Inverse head and shoulder pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

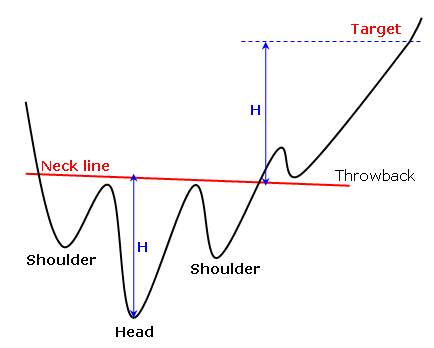

Inverse head and shoulder pattern Inverse head & shoulder pattern aik takneeki tajzia chart patteren hai jisay tajir mumkina rujhan ki tabdeeli ki nishandahi karne ke liye istemaal karte hain. yeh teen shoulders se bantaa hai, darmiyani head deegar do shoulders (" kaandhon" ) se kam hoti hai . Inverse head & shoulder pattern ki shanakht ke liye yeh iqdamaat hain : Neechay ka rujhan talaash karen : ulta sir aur kaandhon ka patteren aik ulta patteren hai jo neechay ke rujhan ke ekhtataam par hota hai. qeemat chart par neechay ka rujhan talaash karen . Look for a downtrend : Baen kandhay ki qeemat chart mein kam se banti hai, is ke baad onche kam hoti hai. yeh kam sir ke zareya ban'nay walay baad ke kam se kam hona chahiye . Identify the head : Qeemat ke chart mein sir kam se bantaa hai, jo baen aur dayen kaandhon ki taraf se ban'nay walay nichale hissay se kam hota hai . Identify the right shoulder : Dayan kandha qeemat chart mein kam se bantaa hai, is ke baad onche kam hoti hai. yeh kam sir ki taraf se qaim kam se ziyada hona chahiye . Look for the neckline : Naik line aik ufuqi lakeer hai jo baen aur dayen kaandhon se ban'nay wali oonchaiyon ko judte hai. yeh line muzahmati satah ke tor par kaam karti hai Wait for the breakout : Aik baar dayen kandhay ke ban'nay ke baad, qeemat ke gardan ke oopar totnay ka intzaar karen. yeh break out hajam mein izafay ke sath hona chahiye . Place a buy order : Aik baar jab qeemat naik line se oopar aajay to khareed order den. hadaf ki qeemat ka hisaab sir aur gardan ke darmiyan faaslay ki pemaiesh karkay aur usay break out point mein shaamil karkay lagaya ja sakta hai . Yeh note karna zaroori hai ke tamam ultay sir aur kaandhon ke namonon ka nateeja rujhan ko tabdeel nahi kere ga, lehaza patteren ki tasdeeq ke liye deegar takneeki tajzia ke alaat aur isharay istemaal karna zaroori hai . Purpose of Inverse Head & Shoulder Pattern Head & Shoulder Pattern ka maqsad market mein mumkina rujhan ki tabdeeli ki nishandahi karna hai. patteren qeemat ki naqal o harkat ki aik series se bantaa hai jo market ke jazbaat mein mandi se taizi ki taraf tabdeeli ki nishandahi karta hai. baen aur dayen kandhay qaleel mudti rilyon ki numaindagi karte hain jo pichli oonchai ko tornay mein nakaam rehtay hain, jabkay sir aik gehri pal back ki numaindagi karta hai . Right shoulder ke ban'nay ke baad, patteren batata hai ke mandi ka rujhan apni raftaar kho raha hai aur bail mazboot ho rahay hain. naik line ke oopar break out patteren ki tasdeeq karta hai aur market ke rujhan mein mumkina tabdeeli ka ishara deta hai. tajir is patteren ko mumkina kharidari ke mawaqay ki nishandahi karne ke liye istemaal karte hain, hadaf ki qeemat ka hisaab sir aur gardan ki lakeer ke darmiyan faaslay ki pemaiesh ke zariye kya jata hai . Taham, yeh note karna zaroori hai ke tamam ultay sir aur kaandhon ke patteren ke nateejay mein rujhan tabdeel nahi hoga, aur taajiron ko patteren ki tasdeeq ke liye deegar takneeki tajzia ke alaat aur isharay istemaal karne chahiye. trading ke bakhabar faislay karne ke liye patteren ko tajir ke tool box mein bohat se tools mein se aik samjha jana chahiye -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Introduction: Inverse Head and Shoulders pattern (Ulta Sar aur Kandhon ka Pattern) Forex trading mein ek aham chart pattern hai. Yeh pattern bullish trend ke reversal ko indicate karta hai. Inverse Head and Shoulders pattern ko identify karna Forex traders ke liye zaruri hai, kyunki yeh pattern trading opportunities provide karta hai. Iss pattern mein kuch specific steps ko follow karke traders isko samajh sakte hain. Neechay diye gaye steps explain kiye gaye hain: 1. Left Shoulder : Pattern ki formation left shoulder ke saath shuru hoti hai. Jab kisi currency pair ya stock ka price chart downtrend se uptrend mein transition karta hai, tab left shoulder ban sakta hai. 2. Head : Left shoulder ke baad price chart ek temporary downtrend mein jaata hai aur phir reversal point pe sar banata hai. Sar left shoulder se neeche hota hai aur jyada neeche nahi jaata hai. 3. Right Shoulder: Sar banne ke baad price chart phir se ek temporary downtrend mein jaata hai aur phir right shoulder banata hai. Right shoulder left shoulder se neeche hota hai aur left shoulder ki tarah ka size hota hai. 4. Neckline : Left shoulder, head aur right shoulder ki formation ke baad neckline draw ki jaati hai. Neckline horizontal line hoti hai aur left shoulder aur right shoulder ke bottom points ko join karti hai. 5. Breakout: Jab price chart neckline ko cross karta hai aur neckline ke upar sustain karta hai, tab traders ko buy position lena chahiye. Breakout ke saath saath volume bhi increase hona chahiye, jo ki bullish momentum ko confirm karta hai. 6. Target: Inverse Head and Shoulders pattern mein target calculation neckline ke height se kiya jaata hai. Neckline se calculate kiya gaya height ko pattern ka depth kehete hain. Pattern ka depth upside move ko indicate karta hai, jiski length target level ke liye use hoti hai. Iss tarah se, Inverse Head and Shoulders pattern ka use karke Forex traders bullish reversal opportunities explore kar sakte hain. Yeh ek important chart pattern hai, jise traders ko samajhna chahiye. -

#4 Collapse

Inverse Head and Shoulders Candlestick Pattern ko samjhane ke liye, pehle hum "Candlestick Patterns" aur "Inverse Head and Shoulders" dono concepts ko samjhein. Candlestick Patterns. Candlestick Patterns stock market analysis mein istemal hone wale graphical patterns hote hain. Ye patterns price action ko visualize karte hain aur traders ko price movements aur market sentiment ke bare mein insights dete hain. Har candlestick ek time period (jaise 1 din, 1 ghanta, 15 minute, etc.) ko represent karta hai. Inverse Head and Shoulders. Inverse Head and Shoulders ek bullish reversal pattern hai, jiska matlab hota hai ke jab ye pattern ban jata hai, toh market ki bearish trend ko reverse hone ka indication hota hai. Ye pattern market ke bottoms pe develop hota hai aur generally downtrend ke baad paya jata hai. Ab hum "Inverse Head and Shoulders Candlestick Pattern" ke components aur unke meanings ko samjhein: 1. Head. Head sabse important part hota hai. Ye pattern ke center mein hota hai aur dusre "shoulders" se higher hota hai. Ye bearish trend ke bottom pe form hota hai. 2. Shoulders. Shoulders head ke dono taraf hote hain. Ye head se lower hote hain aur symmetric hote hain. Jab market bottom se recover karta hai, toh pehle shoulder ban jata hai, phir head, aur phir dusra shoulder. 3. Neckline. Neckline pattern ke bottom pe draw ki jati hai. Ye line head aur shoulders ke bottoms ko join karti hai. Neckline ka break ek significant event hai aur bullish trend ke confirmation ke taur pe consider kiya jata hai. 4. Volume. Volume bhi pattern ke analysis mein important hai. Generally, jab price neckline ko break karta hai, toh us time volume increase hone ka indication hota hai. High volume breakout pattern ki strength aur validity ko enhance karta hai.Inverse Head and Shoulders Candlestick Pattern samjhein toh ye ek bullish reversal pattern hai, jo market ke bottoms pe form hota hai aur neckline ko break karke bullish trend ko confirm karta hai. Ye pattern ke analysis mein price action aur volume dono ko consider karna important hai. -

#5 Collapse

Presentation Of Inverse Head And Shoulder Pattern. Inverse head and shoulders chart pattern 1 negative reversal pattern ha jo currency sets aur things k expense chart me long baad example ki base per creat hota ha. ye configuration unsurpassed casings mein show hota ha. es pattern me price ( 3 )consecutive lows creat krti ha.aur mid wali low ko head kehtay hain.and staying two ko Right shoulder and left shoulder kehtay hain. each of the three candles k top ( 1 ) typical expense level se start hoti han, ager en beginning price levels ko aik design line sy interface kiya jaye to es line ko neckline kehtay hain. How We Can Trade With Inverse Head And Shoulder Pattern. es pattern per trading k liye seller price k neck area ko break krna ka intezar krta ha. Is configuration man sellers multiple times cost ko down le ker jatay hain however buyers again osko invert le jaty hain. at the point when price third low creat krti ha and buyers price ko upper le jaty hainn,agr esteem neck area se upper candle ka close kry to is se breakout ki assertion ho jati ha. traders ko price ka neck region ko retest kernay ka intezar krna hota h.. whenever price jub neck region ko re contact kerti ha to is per shipper ko buy ki trade place krni chahye,aur ager aisi circumstance mein koi broker sell ki trade place kr leta ha to ye trade osko stop loss de sakti ha.es leye consistently pattern ko comprehend krna chahye aur latest thing aur design ko follow kr k productive trading krni chahye... Instructions to Place SL And TP reversal head and shoulders chart Pattern per trade krtay huway( S.L ) ko right shoulder se down place kerna chahye and( T.P) neck area and head k focus mein place krna chaheye. -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Introduction:Inverse Head and Shoulders (IHS) ek technical analysis pattern hai jo stock market mein istemal hota hai. Ye pattern generally bullish (upward) trend ko indicate karta hai. IHS chart pattern mein, price action mein ek "head" aur do "shoulders" dikhte hain, jo ek saath ek specific sequence mein appear hote hain. Is pattern ko recognize karke, traders aur investors market trend ko predict kar sakte hain aur potential buying opportunities dhund sakte hain.Inverse Head and Shoulder Inverse Head and Shoulder pattern ke liye pehle humein "shoulders" aur "head" ke concepts ko samajhna zaroori hai. Jab hum price action ko analyze karte hain, to hum price peaks aur troughs par focus karte hain. "Shoulder" peaks hote hain jab price initially upar jaata hai, phir down jaata hai, aur phir se upar jaata hai, lekin pehle upar jaane se kam high tak. Is tarah se, price action mein do shoulder peaks dikhte hain, jo symmetrically positioned hote hain."Head" peak shoulder peaks ke beech hota hai, aur generally shoulders se higher hota hai. Is peak ke around price action usually bahut volatile hota hai. Jab hum shoulders aur head ko connect karte hain, to ye ek pattern banate hain jo human shoulder aur head shape ko resemble karta hai. Isliye ise "head and shoulders" pattern kaha jata hai.Inverse Head and Shoulder pattern mein inverse hota hai, matlab ki yahan price action pehle down direction mein move karti hai, phir up direction mein move karti hai, aur phir se down direction mein move karti hai. Ye pattern bearish (downward) trend ko indicate karta hai aur price action mein reversal ko suggest karta hai. Explanation Inverse Head and Shoulder pattern ko recognize karne ke liye, humein kuch important points par dhyan dena hota hai. Sabse pehle, initial downtrend mein price action ki movement dekhni hoti hai. Price action jab bottom par reach karta hai, to ye "left shoulder" banata hai. Iske baad, price action upar jaata hai, lekin pehle high se kam tak pahunchta hai. Ye "head" banata hai. Phir price action dobara down jaata hai, lekin pehle down se kam tak jaata hai. Ye "right shoulder" banata hai.Jab ye peaks form ho jate hain, to traders IHS pattern ko confirm karne ke liye "neckline" ko draw karte hain. Neckline ek horizontal line hoti hai jo left shoulder aur right shoulder peaks ko connect karti hai. Jab price action neckline ko break karke upar jaata hai, to Inverse Head Shoulder pattern confirm hota hai aur bullish reversal signal deta hai. Conclusion Inverse Head and Shoulder pattern ke breakout ke baad traders generally buying opportunity dhundte hain. Target price ko calculate karne ke liye, hum neckline se head ka distance measure karte hain aur us distance ko breakout point se upar extend karte hain. Ye target price hota hai jahan tak price action ka potential move ho sakta hai.Inverse Head and Shoulders pattern ko samajhna aur interpret karna technical analysis ka ek important aspect hai. Ye pattern market sentiment ko samajhne aur trading decisions lene mein madad karta hai. Lekin, is pattern ki accuracy 100% nahi hoti aur dusre technical indicators aur analysis tools ke saath combine karna zaroori hota hai. Thanks for all guys -

#7 Collapse

Inverse head and shoulder pattern. Inverse Head and Shoulders Candlestick Pattern ko samjhane ke liye, pehle hum "Candlestick Patterns" aur "Inverse Head and Shoulders" dono concepts ko samjhein. Candlestick Patterns. Candlestick Patterns stock market analysis mein istemal hone wale graphical patterns hote hain. Ye patterns price action ko visualize karte hain aur traders ko price movements aur market sentiment ke bare mein insights dete hain. Har candlestick ek time period (jaise 1 din, 1 ghanta, 15 minute, etc.) ko represent karta hai. Importance. Head & Shoulder Pattern ka maqsad market mein mumkina rujhan ki tabdeeli ki nishandahi karna hai. patteren qeemat ki naqal o harkat ki aik series se bantaa hai jo market ke jazbaat mein mandi se taizi ki taraf tabdeeli ki nishandahi karta hai. baen aur dayen kandhay qaleel mudti rilyon ki numaindagi karte hain jo pichli oonchai ko tornay mein nakaam rehtay hain, jabkay sir aik gehri pal back ki numaindagi karta hai . Right shoulder ke ban'nay ke baad, patteren batata hai ke mandi ka rujhan apni raftaar kho raha hai aur bail mazboot ho rahay hain. naik line ke oopar break out patteren ki tasdeeq karta hai aur market ke rujhan mein mumkina tabdeeli ka ishara deta hai. tajir is patteren ko mumkina kharidari ke mawaqay ki nishandahi karne ke liye istemaal karte hain, hadaf ki qeemat ka hisaab sir aur gardan ki lakeer ke darmiyan faaslay ki pemaiesh ke zariye kya jata hai . Taham, yeh note karna zaroori hai ke tamam ultay sir aur kaandhon ke patteren ke nateejay mein rujhan tabdeel nahi hoga, aur taajiron ko patteren ki tasdeeq ke liye deegar takneeki tajzia ke alaat aur isharay istemaal karne chahiye. trading ke bakhabar faislay karne ke liye patteren ko tajir ke tool box mein bohat se tools mein se aik samjha jana chahiye.

-

#8 Collapse

Introduction of head and shoulders rule:​Inverse head and shopattpattern patter El reverse pattern haiJo chart may loss ya gain ko chart py create k ye pattern unsurpassesd pattern ki configuration may show hoti hai . Is pattern may configuration low price show krta hai ur low hconfiguguration ko head kahty hai each of the three candle ðŸ•¯ï¸ stock k expensive sy start hoti hai. Agr iss beginning line ko designs line price may show kia jye tu is line ko neckline kahty hai. How can we trade with head and shoulders rules pattern: Is pattern pr Kam krny k liye trading k neck earea ko break krny tk wait krna prta hai . Is seller price may seller multiple times trade ko down ly k jaty hai kb k buyers b multiple times trade ko oper ly k jaty hai. Asy hi JB trade rule k shoulder tk ponch jye tu buyers ko wait krna prta hai JB tk trade again neck tk na ponch jye seller down ly kr jata ha i ur buyer up ly kr jata hai. -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Introduction of head and shoulders rule:​Inverse head and shopattpattern patter El reverse pattern haiJo chart may loss ya gain ko chart py create k ye pattern unsurpassesd pattern ki configuration may show hoti hai . Is pattern may configuration low price show krta hai ur low hconfiguguration ko head kahty hai each of the three candle ðŸ•¯ï¸ stock k expensive sy start hoti hai. Agr iss beginning line ko designs line price may show kia jye tu is line ko neckline kahty hai. How can we trade with head and shoulders rules pattern:Is pattern pr Kam krny k liye trading k neck earea ko break krny tk wait krna prta hai . Is seller price may seller multiple times trade ko down ly k jaty hai kb k buyers b multiple times trade ko oper ly k jaty hai. Asy hi JB trade rule k shoulder tk ponch jye tu buyers ko wait krna prta hai JB tk trade again neck tk na ponch jye seller down ly kr jata hai ur buyer up ly kr jata hai. Instructions to place sR aand : Reversal head and shoulders price ki configuration may S.l ko shoulder ki downward move krty hai ur To ko head and shoulders ki upward move krty hai, iss sy traders ki head and shoulders price ki configuration improve hoti hai -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#10 Collapse

Introduction of head and shoulders rule:​Inverse head and shopattpattern patter El reverse pattern haiJo chart may loss ya gain ko chart py create k ye pattern unsurpassesd pattern ki configuration may show hoti hai . Is pattern may configuration low price show krta hai ur low hconfiguguration ko head kahty hai each of the three candle ðŸ•¯ï¸ stock k expensive sy start hoti hai. Agr iss beginning line ko designs line price may show kia jye tu is line ko neckline kahty hai. How can we trade with head and shoulders rules pattern:Is pattern pr Kam krny k liye trading k neck earea ko break krny tk wait krna prta hai . Is seller price may seller multiple times trade ko down ly k jaty hai kb k buyers b multiple times trade ko oper ly k jaty hai. Asy hi JB trade rule k shoulder tk ponch jye tu buyers ko wait krna prta hai JB tk trade again neck tk na ponch jye seller down ly kr jata hai ur buyer up ly kr jata hai. Instructions to place sR aand :Reversal head and shoulders price ki configuration may S.l ko shoulder ki downward move krty hai ur To ko head and shoulders ki upward move krty hai, iss sy traders ki head and shoulders price ki configuration improve hoti hai

- Mentions 0

-

سا0 like

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 09:17 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим