What is Inverted Hammer candlestick pattern?

`

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔ٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

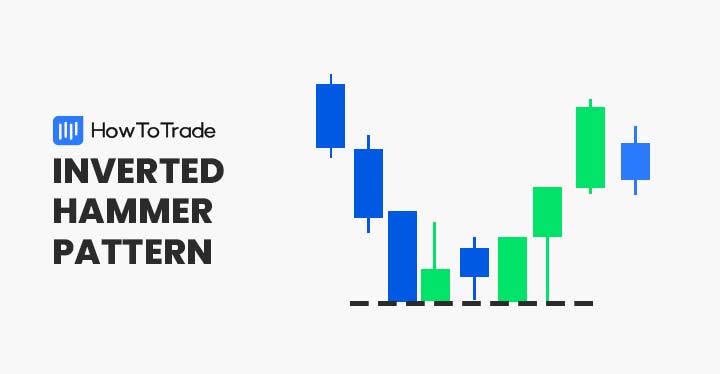

Kise he ap sab log aj is thread me apko me Pakistan forex trading ke ak bhot he important topic Inverted Hammer candlestick pattern ki importance ke bare Me btao ga or me umeed karta ho ke jo information me apse share Karo ga wo apke knowledge or experience me zaror izafa kare ge. What is Inverted Hammer candlestick pattern? Inverted Hammer candle stuck patteren ( ya ulta hathora ) aik candle stuck hai jo chart par is waqt zahir hoti hai jab kharidaron ki taraf se kisi asasay ki qeemat ko badhaane ka dabao hota hai. yeh aksar neechay ke rujhan ke nichale hissay mein zahir hota hai, mumkina taizi ke ulat jane ka ishara deta hai. ulta hathora patteren is ki shakal se is ka naam laita hai - yeh aik ulta hathora lagta hai. ulti hui hathori mom batii ko pehchanney ke liye, oopar ki lambi batii, aik choti nichli batii aur aik chhota sa jism talaash karen . Importance Aik ulti hathori candle stick is waqt banti hai jab taizi se tajir aetmaad haasil karna shuru karte hain. batii ka oopri hissa is waqt bantaa hai jab bail qeemat ko jahan tak woh kar satke hain berhate hain, jabkay batii ka nichala hissa reechh ( ya kam farokht karne walay ) ki wajah se hota hai jo ziyada qeemat ke khilaaf muzahmat karne ki koshish karte hain. taham, taizi ka rujhan bohat mazboot hai, aur market ziyada qeemat par tay karti hai. aik ulta hathora taajiron ko batata hai ke khredar market par dabao daal rahay hain. yeh mutnabba karta hai ke mandi ke rujhan ke baad qeemat mein rdobdl ho sakta hai. yeh yaad rakhna zaroori hai ke ulti hui hathori candle stick ko tanhai mein nahi dekha jana chahiye – hamesha izafi farmishnz ya takneeki isharay ke sath kisi bhi mumkina signal ki tasdeeq karen. aakhir mein, ultay hathoray par amal karne se pehlay –apne tijarti mansoobay se mahswara karen . Example farz karen ke aap Facebook ke hasas ki qeemat ko falo kar rahay hain, jo neechay ke rujhan par hai, aakhri baar $ 160. 06 par band sun-hwa. aglay din, yeh $ 160. 91 par khilta hai, intra day ki kam tareen $ 160. 52 aur ziyada $ 163. 80 ke sath. Facebook ke hasas ki qeemat $ 161. 38 par band hoti hai, aik ulta hathora patteren banata hai, jaisa ke zail mein dekha gaya hai. aglay do dinon mein, hasas ki qeemat $ 166. 55 tak barh jati hai, is baat ki tasdeeq karta hai ke ulta hathora taizi ke ulat jane ka ishara deta hai . -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Inverted Hammer candlestick pattern forex mein ek technical analysis tool hai jo price trends mein potential reversals ko identify karne ke liye istemal hota hai. Yeh pattern generally uptrend ke baad dikhta hai aur bearish reversal ka signal deta hai. Inverted Hammer ek single candlestick pattern hota hai jo traders ko price action analysis mein madad karta hai. Inverted Hammer pattern ki shape uske formation se pehle ki trend ke basis par identify ki jaati hai. Is pattern mein price initially uptrend mein hota hai, lekin candlestick formation ke baad price reversal ke chances increase ho jaate hain. Is pattern ko samajhne ke liye kuch key elements aur characteristics ko dhyan mein rakhna zaroori hai. Inverted Hammer pattern ka shape ek hammer ki tarah hota hai, jahan handle (nicha wala hissa) upside mein point hota hai aur head (upper wala hissa) downside mein point hota hai. Is pattern mein candlestick ka body chota hota hai aur upper shadow (head) bada hota hai. Lower shadow (handle) ideally ya toh bilkul na ho ya bahut chota ho. Is shape se pattern ko pehchanne mein madad milti hai. Inverted Hammer candlestick ka color trend ke basis par decide hota hai. Agar is pattern ka color green hai, toh ise bullish Inverted Hammer kaha jata hai aur ye bearish reversal ke baad bull trend ke indication ho sakta hai. Agar iska color red hai toh ise bearish Inverted Hammer kaha jata hai aur ye bullish reversal ke baad bear trend ke indication ho sakta hai. Inverted Hammer pattern mein upper shadow handle se zyada extend hota hai. Yeh shadow represents selling pressure ya profit booking ko indicate karta hai. Jitna lamba upper shadow hoga, utna strong reversal signal hai. Lower shadow ideally chota hota hai ya bilkul na hota hai. Agar handle ke neeche koi lower shadow hai, toh wo handle ki strength ko weak kar sakta hai. Isliye ideally lower shadow ka hona zaroori nahi hai. Inverted Hammer pattern ka interpretation traders ke liye crucial hota hai. Agar ye pattern uptrend ke baad dikhta hai, toh ye bearish reversal ka signal hai aur sell ki indication deta hai. Jab ye pattern confirm hota hai, toh traders short positions lena ya existing long positions ko close karna consider karte hain. Stop-loss orders ko properly place karna aur risk management ko dhyan mein rakhna bhi zaroori hai. Iske ilawa traders ko confirmation ke liye dusre technical indicators aur price patterns ka istemal karna chahiye. Inverted Hammer pattern single candlestick hai, isliye ek confirmatory candlestick pattern aur price action ki confirmation dekhna zaroori hai. Is pattern ko dusre indicators aur patterns ke saath milakar istemal karne se trading decisions ko validate karne mein madad milti hai. Kuch traders Fibonacci retracements, moving averages, ya trend lines jaise tools ka istemal karte hain Inverted Hammer pattern ke sath confirmatory signals dhoondhne ke liye. Is tarah ke tools ki madad se traders trend reversal points aur entry/exit levels ko identify kar sakte hain. Inverted Hammer pattern ke trading strategies aur signals bhi traders ke liye useful hote hain. Jab Inverted Hammer pattern uptrend ke baad dikhe aur confirm ho jaye, tab traders short positions lena ya existing long positions ko close karna consider karte hain. Stop-loss orders ko properly place karna aur risk management ko dhyan mein rakhna bhi zaroori hai.

Inverted Hammer pattern mein upper shadow handle se zyada extend hota hai. Yeh shadow represents selling pressure ya profit booking ko indicate karta hai. Jitna lamba upper shadow hoga, utna strong reversal signal hai. Lower shadow ideally chota hota hai ya bilkul na hota hai. Agar handle ke neeche koi lower shadow hai, toh wo handle ki strength ko weak kar sakta hai. Isliye ideally lower shadow ka hona zaroori nahi hai. Inverted Hammer pattern ka interpretation traders ke liye crucial hota hai. Agar ye pattern uptrend ke baad dikhta hai, toh ye bearish reversal ka signal hai aur sell ki indication deta hai. Jab ye pattern confirm hota hai, toh traders short positions lena ya existing long positions ko close karna consider karte hain. Stop-loss orders ko properly place karna aur risk management ko dhyan mein rakhna bhi zaroori hai. Iske ilawa traders ko confirmation ke liye dusre technical indicators aur price patterns ka istemal karna chahiye. Inverted Hammer pattern single candlestick hai, isliye ek confirmatory candlestick pattern aur price action ki confirmation dekhna zaroori hai. Is pattern ko dusre indicators aur patterns ke saath milakar istemal karne se trading decisions ko validate karne mein madad milti hai. Kuch traders Fibonacci retracements, moving averages, ya trend lines jaise tools ka istemal karte hain Inverted Hammer pattern ke sath confirmatory signals dhoondhne ke liye. Is tarah ke tools ki madad se traders trend reversal points aur entry/exit levels ko identify kar sakte hain. Inverted Hammer pattern ke trading strategies aur signals bhi traders ke liye useful hote hain. Jab Inverted Hammer pattern uptrend ke baad dikhe aur confirm ho jaye, tab traders short positions lena ya existing long positions ko close karna consider karte hain. Stop-loss orders ko properly place karna aur risk management ko dhyan mein rakhna bhi zaroori hai.  Inverted Hammer pattern ke saath ek aur variation hoti hai, jise Hanging Man pattern kehte hain. Hanging Man pattern Inverted Hammer pattern ki opposite formation hoti hai. Hanging Man pattern bhi single candlestick pattern hota hai, lekin isme handle upper side mein hota hai aur head lower side mein. Hanging Man pattern bearish reversal ka signal deta hai aur bullish trend ke baad dikhta hai. Inverted Hammer pattern ki successful identification aur trading strategies ko master karna experience aur practice ki zaroorat hai. Traders ko is pattern ke sath hone wali false signals aur market conditions ko bhi samajhna zaroori hai. Isliye, demo trading accounts mein practice karke aur real-time market analysis ke sath Inverted Hammer pattern ke proficiency ko develop karna zaroori hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Inverted Hammer pattern ke saath ek aur variation hoti hai, jise Hanging Man pattern kehte hain. Hanging Man pattern Inverted Hammer pattern ki opposite formation hoti hai. Hanging Man pattern bhi single candlestick pattern hota hai, lekin isme handle upper side mein hota hai aur head lower side mein. Hanging Man pattern bearish reversal ka signal deta hai aur bullish trend ke baad dikhta hai. Inverted Hammer pattern ki successful identification aur trading strategies ko master karna experience aur practice ki zaroorat hai. Traders ko is pattern ke sath hone wali false signals aur market conditions ko bhi samajhna zaroori hai. Isliye, demo trading accounts mein practice karke aur real-time market analysis ke sath Inverted Hammer pattern ke proficiency ko develop karna zaroori hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#4 Collapse

Asslam-O-Alaikum! Dear members Me ummed kerti hoke ap sb ka forex trading py kam bht acha chl rha hoga. Aj jis topic py hum baat kre gy wo Neeche mention hy. Topic: What is Inverted Hammer candlestick pattern Inverted hammer aik wahid japani candle stuck patteren hai .yeh aik taizi se reversal patteren hai . neechay ke rujhan mein, open kam hota hai, phir qeemat ziyada tijarat karti hai, lekin khulay ke qareeb band hojati hai . Inverted hammer candle stick patteren siyah ya safaid mom batii par mushtamil hota hai jo ulta hathora ki position mein hota hai . inverted hammer ka bearish version shooting star hai jo up trained ke baad hota hai . Explaination: lambay davn trained ke baad, inverted hammer ki tashkeel mein taizi hai kyunkay qeemat mein kami khuli qeemat ke qareeb mehdood thi . is ke bajaye, qeemat bherne ke qabil thi lekin baichnay walay wapas aaye aur qeemat ko khulay ke qareeb wapas dhakel diya . haqeeqat yeh hai ke qeematein numaya tor par bherne ke qabil theen is se zahir hota hai ke kharidari ka dabao hai . inverted hammer patteren ke baad agli candle stick ke douran jo kuch hota hai wohi taajiron ko andaza deta hai ke aaya qeemat mazeed barhay gi ya nahi . inverted hammer candlestick patteren ki shanakht karne ke liye, darj zail mayarat ko dekhen mom batii neechay ke rujhan ke baad honi chahiye . oopar ka saya mom batii ke jism ki oonchai se kam az kam do gina hona chahiye . neechay ka saya ya to mojood nahi hona chahiye ya bohat chhota hona chahiye . body trading range ke nichale siray par waqay honi chahiye . is chhootey jism ka rang ahem nahi hai, halaank yeh rang qadray ziyada taizi ya mandi ka taasub zahir kar sakta hai . khulasa tor par, inverted hammer neechay ke rujhan ke douran zahir hota hai jis mein aik lamba oopri saya ziyada qeematon ki koshish ki akkaasi karta hai, aur range ke nichale siray par aik chhota sa haqeeqi jism kharidaron aur farokht knndgan ke darmiyan peda honay walay tawazun ki akkaasi karta hai kyunkay baichnay walay kuch control kho chuke hain . ho sakta hai qeemat neechay tak pahonch gayi ho aur oopar jane ke liye tayyar ho . Inverted hammer candle stick ki tashkeel bunyadi tor par neechay ke rujhanaat ke neechay hoti hai aur mumkina rujhan ke ulat jane ki warning ke tor par kaam kar sakti hai . oopri saya jitna lamba hoga, ulat palat honay ka imkaan itna hi ziyada hoga . pichli mom batii ke qareeb se neechay ka farq aik mazboot ulat set karta hai . ulta hathora honay walay session par bara hajam is imkaan ko berhata hai ke baalo of taap waqay sun-hwa hai . aik safaid jism mein ziyada taizi ka taasub hota hai. aik siyah jism mein ziyada mandi ka taasub hota hai . -

#5 Collapse

Assalamualaikum! Umeed hai k ap sb khariyat sy hongy. R apky trading sessions achy jaa rhy hongy.Aj ka hmra or discussion topic "Inverted hammer candlestick pattern". Dekhty hain k ye hmein Kya information deta hai r hmry ilam Mai Kesy ezafa krta hai. Introduction candle stuck charting mein hathora qeemat ka aik Mein namona hai jo is waqt hota hai jab koi security –apne koi khilnay se numaya tor par kam tijarat karti hai, lekin iftitahi qeemat ke qareeb band honay ki muddat mein reliyan hoti hai. yeh namona hathoray ki shakal ki shama daan banata hai, jis mein nichala saya haqeeqi jism ke size se kam az kam dugna hota hai. candle stick ka body iftitahi aur band honay wali qeematon ke darmiyan farq ko zahir karta hai, jabkay shadow is muddat ke liye aala aur kam qeematon ko zahir karta hai . keysteps hathoray ki shammen aam tor par qeemat mein kami ke baad hoti hain. un ka aik chhota sa asli jism aur aik lamba nichala saya hai. hathora candle stick is waqt hoti hai jab baichnay walay qeemat mein kami ke douran market mein daakhil hotay hain. market band honay tak, khredar koi farokht ke dabao ko jazb karte hain aur market ki qeemat ko ibtidayi qeemat ke qareeb dhakel dete hain. band ho khilnay ki qeemat se oopar ya neechay ho sakta hai, acha halaank band khulay ke qareeb hona chahiye taakay koi candle stick ka asli body chhota rahay. nichala saya hua haqeeqi jism ki oonchai se kam az kam do gina hona to chahiye. hathora candle asterisk mumkina qeemat ke ulat jane ki nishandahi karti hai. hathoray ke baad qeemat ho barhna shuru ho jaye gi. usay tasdeeq kehte hain . Explanation hathoray farokht knndgan ki taraf se aik nichala hissa ho bananay ke liye mumkina had bandi ka ishara dete hain, jis ke sath qeemat mein izafay ke sath qeemat ki simt mein mumkina ulat phair ki nishandahi hoti hai. yeh sab aik hi muddat ke douran hota hai, jahan qeemat khilnay ke baad girty hai lekin khilnay wali qeemat ke qareeb band honay ke liye dobarah group ban jati hai. aik hathora" t" ki terhan nazar aana chahiye. yeh hathoray ki mom batii ki salahiyat ki nishandahi karta hai. aik hathora candle stick is waqt tak qeemat ke ulat jane ki nishandahi nahi karti jab tak ke is ki tasdeeq nah ho jaye. tasdeeq is waqt hoti hai jab ho hathoray ke baad candle hathoray ki band honay wali hue qeemat se oopar band ho jati hai. misali tor par, yeh es tasdeeqi mom batii mazboot khareed ko zahir karti hai. candle stuck ke tajir aam tor par confirmation candle ke douran ya is ke baad lambi pozishnon mein daakhil honay ya mukhtasir pozishnon se bahar nikaltay nazar ayen ge. nai lambi position lainay walon ke liye, hathoray ke saaye ke neechay aik stap nuqsaan rakha ja sakta hai. hathoray aam tor par tanhai mein istemaal nahi hotay hain, yahan tak ke tasdeeq ke sath. mom batii ke namonon ki mazeed tasdeeq ke liye tajir umooman qeemat ya rujhan ke tajzia, ya takneeki isharay ka istemaal karte hain. hathoray har waqt ke framon par hotay hain, Bashmole aik minute ke koi chart, rozana chart, aur hafta waar chart. Example chart qeemat mein kami ko zahir karta hai jis ke baad koi hathora patteren hota hai. is patteren mein aik lamba bhe nichala saya tha, jo asli jism se kayi gina lamba tha. Asa hathoray ne mumkina qeemat ke ulat jane ka ishara diya. tasdeeq agli mom batii par aayi, jis ne ziyada farq kya aur phir dekha ke qeemat hathoray ki band honay wali qeemat se qareeb qareeb tak boli jati hai. tajir aam tor par koi bhe tasdeeqi mom batii ke douran kharidne ke liye qadam ho rakhtay hain. aik stap nuqsaan hathoray ke nichale hissay se neechay rakha jata hai, ya mumkina tor par hathoray ke asli jism ke bilkul neechay rakha jata hai agar tasdeeqi ho mom batii ke douran qeemat jarehana tor par ziyada ho rahi ho . -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What is Inverted Hammer candlestick pattern? Kise he ap sab log aj is string me apko me Pakistan forex exchanging ke ak bhot he significant theme Reversed Sledge candle design ki significance ke exposed.Me btao ga or me umeed karta ho ke jo data me apse share Karo ga wo apke information or experience me zaror izafa kare ge.Transformed Sledge flame stuck patteren ( ya ulta hathora ) aik light stuck hai jo outline standard is waqt zahir hoti hai hit kharidaron ki taraf se kisi asasay ki qeemat ko badhaane ka dabao hota hai. yeh aksar neechay ke rujhan ke nichale hissay mein zahir hota hai, mumkina taizi ke ulat jane ka ishara deta hai. ulta hathora patteren is ki shakal se is ka naam laita hai - yeh aik ulta hathora lagta hai. ulti hui hathori mother batii ko pehchanney ke liye, oopar ki lambi batii, aik choti nichli batii aur aik chhota sa jism talaash karen Significance Aik ulti hathori candle is waqt banti hai hit taizi se tajir aetmaad haasil karna shuru karte hain. batii ka oopri hissa is waqt bantaa hai hit bail qeemat ko jahan tak woh kar satke hain berhate hain, jabkay batii ka nichala hissa reechh ( ya kam farokht karne walay ) ki wajah se hota hai jo ziyada qeemat ke khilaaf muzahmat karne ki koshish karte hain. taham, taizi ka rujhan bohat mazboot hai, aur market ziyada qeemat standard tay karti hai.

Aik ulta hathora taajiron ko batata hai ke khredar market standard dabao daal rahay hain. yeh mutnabba karta hai ke mandi ke rujhan ke baad qeemat mein rdobdl ho sakta hai. yeh yaad rakhna zaroori hai ke ulti hui hathori candle ko tanhai mein nahi dekha jana chahiye - hamesha izafi farmishnz ya takneeki isharay ke sath kisi bhi mumkina signal ki tasdeeq karen. aakhir mein, ultay hathoray standard amal karne se pehlay - apne tijarti mansoobay se mahswara karen .

Model farz karen ke aap Facebook ke hasas ki qeemat ko falo kar rahay hain, jo neechay ke rujhan standard hai, aakhri baar $ 160. 06 standard band sun-hwa. aglay racket, yeh $ 160. 91 standard khilta hai, intra day ki kam tareen $ 160. 52 aur ziyada $ 163. 80 ke sath. Facebook ke hasas ki qeemat $ 161. 38 standard band hoti hai, aik ulta hathora patteren banata hai, jaisa ke zail mein dekha gaya hai. aglay do dinon mein, hasas ki qeemat $ 166. 55 tak barh jati hai, is baat ki tasdeeq karta hai ke ulta hathora taizi ke ulat jane ka ishara deta hai .

Model farz karen ke aap Facebook ke hasas ki qeemat ko falo kar rahay hain, jo neechay ke rujhan standard hai, aakhri baar $ 160. 06 standard band sun-hwa. aglay racket, yeh $ 160. 91 standard khilta hai, intra day ki kam tareen $ 160. 52 aur ziyada $ 163. 80 ke sath. Facebook ke hasas ki qeemat $ 161. 38 standard band hoti hai, aik ulta hathora patteren banata hai, jaisa ke zail mein dekha gaya hai. aglay do dinon mein, hasas ki qeemat $ 166. 55 tak barh jati hai, is baat ki tasdeeq karta hai ke ulta hathora taizi ke ulat jane ka ishara deta hai .

-

#7 Collapse

forex exchanging ke ak bhot he significant theme Reversed Sledge candle design ki significance ke exposed.Me btao ga or me umeed karta ho ke jo data me apse share Karo ga wo apke information or experience me zaror izafa kare ge.Transformed Sledge flame stuck patteren ( ya ulta hathora ) aik light stuck hai jo outline standard is waqt zahir hoti hai hit kharidaron ki taraf se kisi asasay ki qeemat ko badhaane ka dabao hota hai. yeh aksar neechay ke rujhan ke nichale hissay mein zahir hota hai, mumkina taizi ke ulat jane ka ishara deta hai. ulta hathora patteren is ki shakal se is ka naam laita hai - yeh aik ulta hathora lagta hai. ulti hui hathori mother batii ko pehchanney ke liye, oopar ki lambi batii, aik choti nichli batii aur aik chhota sa jism talaash karen Significance Aik ulti hathori candle is waqt banti hai hit taizi se tajir aetmaad haasil karna shuru karte hain. batii ka oopri hissa is waqt bantaa hai hit bail qeemat ko jahan tak woh kar satke hain berhate hain, jabkay batii ka nichala hissa reechh ( ya kam farokht karne walay ) ki wajah se hota hai jo ziyada qeemat ke khilaaf muzahmat karne ki koshish karte hain. taham, taizi ka rujhan bohat mazboot hai, aur market ziyada qeemat standard tay karti hai.

Aik ulta hathora taajiron ko batata hai ke khredar market standard dabao daal rahay hain. yeh mutnabba karta hai ke mandi ke rujhan ke baad qeemat mein rdobdl ho sakta hai. yeh yaad rakhna zaroori hai ke ulti hui hathori candle ko tanhai mein nahi dekha jana chahiye - hamesha izafi farmishnz ya takneeki isharay ke sath kisi bhi mumkina signal ki tasdeeq karen. aakhir mein, ultay hathoray standard amal karne se pehlay - apne tijarti mansoobay se mahswara karentechnical indicators aur price patterns ka istemal karna chahiye. Inverted Hammer pattern single candlestick hai, isliye ek confirmatory candlestick pattern aur price action ki confirmation dekhna zaroori hai. Is pattern ko dusre indicators aur patterns ke saath milakar istemal karne se trading decisions ko validate karne mein madad milti hai. Kuch traders Fibonacci retracements, moving averages, ya trend lines jaise tools ka istemal karte hain Inverted Hammer pattern ke sath confirmatory signals dhoondhne ke liye. Is tarah ke tools ki madad se traders trend reversal points aur entry/exit levels ko identify kar sakte hain. Inverted Hammer pattern ke trading strategies aur signals bhi traders ke liye useful hote hain. Jab Inverted Hammer pattern uptrend ke baad dikhe aur confirm ho jaye, tab traders short positions lena ya existing long positions ko close karna consider karte hain. Stop-loss orders ko properly place karna aur risk management ko dhyan mein rakhna bhi zaroori hai.

-

#8 Collapse

What is Inverted Hammer candlestick pattern:? INTRODCUTION&EXPLANATION: sirr, My dear sweet members,jesa keh ap janty hein keh,Inverted Hammer candlestick pattern forex mein ek technical analysis tool hai jo price trends mein potential reversals ko identify karne ke liye istemal hota hai. Yeh pattern generally uptrend ke baad dikhta hai aur bearish reversal ka signal deta hai. Inverted Hammer ek single candlestick pattern hota hai jo traders ko price action analysis mein madad karta hai. Inverted Hammer pattern ki shape uske formation se pehle ki trend ke basis par identify ki jaati hai. Is pattern mein price initially uptrend mein hota hai, lekin candlestick formation ke baad price reversal ke chances increase ho jaate hain. Is pattern ko samajhne ke liye kuch key elements aur characteristics ko dhyan mein rakhna zaroori hai. 1. Inverted Hammer pattern ka shape ek hammer ki tarah hota hai, jahan handle (nicha wala hissa) upside mein point hota hai aur head (upper wala hissa) downside mein point hota hai. Is pattern mein candlestick ka body chota hota hai aur upper shadow (head) bada hota hai. Lower shadow (handle) ideally ya toh bilkul na ho ya bahut chota ho. Is shape se pattern ko pehchanne mein madad milti hai. Inverted Hammer candlestick ka color trend ke basis par decide hota hai. Agar is pattern ka color green hai, toh ise bullish Inverted Hammer kaha jata hai aur ye bearish reversal ke baad bull trend ke indication ho sakta hai. Agar iska color red hai toh ise bearish Inverted Hammer kaha jata hai aur ye bullish reversal ke baad bear trend ke indication ho sakta hai. Inverted Hammer pattern mein upper shadow handle se zyada extend hota hai. Yeh shadow represents selling pressure ya profit booking ko indicate karta hai. Jitna lamba upper shadow hoga, utna strong reversal signal hai. Lower shadow ideally chota hota hai ya bilkul na hota hai. Agar handle ke neeche koi lower shadow hai, toh wo handle ki strength ko weak kar sakta hai. Isliye ideally lower shadow ka hona zaroori nahi hai. Inverted Hammer pattern ka interpretation traders ke liye crucial hota hai. Agar ye pattern uptrend ke baad dikhta hai, toh ye bearish reversal ka signal hai aur sell ki indication deta hai. Jab ye pattern confirm hota hai, toh traders short positions lena ya existing long positions ko close karna consider karte hain. Stop-loss orders ko properly place karna aur risk management ko dhyan mein rakhna bhi zaroori hai. Iske ilawa traders ko confirmation ke liye dusre technical indicators aur price patterns ka istemal karna chahiye. Inverted Hammer pattern single candlestick hai, isliye ek confirmatory candlestick pattern aur price action ki confirmation dekhna zaroori hai. Is pattern ko dusre indicators aur patterns ke saath milakar istemal karne se trading decisions ko validate karne mein madad milti hai. Kuch traders Fibonacci retracements, moving averages, ya trend lines jaise tools ka istemal karte hain Inverted Hammer pattern ke sath confirmatory signals dhoondhne ke liye. Is tarah ke tools ki madad se traders trend reversal points aur entry/exit levels ko identify kar sakte hain. Inverted Hammer pattern ke trading strategies aur signals bhi traders ke liye useful hote hain. Jab Inverted Hammer pattern uptrend ke baad dikhe aur confirm ho jaye, tab traders short positions lena ya existing long positions ko close karna consider karte hain. Stop-loss orders ko properly place karna aur risk management ko dhyan mein rakhna bhi zaroori hai.

Inverted Hammer pattern mein upper shadow handle se zyada extend hota hai. Yeh shadow represents selling pressure ya profit booking ko indicate karta hai. Jitna lamba upper shadow hoga, utna strong reversal signal hai. Lower shadow ideally chota hota hai ya bilkul na hota hai. Agar handle ke neeche koi lower shadow hai, toh wo handle ki strength ko weak kar sakta hai. Isliye ideally lower shadow ka hona zaroori nahi hai. Inverted Hammer pattern ka interpretation traders ke liye crucial hota hai. Agar ye pattern uptrend ke baad dikhta hai, toh ye bearish reversal ka signal hai aur sell ki indication deta hai. Jab ye pattern confirm hota hai, toh traders short positions lena ya existing long positions ko close karna consider karte hain. Stop-loss orders ko properly place karna aur risk management ko dhyan mein rakhna bhi zaroori hai. Iske ilawa traders ko confirmation ke liye dusre technical indicators aur price patterns ka istemal karna chahiye. Inverted Hammer pattern single candlestick hai, isliye ek confirmatory candlestick pattern aur price action ki confirmation dekhna zaroori hai. Is pattern ko dusre indicators aur patterns ke saath milakar istemal karne se trading decisions ko validate karne mein madad milti hai. Kuch traders Fibonacci retracements, moving averages, ya trend lines jaise tools ka istemal karte hain Inverted Hammer pattern ke sath confirmatory signals dhoondhne ke liye. Is tarah ke tools ki madad se traders trend reversal points aur entry/exit levels ko identify kar sakte hain. Inverted Hammer pattern ke trading strategies aur signals bhi traders ke liye useful hote hain. Jab Inverted Hammer pattern uptrend ke baad dikhe aur confirm ho jaye, tab traders short positions lena ya existing long positions ko close karna consider karte hain. Stop-loss orders ko properly place karna aur risk management ko dhyan mein rakhna bhi zaroori hai.  Inverted Hammer pattern ke saath ek aur variation hoti hai, jise Hanging Man pattern kehte hain. Hanging Man pattern Inverted Hammer pattern ki opposite formation hoti hai. Hanging Man pattern bhi single candlestick pattern hota hai, lekin isme handle upper side mein hota hai aur head lower side mein. Hanging Man pattern bearish reversal ka signal deta hai aur bullish trend ke baad dikhta hai. Inverted Hammer pattern ki successful identification aur trading strategies ko master karna experience aur practice ki zaroorat hai. Traders ko is pattern ke sath hone wali false signals aur market conditions ko bhi samajhna zaroori hai. Isliye, demo trading accounts mein practice karke aur real-time market analysis ke sath Inverted Hammer pattern ke proficiency ko develop karna zaroori hai.[/INDENT][/COLOR] THANKS TO ALL MY SWEET MEMBERS..........,,,,,,,,,,,,,,

Inverted Hammer pattern ke saath ek aur variation hoti hai, jise Hanging Man pattern kehte hain. Hanging Man pattern Inverted Hammer pattern ki opposite formation hoti hai. Hanging Man pattern bhi single candlestick pattern hota hai, lekin isme handle upper side mein hota hai aur head lower side mein. Hanging Man pattern bearish reversal ka signal deta hai aur bullish trend ke baad dikhta hai. Inverted Hammer pattern ki successful identification aur trading strategies ko master karna experience aur practice ki zaroorat hai. Traders ko is pattern ke sath hone wali false signals aur market conditions ko bhi samajhna zaroori hai. Isliye, demo trading accounts mein practice karke aur real-time market analysis ke sath Inverted Hammer pattern ke proficiency ko develop karna zaroori hai.[/INDENT][/COLOR] THANKS TO ALL MY SWEET MEMBERS..........,,,,,,,,,,,,,,

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Inverted Hammer Candlestick Pattern : Inverted Hammer candlestick pattern forex trading mein ek popular price action signal hai. Yecandlestick pattern bullish reversal ke indication ke liye istemal kiya jata hai. Is article mein, huminverted hammer candlestick pattern ke bare mein detail se baat karenge. 1. Introduction: Inverted Hammer ek single candlestick pattern hai, jo traders ke liye ek bullish reversal signalprovide karta hai. Ye candlestick pattern, price action analysis ke liye important hai aur forextraders iska use apni trading strategy mein karte hain. 2. Shape aur Appearance: Inverted Hammer, ek small body aur upper shadow wali candle hoti hai, jiska lower shadow nake barabar hota hai. Ye candlestick pattern, long lower shadow ke sath hoti hai, jabki body aurupper shadow chote hote hain. Iski appearance ki wajah se ise inverted hammer kaha jata hai. 3. Interpretation: Inverted Hammer candlestick pattern ko dekh kar, traders bullish reversal ki expectation rakhtehain. Iska interpretation ye hota hai ke price downtrend ke baad, market sentiment bullish horaha hai. Ye candlestick pattern, ek bullish trend reversal ke liye important signal hai. 4. Confirmation: Inverted Hammer candlestick pattern ki confirmation traders ko next candle ki performance semilta hai. Agar next candle bullish candle hai aur price higher level par close karta hai tou iskamatlab hai keh bullish trend start hone ki chances hain. Agar next candle bearish candle hai touiska matlab hai keh trend reversal ki jagah continuation ho sakti hai. 5. Trading Strategy: Inverted Hammer candlestick pattern ko identify karne ke baad, traders long position enter kartehain. Stop loss order, lower shadow ke niche set kiya jata hai. Target profit, previous resistancelevel ke near rakha jata hai. Traders, is trading strategy ko confirm karne ke liye, volume aurother indicators ka bhi use karte hain. 6. Conclusion: Inverted Hammer candlestick pattern, forex trading mein ek popular bullish reversal signal hai.Iske appearance aur interpretation ko samajhna traders ke liye important hai. Iske sath hi,trading strategy ko effectively implement karne ke liye, stop loss order aur target profit ka usekarna bhi important hai. -

#10 Collapse

Inverted pattern ka introduction kya hy???? pattern forex mein ek technical analysis tool hai jo price trends mein potential reversals ko identify karne ke liye istemal hota hai. Yeh pattern generally uptrend ke baad dikhta hai aur bearish reversal ka signal deta hai. Inverted Hammer ek single candlestick pattern hota hai jo traders ko price action analysis mein madad karta hai. Inverted Hammer pattern ki shape uske formation se pehle ki trend ke basis par identify ki jaati hai. Is pattern mein price initially uptrend mein hota hai, lekin candlestick formation ke baad price reversal ke chances increase ho jaate hain. Is pattern ko samajhne ke liye kuch key elements aur characteristics ko dhyan mein rakhna zaroori hai.Inverted Hammer pattern ka shape ek hammer ki tarah hota hai, jahan handle (nicha wala hissa) upside mein point hota hai aur head (upper wala hissa) downside mein point hota hai. Is pattern mein candlestick ka body chota hota hai aur upper shadow (head) bada hota hai. Lower shadow (handle) ideally ya toh bilkul na ho ya bahut chota ho. Is shape se pattern ko pehchanne mein madad milti hai. Inverted Hammer candlestick ka color trend ke basis par decide hota hai. Inverted hammer pattern ki phchan aur Importance kya hy pattern mein upper shadow handle se zyada extend hota hai. Yeh shadow represents selling pressure ya profit booking ko indicate karta hai. Jitna lamba upper shadow hoga, utna strong reversal signal hai. Lower shadow ideally chota hota hai ya bilkul na hota hai. Agar handle ke neeche koi lower shadow hai, toh wo handle ki strength ko weak kar sakta hai. Isliye ideally lower shadow ka hona zaroori nahi hai. Inverted Hammer pattern ka interpretation traders ke liye crucial hota hai. Agar ye pattern uptrend ke baad dikhta hai, toh ye bearish reversal ka signal hai aur sell ki indication deta hai. Jab ye pattern confirm hota hai, toh traders short positions lena ya existing long positions ko close karna consider karte hain. Stop-loss orders ko properly place karna aur risk management ko dhyan mein rakhna bhi zaroori hai.Iske ilawa traders ko confirmation ke liye dusre technical indicators aur price patterns ka istemal karna chahiye. Inverted Hammer pattern single candlestick hai, isliye ek confirmatory candlestick pattern aur price action ki confirmation dekhna zaroori hai. Is pattern ko dusre indicators aur patterns ke saath milakar istemal karne se trading decisions ko validate karne mein madad milti hai. Kuch traders Fibonacci retracements, moving averages, ya trend lines jaise tools ka istemal karte hain Inverted Hammer pattern ke sath confirmatory signals dhoondhne ke liye. Is tarah ke tools ki madad se traders trend reversal points aur entry/exit levels ko identify kar sakte hain. Inverted Hammer pattern ke trading strategies aur signals bhi traders ke liye useful hote hain.

Inverted hammer pattern ki phchan aur Importance kya hy pattern mein upper shadow handle se zyada extend hota hai. Yeh shadow represents selling pressure ya profit booking ko indicate karta hai. Jitna lamba upper shadow hoga, utna strong reversal signal hai. Lower shadow ideally chota hota hai ya bilkul na hota hai. Agar handle ke neeche koi lower shadow hai, toh wo handle ki strength ko weak kar sakta hai. Isliye ideally lower shadow ka hona zaroori nahi hai. Inverted Hammer pattern ka interpretation traders ke liye crucial hota hai. Agar ye pattern uptrend ke baad dikhta hai, toh ye bearish reversal ka signal hai aur sell ki indication deta hai. Jab ye pattern confirm hota hai, toh traders short positions lena ya existing long positions ko close karna consider karte hain. Stop-loss orders ko properly place karna aur risk management ko dhyan mein rakhna bhi zaroori hai.Iske ilawa traders ko confirmation ke liye dusre technical indicators aur price patterns ka istemal karna chahiye. Inverted Hammer pattern single candlestick hai, isliye ek confirmatory candlestick pattern aur price action ki confirmation dekhna zaroori hai. Is pattern ko dusre indicators aur patterns ke saath milakar istemal karne se trading decisions ko validate karne mein madad milti hai. Kuch traders Fibonacci retracements, moving averages, ya trend lines jaise tools ka istemal karte hain Inverted Hammer pattern ke sath confirmatory signals dhoondhne ke liye. Is tarah ke tools ki madad se traders trend reversal points aur entry/exit levels ko identify kar sakte hain. Inverted Hammer pattern ke trading strategies aur signals bhi traders ke liye useful hote hain.  Inverted pattern min Tijrat kasy krty hy??? pattern ke saath ek aur variation hoti hai, jise Hanging Man pattern kehte hain. Hanging Man pattern Inverted Hammer pattern ki opposite formation hoti hai. Hanging Man pattern bhi single candlestick pattern hota hai, lekin isme handle upper side mein hota hai aur head lower side mein. Hanging Man pattern bearish reversal ka signal deta hai aur bullish trend ke baad dikhta hai. Inverted Hammer pattern ki successful identification aur trading strategies ko master karna experience aur practice ki zaroorat hai. Traders ko is pattern ke sath hone wali false signals aur market conditions ko bhi samajhna zaroori hai.

Inverted pattern min Tijrat kasy krty hy??? pattern ke saath ek aur variation hoti hai, jise Hanging Man pattern kehte hain. Hanging Man pattern Inverted Hammer pattern ki opposite formation hoti hai. Hanging Man pattern bhi single candlestick pattern hota hai, lekin isme handle upper side mein hota hai aur head lower side mein. Hanging Man pattern bearish reversal ka signal deta hai aur bullish trend ke baad dikhta hai. Inverted Hammer pattern ki successful identification aur trading strategies ko master karna experience aur practice ki zaroorat hai. Traders ko is pattern ke sath hone wali false signals aur market conditions ko bhi samajhna zaroori hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#11 Collapse

What is Modified Sledge candle design? Modified Sledge light stuck patteren ( ya ulta Modified Sledge light stuck patteren ( ya ulta hathora ) aik candle stuck hai jo diagram standard is waqt zahir hoti hai punch kharidaron ki taraf se kisi asasay ki qeemat ko badhaane ka dabao hota hai. yeh aksar neechay ke rujhan ke nichale hissay mein zahir hota hai, mumkina taizi ke ulat jane ka ishara deta hai. ulta hathora patteren is ki shakal se is ka naam laita hai - yeh aik ulta hathora lagta hai. ulti hui hathori mother batii ko pehchanney ke liye, oopar ki lambi batii, aik choti nichli batii aur aik chhota sa jism talaash karen . SignificanceAik ulti hathori candle is waqt banti hai punch taizi se tajir aetmaad haasil karna shuru karte hain. batii ka oopri hissa is waqt bantaa hai punch bail qeemat ko jahan tak woh kar satke hain berhate hain, jabkay batii ka nichala hissa reechh ( ya kam farokht karne walay ) ki wajah se hota hai jo ziyada qeemat ke khilaaf muzahmat karne ki koshish karte hain. taham, taizi ka rujhan bohat mazboot hai, aur market ziyada qeemat standard tay karti hai. aik ulta hathora taajiron ko batata hai ke khredar market standard dabao daal rahay hain. yeh mutnabba karta hai ke mandi ke rujhan ke baad qeemat mein rdobdl ho sakta hai. yeh yaad rakhna zaroori hai ke ulti hui hathori candle ko tanhai mein nahi dekha jana chahiye - hamesha izafi farmishnz ya takneeki isharay ke sath kisi bhi mumkina signal ki tasdeeq karen. aakhir mein, ultay hathoray standard amal karne se pehlay - apne tijarti mansoobay se mahswara karen . Modelfarz karen ke aap Facebook ke hasas ki qeemat ko falo kar rahay hain, jo neechay ke rujhan standard hai, aakhri baar $ 160. 06 standard band sun-hwa. aglay racket, yeh $ 160. 91 standard khilta hai, intra day ki kam tareen $ 160. 52 aur ziyada $ 163. 80 ke sath. Facebook ke hasas ki qeemat $ 161. 38 standard band hoti hai, aik ulta hathora patteren banata hai, jaisa ke zail mein dekha gaya hai. aglay do dinon mein, hasas ki qeemat $ 166. 55 tak barh jati hai, is baat ki tasdeeq karta hai ke ulta hathora taizi ke ulat jane ka ishara deta hai .

- Mentions 0

-

سا0 like

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 01:15 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим