How to trade the MACD

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

How to trade the MACD -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

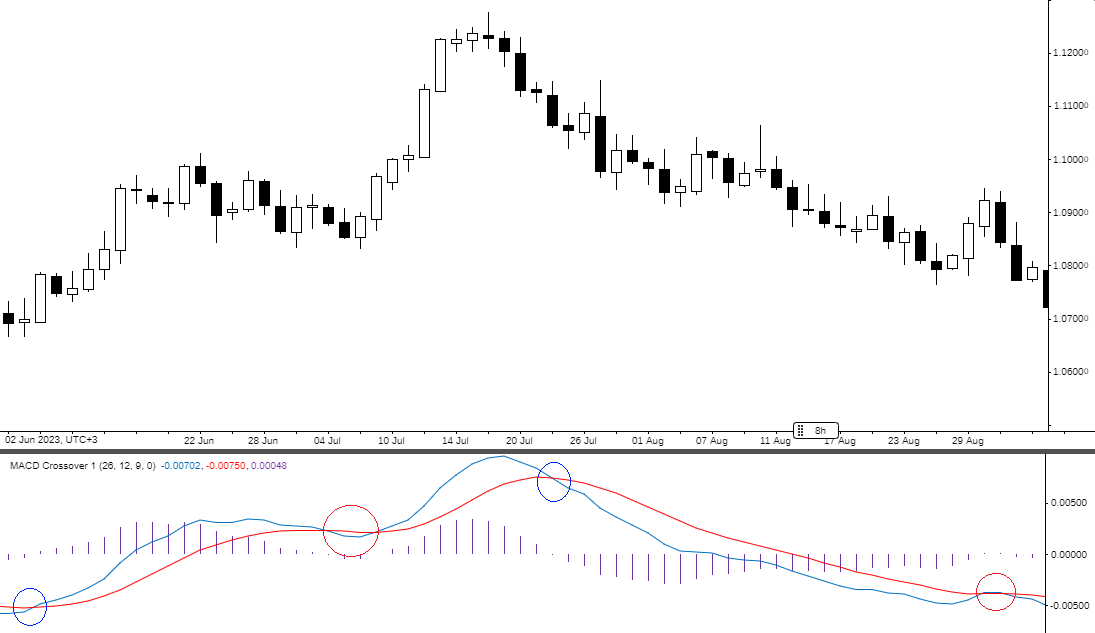

How to Trade the MACD Defination macd bohat se taajiron ke hathyaaron mein sab se ziyada taaqatwar takneeki tools mein se aik hai. isharay ka istemaal rujhan ki taaqat aur simt ko jhanchne ke sath sath ulat points ki wazahat ke liye kya jata hai. macd ka matlab moving average knorjns hai aur qeemat ke do moving ka talluq zahir karta hai . How to MACD work macd ke peechay bunyadi khayaal yeh hai ke yeh taweel mudti harkat pazeeri ost ko mukhtasir muddat ki harkat ost se hai. is terhan yeh rujhan ki pairwi karne walay isharay ko momentum one mein badal deta hai aur dono ki khususiyaat ko yakja karta hai. macd ki koi had nahi hai, lekin is ka aik sifar ka matlab hai, jis ke ird gird yeh harkat Pazeer ke aapas mein jurne, aik dosray ko katnay aur mukhtalif honay ki wajah se dohraya jata hai. hum ahangi is waqt hoti hai jab mutharrak ost aik dosray ki taraf barhatay hain. inhiraf is waqt hota hai jab mutharrak ost aik dosray se daur ho jatay hain. macd se oopar hai jab 12 ma 26- mudat ma se oopar hai aur 0 se neechay hai jab chhota ma taweel ma se neechay hai. nateejay ke tor par, ki misbet qadren taizi ke rujhan ki taraf ishara karti hain, jab ke manfi qadron ka matlab neechay ka rujhan hai . How to use the MACD in Forex trading macd kuch taajiron ke liye aik mufeed tool ho sakta hai. jab ke hum ne usay oopar parhnay ke tareeqa ke baray mein thori si wazahat ki hai, aayiyae yeh batatay hain ke yeh kaisay kaam karta hai. yeh taiz raftaar macd line aur signal line ke darmiyan farq ko zahir karta hai. traders macd ko aik momentum indicator ke tor par istemaal kar satke hain taakay market ke jazbaat mein tabdeeli se agay barh saken. ke sath teen mukhtalif anasir shaamil hain, jo aik bees line ke ird gird naqsha banaye gaye hain : macd line ( aik qaleel mudti ema se taweel mudti moving average ( ema ) ko ghatana ) signal line ( do emas ko ghatana aur no din ki harkat pazeeri ost banana ) ( signal line se macd line ko ghatana ) zehen mein rakhen, taham, ke is ki ghaltion ke baghair nahi aata hai. bohat se tajir aksar market ke jazbaat ki bunyaad par apni chalon ka taayun karne aur karne ke liye dosray tools aur ka istemaal karte hain, jaisay ke di gayi security ka tijarti hajam . -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamu Alaikum Dosto!MACD Indicator

Indicators trading strategies ki formation mein apni maojodgi ko barqarar rakhte hain. Maojoda waqt ke trader, chahe woh new ho ya expert pro, ko moqa nahi mil sakta ke woh automate signals ki madad par bharosa kare. MACD modern trading ke format mein mukammal taur par fit hota hai aur yeh ahem trading signals ka wide set paish karta hai.

Iske purane hone ke bawajood, yeh apni kashish nahi khota. Mukhtalif qualification ke tajir isay asaan aur mushkil trading strategies mein kamyabi se istemal karte hain, jisme MACD system ka laazim hissa hota hai.

1970 mein Gerald Appel, ek kamyab tajir aur mutafail analist, ne yeh khayal paaya ke ek aisa technical analysis tool banaya jaye jo oscillators aur trend indicators ki asal fawaid ko jama kare, inke nuksanat ko nikal kar.

Isi tarah MACD (Moving Average Convergence/Divergence) indicator tashkeel paya. Yeh ek technical analysis tool hai, jo do Moving Averages ke ittefaq aur tanaza ka hamil hone ka natija nikalta hai. MACD seedhe alfaz mein do mukhtalif Moving Averages ke hamil hone ka natija hai.

MACD ke peeche ke raaz yeh hai ke slow Moving Average lambi muddat ke market trend ko dikhata hai aur fast Moving Average dikhata hai ke trading floor mein abhi ya qareeb anay wale waqt mein kya hone wala hai. Agar in dono mein mukhtalif ziada farq ho, toh hum ek mazboot overbought ya oversold haalat ke baare mein baat kar sakte hain. Isi tarah, Moving Averages bhi aapas mein mukhtalif ho sakti hain, jo ke market mein price ki equilibrium halat ke banne ka ishara karta hai.

MACD indicator chart par aam tawar par Moving Averages ki tarah lagta hai, jin ka aapas mein takrao market mein dakhil hone ke liye signals deta hai. Lekin, MACD ka modern version aaj kal ek histogram hai, jisme se ek Moving Average ko ek line ki bajaye zero line par shuru hone wale vertical bars ke roop mein darust kiya gaya hai. Is liye MACD aaj kal line indicator aur histogram ke roop mein paish kiya jata hai.

MACD Kaise Kaam Karta Hai

Indicator ke positive target mein izafay ka tezi se barhna ye sabit karta hai ke jab price tezi se badh rahi hoti hai, tab fast average slow se pehle hota hai. Barabri ke mutabiq, in ke darmiyan faasla barh jata hai, jo ke histogram mein columns ke size mein izafay ke roop mein numayan hota hai.

Jab MACD ek taqatwar downtrend dikhata hai aur iski dynamics manfi zone mein hoti hain, toh hum baat kar sakte hain ek bearish trend ki - slow Moving Average phir se fast se nahi mil pata, lekin is bar wo price mein giravat hoti hai. Jab indicator ka harkat dhire ho jata hai, toh ye trend kamzor hone ka ishara hai - price ki dynamics mein kami slow Moving Average ko fast se qareeb anay ki ijaazat deti hai. In ki takrao chart par histogram ke zero point par hoti hai.

Histogram ke ilawa, is indicator mein do lines hain - pehli line khud indicator ki chart hai. Ise banane ke liye chhoti Moving Average ko lambi se minus kiya jata hai. Amooman, standard terminal settings mein, pehli 26 dinon ke liye aur dusri 12 dinon ke liye set ki jati hai, lekin ye zaruri nahi hai - MACD trader ke zarurat ke mutabiq set hota hai. Bohat se traders MACD line ko chart par chhupa dete hain taake isse agle element ke sath trade karte waqt gumrah na ho.

Dusri line signal line ke naam se hai aur khud MACD ki ek Moving Average hai. Is average ki classic lambai 9 hai, lekin ye bhi koi mustamil qaid nahi hai.

MACD Indicator Ki Configuration & Time Frame Ka Intikhab

Jab aap is indicator ke istemal se trade karna shuru karte hain, toh aapko khaas tawajjuh deni chahiye ke is analysis tool ko durust taur par kaam karne ke liye kon se parameters ke chunav kiye gaye hain. MACD ko tarteeb dena kuch khaas mushkil nahi hai. Is indicator ke 4 main parameters hote hain:- Fast Moving Average ke doura (period)

- Slow Moving Average ke doura (period)

- Signal Moving Average ke doura (period)

- calculation ke liye price

Agar market mein girawat ki taraf trade karna hai, toh MACD ke standard settings slow MA ke liye 26 aur fast MA ke liye 12 periods hote hain, is halat mein signal MA ke liye 9 periods hota hai, aur is case mein calculation ke liye candle ke band hone ki keemat hoti hai.

Agar market mein izafa ki taraf trade karna hai, toh parameters 26 aur 12 ko 17 aur 8 ke liye replace kiya jata hai. Ye settings is indicator ke istemal ke liye stock market mein tajir ke dwara recommended ki gayi hain. Bohat se tajir standard parameters ko badle bina MACD ko futures market aur forex mein bhi kamyabi se istemal karte hain.

MACD indicator kisi bhi time frame par istemal kiya ja sakta hai, lekin iski sabse asarandaz aur behtareen analysis H1 aur is se ooper ke time frames par hai. Indicator signals mein ek moayana lag (lag) hai jo kam time frame wale charts par pura mehsoos ho sakta hai. Isi tarah, kam time frames par ghair sahi signals bhi mumkin hain. Is liye MACD scalping strategies ke liye jin mein kam time frames hote hain, munasib nahi hai.

Yeh maqool hai ke is indicator ke saath trading H1 ya is se ooper ke time frames par ki jaye, lekin kai mahir tajireen ke mutabiq iska asal asar daily time frames mein hota hai. Iske ilawa, har koi is baat ka ilm nahi rakhta ke iski standard values 12, 26, aur 9 asal mein daily time frame ke liye taiyar ki gayi thi.

MACD Indicator Aur Uske Signals Ka Istemal Kaise Karein

MACD se hasil hone wale kai tarah ke signals hote hain. Pehla signal hai trend ki shakhsiyat aur taqat ke baare mein malumat: indicator ke dheere izafay se market mein trend movement ki mojoodgi ka andaza lagaya ja sakta hai, jabke histogram bars ke size uski taqat ko dikhata hai.

Iske ilawa, MACD tajireen ko munsalik nukta-e-raftaar ke baare mein malumat dene mein madad karta hai. Histogram par local extremums ki banawat reversal formation ke ishara ke tor par li jati hai. Lekin, samajhna chahiye ke inka zahoor hamesha trend ke ulte hone ki taraf signal nahi hai - is tarah ke signals ko test kiya jana chahiye.

Isi tarah, MACD tajaweez hai ke Moving Averages ke takrao ko wazeh kar sake, jo ke kai strategies mein market mein dakhil hone ka ishara hota hai. Isko chart par ek bar ke zero coordinate line ko cross karte waqt dikhaya jata hai. Histogram is line ko upar se neeche cross hone par sell ka signal aur neeche se upar cross hone par buy ka signal hai.

Iske ilawa, MACD apne apne Moving Average - signal line - ka cross hona aksar ek paish gawahi (warning) ke tor par istemal hota hai. For example, agar MACD line apne apne Moving Average ko neeche se upar cross karti hai aur zero ke neeche hai, toh isay khareedne ka pehla ishara samjha ja sakta hai.

Ek aur ahem signal divergence ya convergence hai. In formations ko mazeed tafseel se samajhne ke liye inhe mukammal tor par daryaft kiya jaye."

MACD Convergence & Divergence

Divergence aur Convergence MACD indicator k sab se relaible signals mein se aik hai. Is k elawa Divergence aur Convergence oscillators k sab se accurate signals bhi mane jate hen.

MACD mein 'D' harf Divergence ke liye khara hota hai - do EMAs ka iktifa (branching), jo ke is indicator ki bunyad hai. Chart par is ka looks yeh hai ke MACD histogram band ya zero line se kinaara hat raha hota hai. Is halat mein, keemaat market mein nai 'momentum' hasil karti hai, aur hum trend ki tezi ki baat kar sakte hain.

MACD mein 'C' ka abbreviation Convergence ke liye hai - do EMAs ka ittefaq, jo ke is indicator ki bunyad hain. Price chart par, yeh process MACD bar ya MACD histogram ki akhri hisse ki zero line ke saath ittefaq ki tarah dikhai deta hai.

Jaise ke pehle hi zikr hua hai, MACD divergence ek taqatwar signal hai. Agar trading chart par EMA indicator ka divergence hai, toh tajir ko position band karnay ya counter-trend position kholnay ka tawajo dena chahiye, kyun ke qareeb hi mustaqbil mein keemat ki taraf muddat badalne wala hai.

Is qaid se ikhtilaaf ho sakta hai agar divergence zero line ke qareeb nazar aata hai, as a rule, is case mein market ko halki correction aur trend movement ki jareh zarurat hoti hai.

Convergence itna taqatwar signal nahi hai, lekin iska zahoor MACD ke extremums par reversal movement ki taraf ishara karta hai.

MACD ke saath divergence/convergence aur doosre indicators jaise ke RSI, Stochastic, Alligator, support/resistance aur Fibonacci Retracement ka istemal karna aam taur par hota hai.

MACD Ka Chart Par Installation & Accurate Configuration

Installation

MACD indicator basic trading platforms ke set mein shamil hai aur ise select kiye gaye maali asset ke price chart par aasani se install kiya ja sakta hai. Indicator data basement window mein dikhaya jata hai aur yeh mukammal field ko load nahi karta, jahan additional graphical drawings ki zarurat hoti hai. MetaTrader terminals ke misal ke tor par, installation ka algorithm is tarah dikhai deta hai:- "Insert" menu ko Open karen;

- "Indicators" - "Oscillators" - MACD mein jaayen;

- Indicator settings ki window ko kholen aur agar zarurat ho to default parameters ko badal lein (different time frames ke liye yeh option relevant hai);

- Indicator settings ki window mein "ok" press karen.

Configuration

MACD ke parameters ko configure karne ka option "settings window" mein mojood hai aur isme EMA periods ke value ko select karne, prices ko apply karne, color scheme, aur display areas ko choose karne ka izazat hota hai.

EMA period settings ka sab se ahem kirdar hai, jo ke chuni gayi trading strategy (short-term, medium-term, long-term) ke mutabiq hone chahiye.

Settings badalne se indicator ki behavior mein tabdili hogi:- Agar aap EMA periods ki lambai badhaate hain, toh indicator behtar taur par false signals se niptega, lekin iske natije mein kuch faide ke signals ko 'qurbaan' karna padega.

- Agar aap EMA periods ko ghatate hain, toh MACD zyada sensitive ho jayega - signals ki tadad badhegi lekin market noise ko filter karne mein itna kargar nahi hoga.

MACD K Strategies

Chaliye woh sabse popular strategies dekhein jo MACD indicator aur histogram ka istemal karti hain. Shayad ek sabse mashhoor aur asaan strategy woh hai jo Stochastic aur MACD ke combination par mabni hai. Is strategy ko implement karne ke liye trader ko chahiye hoga:- Stochastic oscillator;

- MACD;

- EMA of period 200 (additional filter ke tor par).

System par trading H1 time frame mein ki jaati hai, woh trend ki taraf jo ek time interval upar maujood hai, yaani H4 time frame mein woh trend.

Buy order place karne ke liye, ye shartein zaroori hain:- MACD (standard settings ke saath) H4 chart mein zero level ke upar hai;

- Stochastic lines (settings ke saath 3, 5, 11) H1 time frame mein oversold area mein cross hoti hain (agar market volatile hai, toh overbought/oversold levels ko 20 aur 80 par set karen, jabke calm price movement mein - 30 aur 70 par).

Short position open karte waqt, shartein inverse hone chahiye:- MACD H4 chart mein zero level ke neeche hona chahiye;

- Stochastic lines H1 time frame mein overbought area mein cross hoti hain.

MACD - Stochastic strategy loss ko limit mein rakhne ka maqsad rakhti hai. Stop Loss najdik tareen local extremum ke peeche set kiya jata hai. Take Profit set nahi hota, market se bahir nikalne ka faisla support/resistance levels ke mutabiq ya trading system ke opposite signal ke mutabiq hota hai.

Ek doranay waqt mein, yeh trading system kai tajireen ke darmiyan mashhoor thi, aur is par MACD Stochastic trading advisor mabni gayi thi. Lekin, is naam ke strategy ke mukablay mein, yeh itna stable trading result nahi deti thi.

Ek aur kaafi kargar strategy, jo MACD par mabni hai, histogram ke extremum ke breakout par mabni hai:- MACD histogram ka zero level breakout karne par pehla extremum banata hai;

- Pehle extremum ki formation ke baad, ek chhota pullback hota hai, aur yeh almost hamesha ek aur extremum banane aur movement jaari rehne ke saath hota hai;

- Order pehle extremum ke zahoor hone ke baad hi lagaya jata hai, behtar yeh hai ke yeh candle ke peeche lagaya jaye jo woh extremum banata hai;

- Loss limitation ke liye Stop Loss zero line ke level par set kiya jata hai;

- Market se bahir nikalne ka faisla Take Profit ke zariye hota hai, jo ke loss limitation ke faaslay ka 2-3 guna hota hai.

Yeh strategy scalping trading systems ke kaafi mushabihat rakhti hai, lekin is case mein kaam zyada time frames mein hota hai.

MACD Indicator Ke Benifits & Drawbacks

Yeh koi aam baat nahi hai ke MACD ek basic aur versatile indicator mein se aik hai. Yeh lagbhag tamam time frames aur assets ke liye trading ke liye munasib hai. Yeh sirf forex mein hi nahi, balki stock, commodities, futures, aur cryptocurrency markets mein bhi istemal hota hai.

Iske signals beginners ke liye bhi asaan aur wazeh hote hain. Yeh Moving Average ya simple indicators jaise ke Stochastic ya RSI se zyada malumat deta hai.

Lekin yeh malumat ek pur-faqa trade ke liye kaafi nahi hoti. MACD apne aap mein kamzor hai aur is ne kai false signals diye hain. Isko munasib trading ke liye doosre indicators ke saath milana zaruri hai. Ant mein, MACD ki kargar taur par asar hone ki kamyabi doosre tools ke saath milne wale system par depend karegi.

MACD Indicator Istemal Karne Ke Liye Tips

Jo traders is indicator ko istemal karte hain, unhon ne kuch strategies note ki hain. Aapko trading ki kifayat ko behtar banane ke liye kuch tips ka khayal rakhna chahiye:- Indicators ka ittefaq. Sab se behtareen settings ke saath bhi, MACD false signals dene ki tendency rakhta hai. Inhe filter karne ke liye, behtar hai ke aap doosre indicators ka istemal karen jo aise signals ko confirm kar sakte hain.

- Discipline. Is tool ke saath kaam karte waqt, aapko chuni gayi strategy aur mal management ki mukhlis rahna chahiye, trades ke taayin shuda sizes se bahir na jana chahiye, risk/reward aur maballow drawdown ke ratio ko yaad rakhna chahiye.

- Lambi muddat ki trading. MACD ko scalper strategies mein istemal karne ke liye tayyar nahi kiya gaya hai, is liye iske saath kaam karne ke liye behtar hai ke aap zyada time frames ko chunen.

- Trend. Sab se zyada taqatwar MACD reversal signals bhi ek mazboot trend mein be asar hote hain. Is baat ko yaad rakhna zaruri hai, kyun ke ek mazboot trend mein bhi multiple divergences ek false signal ho sakti hain.

Yeh chand asaan strategies trading mein soorat-e-haal behtar banane mein madad karti hain, lekin yeh previous trading strategy mein iske kamyabi ke imkanat ko izafah nahi kar sakti. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#4 Collapse

MACD ek popular technical indicator hai jo price trends aur potential reversals ko identify karne ke liye use hota hai. Yeh indicator traders ko short-term aur long-term trends ko samajhne mein madad deta hai aur unhe profitable trading decisions lene mein assist karta hai.

MACD

MACD ek momentum oscillator hai jo do different moving averages ka difference calculate karta hai. Yeh do moving averages 26-period aur 12-period Exponential Moving Averages hain. MACD line 12-period EMA aur 26-period EMA ka difference hoti hai. Signal line, jo 9-period EMA hoti hai, MACD line ke upar plot ki jaati hai.

Components of MACD

MACD indicator ke kuch ahem components yeh hain:- MACD Line: 12-period EMA minus 26-period EMA.

- Signal Line: 9-period EMA of the MACD line.

- Histogram: MACD line aur Signal line ke darmiyan ka difference jo histogram form mein represent hota hai.

Trading Strategies

MACD ko trade karne ke liye kuch common strategies hain jo traders use karte hain:- MACD Line and Signal Line Crossovers

- Histogram Analysis

- Divergences

Yeh strategy bohot common aur simple hai. Jab MACD line Signal line ko cross karti hai, yeh ek trading signal generate karti hai.- Bullish Crossover : Jab MACD line Signal line ko neeche se upar cross karti hai, yeh ek buy signal hota hai. Iska matlab hai ke price uptrend mein ja sakti hai.

- Bearish Crossover : Jab MACD line Signal line ko upar se neeche cross karti hai, yeh ek sell signal hota hai. Iska matlab hai ke price downtrend mein ja sakti hai.

2. Histogram Analysis

MACD Histogram do lines ke darmiyan ke difference ko visually represent karta hai. Jab histogram positive territory mein hota hai aur barhe rahta hai, yeh ek bullish signal hota hai. Jab histogram negative territory mein hota hai aur girta rahta hai, yeh ek bearish signal hota hai.- Increasing Positive Histogram: Jab histogram positive ho aur increase kar raha ho, yeh trend continuation ka indication hota hai.

- Decreasing Negative Histogram: Jab histogram negative ho aur decrease kar raha ho, yeh bhi trend continuation ka indication hota hai.

3. Divergences

MACD Divergence tab hoti hai jab price aur MACD indicator opposite directions mein move karte hain. Divergences potential trend reversals ko indicate karte hain.- Bullish Divergence: Jab price lower lows banati hai lekin MACD higher lows banata hai, yeh ek bullish divergence hai aur potential uptrend ka indication hota hai.

- Bearish Divergence: Jab price higher highs banati hai lekin MACD lower highs banata hai, yeh ek bearish divergence hai aur potential downtrend ka indication hota hai.

Application of MACD

MACD ko effectively use karne ke liye kuch practical steps aur tips hain jo traders follow kar sakte hain:- Combine with Other Indicators: MACD ko akela use karna risky ho sakta hai. Isliye, isse other indicators jaise ke RSI aur Moving Averages ke saath combine karke use karna chahiye taake better confirmation mil sake.

- Identify Trends: MACD ka primary use trend identification aur trend reversal signals generate karna hota hai. Isliye, trend ko identify karna aur MACD signals ka accordingly use karna zaroori hai.

- Set Stop-Loss Orders: Har trade ke saath stop-loss orders set karna zaroori hai taake significant losses se bacha ja sake. MACD signals ka follow karte waqt, appropriate stop-loss levels ko set karna bhi zaroori hai.

- Practice with Demo Accounts: New traders ko MACD use karne se pehle demo accounts par practice karni chahiye taake woh is indicator ke signals aur strategies ko achi tarah samajh sakein.

- Monitor Economic News: Economic news aur events market movements ko significantly impact kar sakte hain. Isliye, MACD signals ke sath sath economic news ko bhi monitor karna chahiye.

Trade Using MACD

Consider karein ke aap ek stock trade kar rahe hain aur aap ne following steps follow kiye:- Identify Trend: Aapne dekha ke stock ek uptrend mein hai.

- Apply MACD: Aapne MACD indicator apply kiya aur dekha ke MACD line Signal line ko neeche se upar cross kar rahi hai .

- Confirm with RSI: Aapne RSI indicator apply kiya aur dekha ke RSI bhi overbought condition show nahi kar raha, yeh bullish signal ko confirm kar raha hai.

- Set Stop-Loss: Aapne apna stop-loss recent low ke neeche set kiya taake aap significant losses se bach sakein.

- Enter Trade: Aapne buy position enter ki aur trade ko monitor karte rahe.

- Monitor MACD and News: Aapne MACD histogram aur economic news ko monitor kiya taake timely exit decision le sakein.

- Exit Trade: Jab aapne dekha ke MACD line Signal line ko upar se neeche cross kar rahi hai (bearish crossover), to aapne sell position le li aur trade ko exit kar diya.

MACD ek powerful technical indicator hai jo traders ko price trends aur potential reversals ko identify karne mein madad deta hai. MACD line aur Signal line crossovers, histogram analysis, aur divergences kuch common strategies hain jo traders use karte hain profitable trading decisions lene ke liye. MACD ko effectively use karne ke liye other indicators ke sath combine karna, trends ko identify karna, aur stop-loss orders set karna zaroori hai. MACD signals ko practice karne aur economic news ko monitor karne se traders apni strategies ko enhance kar sakte hain aur stock market ki complexities ko behtar tor par navigate kar sakte hain.

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 08:40 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим