Copy Trading In Forex

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

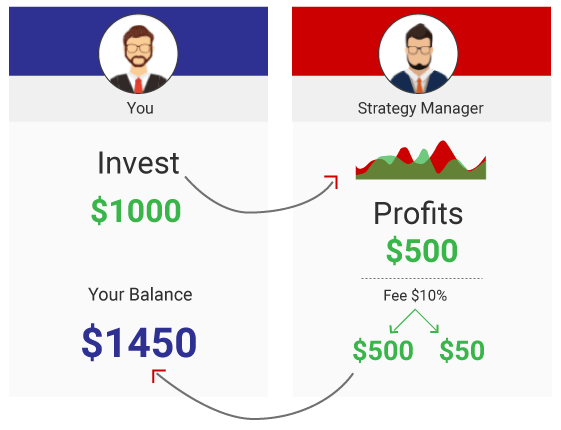

Forex trading ke duniya mein copy trading ek new technology hai jisse traders apne trading kaam ko simplify kar sakte hain. Copy trading ka matlab hai, ek trader dusre trader ki trading strategy aur positions ko copy karta hai, jisse wo apne profits ko maximize kar sakein. Copy trading ek simple aur effective tarike se traders ko trading world mein participate karne ki anumati deta hai. Yeh ek automated process hai, jisme traders ko apne trades ke decisions lene ke liye khud ko engage karne ki zarurat nahi hoti hai. Isme traders ka kaam hota hai, kisi dusre trader ko choose karna, jiski trading history, trading style, aur risk management techniques unhe achi lagti hai. Fir wo us trader ko apne trading account mein copy karte hain aur uske trades ko automatically follow karte hain. Copy trading ka kaam karne ke liye traders ko kisi social trading platform ka use karna hota hai. In platforms mein traders dusre traders ki trading history, performance, aur rankings ko dekh sakte hain, aur unhe follow kar sakte hain. In platforms mein aapko trading strategies, indicators, aur charts ki bhi madad milti hai, jisse aap apni trading decisions ko sahi tarike se lena sikh sakte hain. Copy trading ka advantage yeh hai ki isme trading kaam ko bahut hi easy banata hai. Isme aapko khud ko analysis aur research ke liye time nahi dena padta hai. Aap kisi dusre trader ko choose karke unke trades ko automatically follow kar sakte hain. Iske alawa, copy trading ka ek aur bada advantage yeh hai ki isme aapko kaafi flexibility milti hai. Aap kisi bhi trader ko choose kar sakte hain, apne risk management techniques ko apply kar sakte hain, aur apni trades ko manually bhi control kar sakte hain.Copy trading mein ek aur bada advantage yeh hai ki isme traders ko apni trades ko achi tarah se manage karna nahi padta hai. Jab aap kisi dusre trader ko follow karte hain, toh wo trader apni trades ko khud manage karta hai, jisse aapko trading ke liye time nahi dena padta hai. Isse aap apne kaam, family aur personal life mein bhi engage reh sakte hain, aur apne trading ke saath-saath dusre kaam bhi kar sakte hain. Copy trading mein disadvantage yeh hai ki isme traders ko kisi bhi trader ki history, rankings, aur trading style par rely karna padta hai. Aapko apne criteria ko achi tarah se define karna hoga, taki aapko sahi trader ko choose karne mein help ho sakein. Copy trading mein traders ko kisi bhi trader ki performance par blind faith nahi karna chahiye, aur regular monitoring aur reviews ke through unki trades ko dekhna chahiye. Copy trading ka ek aur bada disadvantage yeh hai ki isme traders ko kisi bhi trader ki performance ko copy karte huye unke profits ke kuch hisse ko share karna padta hai. Yeh fees normally aapke profits ke percentage ke hisab se decide ki jati hai, aur alag-alag social trading platforms mein alag-alag fees hoti hain. Traders ko apni fees ke baare mein achi tarah se jaankari honi chahiye, aur unhe fees ki taraf se apni trading decisions ko bhi consider karna chahiye. Copy trading mein traders ko kisi bhi trader ki performance aur history ko carefully analyze karna chahiye, aur apni trades ko manually bhi manage karna chahiye. Isse unhe apni trading performance ko improve karne ke liye acchi knowledge aur skills develop hote hain. Copy trading mein traders ko apni trading strategy, risk management techniques aur trading goals ko achi tarah se define karna chahiye. Isse wo apni trades ko achi tarah se manage kar sakte hain, aur apne profits ko maximize karne ke liye sahi tarike se trades ko execute kar sakte hain. Copy trading mein traders ko apni trades ko regularly monitor karna chahiye, aur apni trades ke saath-saath dusre traders ki trades ko bhi monitor karna chahiye. Isse unhe pata chalta hai ki wo sahi direction mein ja rahe hain, aur unhe apni trades ko adjust karne ki flexibility milti hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#3 Collapse

Assalamu Alaikum Dosto!

Copy Trade

Forex trading aik asaan kam nahi hai, jiss mein har koi kamyab ho sake, yahan par emotions, aur dosre jaise awamel asar andaz hone ki waja se ziada tar traders (khas kar new traders) kamyab nahi ho pate hen. Forex copy trading ek tez aur aasan tareeqa hai trading shuru karne ka. Yeh ek aisi soch hai jisme tajurba kaar investors ke trades ko replicate kiya jata hai aur munafa ya nuksan dono share kiye jate hain. Yeh kehna ghalat hoga ke copy trading 100% kamiyabi ki guarantee deti hai. Magar yeh shayad ek behtareen aur mehfooz tareeqa hai naye logon ke liye market ko samajhne ka aur behtareen traders se real-time me seekhne ka.

Copy trade technique ek naye aur dilchasp inqilab ke taur par samne aayi. Ab naye log bina kisi investing background ya learning curve ke Forex trading aur doosri financial markets me shamil ho sakte hain. Yeh un logon ke liye ek best solution hai jo behtareen Forex experts ko real-time me dekhna aur unse seekhna chahte hain, saath hi unki kamiyabi ka hissa banna chahte hain.

Proven Copy Trading Strategies Istemaal Karne ke 4 Aham Wajuhat

Yeh tareeqa bohat si zabardast faiday deta hai jinka hum zikar karenge. Iske ilawa, yeh bohat flexible bhi hai. Yeh sirf Forex copy trading tak mehdood nahi balki doosri markets jese ke crypto, indices, commodities, aur zyada trading instruments ko bhi shaamil karta hai.

Ahem faiday yeh hain:- Minimum Learning Curve

Agar koi kahe ke “trading bohat aasan hai”, toh kabhi na maanein. Yeh bohat mushkil process hai jise samajhne ke liye financial markets ka gehra ilm zaroori hai. Magar copy trading ke zariye aap tajurba kaar investors ke trades replicate kar sakte hain bina kisi mushkil training ke. Aap sirf ek acha copy trading platform select karein aur behtareen traders ke sath apni journey shuru karein. - Time-Saving Approach

Agar aap full-time trader nahi banna chahte toh copy trading ek acha option hai. Professionals har din ghanton market ko study karte hain taake behtareen trade opportunities dhoond sakein. Agar aap ke paas itna waqt nahi hai, toh ya toh trading start na karein ya phir copy trading ka sahara lein. - Portfolio Diversification

Portfolio ko diversified rakhna bohat zaroori hai taake aap apni investment ko nuksan se mehfooz rakh sakein. Agar aap sirf ek asset ko baar baar trade karein, toh risk bohat zyada hota hai. Magar jab aap multiple signal providers ko follow karte hain, toh aap apni strategy diversify karte hain jo ke better hai. - Stable Passive Income

Yeh tareeqa ek mukammal passive income ka source ban chuka hai. Pehle yeh sirf trading signals provide karne ka tareeqa tha, magar ab yeh ek full-fledged automated system hai jo ke aap ke liye passive income generate kar sakti hai bina kisi manual configuration ke.

Copy Trading Ke Risks Jo K Maloom Hone Chahiye

Agar koi puche ke copy trading risky hai? Toh jawab hoga “haan”. Har trading strategy me risk hota hai chahe aap kitne bhi tajurba kaar hon. Market kisi bhi waqt unexpected tareeke se move kar sakti hai. Magar ek achi copy trading strategy bana kar aap zyadatar risks se bach sakte hain.

Kuch ahem steps jo aapko risk kam karne me madad dein ge:- Risk Score Ko Track Karein – Har signal provider ya Introducing Broker (IB) ke past results zaroor check karein taake behtareen aur kam-risk investor ko choose kiya ja sake.

- Copied Positions Ka Jaiza Lein – Jo positions aap copy kar chuke hain unhe review karein, chahe woh profitable hon ya loss-making. Isse aap real-time me seekh sakein ge.

- Portfolio Ko Diversify Rakhein – Jitna zyada diversified portfolio hoga, utna hi aapka risk kam hoga.

Behtareen Copy Trade Markets Ka Intikhab

New traders ke liye sabse pehle market ka intikhab karna zaroori hai. Har market ka apna ek tareeqa aur dynamics hote hain. Acchi baat yeh hai ke copy trading cross-market solution hai jisme aap multiple assets me invest kar sakte hain. Forex, stocks, indices, commodities – aap apni trading style aur preference ke mutabiq chun sakte hain.

Forex copy trading sabse aasaan aur tez tareeqa lagta hai. InstaForex market kaafi volatile hai, jo ke aapko chhoti time-frame me bade trades lene ka mauqa deti hai. Aap InstaForex aur stock trading ka muqabla kar ke yeh faisla kar sakte hain ke aapke liye kaunsa better hai.

Forex Copy Trading shuru karne ke chand faiday:- Global currency market ka size $5 trillion se zyada hai.

- Equity market se 27 times bara hai.

- 80% se zyada transactions major currency pairs (EUR/USD, GBP/USD, etc.) me hoti hain.

Forex Copy Trading Ke Faiday Aur Risks

Market choose karne ke baad agla qadam yeh dekhna hai ke copy trading ke faiday aur risks kya hain. 100% success guarantee nahi hai, lekin experienced traders ke trades copy karne se aapka nuksan hone ka chance kam hota hai. Aap ek behtareen signal provider choose karke apni investment secure rakh sakte hain.

Agar aap samajhdari se copy trading karenge, toh yeh aap ke liye ek profitable aur long-term trading strategy sabit ho sakti hai.

Copy Trading Ke Advantages

Toh, copy trading ke ahem faiday yeh hain:- Mukhtalif Specialists Ka Intikhab

Yeh sirf behtareen stats wale trader ko chun’ne ki baat nahi. Aapko ek aise signal provider ka intekhab karna chahiye jo aapki trading strategy aur approach se milta julta ho. Yaqeen karlein ke jo specialist aap chunte hain, woh market ko aapki tarah dekhta ho aur uska trading style aapke liye munasib ho. Aap dono mil kar Forex market ke utar chadhav ka samna karein ge, jo ek acchi strategy ka hissa hai. - Accessibility

Forex market me enter hone ka is se asaan tareeqa koi aur nahi ho sakta. Sab se ahem baat yeh hai ke yeh investment solution bilkul free hai. Aapko sirf ek account banana hai aur ek investor select karna hai jise aap mimic kar sakein. Copy investors bhi wahi wagering requirements follow karte hain jo doosre traders ke liye hoti hain. Koi special fee ya extra charges nahi lagte. - Behtar Trading Knowledge

Copy trading ke zariye aapko real-market conditions me seekhne ka moka milta hai. Aap apne mentor ko dekh sakte hain, unke kaam ko samajh sakte hain, apni forex strategy ko adjust kar sakte hain aur agar zaroorat ho toh apna trading style bhi badal sakte hain. - Portfolio Diversification

Ek well-diversified portfolio aapki risk-management strategy ka ahem hissa hai. Yeh aapko is baat se mehfooz rakhta hai ke aap apna sara capital ek hi jagah kho dein. Diversification ka maksad yeh hai ke aap apne risk ko mukhtalif markets aur assets me distribute karein. Jaise pehle bhi kaha gaya, ek copy trading platform cross-market solution hai jo aapko mukhtalif trading instruments ka intekhab karne ka moka deta hai.

Iske ilawa, aapke paas bohat zyada free time bhi bachega. Naye traders ko ab time-consuming learning curve follow karne ki zaroorat nahi. Agar aap trading ke doran seekhna nahi chahte, toh aapke IBs aapke liye pura process handle kar lenge, jis se aap apni daily routine par tawajjo de sakte hain.

Copy Trading Ke Risks

Sabse bara risk yeh hai ke aap ek financial implication ka hissa ban rahe hain. Har naye trader is stress ko bardasht nahi kar sakta. Apni fitrat me, FX market ek risky sector hai aur koi bhi aapko success ki guarantee nahi de sakta.

Doosre risks yeh hain:- Investment Risks

Market risks ko mad e nazar rakhna bohat zaroori hai. Chahe aapke paas ek tajurba kaar investor ka support ho, tab bhi aapka capital risk par hota hai. Isliye, aapko emotional taur par har nuksan bardasht karne ke liye tayar rehna chahiye. Golden rule follow karein: kabhi bhi utna invest na karein jitna aap kho nahi sakte. - Traders Ke Natayij

Kabhi kabhi IBs apni trading history ko behtar dikha kar dikhate hain jo asal me waqai itni acchi nahi hoti. Is wajah se ek acha expert choose karna mushkil ho sakta hai. Aapko ek trusted aur reliable platform ka intekhab karna chahiye jo real-time traders ke stats aur leaderboards dikhaye. - Execution-Related Risks

Illiquidity bhi ek bara risk hai. Yeh zaroor dekhein ke jab aap kisi current position se exit karna chahein toh aapko koi masla na ho. Iske ilawa, traders ke potential returns ke sath jude huye costs ka bhi dhyan rakhein. Spreads ko check karein jo ke officially published returns me shaamil hote hain.

Copy Trading Software Ka Intikhab

Zyada tar brokers copy trading ke liye teen tareeqe ke software provide karte hain. Ye software ya toh manual hote hain, semi-automated hote hain, ya phir fully automated hote hain.

MTrading ek ultimate copy trading solution provide karta hai jo fully automated system ko manual forex strategies ke sath configure karne ki sahulat deta hai. Yeh platform MT4 ke sath fully compatible hai. Investors isse Windows, Mac, aur mobile devices par use kar sakte hain taake wo apne copy masters ko har jagah follow kar sakein.

Ab dekhein ke har software kis tarah kaam karta hai:- Manual Software

Yeh ek normal trading ki tarah kaam karta hai. Aap khud decide karte hain ke kisi IB ka trade follow karna hai ya nahi. Investors khud yeh faisla karte hain ke kisi underlying trade ko copy karna hai ya skip karna hai. - Semi-Automated Software

Isme aapko trade execute hone se pehle copy master ke sabhi positions ko dekhne aur samajhne ka moka milta hai. Aapko apni strategy change karne ka ya market me enter hone se pehle decision lene ka pura time milta hai. - Automated Software

Yeh un logon ke liye behtareen hai jo khud trading process me shamil nahi hona chahte. Aapko sirf ek account banana hai, ek copy master ka intekhab karna hai, aur phir system aapke liye sab kuch khud karega.

Agar aap trading knowledge ko improve karna chahte hain, toh manual approach behtar hai. Magar agar aap ke paas waqt nahi hai ya aap trading me dilchaspi nahi rakhte, toh automated platform ka use karein.

Jo bhi aap chunein, InstaForex Trading ek aisa solution provide karta hai jo har trader ki zaroorat ke mutabiq kaam karta hai. - Minimum Learning Curve

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#4 Collapse

Copy Trading in Forex Aasan Tareeqa Munafa Kamane Ka

Forex trading duniya ka sab se bara financial market hai, jahan har roz trillion dollars ka lena-dena hota hai. Lekin naye traders ke liye forex market samajhna aur profitable trading karna mushkil ho sakta hai. Isi wajah se copy trading ek behtareen option hai, jahan aap bina khud trading seekhe bhi expert traders ke trades copy karke munafa kama sakte hain.

Copy Trading Kya Hai?

Copy trading ek aisi technique hai jisme aap kisi professional trader ke trades ko automatically apne account me copy karte hain. Jab woh trader koi buy ya sell order lagata hai, toh wahi trade aapke account me bhi execute ho jata hai. Yeh system khas tor par un logon ke liye faidemand hai jo forex trading seekhne ya full-time karne ka waqt nahi rakhte.

Copy Trading Kaise Kaam Karti Hai?

1. Ek Reliable Broker Choose Karein – Pehle aapko ek trusted forex broker ke sath account banana hoga jo copy trading ki facility deta ho.

2. Best Trader Select Karein – Broker ki platform pe aapko kai professional traders milenge. Aap inke past performance, risk level aur profit percentage ko check karke apne liye best trader select kar sakte hain.

3. Investment Set Karein – Aap decide karte hain ke aap kitni investment karna chahte hain aur kis trader ko follow karna chahte hain.

4. Automatic Trading Start Ho Jati Hai

Jab bhi aapka selected trader koi naya trade open karega, wohi trade aapke account me bhi lag jayega.

Copy Trading Ke Faiday

Asaan aur Beginner Friendly Forex trading seekhne ki zaroorat nahi, sirf expert ko follow karein.

Time-Saving Aapko market analyze karne ya charts dekhne ki zaroorat nahi hoti.

Diversification Aap ek se zyada traders follow karke apna risk manage kar sakte hain.

Nuksan Aur Risk

100% guarantee nahi hoti ke har trade profit dega.

Agar aap inexperienced trader ko follow karenge toh nuksan ho sakta hai.

High leverage use karna risky ho sakta hai.

Final Thoughts

Agar aap forex trading me naye hain aur professional traders ki skills ka faida uthana chahte hain, toh copy trading ek behtareen option hai. Magar hamesha achi research karein, risk management ka khayal rakhein aur sirf utna invest karein jitna loss hone ki surat me afford kar sakein.

Agar aap ne abhi tak copy trading try nahi ki, toh abhi ek achay broker ka account bana kar apni forex journey start karein!

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 09:37 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим