Complete guide to profit trade earning via Fibonacci retracement indicator

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

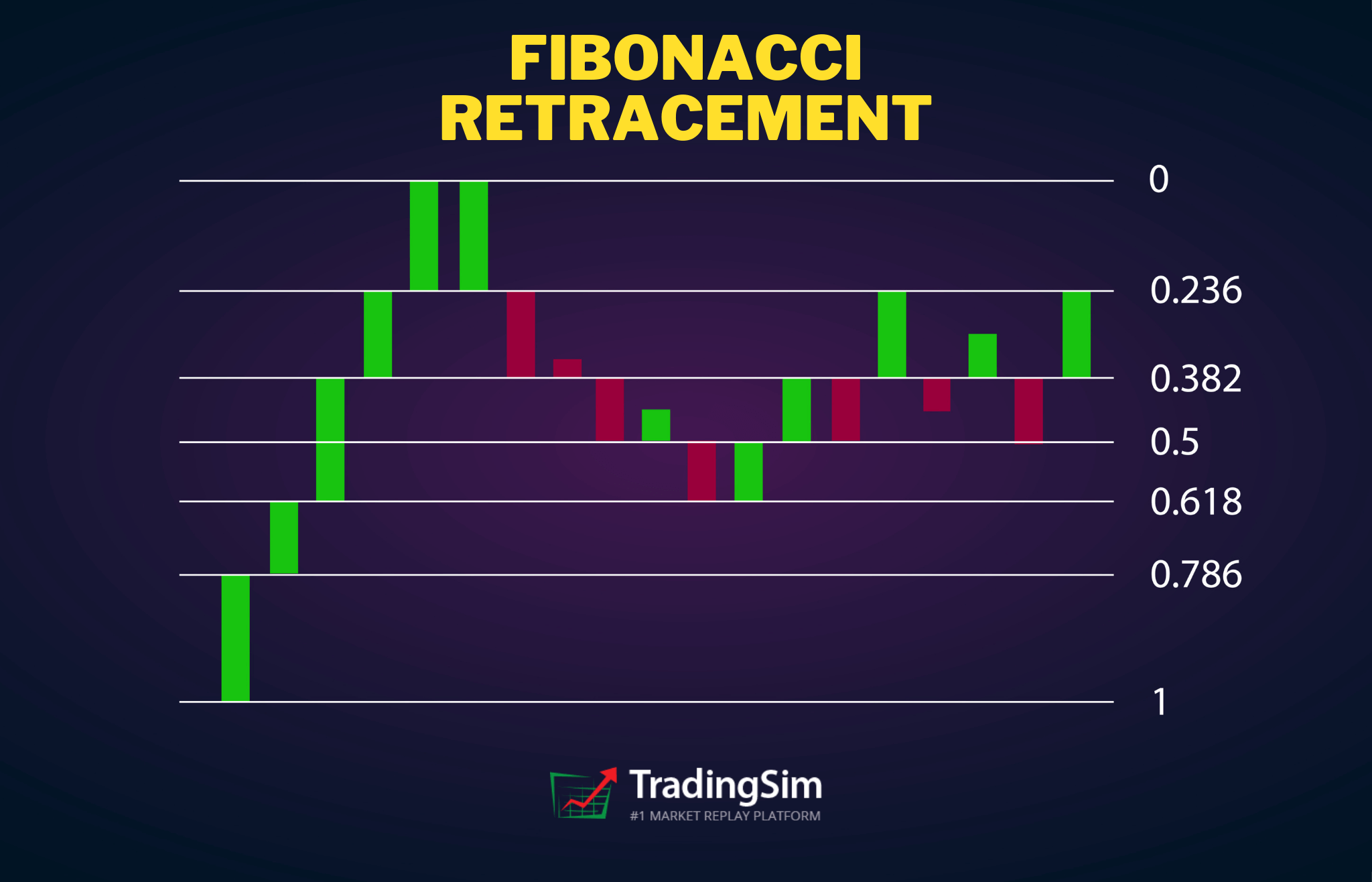

FIBONACCI RETRACEMENT INDICATORBASIC INFO Fibonacci retracement indicator Fibonacci retracement indicator ka istemal trading aur technical analysis mein hota hai. Iska concept Fibonacci sequence aur Golden ratio se juda hai. Fibonacci sequence mein har number pehle do numbers ka sum hota hai, jaise ke 0, 1, 1, 2, 3, 5, 8, 13, 21, aur aage aise hi chalta rehta hai. Golden ratio, ya phi (1.618) bhi Fibonacci sequence mein paya jata hai. DETAILS Fibonacci retracement indicator trading charts pe horizontal lines ka set hota hai, jinhe Fibonacci levels kaha jata hai. Ye levels major price movements aur trends ke important support aur resistance levels ko darshate hain. Fibonacci levels ki values 0%, 23.6%, 38.2%, 50%, 61.8%, 78.6%, aur 100% hote hain. TIPS FOR TRADERS Is indicator ka istemal karke traders past price trends aur movements analyze karte hain. Jab kisi stock ya market ki price upar jati hai, toh traders Fibonacci retracement levels pe focus karte hain. Ye levels indicate karte hain ke kis level pe price reversal ho sakta hai ya support/resistance mil sakta hai. Fibonacci retracement formula ka istemal karke, Fibonacci levels ko calculate kiya jata hai. Ye formula ye calculation karta hai: High point se low point tak ka price range calculate karen. Us price range ko Fibonacci ratios (0%, 23.6%, 38.2%, 50%, 61.8%, 78.6%, 100%) se multiply karen. Resulting values Fibonacci retracement levels honge.Fibonacci retracement indicator traders ko price levels provide karta hai jin pe price reversal ho sakta hai. Agar price kisi Fibonacci level se bounce back karta hai, toh ye indicate karta hai ke trend continue ho sakta hai. Agar price kisi Fibonacci level ko cross kar deta hai, toh ye indicate karta hai ke trend change ho sakta hai. TRADING STRATEGY Fibonacci retracement indicator ka istemaal karke trading strategy ko nechy byaan kiya jata hy STEP 1 Trend ka pehchan karen: Fibonacci retracement indicator ko istemaal karne se pehle, trend ka pehchan karna zaruri hai. Agar aap uptrend (price ka barhna) ya downtrend (price ka ghatna) ko identify kar sakte hain, toh aap Fibonacci retracement indicator ko sahi tareeke se istemaal kar payenge. STEP 2 Swing high aur swing low points ko mark karen: Swing high point wo point hota hai jahan price ka movement trend mein upar ki taraf ruk jata hai aur swing low point wo point hota hai jahan price ka movement trend mein neeche ki taraf ruk jata hai. In points ko identify karen aur unko chart par mark karen. STEP 3 Fibonacci retracement levels ko plot karen: Fibonacci retracement levels 0%, 23.6%, 38.2%, 50%, 61.8% aur 100% hote hain. In levels ko Fibonacci retracement indicator ke zariye chart par plot karen. Ye levels price movement ke retracement areas ko represent karte hain. STEP 4 Entry aur exit points ka tayyari karen: Fibonacci retracement levels ko istemaal karke entry aur exit points tayyar karen. Agar price retracement ke dauran kisi Fibonacci level tak pahunchta hai, toh aap entry ya exit ka faisla kar sakte hain. STEP 5 Risk aur reward ka ratio tayyar karen: Har trade mein risk aur reward ka ratio tayyar karna zaruri hai. Fibonacci retracement levels se aap price ka retracement area aur stop loss tayyar kar sakte hain. Iske saath hi profit target ko bhi determine karen, jisko aapko Fibonacci extension levels ke zariye plot kar sakte hain. STEP 6 Stop loss aur take profit orders lagayen: Apne trading plan ke mutabik stop loss aur take profit orders lagayen. Stop loss order aapko trade ko khatam karne ka point provide karta hai, jab price aapke expected direction ke khilaf ja raha hai. Take profit order aapko trade ko profitable hote hi khatam karne ka point provide karta hai. STEP 7 Trade ko monitor karen: Apni trade ko closely monitor karen aur price movement ke saath judi hui technical analysis ka istemaal karen. Fibonacci retracement levels ko regularly update karen, taaki aap price ka retracement aur extension areas sahi tareeke se track kar saken. STEP 8 Discipline aur risk management par tawakkal rakhen: Fibonacci retracement indicator ki strategy par amal karte waqt discipline aur risk management par tawakkal rakhen. Apne trading plan ko follow karen aur apne risk tolerance ke had tak trade karen. SUMMARY Fibonacci retracement indicator traders ko price movements ke important levels aur potential entry/exit points ke bare mein information deta hai. Iska istemal karke traders apni trading strategies ko improve kar sakte hain aur market trends ka better analysis kar sakte hain.IMPORTANT NOTE -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamu Alaikum Dosto!

Fibonacci Indicator

'Mastering the time and price advantage' aik tareeqa hai Fibonacci Forex trading strategy ki art ko sum up karne ka. Lekin pehle, yeh samajhna zaroori hai ke yeh growingly popular trading method kahan se aayi hai. Yeh sab shuru hota hai Leonardo Pisano Bogollo se, jo aik Italian mathematician tha, jis ne 13th century mein pehli dafa Fibonacci sequence ko West mein introduce karaya. In numbers ki strings mein unique mathematical properties aur ratios hoti hain jo ke aaj bhi nature, architecture aur biology mein milti hain. Universe mein in ratios ki wide-ranging presence financial markets tak bhi extended hoti hai. Yeh sirf aik wajah hai ke bohot se traders Fibonacci Forex trading strategy ko market mein turning points identify karne ke liye use karte hain, aur aapko bhi is par ghour karna chahiye. Is online trading education guide segment mein, hum overview denge ke kaise Fibonacci retracement levels ko effectively apni Forex trading strategy mein use kar sakte hain.

Fibonacci Trading kaise kaam karta hai?

Pehle hum mechanics of Fibonacci trading aur kaise yeh Forex Fibonacci trading strategy mein translate hoti hai, par dekhenge, yeh samajhna zaroori hai ke Fibonacci sequence aur yeh unique mathematical properties kya hain.

Fibonacci sequence numbers ka aik aisa sequence hai jahan, 0 aur 1 ke baad, har number pichle do numbers ka sum hota hai. Yeh infinity tak continue karta hai.

0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233, 377, 610, 987, 1597, 2584, 4181, 6765….

In numbers ke darmiyan kuch interesting relationships hain jo Fibonacci numbers trading ka basis banate hain. Hum is article mein sab relationships cover nahi kar sakte, lekin niche kuch important hain jo aapko maloom hone chahiyein jab hum aage chal kar Fibonacci Forex trading strategy par baat karenge:- Agar aap aik number ko pichle number se divide karen to yeh 1.618 ke approx hoga. Yeh Fibonacci extensions mein aik key level ke tor par use hota hai, jaise aap aage article mein seekhenge.

- Agar aap aik number ko agle higher number se divide karen to yeh 0.618 ke approx hoga. Yeh number 61.8% Fibonacci retracement level ka basis banata hai.

- Agar aap aik number ko do places higher number se divide karen to yeh 0.382 ke approx hoga. Yeh number 38.2% Fibonacci retracement level ka basis banata hai.

- 1.618 ko Golden Ratio, Golden Mean, ya Phi ke naam se bhi jaana jata hai. Iska inverse 0.618 hota hai aur yeh dono numbers nature, biology aur cosmos mein milte hain.

Asal mein, Smithsonian Magazine ke William Hoffner ke mutabiq December 1975 mein: "The proportion of .618034 to 1 is the mathematical basis for the shape of playing cards and the Parthenon, sunflowers and snail shells, Greek vases and the spiral galaxies of outer space. The Greeks based much of their art and architecture upon this proportion."

Toh, trading mein Golden Ratio aur doosre Fibonacci levels kaise use hote hain? Pehle yeh 'special' numbers Fibonacci retracement levels aur Fibonacci extension levels mein split hote hain jo phir market mein possible turning points ko identify karte hain. Chaliye inhe detail mein dekhte hain.

Fibonacci Retracement Levels: Inhe kaise use karein

Fibonacci retracement levels price levels of support aur resistance provide karte hain jahan direction mein reversal ho sakta hai aur entry levels establish karne ke liye use ho sakte hain. Fibonacci retracement levels market ke prior move par base hote hain:- Price mein aik bara rise hone ke baad, traders bottom se top tak move ko measure karenge taake dekhen ke price kahan tak retrace kar sakti hai before bouncing higher aur overall trend higher continue karti hai.

- Price mein aik bara fall hone ke baad, traders top se bottom tak move ko measure karenge taake dekhen ke price kahan tak retrace kar sakti hai before correcting lower aur overall trend lower continue karti hai.

- Pehle hum ne Fibonacci sequence ke darmiyan relationships calculate kiye taake kuch important Fibonacci ratios jaise ke 0.618 (jo 61.8% Fibonacci retracement level ka basis banata hai) aur 0.382 number (jo 38.2% Fibonacci retracement level ka basis banata hai) identify karein.

Traders kuch aur Fibonacci trading ratios bhi use karte hain jaise ke 23.6% aur 78.6%, among others. Diagram mein dikhaye gaye chaar commonly used Fibonacci retracement levels hain.- Buy pattern tab use hota hai jab market uptrend mein hoti hai. Traders attempt karte hain ke price kitna X se A move (swing low se swing high) tak retrace karti hai before finding support aur bouncing back higher (B). Yeh support levels Fibonacci retracement levels hote hain aur yeh X se A move ke 23.6%, 38.2%, 61.8% ya 78.6% retracement ho sakte hain.

- Sell pattern tab use hota hai jab market downtrend mein hoti hai. Traders attempt karte hain ke price kitna X se A move (swing high se swing low) tak retrace karti hai before finding resistance aur correcting back lower (B). B point koi bhi listed Fibonacci retracement levels ho sakta hai.

Yeh aam baat hai ke traders doosre technical analysis tools jaise trading indicators ya price action trading patterns ko confirmation ke liye use karte hain ke kaunsa Fibonacci retracement level par price turn kar sakti hai. Yeh aage detail mein Fibonacci Forex trading strategy section mein cover kiya gaya hai.

Kaise trade karein Fibonacci Extension Levels

Fibonacci extension levels bhi price levels of support aur resistance provide karte hain lekin yeh calculate karte hain ke retracement khatam hone ke baad price kitni door tak travel kar sakti hai. Asal mein, agar Fibonacci retracement levels trend enter karne ke liye use hote hain, to Fibonacci extension levels trend ke end ko target karne ke liye use hote hain.- Pehle discuss kiya gaya ke 1.618 Fibonacci sequence mein aik key number hai jo ke Golden Ratio kehlata hai. Yeh sab se popular Fibonacci extension level - 161.8% level - ka basis banata hai.

- Uptrend mein, traders point B par 'bounce' enter karte hain aur phir last Fibonacci retracement A se B tak measure karte hain, taake dekhen ke trend C point - 161.8% level - tak jaane se pehle kitni door tak ja sakta hai.

- Downtrend mein, traders point B par 'correction' enter karte hain aur phir last retracement A se B tak measure karte hain, taake dekhen ke trend C point - 161.8% level - tak jaane se pehle kitni door tak ja sakta hai.

- Reversal traders bhi 161.8% level ko counter-trend trades mein enter karne ke liye use kar sakte hain lekin yeh advanced traders ke liye zyada suitable hai.

Ab tak aap ne seekha ke Fibonacci retracement levels ko preceding trend ke direction mein trade enter karne ke liye support aur resistance levels dhoondhne ke liye use kiya jata hai. Fibonacci extension levels ko calculate karne ke liye use kiya jata hai ke trend kitni door tak ja sakta hai pehle ke reversing aur exit levels ke tor par use hote hain.

Fibonacci Trading Software aur Fibonacci Retracement Indicators

Fibonacci trading software use karte waqt (jaise humara MetaTrader 5 FREE trading platform, niche pictured), do different types ke Fibonacci indicators hain jo traders ko retracement aur extension levels plot karne mein madad karte hain. Trader ko sirf X se A cycles ko measure karna hota hai jaise pehle examples mein dikhaya gaya aur aage sections mein aur detail mein explain kiya gaya hai.

Jab trader ne Fibonacci tool use karte huye X se A distance measure kar liya, software vertical distance ko Fibonacci ratios (23.6%, 38.2%, 61.8%, 78.6%, etc) se divide karega taake Fibonacci levels plot ho sakein. Iska matlab hai ke aapko manually Fibonacci retracement aur extension levels calculate karne nahi seekhna parega kyunke software aap ke liye plot kar dega - jo ke aik huge time saver hai.

Trading Indication

Forex trading market me Fibonacci Retracement indicator ko technical analysis k leye istemal karte hen, aur Fibonacci Retracement indicator ki madad hum forex trading market me kisi trade k leye support and resistance level ko bhi malom karte hen. Is k elawa forex trading market me Fibonacci Retracement indicator ko hum market me kisi trade ki entry aur exit point k leye bhi istemal karte hen. Forex trading market me hum Fibonacci Retracement indicator ko long term entry k leye istemal karte hen aur is indicator ki madad se hum market me bari bari lot k leye ziada bare margin se trading karte hen.

Forex trading marjet me Fibonacci Retracement indicator hamen market ki chart pattren pe horizontal line draw karta hia ur ye market me percentage k hisab se hi count hoti hai. Forex trading me agar hum ne Fibonacci Retracement indicator se trading indication lena ho to is ka aik khas tareeqakar hai jo kuch is tarah se hai.- Pehlay hum jis platform pe kaam kar rahe hon, to us pe Fibonacci Retracement indicator ko on karna hai. Mt4 me by default nahi hai albata mt5vme by default maojood hota hai.

- Market ki current point ko dekhen aur us me market ki highst point aur lowest point ko dekhen, jo highes ya lowest points hon us se mazeed koi bara point us chart me maojood na ho.

- Pher aik line ko draw karen jo highes point ko lowest point se mela de.

- Agar trend bullish side ki malom karni ho to line nechay se oper ki taraf draw karen aur agar market ki trend bearish malom karni ho to chart pe line top se nechahy ki taraf draw karen, apni asani k leye ye line left side se right side pe honi chaheye.

- Jab bhi hum line ko draw karengay to chart pattren k oper six (6) horizontal Fibonacci levels appear ho jayengi, jin ki formation kuch aisi hogi, 0.0%, 23.6%, 38.2%, 50%, 61.8%, 100%. Agar hamen mazeed levwls chaheye jo hamari strategy ko requires ho to hum aur bhi lines draw kar sakte hen.

- Ye point s market ki support aue resistance levwls ko show karti hai, agar market me koi aik point kisi bhi side pe line ko break karti hai to is ka ye matlab hoga k market me trend bohut hi ziada steong hai is waja se ab market ki price next point ki taraf move karegi.

So far you have learnt that in an uptrend Fibonacci retracement levels can act as a support level jahan price bounce kar sakti hai aur upar move karti reh sakti hai. Conversely, in a downtrend Fibonacci retracement levels resistance level ke tor par kaam kar sakte hain jahan price bounce kar ke neeche correct kar sakti hai. Aapne yeh bhi seekha hai ke kaise in levels ko plot karna hai using the Fibonacci indicator in the MetaTrader trading platform provided by InstaForex, aur kaise use karna hai Fibonacci extension levels.

Dono Fibonacci retracement levels aur Fibonacci extension levels ko bohot se different trading styles aur timeframes cover karne wale traders use karte hain, jaise long-term trading, intraday trading aur swing trading. Yeh levels different markets jaise Forex, Stocks, Indices aur Commodities mein bhi use hote hain.[LIST][*] Drawing Fibonacci Retracement Levels In a Downtrend [LIST][*] X se A cycle ko find karen jo ek bara cycle, ya wave lower hai.[*]Fibonacci Retracement tool ko top menu se select karen: Insert -> Objects -> Fibonacci -> Fibonacci Retracement.[*]Cycle ke top par, X, left-click karen aur button ko hold karen.[*]Mouse button ko hold karte hue, line ko cycle ke bottom, A, tak drag karen.[*]Fibonacci indicator automatically Fibonacci retracement levels draw kar dega.- Drawing Fibonacci Retracement Levels In an Uptrend

- X se A cycle ko find karen jo ek bara cycle, ya wave higher hai.

- Fibonacci Retracement tool ko top menu se select karen: Insert -> Objects -> Fibonacci -> Fibonacci Retracement.

- Cycle ke bottom par, X, left-click karen aur button ko hold karen.

- Mouse button ko hold karte hue, line ko cycle ke top, A, tak drag karen.

- Fibonacci indicator automatically Fibonacci retracement levels draw kar dega.

-

#4 Collapse

Forex Market Mein Fibonacci Retracement Indicator{}{}{}

Forex market mein Fibonacci retracement indicator ek technical analysis tool hai jo traders ko price movements ka potential support aur resistance level identify karne mein madad karta hai. Ye indicator Fibonacci sequence ka use karta hai, jismein specific ratios ka istemal kiya jata hai, jaise ki 23.6%, 38.2%, 50%, 61.8%, aur 100%.

Jab price ek trend mein hota hai aur retracement ya reversal hota hai, tab Fibonacci retracement levels use kiye jaate hain taki traders ko pata chal sake ke price kis level tak reh sakta hai ya phir wapas kis direction mein move kar sakta hai. Ye levels traders ko entry aur exit points decide karne mein madad karte hain.

Forex Market Mein Fibonacci Retracement Indicator Ke Features{}{}{}

Fibonacci retracement indicator ke kuch important features hain:- Customizable Levels: Ye indicator aam tor par customizable hota hai, matlab aap ise apne trading strategy ke anusar adjust kar sakte hain. Aap levels ko add, remove, ya modify kar sakte hain according to your preference.

- Multiple Time Frame Support: Ye indicator aksar multiple time frames par kaam karta hai, jisse traders ko short-term aur long-term trends ka pata lag sake. Isse traders ko ek comprehensive view milta hai market ke movements ka.

- Automated Drawing: Kuch trading platforms mein Fibonacci retracement indicator ko automatically price charts par draw kiya jaata hai jab aap use apply karte hain. Ye traders ko manual drawing ki zarurat nahi padti, jo ki time save karta hai.

- Display Options: Is indicator ke saath kuch display options bhi hote hain jaise ki colors, line styles, aur thickness. Ye aapko indicator ko visually customize karne mein madad karta hai aur aapki readability ko improve karta hai.

- Alerts: Kuch advanced trading platforms mein Fibonacci retracement indicator ke saath alerts ka feature hota hai. Jab price levels ke paas aata hai ya unhe cross karta hai, toh traders ko alerts milte hain. Isse unhe trading opportunities ka pata chalta hai without needing constant monitoring.

- Backtesting Support: Kuch platforms mein Fibonacci retracement indicator ko historical data par test karne ka option hota hai. Traders isse apni strategies ko backtest kar sakte hain aur indicator ki effectiveness ko evaluate kar sakte hain.

Ye features Fibonacci retracement indicator ko ek powerful tool banate hain jo traders ko market analysis mein madad karta hai. Lekin hamesha yaad rahe ke kisi bhi indicator ko isolated form mein istemal nahi karna chahiye, balki dusre technical analysis tools aur market conditions ke saath milakar istemal karna chahiye. -

#5 Collapse

Fibonacci Retracement Indicator se Profit Trade Earning ka Mukammal Guide

1. Ta'aruf: Fibonacci Retracement Kya Hai?

Fibonacci retracement ek technical analysis tool hai jo traders ko market mein potential reversal points identify karne mein madad karta hai. Ye concept 13th century ke Italian mathematician Fibonacci ke naam par hai, jinhone ek particular number sequence ko discover kiya tha jo natural world mein kai jagah paya jata hai.

2. Fibonacci Sequence ka Bunyadi Tasawur

Fibonacci sequence ek mathematical concept hai jo sequence mein har number ko us se pehle do numbers ka sum banaata hai. Yani, 0, 1, 1, 2, 3, 5, 8, aur aise hi aage. Is sequence ka khaas feature hai ke har number approximately 1.618 times the preceding number se zyada hota hai, jo Fibonacci ratio ya Golden ratio ke roop mein jaana jata hai.

3. Trading mein Fibonacci Levels ka Kirdar

Fibonacci retracement levels ko trading mein is liye use kiya jata hai kyunke ye levels potential reversal points ko identify karne mein madadgar hote hain. Jab price trend mein hoti hai aur ek retracement aati hai, to Fibonacci levels traders ko ye batate hain ke potential reversal points kahan ho sakte hain.

4. Key Fibonacci Levels

Key Fibonacci retracement levels hain: 23.6%, 38.2%, 50%, 61.8%, aur 78.6%. Ye levels Fibonacci ratio se derive kiye jate hain aur traders inko price movements ko analyze karne ke liye istemal karte hain.

5. Fibonacci Retracement Tool Ka Istemaal

Fibonacci retracement tool ko charts pe lagana asaan hai. Traders apni charting software mein is tool ko select karte hain aur phir ek swing high aur swing low ke darmiyan draw karte hain. Tool automatically retracement levels ko calculate kar deta hai.

6. Swing High aur Swing Low ka Intikhab

Swing high wo point hai jahan se price ne apni upar wali movement khatam ki aur neeche aana shuru kiya. Swing low wo point hai jahan se price ne neeche se upar ki taraf movement start ki. Fibonacci retracement lagane ke liye in points ka intikhab zaroori hai.

7. Trend Identification

Fibonacci retracement tool ko effective use karne ke liye trend ko pehchanna bohot zaroori hai. Agar market uptrend mein hai, to Fibonacci retracement levels potential support levels provide kar sakta hai, jabke downtrend mein hote hue, yeh resistance levels ke roop mein kaam karta hai.

8. Buying aur Selling Opportunities

Fibonacci retracement levels potential buying aur selling opportunities ko identify karte hain. For example, agar price retrace hokar 61.8% level tak aata hai aur wahan support milta hai, to yeh buying opportunity ho sakti hai. Is tarah se traders Fibonacci levels ka istemal karke entry aur exit points ko determine karte hain.

9. Stop-Loss Placement

Stop-loss orders ko effective tariqe se place karne ke liye Fibonacci levels ko use kiya ja sakta hai. Agar aap buy kar rahe hain to aapka stop-loss retracement level ke thoda neeche hona chahiye. Yeh aapko losses se bachane mein madad karta hai agar price retracement expected direction mein nahi jaati.

10. Target Levels

Profit targets ko set karne ke liye bhi Fibonacci levels ko use kiya ja sakta hai. Agar aap 38.2% level pe buy karte hain, to aapka target 50% ya 61.8% level ho sakta hai. Fibonacci retracement levels ko use karke traders apne profit targets ko set karte hain aur trading plan ko execute karte hain.

11. Combining Fibonacci with Other Indicators

Fibonacci retracement ko doosre technical indicators ke saath mila kar use karna trading decisions ko aur bhi mazboot bana sakta hai. Indicators jaise ke Moving Averages, RSI, MACD ke saath combination beneficial ho sakta hai. Yeh ek holistic approach provide karta hai market analysis mein.

12. Real Market Examples

Real market examples ka analysis karna zaroori hai taake aap Fibonacci retracement ke practical application ko samajh saken. Different timeframes pe Fibonacci levels ka analysis karna helpful hota hai. Traders ko actual market scenarios pe Fibonacci retracement levels ka istemal karke potential trading opportunities ko identify karna chahiye.

13. Risk Management

Trading mein risk management bohot ahmiyat rakhta hai. Fibonacci retracement ko risk management strategy ka hissa banaana aapko potential losses se bacha sakta hai. Stop-loss orders ko place karte waqt Fibonacci retracement levels ko consider karna zaroori hai, taake aap apni trades ko control mein rakhein.

14. Practice and Backtesting

Fibonacci retracement ko use karne ka best tareeqa ye hai ke aap isko backtest karein aur demo accounts pe practice karein. Is se aapko is tool ke practical aspects ka achi tarah se idea ho jaye ga. Real-time market data pe Fibonacci retracement levels ka application karke aap apne trading strategies ko refine kar sakte hain.

15. Conclusion: Fibonacci Retracement ki Ahmiyat

Fibonacci retracement indicator ek powerful tool hai jo trading mein potential profit earning opportunities ko identify karne mein madad karta hai. Iska sahi tariqe se istemaal karke aap apni trading strategies ko enhance kar sakte hain aur zyada faida hasil kar sakte hain. Traders ko Fibonacci retracement levels ke significance ko samajhna chahiye aur isko apne trading plan mein shamil karna chahiye for better decision making.

Fibonacci retracement ka istemal karte waqt, traders ko ye dhyaan mein rakhna chahiye ke yeh ek tool hai, aur ek sahi aur mufeed trading strategy ka hissa hona chahiye, lekin yeh ek dum perfect nahi hota. Isliye, traders ko Fibonacci retracement levels ke saath doosre technical analysis tools aur market indicators ka bhi istemal karna chahiye.

Market conditions aur price action ke changes ko samajhne ke liye, traders ko regularly apne analysis techniques ko update karna chahiye. Fibonacci retracement ka istemal karne se pehle, traders ko market ki overall trend aur current sentiment ka analysis karna chahiye taake woh sahi Fibonacci levels ko identify kar sakein.

Iske alawa, Fibonacci retracement ke saath sahi risk management techniques ka istemal karna bhi zaroori hai. Stop-loss orders lagana, position size ko manage karna, aur apne trading plan ko consistently follow karna bohot ahmiyat rakhta hai. Fibonacci retracement levels sirf ek tool hain, lekin unka istemal trading strategy ke saath mila kar hi traders ko consistent success milta hai.

Aakhir mein, Fibonacci retracement ke istemal ka maqsad sirf entry aur exit points ko determine karna nahi hota. Iska asal maqsad traders ko market ke potential turning points ko identify karne aur un par react karne mein madad karna hai. Is liye, traders ko Fibonacci retracement levels ko samajhna aur unka sahi istemal karna bohot zaroori hai.

Overall, Fibonacci retracement indicator ek powerful tool hai jo traders ko market analysis mein madad karta hai. Lekin, iska sahi tariqe se istemal karne ke liye, traders ko thorough understanding aur practice ki zaroorat hoti hai. Fibonacci retracement levels ko sahi tariqe se interpret karke, traders apne trading strategies ko refine kar sakte hain aur zyada consistent aur profitable trades kar sakte hain. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Pura Tareeqa: Fibonacci Retracement Indicator se Faida Mand Trade Kamai ka Mukammal Rehnumai- Fibonacci Retracement Indicator Ki Tafseel

Fibonacci Retracement Indicator ek technical analysis tool hai jo traders ko market trends aur price movements ka analysis karne mein madad deta hai. Iska istemal karte hue traders market mein potential entry aur exit points ka pata lagate hain aur is tarah se profit kamane ki koshish karte hain. Yeh indicator Fibonacci sequence ke mathematical concepts par based hai, jisme har number apne pichle do numbers ka addition hota hai, jaise 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, aur aage chalte hue. Is sequence ko Fibonacci retracement levels banane ke liye istemal kiya jata hai, jo market mein retracement levels ko indicate karte hain.

Fibonacci retracement indicator ek graphical tool hota hai jo chart par draw kiya jata hai. Is tool mein traders ko ek high point se low point tak ki range di jati hai, aur phir Fibonacci retracement levels automatically calculate kiye jate hain. In levels ko analyze karke traders market mein reversals aur trend changes ka pata lagate hain.

- Fibonacci Sequence ki Ahmiyat

Fibonacci sequence ek mathematical concept hai jo natural world mein patterns ki pehchan ke liye istemal hota hai. Is sequence ke numbers ko Fibonacci numbers kehte hain, aur yeh numbers natural phenomena mein bhi frequently dekhe jate hain, jaise ki phoolon ke petals, naqliyoon ke shells, aur seashells mein spiral shapes mein. Trading mein, Fibonacci sequence ka istemal market mein patterns aur trends ko analyze karne ke liye kiya jata hai.

Fibonacci sequence ke kuch ahem properties hain, jaise ki golden ratio (1.618), jo trading mein bhi ahem role ada karta hai. Golden ratio Fibonacci sequence ka ek hissa hai jo traders ko market mein crucial points ka pata lagane mein madad karta hai. Is ratio ko Fibonacci retracement levels ko calculate karne ke liye bhi istemal kiya jata hai, jisse traders ko market ke potential reversal points ka pata chalta hai.

- Trend Analysis ka Tareeqa

Fibonacci retracement indicator ka istemal trend analysis ke liye kiya jata hai. Trend analysis market mein trend ki direction aur strength ko determine karne ka tareeqa hai. Jab traders Fibonacci retracement levels ko chart par draw karte hain, toh woh market mein current trend ko identify karne ki koshish karte hain.

Fibonacci retracement levels ko draw karne ke liye, traders ko ek recent trend ke high point aur low point ko identify karna hota hai. Phir Fibonacci retracement levels ko in points ke basis par calculate kiya jata hai, jo traders ko market mein potential reversal points ka pata lagane mein madad karte hain. Agar market uptrend mein hai, toh Fibonacci retracement levels ko high se low ki taraf draw kiya jata hai, aur agar market downtrend mein hai, toh low se high ki taraf draw kiya jata hai.

- Retracement Levels Ki Samajh

Fibonacci retracement levels market mein reversals ke possibilities ko indicate karte hain. In levels ko draw karne ke liye traders ko ek recent trend ke high aur low points ko identify karna hota hai. Phir Fibonacci retracement tool ko is range par apply kiya jata hai, jisse retracement levels automatically calculate ho jate hain.

Fibonacci retracement levels ka primary use hota hai market mein retracement points ko identify karna. Retracement points woh points hote hain jahan market ke current trend mein temporary reversals hoti hain, aur phir market wapas apne original trend ki direction mein move karti hai. Traders in retracement levels ko analyze karke entry aur exit points ka faisla karte hain.

- Golden Ratio ka Istemal

Golden ratio Fibonacci sequence ka ek ahem hissa hai jo trading mein istemal hota hai. Golden ratio ka value 1.618 hai, aur yeh ratio Fibonacci retracement levels ko calculate karne mein istemal hota hai. Golden ratio ke multiples Fibonacci retracement levels ko define karte hain, jisse traders ko market mein crucial points ka pata lagane mein madad milti hai.

Fibonacci retracement levels ke andar golden ratio ke multiples ka istemal karke traders market mein potential reversal points ka pata lagate hain. Jab price retracement hoti hai, toh Fibonacci retracement levels ko dekhte hue traders apne trading strategies ko adjust karte hain aur potential entry aur exit points ka faisla karte hain.

- Entry Aur Exit Points Ka Chunav

Fibonacci retracement levels ko analyze karke traders entry aur exit points ka faisla karte hain. Jab market mein retracement hoti hai, toh Fibonacci retracement levels ko dekh kar traders market mein potential entry points ko identify karte hain.

Entry points ko define karne ke liye traders Fibonacci retracement levels ke sath-sath price action aur other technical indicators ka bhi istemal karte hain. Is tarah se woh apne trades ko confirm karte hain aur high probability trades execute karte hain.

Exit points ka faisla bhi Fibonacci retracement levels ke basis par kiya jata hai. Traders apne positions ko close karne ke liye Fibonacci retracement levels ke nearby support aur resistance levels ko dekhte hain. Is tarah se woh apne profits ko secure karte hain aur losses ko minimize karte hain.

- Trend Reversal ke Sujhaav

Fibonacci retracement levels ko dekh kar traders ko trend reversal ke signs milte hain. Jab market mein retracement hoti hai, toh Fibonacci retracement levels ke sath-sath other technical indicators ka bhi istemal kiya jata hai, jisse trend reversal ke possibilities ko confirm kiya ja sakta hai.

Trend reversal ke signs ko identify karne ke baad, traders apne trading strategies ko adjust karte hain aur market ke opposite direction mein trades execute karte hain. Is tarah se woh market ke movements ko anticipate karte hain aur profitable trades execute karte hain.

- Price Action ke Saath Milaap

Fibonacci retracement indicator ko price action ke saath mila kar istemal karne se traders ko better understanding milti hai market ke movements ki. Price action ek trading methodology hai jisme traders market ke price movements aur patterns ko analyze karte hain, bina kisi indicators ke istemal kiye.

Fibonacci retracement levels ko price action ke sath combine karne se traders ko market ke crucial points ka pata lagta hai aur unhe market ki dynamics ko samajhne mein madad milti hai. Price action ke saath Fibonacci retracement levels ka istemal karke traders price patterns aur retracement levels ke sath-sath market ke potential reversal points ko bhi identify kar sakte hain.

- Risk Management ka Tareeqa

Fibonacci retracement indicator ka istemal karke traders apna risk management plan bana sakte hain. Risk management trading mein ek ahem hissa hai, kyunki yeh traders ko losses se bachata hai aur unhe long-term success ki taraf le jata hai.

Fibonacci retracement levels ko dekh kar traders apne stop loss orders ko place karte hain, jisse unka risk kam hota hai. Is tarah se woh apne trading positions ko protect karte hain aur unexpected losses se bachte hain. Saath hi, Fibonacci retracement levels ka istemal karke traders apne position sizes ko bhi adjust kar sakte hain, jisse unka risk spread hota hai aur unke overall trading portfolio ka risk kam hota hai.

- Trading Strategy ki Tadbeer

Fibonacci retracement indicator ko apni trading strategy ka ek hissa banane se traders apne trading approach ko refine kar sakte hain. Har trader ki apni trading strategy hoti hai, jisme woh apne risk tolerance, trading goals aur market conditions ko dhyan mein rakhte hue trades execute karte hain.

Fibonacci retracement levels ko apni trading strategy mein incorporate karke traders apne trading decisions ko validate karte hain. Is tarah se woh apne trades ko analyze karte hain aur high probability setups ko identify karke consistent profits earn karte hain. Har trader ki trading strategy alag hoti hai, lekin Fibonacci retracement indicator ek common tool hai jo har trader ke liye beneficial ho sakta hai.

- Historical Data ka Tafteesh

Fibonacci retracement levels ko historical data ke saath tafteesh karke traders future price movements ka andaza lagate hain. Historical data analysis ek ahem part hai trading mein, kyunki isse traders ko market ke past patterns aur trends ka pata lagta hai.

Fibonacci retracement levels ko historical data ke sath compare karke traders ko market mein potential reversal points aur trend changes ka pata lagta hai. Is tarah se woh market ke movements ko anticipate karte hain aur apne trading strategies ko adjust karte hain. Historical data analysis ke through traders apne trading decisions ko validate karte hain aur consistent profits earn karte hain.

- Multiple Timeframes ka Tafteesh

Fibonacci retracement levels ko different timeframes par analyze karke traders ko market ka pura picture milta hai. Market analysis ke liye multiple timeframes ka istemal karna ek common practice hai, kyunki isse traders ko market ke long-term aur short-term trends ka pata lagta hai.

Fibonacci retracement levels ko different timeframes par analyze karke traders ko market ke various aspects ka pata lagta hai, jaise ki short-term retracements aur long-term trend reversals. Is tarah se woh market ke movements ko better understand karte hain aur apne trading decisions ko strengthen karte hain. Multiple timeframes ka istemal karke traders apne trades ko confirm karte hain aur consistent profits earn karte hain.

- Trading Psychology ka Asar

Fibonacci retracement levels ka istemal karke traders apni trading psychology ko bhi improve kar sakte hain. Trading psychology ek ahem aspect hai trading mein, kyunki isse traders ke emotions aur behavior ko control kiya ja sakta hai.

Fibonacci retracement levels ko analyze karke traders apne trading decisions par confidence gain karte hain. Is tarah se woh apne trades ko with discipline execute karte hain aur emotional biases ko minimize karte hain. Saath hi, Fibonacci retracement levels ke saath trading karke traders apne success aur failures ko analyze karke apne mistakes se seekhte hain, jisse unka confidence aur proficiency barh jata hai.

- Educational Resources ka Fayda

Fibonacci retracement indicator ke istemal ke liye traders ko educational resources ka sahara lena chahiye. Trading ek dynamic field hai jisme market conditions aur trends frequently change hote hain. Isliye traders ko apne knowledge aur skills ko regularly update karte rehna chahiye.

Educational resources jaise ki books, online courses, webinars aur seminars traders ko Fibonacci retracement indicator ke istemal ke bare mein detailed information provide karte hain. Is tarah se traders apne knowledge aur understanding ko improve karte hain aur apne trading skills ko refine karte hain. Saath hi, traders ko market ke latest developments aur strategies ka bhi pata chalta hai, jisse unka trading approach aur performance improve hota hai.

- Practice Aur Persistence ka Ahmiyat

Fibonacci retracement indicator ko samajhne aur uska sahi istemal karne ke liye practice aur persistence ki zaroorat hai. Trading ek challenging field hai jisme success achieve karna time aur dedication require karta hai.

Practice karke traders Fibonacci retracement levels ko analyze karte hue apne skills ko improve karte hain aur apne trading strategies ko refine karte hain. Saath hi, persistence se traders apne mistakes se seekhte hain aur apne trading approach ko continuously improve karte hain. Is tarah se woh consistent profits earn karte hain aur trading career mein success achieve karte hain.

Yeh tha Fibonacci retracement indicator se faida mand trade kamai ka mukammal rehnumai. Is indicator ko samajhne aur istemal karne ke liye traders ko patience aur dedication ki zaroorat hoti hai. Lekin agar sahi tareeqe se istemal kiya jaye, toh Fibonacci retracement indicator traders ko market ke movements ko better understand karne mein madad karta hai aur unhe profitable trading opportunities provide karta hai. - Fibonacci Retracement Indicator Ki Tafseel

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 04:50 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим