Cup and handle pattern in forex

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

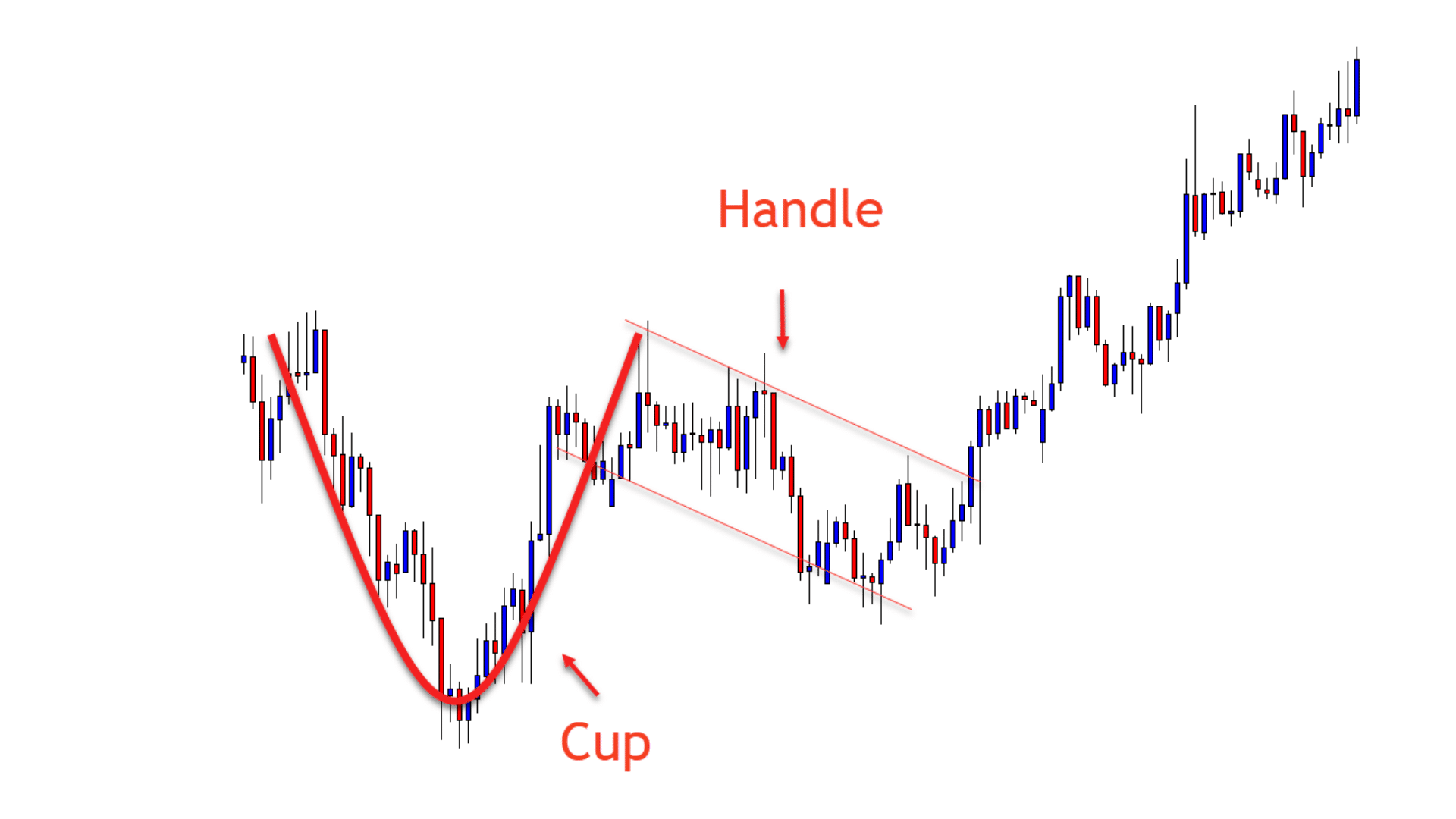

Introduction Safety and price chart kase aur handle ko taizi ka signal samjha jata hai, patteren kana dayen taraf ko aam tor par kam tijarti hajam ka saamna hota hai. pattern ki tashkeel saat hafton tak ya 65 hafton tak taweel hosakti hai .Dear members Forex trading forex card kaam main number of time patterns different graphics trader hot jin tara hum trading lucky k acha lucky lucky lucky trader main trading number passed CUP and handle pattern bhe hota hy commercial carny k liay sub sy pehli chez ye hoti hy old form U honi chaye agr U build main hoga usy hum pattern CUP standard name dain gy aur isk bad main aik handle banta hy kami k k k k breakout par hun Commercial sakty hain aur kami main hum trager cup k size ka asani sy laga sakty hain jitny throughout the main time period yee ban ka uska humain utja he bara target mil sakta hy main apa apa SL handle k nechi hata hy aur apaka TP ap CUP k Size k jitna oper laga sakty hain jesa k hum pattern what ko asani sy samjh sakti hain salam. Key features of the Cup and Handle Pattern: Dear friends Agr trading application Forex MI cup and pattern ko dekhna Chahte Hain Meah banta hai image. Or the old form of 2 different tarah ki ho sakti hai U form high sa nechi bhi ban sakhta hai or high behi ban sakhta hai. Or build ka sath aik handle banta hai tu ya cup and handle full pattern ho jata hai. Cup and handle pattern: Dear brothers, Jab Cup and Handle pattern full ho jata hai tu isk bad old breakout hoti hai or aik confirmation candle banti hai agr wo bullish candle banti hai tu Cup ka size jitna bullish ja sakhti hai or agr bear candle bandi hai tu Cup ka ake jitna take action kr sakti hai. Bananas are beneficial for trading hum apni ki koshish kar sakte hain likn hum ko Breakout ka intezar nezamji krna cheye or jaldbaji ma kei sada ni krni cheye. -

#3 Collapse

opening Dear friends main aapko ek achcha aur pyara knowledge dene Laga Hoon is topic ko gaur se padhen sikhe ise knowledge aasan Karen Agar naleja sil karenge do hi kuchh aur n karenge adervise aap kuchh Nahin hasil kar sakenge isliye koshish karen ki isko samajhne ki koshish karen Taki aap ek acchi kar saken afta per kuchh samjhe FIR red Karen Security and price chart pattern hota hy commercial carni k liay sub sy pehli chez ye hoti hy form old U honi chaye agr U build hoga main pattern hum CUP standard name dain gy aur isk bad main aik handle banta hy kami k k k k breakout par hun Trade sakty hi aur we play hum trager cup k size ka asani sy laga sakty hai jitny during prime time or bank ka uska humain utja he bara target mil sakta hy main apa apa SL handle k nechi error hy aur apaka TP ap CUP k Size k jitna oper laga sakti hain jesa k hum what pattern is easy samjh sakti hain salam. Key features of the Cup and Handle Pattern: Dear Friends Agr Trading App Forex MI Cup And Pattern Chahte Hain Meah banta hai image. 2a or 2 different tarah ki ho sakti hai U top type sa nechi bhi ban sakhta hai or behi ban sakhta hai. Build kaa ka sath aik handle banta hai tu ya cup and run a full pattern ho jata hai. Cup and Handle Pattern: Brothers and sisters, Jab Cup and handle pattern jitna action kr sakti hai. Banana, hum apni ki koshish kar sakte hain likn hum ko Breakout ka intezar nezamji krni cheye or jaldbaji ma kei sada ni krni cheye useful for trading. -

#4 Collapse

Opening Post ka achcha aur kamal ka hona lajmi hai agar post acchi aur Kamal Ki hogi knowledge wale hogi to hi kuchh ismein aapko fayda hoga otherwise aap isase paida aasan Nahin kar sakte Aaj ham baat karenge cope and handle ke bare mein aur iski knowledge aapas mein share karenge aur guftgu karenge is topic per Dear friends, I have given you the knowledge you want and love. Rede FIR per Kuch SampagSECURITY AND PRICE CHART PATTERN HOTA HI COMMERCIAL CARNI KE LIA SUB C PALEI CHASE YE HOTI hai FORM OLD U HONEY CHAYE AGR U BUILD HOGA MAIN PATTERN HUM CUP STANDARD NAME DAING GEE AUR ISK BAD MAIN IK HANDLE BANTA HI KAMI KK BREAKOUT I Trade shakit hi aur we play hum trager cup ke size ka asani si laga sakti hai win during prime time ke bank ka uska hamain itja he bara target mil sakta hi mein apa apa sl handle ke nechi error hai aur apka tp ap cup ke size Ke jeetna opar lagga hai jesa ke hum what pattern is easy understanding power hai salam. Key Features of Cup and Handle Pattern: Dear Friends Agr Trading App Forex MI Cup And Pattern Chahate Hain Meh Banta Hai Image. 2a or 2 different tarah ki ho makti hai u top type sa nechi bhi bana sakhta hai ke behi bana sakhta hai. Ka ka saath make a handle banta hai tu ya cup and full pattern ho jata hai. Cup and Handle Pattern: Brothers and sisters, the jab cup and handle pattern can do the winning action. Banana, hum apni ki khish kar sakte hain likhan hum ko breakout ka intezar nezamji krini ke jaladbaji ma ke sada ni karni chiye is useful for business. -

#5 Collapse

Cup and Handle Pattern ki Formation ki Samajh and Formation: "Cup and Handle" sample, yaani "Gulab aur Munhwaala" sample, inventory market ke technical analysis mein ek prasiddh sample hai jo buyers aur investors dwara price moves ke analysis ke liye istemaal kiya jata hai. Is pattern ka naam isliye hai kyunki ye ek kulhad aur uske manage jaisa dikhta hai. Ye pattern bullish fashion ke indication ke liye istemaal hota hai, yaani stock fee mein upward motion ka sanket deta hai. Is pattern mein fee first of all down hoti hai, phir gradual tareeke se recover karke ek round shape bana leti hai, aur phir ek chhota deal with shape bana leti hai. Round form ko "cup" aur handle form ko "manage" kaha jata hai. "Cup and Handle" sample ke pehle cup ka formation bahut critical hota hai. Cup form banane mein rate ka samay lagta hai. Cup form normally numerous weeks ya months ke dauraan ban sakta hai. Cup shape banane ke baad price mein mild decline hoti hai aur deal with shape banane lagti hai. Handle commonly ek chhota rectangle ya sideways movement ke shape mein dikhta hai. Ye pattern tabhi sahi tarike se verify hota hai jab manage form ke breakout ke baad rate mein extensive upward movement hota hai. Breakout ke baad, charge commonly cup shape ki height tak pahunchta hai ya u.S. Bhi upar chala jata hai. Is breakout ke baad investors aur buyers buy positions lete hain aur inventory rate ko further push karne ki koshish karte hain. Investors aur Fundamental Analysis: "Cup and Handle" sample ka istemaal karke investors aur buyers ko entry aur go out points determine karne mein madad milti hai. Jab cup shape ban raha hota hai, tab investors ko entry factor ka samay dekhna chahiye. Cup form banne ke baad manage form mein fee ka decline hone se pehle access ki making plans karna zaroori hota hai. Handle shape ke breakout ke baad, traders ko buy positions lete waqt stop-loss stage aur target fee ko dhyan mein rakhna chahiye. Stop-loss stage ko manage shape ke backside ke just neeche rakha jata hai taaki agar rate surprising decline kare toh loss manage mein rahe. Target rate ko cup shape ki peak ya preceding highs se estimate kiya jata hai. Ye sample lengthy-time period traders ke liye bhi beneficial ho sakta hai. Agar kisi stock ka "Cup and Handle" sample form ho raha hai, toh lengthy-term traders ko inventory ki performance aur destiny boom potentialities ko compare karne ka mauka milta hai. Is sample ke breakout ke baad stock rate mein sustained upward movement hone ke possibilities hote hain. "Cup and Handle" sample ka istemaal karne ke liye, buyers aur buyers ko price movements, quantity, aur marketplace sentiment ka dhyan rakhna zaroori hota hai. Is sample ke saath saath dusre technical indicators jaise ki transferring averages, oscillators, aur trend strains ka istemaal karke confirmatory alerts dhundhne chahiye.

Investors aur Fundamental Analysis: "Cup and Handle" sample ka istemaal karke investors aur buyers ko entry aur go out points determine karne mein madad milti hai. Jab cup shape ban raha hota hai, tab investors ko entry factor ka samay dekhna chahiye. Cup form banne ke baad manage form mein fee ka decline hone se pehle access ki making plans karna zaroori hota hai. Handle shape ke breakout ke baad, traders ko buy positions lete waqt stop-loss stage aur target fee ko dhyan mein rakhna chahiye. Stop-loss stage ko manage shape ke backside ke just neeche rakha jata hai taaki agar rate surprising decline kare toh loss manage mein rahe. Target rate ko cup shape ki peak ya preceding highs se estimate kiya jata hai. Ye sample lengthy-time period traders ke liye bhi beneficial ho sakta hai. Agar kisi stock ka "Cup and Handle" sample form ho raha hai, toh lengthy-term traders ko inventory ki performance aur destiny boom potentialities ko compare karne ka mauka milta hai. Is sample ke breakout ke baad stock rate mein sustained upward movement hone ke possibilities hote hain. "Cup and Handle" sample ka istemaal karne ke liye, buyers aur buyers ko price movements, quantity, aur marketplace sentiment ka dhyan rakhna zaroori hota hai. Is sample ke saath saath dusre technical indicators jaise ki transferring averages, oscillators, aur trend strains ka istemaal karke confirmatory alerts dhundhne chahiye. Cup and Handle Pattern ke Amli Namunon aur Case Studies: Lekin, har pattern ki tarah, "Cup and Handle" pattern bhi one hundred% reliable nahi hota hai. Market mein humesha threat hota hai aur inventory prices unpredictable ho sakte hain. Isliye, is pattern ko samajhne aur istemaal karne se pehle, investors aur traders ko thorough research aur technical analysis ki understanding honi chahiye. Price actions ke saath saath agency basics, industry tendencies, aur market conditions ko bhi evaluate karna zaroori hai. "Cup and Handle" pattern ka ek drawback ye hai ki occasionally false breakouts bhi ho sakte hain. Breakout ke baad bhi fee mein sudden decline ho sakta hai, jisse investors ko nuksan uthana pad sakta hai. Isliye, breakout ke affirmation ke liye volume analysis bhi important hota hai. High extent ke saath breakout hone par pattern ki validity aur strength badhti hai. "Cup and Handle" pattern ko become aware of karna aur interpret karna skill aur revel in ke saath expand hota hai. Traders aur traders ko charge charts ko analyze karna aur pattern ki sahi reputation ke liye exercise karna chahiye. Historical records aur charting software program ka istemaal karke buyers aur investors sample ko samajhne aur examine karne mein assist le sakte hain. Is pattern ka istemaal karne se pehle, investors aur buyers ko threat control ka dhyan rakhna zaroori hai. Stop-loss orders aur threat-praise ratios ke saath exchange karna chahiye taaki ability losses ko control kiya ja sake. Iske saath saath, marketplace volatility, news activities, aur monetary elements ko bhi monitor karna essential hai. Tareekhi Karkardagi aur Cup and Handle Pattern ki Kamyabi: Conclusion mein, "Cup and Handle" pattern ek famous technical analysis tool hai jo traders aur investors ko bullish fashion ke symptoms ke liye assist karta hai. Ye sample rate moves ke evaluation mein istemaal kiya jata hai aur entry aur exit factors decide karne mein madad deta hai. Lekin, is pattern ke istemaal ke liye thorough studies, market analysis, aur danger management ka dhyan rakhna zaroori hai. Trading aur investing mein hone wale risks ko samajhkar, investors aur buyers pattern ke saath aur dusre equipment ke saath sahi decisions lene mein safal ho sakte hain. "Cup and Handle" pattern, jise "Gulab aur Munhwaala" sample bhi kaha jata hai, stock market mein technical analysis ka pramukh device hai. Is pattern ko samajhne aur istemaal karne se pehle, inventory market aur fee actions ke basic ideas ko samajhna zaroori hai. "Cup and Handle" pattern ka mool udeshya stock rate ka trend identify karna hai. Ye pattern in most cases bullish fashion ke symptoms offer karta hai, yaani stock fee mein upward movement ka sanket deta hai. Pattern ke formation ke dauran rate to begin with down hoti hai, phir gradual tareeke se get better karke ek round form bana leti hai, aur phir ek chhota take care of shape banati hai. Pattern ke pehle cup form ki formation hoti hai, jo normally weeks ya months tak ka time le sakta hai. Cup shape banane ke dauran price ka gradual recuperation hota hai, jisse ek U-shape ki formation banti hai. Cup shape ke formation ke baad rate mein mild decline hoti hai aur manage shape banane lagti hai.

Cup and Handle Pattern ke Amli Namunon aur Case Studies: Lekin, har pattern ki tarah, "Cup and Handle" pattern bhi one hundred% reliable nahi hota hai. Market mein humesha threat hota hai aur inventory prices unpredictable ho sakte hain. Isliye, is pattern ko samajhne aur istemaal karne se pehle, investors aur traders ko thorough research aur technical analysis ki understanding honi chahiye. Price actions ke saath saath agency basics, industry tendencies, aur market conditions ko bhi evaluate karna zaroori hai. "Cup and Handle" pattern ka ek drawback ye hai ki occasionally false breakouts bhi ho sakte hain. Breakout ke baad bhi fee mein sudden decline ho sakta hai, jisse investors ko nuksan uthana pad sakta hai. Isliye, breakout ke affirmation ke liye volume analysis bhi important hota hai. High extent ke saath breakout hone par pattern ki validity aur strength badhti hai. "Cup and Handle" pattern ko become aware of karna aur interpret karna skill aur revel in ke saath expand hota hai. Traders aur traders ko charge charts ko analyze karna aur pattern ki sahi reputation ke liye exercise karna chahiye. Historical records aur charting software program ka istemaal karke buyers aur investors sample ko samajhne aur examine karne mein assist le sakte hain. Is pattern ka istemaal karne se pehle, investors aur buyers ko threat control ka dhyan rakhna zaroori hai. Stop-loss orders aur threat-praise ratios ke saath exchange karna chahiye taaki ability losses ko control kiya ja sake. Iske saath saath, marketplace volatility, news activities, aur monetary elements ko bhi monitor karna essential hai. Tareekhi Karkardagi aur Cup and Handle Pattern ki Kamyabi: Conclusion mein, "Cup and Handle" pattern ek famous technical analysis tool hai jo traders aur investors ko bullish fashion ke symptoms ke liye assist karta hai. Ye sample rate moves ke evaluation mein istemaal kiya jata hai aur entry aur exit factors decide karne mein madad deta hai. Lekin, is pattern ke istemaal ke liye thorough studies, market analysis, aur danger management ka dhyan rakhna zaroori hai. Trading aur investing mein hone wale risks ko samajhkar, investors aur buyers pattern ke saath aur dusre equipment ke saath sahi decisions lene mein safal ho sakte hain. "Cup and Handle" pattern, jise "Gulab aur Munhwaala" sample bhi kaha jata hai, stock market mein technical analysis ka pramukh device hai. Is pattern ko samajhne aur istemaal karne se pehle, inventory market aur fee actions ke basic ideas ko samajhna zaroori hai. "Cup and Handle" pattern ka mool udeshya stock rate ka trend identify karna hai. Ye pattern in most cases bullish fashion ke symptoms offer karta hai, yaani stock fee mein upward movement ka sanket deta hai. Pattern ke formation ke dauran rate to begin with down hoti hai, phir gradual tareeke se get better karke ek round form bana leti hai, aur phir ek chhota take care of shape banati hai. Pattern ke pehle cup form ki formation hoti hai, jo normally weeks ya months tak ka time le sakta hai. Cup shape banane ke dauran price ka gradual recuperation hota hai, jisse ek U-shape ki formation banti hai. Cup shape ke formation ke baad rate mein mild decline hoti hai aur manage shape banane lagti hai. Cup and Handle Pattern ka Istemaal Karke Trade Mein Kamyabi: Handle shape commonly ek chhota rectangle ya sideways movement ke shape mein dikhta hai. Handle shape ke breakout ke baad rate mein enormous upward motion dekha jata hai. Breakout ke baad, investors aur traders purchase positions lete hain aur stock price ko further push karne ki koshish karte hain. Pattern ke breakout ke baad, traders ko access aur go out factors determine karne mein madad milti hai. Cup form banane ke dauran, investors ko access point ka samay dekhna chahiye. Cup shape banane ke baad handle shape mein price ka decline hone se pehle access ki making plans karna zaroori hota hai. Handle shape ke breakout ke baad, traders ko purchase positions lete waqt forestall-loss degree aur goal rate ko dhyan mein rakhna chahiye. Stop-loss degree manage form ke backside ke simply neeche rakha jata hai, taaki agar price surprising decline kare toh loss control mein rahe. Target charge ko cup shape ki height ya preceding highs se estimate kiya jata hai. Is sample ko samajhne aur affirm karne ke liye, traders aur investors ko charge movements ke saath saath volume evaluation bhi karna chahiye. High volume ke saath breakout hone par sample ki validity aur electricity badhti hai. Volume analysis, breakout ko verify karne mein madad karta hai aur false breakouts se bachne mein sahayak hota hai.

Cup and Handle Pattern ka Istemaal Karke Trade Mein Kamyabi: Handle shape commonly ek chhota rectangle ya sideways movement ke shape mein dikhta hai. Handle shape ke breakout ke baad rate mein enormous upward motion dekha jata hai. Breakout ke baad, investors aur traders purchase positions lete hain aur stock price ko further push karne ki koshish karte hain. Pattern ke breakout ke baad, traders ko access aur go out factors determine karne mein madad milti hai. Cup form banane ke dauran, investors ko access point ka samay dekhna chahiye. Cup shape banane ke baad handle shape mein price ka decline hone se pehle access ki making plans karna zaroori hota hai. Handle shape ke breakout ke baad, traders ko purchase positions lete waqt forestall-loss degree aur goal rate ko dhyan mein rakhna chahiye. Stop-loss degree manage form ke backside ke simply neeche rakha jata hai, taaki agar price surprising decline kare toh loss control mein rahe. Target charge ko cup shape ki height ya preceding highs se estimate kiya jata hai. Is sample ko samajhne aur affirm karne ke liye, traders aur investors ko charge movements ke saath saath volume evaluation bhi karna chahiye. High volume ke saath breakout hone par sample ki validity aur electricity badhti hai. Volume analysis, breakout ko verify karne mein madad karta hai aur false breakouts se bachne mein sahayak hota hai. Conclusion and Planning about Advance Features: Lekin, har sample ki tarah, "Cup and Handle" sample bhi a hundred% reliable nahi hota hai. Market mein humesha risk hota hai aur stock costs unpredictable ho sakte hain. Isliye, is pattern ka istemaal karne se pehle, buyers aur traders ko thorough research aur technical analysis ki expertise honi chahiye. Pattern ke saath saath dusre technical indicators jaise ki shifting averages, oscillators, aur fashion strains ka istemaal karke confirmatory signals dhundhne chahiye. Iske saath saath, investors aur investors ko organisation basics, enterprise trends, aur market situations ka bhi dhyan rakhna zaroori hai. Conclusion mein, "Cup and Handle" sample ek effective technical evaluation tool hai jo traders aur investors ko stock fee ke bullish trend ke warning signs offer karta hai. Is sample ka istemaal karke traders access aur exit points determine kar sakte hain.

Conclusion and Planning about Advance Features: Lekin, har sample ki tarah, "Cup and Handle" sample bhi a hundred% reliable nahi hota hai. Market mein humesha risk hota hai aur stock costs unpredictable ho sakte hain. Isliye, is pattern ka istemaal karne se pehle, buyers aur traders ko thorough research aur technical analysis ki expertise honi chahiye. Pattern ke saath saath dusre technical indicators jaise ki shifting averages, oscillators, aur fashion strains ka istemaal karke confirmatory signals dhundhne chahiye. Iske saath saath, investors aur investors ko organisation basics, enterprise trends, aur market situations ka bhi dhyan rakhna zaroori hai. Conclusion mein, "Cup and Handle" sample ek effective technical evaluation tool hai jo traders aur investors ko stock fee ke bullish trend ke warning signs offer karta hai. Is sample ka istemaal karke traders access aur exit points determine kar sakte hain.

-

#6 Collapse

Aslamoalekum members kesay hain ap sab. Mujhay umed hay sah thek thak hon gay. Aj ka hamara disscussion ka jo topic hay cup and handle pattern kay bary hain. Isy dekhty hain kay yeh kia hay r hamen kia information deta hay. cup and handle pattern Cup and handle pattern forex trading mein ek maqbool chart pattern hai jo trend reversal ko numaindgi karta hai. Is pattern ko garaph kay zariye neshandahi kay ly karnay mein ak cup aur ak handle ke shakal mein dikhaya jata hai.Cup and handle pattern amm tor pr bullish trend ke end mein tashkeel hota hai jbb market ki to price down trend se up trend mein shift ho rahi hoti hai. Cup or handle pattern mein price chart pe U ke shakal ki cup ban jati hai jo keemat k therau ko zahir karta hai phir ek wasti tejarati had ise handle kehte hai wh ban jata hai. Jab market ka price handle tak pohanch jata hain to traders ko buy karna shuru karna chahiye or kyun ke handle breakout ke baad market price ko brha deny ke quwat rakhta hai. Is pattern ko trade karte waqt traders ko chart analysis karna chahiye aur stop sy loss ka estemal kar khatrat ko kam say kam karna chahiye. Achi tejarti sargarmi ke sath cup and handle pattern ko trade karne se traders ko acha faida mil sakta hai. limitations Cup and handle pattern forex trading mein ek maqbool chart pattern hai lekin iske bhi kuch nuqsanat hote hain jinhe traders ko samajhna zaroori hai. Kuch is trah nuqsanat is tarah hain sab say pehly to bht zeadq ehtyat krna hoti hay Cup and handle pattern mein bht dafa yeh ishary galat hone ke chances hote hain jab handle breakout ki jagah price chart mein down trend follow karta hai. Galat isharo se traders ko nuqsanat ka samna karna pad sakta hai. Cup and handle pattern ki tarah success rate market conditions par inhasar karta hai. Agar market price chart mein choppy ho rahi hai, to cup and handle pattern ki kamyabi ke sharah kam ho jati hai.Cup and handle pattern ko shankht karne mein zyada time lag sakta hai, kyunki iske takmeel ke liye market mein kafi time ki zaroorat hoti hai. Is tarah ke long timeframes mein trading karne se traders ko sabar rakhna zaroori hai.Cup and handle pattern ke signals ko bhi samajhna zaroori hai, kyunki ismein bhi false ishary ka risk hota hai. Traders ko apny tajziya ko tasdeeq karne ke liye aur tachniqi ishary ka istemal karna chahiye.Isliye traders ko cup and handle pattern ko samajne ke liye kafi tajarby r ilam ki zaroorat hoti hai. Agar traders is pattern ko samajh kar iska sahi istemal karte hain to iska faida bhi bahut acha ho sakta hai. -

#7 Collapse

Cup and handle pattern forex trading mein ek maqbool chart pattern hai jo trend reversal ko numaindgi karta hai. Is pattern ko garaph kay zariye neshandahi kay ly karnay mein ak cup aur ak handle ke shakal mein dikhaya jata hai.Cup and handle pattern amm tor pr bullish trend ke end mein tashkeel hota hai jbb market ki to price down trend se up trend mein shift ho rahi hoti hai. Cup or handle pattern mein price chart pe U ke shakal ki cup ban jati hai jo keemat k therau ko zahir karta hai phir ek wasti tejarati had ise handle kehte hai wh ban jata hai. Jab market ka price handle tak pohanch jata hain to traders ko buy karna shuru karna chahiye or kyun ke handle breakout ke baad market price ko brha deny ke quwat rakhta hai. Is pattern ko trade karte waqt traders ko chart analysis karna chahiye aur stop sy loss ka estemal kar khatrat ko kam say kam karna chahiye. Achi tejarti sargarmi ke sath cup and handle pattern ko trade karne se traders ko acha faida mil sakta ha Handle shape commonly ek chhota rectangle ya sideways movement ke shape mein dikhta hai. Handle shape ke breakout ke baad rate mein enormous upward motion dekha jata hai. Breakout ke baad, investors aur traders purchase positions lete hain aur stock price ko further push karne ki koshish karte hain. Pattern ke breakout ke baad, traders ko access aur go out factors determine karne mein madad milti hai. Cup form banane ke dauran, investors ko access point ka samay dekhna chahiye. Cup shape banane ke baad handle shape mein price ka decline hone se pehle access ki making plans karna zaroori hota hai. Handle shape ke breakout ke baad, traders ko purchase positions lete waqt forestall-loss degree aur goal rate ko dhyan mein rakhna chahiye. Stop-loss degree manage form ke backside ke simply neeche rakha jata hai, taaki agar price surprising decline kare toh loss control mein rahe. Target charge ko cup shape ki height ya preceding highs se estimate kiya jata hai. Is sample ko samajhne aur affirm karne ke liye, traders aur investors ko charge movements ke saath saath volume evaluation bhi karna chahiye. High volume ke saath breakout hone par sample ki validity aur electricity badhti hai. Volume analysis, breakout ko verify karne mein madad karta hai aur false breakouts se bachne mein sahayak hota hai -

#8 Collapse

CUP AND HANDLE PATTERN IN FOREX DEFINITION Security ke chart price per cup and handle ki price ka Ek technical indicator hai cup and handle Ko bullish Ka signal Samjha jata hai pattern ki Tashkel 7 weeks tak ya 65 tak long ho sakti hai Jo handle wale Cup se Milta Hai cup U ki Shakal Ka Hota Hai is pattern ko banane wala stock Old High ko test karta hai jinmen invester per selling ka pressure Hota Hai aur yah down trend se up trend Mein paya jata hai cup and handle ki identify ke Liye sTop ki maloomat ki Jaati Hai bullish volume niche wale kab se avoid Karte Hain cup and handle donon ke shares banana chahiye ismein break out kar Hona bahut zaruri hai Jab price pattern ki resistance torti hai traders ezafi slippage ka experience kar sakte hain handle ke upri trend Line ki price ke close hone ka wait Karen CUP OF BULLISH WITH INDICATOR Cup Mein Bullish indicator ka order learn Karen Agar ismein price Aage barti rahti hai aur Piche Nahin Hatti hai to trades ke chhut jaane ka Risk Hai ismein aap handle ko bhi analyse kar sakte hain aur Pull back Mein cup and handle ki determine ki Jaati Hai cup and handle pattern ke target ko point mein add karna chahie aur Iske rules ko follow karna chahie Forex trading mein zyada Se zyada knowledge Hasil Karen world ke sabse Bare crypto- asset exchange mein main se ek aapke liye ready hai customer is support per interest Karte Hain aur ismein ek account banaen Jisko demo account Kahate Hain iske sath reall account Bhi Banaya na chahie Uske bad aap apni trade Mein Achcha profit Hasil kar sakte hain aur loss se Bach sakte hain cup and handle Mein Stop loss Lagana chahie

CUP OF BULLISH WITH INDICATOR Cup Mein Bullish indicator ka order learn Karen Agar ismein price Aage barti rahti hai aur Piche Nahin Hatti hai to trades ke chhut jaane ka Risk Hai ismein aap handle ko bhi analyse kar sakte hain aur Pull back Mein cup and handle ki determine ki Jaati Hai cup and handle pattern ke target ko point mein add karna chahie aur Iske rules ko follow karna chahie Forex trading mein zyada Se zyada knowledge Hasil Karen world ke sabse Bare crypto- asset exchange mein main se ek aapke liye ready hai customer is support per interest Karte Hain aur ismein ek account banaen Jisko demo account Kahate Hain iske sath reall account Bhi Banaya na chahie Uske bad aap apni trade Mein Achcha profit Hasil kar sakte hain aur loss se Bach sakte hain cup and handle Mein Stop loss Lagana chahie  HANDLE TI REVERSAL MID POINT Cup and handle Mein reversal ke liye entry point ko Dekhen Agar iski moving average positive hoti hai to aap ismein investment kar sakte hain aap apne future Mein cup and handle increase Karen investors ke liye technical analysis Ek tool hai

HANDLE TI REVERSAL MID POINT Cup and handle Mein reversal ke liye entry point ko Dekhen Agar iski moving average positive hoti hai to aap ismein investment kar sakte hain aap apne future Mein cup and handle increase Karen investors ke liye technical analysis Ek tool hai

-

#9 Collapse

CUP AND HANDLE PATTERN FOREX TRAIDING:- Is article mein hum "CUP aur HANDLE Pattern" ke baare mein baat karenge, jo forex market mein ek aam technical analysis pattern hai. Ye pattern market ke trends aur price movements ko samajhne aur trading decisions lene ke liye istemal kiya jata hai.Cup aur Handle Pattern ek price chart pattern hai, jisme ek "CUP" aur "HANDLE" ki shakal banti hai. Is pattern mein price chart par ek cup jaise curve banti hai, jise "cup" kaha jata hai. Uske baad ek chhoti horizontal line, jise "handle" kaha jata hai, banti hai. Cup aur Handle Pattern ki pehchan ke liye, kuch mukhtalif points ka dhyan dena zaruri hai:. Forex market mein trading karne se pehle, apko market ki complete research aur risk management techniques ka istemal karna chahiye. Yeh article sirf basic information provide kar raha hai aur trading decisions ke liye kisi professional financial advisor ki madad lena zaroori hai. COMPONENTS OF CUP AND HANDLE IN FOREX:- CUP: Cup pattern ek BULLISH trend ke baad paida hota hai. Is pattern mein price initially upar ki taraf move karta hai aur phir downsideways ki taraf move karta hai. Yeh pattern generally round shape ka hota hai aur time period kuch weeks se kuch months tak ho sakta hai. Is pattern mein cup ki shape important hoti hai, jisay sahi tarah se define karna zaroori hai. Cup pattern mein neechay diye gaye components hote hain: Left Side of the Cup: Cup pattern ki shuruat bullish trend ke baad hoti hai. Price initially upar ki taraf move karti hai aur ek high point tak pohanchti hai. Bottom of the Cup: Price phir downsideways move karti hai aur ek low point tak pohanchti hai, jo left side of the cup se neechay hota hai. Right Side of the Cup: Price phir se upar ki taraf move karti hai aur left side of the cup ke high point ko cross karke wapas upar ki taraf jaati hai. Cup ki shape round aur smooth honi chahiye, jisay sahi tarah se recognize kiya ja sakay.Cup ki tashkeel mein price chart par ek upward trend hota hai, jisme price initially upar jata hai aur phir dheere dheere neeche aa jata hai, ek u-turn lekar. Ye u-turn curve ki shakal mein dikhayi deta hai. Cup ki lambai aur gehrai alag-alag ho sakti hai. HANDLE:- Cup pattern ke baad handle pattern banata hai. Handle pattern mein price phir se neechay move karti hai aur phir se upar ki taraf move karti hai. Handle pattern ki shape generally flat aur sideways hoti hai. Handle ki shape important hoti hai, jisay sahi tarah se identify kiya jata hai. Handle pattern mein neechay diye gaye components hote hain: Low Point: Handle pattern mein price cup ki bottom se neechay move karti hai aur ek low point tak pohanchti hai. Consolidation: Price phir handle ki shape mein flat aur sideways move karti hai. Handle ki shape generally short hoti hai aur cup pattern ke low point se neechay rehti hai. -Breakout: Price handle pattern ke high point ko cross karti hai aur upar ki taraf move karti hai. Handle pattern ki shape cup pattern ki shape ke barabar honi chahiye.Cup ke baad, price chart par ek chhoti horizontal line banti hai, jise "handle" kaha jata hai. Handle usually kam samay mein banti hai aur price ke kam movement ke saath rehti hai. Cup aur Handle Pattern ek bullish pattern hai, jiska matlab hota hai ki ye pattern usually price ke upar jaane ki tendency dikhata hai. Is pattern ki tashrih niche di gayi hai. Cup: Cup ki formation se pata chalta hai ki market initially price ko upar le gaya hai, phir neeche aaya hai, aur phir se upar ja raha hai. Ye ek strong bullish signal hai. Handle, cup ke baad price mein thoda consolidation aur sideways movement ko darshata hai. Ye ek chhota retracement ho sakta hai, lekin overall trend positive rehta hai. CHART PATTERN OF CUP AND HANDLE:- Cup aur Handle Pattern ko forex trading mein istemal karne se pehle, iski tashkeel aur confirmation ke liye doosre technical indicators aur tools ka istemal kiya ja sakta hai. Kuch traders trend lines, moving averages, aur volume analysis ka istemal karte hain. Pattern ki confirmation ke baad, traders buy entry point ke liye wait karte hain. Jab price handle se upar jaata hai aur cup ke peak level ko cross karta hai, tab traders long position le sakte hain. Stop Loss: Har trading strategy mein stop loss ka istemal zaruri hota hai. Traders apne risk tolerance ke hisab se stop loss level set karte hain, taki agar trade against direction jaaye, toh nuksaan kam ho ga. Target price ko set karte samay, traders cup ki lambai ko handle ki height se add kar sakte hain. Ye target price ho sakta hai, jahan traders partial ya full profit book kar sakte hain. Cup aur Handle Pattern ek powerful trading tool hai, lekin iski effectiveness aur profitability ki guarantee nahi Cup aur handle chart pattern forex market mein commonly istemaal hony wala ek technical analysis tool hai. Yeh pattern market trends aur price movements ko identify karne ke liye istemal hota hai. Cup aur handle pattern traders ko future price movement ke bare mein sahayta pohanchata hai. Is article mein hum cup aur handle pattern ke mukhtalif components aur unke matlab ko samjhain. Cup aur handle pattern ke components ki sahi identification aur confirmations ke baad, traders future price movement aur possible entry/exit points ka faisla kar saktay hain. Technical analysis aur candlestick patterns ke saath sath, cup aur handle pattern forex trading mein aik powerful tool ban sakta hai.

- Mentions 0

-

سا0 like

-

#10 Collapse

INTRODUCTION Safety and price chart kase aur handle ko taizi ka signal samjha jata hai, patteren kana dayen taraf ko aam tor par kam tijarti hajam ka saamna hota hai. pattern ki tashkeel saat hafton tak ya 65 hafton tak taweel hosakti hai .Dear members Forex trading forex card kaam main number of time patterns different graphics trader hot jin tara hum trading lucky k acha lucky lucky lucky trader main trading number passed CUP and handle pattern bhe hota hy commercial carny k liay sub sy pehli chez ye hoti hy old form U honi chaye agr U build main hoga usy hum pattern CUP standard name dain gy aur isk bad main aik handle banta hy kami k k k k breakout par hun Commercial sakty hain aur kami main hum trager cup k size ka asani sy laga sakty hain jitny throughout the main time period yee ban ka uska humain utja he bara target mil sakta hy main apa apa SL handle k nechi hata hy aur apaka TP ap CUP k Size k jitna oper laga sakty hain jesa k hum pattern what ko asani sy samjh sakti hain salam. CUP AND HANDLE PATTERN: Brothers and sisters, Jab Cup and handle pattern jitna action kr sakti hai. Banana, hum apni ki koshish kar sakte hain likn hum ko Breakout ka intezar nezamji krni cheye or jaldbaji ma kei sada ni krni cheye useful for trading. KEY FEATURE OF CUP AND CANDLE PATTERN: Dear Friends Agr Trading App Forex MI Cup And Pattern Chahate Hain Meh Banta Hai Image. 2a or 2 different tarah ki ho makti hai u top type sa nechi bhi bana sakhta hai ke behi bana sakhta hai. Ka ka saath make a handle banta hai tu ya cup and full pattern ho jata hai. INVESTORS AND FUNDAMENTAL PATTERN: "Cup and Handle" sample ka istemaal karke investors aur buyers ko entry aur go out points determine karne mein madad milti hai. Jab cup shape ban raha hota hai, tab investors ko entry factor ka samay dekhna chahiye. Cup form banne ke baad manage form mein fee ka decline hone se pehle access ki making plans karna zaroori hota hai. Handle shape ke breakout ke baad, traders ko buy positions lete waqt stop-loss stage aur target fee ko dhyan mein rakhna chahiye. Stop-loss stage ko manage shape ke backside ke just neeche rakha jata hai taaki agar rate surprising decline kare toh loss manage mein rahe. Target rate ko cup shape ki peak ya preceding highs se estimate kiya jata hai. Ye sample lengthy-time period traders ke liye bhi beneficial ho sakta hai. Agar kisi stock ka "Cup and Handle" sample form ho raha hai, toh lengthy-term traders ko inventory ki performance aur destiny boom potentialities ko compare karne ka mauka milta hai. Is sample ke breakout ke baad stock rate mein sustained upward movement hone ke possibilities hote hain. "Cup and Handle" sample ka istemaal karne ke liye, buyers aur buyers ko price movements, quantity, aur marketplace sentiment ka dhyan rakhna zaroori hota hai. Is sample ke saath saath dusre technical indicators jaise ki transferring averages, oscillators, aur trend strains ka istemaal karke confirmatory alerts dhundhne chahiye. -

#11 Collapse

Assalamo Alaekum friends. Kasy hain ap sabMain umed karta hon ap sab bilkul thek thak hon gay. Aj ka jo topic zer e behs hay uska nam cup and handle candlestick patterns hay . Yeh hamen kia btayega r kia information deta hay yeh dekhty hain. Yeh hamen kia kuch btaya hay yeh ab ham agy mazeed dekhty hain. Cup And Handle Pattern Aek cup or handle ko taizi ka ishara smjha jata hy jo upri rujhan ko brhata hy or isy taweel safar k mawaqy talash krny k leay istmal kya jata hy Is isharay ka istmal krny waly technique tajiro ko pattern k handle waly hissy ki opri trend line sy thora opr stop buy order dena chaheay. How to Trade in CuP and Handle Pattern? Cup or handle ki tijarat tk pohnchny k kai tareeqy hy likn sb sy bunyadi aek lambi position me dakhil hony ki talash hy neechy di gae tasweer me classic cup or handle ki tashkeel ko dikhaya geya hy.Handle k opri trend line sy thora opr stop buy order dy.Order pr amal dramad srf us surat me hona chaheay jb qeemat pattern ki muzahmat ko torti hy.Tajir izafi phislan ka tajarba kr skty hy or jarihana andaz ja istmal krty hoey ghlt break out dakhil kr skty hy.Mutabadil k tor pr ,handle ki opri trendline k opr us qeemat k bnd hony ka intazar kry.bad me pattern k break out level sy thora neechy had ka order dy is pr amal dramad hasil krny ki koshish kry agr qeemat peechy ht jati hy agr qeemat agy brhti rhti hy or peechy ni hat ti to tijarat k chor jany ka khatra hy.Munafa ka hadaf cup k nichly hissy or pattern k break out level k drmyan fasly ki pymaish kr k or is faslay ko break outsy opr ki trf brha kr ty kya jata hy Misal k tor pr aek cup k neechy handle break out level k drmyan fasla 20 points hy to munafa ka hadaf pattern k handle sy 20 points opr rkha jata hy Stop loss orders ya to handle k neechy ha cup k neechy traders k khtry ki brdasht or market k utaar charhao pr munhasir ho skty hy. -

#12 Collapse

Asslam o Alaikum forex trading pr ap logo ka kam Acha chl rha hoga aj jis mozo pr hum bt krain ga wo nicha hain TOPIC :CUP AND HANDLE PATTERN IN FOREX stock ke chart par waqt ke sath sath aik cup and handle stock patteren tashkeel diya jata hai jab aik oopar ki taraf rujhan hota hai jis ke baad aik waqfa ya istehkaam ki muddat hoti hai jahan qeematein kam ho rahi hain phir kami ke baad aik aur izafah hota hai . kuch tajir is qisam ke patteren ko tasalsul ke patteren ya ulat patteren ke tor par dekhen ge . yeh tashkeel is baat se aati hai ke kuch tajir chart par nazar anay walay namonon aur rujhanaat ki tijarat ke liye raftaar ki hikmat e amli ka istemaal karte hain jabkay un ilaqon ki bhi nishandahi karte hain jahan kharidaron mein dilchaspi kam hosakti hai jis ki wajah se woh apni boli ki qeematon mein izafah karna chore dete hain jis se baichnay walon ko ziyada control mil jata hai kyunkay khredar ab qeematon ko jab stock ki qeemat muzahmati line se oopar jati hai jo handle ke ounchay hissay se banai jati hai, to kaha jata hai ke yeh toot gaya hai aur yeh taajiron ko ishara karta hai ke qeemat mein ziyada ulta harkat ka imkaan hai . aik ahem kami ke baad, qeemat aik cupp bananay ke liye barhti hai ye hafton ya mahinay lag sakta hai . handle is waqt bantaa hai jab qeemat ruk jati hai aur dobarah oopar jane se pehlay aik taraf hoti hai. aik break out is waqt hota hai jab stock ki qeemat handle ki oonchai se peda honay wali muzahmat ki satah se oopar dhkilti hai . bohat se tajir hajam ki tasdeeq ki talaash karte hain taakay yeh ishara kya ja sakay ke kharidari ki zamanat hai . break out ke douran hajam mein bara izafah yeh tajweez kar sakta hai ke idaara jati sarmaya car stock ke peechay ja rahay hain. is se mustaqbil mein qeematon mein mazeed izafah ho sakta hai . cup aur handle patteren ko istemaal karne ke liye, taajiron ko un iqdamaat par amal karna chahiye : patteren ki shanakht karen : aik gole neechay ki tashkeel ke liye dekho, is ke baad handle bananay ke istehkaam ki aik mukhtasir muddat ke baad. cupp aur handle sadool hona chahiye, aur handle waqt mein nisbatan short mukhtasir hona chahiye . is ki taaqat ka andaza karen : cupp ki geherai aur handle ki lambai aur zavia check karen. aik gehra cupp aur ziyada batadreej handle anay walay taizi ke rujhan ke mazboot isharay hain . patteren ki tasdeeq karen : ahem tijarti hajam par handle ke oopar stock ki qeemat ke totnay ka intzaar karen. yeh break out patteren ki sadaqat ki tasdeeq karta hai . tijarti hikmat e amli par amal karen : aik baar patteren ki tasdeeq hojane ke baad, handle ke nichale hissay ke neechay stop nuqsaan ka order dete hue, lambi position mein daakhil honay par ghhor karen. tajir patteren ki taaqat ki tasdeeq karne aur apni tijarti hikmat e amli par amal daraamad ke liye moving average aur axcelator jaisay takneeki isharay bhi istemaal kar satke hain . yeh baat zehen mein rakhna bohat zaroori hai ke cupp aur handle ka namona hamesha mustaqbil ki qeematon mein naqal o harkat ka qabil aetmaad isharay nahi hota hai, aur taajiron ko bakhabar tijarti faislay karne ke liye usay dosray takneeki aur bunyadi tajzia tools ke sath mil kar istemaal karna chahiye. mumkina nuqsanaat ko munazzam karne ke liye munasib khatray ke intizam aur position ka size bhi ahem hai . -

#13 Collapse

Opening :Post ka achcha aur kamal ka hona lajmi hai agar post acchi aur Kamal Ki hogi information grain hogi to hey kuchh ismein aapko fayda hoga in any case aap isase paida aasan Nahin kar sakte Aaj ham baat karenge adapt and deal with ke uncovered mein aur iski information aapas mein share karenge aur guftgu karenge is point perDear companions, I have given you the information you need and love. Rede FIR per Kuch SampagSECURITY AND Value Diagram Example HOTA Howdy Business CARNI KE LIA SUB C PALEI Pursue YE HOTI hai Structure OLD U HONEY CHAYE AGR U Form HOGA Fundamental Example Murmur CUP STANDARD NAME DAING Hmm AUR ISK Terrible Primary IK HANDLE BANTA Hey KAMI KK BREAKOUT I Exchange shakit greetings aur we play murmur trager cup ke size ka asani si laga sakti hai win during ideal time ke bank ka uska hamain itja he bara target mil sakta hey mein apa sl handle ke nechi blunder hai aur apka tp ap cup ke size Ke jeetna opar lagga hai jesa ke murmur what example is simple comprehension power hai salam.Key Elements of Cup and Handle Example:Dear Companions Agr Exchanging Application Forex MI Cup And Example Chahate Hain Meh Banta Hai Picture. 2a or 2 different tarah ki ho makti hai u top sort sa nechi bhi bana sakhta hai ke behi bana sakhta hai. Ka saath make a handle banta hai tu ya cup and full example ho jata hai.Cup and Handle Example:Family, the hit cup and deal with example can do the triumphant activity. Banana, murmur apni ki khish kar sakte hain likhan murmur ko breakout ka intezar nezamji krini ke jaladbaji mama ke sada ni karni chiye is valuable for business. -

#14 Collapse

Cup and Handle Example ki Arrangement ki Samajh and Development "Cup and Handle" test, yaani "Gulab aur Munhwaala" test, stock market ke specialized examination mein ek prasiddh test hai jo purchasers aur financial backers dwara cost moves ke investigation ke liye istemaal kiya jata hai. Is design ka naam isliye hai kyunki ye ek kulhad aur uske oversee jaisa dikhta hai. Ye design bullish style ke sign ke liye istemaal hota hai, yaani stock expense mein up movement ka sanket deta hai. Is design mein charge above all else down hoti hai, phir steady tareeke se recuperate karke ek round shape bana leti hai, aur phir ek chhota manage shape bana leti hai. Round structure ko "cup" aur handle structure ko "make due" kaha jata hai. "Cup and Handle" Financial backers aur Crucial Examination "Cup and Handle" test ka istemaal karke financial backers aur purchasers ko passage aur go out focuses decide karne mein madad milti hai. Poke cup shape boycott raha hota hai, tab financial backers ko passage factor ka samay dekhna chahiye. Cup structure banne ke baad oversee structure mein expense ka decline sharpen se pehle access ki making arrangements karna zaroori hota hai. Handle shape ke breakout ke baad, merchants ko purchase positions lete waqt stop-misfortune stage aur target expense ko dhyan mein rakhna chahiye. Stop-misfortune stage ko oversee shape k Cup and Handle Example ke Amli Namunon aur Contextual analyses: Lekin, har design ki tarah, "Cup and Handle" design bhi one hundred% dependable nahi hota hai. Market mein humesha danger hota hai aur stock costs eccentric ho sakte hain. Isliye, is design ko samajhne aur istemaal karne se pehle, financial backers aur dealers ko thorou Tareekhi Karkardagi aur Cup and Handle Example ki Kamyabi End mein, "Cup and Handle" design ek well known specialized investigation apparatus hai jo merchants aur financial backers ko bullish style ke side effects ke liye help karta hai. Ye test rate moves ke assessment mein istemaal kiya jata hai aur section aur leave factors choose karne mein madad deta hai. Lekin, is design ke istemaal ke liye careful investigations, market examination, aur risk the executives ka dhyan rakhna zaroori hai. Exchanging aur contributing mein sharpen wal Cup and Handle Example ka Istemaal Karke Exchange Mein Kamyabi Handle shape ordinarily ek chhota square shape ya sideways development ke shape mein dikhta hai. Handle shape ke breakout ke baad rate mein gigantic End and Arranging about Advance Elements Lekin, har test ki tarah, "Cup and Handle" test bhi a hundred% dependable nahi hota hai. Market mein humesha risk hota hai aur stock costs erratic ho sakte hain. Isliye, is design ka istemaal karne se pehle, purchasers aur merchants ko intensive exploration aur specialized examination ki aptitude honi chahiye. Design ke saath dusre specialized pointers jaise ki moving midpoints, oscillators, aur style strains ka istemaal karke con -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 Collapse

Cup and Handle Model ki Course of action ki Samajh and Improvement "Cup and Handle" test, yaani "Gulab aur Munhwaala" test, securities exchange ke specific assessment mein ek prasiddh test hai jo buyers aur monetary sponsor dwara cost moves ke examination ke liye istemaal kiya jata hai. Is plan ka naam isliye hai kyunki ye ek kulhad aur uske manage jaisa dikhta hai. Ye plan bullish style ke sign ke liye istemaal hota hai, yaani stock cost mein up development ka sanket deta hai. Is plan mein run after regardless of anything else hoti hai, phir consistent tareeke se recover karke ek round shape bana leti hai, aur phir ek chhota oversee shape bana leti hai. Round structure ko "cup" aur handle structure ko "make due" kaha jata hai. "Cup and Handle" Monetary patrons aur Significant Assessment "Cup and Handle" test ka istemaal karke monetary supporters aur buyers ko section aur go out centers choose karne mein madad milti hai. Jab cup shape blacklist raha hota hai, tab monetary patrons ko entry factor ka samay dekhna chahiye. Cup structure banne ke baad regulate structure mein cost ka decline hone se pehle access ki making plans karna zaroori hota hai. Handle shape ke breakout ke baad, dealers ko buy positions lete waqt stop-disaster stage aur target cost ko dhyan mein rakhna chahiye. Stop-incident stage ko regulate shape k Cup and Handle Model ke Amli Namunon aur Relevant examinations: Lekin, har plan ki tarah, "Cup and Handle" plan bhi one hundred% trustworthy nahi hota hai. Market mein humesha peril hota hai aur stock costs unconventional ho sakte hain. Isliye, is plan ko samajhne aur istemaal karne se pehle, monetary sponsor aur vendors ko thorou Tareekhi Karkardagi aur Cup and Handle Model ki Kamyabi End mein, "Cup and Handle" plan ek notable particular examination contraption hai jo shippers aur monetary sponsor ko bullish style ke incidental effects ke liye help karta hai. Ye test rate moves ke appraisal mein istemaal kiya jata hai aur segment aur leave factors pick karne mein madad deta hai. Lekin, is plan ke istemaal ke liye cautious examinations, market assessment, aur risk the chiefs ka dhyan rakhna zaroori hai. Trading aur contributing mein hone wal Cup and Handle Model ka Istemaal Karke Trade Mein Kamyabi Handle shape conventionally ek chhota square shape ya sideways advancement ke shape mein dikhta hai. Handle shape ke breakout ke baad rate mein colossal End and Orchestrating about Advance Components Lekin, har test ki tarah, "Cup and Handle" test bhi a hundred% trustworthy nahi hota hai. Market mein humesha risk hota hai aur stock costs sporadic ho sakte hain. Isliye, is plan ka istemaal karne se pehle, buyers aur vendors ko escalated investigation aur particular assessment ki fitness honi chahiye. Plan ke saath dusre specific pointers jaise ki moving midpoints, oscillators, aur style strains ka istemaal karke con

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 02:48 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим