Descending Hawk pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

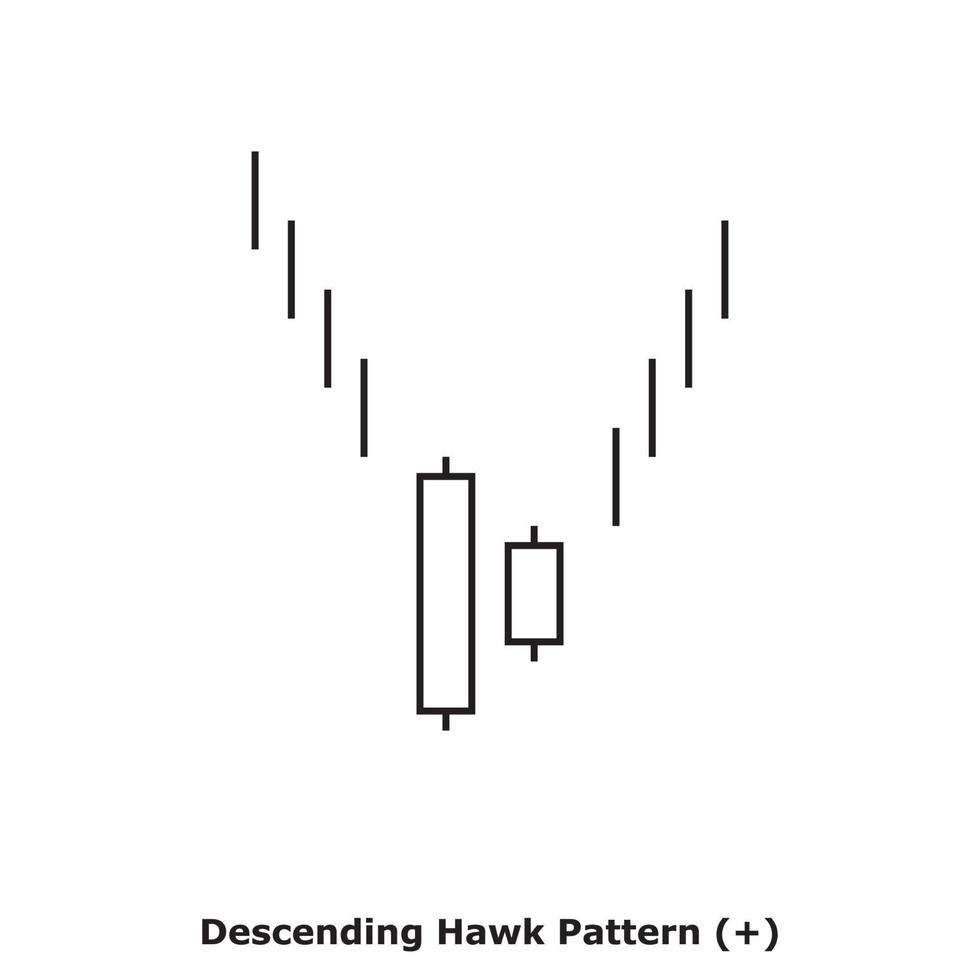

Descending hawk patternDescending hawk pattern two days candles par mushtamil aik bear trend reversal pattern hai yes k price k top par ya bullish trend k akhtetam par banta hai. Pattern ki pehli aur dosri candle same bull candles hoti hai jis main dosri candle pehli candle k andar open aur close hoti hai. Descending hawk pattern ki dosri candle formation ki same "bearish Harami pattern" aur "bearish Harami cross pattern" jaisi hai lekin aik to iss candle ka color white hoti hai, jo k "bearish harami pattern" k candle main black hoti, dosra ye candle small real body ki hoti hai, yes k "Bearish Harami Cross Pattern" ki candle doji candle hoti hai, jiss ka open aur close same hota hai. Descending hawk pattern aik bear trend reversal pattern hai, yes k price k top par ya bull trend main banta hai. Ye pattern bull k kamzori ki nishan dahi karta karta hai. Dosree candle aik aik small real body wali bull candle hoti hai jo uptrend ka ikhtetaam karti hai, jiss k baad prices bear trend reversal ka sabab banti hai. Trading Dear members descending hawk pattern bhi 2osrie bear trend reversal patterns ki jesy sell kay signals deta hay. Trading pattern ka tarek kar bi bearish Harami pattern jesa hay. Jis per market mein sell ki entry ki jati hay. Trading pattern see prices Pehly ka begeer study kar lein key yah to yeh uptrend mein honni chaey or yah high level py honey chaey. Pattern ki first candle normal long real body vali hoti hay. Jis ko 2osri din ki small bull candle follow krtti hay. Descending hawk pattern mein 2osre din ki candle ki formation bht eham hay. Jjo key 1st candle key under honi cheay yanni candle ki open or close 2ono key first candle open or r close see km honi chaey. Descending hawk Candlestick key leay trend confirmation trade entry see phle eham hay. jab bhi pattern key baad 3esri din ki candle bearish yah kali candle banne gi to yeah market mein sell see entry karne ka time hoga. SL pattern key sab see highest price yah bear candle key top see aek yah 2 pips upre resistance point par lgaty hain. candlestick formation,, Descending hawk candlestick pattern Descending candlestick design bird of prey aik negative inversion pattern sharpen ki waja se qeematon ka pehle se bullish pattern ya exorbitant costs region me hona chaheye.Descending hawk candlestick pattern Design ki first flame aik bari right body wali white candle hoti hai, yes k negative pattern ki alamat hoti hai pattern ki second candle aik small right body wali white candle hoti hai, yes k inversion pattern ka kaam karti hai. Design ki first light second flame size me ziyaa ya bari hoti hai Pattern ki Descending hawk candlestick pattern second white candle first white candle k inside open aur close hoti hai. Design ki dono candles right body aur shadow samet ho sakti hai, punch k second candle ki right body first flame ki right body se lazmi kam hona chahyee gy.... Explanation Descending hawk pattern bhi dosre negative inversion pattern patterns ki tarah sell k sign deta hai. Design standard exchange ka tareeqay kar bhi "Negative Harami pattern" jaisa hai, jiss standard market fundamental sell ki section ki jati hai. Design standard exchange se pehle cost ka baghawar study karlen k ya to ye upswing me honni chaheye aur ya ye significant level pe hon. Design ki pehlee candle typical long right body wali hotti hai, jis ko dosre cry ki small bull light follow kartti hai. Slipping bird of prey design me dosre clamor ki candle ki development bohut zarrori hai, yes k pehli light k under honi chaheye, yanni candle ki open aur close dono pehli candle k open aur close se kam honi chaheye. Diving falcon Candlestick k leye pattern confirmation exchange passage se pehle zarrori hai, punch bhi design k baad teesre noise ki candle negative ya dark light banne gi to ye market principle me sell yourself section karne ka time hoga. -

#3 Collapse

Descending Hawk Pattern in Forex. Forex mein chart patterns traders ke liye aik mofeed tool hai jo unhe trend ki prediction karnay mein madad deta hai. Descending hawk pattern bhi in patterns mein se aik hai, jo traders ke liye useful ho sakta hai. Is article mein ham descending hawk pattern ke baray mein roman urdu mein batayenge. Hawk pattern ko aksar trend reversal indicator ke tor par istemaal kiya jata hai. Is pattern mein market mein bullish trend ke baad bearish trend ka aana indicate hota hai. Is pattern ki shape aik hawk jaisi hoti hai jis mein do wings aur head hote hain. Head upper side par hota hai jabke wings lower side par hotay hain. Is pattern ko recognize karna chart par aik mushkil kaam hai, lekin usko samajhna traders ke liye zaroori hai. Descending Hawk Pattern Market Anylesis. Descending hawk pattern mein bhi bearish trend ki prediction hoti hai. Is pattern mein bhi hawk ki shape hoti hai, lekin is mein wings upar ki taraf hote hain aur head neechay ki taraf hota hai. Is pattern mein market mein downtrend ki prediction hoti hai. Jab market mein downtrend aana shuru ho jata hai, to is pattern ki shape form hona shuru ho jati hai. Descending Hawk Pattern Recognize. Descending hawk pattern ko recognize karna chart par mushkil ho sakta hai. Is pattern mein market ka trend change hone ki prediction hoti hai, is liye isko recognize karna traders ke liye zaroori hai. Is pattern ko recognize karne ke liye aapko chart par bearish trend ko dekhna hoga. Jab bearish trend ho to is pattern ki shape banne lagti hai. Is pattern ki shape complete hone ke baad aap sell position ko enter kar sakte hain. More Important. Descending hawk pattern ko recognize karna chart par mushkil ho sakta hai, lekin isko samajhna traders ke liye zaroori hai. Is pattern ki shape bearish trend ke baad complete hoti hai aur isko recognize karne ke baad aap sell position mein enter ho sakte hain. Is pattern ko samajhna aur recognize karna forex trading ke liye zaroori hai. -

#4 Collapse

Descending Hawk Pattern" technical analysis ka ek pattern hai jo stock market ya kisi bhi financial instrument ki chart analysis me istemaal hota hai. Is pattern ka naam "Descending Hawk" isliye rakha gaya hai kyunki iske formation ko baaj ke girne jaise dekhne ki wajah se yeh naam diya gaya hai.Is pattern ki formation kehte hai jab kisi stock ya financial instrument ki price chart par ek bearish trend ho aur us trend me kuch spikes hone ke baad, price kuch dino ke liye sidha rehta hai, jise "consolidation phase" kehte hai. Uske baad, price phir se niche jata hai aur is baar ek downward trend banata hai. Is downward trend me kuch upar ki taraf spikes hote hai, jo ki hawk ke uddne ki tarah lagte hai, isliye isko "Descending Hawk Pattern" kehte hai. Is pattern ki formation ko samajhne ke liye, kuch important points niche diye gaye hai: 1. Bearish Trend: Descending Hawk Pattern tabhi ban sakta hai jab stock ya financial instrument ka price chart bearish trend me ho. Iska matlab hai ki price continuously down trend me hai aur sellers ki taraf se selling pressure hai. 2. Consolidation Phase: Consolidation phase us samay hota hai jab price chart par kuch spikes hote hai aur phir kuch dino ke liye price sidha rehta hai. Is phase me buyers aur sellers ki taraf se koi dominant trend nahi hota hai. 3. Downward Trend: Consolidation phase ke baad, price phir se downward trend banata hai, jisme sellers ki taraf se selling pressure badhta hai aur price niche jata hai. 4. Spikes: Downward trend me bhi kuch spikes hote hai, jo ki upar ki taraf jaane ka indication dete hai, lekin yeh sirf temporary movements hote hai aur overall trend bearish hi rehta hai. 5. Volume: Volume bhi ek important factor hai, jo ki Descending Hawk Pattern ki formation me dekhna zaroori hai. Is pattern me, consolidation phase ke dauran volume kam hota hai, jabki downward trend me volume badhta hai. Formation of Pattern. Is pattern ki formation me, consolidation phase ke baad, price ki down move ki wajah se traders aur investors ko selling ki taraf attract hota hai aur isliye price aur jyada niche jaane lagta hai. Jab price niche jata hai, toh kuch temporary spikes ke baad phir se downward trend ban jata hai.Descending Hawk Pattern ki formation bearish trend ke beech me hoti hai, isliye yeh ek bearish reversal pattern mana jata hai. Is pattern ko dekhkar traders aur investors selling ki taraf attract hote hai aur isliye is pattern ka istemaal bearish trend ke beech me trades ke liye kiya jata hai. Is pattern ka istemaal karne se pehle, traders aur investors ko ek acchi technical analysis ki zaroorat hoti hai aur iske alawa ek accha risk management system bhi hona zaroori hai. Iske bina, is pattern ke istemaal se traders aur investors apni investment aur trading capital ko nuksan me daal sakte hai. -

#5 Collapse

Detail and explaination of Descending Hawk Pattern. descending hawlk pattern donu bullish candles pe depended hota he aur yeh aik negative pattern inversion design hota hy jo price chart k top ya bullish pattern me banta hai. pattern ki first candle aik bullish candle hoti hai, jo k size mein bohut long hoti hai. pehli candle k baad dosri candle bhi same white ya bullish candle banti hai. bullish pattern aur price k potential me creation ki waja se ye design negative pattern inversion pattern bn jata hai. is patteen ki primary first candle to long measure ki hoti hai lekin second candle aik little genuine body mein banti hai, jis ka open aur close both pehli candle ki genuine body k centre me hoti hai. Identification Of Candles. descending hawlk pattern mein two candles same bullish pattern ki wajah se ye pattern price chart pe bearish pattern inversion design ka work karta hai, ye design same negative harami design jaisa hai lekin second candle is ki bullish hoti hai.. (Day 1 ) ki candle aik long genuine body bullish candle hoti hai, jis ko (day 2 ) ki aik little genuine body wali candle follow karti hai. bullish little candle ki open aur close dono pehli candle k focus me hoti hai, ye candle bullish pattern ko end karke new example ko start krti hai.. Trading Method For Descending Hawlk Pattern descending hwlk pattern aik inversion design hota hai, jiss ka start aik bullish long genuine body wali candle se hota hai. pattern ki dosri candle bhi bullish hoti hai, lekin little genuine body honay ki waja se ye design bullish pattern ko khatam karti hai. candle k complete sharpen k baad market teesri negative candle ka wait karna chaheye, jiss k baad market mein purchase ki trade se section ho sakti hai. without pattern affirmation k pattern ziadda tarr impartial tasawarr keye jatte hen. Stop Loss Stop Loss pattern k sab se top point jo k pehli cande ka close point hai, os se two pips ziada set karna chahye es tarah acha profit hasil kiya ja sakta hy... -

#6 Collapse

decending haaak patteren aik takneeki tajzia patteren hai jisay forex trading mein qeemat ke rujhanaat mein mumkina mandi ke ulat jane ki nishandahi karne ke liye istemaal kya jata hai. usay classic sir aur kaandhon ke patteren ki aik tabdeeli samjha jata hai aur yeh teen chotyon se bantaa hai jis ki darmiyani chouti ( sir ) dosray do ( kaandhon ) se onche hoti hai . utartay hue haaak patteren mein, pehli chouti baen kandhay ki numaindagi karti hai aur is ke baad aik onche chouti hoti hai, jo sir banati hai. sir ke baad, aik aur chouti hai, jo sir se neechay hai, dayen kandhay ki tashkeel karti hai. is patteren ko is ka naam chotyon ki aik haaak ke paron se mushabihat ki wajah se mila hai, jis ka sir sab se ouncha hai . utartay hue haaak patteren se pata chalta hai ke up trained raftaar kho raha hai aur yeh ke mumkina rujhan ulat sakta hai. tajir patteren ki tasdeeq ke liye makhsoos khususiyaat talaash karte hain, jaisay ke baen kandhay aur dayen kandhay ke darmiyan neech ko jornay wali gardan ki lakeer. naik line support level ke tor par kaam karti hai, aur agar yeh toot jati hai, to yeh bearish reversal ki tasdeeq karti hai . jab naik line ki khilaaf warzi hoti hai to, tajir aksar mukhtasir position shuru karte hain, qeemat mazeed kam honay ki tawaqqa rakhtay hain. utartay hue haaak patteren ka hadaf aam tor par sir se gardan ki lakeer tak faaslay ki pemaiesh karkay aur usay break out point se neechay ki taraf paish karte hue lagaya jata hai. is se andaza hota hai ke qeemat mumkina tor par kitni kam ho sakti hai . yeh note karna zaroori hai ke decending haaak patteren aik qabil aetmaad reversal patteren ho sakta hai, lekin yeh durust nahi hai, aur taajiron ko –apne tijarti faislon ki tasdeeq ke liye usay deegar takneeki isharay aur tajzia ke tareeqon ke sath mil kar istemaal karna chahiye. ghalat signals ho satke hain, aur market ke halaat hamesha tabdeel ho satke hain, is liye rissk managment aur munasib stap loss orders bohat ahem hain . aakhir mein, decending haaak patteren aik bearish reversal patteren hai jo forex trading mein dekha jata hai. yeh up trained se neechay ke rujhan ki taraf mumkina rujhan ke ulat jane ki nishandahi karta hai. tajir mumkina dakhlay aur kharji raastoon ki nishandahi karne ke liye patteren ka tajzia karte hain, naik line ko support ki kaleedi satah ke tor par istemaal karte hain. taham, kisi bhi takneeki tajzia ke patteren ki terhan, tijarti hikmat amlyon mein utartay hue haaak patteren ko shaamil karte waqt deegar awamil par ghhor karna aur rissk managment ki munasib tecnique ka istemaal karna zaroori hai ."Dream bigger. Do bigger"

(mahroosh) :1f607:

-

#7 Collapse

Kamyabi se forex trading karne ke liye ek zaroori skill hai ke alag-alag technical indicators aur price patterns ko parhna aur samajhna. Ek aisa pattern hai Descending Hawk Pattern. Descending Hawk Pattern ek technical analysis tool hai jo traders istemal karte hain ek nichle market mein potential trend reversals ko pehchanne ke liye. Ye ek candlestick pattern hai jo do candles aur ek khaas price action se bana hota hai. Pattern ko Descending Hawk isliye kaha jata hai kyun ke ye ek hawk ke niche urte hue hone ki tarah lagta hai.

Components of the Descending Hawk Pattern

Descending Hawk Pattern in cheezon se bana hota hai:- Pehli Candle: Ek lambi laal bearish candle, jo market mein taqatwar selling pressure ko darust karti hai.

- Dusri Candle: Ek chhoti hari bullish candle, jo pehli candle ke neeche ek gap banati hai. Ye candle temporary buying pressure ko darust karti hai, lekin selling pressure ab bhi dominant hai.

- Price Action: Price dusri candle ke neeche qareeb qareeb band honi chahiye, jo nichle trend ki jari rakhwast ko tasdeeq karta hai.

Ek Descending Hawk Pattern ko pehchanne ke liye, ye steps follow karein:- Step 1: Market mein ek downward trend ka pehchan karein.

- Step 2: Pehli lambi laal candle ko dekhein, jo taqatwar selling pressure ko darust karti hai.

- Step 3: Agla, dekhein ek chhoti hari candle jo pehli laal candle ke neeche ek gap banati hai.

- Step 4: Aakhir mein, yaqeeni banayein ke price dusri hari candle ke neeche qareeb qareeb band hoti hai, jo downward trend ki jari rakhwast ko darust karta hai.

Trading Strategies Using the Descending Hawk Pattern

Jab Descending Hawk Pattern pehchan liya jata hai, traders ise trading strategies banane ke liye istemal kar sakte hain. Yahan kuch aam tareeqay hain:- Short Sell: Traders ek short position khol sakte hain, taqatwar downward trend ki jari rakhwast se faida uthane ke liye. Stop-loss level dusri hari candle ke top ke neeche rakha jata hai, jabke take-profit target pichle support level ya Fibonacci retracement level par set kiya jata hai.

- Wait for Confirmation: Traders ko price ko dusri hari candle ke neeche tootne ka intezaar kar sakte hain pehle ek short position mein dakhil hone se pehle. Ye tareeqa ek ghalat breakout ke doran trade mein dakhil hone ka khatra kam karta hai.

- Combine with Other Indicators: Traders Descending Hawk Pattern ko digar technical indicators jaise ke moving averages, Relative Strength Index (RSI), ya MACD ke saath mila kar istemal kar sakte hain, trend reversal ko tasdeeq karte hue aur trade entry signals ko behtar banate hue.

Limitations of the Descending Hawk Pattern

Jabke Descending Hawk Pattern potential trend reversals ko pehchanne ke liye ek mufeed tool ho sakta hai, iske kuch hadood hain:- False Signals: Jaise ke kisi bhi digar technical indicator, Descending Hawk Pattern ghalat signals paida kar sakta hai, agar isay durust taur par manage nahi kiya jaye.

- Market Volatility: Zyada volatility pattern ki shakal ko distort kar sakti hai aur isay samajhna mushkil bana sakti hai.

- Market Noise: Na sudden news events ya market sentiment ke tabdeel hone se pattern ki reliable hone mein asar ho sakta hai

Descending Hawk Pattern forex traders ke liye ek qeemti tool hai jo ek nichle market mein potential trend reversals ko pehchanne ki koshish karte hain. Iske components, formation, aur trading strategies ko samajh kar, traders is pattern ka istemal kar ke maloomat par mabni faislay kar sakte hain aur forex market se faida utha sakte hain. Lekin, is pattern ke hadood ko mad e nazar rakhte hue aur digar technical indicators aur market analysis ke saath istemal karke risk ko kam aur potential profits ko zyada karna ahem hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#8 Collapse

Descending Hawk Pattern:

Candlestick patterns tijarati dunya mein ahem tools hain jo ke traders ko market ke mukhtalif reversals aur trends ka andaza lagane mein madad karte hain. Ek aham candlestick pattern jo ke bearish reversals ko identify karne mein istemal hota hai, woh hai "Descending Hawk Pattern". Iss article mein hum Descending Hawk Pattern par ghaur karenge aur iski key characteristics aur istemal ke baare mein baat karenge.

Descending Hawk Pattern Ki Khasosiyat:- Appearance: Descending Hawk Pattern ek bearish reversal candlestick pattern hai jo ke uptrend ya phir bullish movement ke doran paya jata hai. Is pattern mein ek bara bearish candle hota hai jo ke pehle bullish candle ke body ko partially cover karta hai. Bearish candle ka close price bullish candle ke close price se neeche hota hai.

- Reversal Signal: Descending Hawk Pattern ek reversal signal provide karta hai jo ke bullish trend ke baad dekha jata hai. Iska matlab hai ke market ne upar jaane ki koshish ki hai lekin bearish pressure ne phir se control hasil kiya hai, jo ke ek possible trend reversal ka indication hai.

- Volume aur Confirmation: Descending Hawk Pattern ke significance ko samajhne ke liye volume ka bhi dhyan diya jata hai. Agar Descending Hawk Pattern ke sath zyada volume hai, to iska matlab hai ke traders ne uss level par interest dikhaya hai aur ye pattern strong reversal signal provide kar sakta hai. Confirmation ke liye, traders doosri technical aur fundamental analysis ki bhi zarurat hoti hai.

Descending Hawk Pattern Ka Istemal:

Descending Hawk Pattern ka istemal karke traders market mein potential reversals ko identify kar sakte hain. Jab ye pattern ek bullish trend ke baad ya resistance level ke qareeb dekha jata hai, to traders ko short positions ya phir bearish strategies par focus karne chahiye. Lekin, yaad rahe ke sirf ek Descending Hawk Pattern ke base par trading decision lena munasib nahi hai, aur isay confirm karne ke liye doosri technical aur fundamental analysis ki zarurat hoti hai.

Descending Hawk Pattern tijarati dunya mein ek ahem aur mufeed candlestick pattern hai jo ke traders ko market ke bearish reversals ka andaza lagane mein madad karta hai. Lekin, jaise ke har tijarati tool ki tarah, isay sahi tareeqay se samajhna aur istemal karna zaroori hai. Iske ilawa, risk management aur doosri tajurbaat sey hai trading ko aur bhi mufeed banata hai.

-

#9 Collapse

Descending Hawk" pattern ko Urdu mein "Girte Hathiyaar" pattern kehte hain. Yeh ek technical analysis pattern hai jo trading charts par paya jata hai. Is pattern mein price ka movement nichay ki taraf hota hai aur isay bearish reversal pattern bhi kaha jata hai. Yahan, main "Descending Hawk" pattern ko describe kar raha hoon:

Girte Hathiyaar (Descending Hawk) Pattern:

Asal Tijarat Ka Aghaz:

Girte Hathiyaar pattern bearish reversal pattern hota hai aur iska aghaz uptrend ke baad hota hai.

Pecheeda (Hidden) Chhati:

Is pattern mein, price ke girne ke dauran ek pecheeda chhati (hidden chest) ban jati hai.Yeh chhati bearish divergence ko darust karti hai, iska matlab hai ke price gir rahi hai lekin indicators ya oscillators mein kisi bhi tarah ka strong giravat nahi aa rahi.

Jhilmile Hue Pairon Ki Tarah:

Girte Hathiyaar ki pehchan karne ke liye, candlesticks ko dekhein jo ek dosre ke sath mil rahe hain aur girne ka aghaz kar rahe hain.Yeh candles jhilmile hue pairon ki tarah hoti hain jinse giravat ka pata lagaya ja sakta hai.

Volume Ka Tafteesh:

Is pattern ke dauran volume ka bhi khayal rakha jata hai.Agar price gir rahi hai aur volume bhi badh raha hai, toh yeh bearish reversal signal ko aur bhi mazbooti deta hai.

Neeyat Ka Badalna:

Jab Girte Hathiyaar pattern complete hota hai, toh yeh darust hota hai ke uptrend ki jagah downtrend shuru hone wala hai.Traders ko tayyar ho kar apne positions ko adjust karna chahiye.

Stop Loss Aur Target Levels:

Girte Hathiyaar pattern ke istemal mein stop loss aur target levels tay karna ahem hai.Stop loss ko achi tarah se set karna, taki nuksan se bacha ja sake, aur target levels ko bhi samajhdaari se chunna important hota hai.

Tawun Aur Muhimat:

Is pattern ke istemal mein doosre technical indicators aur patterns ke saath tawun karna bhi zaroori hai.Muhimat (confirmation) hasil karne ke liye, doosre signals ka bhi khayal rakhna chahiye.Girte Hathiyaar pattern, traders ko market ki mawafiqat ko samajhne mein madadgar ho sakta hai, lekin yeh hamesha 100% confirm nahi hota aur is par bharosa karne se pehle doosre factors ka bhi tajziya karna zaroori hai.

-

#10 Collapse

1. Introduction (Muqadma):

Descending Hawk Pattern ek technical analysis pattern hai jo traders ko bearish reversal signals provide karta hai. Is pattern ka istemal market trends ko identify karne aur potential entry/exit points tay karne mein hota hai. Is article mein, hum Descending Hawk Pattern ki tafsili tajziyaat par ghor karenge aur samajhenge ke ye kaise kaam karta hai.

2. Descending Hawk Pattern: An Overview (Descending Hawk Pattern: Ek Jhalak):- Appearance: Descending Hawk Pattern ek bearish reversal pattern hai jo downtrend ke baad aata hai. Is pattern mein, prices pehle se kam ho jate hain aur fir sharp bounce ke baad dubara se girte hain, creating a shape similar to a hawk flying downward.

- Components of the Pattern: Descending Hawk Pattern me typically teen main components hote hain - pehle ek downtrend, fir price mein sharp decline, aur phir ek bounce jise "hawk" ka shape banta hai.

3. Identifying Descending Hawk Pattern (Descending Hawk Pattern Ko Pehchanne Mein):- Downtrend Recognition: Descending Hawk Pattern ka pehla component hai ek clear downtrend. Traders ko pehle yehi confirm karna hota hai ke market mein bearish trend hai.

- Sharp Decline: Iske baad, sharp decline hota hai jisse prices mein significant giravat hoti hai. Ye decline downtrend ke continuation ko indicate karta hai.

- Bounce and Resumption of Downtrend: Uske baad, prices me ek bounce aata hai, lekin ye bounce typically pehle ke decline ke level se kam hota hai. Aur phir, prices dubara se downtrend mein chale jate hain.

4. Trading Strategies with Descending Hawk Pattern (Descending Hawk Pattern Ke Saath Trading Strategies):- Confirmation with Other Indicators: Descending Hawk Pattern ke signals ko confirm karne ke liye traders doosre technical indicators ka bhi istemal karte hain jaise ki volume analysis, RSI, ya moving averages.

- Entry and Exit Points: Traders Descending Hawk Pattern ke signals ke basis par apne entry aur exit points tay karte hain. Pattern ke pura hone ke baad, traders apne positions ko enter karte hain aur fir trend ke continuation ke liye follow karte hain.

5. Risks and Limitations of Descending Hawk Pattern (Descending Hawk Pattern Ke Risks Aur Hudood):- False Signals: Jese ki har technical pattern mein hota hai, Descending Hawk Pattern bhi false signals generate kar sakta hai. Isliye, confirmatory indicators ka istemal zaroori hai.

- Market Context: Descending Hawk Pattern ke signals ko sahi taur par interpret karne ke liye overall market context ko bhi samajhna zaroori hai. Market mein hone wale kisi bhi unexpected event ka impact bhi pattern ko affect kar sakta hai.

6. Psychological Impact on Traders (Traders Par Asar):- Bearish Sentiment: Descending Hawk Pattern ka dekhna traders ke beech bearish sentiment ko strengthen karta hai. Ye pattern unko indicate karta hai ke downtrend continue hone ke chances hain.

- Cautious Trading: Traders Descending Hawk Pattern dekh kar cautious trading approach adopt karte hain aur apne positions ko carefully manage karte hain.

7. Conclusion (Ikhtitam):

Descending Hawk Pattern ek powerful bearish reversal pattern hai jo traders ko market trends ke potential changes ke liye alert karta hai. Lekin, is pattern ke signals ko sahi taur par interpret karne ke liye confirmatory indicators aur market context ka bhi madde nazar rakhna zaroori hai. Descending Hawk Pattern ke saath judi trading strategies ke tajziya se, traders apne trading approach ko enhance kar sakte hain aur market ke nuances ko samajh sakte hain.

- CL

- Mentions 0

-

سا0 like

-

#11 Collapse

Descending Hawk pattern

"Descending Hawk" pattern ek technical pattern hai jo candlestick charting mein istemal hota hai. Ye pattern ek descending ya sloping pattern hota hai jo ek shikra ke pankh jaise dikhayi deta hai, is liye is ka naam "Descending Hawk" hai. Neechay uski tafseel di gayi hai:- Dikhai: Descending Hawk pattern aam tor par ek series ke sath aane wale candlesticks ko represent karta hai jinke highs aur lows kam hote hain, jo ek descending ya sloping pattern banate hain jo shikra ke pankh jaise lagta hai.

- Bearish Reversal Pattern: Descending Hawk pattern ko ek bearish reversal pattern ke tor par samjha jata hai, jo market ke sentiment mein ek potential change ko darust kar sakta hai, bullish se bearish.

- Pehechan:

- Pattern ek relatively large bullish candlestick se shuru hota hai, jo strong buying pressure ko darust karta hai.

- Agle candlesticks mein kamzor bullish momentum dekha jata hai, har candlestick pehle wale se kam highs aur lows rakhta hai.

- Ye pattern ek descending triangle ki tarah hota hai, lekin horizontal support ki bajaye descending highs aur lows ko dikhaata hai.

- Volume: Jaise ke doosre candlestick patterns mein, Descending Hawk pattern ki confirmation ke liye trading volume ka dekha jata hai. Aam tor par, traders kam volume ki taraf dekhte hain, jo kamzor buying interest ko darust karta hai.

- Confirmation: Traders aksar confirmation ka intezaar karte hain pehle trading ko shuru karne se pehle Descending Hawk pattern ke. Confirmation doosre bearish candlestick patterns (jaise ke bearish engulfing ya evening star pattern) ya phir kisi significant support level ke niche breakout ka hisaab hota hai.

- Price Targets: Descending Hawk pattern ke liye price target aksar pattern ki height ko measure karke aur usay breakout point se neeche project karke nikala jata hai.

- Risk Management: Jaise ke har trading signal, risk management Descending Hawk pattern par trading karte waqt zaroori hai. Traders aksar apne positions ke liye stop-loss orders ko pattern ke high ke upar rakhte hain taake agar market unke position ke khilaaf jaaye to nuksan mehdood ho.

- Market Conditions: Jabki Descending Hawk pattern aam tor par ek bearish reversal pattern ke roop mein samjha jata hai, traders ko mazeed market ke overall context aur doosre technical indicators ko bhi madde nazar rakhte hue uska istemal karna chahiye.

Aam tor par, Descending Hawk pattern potential market sentiment ka pata lagane mein madad karta hai aur sahi trading opportunities provide karta hai. Lekin, jaise ke har technical pattern, isay bhi doosri analysis tools ke saath istemal karna zaroori hai aur sahi risk management ka amal karna chahiye.

-

#12 Collapse

Descending hawk pattern

Technical analysis mein istemal hone wale mukhtalif chart patterns mein se aik hai "Descending Hawk Pattern." Yeh pattern market ke trend ko samajhne aur future predictions banane mein madad karta hai. Is pattern ka istemal traders aur investors dwara market ke movements ko samajhne mein hota hai.

1. Ta'aruf (Introduction):

Descending Hawk Pattern ek bearish reversal pattern hai jo market mein girawat hone ka ishara karta hai. Is pattern ki pehchan karne ke liye traders ko chart analysis aur candlestick patterns par tawajju deni parti hai.

2. Descending Hawk Pattern Ki Pechan (Identification of Descending Hawk Pattern):

Descending Hawk Pattern ko pehchanne ke liye, traders ko pehle market ke current uptrend (tezi barhne wala trend) ko dhyan se dekhna hota hai. Phir, ek series of higher highs aur higher lows ke bad, market mein ek bearish reversal hone par is pattern ka zahir hona shuru hota hai.

3. Candlestick Analysis (Candlestick Ki Tehqiq):

Descending Hawk Pattern mein, bearish reversal ke signals candlesticks se aate hain. Is pattern mein ek ya do lambi bearish candles shamil hoti hain jo market mein selling pressure ko darust karti hain.

4. Volume Ki Tafseelat (Volume Analysis):

Is pattern ko samajhne ke liye, volume ka bhi tawajju dena zaroori hai. Agar bearish reversal ke doran volume mein izafah hota hai, to yeh pattern aur bhi strong hota hai.

5. Descending Hawk Pattern Ka Matlab (Meaning of Descending Hawk Pattern):

Descending Hawk Pattern ka zahir hona, market mein bearish sentiment ko darust karta hai. Is pattern ke mutabiq, uptrend ke baad market mein girawat hone ka imkan hai. Traders is pattern ko dekhte hue apni trading strategies ko adjust kar sakte hain.

6. Trading Strategy:

Descending Hawk Pattern ke istemal mein, traders ko market ki aur bhi tafseelat par tawajju deni chahiye. Yeh pattern ek indicator hai aur isay doosre technical analysis tools ke sath istemal karke hi trading decisions lena chahiye.

7. Ehtiyaat (Caution):

Har ek chart pattern ki tarah, Descending Hawk Pattern ko bhi ehtiyaat ke sath istemal karna chahiye. Market mein hamesha uncertainty hoti hai aur ek pattern par pura bharosa karne se pehle doosre factors ko bhi mad e nazar rakha jana chahiye.

Descending Hawk Pattern, market ke movements ko samajhne ka aik tareeqa hai, lekin isay istemal karne se pehle traders ko market ki tamam aspects ko mad e nazar rakhte hue apne decisions ko carefully lena chahiye.

-

#13 Collapse

**Descending Hawk Pattern: Forex Trading Mein Ek Detailed Analysis**

Forex trading mein candlestick patterns trading decisions ko guide karne mein bohot madadgar hote hain. In patterns ki madad se traders market trends aur potential reversals ko identify kar sakte hain. Unmein se ek important pattern hai “Descending Hawk Pattern.” Yeh pattern price action aur trend reversal signals ko understand karne mein help karta hai. Is post mein, hum Descending Hawk Pattern ke features, formation, aur trading implications ko detail mein discuss karenge.

**Descending Hawk Pattern Ki Pehchan**

Descending Hawk Pattern ek bearish reversal pattern hai jo market ke uptrend ke end par form hota hai. Yeh pattern typically ek strong uptrend ke baad develop hota hai aur market ke reversal ko indicate karta hai. Pattern ka naam iski formation aur price action ke movement ko describe karta hai.

**Pattern Ki Formation**

1. **Strong Uptrend:** Descending Hawk Pattern ka formation ek clear uptrend ke baad hota hai. Yeh trend ek strong bullish move ko represent karta hai jo market ko high price levels tak push karta hai.

2. **First Hawk Candle:** Pattern ka pehla candle ek large bullish (green) candle hoti hai jo strong buying pressure ko indicate karti hai. Yeh candle market mein high buying interest ko show karti hai aur uptrend ko continue karti hai.

3. **Second Hawk Candle:** Iske baad, second candle bhi bullish hoti hai lekin iska size pehli candle se chhota hota hai. Yeh candle uptrend ko sustain karti hai lekin buying pressure mein thodi si kami indicate karti hai.

4. **Bearish Reversal Candle:** Last candle bearish hoti hai aur pehli dono candles ke body ko engulf karti hai. Yeh candle market ke reversal ko indicate karti hai aur selling pressure ke increase ko show karti hai.

**Trading Implications**

1. **Reversal Signal:** Descending Hawk Pattern bearish reversal signal provide karta hai. Yeh pattern indicate karta hai ke market ki bullish momentum thama hai aur bearish trend start ho sakta hai.

2. **Entry Points:** Pattern ke formation ke baad, traders bearish entry points ko consider kar sakte hain. Entry point typically third candle ke close ke baad hota hai, jab confirmation mil jati hai ke bearish trend start ho gaya hai.

3. **Stop-Loss Aur Target Levels:** Risk management ke liye, stop-loss orders ko recent high ke upar place karna chahiye. Target levels ko pattern ke size aur market conditions ke hisab se adjust kiya jata hai.

**Pattern Ke Fayde Aur Nuqsan**

**Fayde:**

- **Reversal Confirmation:** Yeh pattern market ke bearish reversal ko effectively confirm karta hai, jo trading decisions ko better guide karta hai.

- **Trend Change Indicator:** Descending Hawk Pattern trend change ko identify karne mein help karta hai, jo traders ko market ke new trend ke sath align karne mein madad karta hai.

**Nuqsan:**

- **False Signals:** Jaisay ke har pattern ke sath hota hai, Descending Hawk Pattern bhi false signals generate kar sakta hai agar pattern properly form nahi hota ya market conditions unfavorable hoti hain.

- **Market Volatility:** High market volatility ke sath, pattern ke formation aur signals ko accurately interpret karna challenging ho sakta hai.

**Conclusion**

Descending Hawk Pattern Forex trading mein bearish reversal aur trend change ko identify karne ke liye ek valuable tool hai. Pattern ki formation aur key characteristics ko samajh kar, traders market ke reversal points aur entry opportunities ko effectively identify kar sakte hain. Lekin, pattern ke signals ko use karne ke sath, risk management aur market conditions ka bhi dhyan rakhna zaroori hai. Accurate analysis aur disciplined approach ke sath, Descending Hawk Pattern trading decisions ko better guide kar sakta hai aur market trends ko capitalize karne mein madad kar sakta hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#14 Collapse

**Descending Hawk Pattern: Ek Technical Trading Strategy**

Trading ki duniya mein, kai tarah ke patterns aur strategies ka istemal kiya jata hai taake market movements ko samjha ja sake aur profitable trades kiye ja sakein. Aaj hum aik ahem pattern ke baare mein baat kareinge, jo ke **Descending Hawk Pattern** hai. Ye pattern price action ke analysis ka aik tariqa hai jo traders ko potential reversal aur continuation signals dikhata hai.

### Descending Hawk Pattern Kya Hai?

Descending Hawk Pattern aik bearish continuation pattern hai jo aksar downtrend ke dauran develop hota hai. Is pattern ka naam is liye "Descending Hawk" rakha gaya hai kyunki price chart par ye pattern hawk (baaz) ki tarah dikhta hai jo neeche ki taraf uran bhar raha hota hai. Is pattern mein, price ek downward slope banati hai jo indication deta hai ke market aur neeche jaane wali hai.

Is pattern ka sab se bara indicator ye hota hai ke price ek descending channel mein move karti hai. Yani ke highs aur lows, dono neeche ki taraf hotay hain. Price kabhi kabhi upar jati hai lekin fir jaldi se neeche aa jati hai, jo ke downward momentum ko dikhata hai.

### Descending Hawk Pattern Ki Pehchan

Descending Hawk Pattern ko pehchan ne ke liye aapko kuch key features per focus karna hota hai:

1. **Downward Slope:** Sab se pehla indicator ye hai ke market ek consistent downward slope banati hai. Iska matlab hota hai ke price lower highs aur lower lows bana rahi hoti hai, jo ke bearish trend ki nishani hoti hai.

2. **Retracement:** Har downward movement ke baad price thodi si recover karti hai, magar ye recovery strong nahi hoti. Ye retracement bearish trend ke dauran hota hai, jise aksar pullback bhi kaha jata hai.

3. **Volume Analysis:** Jab price neeche ki taraf move kar rahi hoti hai, to volume kaafi zyada hota hai. Lekin jab retracement hota hai to volume kam ho jata hai, jo ke weak buying interest ko dikhata hai. Ye indicate karta hai ke sellers market mein zyada active hain.

4. **Breakout Point:** Jab ye pattern complete hota hai to price ek significant support level ko todti hai, jise **breakout** kehte hain. Is waqt selling pressure aur barh jata hai, aur price aur neeche gir sakti hai.

### Descending Hawk Pattern ke Zariye Trading

Descending Hawk Pattern ko identify karne ke baad, aap isse bearish trades execute karne ke liye use kar sakte hain. Jab ye pattern form ho raha ho aur price neeche gir rahi ho, to aap sell positions lena start kar sakte hain. Lekin hamesha breakout ka intizar karna chahiye taake aap ek clear confirmation lein ke price ab aur neeche jaane wali hai.

**Stop-Loss:** Stop-loss levels ko use karna bohot zaroori hai. Is pattern mein aap apna stop-loss retracement points ke upar rakh sakte hain, taake agar market aapke against jaye to aapke losses limited hon.

**Target Levels:** Target levels ko identify karte waqt aap previous support zones ko dekh sakte hain. Agar price un levels ko break kar rahi ho to aap apna profit book kar sakte hain.

### Conclusion

Descending Hawk Pattern ek bearish continuation pattern hai jo downtrend ke dauran trading opportunities dikhata hai. Is pattern ko samajhne aur sahi waqt par trade enter karne se aap apne profits maximize kar sakte hain. Lekin hamesha yaad rakhein ke risk management trading ka ahm hissa hai, aur stop-loss ka istemal zaroori hai taake aapko kisi unexpected market movement se bacha ja sake.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 05:26 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим