Dow Theory in forex trading

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

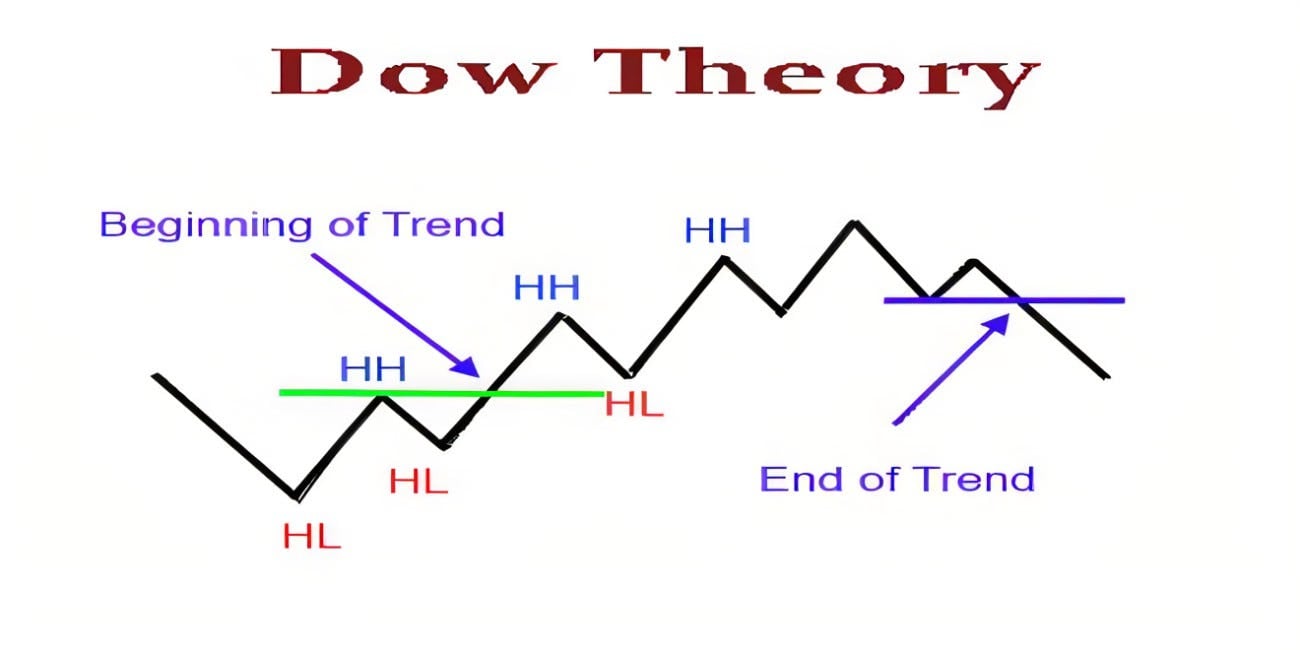

Assalamu Alaikum dear Jab hum Forex trading market Mein kam karte Hain To Kuchh aisi important chijen hoti hain jo ki hamen market ki condition aur movement se related important information provide Karti Hai unke bare mein Janna hamare liye bahut jaruri Hota Hai tabhi Ham market Mein successfully trading kar sakte hain isiliye hamen chahie ki UN chijon ke bare mein complete knowledge aur information hasil Karen Taki hamen acchi entries available ho aur market se hamen maximum profit mil sake Kyunki Kisi bhi business Kam Nahin per bus hamen profit hasil karna Hota Hai aur vah hamen usi surat Mein milta Hai Jab hamari working quality acchi hoti hai.Dow Theory:Dear forex trading market Mein dow theory market ki moment Ki Kisi bhi trend mein possible moment Jo ke expected hoti hai agar market Kisi trend per movement kar rahi hoti hai to usmein aap apne advantages ko increase kar sakte hain aur maximum price ko break karke bahut zada movement Karegi Jab Kisi Ki movement bahut jyada Hoti Hai To vah Achanak se revers movement start kar deti hai isliye aapko ismein entry lene ke liye bahut hi acchi experience ke sath kam karna Hota Hai Kyunki agar aap market trend aur Market movement ko acchi tarike se samajhne ke bad entry lete hain to aapko maximum advantages mil sakte hain.Basic Principles of Dow Theory:1: stock price har chij ko reflect karti hai Jis bhi chij ka talluk stock Se Hota Hai. 2: stock market mein teen trends maujud hote Hain primary trend secondary Trend and minor Trend. 3: primary Trend ke liye teen face hote Hain aur ab train ke liye accumulation public participation aur acces phase Hota Hai aur down Trend ke liye yah distribution public participation panic phases hota hai. 4: tamam average is Ek dusre ko confirm karti hain. 5: volume trend ko define karta hai Kyunki Jab primary Trend ki taraf market apni movement Karti Hai To volume increase Hota Hai aur dusri surat Mein friend week Hota Hai. 6: koi bhi trend use waqt tak intact rahata Hai Jab tak vah definite reversal signal deta hai.Importance:Dear forex trading market Mein Jab aap kam kar rahe hote hain to usmein aapko bahut hi acche experience ke sath kam karna hota hai aur apni planning ke sath kam karna hota hai. agar aap market Mein successful trading karna chahte hain to usmein do theory market ki movement Ki Kisi bhi train mein maximum limit aur farder mein Hone Wali market ki expansion hoti hai. agar Kisi pair Mein market apni maximum price limit per pahunchkar revers movement karna start kar deti hai. to dow theory ke mutabi market Kuchh time period Tak same limit ko cross nahi karne Karegi ya Agar break out Karti bhi hai to same break out Itna Jyada Nahin Hoga, market maximum price ki break karne ke bad bahut badi moment kar Jayegi lekin Agar market Kisi bhi pair Mein Apni maximum price limit ko break out karne ke bad father Kuchh movement karne ke bad revers direction Mein movement karna start kar deti hai Forex trading business Mein do theory ki importance bahut jyada hai isiliye aapko is pattern ko bhi acche tarike se samajhne ke bad is par working karni chahiye tabhi aap is business Mein successful honge.Trading Strategy:Dear market Mein different analysis per completely study Karni chahie aur acche experience surakshit knowledge ke sath kam karna chahie Jitna Achcha aapke pass knowledge Hoga aur experience hoga to aap is market Mein successful Honge Jo members forex market Mein acchi learning ke sath Kam Nahin Karte vah Hamesha nakam Ho Jaate Hain agar aap market Mein successful Hona Chahte Hain. To aapko apni learning perfect banana Hogi aur Market Mein proper time Dena Hoga Jitna Jyada market ko time Denge aur Market ko focus Karenge to aap is market mein itna hi acchi running kar sakte hain aap Agar market Mein successful aur Achcha result Hasil karna chahte hain to aapko iske liye complete knowledge or information hasil karna hoga tabhi aap is chudi ke mutabik working karte hue market Mein successful ho sakenge. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamo Alaekum friends. Kasy hain ap sabMain umed karta hon ap sab bilkul thek thak hon gay. Aj ka jo topic zer e behs hay uska nam dow theory hay . Yeh hamen kia btayega r kia information deta hay yeh dekhty hain. Yeh hamen kia kuch btaya hay yeh ab ham agy mazeed dekhty hain. Dow Theory Forex trading ki mukhtasar si theory yeh hai ke jis currency kay joray mein aap invest karte hain us mein aapko do eham bhe currencies hote hain ek base currency aur ek quote currency. Jab aap kisi currency kay joray ko trade karte hain to aap base currency ko quote currency ke against sell karte hain ya phir quote currency ko base currency ke mukhalif ja kr buy karte hain.Forex market mein trading ke liye traders ko price charts ka tajziya karna hoti hai, jis se wo market trends aur keemat ka oper nchy hona sab zahir krta hay kay ab market ks simat main jany ko.hayko samajh sakein aur apni trades ke liye entry aur exit point ka fesla kar sakein. Techniqi r bunyadi tajziya jaise tools use kiye jate hain, jinse traders ko market ke harkat ke baare mein malomat milta hai. Forex market bahut zeada had tak mushkil hay isy smjhna mshkil hota hai, is liye traders ko market ki harkat ko bht bareek beni say mutala karna zaroori hai. Trading ke liye, traders apni khatrat k bardasht aur investment goals ko bhi gor karte hain, aur apni tejarti sargarmion ko us ke hisab se bandobast karte hain. Trading ke liye nazm o zabt aur Sabar bahut zaroori hai, aur traders ko apni emotions ko control karne ki bhi zaroorat hoti hai, taaki wo apni trades ko muasir trah sy kar sakein. Explanation Dow Theory, jo ke techniki tajziya ka ek tareeqa hai forex trading ke liye bhi istemal kiya jata hai. Is tareeqe mein market ke trends ke baare mein info hasil ki jati hai, jis se traders apni trades ko achay say kar sakte hain. Lekin, jaisa ke har tejarat ki sargarmi ke apne faidy r nuqsaanat hote hain, isi tarah Dow Theory ke bhi kuch nuqsanat hote hain:Late entry aur early exit Dow Theory mein trend reversal ke signals late aate hain, is liye traders ki entry aur exit points ko miss karne ka khatra rehta hai. Dow Theory ke ishary mein overlapping signals ki problem ho sakti hai, jis se traders ko paryshani ho sakta hai. Bht say galat fesly Market mein kabhi kabhi false signals bhi hty ho sakte hain, jis se traders ko nuqsan uthana par sakta hai.Dow Theory ki indicators sabhi markets ke liye munasib nahi hote, is liye traders ko apni tejarti islahat ko hamwar karna hota hai.Jaisa ke har sargarmi ke liye hai, Dow Theory ke bhi koi kamyabi ki zamanat nahi hoti hai. Traders ko apni ehtyat sy ke hisab se apni strategy ko khyal karna hota hai. In nuqsanat ko samajh kar traders ko apni tejarti sargarmion karna chahiye taaky wo market ke harkat ke hisab se apni trades ko munazam kar sakein aur apne maqasid ko hasil kar sakein. -

#4 Collapse

Dow Theory trading aur technical analysis ki dunya mein aik bohot mashhoor aur ahem concept hai. Yeh theory Charles H. Dow ne 19th century ke akhir mein introduce ki thi, jo Wall Street Journal ke co-founder aur Dow Jones & Company ke co-creator bhi thay. Dow Theory ko stocks aur financial markets ka analysis karne ke liye istemal kiya jata hai, lekin yeh forex trading mein bhi equally effective aur relevant hai.

Dow Theory aik financial theory hai jo market trends aur price movements ko analyze karne ke liye use hoti hai. Is theory ke mutabiq, market trends ko identify karne aur unhein predict karne ke liye kuch specific principles aur rules follow kiye jate hain. Dow Theory ke mutabiq, market trend hamesha teen phases mein move karta hai: primary trend, secondary trend, aur minor trend.

Dow Theory Ke Fundamentals

Dow Theory ke kuch basic fundamentals hain jo har trader ko samajhne chahiye:- Market Discounts Everything: Dow Theory ke mutabiq, market price har available information ko discount karti hai. Har relevant factor, be it political, economic, or social, already market price mein reflect hota hai. Iska matlab yeh hai ke price movements aur trends sab available information ko incorporate karte hain.

- Market Moves in Trends: Dow Theory kehte hai ke market hamesha trends mein move karti hai. Yeh trends primary, secondary, aur minor trends mein divide hote hain. Primary trends long-term trends hain jo kuch months se le kar several years tak chal sakte hain. Secondary trends intermediate trends hain jo primary trends ke against move karte hain aur kuch weeks se kuch months tak chal sakte hain. Minor trends short-term price movements hain jo kuch days se kuch weeks tak chal sakte hain.

- Primary Trends Have Three Phases: Dow Theory ke mutabiq, primary trends hamesha teen phases mein divide hote hain:

- Accumulation Phase: Yeh phase tab hoti hai jab informed investors aur insiders buy karte hain, market sentiment negative hota hai, aur prices low hoti hain.

- Public Participation Phase: Is phase mein broader public aur retail investors market mein enter hote hain, prices rapidly increase hoti hain aur trend zyada visible hota hai.

- Distribution Phase: Yeh phase tab hoti hai jab insiders aur informed investors apne holdings ko sell karna shuru karte hain, prices high hoti hain aur market sentiment extremely positive hota hai.

- Indices Must Confirm Each Other: Dow Theory ke mutabiq, different market indices ko ek dusre ko confirm karna chahiye. Agar aik index new high banata hai to dusra index bhi new high banana chahiye, tabhi trend valid mana jata hai. Yeh principle forex market mein bhi apply hota hai jahan different currency pairs ek dusre ko confirm karte hain.

- Volume Must Confirm the Trend: Trend ki validity ko confirm karne ke liye volume bohot zaroori hai. Increasing volume ke saath price movements trend ko confirm karte hain. Agar volume trend ke direction mein increase hota hai to trend strong mana jata hai.

- Trends Persist Until a Clear Reversal Occurs: Dow Theory ke mutabiq, trend tab tak continue karta hai jab tak clear reversal signals nahi milte. Matlab agar market ek primary uptrend mein hai to tab tak yeh trend continue karega jab tak clear reversal signals nahi milte.

Forex trading mein Dow Theory ko istemal karte hue aap market trends ko analyze aur predict kar sakte hain. Aaye kuch important aspects discuss karte hain jo forex trading mein Dow Theory ko samajhne aur istemal karne mein madadgar hain.

Primary Trend Identification

Primary trend identify karna Dow Theory ka aik ahem aspect hai. Forex market mein yeh trends long-term hote hain aur fundamental economic factors, central bank policies, aur geopolitical events se driven hote hain. Primary trend ko identify karne ke liye aapko market ka broader perspective samajhna hoga.

Secondary Trends aur Corrections

Secondary trends primary trend ke against move karte hain aur yeh corrections aur retracements hote hain. Forex trading mein yeh intermediate trends important hote hain kyunke yeh aapko re-entry points aur profit-taking opportunities de sakte hain. Secondary trends ko samajhne ke liye aapko technical analysis tools jaise ke Fibonacci retracement aur moving averages ko use karna hoga.

Volume Analysis

Forex market decentralized hoti hai isliye volume analysis thora tricky ho sakta hai, lekin aap different liquidity providers aur forex brokers ke volume data ko analyze kar sakte hain. Increasing volume ke saath price movements ko analyze karna important hota hai takay trend ki strength ko confirm kiya ja sake.

Trend Confirmation

Forex market mein different currency pairs aur indices ko use kar ke trend confirmation ki jati hai. Jaise ke agar EUR/USD pair ek uptrend mein hai to GBP/USD aur AUD/USD pairs ko bhi analyze kar ke confirmation leni chahiye. Agar yeh pairs bhi similar trends show karte hain to trend ki validity confirm hoti hai.

Phases of Primary Trend

Primary trend ke teen phases ko samajhna aur unhein identify karna forex trading mein bohot important hai. Accumulation phase mein informed investors apni positions build karte hain aur aapko market sentiment ko analyze karna hoga. Public participation phase mein broader public market mein enter hoti hai aur prices rapidly increase hoti hain. Distribution phase mein informed investors apni holdings sell karte hain aur prices high hoti hain.

Dow Theory ke Principles ko Apply Karna

Dow Theory ke principles ko forex trading mein apply karne ke liye kuch practical steps hain jo aap follow kar sakte hain:- Market Analysis: Forex market ka broader analysis karna zaroori hai. Fundamental analysis aur economic indicators ko dekhte hue market ka broader trend samajhna hoga.

- Technical Analysis Tools: Technical analysis tools jaise ke trend lines, moving averages, aur oscillators ko use kar ke market trends ko identify aur confirm karna hoga.

- Volume Analysis: Volume data ko analyze karna aur price movements ke saath volume changes ko dekhte hue trend ki strength ko confirm karna hoga.

- Trend Confirmation: Different currency pairs aur indices ko analyze kar ke trend confirmation leni hoga takay trend ki validity ko confirm kiya ja sake.

- Phases Identification: Primary trend ke different phases ko identify karna aur unhein samajhna zaroori hai takay aap apni trading strategy ko uske mutabiq adjust kar sakein.

Suppose kijiye ke aap EUR/USD pair ko trade kar rahe hain aur aapko lagta hai ke market ek primary uptrend mein hai. Aapne fundamental analysis ke zariye ye samjha ke European Central Bank ki policies aur economic indicators strong hain aur euro ki demand increase ho rahi hai.- Market Analysis: Aapne dekha ke EUR/USD pair ne recent months mein higher highs aur higher lows banaye hain, jo ke ek clear uptrend ka indication hai.

- Technical Analysis Tools: Aapne trend lines aur moving averages ko use kar ke dekha ke price consistently 50-day aur 200-day moving averages ke upar hai, jo ke ek strong uptrend ka indication hai.

- Volume Analysis: Aapne volume data ko analyze kiya aur dekha ke price increases ke saath volume bhi increase ho rahi hai, jo ke trend ki strength ko confirm karta hai.

- Trend Confirmation: Aapne GBP/USD aur AUD/USD pairs ko bhi analyze kiya aur dekha ke yeh pairs bhi similar uptrend show kar rahe hain, jo ke trend ki validity ko confirm karta hai.

- Phases Identification: Aapne dekha ke market accumulation phase se guzarta hua public participation phase mein enter ho gaya hai aur prices rapidly increase ho rahi hain.

Dow Theory forex trading mein aik bohot ahem aur valuable tool hai jo aapko market trends ko identify aur predict karne mein madad deta hai. Is theory ke basic principles ko samajh kar aur unhein effectively apply karke aap apni trading strategy ko enhance kar sakte hain aur consistent profits hasil kar sakte hain. Forex trading mein kamiyabi hasil karne ke liye knowledge, analysis, aur discipline zaroori hain aur Dow Theory in sab aspects ko cover karne mein madadgar hoti hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#5 Collapse

Dow Theory In Forex Trading

Dow Theory, jo Charles H. Dow ne introduce ki thi, trading aur investing ke liye ek buniyadi nazariya hai. Yeh theory asal mein stock market ke liye develop hui thi, lekin forex trading mein bhi iske bohat se principles apply hote hain. Roman Urdu mein, hum Dow Theory ke principles ko samajhne ki koshish karte hain aur dekhte hain ke yeh forex trading mein kaise madadgar ho sakti hai.

**Dow Theory ke Principles**

1. **Market ke Three Movements**: Dow Theory ke mutabiq market mein teen tarah ke movements hote hain: primary, secondary, aur minor. Primary movements market ke major trends ko represent karte hain jo months ya even years tak chal sakti hain. Secondary movements corrections hoti hain jo primary trend ke against hoti hain aur kuch weeks ya months tak rehti hain. Minor movements short-term fluctuations hain jo sirf kuch din ya weeks tak chalti hain.

2. **Trends mein Phases**: Dow Theory kehta hai ke har primary trend ke teen phases hote hain. Uptrend ke case mein, pehla phase accumulation phase hota hai, jahan informed investors buying karte hain. Dusra phase public participation phase hota hai, jahan wider public buying shuru kar deti hai. Teesra phase distribution phase hota hai, jahan informed investors apni holdings ko sell karna shuru kar dete hain. Downtrend ke case mein yeh phases ulte hote hain.

3. **Volume ka Importance**: Dow Theory ke mutabiq volume ek important indicator hai. Agar price trend ke direction mein volume bhi increase ho raha hai, to yeh trend ko confirm karta hai. Agar volume kam ho raha hai, to yeh trend weak hone ki nishani ho sakta hai.

4. **Confirmation**: Dow Theory kehta hai ke trend ko confirm karne ke liye different indices ka confirmation zaroori hai. Stock market mein Dow Jones Industrial Average aur Dow Jones Transportation Average ka confirmation dekha jata hai. Forex market mein, different currency pairs ko dekhna zaroori hota hai.

5. **Trends ko Follow karna**: Dow Theory kehti hai ke trend ko follow karna chahiye jab tak clear signals na milen ke trend reverse hone wala hai. Yeh principle forex trading mein bhi apply hota hai. Trend following strategies is principle ke mutabiq banayi ja sakti hain.

6. **Price Discounts Everything**: Dow Theory kehti hai ke market price har cheez ko reflect karti hai, chahe woh economic factors hoon, political events hoon, ya natural disasters. Yeh principle forex trading mein bhi apply hota hai, jahan market sentiment aur news events price movements ko influence karte hain.

**Forex Trading mein Dow Theory ka Application**

Forex trading mein Dow Theory ke principles ko apply karke aap market trends ko better samajh sakte hain aur informed trading decisions le sakte hain. Trend identification aur following ke liye aap primary movements ko identify kar sakte hain aur uske mutabiq apni trading strategy develop kar sakte hain.

**Trend Identification**: Forex market mein, aap technical analysis tools jaise ke moving averages, trendlines, aur RSI ka use karke trends ko identify kar sakte hain. Dow Theory ke principles ko incorporate karke, aap primary, secondary aur minor movements ko differentiate kar sakte hain.

**Volume Analysis**: Forex market mein volume ka analysis thoda mushkil hota hai kyun ke centralized exchange nahi hota. Lekin aap different indicators jaise ke On-Balance Volume (OBV) ka use karke volume trends ko analyze kar sakte hain.

**Confirmation**: Different currency pairs aur related assets ka analysis karke aap trends ko confirm kar sakte hain. For example, agar EUR/USD aur GBP/USD dono uptrend mein hain, to yeh ek strong confirmation ho sakta hai.

**Trend Following**: Dow Theory ke trend following principle ko apply karke aap apni trading strategy ko align kar sakte hain. For example, agar aapko lagta hai ke market uptrend mein hai, to aap buying opportunities dhoondh sakte hain jab tak clear reversal signals na milen.

Dow Theory ke principles ko samajh kar aur apply karke, forex trading mein aap apni success rate ko improve kar sakte hain. Yeh theory aapko market trends ko better understand karne aur informed trading decisions lene mein madadgar sabit ho sakti hai. -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Dow Theory in forex trading

Introduction: Dow Theory aik purani aur fundamental technical analysis ka principle hai jo Charles Dow ne develop kiya tha. Yeh theory stock market ke movements ko samajhne ke liye bani thi lekin isko Forex trading mein bhi istemal kiya ja sakta hai. mein Dow Theory ko samajhne se traders Forex market ke trends aur movements ko behtar samajh sakte hain.

Dow Theory Ke Principles:- Market Discounts Everything: Dow Theory kehta hai ke market price har cheez ko discount karti hai, yaani sab kuch market price mein reflect hota hai. News, economic data, aur sentiments sab kuch price mein shaamil hota hai. Forex market mein yeh principle apply hota hai ke currencies ka price already har available information ko consider karta hai.

- Three Market Trends: Dow Theory kehta hai ke market mein teen tareeke ke trends hotay hain:

- Primary Trend: Long-term trend jo months ya years tak chal sakta hai. Forex market mein yeh ek strong uptrend ya downtrend ho sakta hai.

- Secondary Trend: Medium-term trend jo weeks ya months tak chal sakta hai. Yeh primary trend ke dauran corrections ya retracements hoti hain.

- Minor Trend: Short-term trend jo days ya weeks tak chal sakta hai. Yeh daily price fluctuations aur noise ko represent karta hai.

- Trends Have Three Phases: Har primary trend ke teen phases hotay hain:

- Accumulation Phase: Market mein smart investors quietly buying karte hain jabke general public bearish hoti hai.

- Public Participation Phase: Market ki trend obvious ho jati hai aur majority of investors participate karte hain.

- Distribution Phase: Smart investors apni holdings ko sell karte hain aur market mein top ya bottom banne lagta hai.

- Indices Must Confirm Each Other: Dow Theory kehta hai ke different market indices ko ek doosre ko confirm karna chahiye. Forex market mein different currency pairs ke trends ko ek doosre ke sath compare karke trend confirmation kiya jata hai.

- Volume Confirms the Trend: Volume market ke trend ko confirm karta hai. Agar price move high volume ke sath ho, to yeh strong trend indication hota hai. Forex market mein trading volume data available hota hai jo trend confirmation ke liye use hota hai.

- Trends Persist Until a Clear Reversal Occurs: Dow Theory kehta hai ke trend tab tak chalti rahegi jab tak ek clear reversal signal nahi milta. Forex market mein trends ko follow karte hue traders ko reversal signals dekhne chahiye jaise ke trendline breaks, moving average crossovers, aur candlestick patterns.

Dow Theory Ka Forex Trading Mein Istemaal:- Trend Identification: Dow Theory ke principles ko use karke Forex market mein trend identify karna zaroori hai. Primary, secondary, aur minor trends ko identify karna trading strategy ke liye important hota hai.

- Trading the Primary Trend: Primary trend ko identify karke long-term positions hold karna profitable ho sakta hai. For example, agar EUR/USD pair mein primary uptrend chal raha hai, to traders buy positions hold kar sakte hain.

- Using Secondary Trends for Entries and Exits: Secondary trends ko use karke entry aur exit points identify kiye ja sakte hain. Agar primary trend uptrend hai aur secondary trend mein correction ho rahi hai, to yeh buy karne ka acha mauka ho sakta hai.

- Volume Analysis: Volume data ko use karke trend confirmation karna zaroori hai. High volume ke sath price moves ko monitor karna aur unhe trade karna profitable ho sakta hai.

- Risk Management: Dow Theory ke principles ko use karte hue risk management bhi important hai. Stop-loss levels ko define karna aur apne trades ko protect karna zaroori hai.

Conclusion: Dow Theory ek valuable tool hai jo Forex trading mein market trends aur movements ko samajhne mein madadgar hota hai. mein is theory ko samajhne se, traders market ke sentiment aur trend direction ko behtar tor par samajh sakte hain aur sahi trading decisions le sakte hain. Yeh principles trading strategies ko refine karne aur potential profits ko maximize karne mein madadgar hote hain.

4o

-

#7 Collapse

Dow Theory in forex trading

Dow Theory, developed by Charles Dow, is a foundational theory in technical analysis that originated in stock trading but is also relevant to forex trading. It's based on six main principles:- The Market Discounts Everything: All information, including economic data and market fundamentals, is already reflected in the price.

- Market Trends Have Three Phases: Trends consist of primary (long-term), secondary (intermediate), and minor (short-term) trends.

- Trend Confirmation: For a trend to be valid, it should be confirmed by higher highs and higher lows (in uptrends) or lower highs and lower lows (in downtrends).

- Volume Should Confirm the Trend: Volume should increase in the direction of the trend. Higher volume confirms a strong trend, while lower volume may indicate weakness.

- Trends Persist Until Reversal Signals: Trends are assumed to persist until clear reversal signals indicate otherwise.

- Indexes Must Confirm Each Other: The theory suggests that movements in major indexes (like Dow Jones Industrial Average and Dow Jones Transportation Average) should confirm each other to confirm the strength of a trend.

In forex trading, traders apply these principles by analyzing price charts, volume data (if available), and using technical indicators to identify trends and potential reversals. While originally designed for stocks, the core principles of Dow Theory can be adapted to other financial markets, including forex, to make informed trading decisions.

Sure, here's a more detailed explanation of Dow Theory and its application in forex trading:

1. The Market Discounts Everything

This principle asserts that all known information (economic data, news, geopolitical events, etc.) is already reflected in the current market price. In forex, this means that currency prices are influenced by a myriad of factors, such as interest rates, political stability, and economic performance. Traders believe that analyzing price movements can provide insights into the market's future direction because the price reflects all relevant information.

2. Market Trends Have Three Phases

Dow Theory identifies three phases within a trend:- Primary Trends: These are long-term trends that can last for several months to years. In forex, a primary trend might be driven by long-term economic policies, interest rate changes, or sustained geopolitical factors.

- Secondary Trends: These are shorter-term corrections within the primary trend, lasting from a few weeks to several months. They often represent a counter-movement against the primary trend (e.g., a temporary pullback in an upward primary trend).

- Minor Trends: These are short-term movements, lasting from a few days to a few weeks. Minor trends can be caused by short-term news events or market sentiment changes.

A trend is confirmed when the market shows consistent patterns:- Uptrend: Higher highs and higher lows.

- Downtrend: Lower highs and lower lows. For forex traders, confirming a trend involves looking at price charts over different timeframes to identify these patterns.

In the context of stock markets, volume is a crucial indicator of the strength of a trend. However, in forex trading, volume data can be less reliable because the forex market is decentralized. Instead, traders may use other indicators, such as the Average Directional Index (ADX) or momentum indicators, to gauge the strength of a trend.

5. Trends Persist Until Reversal Signals

According to Dow Theory, a trend remains in effect until there are clear signals of a reversal. Reversal signals might include:- Double Top/Bottom: A pattern indicating a potential reversal of the current trend.

- Head and Shoulders: A common reversal pattern.

- Divergences: When the price moves in the opposite direction to an indicator (e.g., RSI, MACD).

In the original Dow Theory, confirmation between different indexes (like industrial and transportation indexes) was essential. In forex trading, this principle can be applied by looking for confirmation across different currency pairs. For instance, if EUR/USD is in an uptrend, confirmation might come from observing similar trends in other euro pairs like EUR/JPY or EUR/GBP.

Applying Dow Theory to Forex Trading

To effectively apply Dow Theory to forex trading, consider the following steps:- Identify the Trend: Use multiple timeframes to identify primary, secondary, and minor trends. This helps in understanding the overall market direction.

- Confirm the Trend: Look for patterns of higher highs and higher lows in uptrends or lower highs and lower lows in downtrends. Use technical indicators to confirm the strength of the trend.

- Monitor Volume or Alternative Indicators: Since volume data might not be reliable in forex, use other indicators like ADX, RSI, or MACD to gauge trend strength.

- Look for Reversal Signals: Be vigilant for patterns or divergences that indicate a potential trend reversal.

- Cross-Check Currency Pairs: Confirm trends by checking other related currency pairs to ensure consistency in the observed trend.

By incorporating these principles, forex traders can better understand market movements and make more informed trading decisions.

-

#8 Collapse

Dow Theory ek foundational concept hai jo financial markets ke price movements ko samajhne aur predict karne ke liye use hota hai. Yeh theory Charles Dow ne develop ki thi, jo Dow Jones Industrial Average ke co-founder the. Dow Theory ko forex trading mein bhi apply kiya ja sakta hai. Is theory ke kuch basic principles hain:- Market Discounts Everything: Dow Theory ke mutabiq, saari available information (news, earnings reports, etc.) already market price mein factored hoti hai. Price action hi sabse important indicator hota hai.

- Market Trends: Market teen types ke trends follow karta hai:

- Primary Trend: Long-term trend jo several months ya years tak chal sakti hai. Yeh trend ya to bullish (upward) ya bearish (downward) hota hai.

- Secondary Trend: Intermediate trend jo weeks ya months tak chal sakta hai. Yeh primary trend ke against move karta hai aur primary trend ke correction ko represent karta hai.

- Minor Trend: Short-term trend jo days ya weeks tak chal sakta hai aur secondary trend ke against move karta hai.

- Three Phases of Primary Trend:

- Accumulation Phase: Yeh phase tab hota hai jab informed investors quietly buy kar rahe hote hain aur market sentiment generally bearish hoti hai.

- Public Participation Phase: Is phase mein market trend clear hoti hai aur broader public participation start hota hai.

- Distribution Phase: Is phase mein smart money ya informed investors apne positions sell kar rahe hote hain aur market sentiment generally bullish hoti hai.

- Indexes Must Confirm Each Other: Dow Theory ke mutabiq, agar ek market index (jaise Dow Jones Industrial Average) trend reversal show kar raha hai, toh doosre related index (jaise Dow Jones Transportation Average) ko bhi us trend reversal ko confirm karna chahiye.

- Volume Must Confirm the Trend: Trend ke direction ko volume bhi support karni chahiye. Bullish trend ke waqt, volume high honi chahiye jab price rise kare aur bearish trend ke waqt, volume high honi chahiye jab price fall kare.

- Trends Persist Until a Clear Reversal Occurs: Market trends continue karte hain until a definitive reversal signal hota hai. Yeh principle market trends ke continuity ko emphasize karta hai.

Forex trading mein Dow Theory ka use karke traders long-term trends identify kar sakte hain, trend reversals ko confirm kar sakte hain, aur apni trading strategies ko effectively plan kar sakte hain. Yeh theory ek comprehensive framework provide karti hai jisse market movements ko better understand kiya ja sakta hai.

Dow Theory ek foundational concept hai jo financial markets ke price movements ko samajhne aur predict karne ke liye use hota hai. Yeh theory Charles Dow ne develop ki thi, jo Dow Jones Industrial Average ke co-founder the. Dow Theory ko forex trading mein bhi apply kiya ja sakta hai. Is theory ke kuch basic principles hain:- Market Discounts Everything: Dow Theory ke mutabiq, saari available information (news, earnings reports, etc.) already market price mein factored hoti hai. Price action hi sabse important indicator hota hai.

- Market Trends: Market teen types ke trends follow karta hai:

- Primary Trend: Long-term trend jo several months ya years tak chal sakti hai. Yeh trend ya to bullish (upward) ya bearish (downward) hota hai.

- Secondary Trend: Intermediate trend jo weeks ya months tak chal sakta hai. Yeh primary trend ke against move karta hai aur primary trend ke correction ko represent karta hai.

- Minor Trend: Short-term trend jo days ya weeks tak chal sakta hai aur secondary trend ke against move karta hai.

- Three Phases of Primary Trend:

- Accumulation Phase: Yeh phase tab hota hai jab informed investors quietly buy kar rahe hote hain aur market sentiment generally bearish hoti hai.

- Public Participation Phase: Is phase mein market trend clear hoti hai aur broader public participation start hota hai.

- Distribution Phase: Is phase mein smart money ya informed investors apne positions sell kar rahe hote hain aur market sentiment generally bullish hoti hai.

- Indexes Must Confirm Each Other: Dow Theory ke mutabiq, agar ek market index (jaise Dow Jones Industrial Average) trend reversal show kar raha hai, toh doosre related index (jaise Dow Jones Transportation Average) ko bhi us trend reversal ko confirm karna chahiye.

- Volume Must Confirm the Trend: Trend ke direction ko volume bhi support karni chahiye. Bullish trend ke waqt, volume high honi chahiye jab price rise kare aur bearish trend ke waqt, volume high honi chahiye jab price fall kare.

- Trends Persist Until a Clear Reversal Occurs: Market trends continue karte hain until a definitive reversal signal hota hai. Yeh principle market trends ke continuity ko emphasize karta hai.

Forex trading mein Dow Theory ka use karke traders long-term trends identify kar sakte hain, trend reversals ko confirm kar sakte hain, aur apni trading strategies ko effectively plan kar sakte hain. Yeh theory ek comprehensive framework provide karti hai jisse market movements ko better understand kiya ja sakta hai.

Dow Theory forex trading mein bohot important hai aur yeh kuch basic principles pe focus karti hai:- Market Sab Kuch Discount Karta Hai: Is theory ke mutabiq, market ki price already saari information ko reflect karti hai. Koi bhi news ya reports ka impact market price mein shamil hota hai.

- Market Trends:

- Primary Trend: Yeh long-term trend hota hai jo kaafi months ya years tak chal sakta hai. Yeh trend bullish (upar ki taraf) ya bearish (neeche ki taraf) hota hai.

- Secondary Trend: Yeh intermediate trend hota hai jo weeks ya months tak chal sakta hai. Yeh primary trend ke against hota hai aur uska correction hota hai.

- Minor Trend: Yeh short-term trend hota hai jo days ya weeks tak chal sakta hai aur secondary trend ke against hota hai.

- Primary Trend ke Teen Phases:

- Accumulation Phase: Is phase mein informed investors buy karte hain jab market sentiment bearish hoti hai.

- Public Participation Phase: Is phase mein market trend clear hoti hai aur general public participate karti hai.

- Distribution Phase: Is phase mein smart investors apne positions sell karte hain jab market sentiment bullish hoti hai.

- Indexes Ko Ek Dusre Ko Confirm Karna Chahiye: Agar ek market index trend reversal show kar raha hai, toh related index ko bhi us trend reversal ko confirm karna chahiye.

- Volume Ko Trend Confirm Karna Chahiye: Trend ke direction ko volume support karni chahiye. Bullish trend ke doran, jab price upar jati hai, toh volume high honi chahiye aur bearish trend ke doran, jab price neeche jati hai, toh volume high honi chahiye.

- Trends Continue Karte Hain Jab Tak Clear Reversal Na Ho: Market trends continue karte hain jab tak clear reversal signal na ho. Yeh principle market trends ke continuity ko emphasize karta hai.

Forex trading mein Dow Theory ka use karte hue, traders long-term trends ko identify kar sakte hain, trend reversals ko confirm kar sakte hain aur trading strategies ko effectively plan kar sakte hain. Yeh theory ek comprehensive framework provide karti hai jo market movements ko samajhne mein madad karti hai.

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Dow Theory in forex trading

Dow Theory forex trading mein ek fundamental concept hai jo market trends aur movements ko samajhne mein madad karta hai. Yeh theory Charles Dow ke kaam par mabni hai, jo ek financial journalist aur Wall Street Journal ke co-founder the. Dow Theory market trends, price movements aur trading signals ke analysis mein bohot useful hoti hai.

### Dow Theory Ke Basic Principles

1. **Market Discounts Everything**: Dow Theory ke mutabiq, market price already sab information ko discount karti hai. Yeh matlab hai ke market ke andar sab kuch price mein reflect hota hai, jaise news, economic data, aur political events.

2. **Market Moves in Trends**: Market mein primarily three tarah ke trends hote hain:

- **Primary Trend**: Yeh long-term trend hota hai jo months ya years tak chal sakta hai. Yeh trend market ka major direction decide karta hai.

- **Secondary Trend**: Yeh intermediate trends hote hain jo primary trend ke andar fluctuations ko represent karte hain. Yeh weeks ya months tak chal sakte hain.

- **Minor Trend**: Yeh short-term trends hote hain jo secondary trends ke andar fluctuations ko represent karte hain. Yeh days ya weeks tak chal sakte hain.

3. **Trends Have Three Phases**:

- **Accumulation Phase**: Yeh phase tab hota hai jab informed investors buying ya selling karna shuru karte hain aur market ka sentiment neutral ya bearish hota hai.

- **Public Participation Phase**: Yeh phase tab hota hai jab wider public market mein enter karti hai aur trend strong hota hai. Price movements significant hoti hain.

- **Distribution Phase**: Yeh phase tab hota hai jab informed investors apne positions ko distribute karna shuru karte hain aur market ka sentiment bullish hota hai, lekin price movement weak hoti hai.

4. **Averages Must Confirm Each Other**: Dow Theory ke mutabiq, different market indices ko ek doosre ko confirm karna chahiye. Agar ek index new high banata hai, toh dusre index ko bhi usse confirm karna chahiye. Forex market mein yeh principle different currency pairs ko analyze karne mein madad karta hai.

5. **Volume Confirms Trend**: Dow Theory ke mutabiq, volume trend ko confirm karta hai. Agar price movement high volume ke sath hoti hai, toh trend strong hota hai. Agar low volume ke sath hoti hai, toh trend weak hota hai.

6. **Trend Continues Until a Clear Reversal Occurs**: Dow Theory ke mutabiq, trend tab tak continue hoti hai jab tak clear reversal signals nahi milte. Trend reversal ko identify karne ke liye price patterns aur technical indicators ka use hota hai.

### Dow Theory Ka Forex Trading Mein Use

1. **Trend Identification**: Dow Theory ka use karke traders market trends ko identify kar sakte hain. Primary, secondary, aur minor trends ko analyze karke better trading decisions le sakte hain.

2. **Entry and Exit Points**: Dow Theory ke principles ko follow karte hue, traders entry aur exit points ko effectively determine kar sakte hain. Accumulation aur distribution phases ko identify karna profitable entry aur exit points ko locate karne mein madad karta hai.

3. **Risk Management**: Dow Theory ka use risk management mein bhi hota hai. Trends ke different phases ko samajh kar stop-loss aur take-profit levels ko set karna easy hota hai.

4. **Volume Analysis**: Volume analysis ka use karke traders trend ki strength ko evaluate kar sakte hain. High volume trends ko prefer karna aur low volume trends se bachna important hai.

### Example

Suppose aap EUR/USD pair trade kar rahe hain aur aap primary trend ko identify karte hain jo upward hai. Secondary trend mein aap minor corrections observe karte hain. Aap Dow Theory ke principles ko follow karte hue accumulation phase mein entry le sakte hain aur public participation phase mein apne profits ko maximize kar sakte hain. Distribution phase ko identify karke timely exit kar sakte hain.

### Conclusion

Dow Theory forex trading mein ek fundamental framework provide karti hai jo market trends aur price movements ko samajhne mein madad karti hai. Market discounts everything, trends ke different phases, averages ka confirmation, volume analysis, aur trend continuation ke principles ko samajh kar traders better trading decisions le sakte hain. Forex trading mein success hasil karne ke liye, Dow Theory ko effectively use karna aur apply karna zaroori hai.

-

#10 Collapse

Forex Trading Mein Dow Theory:Dow Theory forex trading ka aik aham hissay main shamil hoti hai aur isay samajhna trading decisions lehnay mein madadgar ho sakta hai. Ye theory Charles H. Dow ne develop ki thi aur ye stock market analysis ke basic principles mein se aik hai. Hum is post mein Dow Theory ke mukhtalif principles ko forex trading ke context mein samjhenge.

Dow Theory ke Bunyadi Principles:1. Market Discounts Everything

Market ki har cheez ko incorporate karti hai, yani sab news, events, aur information already market prices mein shamil hoti hain. Iska matlab hai ke jab bhi koi new information ati hai, wo turant prices ko affect karti hai.

2. Three Types of Market Trends

Dow Theory ke mutabiq market mein teen qisam ke trends hotay hain:

1. Primary Trend:

Ye bara trend hota hai jo kai months ya even years tak chalta hai.

2. Secondary Trend:

Ye primary trend ke against chota trend hota hai aur kuch weeks ya months tak chalta hai.

3. Minor Trend:

Ye short-term movements hoti hain jo kuch days ya weeks tak chalti hain.

3. Three Phases of Primary Trends

Primary trends ko teen phases mein divide kiya ja sakta hai:

1. Accumulation Phase:

Ye wo phase hai jahan smart investors buy ya sell karna shuru kartay hain kyunki unhe maloom hota hai ke market trend badalnay wala hai.

2. Public Participation Phase:

Ye wo phase hai jahan ziada tar investors market trend ko recognize karna shuru kartay hain aur usmein participate kartay hain.

3. Distribution Phase:

Ye wo phase hai jahan smart investors apni positions ko close karna shuru kartay hain kyunki unhe maloom hota hai ke market trend khatam honay wala hai.

4. The Stock Market Averages Must Confirm Each Other

Dow Theory ke mutabiq agar market ka aik index (jese Dow Jones Industrial Average) new high banata hai to doosra related index (jese Dow Jones Transportation Average) ko bhi new high banana chahiye, taake trend ko confirm kiya ja sake.

5. Volume Must Confirm the Trend

Trading volume ka increase hona zaroori hai jab market trend positive ho aur decrease hona chahiye jab market trend negative ho, taake trend ki reliability confirm ki ja sake.

6. A Trend is Assumed to be in Effect Until It Gives Definite Signals That It Has Reversed

Jab tak clear reversal signals na milen, trend ko assume kiya jata hai ke wo continue rahega.

Dow Theory ka Forex Trading Mein Istemaal:

Market Discounts Everything:

Forex market mein bhi sari information prices mein shamil hoti hai. Economic reports, political events, aur other news turant forex prices ko affect karti hain.

Three Types of Market Trends:

Forex market mein bhi primary, secondary, aur minor trends hotay hain. Primary trends long-term movements hoti hain, secondary trends short-term corrections hoti hain, aur minor trends day-to-day price movements hoti hain.

Three Phases of Primary Trends:

Forex trading mein bhi accumulation, public participation, aur distribution phases hotay hain. Smart money pehle positions le leti hai, phir general public enter hoti hai, aur finally smart money exit kar leti hai.

Market Averages Must Confirm Each Other:

Forex pairs mein bhi agar ek pair new high banata hai to related pairs ko bhi similar movements show karni chahiye.

Volume Must Confirm the Trend:

Forex market mein volume data available hota hai jo trend ki reliability ko confirm karne mein madadgar hota hai.

Trend Reversals:

Jab tak clear reversal signals na milen, existing trend ko continue mana jata hai. Reversal patterns aur indicators ko analyze karna zaroori hota hai taake right trading decisions liye ja sakein.

Dow Theory ko samajh kar aur usay forex trading mein apply kar ke aap better trading decisions le sakte hain aur market trends ko accurately predict kar sakte hain. Trading mein risk management aur proper analysis bohat zaroori hota hai.

-

#11 Collapse

Dow Theory trading aur technical analysis ki dunya mein aik bohot mashhoor aur ahem concept hai. Yeh theory Charles H. Dow ne 19th century ke akhir mein introduce ki thi, jo Wall Street Journal ke co-founder aur Dow Jones & Company ke co-creator bhi thay. Dow Theory ko stocks aur financial markets ka analysis karne ke liye istemal kiya jata hai, lekin yeh forex trading mein bhi equally effective aur relevant hai.

Dow Theory aik financial theory hai jo market trends aur price movements ko analyze karne ke liye use hoti hai. Is theory ke mutabiq, market trends ko identify karne aur unhein predict karne ke liye kuch specific principles aur rules follow kiye jate hain. Dow Theory ke mutabiq, market trend hamesha teen phases mein move karta hai: primary trend, secondary trend, aur minor trend.- Market Discounts EverythingDow Theory ke mutabiq, saari available information (news, earnings reports, etc.) already market price mein factored hoti hai. Price action hi sabse important indicator hota hai.

- Market Trends: Market teen types ke trends follow karta hai:

- Primary Trend: Long-term trend jo several months ya years tak chal sakti hai. Yeh trend ya to bullish (upward) ya bearish (downward) hota hai.

- Secondary Trend: Intermediate trend jo weeks ya months tak chal sakta hai. Yeh primary trend ke against move karta hai aur primary trend ke correction ko represent karta hai.

- Minor Trend: Short-term trend jo days ya weeks tak chal sakta hai aur secondary trend ke against move karta hai.

- Three Phases of Primary Trend:

- Accumulation Phase: Yeh phase tab hota hai jab informed investors quietly buy kar rahe hote hain aur market sentiment generally bearish hoti hai.

- Public Participation Phase: Is phase mein market trend clear hoti hai aur broader public participation start hota hai.

- Distribution Phase: Is phase mein smart money ya informed investors apne positions sell kar rahe hote hain aur market sentiment generally bullish hoti hai.

- Indexes Must Confirm Each Other: Dow Theory ke mutabiq, agar ek market index (jaise Dow Jones Industrial Average) trend reversal show kar raha hai, toh doosre related index (jaise Dow Jones Transportation Average) ko bhi us trend reversal ko confirm karna chahiye.

- Volume Must Confirm the Trend: Trend ke direction ko volume bhi support karni chahiye. Bullish trend ke waqt, volume high honi chahiye jab price rise kare aur bearish trend ke waqt, volume high honi chahiye jab price fall kare.

- Trends Persist Until a Clear Reversal Occurs: Market trends continue karte hain until a definitive reversal signal hota hai. Yeh principle market trends ke continuity ko emphasize karta hai.

-

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Dow theory in forex trading

400 word in roman urdu

-

#13 Collapse

Dow Theory in Forex Trading

Forex trading main Dow Theory aik fundamental concept hai jo market trends aur price movements ko samajhne ke liye use hota hai. Ye theory Charles Dow ne develop ki thi, jo Wall Street Journal ke co-founder aur Dow Jones Industrial Average ke creator the. Dow Theory market analysis aur trading decisions ko guide karne main bohot helpful hai. Aaiye, Dow Theory ke key principles aur unka forex trading main istemal detail se samajhte hain.

1. Dow Theory Kya Hai?

Dow Theory ek financial theory hai jo market trends aur price movements ko analyze karne ke liye use hoti hai. Ye theory chhe basic principles par based hai jo market ki direction aur trend reversals ko identify karne main madad karte hain.

2. Dow Theory Ke Principles

Dow Theory ke chhe main principles ye hain:

Principle 1: Market Discounts Everything

Is principle ke mutabiq market price sab information ko reflect karta hai, chahe wo past, present ya future events ki ho. Market price har tarah ki information aur news ko incorporate kar leta hai.

Principle 2: Market Moves in Trends

Dow Theory kehte hai ke market trends main move karta hai. Ye trends teen types ke hote hain:

- Primary Trend:

Ye long-term trend hota hai jo months ya years tak chal sakta hai.

- Secondary Trend:

Ye medium-term trend hota hai jo weeks ya months tak chal sakta hai aur primary trend ke against move kar sakta hai.

- Minor Trend:

Ye short-term trend hota hai jo days ya weeks tak chal sakta hai aur secondary trend ke against move kar sakta hai.

Principle 3: Major Trends Have Three Phases

Primary trends teen phases main divide hote hain:

- Accumulation Phase:

Ye phase wo hota hai jab informed investors buying ya selling start karte hain, magar market abhi trend ko recognize nahi karta.

- Public Participation Phase:

Ye phase wo hota hai jab market trend ko recognize karta hai aur majority traders us trend main enter karte hain.

- Distribution Phase:

Ye phase wo hota hai jab informed investors apni positions ko close karte hain aur profit book karte hain.

Principle 4: Averages Must Confirm Each Other

Dow Theory ke mutabiq, different market indices ko ek doosre ko confirm karna chahiye. Forex market main, ye principle different currency pairs ya correlated markets ke beech relationship ko analyze karne main help kar sakta hai.

Principle 5: Volume Must Confirm the Trend

Is principle ke mutabiq, trend ko support karne ke liye volume bhi increase hona chahiye. Agar price trend direction main move ho raha hai aur volume bhi increase ho raha hai, to trend strong hota hai.

Principle 6: A Trend Is Assumed to Be in Effect Until It Gives Definite Signals of Reversal

Dow Theory ke mutabiq, trend ko reverse hone tak assume karna chahiye ke wo continue rahega. Trend reversal tab hota hai jab market clear signals deta hai ke trend change hone wala hai.

3. Dow Theory Ka Forex Trading Main Use

Dow Theory ko forex trading main different tarikon se use kiya ja sakta hai:

- Trend Identification:

Primary, secondary, aur minor trends ko identify kar ke trading decisions le sakte hain.

- Entry and Exit Points:

Accumulation aur distribution phases ko analyze kar ke entry aur exit points identify kar sakte hain.

- Volume Analysis:

Volume trends ko analyze kar ke trend strength ko confirm kar sakte hain.

- Market Correlations:

Different currency pairs ya correlated markets ko analyze kar ke market direction aur trends ko better samajh sakte hain.

Conclusion

Dow Theory ek powerful analytical tool hai jo forex traders ko market trends aur price movements ko samajhne main madad deta hai. Is theory ke principles ko samajh kar aur use karke aap apni trading strategy ko enhance kar sakte hain aur better trading decisions le sakte hain. Har trader ko Dow Theory ke basics ko samajh kar apni trading strategy main include karna chahiye.

-

#14 Collapse

Dow Theory forex trading mein ek important concept hai jo market analysis aur trends ko samajhne mein madad deta hai. Charles Dow ne late 19th century mein is theory ko develop kiya tha, jo ab bhi trading community mein significant hai.

Dow Theory ke mukhtasar principles hain:

1. **Market Trends**: Dow Theory kehta hai ke market mein 3 types ke trends hote hain - primary (long-term), secondary (intermediate), aur minor (short-term). Traders ko in trends ko identify karke unke direction ko samajhna chahiye.

2. **Market Phases**: Dow Theory mein market ke phases ko recognize kiya gaya hai - accumulation (bottom formation), uptrend, distribution (top formation), aur downtrend. In phases ko samajh kar traders entry aur exit points tay kar sakte hain.

3. **Confirmation**: Dow Theory mein ek important concept hai ke trends ko confirm karna. Yani, ek trend valid tab hota hai jab wo high volumes aur price movement ke sath confirm hota hai.

Forex trading mein Dow Theory ka application kaise hota hai?

- **Trend Identification**: Dow Theory ke principles ka use karke traders forex market mein long-term, intermediate aur short-term trends ko identify kar sakte hain. Isse unko market ka overall direction samajhne mein madad milti hai.

- **Entry aur Exit Points**: Dow Theory ke phases ko samajh kar traders entry aur exit points decide kar sakte hain. Jaise ki, uptrend phase mein positions lena aur distribution phase mein profit booking karna.

- **Confirmation of Trends**: Dow Theory ke through traders trends ko confirm karte hain, jaise ki price movements aur volumes ki analysis se. Isse false signals se bacha ja sakta hai.

Dow Theory forex trading mein ek foundation provide karta hai jo traders ko market behavior ko samajhne mein help karta hai. Yeh principles market analysis ka ek important aspect hai aur experienced traders ise apne trading strategies mein integrate karte hain. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Dow Theory aur Uska Istemaal Forex Trading Mein

Dow Theory ek purani aur mukhtalif approach hai jo stock market analysis ke liye develop ki gayi thi, lekin iska principles forex trading mein bhi istemaal kiya ja sakta hai. Is article mein hum Dow Theory ke fundamental concepts ko samjhenge aur dekhenge ki kaise iska istemaal forex trading mein kiya ja sakta hai.

Dow Theory ke Fundamental Concepts

Dow Theory ke mukhya concepts niche diye gaye hain:- Trend Analysis: Dow Theory kehta hai ki market ek primary trend, intermediate trend, aur minor trend mein move karta hai. Primary trend weeks se months tak ka time frame cover karta hai, jabki intermediate trend weeks se months ke beech mein hota hai. Minor trend daily movements ko define karta hai.

- Market Movements: Dow Theory ke anusaar, uptrend higher highs aur higher lows banata hai jabki downtrend lower highs aur lower lows banata hai. Yeh price patterns ko analyze karne mein madad karta hai.

- Volume Confirmation: Price movements ke saath saath volume bhi dekha jata hai. Dow Theory kehta hai ki price trend ko validate karne ke liye volume trend ke saath confirm hona chahiye.

- Market Averages: Dow Theory mein market indices (jaise ki Dow Jones Industrial Average) ke movements ko analyze kiya jata hai.

Forex trading mein Dow Theory ke concepts ko kaise apply kiya ja sakta hai:- Trend Identification: Dow Theory ke principles ko istemaal karke traders trend identification mein madad le sakte hain. Agar price higher highs aur higher lows banata hai, toh yeh uptrend ko indicate karta hai aur traders long positions le sakte hain. Agar price lower highs aur lower lows banata hai, toh yeh downtrend ko indicate karta hai aur traders short positions le sakte hain.

- Volume Analysis: Dow Theory kehte hain ki price movements ko confirm karne ke liye volume ka bhi analysis important hai. Agar price trend higher volume ke saath hai, toh yeh trend ko strong maana jata hai. Agar volume low hai aur price movement inconsistent hai, toh yeh trend weak ho sakta hai.

- Market Indices aur Correlations: Forex traders Dow Jones ya dusre major stock indices ke movements ko bhi observe karte hain. Agar stock market mein strong trend hai, toh yeh forex market par bhi impact dal sakta hai, especially USD pairs mein.

- Support aur Resistance Levels: Dow Theory ke principles support aur resistance levels ko bhi consider karte hain. Support level par price ka bounce aur resistance level par price ka reversal ho sakta hai, jo traders ke liye entry aur exit points provide karte hain.

Dow Theory ka forex trading mein istemaal karne se kuch fayde hain:- Clear Trend Identification: Dow Theory trend identification mein madad deta hai, jo trading decisions ke liye crucial hota hai.

- Volume Confirmation: Volume analysis ke through trend ki validity ko confirm karne mein madadgar sabit hota hai.

- Historical Analysis: Dow Theory historical price patterns ko analyze karne mein bhi madad deta hai, jo future price movements predict karne mein help karta hai.

Dow Theory ek classical approach hai jo market trends aur movements ko analyze karne mein madad deta hai. Iska forex trading mein istemaal karne se traders ko market dynamics ko samajhne aur effective trading decisions lene mein madad milti hai. Zaroori hai ke har trader apne trading style aur risk tolerance ke hisab se Dow Theory ke principles ko adapt kare aur market conditions ko samajhne ke liye dusre technical indicators aur fundamental analysis ke saath combine kare.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 01:43 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим