Pan bottom patterns trading

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

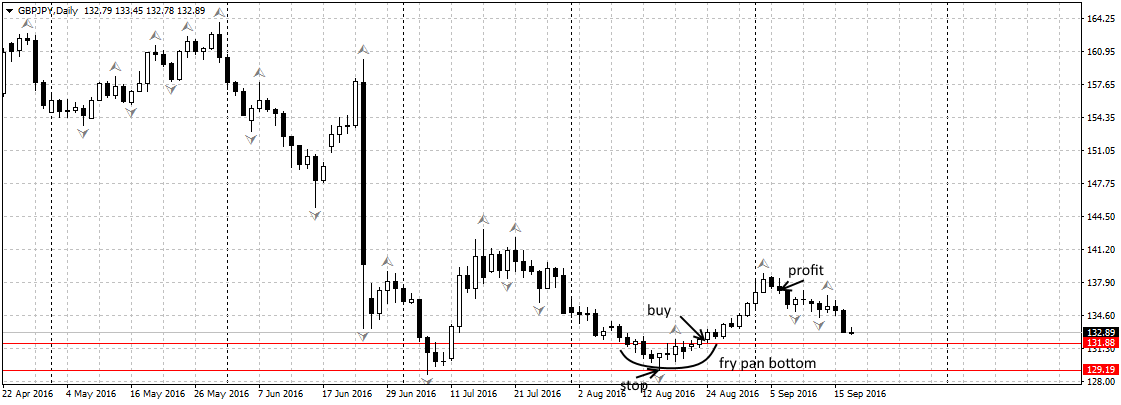

Pan Bottom Pattern Trading Introduction Assalam walekum kaise hain flex ke tamam ke tamam member of Allah Ke Karam se theek honge acchi runs kar rahe honge aur Khushi Ke sath apna Kam bhi kar rahe honge Aaj ham baat karenge pelvis bottom pattern ke bare mein aur mukmmal tafseel as topic mn ho gePatteren forex trading ki duniya mein aik maqbool takneeki tajzia patteren hai. yeh aik lambay u ke size ke neechay ki taraf se khususiyaat hai jo aik pain ki terhan hai, lehaza naam. yeh patteren aksar market mein mumkina kharidari ke mawaqay ki nishandahi karne ke liye istemaal hota hai. pain patteren ki nishandahi karne ke liye, tajir nichli sthon ki aik series talaash karte hain jis ke baad aik taweel arsay tak istehkaam hota hai, jahan currency ke jore ki qeemat aik tang range ke darmiyan hai. aakhir-kaar, qeemat you ke size ke neechay ke dayen janib bantay hue, istehkaam ki had se oopar toot jati hai. yeh break out aam tor par aala tijarti hajam ke sath hota hai, jo market ke jazbaat mein numaya tabdeeli ki nishandahi karta hai. break out honay ke baad, tajir qeemat ki karwai ko dekh kar patteren ki tasdeeq ke liye talaash karte hain. misali tor par, qeemat ko break out level ko dobarah janchna chahiye aur pain ke neechay ke patternen ka handle banatay hue, support ke tor par pakarna chahiye. yeh dobarah test is baat ki tasdeeq karne mein madad karta hai ke break out haqeeqi tha nah ke ghalat signal. pain बातà¥à¤® patteren ko aksar taizi se patteren samjha jata hai, kyunkay yeh batata hai ke neechay ka rujhan khatam ho raha hai. yes tajir je patteren ko dekhte hain woh lambi pozishnon mein daakhil honay ki umeed rakhtay hain, qeemat ziyada jari rehne ki tawaqqa rakhtay hain. woh –apne manfi khatray ko mehdood karne ke liye break out level se neechay stap loss order bhi set kar satke hain. yeh note karna zaroori hai ke pain बतà¥à¤® pattern hamesha qabil bharosa nahi hota hai, aur taajiron ko bakhabar tijarti faislay karne ke liye deegar takneeki isharay aur tajzia ke tools ke sath mil kar istemaal karna chahi ghalat break out aur nakaam pattern ho satke hain, aur taajiron ko hamesha mumkina nuqsanaat ko kam karne ke liye khatray ke intizam ki munasib par amal karna chahiye. aakhir mein, pain patteren forex traders ke liye aik mufeed tool hai jo market mein mumkina kharidari ke mawaqay talaash kar rahay hain. u walay neechay ki shanakht karkay aur is ke baad break out aur dobarah test karne se, tajir mumkina tor par lambi pozishnon mein daakhil ho satke hain aur taizi ke ulat phair se faida utha satke hain. taham, taajiron ko takneeki tajzia ke namonon ka istemaal karte hue tijarat karte waqt hamesha ahthyat aur munasib risk management taknik ka istemaal karna chahiye Explanation Market mn kami ka rojhan hona Chaiy.Pan lower pattren chart par zahir hona chaiy iski asal body choti honi chaiy or candle stick k neechy honi Chaiy,Pan ban jaban bottom ka oppari sayia lamba hona Chaiy or asal body k opper achi tarha paihlna Chaiy,is sy tajron ko market mn mumkina tabdelion ki neeshandhai krny mn madad mil skti h .yeh tajron ko rojhan ki simat mn mumkina warning tabdeli mn mumkina h.Is sy tajron ko je bary mn bakhaber faisly krny mn i madad milt skti h k kab tejarat mn dakhil hona h or kb bahir niklna h.Yeh market k tamam Halat mn qibalay aitmad nhi ho skta tajegary takneyi k is takneekon k sath mil kr istamal kia jana chaiy.Yeh had sy munsilik market mn kam qabily aitmad ho skta h ,Jhn qeemat ki karwai aik makhsoos qaimat jo ki had k ander bulandion or truck ki aik liquid rows sy numy b tejarti hujam wali mandi mn yeh kam moasar ho skta h q k ho skta h ulat ho pheer ki hemyiat krny waly shorika na hn.Zyada utar charhao wali market mn yeh kam qibalay aitmad hn kra gtren sk tmad hn or pat k bray jpedho ty hn.yeh mazboot bunyadi driveron wali market mn kam moasar hota h q k bunyadi mayashi halat technique awamal sy khn zyada ho skty hn yeh tajron ki likaleay position lambi mn dakhil hony or uptrend mn sawar hony htaqa hony ka Acha -

#3 Collapse

Ek aise pattern ka naam hai jo traders aksar milti hai wo hai Pan Bottom pattern. Ye pattern un logon ke liye ahem hai jo forex market mein dakhil hona chahte hain ya apni mojooda trading strategies ko behtar banana chahte hain. Pan bottom pattern, jo ke Reversal Bottom ya Reverse Head and Shoulders ke naam se bhi jana jata hai, ek technical analysis ka zaria hai jo traders istemal karte hain takay forex market mein ek mumkin trend reversal ka andaza lagaya ja sake. Ye pattern aik series of lower lows ke sath paish ata hai jo ke phir price mein izafa ka ishara deta hai, jo market sentiment mein tabdeeli ka nishaan hota hai. Pan ka naam Greek mythological figure, Pan, se liya gaya hai, jo ke afadiyat aur taraqqi le kar ata hai. Forex trading ke context mein, Pan bottom pattern ek lambi downtrend ke baad market mein taqat ka izhar karta hai

Components of a Pan Bottom Pattern

Pan bottom pattern ko pehchan'ne ke liye, traders ko is ke key components ko pehchanna zaroori hai:- Left Shoulder: Left shoulder pehle stage ko darust karta hai jo ke downtrend ka hai, jahan price ek series of lower lows ka samna karta hai. Ye stage market mein kamzori ka ishara karta hai.

- Head: Head downtrend ka sab se nizam aur ghurbat ka waqt hota hai jo traders mein ziada be'atari aur mayoosi ka waqt hota hai.

- Right Shoulder: Right shoulder left shoulder ka chota version hota hai, jahan price lower lows banata hai lekin head ke tarah gehra nahi hota. Ye stage darust karta hai ke market ek bottom dhoond raha hai.

- Neckline: Neckline ek horizontal trendline hai jo head aur right shoulder ke lows ko jorta hai. Ye pattern ke liye ek ahem support level ka kaam karta hai.

Pan bottom pattern ko pehchane ke liye, ye steps follow karein:- Analyze the chart: Forex chart ka tajziya karna shuru karen ek munasib time frame ke sath, jaise ke daily ya weekly. Downtrend ko dekhen jo lower lows aur lower highs ke sath pai jati hai.

- Identify the left shoulder: Downtrend ke pehle stage ko pehchanen, jahan price ek series of lower lows ka samna karta hai.

- Identify the head: Downtrend ka sab se nizam point ko dhoonden, jo traders ke darmiyan ziada mayoosi ka waqt hota hai.

- Identify the right shoulder: Downtrend ke ek chote version ko dhoonden jahan price head se lower lows banata hai lekin pehle downtrend ke tarah gehra nahi hota.

- Draw the neckline: Head aur right shoulder ke lows ko jorna ek horizontal trendline banayen.

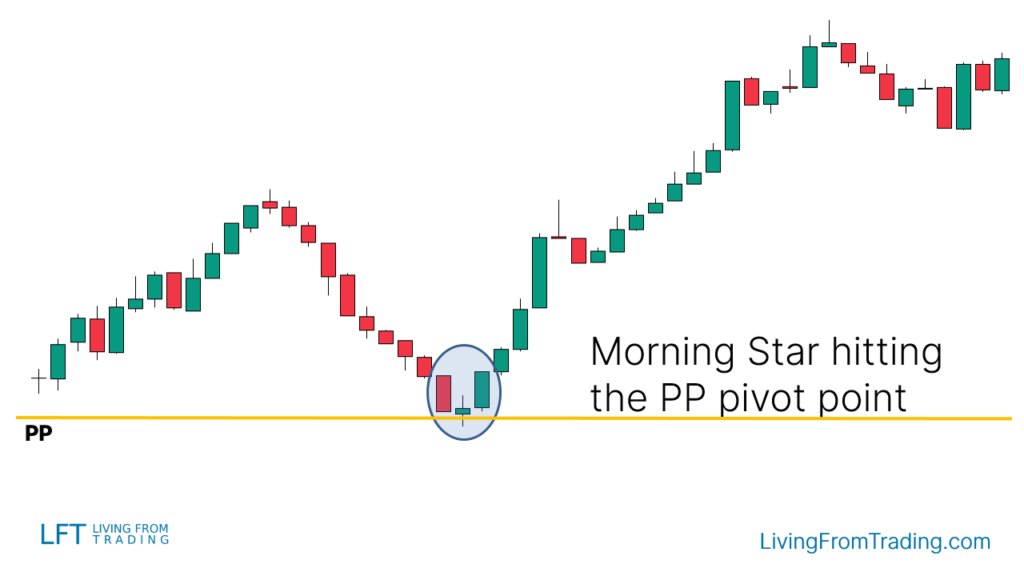

Jab ek Pan bottom pattern pehchan'liya jata hai, traders munasib trend reversal par faida uthane ke liye mukhtalif strategies istemal kar sakte hain:- Buy on a Breakout: Traders long position mein dakhil ho sakte hain jab price neckline ke upar break karta hai, jo market sentiment mein tabdeeli ka ishara deta hai. Risk ko manage karne ke liye neckline ke neeche stop-loss order lagayen.

- Wait for Confirmation: Kuch traders prefer karte hain ke price ko neckline ko support ke tor par dobara test karna aur phir upar bounce back karne se pehle long position mein dakhil ho jayein. Ye approach false breakout ka risk kam karta hai.

- Use Volume Indicators: Volume indicators shamil karna reversal ki taqat ko tasdeeq karne mein madadgar ho sakta hai. Breakout ke doran volume mein izafa ek mazboot trend reversal ka ishara kar sakta hai.

Jab ke Pan bottom patterns potential trend reversals ko pehchanne ke liye ahem asbaab hote hain, magar ye foolproof nahi hote. Traders ko neechay diye gaye risks aur limitations ke bare mein maloom hona zaroori hai:- False Breakouts: Price neckline ke briefly upar break kar sakta hai lekin upar ki momentum ko barqarar rakhne mein naqami ka samna kar sakte hain, jis se false breakout aur potential nuqsan ho sakta hai.

- Market Volatility: Faraibati khabron ka achanak paish ana ya ghair mutawaqqa economic data market mein significant volatility ko paida kar sakte hain, jo pattern ko naqis bana sakta hai.

- Market Sentiment: Pan bottom patterns market sentiment par mabni hote hain jo ke mayoosi se umeed par tabdeel hone par mushtamil hota hai. Agar market sentiment tabdeel nahi hota, to pattern mukammal nahi hota.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#4 Collapse

Pan bottom patterns trading

Pan Bottom Patterns Kya Hain?

Pan Bottom Patterns forex trading mein ek aham technical analysis tool hain jo traders ko potential trend reversals ki indication deta hai. Yeh pattern market ke bottoms ko identify karta hai jab price action mein ek reversal process shuru hota hai. Pan Bottom Patterns ko "pan" jese shape se compare kia jata hai jismein gradual price decline ya consolidation ke baad ek base form hota hai.

Pan Bottom Patterns Ki Formation

Pan Bottom Patterns ki formation mein kuch key elements shamil hote hain:- Downtrend: Pehle toh market mein ek downtrend hona zaroori hai. Yeh downtrend ek extended period ke liye hota hai jahan price action gradually neeche ki taraf move karta hai.

- Base Formation: Downtrend ke baad, price action mein gradual decline ya consolidation phase ata hai jahan price stabilize hone lagti hai. Is phase mein, base formation shuru hoti hai jise pan bottom pattern kehte hain.

- Volume Analysis: Volume bhi ek important aspect hai pan bottom pattern ki formation mein. Typically, jab base formation hoti hai, volume decrease hota hai. Lekin jab reversal ka signal ata hai, volume increase hone ka indication hota hai.

Pan Bottom Patterns Ki Identifications

Pan Bottom Patterns ko identify karna zaroori hai taake traders sahi trading decisions le sakein. Kuch key points hain jo identification mein madad karte hain:- Gradual Base Formation: Price action mein gradual base formation ko dekhna zaroori hai. Yeh formation jese pan bottom shape ki tarah hoti hai.

- Volume Confirmation: Volume ki analysis se pattern ki authenticity ko confirm kiya ja sakta hai. Jab base formation hoti hai, volume usually decrease hota hai. Lekin reversal signal ke waqt, volume me increase hota hai.

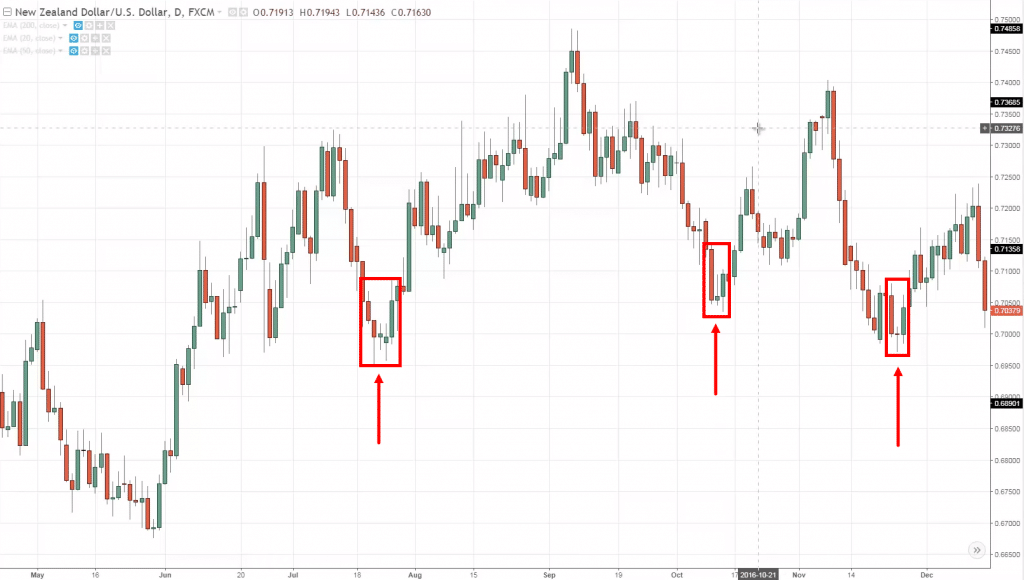

- Candlestick Patterns: Candlestick patterns bhi ek important tool hain pan bottom patterns ko identify karne mein. Bullish reversal candlestick patterns jese ki hammer ya bullish engulfing, base formation ke baad confirmatory signals provide karte hain.

Pan Bottom Patterns Ka Trading Strategy

Pan Bottom Patterns ko istemal karne ke liye kuch key points hain:- Confirmation Wait Karna: Pan bottom pattern ko confirm karne ke liye traders ko ek strong reversal signal ka wait karna chahiye jaise ki bullish candlestick patterns ya price breakout.

- Stop Loss Aur Risk Management: Har trading strategy mein risk management ka crucial role hota hai. Traders ko stop loss levels ko define karna zaroori hai taake losses control mein rahein.

- Target Setting: Ek clear target set karna important hai. Traders ko price action ke movement ko observe karke target levels set karna chahiye jahan se wo profit booking kar sakein.

Conclusion

Pan Bottom Patterns ek powerful tool hain trend reversals ko identify karne ke liye. Lekin, is pattern ko sahi tarah se identify karna aur confirm karna zaroori hai taake traders consistent profits earn kar sakein. Har trading strategy ki tarah, pan bottom patterns ka bhi proper analysis aur risk management ke saath istemal karna zaroori hai.

-

#5 Collapse

Pan Bottom Patterns Trading:

Introduction (پین بوٹم پیٹرن ٹریڈنگ: تعارف)

Forex trading mein, technical analysis ka istemal market trends ko samajhne aur trading decisions ke liye karna aham hota hai. Pan bottom patterns ek aise technical analysis tool hain jo market mein trend reversal ko signal karte hain. Is article mein, hum pan bottom patterns trading ke bare mein roman Urdu mein baat karenge.

II. Pan Bottom Patterns: Aham Tafsilat (پین بوٹم پیٹرن: اہم تفصیلات)- Pan Bottom Patterns Kya Hote Hain? (پین بوٹم پیٹرن کیا ہوتے ہیں؟)

- Pan bottom patterns, market mein bearish trend ke baad aane wale bullish reversal ko represent karte hain.

- Ye patterns market mein buyers ki comeback ko darust karte hain.

- Pan Bottom Patterns ke Components (پین بوٹم پیٹرن کے حصوں)

- Pan bottom patterns typically ek U-shaped formation ko darust karte hain, jismein market pehle neeche jaata hai phir dheere dheere upar uthne lagta hai.

- Is pattern mein do important points hote hain: pan ki base (bottom) aur upar uthne ka hissa (recovery).

- Entry Points Ka Tayaar Karna (انٹری پوائنٹس کا تیار کرنا)

- Pan bottom pattern ke signals par trading ke liye entry points tay karna aham hai.

- Traders ko is pattern ke confirmation ke liye doosre technical indicators ka istemal bhi karna chahiye.

- Stop-Loss Aur Take-Profit Levels (اسٹاپ لاس اور ٹیک پروفٹ لیولز)

- Har trading strategy mein risk management ka hissa hota hai. Traders ko apne trades ke liye stop-loss orders aur take-profit levels tay karna chahiye.

- Double Bottom Patterns (ڈبل بوٹم پیٹرن)

- Ismein do baar market neeche jaata hai aur phir se upar uthne lagta hai.

- Pehli bottom ke baad bhi dobara neeche jaane ka chance hota hai, lekin agar doosri bottom pehli se oonchi hoti hai, to ye bullish reversal ki nishaani ho sakti hai.

- Triple Bottom Patterns (ٹرپل بوٹم پیٹرن)

- Ismein teen baar market neeche jaata hai aur phir se recover hota hai.

- Har bottom pehle se oonchi honi chahiye, indicating a stronger bullish reversal.

Jab bhi traders pan bottom patterns ka istemal karte hain, unhe yaad rakhna chahiye ke kuch false signals bhi hosakte hain. Market mein external factors, news events, ya unexpected economic changes pan bottom patterns ki accuracy ko influence kar sakte hain.

VI. Real-World Example (حقیقت میں مثال)

Ek haqeeqati misal ke taur par, maan lo ke ek currency pair mein bearish trend tha aur phir ek pan bottom pattern ban gaya. Traders ne is pattern ko dekha, doosre technical indicators ke sath confirm kiya, aur phir entry points tay kiye.

VII. Pan Bottom Patterns Ka Istemal Aur Future Predictions (پین بوٹم پیٹرنز کا استعمال اور مستقبل کی پیشگوئی)

Pan bottom patterns ka istemal karke traders market trends ko samajh sakte hain aur future predictions bana sakte hain. Lekin, hamesha yaad rahe ke market mein risk hota hai, aur har trading decision ko careful planning ke sath lena chahiye.

VIII. Khatima (ختم)

To conclude, pan bottom patterns trading ek powerful tool hai jo market trends ko samajhne aur potential reversals ko pehchanne mein madad karta hai. Traders ko is pattern ka sahi tarah se istemal karne ke liye market conditions aur doosre factors ka bhi dhyan rakhna chahiye. Pan bottom patterns ka istemal karke traders apni trading strategies ko refine kar sakte hain, lekin hamesha prudent aur disciplined taur par kaam karna zaroori hai.

- Pan Bottom Patterns Kya Hote Hain? (پین بوٹم پیٹرن کیا ہوتے ہیں؟)

-

#6 Collapse

1. (Introduction to Pan Bottom Pattern):

Pan Bottom Pattern, ek tijarat aur share bazar mein istemal hone wala aham pattern hai jo ke technical analysis mein istemal hota hai. Ye pattern market mein mawjood stocks ya commodities ki keemat mein tabdiliyon aur unke future trends ko samajhne ke liye istemal hota hai. Pan Bottom Pattern ka naam iske shape se aaya hai, jo ek pan ya bartan ki tarah hoti hai, jismein keemat mein neeche ki taraf jhukav hota hai, phir tezi se barhne lagti hai.

2. (Advantages of Pan Bottom Pattern Trading):

Pan Bottom Pattern ka istemal karne ke kai fawaid hain, jin mein se kuch nichay diye gaye hain:- Trend Reversal Ki Pehchan: Pan Bottom Pattern, jaise ke iska naam bayan karta hai, aksar market mein hone wale downtrend ke bad ek trend reversal ko darust karti hai. Jab market mein keemat neeche jaati hai aur phir tezi se barhne lagti hai, toh Pan Bottom Pattern is badalte hue trend ko darust karti hai.

- Entry and Exit Points: Pan Bottom Pattern traders ko behtar entry aur exit points provide karti hai. Jab yeh pattern ban raha hota hai, toh yeh traders ko signal deta hai ke ab sahi waqt hai buy ya sell karne ka.

- Risk Management: Pan Bottom Pattern ke istemal se traders apne risks ko kam kar sakte hain. Is pattern ki madad se, traders ko market ke potential reversals ka pata chal jata hai, jisse ke wo apne positions ko sahi waqt par adjust kar sakein.

Conclusion

Pan Bottom Pattern Trading, jo ke technical analysis mein ek ahem hissa hai, traders ko market trends ko samajhne aur faiday uthane mein madad karta hai. Is pattern ka istemal karke, traders apne tajziyati faisle behtar taur par le sakte hain aur market ke muqablay mein behtar taur par apne maqsad hasil kar sakte hain.

-

#7 Collapse

Pan Bottom Pattern" trading mein ek specific technical analysis pattern hai jo market trends ko identify karne aur future price movements ko predict karne me istemal hota hai. Ye ek bullish reversal pattern hai, jiska main maqsad hota hai market ke downtrend ke baad ek trend reversal ko point out karna.Is pattern ko identify karne ke liye traders candlestick charts ka istemal karte hain. Pan bottom pattern ka naam isliye hai kyunki iska appearance ek "pan" ya "bowl" ki tarah hota hai. Is pattern ki characteristics mein include hote hain:

Downtrend:

Pehle, market mein ek downtrend hota hai, jiska matlab hai ke prices continuously gir rahe hain.

Bottom Formation:

Downtrend ke baad, prices ek point par stabilize hote hain aur ek saucer ya bowl ki tarah dikhai dete hain, is point ko "bottom" kehte hain.

Uptrend Start:

Jab prices ne bottom banaya hota hai, aur phir se upar ki taraf move karte hain, tab traders ko lagta hai ke ab ek naya uptrend shuru ho sakta hai.

Volume Confirmation:

Traders volume ko bhi observe karte hain. Agar price ke sath saath volume bhi increase ho rahi hai, toh ye confirm karta hai ke trend reversal hone ke chances hain.Traders ko chahiye ke is pattern ko confirm karne ke liye doosre technical indicators ka bhi istemal karein aur risk management ko dhyan mein rakhein. Pan bottom pattern ke istemal mein, traders ko hamesha market ke overall context aur market conditions ka bhi dhyan rakhna important hai.Har trading decision se pehle, thorough analysis karna aur risk management ko prioritize karna zaroori hai.

-

#8 Collapse

Pennant Bottom Patterns" ya "Pan Bottom Patterns" trading mein istemal hone wale chart patterns hote hain. Ye patterns market analysis mein istemal hote hain aur traders ko potential trend reversals ya trend continuation ke signals provide karte hain. Chaliye isey Roman Urdu mein samajhte hain:Pan Bottom Patterns ek bullish reversal pattern hota hai, jo market mein downtrend ke baad aata hai. Ye pattern market mein trend change hone ki possibility ko indicate karta hai. Pan Bottom Patterns ko samajhne ke liye, aapko kuch key points par dhyan dena hoga:

Shape:

Pan Bottom Pattern ka shape ek pan (bowl) ki tarah hota hai, jismein price ne neeche ki taraf giraavat ko indicate karte huye ek rounded bottom banaya hota hai.

Volume:

Pan Bottom Patterns ke formation ke dauran volume ka bhi dhyan rakha jata hai. Typically, jab price ne bottom banaya hota hai, toh volume mein bhi increase hota hai, jo ki trend reversal ko confirm karta hai.

Breakout:

Jab Pan Bottom Pattern complete ho jata hai, aur price uske upper side se breakout karta hai, toh ye ek bullish signal hota hai. Traders is breakout ke baad long positions lete hain, expecting ke ab market mein uptrend shuru hogi.

Target:

Traders price ka breakout level se ek target set karte hain, jo ki pattern ke height se calculate kiya ja sakta hai. Ye target price uptrend ke shuru hone par achieve ho sakta hai.

Stop-Loss:

Trading mein hamesha risk management ka dhyan rakhna zaroori hai. Pan Bottom Pattern ke case mein, traders apne positions ke liye stop-loss level set karte hain takay in case of adverse market movements, loss ko minimize kiya ja sake.Pan Bottom Patterns ke istemal se traders market ke potential reversals ko early stage mein identify kar sakte hain, jisse unhe trading opportunities milte hain. Lekin, jaise ki har technical analysis tool, ye bhi perfect nahi hota, aur traders ko apne decisions ko aur dusre confirmatory indicators ko bhi consider karna chahiye.

-

#9 Collapse

Pan Bottom Patterns Trading

Forex trading mein pan bottom patterns ka istemal karke traders apni strategies ko mazboot kar sakte hain. Ye patterns market ke reversals ko identify karne mein madadgar hote hain aur traders ko entry aur exit points ka pata lagane mein madad dete hain.

Pan Bottom Patterns Kya Hote Hain?

Pan bottom patterns, price charts par dikhayi dene wale chart patterns hote hain jo market mein bearish trend ke baad ek possible trend reversal ko darust kartay hain. Ye patterns generally "U" shape ki hoti hain jahan price pehle ghat rahi hoti hai phir stable hoti hai aur phir mazeed barhti hai. Ye pattern market ke bottom ko represent karte hain aur traders ko bullish trend ki shuruat ki nishandahi karte hain.

Mukhtalif Pan Bottom Patterns

Double Bottom Pattern

- Double bottom pattern mein price do martaba similar levels tak girti hai aur phir se oopar chadhti hai. Ye ek strong reversal signal hai.

Triple Bottom Pattern

- Triple bottom pattern mein price teen martaba similar levels tak gir kar stabilizes hoti hai, phir se oopar chadhti hai. Ye bhi ek mazboot reversal signal hai.

Saucer Bottom Pattern

- Saucer bottom pattern mein price slow aur steady tareeqay se gir kar stabilize hoti hai phir dheere dheere bullish trend mein chadhti hai.

Pan Bottom Patterns Ka Istemal Trading Mein

Pan bottom patterns ka istemal karne se pehle traders ko kuch zaroori cheezein dhyan mein rakhni chahiye:

Confirmatory Indicators

Pan bottom patterns ke sath confirmatory indicators ka istemal karna zaroori hai jaise volume, momentum indicators, aur trend lines.

Risk Management Har trade mein risk management ka dhyan rakhna zaroori hai. Stop loss orders ka istemal karke nuksan se bacha ja sakta hai.

Entry Aur Exit Points Ka Taeen Karna Pan bottom pattern ko dekhte hue entry aur exit points ko taeen karna zaroori hai. Entry point ko confirm karne ke liye traders ko ek strong bullish candle ya phir breakout ka wait karna chahiye.

Pan Bottom Patterns Ka Trading Example

Maan lijiye, aap EUR/USD currency pair ka trading kar rahe hain aur aapne ek double bottom pattern detect kiya hai. Price do martaba similar levels tak giri hai aur phir se oopar chadhti hai. Aap confirmatory indicators jaise volume aur RSI ka istemal karte hue entry point ka intezar karte hain. Jab aapko ek strong bullish candle milta hai aur volume bhi barh jata hai, to aap entry point confirm karte hain. Stop loss order ko neeche set karte hue aur target price ko calculate karte hue aap trade ko enter karte hain.

Pan Bottom Patterns Ka Istemal Ka Faida

Pan bottom patterns ka istemal karne ke kuch faiday hain:

Trend Reversal Ki Nishandahi Ye patterns trend reversal ki early indications dete hain, jisse traders ko early entry milta hai.

Entry Aur Exit Points Ka Taeen Hona

In patterns ka istemal karke traders ko entry aur exit points ka taeen karna asan ho jata hai.

Risk Ko Kam Karna. Confirmatory indicators aur risk management ke saath istemal karne se risk ko kam kiya ja sakta hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#10 Collapse

### Pan Bottom Patterns Trading

Forex aur stock trading mein "Pan Bottom Pattern" ek important technical analysis tool hai jo trend reversals ko identify karne mein madad karta hai. Is pattern ko samajhna aur sahi waqt par identify karna traders ke liye ek successful trading strategy ke liye zaroori hai. Aaj hum Pan Bottom Pattern ke baare mein detail se baat karenge aur iska trading mein kaise istemal kiya ja sakta hai.

**Pan Bottom Pattern Kya Hai?**

Pan Bottom Pattern ek technical chart pattern hai jo downtrend ke baad banta hai aur market ke reversal ka signal provide karta hai. Is pattern ko "Cup and Handle" pattern ka variant bhi samjha ja sakta hai, lekin ismein thoda sa modification hota hai. Yeh pattern do phases par base hota hai:

1. **Pan Phase**: Is phase mein market ka price niche ki taraf move karta hai aur ek rounded bottom banata hai. Is stage mein selling pressure dominant hota hai aur price low levels par stabilize hoti hai. Yeh phase ek consolidation phase hota hai jahan market apne aap ko range-bound karta hai.

2. **Bottom Formation**: Jab price apne low points ko touch kar leti hai aur ek stable base banati hai, to isse pan bottom pattern ke formation ki confirmation milti hai. Yeh pattern tab complete hota hai jab price ek breakout point ko cross karti hai aur upwards movement shuru hoti hai.

**Pattern Ki Characteristics:**

1. **Rounded Bottom**: Pan Bottom Pattern ki ek khasiyat yeh hoti hai ke ismein price ka bottom rounded aur smooth hota hai. Sharp declines aur rapid reversals nahi hote, balki gradual decline aur stabilization hoti hai.

2. **Volume Increase**: Pattern ke completion ke dauran volume ka increase bhi dekhne ko milta hai. Jab price breakout point ko cross karti hai, to volume increase hota hai jo pattern ke validity ko confirm karta hai.

**Trading Strategy:**

1. **Entry Point**: Pan Bottom Pattern ke trading mein entry point tab hota hai jab price pattern ke resistance level ko breakout karti hai. Yeh breakout point market ke bullish reversal ka indication hota hai.

2. **Stop Loss**: Stop loss ko pattern ke low point ke niche set kiya jata hai. Isse aap potential losses se bach sakte hain agar market aapke expected direction ke opposite move kare.

3. **Profit Target**: Profit target ko pattern ki height ke base par set kiya jata hai. Isse aapko trade se maximum benefit mil sakta hai.

**Conclusion:**

Pan Bottom Pattern trading mein ek valuable tool hai jo trend reversals aur buying opportunities ko identify karne mein madad karta hai. Is pattern ko sahi tarike se analyze karne ke liye aapko price movements aur volume changes ko closely monitor karna hoga. Trading decisions se pehle thorough analysis aur risk management zaroori hai. Happy trading!

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 10:10 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим