsila hai jo pehli candle ke muqable mein musalsal buland hoti hain.

- Candlestick Bodies: Har candlestick ke bareek jism hote hain aur bohot choti ya koi wicks nahi hoti, jo mazboot kharidari dabao aur minimul farokht ke dabao ko darust karta hai.

- Location: Ye pattern aam tor par ek downtrend ke nichle hisse par dekha jata hai, aik mogheera reversal ki taraf ki nishandahi karta hai.

In ahem khasoosiyaton ko dekhte hue - teen musalsal bullish candlesticks jo buland highs ke saath aur kam wicks ke saath downtrend ke nichle hisse par hote hain - traders Three White Soldiers candlestick pattern ko aik potential bullish reversal signal ke tor par pehchan sakte hain technical analysis mein.

Three White Soldier Patterns Ki Classification

Candles ki configuration aur woh area jahan ye appear hoti hain ke mutabiq, is pattern ki sub-types hoti hain jinhein "repulsed attack" aur "deceleration" kehte hain. Agar kuch shartein milti hain, to ye market reversal ya correction/consolidation ka aghaz darust kar sakti hain. Hum is pattern se market reversal par trade nahi karte.

Deceleration surat-e-haal tab paida hoti hai jab trend slow ho raha hota hai. Ye reversal ke baare mein nahi, lekin pura three white soldiers pattern nahi banta. Teesre candlestick mein jo chhota sa range hota hai, woh bulls ki tawajju ki nishani hai. Aksar 2nd candlestick mein volatility mein izafah hota hai - is ki range neighbours ke candlesticks se ziada hoti hai.

Maximum ko update kiya ja sakta hai, lekin thori si duri ke saath. Teen aise candles ke baad market reversal ka 100% imkan nahi hota, lekin agar long positions khuli hain to unki Stop Loss ko kam se kam breakeven par le jaana chahiye.

Agar deceleration pattern resistance level ke qareeb dikhai de raha hai, to kam se kam correction hone ki mumkinat barh jati hain. Isay reversal signal ke tor par istemaal na karen.

Deceleration pattern ki pehchan mein ye chezein dekhen:- Teeno candle ki range. Agar ye ek wave hai (aik candle jiska body chhoti hai aur almost koi shadow nahi hoti), to urooj mein rukawat hai;

- Niche se aik lambi shadow ki mojoodgi. Iski mojoodgi ye darust karti hai ke bears ne trend ko palatne ki koshish ki hai. Is natijay mein teen white candlesticks to banti hain, lekin bulls ko sellers ke dabav ka muqablah karna mushkil ho jata hai;

- Qareebi level ki mojoodgi, iski touching zaroori nahi hai.

Hum ye mashwarah dete hain ke jab aise patterns banen to kam se kam hissa munafa band kar len.

Repulsed Attack

Ye teen white soldiers ko is naam se bulaya jata hai, jismein teesri candle mein aik mazboot reversal configuration hota hai. Yani ke ooper se lambi shadow hoti hai - bulls ne mojooda trend ko jaari rakhne ki koshish ki, lekin bears ne attack ko repel kar diya (is naam ka asal matlab yahi hai) aur price ko neeche le gaya. Ye mojooda harkat 2nd candle par bhi zahir ho sakti hai.

Is pattern aur deceleration ke darmiyan farq bohat majazi hai, lekin maayne wahi hain. Agar aap in patterns ko gumrahi se milatay hain, to tragedy nahi hoti. Forex mein ahem ye hai ke na keh terminology, balki market mein ho rahe cheezon ki samajh hai.

Is pattern ke saath kaam karne ka usool waisa hi hai - ye aik marker hai jo darust hai ke humein apne open positions ko hedge karna chahiye. Humein hissa munafa fix karna chahiye, aur balance par Stop Loss ko breakeven par le jana chahiye.

Three White Soldiers & Three Black Crows Pattern

Three White Soldiers aur Three Black Crows candlestick patterns ke darmiyan farq unke market ke asraat aur formations mein hai.- Three White Soldiers:

- Pattern: Ek bullish reversal pattern jo ek downtrend ke ikhtitaam par hota hai.

- Formation: Teen musalsal lambi bullish candles ka silsila jisme har ek candle pichli candle ke asal jism ke andar kholi jati hai aur pichli candle ke unchi band par band hoti hai.

- Implication: Bearish se bullish jazbat ki tabdeeli ka ishaara deta hai, ek mogheera uptrend reversal ki nishandahi karta hai.

- Characteristics: Candle ke darmiyan koi gaps nahi hote, choti ya adhuri upper wicks hoti hain, aur mazboot bullish momentum hota hai.

- Three Black Crows:

- Pattern: Aik bearish reversal pattern jo aksar ek uptrend ke ikhtitaam par banta hai.

- Formation: Teen musalsal lambi bearish candles ka silsila jo lagatar kam hoti hai aur lagatar lower highs aur lower lows ke saath hoti hai.

- Implication: Bullish se bearish jazbat ki tabdeeli ko darust karta hai, aik mogheera downtrend reversal ki nishandahi karta hai.

- Characteristics: Har candle pichli candle ke unchi band ke qareeb kholi jati hai aur nichli band par band hoti hai, jo musalsal farokht ke dabao ko darust karta hai.

Jabke Three White Soldiers teen musalsal bullish candles ke saath bullish reversal ki nishandahi karte hain, Three Black Crows teen musalsal bearish candles ke saath bearish reversal ko darust karte hain. Ye patterns traders ko moomasil formations aur bullish ya bearish jazbat ka tabdeeli se market ke raah ka pata lagane mein madad karte hain.

Trading

Japanese candlesticks par trading zyada tar ek hunar hai aur koi saamany instructions nahi hote, ahem yeh hai ke samajh aur different angles se situation ko dekhne ki salahiyat hoti hai. Three white soldiers pattern aik strong pattern hai jo kisi bhi confirmation ki zarurat nahi rakhta. Lekin bewaqoofana taur par long position nahi khulni chahiye, bas pattern ko forex chart par dekh kar. Pehle halat ka andaza lagana

chahiye:

- Pattern ke zahir hone se pehle market ka lamba girawahish hona chahiye ya low prices ki jagah par consolidation hona chahiye;

- Agar teeno candlesticks of the pattern zyada chhote aur zyada lambe nahi hain, taqreeban barabar ke size ke hain, aur chhote shadows ke sath hain (ya unke baghair) - to aap long position khul sakte hain;

- Doosri aur teesri (ya sirf teesri) candlesticks chhoti aur kamzor bhi ho sakti hain, lambi upper shadows ke saath. Phir ye sirf three white soldiers nahi hain, balki repulsed attack hain. Iska matlab hai ke yahan kuch ghalat ho gaya hai. Haqeeqatan mein, market growth mein mazboot mawafiqi milti hai aur ye mukhtalif scenarios ki taraf muqbil hai, lekin kehne wale ke liye nahi.

- Ye bhi deceleration pattern ke sath wahi haalat hai: doosri candle ka bohat lamba body aur teesri ki thori si (star formation). Ye bhi aik dafaar hai ke door rahen: agar koi position open nahi hai to behtar hai ke na shuru ki jaye; agar koi open position hai to behtar hai ke munafa le kar market se nikal jaye;

- Aur technical analysis ke indicators ko nazr-andaz na karen. Misal ke tor par, oscillators (RSI, MACD, Momentum) zyada kharidaar market ka darja maloom karne mein madad karenge.

Final Thoughts

Teen white soldiers pattern ko seedha forex market mein trades ke liye istemaal nahi karna chahiye. Ye ishara karta hai ke uptrend ko palatne ke bajaye jari rakhne ke zyada imkanat hain. Humain koi khaas dakhli nuqta nahi milta.

Ye pattern munafa lene ke liye bhi munasib hai. Agar aapko repulsed attack ya deceleration milta hai aur level ke qareeb hai, to aap risk na uthaye aur trades ko munafa ke sath bandh le. Behtar hai ke aap correction ke end par dubara dakhil ho ne ke options dhundhen, munafa ko risk karne ki bajaye.

-

#4 Collapse

Three White Soldiers Candlestick Pattern

Three White Soldiers candlestick pattern ek strong bullish reversal pattern hey jo ke downtrend ke end me appear hota hey. Yeh pattern indicate karta hey ke market me bullish sentiment a gaya hey aur trend reverse ho kar upar ki taraf move kar sakta hey. Yeh pattern teen consecutive bullish candles par mushtamil hota hey aur har candle me kuch specific characteristics hote hein.

Pattern Ki Structure- Three Consecutive Bullish Candles:

- Pattern me teen continuous bullish candles hoti hein jo ke progressively higher close karti hein.

- Har candle pichle candle ke close ke kareeb open hoti hey aur ek lamba bullish body banati hey.

- No or Very Small Wicks:

- In candles me wicks choti ya bilkul nahi hoti, jo ke buyers ke strong control ko indicate karti hey.

- Agar wicks hon, toh bhi woh choti honi chahiye take strong buying momentum ka impression mile.

- Gradual Increase in Prices:

- Har candle pichli candle se thodi si zyada upar close karti hey, jo buyers ke confidence aur momentum ko show karti hey.

Three White Soldiers pattern yeh signal deta hey ke downtrend khatam ho gaya hey aur ab buyers ne market me control le liya hey. Yeh pattern jab kisi support level ke kareeb ya oversold conditions me appear hota hey toh uski reliability aur bhi zyada badh jati hey.

Trading Strategy

Three White Soldiers pattern ke sath trading karte waqt kuch strategies ko follow kar sakty hein:- Confirmation ke liye Indicators: Moving Average ya Relative Strength Index (RSI) jaise indicators use karna behtar hota hey take reversal confirm ho jaye.

- Entry Point: Teesri candle ke close hone ke bad entry kar sakty hein take momentum ki confirmation mil sake.

- Stop Loss: Stop-loss pehli candle ke low ya support level ke niche set karna chahiye.

- Profit Target: Risk/reward ratio aur resistance levels ko dekh kar profit target set karna chahiye.

Three White Soldiers pattern ek powerful reversal indicator hey, lekin hamesha additional analysis ke sath use karna chahiye take trend ki confirmation ho aur false signals avoid kiye ja sakein.

- Three Consecutive Bullish Candles:

-

#5 Collapse

Three White Soldiers Candlestick Pattern

Three White Soldiers candlestick pattern ek strong bullish reversal pattern hey jo ke downtrend ke end me appear hota hey. Yeh pattern indicate karta hey ke market me bullish sentiment a gaya hey aur trend reverse ho kar upar ki taraf move kar sakta hey. Yeh pattern teen consecutive bullish candles par mushtamil hota hey aur har candle me kuch specific characteristics hote hein.

Pattern Ki Structure- Three Consecutive Bullish Candles:

- Pattern me teen continuous bullish candles hoti hein jo ke progressively higher close karti hein.

- Har candle pichle candle ke close ke kareeb open hoti hey aur ek lamba bullish body banati hey.

- No or Very Small Wicks:

- In candles me wicks choti ya bilkul nahi hoti, jo ke buyers ke strong control ko indicate karti hey.

- Agar wicks hon, toh bhi woh choti honi chahiye take strong buying momentum ka impression mile.

- Gradual Increase in Prices:

- Har candle pichli candle se thodi si zyada upar close karti hey, jo buyers ke confidence aur momentum ko show karti hey.

Three White Soldiers pattern yeh signal deta hey ke downtrend khatam ho gaya hey aur ab buyers ne market me control le liya hey. Yeh pattern jab kisi support level ke kareeb ya oversold conditions me appear hota hey toh uski reliability aur bhi zyada badh jati hey.

Trading Strategy

Three White Soldiers pattern ke sath trading karte waqt kuch strategies ko follow kar sakty hein:- Confirmation ke liye Indicators: Moving Average ya Relative Strength Index (RSI) jaise indicators use karna behtar hota hey take reversal confirm ho jaye.

- Entry Point: Teesri candle ke close hone ke bad entry kar sakty hein take momentum ki confirmation mil sake.

- Stop Loss: Stop-loss pehli candle ke low ya support level ke niche set karna chahiye.

- Profit Target: Risk/reward ratio aur resistance levels ko dekh kar profit target set karna chahiye.

Three White Soldiers pattern ek powerful reversal indicator hey, lekin hamesha additional analysis ke sath use karna chahiye take trend ki confirmation ho aur false signals avoid kiye ja sakein.

- Three Consecutive Bullish Candles:

-

#6 Collapse

Teen Safed Candlestick Soldiers: Ek Jaiza

Taqreeban Har Trading Strategy ki Bunyad

Trading mein aksar log mukhtalif patterns aur signals ka istemal karte hain taake woh behtar faisle kar saken. Un patterns mein se ek hai "Three White Candlestick Soldiers" ka pattern. Yeh pattern bullish reversal ya bullish continuation signal ke tor par dekha jata hai. Is article mein, hum is pattern ki pehchaan, significance aur iska istemal karne ka tareeqa samjhenge.

Candlestick Patterns Ki Bunyad

Candlestick charts ek visual representation hain jisse traders market ki movement aur price action ko samajhte hain. Har candlestick price ki movement ko darshata hai ek specific waqt mein. Ek candlestick ka rang (safed ya kale) is baat ka izhar karta hai ke market bullish hai ya bearish. Safed candlestick ka matlab hai ke closing price opening price se upar hai, jabke kale candlestick ka matlab hai ke closing price opening price se neeche hai.

Teen Safed Candlestick Soldiers Ka Pattern

Teen safed candlestick soldiers ka pattern teen consecutive safed candlesticks par mabni hota hai. Yeh pattern tab banta hai jab market mein ek strong bullish momentum hota hai. Is pattern ki khasiyat yeh hai ke har agla candlestick pichlay candlestick se zyada talli hota hai, jo market ke increasing strength ko darshata hai. Is pattern ki pehchaan is tarah ki ja sakti hai:- Pehla Candlestick: Yeh candlestick market ke bullish reversal ka pehla indicator hota hai. Yeh kahin na kahin support level par banta hai.

- Doosra Candlestick: Yeh pehle candlestick ke upar band hota hai, jo bullish momentum ko darshata hai. Is candlestick ki range choti ho sakti hai, magar yeh safed hoti hai.

- Teesra Candlestick: Yeh doosre candlestick se bhi talli hota hai, jo market ki strength ko barhata hai. Agar yeh candlestick bhi safed hai, to yeh bullish trend ka darshan deta hai.

Significance Aur Interpretations

Teen safed candlestick soldiers ka pattern bullish reversal ya continuation ko darshata hai. Yeh market mein buying pressure ka izhar karta hai. Jab traders is pattern ko dekhte hain, toh woh yeh samajhte hain ke buyers ka control market par hai. Is pattern ke piche kuch khaas points hain:- Investor Confidence: Is pattern ka hona investor confidence ko barhata hai, kyun ke yeh market mein strong buying sentiment ka izhar karta hai.

- Volume Ka Barhna: Is pattern ke sath agar volume bhi barhta hai, toh yeh bullish signal ko mazid mazbooti deta hai. Higher volume se yeh sabit hota hai ke trend ko support mil raha hai.

- Momentum Indicators: Jab teen safed candlestick soldiers ka pattern banta hai, traders aksar momentum indicators, jaise RSI (Relative Strength Index) ya MACD (Moving Average Convergence Divergence) ka istemal karte hain taake yeh jaan sakein ke trend ki strength kya hai.

Is Pattern Ko Kahan Istemal Karein

Teen safed candlestick soldiers ka pattern mukhtalif time frames par dekha ja sakta hai, magar yeh intraday aur swing trading ke liye sabse behtar hota hai. Yeh pattern aksar bullish reversal points par banta hai, jahan market pehle bearish tha. Aap is pattern ka istemal karte waqt in baton ka khayal rakhein:- Support Levels: Is pattern ko support levels ke nazdeek dekhna behtar hai. Agar pattern support level par banta hai, toh yeh zyada strong signal hota hai.

- Stop Loss Ka Istemal: Jab aap is pattern ke signal par trade karte hain, toh stop loss zaroor lagayen. Stop loss aapko losses se bacha sakta hai agar market aapke against chala jaye.

- Target Levels: Target levels ko tay karte waqt, previous resistance levels ka khayal rakhein. Yeh aapko help karega profit book karne mein jab market bullish move karega.

Challenges Aur Risks

Har pattern ki tarah, teen safed candlestick soldiers ka pattern bhi kuch challenges aur risks ke sath aata hai. Yeh kuch factors hain jinhen traders ko samajhna chahiye:- False Signals: Kabhi-kabhi yeh pattern false signals de sakta hai. Market ki volatility ya unexpected news ke wajah se yeh pattern fail ho sakta hai.

- Market Sentiment: Market ki overall sentiment ko bhi samajhna chahiye. Agar overall market bearish hai, toh yeh pattern zaroori nahi ke effective ho.

- Risk Management: Effective risk management strategies ka hona zaroori hai. Trading mein kabhi bhi sirf ek pattern par nahi jaana chahiye; iske sath sath market ke doosre indicators ka bhi istemal zaroori hai.

Nateejah

Teen safed candlestick soldiers ka pattern trading ki duniya mein ek qeemti tool hai. Yeh bullish momentum ko darshata hai aur traders ko entry points identify karne mein madad karta hai. Lekin, traders ko yeh yaad rakhna chahiye ke is pattern ka istemal karne ke sath sath risk management aur market sentiment ka bhi khayal rakhna chahiye. Har trader ko chahiye ke woh apne trading strategy ko evolve karein aur is pattern ka behtar istemal karein. Trading ek art aur science dono hai, aur isme sab kuch sikhne aur samajhne ki zarurat hoti hai. -

#7 Collapse

Teen Safed Candlestick Soldiers: A Bullish Reversal Pattern

Forex trading mein candlestick patterns ka kaafi ahm role hota hai. Ye patterns price action ko samajhne aur market ke future movement ko predict karne mein madadgar sabit hote hain. Aaj hum baat karenge ek aise bullish reversal pattern ke baare mein jise "Three White Candlestick Soldiers" kaha jaata hai. Yeh pattern market mein ek significant trend reversal ka signal deta hai.

Three White Candlestick Soldiers Kya Hai?

Three White Candlestick Soldiers ek bullish reversal pattern hai jo aksar downtrend ke baad appear hota hai. Is pattern mein teen consecutive white (ya green) candlesticks hote hain jo ek dusre se barhkar close karte hain. Har candlestick ka body lamba hota hai, aur iske beech me koi significant shadow nahi hoti. Yeh pattern market mein demand ki strong presence aur price ke upar jane ka signal deta hai.

Jab yeh pattern downtrend ke baad banta hai, to yeh market ke mood ko reverse karne aur price ke upar jane ka indication deta hai. Yeh pattern aksar weak trends ya market mein uncertainty ke baad banta hai, jab buyers finally control apne haath mein le lete hain.

Pattern Ka Structure Samajhna

Is pattern ka structure samajhna kaafi zaroori hai. Teen consecutive candlesticks hain, jinmein se har ek ka body lamba aur bullish hota hai. Har next candlestick pehle ke candlestick se higher close karta hai, aur yeh pattern tab complete hota hai jab teesra candlestick apne level se upar band hota hai.

First Candlestick: Pehla candlestick ek large bullish candle hota hai jo market mein upward movement ko start karta hai. Yeh candle downtrend ke baad hota hai aur apne opening price ke comparison mein higher closing price show karta hai.

Second Candlestick: Dusra candlestick bhi bullish hota hai aur pehle ke candle se barh kar close karta hai. Yeh confirm karta hai ke buying pressure market mein strong hai aur sellers ko haraya gaya hai.

Third Candlestick: Teesra candlestick bhi bullish hota hai aur pehle aur dusre candlesticks ke upar band hota hai. Yeh pattern complete hota hai jab yeh candlestick strong upward movement ko confirm karta hai.

Yeh three candlesticks ek strong signal dete hain ke market mein buyers ne control hasil kar liya hai, aur sellers ab momentum lose kar chuke hain.

Pattern Ka Signal

Three White Candlestick Soldiers ka pattern aksar ek strong bullish signal hota hai, jo ke market ke reversal ko show karta hai. Iska matlab yeh hai ke agar yeh pattern downtrend ke baad banta hai, to market me upward trend start ho sakta hai.

Agar yeh pattern strong volume ke saath ban raha ho, to iska signal zyada reliable hota hai. Zyada volume ka matlab hota hai ke market mein high activity ho rahi hai, aur buyers ne apni position ko zyada strong kiya hai.

Traders is pattern ko identify kar ke market mein buying opportunities ko grab karte hain. Agar yeh pattern clear aur strong dikhe, to traders apni buy positions open karte hain, expecting that the price will continue to rise.

Is Pattern Ko Kaise Trade Karein?

Three White Candlestick Soldiers ka pattern aksar bullish reversal ka signal deta hai, lekin isse trade karne ke liye kuch important points hain jo hamesha yaad rakhna chahiye.

Confirm Trend Reversal: Jab yeh pattern banta hai, toh yeh important hai ke aap trend reversal ko confirm karen. Aksar is pattern ko downtrend ke baad dekhna hota hai. Agar yeh pattern sideways market mein ban raha ho, to iska signal weak ho sakta hai.

Volume Check Karein: Volume market ke sentiment ko samajhne mein madad karta hai. Agar yeh pattern high volume ke saath ban raha ho, toh yeh ek strong confirmation hota hai ke trend reversal ho sakta hai.

Stop Loss Set Karein: Agar aap is pattern ko trade karte hain, toh stop loss ka use karna zaroori hai. Aap apna stop loss previous low ke level par set kar sakte hain taake agar market expected direction mein na jaaye, toh aapko loss na ho.

Take Profit Target: Take profit target set karna bhi important hai. Aap trend ke continuation ka faida uthate hue profit le sakte hain. Risk-to-reward ratio ka dhyaan rakhein, taake har trade mein potential profit zyada ho.

Common Mistakes to Avoid

Jab traders Three White Candlestick Soldiers ko trade karte hain, toh kuch common mistakes hote hain jinhe avoid karna zaroori hai.

Pattern ka Early Identification: Kai baar traders jaldi mein pattern ko identify kar lete hain aur trade open kar lete hain, jo ke galat ho sakta hai. Yeh zaroori hai ke pattern ka complete hona dekhein, aur confirmation ke baad hi trade lein.

Volume ka Ignore Karna: Agar pattern low volume ke saath banta hai, toh iska signal weak hota hai. Volume ko ignore karna ek galat decision ho sakta hai.

Risk Management na Karna: Stop loss aur proper risk management ke bina trade karna risky ho sakta hai. Yeh zaroori hai ke aap apni positions ko manage karen aur unnecessary losses se bachne ki koshish karein.

Conclusion

Three White Candlestick Soldiers ek powerful bullish reversal pattern hai jo downtrend ke baad market mein upward movement ko indicate karta hai. Yeh pattern strong buying pressure aur trend reversal ka indication deta hai. Agar aap is pattern ko samajh kar trade karte hain, toh aap apne forex trading mein achi opportunities dhoondh sakte hain. Lekin is pattern ko identify karte waqt proper risk management, volume analysis aur confirmation zaroori hai, taake aap successful trades kar sakein. -

#8 Collapse

**Three White Candlestick Soldiers: Understanding the Pattern**

Forex aur stock trading mein candlestick patterns ka bohot bara role hota hai. In patterns ko samajhna aur unhe apni trading strategy mein implement karna, traders ke liye kaafi faida mand ho sakta hai. Aaj hum baat karenge ek popular bullish candlestick pattern ke baare mein, jise **Three White Candlestick Soldiers** kehte hain. Ye pattern market mein ek strong buying signal deta hai aur price reversal ya continuation ke liye use hota hai.

### What is Three White Candlestick Soldiers?

Three White Candlestick Soldiers ek bullish pattern hai jo teen consecutive white (bullish) candlesticks se milkar banta hai. Ye pattern aksar downtrend ke baad hota hai aur iska main purpose market mein bullish trend ka indication dena hota hai. Jab ye pattern banta hai, to iska matlab hota hai ke buyers market mein enter kar gaye hain aur price upward movement ke liye ready hai.

### Key Features of Three White Candlestick Soldiers

1. **Three Consecutive Bullish Candles:** Is pattern mein teen consecutive bullish candles hoti hain. Har candle ka closing price apni pehli candle se zyada hota hai, jo ke strong buying pressure ko show karta hai.

2. **Candle Bodies:** Har candle ka body full bullish hota hai, matlab ki opening price ne low point ko touch kiya aur closing price high point ke aas-paas tha. Ye indicate karta hai ke market mein buyers ka control hai.

3. **No Gaps Between Candles:** Three White Candlestick Soldiers pattern mein candles ke beech gap nahi hota. Har new candle apne pichli candle ke close ke paas start hoti hai aur higher close karti hai. Iska matlab hai ke market continuous bullish momentum mein hai.

4. **Trend Reversal or Continuation:** Ye pattern aksar downtrend ke baad banta hai, lekin kabhi kabhi ye uptrend ke beech bhi ho sakta hai, jisme trend ki continuation ko indicate karta hai.

### Why Is It Important for Traders?

**1. Bullish Reversal:** Agar market downtrend mein hai aur aapko Three White Candlestick Soldiers pattern nazar aaye, to ye ek bullish reversal ka strong signal hai. Iska matlab hai ke sellers ka control toot gaya hai aur buyers market mein enter kar chuke hain.

**2. Strong Buying Pressure:** Is pattern ke banne se yeh samajh aata hai ke buyers ne apni position strong kar li hai. Jab ye pattern high volume ke saath banta hai, to iska breakout reliable hota hai, aur price upar ki taraf move kar sakta hai.

**3. Trend Confirmation:** Ye pattern aksar trend reversal ke liye use hota hai, lekin agar market already uptrend mein ho aur yeh pattern banta hai, to iska matlab hai ke trend continue karega.

### Trading Strategy with Three White Candlestick Soldiers

Agar aapko Three White Candlestick Soldiers pattern dikhayi de, to aap apni buy position uske next candle ke open pe place kar sakte hain. Stop loss ko pehli candle ke low ke neeche set karen. Is se risk management asaan hota hai. Iske alawa, volume aur other technical indicators jaise RSI ya MACD se confirmation lena bhi zaroori hai, taki pattern ki reliability check ki ja sake.

### Conclusion

Three White Candlestick Soldiers pattern ek powerful bullish signal hai jo traders ko market mein buying opportunity dikhata hai. Is pattern ko samajhna aur effectively use karna aapki trading strategy ko behtar bana sakta hai. Agar aap is pattern ko dusre indicators ke saath combine karte hain, to aapki prediction aur bhi accurate ho sakti hai.

-

#9 Collapse

Three white soldiers trading mein ek bullish candlestick pattern hai jo aksar market ke reversal ya continuation ko signal karta hai. Yeh pattern teen consecutive bullish candles par mushtamil hota hai jo gradually higher close hoti hain. Is pattern ka naam three white soldiers rakha gaya kyunke yeh ek organized aur disciplined bullish movement ko depict karta hai. Yeh pattern aksar technical analysis ke tools ke sath use hota hai aur is ki samajh kisi bhi trader ke liye bohot zaroori hai.

Three White Soldiers Pattern ka Structure

Three white soldiers pattern ka structure simple aur aasaan hota hai, lekin is ka analysis bohot mohim hai. Iska structure kuch is tarah hota hai:- Teen Continuous Bullish Candles: Pattern mein teen continuous green candles ya bullish candles hoti hain jo market ke upward trend ko confirm karti hain.

- Har Candle Previous Candle ke High se Close Hoti Hai: Har aglay candle ka close previous candle ke high se upar hota hai, jo buying pressure ko dikhata hai.

- Small Wicks: Candles ke wicks chhoti hoti hain, jo yeh signal karti hain ke buyers market ko control kar rahe hain aur selling pressure limited hai.

- Steady Growth: Candles steady aur consistent growth ko depict karti hain, bina kisi sudden spikes ke.

Three white soldiers kaafi bullish pattern hai jo aksar downtrend ke baad appear hota hai aur trend reversal ka signal deta hai. Yeh pattern market ke sentiment ko indicate karta hai ke ab bears ki jagah bulls ne le li hai.

Bullish Reversal

Agar yeh pattern ek downtrend ke end mein form ho, to iska matlab hota hai ke market ab upward move karega.

Continuation Pattern

Agar yeh ek ongoing uptrend mein form ho, to iska matlab hota hai ke market bullish direction mein aur zyada strong hoga.

Three White Soldiers Pattern ki Pahchan

Yeh pattern identify karne ke liye aapko kuch key characteristics par focus karna hoga:- Downtrend ke Baad Formation: Yeh pattern aksar downtrend ke baad dikhai deta hai, lekin yeh uptrend ke dauran bhi form ho sakta hai.

- Volume Analysis: Pattern ke sath volume bhi zyada hota hai, jo buying interest ko confirm karta hai.

- Support Levels: Agar yeh pattern kisi strong support level ke kareeb form ho, to iska impact aur zyada hota hai.

- No Overlap: Har candle ka open previous candle ke close ke kareeb hota hai, lekin overlap nahi karta.

Three white soldiers pattern ko trading mein kaise use karte hain? Yahan kuch strategies di gayi hain jo is pattern ke madad se aapko better trading decisions lene mein madad karengi:

Entry Points- Jab yeh pattern complete ho jaye aur teesri candle close ho, to aap ek buy order place kar sakte hain.

- Confirmatory indicators, jaise RSI ya MACD ka use karen, jo bullish momentum ko confirm kar sakein.

Stop-loss order ko pattern ke start point ya first candle ke low ke niche place karen. Yeh aapke risk ko limit karega.

Profit Targets

Profit target set karne ke liye resistance levels ya Fibonacci retracement levels ka use karen.

Combining with Other Indicators

Three white soldiers ko dusre technical indicators ke sath combine karna hamesha acha hota hai. Example ke taur par:- Moving Averages: Agar moving averages crossover ho, to yeh bullish trend ko aur confirm karega.

- RSI: RSI ka oversold zone se upar ana bhi bullish momentum ko support karta hai.

Three white soldiers pattern ka sahi tarah samajhna zaroori hai, lekin kuch cases mein yeh misleading bhi ho sakta hai:- Overbought Market: Agar market overbought ho, to yeh pattern ek false signal bhi de sakta hai.

- Weak Volume: Agar volume low ho, to yeh pattern reliable nahi hota.

- Market Manipulation: Chhoti time frames par yeh pattern market manipulation ka nateeja ho sakta hai, is liye larger time frames par iska analysis karein.

- Context ke Baghair Analysis: Is pattern ko hamesha market ke context mein analyze karein. Agar market ke fundamentals bearish hain, to yeh pattern reliable nahi hoga.

Historical data ka analysis karna aapko is pattern ko samajhne mein madad dega. Aap historical charts par yeh dekh sakte hain ke three white soldiers pattern ka impact kis tarah hota hai aur yeh kis scenarios mein kaam karta hai.

Example 1: EUR/USD Pair

Ek downtrend ke baad three white soldiers pattern form hua aur price mein steady increase dekhne ko mila. Yeh pattern ek strong reversal ka signal tha.

Example 2: S&P 500 Index

Ek bullish continuation ke dauran three white soldiers pattern form hua jo confirm karta hai ke market bulls ke control mein hai.

Three white soldiers pattern ek reliable aur powerful bullish candlestick pattern hai jo market ke trend reversal ya continuation ka signal deta hai. Is pattern ka sahi tarah analysis karna aur isse confirmatory indicators ke sath use karna aapko trading mein better decisions lene mein madad karega. Lekin, hamesha yaad rakhein ke koi bhi pattern 100% accurate nahi hota, aur aapko risk management aur trading plan ke sath kaam karna chahiye.Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#10 Collapse

Three White Soldiers Candlestick Pattern

Three White Soldiers ek bullish candlestick pattern hai jo aksar financial trading mein price reversal ya continuation ko indicate karta hai. Yeh pattern tab banta hai jab market ne pehle downward trend ya consolidation phase face kiya ho, aur ab upward trend ke shuru hone ka signal de raha ho. Is pattern ko Three Advancing Soldiers bhi kaha jata hai.

Pattern Ki Pehchaan

Three White Soldiers pattern mein teen lagataar bullish candlesticks hoti hain jo steadily upward movement ko show karti hain. Is pattern ke kuch khas features hain:- Three Consecutive Candlesticks:

Har din ya session ki closing price pichle session ki closing price se upar hoti hai. - Small Shadows:

Candlesticks ke upar aur neeche shadows chhoti hoti hain, jo strong buying pressure ko dikhata hai. - Open Within Previous Body:

Har candlestick ki opening price pichli candlestick ke body ke andar hoti hai, lekin close hamesha uske upar hota hai. - Steady Growth:

Yeh pattern gradual aur consistent growth ko represent karta hai, jo ek healthy trend ka indication hai.

Pattern Ka Matlab

Three White Soldiers ek bullish reversal ya continuation pattern hai jo traders ko yeh batata hai ke market ab neeche se upar ki taraf ja raha hai. Agar yeh pattern support zone ya oversold conditions ke kareeb form ho, toh yeh trend reversal ka strong signal deta hai.

Key Interpretations:- Trend Reversal:

Agar yeh pattern ek downward trend ke baad aaye, toh iska matlab hai ke bears (sellers) ab control lose kar rahe hain aur bulls (buyers) control le rahe hain. - Trend Continuation:

Agar yeh pattern pehle se upward trend mein aaye, toh iska matlab hai ke buyers market mein dominant hain aur trend continue karega. - Market Confidence:

Is pattern ke zariye traders ko pata chalta hai ke market mein buying interest barh raha hai, jo confidence ko dikhata hai.

Three White Soldiers Pattern Ki Formation

Yeh pattern tab form hota hai jab:- First Candlestick:

Pehla bullish candle downward trend ya sideways market ke baad aata hai, aur iska body strong hota hai. - Second Candlestick:

Dusra candle pehle candle ke upar khulta hai aur uske high se upar close karta hai. Yeh buyers ki strength ko confirm karta hai. - Third Candlestick:

Teesra candle lagataar bullish momentum dikhata hai, aur iska closing price pehle do candles se bhi upar hota hai.

Three White Soldiers Ko Kaise Trade Karein

Three White Soldiers pattern ek strong buying signal hai, magar bina analysis ke blindly trade karna risky ho sakta hai. Is pattern ko effectively trade karne ke liye kuch steps hain:

1. Confirm the Pattern:- Pehle confirm karein ke pattern sahi tareeke se form hua hai.

- Candlesticks ke shadows small honi chahiye, aur consistent upward movement dikhai dena chahiye.

- Volume zyada hona chahiye, jo buyers ke strong interest ko dikhata hai.

- Agar yeh pattern support level ke kareeb form ho, toh yeh aur bhi reliable hota hai.

- RSI: Agar RSI oversold zone se move kar raha ho, toh yeh pattern aur bhi strong ho jata hai.

- Moving Averages: Moving averages ka upward crossover confirmation deta hai.

- Third candle ke close hone ke baad buy karna acha hota hai, ya phir agle session ke start par buy karein.

- Stop-loss pichle swing low ya first candlestick ke neeche set karein.

- Profit ke liye resistance levels ya Fibonacci retracement levels ko target karein.

Pattern Ki Limitations

Har pattern ki tarah Three White Soldiers bhi har situation mein kaam nahi karta. Is pattern ki kuch limitations hain:- Overbought Conditions:

Kabhi kabhi yeh pattern overbought conditions mein bhi form ho sakta hai, jahan price reversal ke chances zyada hote hain. - False Signals:

Agar volume low ho ya pattern resistance zone par form ho, toh yeh false signal de sakta hai. - Market News:

Kabhi kabhi pattern ka signal market ki news ya events ki wajah se distort ho sakta hai. - Risk Management:

Agar stop-loss set na kiya jaye, toh market reversal ki situation mein bara loss ho sakta hai.

Three White Soldiers

Is pattern ka psychological impact yeh hota hai ke:- Bears Weak Ho Jate Hain: Sellers ki demand kam hoti hai, aur price neeche girne ke chances kam hote hain.

- Bulls Confident Ho Jate Hain: Buyers aggressively assets khareedte hain, jo price ko aur barhne mein madad karta hai.

Three White Soldiers candlestick pattern ek powerful bullish signal hai jo traders aur investors ko upward trend ka indication deta hai. Magar is pattern ka use karne ke liye proper analysis, risk management, aur additional tools ka use zaruri hai. Agar sahi tareeke se use kiya jaye, toh yeh pattern profitable trades ke liye madadgar ho sakta hai.

- Three Consecutive Candlesticks:

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#11 Collapse

**Three White Candlestick Soldiers**

Forex trading mein candlestick patterns kaafi important role play karte hain, kyunki yeh market ke potential movements aur sentiment ko samajhne mein madad karte hain. "Three White Soldiers" ek bullish reversal pattern hai, jo market mein strong uptrend ke shuru hone ka indication deta hai. Is pattern ko samajhna aur identify karna traders ke liye kaafi beneficial ho sakta hai, kyunki yeh unhein profitable trading opportunities dikhata hai. Aaj hum is pattern ke baare mein detail mein baat karenge, iske structure ko samjhenge, aur kaise isse trade karna chahiye.

### 1. **Three White Soldiers Kya Hai?**

Three White Soldiers ek candlestick pattern hai jo three consecutive bullish candles par based hota hai. Yeh pattern aksar market ke downtrend ke baad banta hai, aur jab yeh banta hai, to yeh ek strong bullish trend ka signal hota hai. Is pattern mein har ek candle previous candle se zyada long aur strong hoti hai, jo market mein buying pressure ka indication hota hai.

### 2. **Three White Soldiers Pattern Ka Structure**

Three White Soldiers pattern mein total 3 candles hoti hain, jo sequentially ek doosre ke upar move karti hain. In candles ke structure ko samajhna zaroori hai:

- **Pehli Candlestick**: Pehli candlestick ek bullish candle hoti hai, jo market mein pehle se existing downtrend ko reverse karti hai. Yeh candle neechay se upar ki taraf move karti hai aur closing price pehle ke opening price se kaafi upar hoti hai. Pehli candle market mein momentum ka shuru hone ka signal hoti hai.

- **Doosri Candlestick**: Doosri candlestick bhi ek bullish candle hoti hai, jo pehli candle ke close ke baad ban ti hai. Yeh candle pehli candle ke close ke upar open hoti hai aur iski body kaafi long hoti hai, jo strong buying pressure ko indicate karti hai.

- **Teesri Candlestick**: Teesri candlestick bhi ek bullish candle hoti hai, jo doosri candle ke close ke upar open hoti hai. Yeh candle market mein strong bullish momentum ko confirm karti hai aur price ko upar ki taraf le jaati hai. Teesri candlestick sabse zyada important hoti hai, kyunki yeh pattern ke completion ko dikhati hai.

### 3. **Three White Soldiers Ka Kaise Kaam Karta Hai?**

Three White Soldiers pattern market ke downtrend ke baad banta hai aur jab yeh pattern banta hai, to yeh market mein bullish reversal ka signal deta hai. Is pattern mein har candle strong buying pressure ko show karti hai. Agar yeh pattern ek downtrend ke baad banta hai, to yeh indicate karta hai ki bears ka control toot gaya hai aur bulls market ko apne control mein le aaye hain.

Jab yeh pattern banta hai, to traders isse ek confirmation ke roop mein lete hain aur buying positions ko open karte hain. Agar yeh pattern ek existing uptrend ke beech mein ban raha ho, to yeh continuation ka signal de sakta hai.

### 4. **Three White Soldiers Ko Kaise Trade Karein?**

Three White Soldiers pattern ko trade karte waqt kuch important points ka dhyaan rakhna padta hai:

- **Entry Point**: Jab teesri candlestick complete hoti hai aur yeh bullish hoti hai, to yeh entry ka point hota hai. Aap buy position open kar sakte hain jab price teesri candlestick ke close ke upar jata hai.

- **Stop Loss**: Stop loss ko aap teesri candlestick ke low ke neeche set kar sakte hain. Isse aap apne trade ko protect kar sakte hain agar market aapke against move kare.

- **Target**: Target levels ko aap previous resistance levels ya next supply zone ke hisaab se set kar sakte hain. Agar pattern strong hai, to aap target ko thoda bada rakh sakte hain.

- **Confirmation Signals**: Three White Soldiers pattern ko identify karne ke baad, aapko additional confirmation signals ka use karna chahiye, jaise volume indicators. Agar volume increase ho raha hai aur price strong upward movement dikha raha hai, to pattern ka signal zyada reliable hota hai.

### 5. **Three White Soldiers Ke Benefits**

- **Strong Reversal Signal**: Yeh pattern strong bullish reversal signal deta hai. Agar yeh pattern downtrend ke baad banta hai, to yeh ek clear indication hota hai ki market direction change ho sakta hai.

- **Trend Continuation**: Agar yeh pattern existing uptrend ke beech mein banta hai, to yeh trend continuation ka signal de sakta hai. Is case mein, price upward move karte hue trend ko continue karta hai.

- **Simple to Identify**: Yeh pattern kaafi simple hota hai aur traders ke liye identify karna easy hota hai. Jab aapko yeh pattern dikhai de, to aap easily entry aur exit points decide kar sakte hain.

### 6. **Three White Soldiers Ke Limitations**

- **False Signals**: Jaise har candlestick pattern mein hota hai, Three White Soldiers pattern bhi kabhi kabhi false signals de sakta hai. Agar market mein sudden news ya events ho, to yeh pattern apne signal ko reverse kar sakta hai.

- **Need for Confirmation**: Yeh pattern apne aap mein kabhi kabhi false bhi ho sakta hai. Isliye, aapko volume ya momentum indicators ka use karke additional confirmation signals lene chahiye.

- **Risk of Reversal Failure**: Kabhi kabhi, pattern ka reversal fail ho sakta hai. Isliye, aapko stop loss aur risk management ka dhyaan rakhna zaroori hota hai.

### 7. **Conclusion**

Three White Soldiers ek powerful bullish candlestick pattern hai, jo market ke downtrend ke baad banta hai aur strong uptrend ka signal deta hai. Yeh pattern teen consecutive bullish candles par based hota hai, jo buying pressure ko indicate karti hain. Jab aap Three White Soldiers pattern ko sahi tarike se identify karte hain, to yeh aapko profitable trading opportunities de sakta hai. Lekin, aapko additional confirmation signals aur stop loss ka use karna zaroori hota hai taake aap apne risk ko manage kar sakein.

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 08:04 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим