What is stock options?

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Aslam u alaikum dear What is stock options Definition Stock option ( jisay aykoyti option bhi kaha jata hai ), aik sarmaya car ko mutafiqa qeemat aur tareekh par stock kharidne ya baichnay ka haq deta hai, lekin is ki zimma daari nahi. ikhtiyarat ki do kasmain hain : pots, jo ke aik shart hai ke stock giray ga, ya cal, jo aik shart hai ke stock barhay ga. chunkay is ke paas stock ke hasas ( ya stock index ) is ke bunyadi asasay ke tor par hain, stock ke ikhtiyarat aykoyti ki aik shakal hain aur usay aykoyti aapshnz kaha ja sakta hai. aymplayi stak aapshnz ( esos ) aik qisam ka aykoyti muawza hai jo companiyon ki taraf se kuch mulazmeen ya aygziktoz ko diya jata hai jo muaser tareeqay se cal aapshnz ke barabar hota hai. yeh market mein tijarat karne walay stock par darj aykoyti aapshnz se mukhtalif hain, kyunkay woh kisi khaas coopration tak mehdood hain jo inhen –apne mulazmeen ko jari karti hai . Understanding of stock option Is liye, agar xyz stock $ 100 par trade kar raha hai, to $ 120 ki hartaal ki cal mashq karne ke liye faida mand ho jaye gi ( yani, strike price par shiyrz mein tabdeel ) sirf is soorat mein jab market ki qeemat $ 120 se barh jaye. ya, agar hasas $ 80 se neechay ajayeen to $ 80 ki hartaal ka poat faida mand hoga. is waqt, dono aapshnz ko un di money ( itm ) kaha jaye ga, yani un ki kuch androoni qeemat hai ( yani strike price aur market price ke darmiyan farq ). basorat deegar, aapshnz out of di money ( otm ) hain, aur kharji qader par mushtamil hain ( jisay waqt ki qader bhi kaha jata hai ). otm ke ikhtiyarat ki ab bhi qader hai kyunkay bunyadi asasa option ke khatam honay par ya is se pehlay raqam mein muntaqil honay ka kuch imkaan rakhta hai. yeh imkaan option ki qeemat mein zahir hota hai. aykoyti ke ikhtiyarat aik aykoyti security se akhaz kiye gaye hain. sarmaya car aur tajir stock ko khareeday ya mukhtasir kiye baghair stock mein lambi ya mukhtasir position lainay ke liye aykoyti ke ikhtiyarat istemaal kar saktay hain. yeh faida mand hai kyunkay ikhtiyarat ke sath position lainay se sarmaya car / tajir ziyada faida uthata hai jis mein sarmaya ki zaroorat hoti hai jo margin par isi terhan ki lambi ya mukhtasir position se bohat kam hoti hai. lehaza, sarmaya car aur tajir, bunyadi stock mein qeemat ki tehreek se ziyada munafe haasil kar satke hain Expiration date ikhtiyarat ke muahiday sirf aik makhsoos muddat ke liye hotay hain. usay meyaad khatam honay ki tareekh kaha jata hai. taweel meyaad khatam honay ki tarikhon ke sath darj kardah ikhtiyarat mein ziyada waqt ki qeemat hogi kyun ke bunyadi stock ke ghoomnay ke liye itna hi ziyada waqt hota hai jis mein option un di money ban'nay ka ziyada imkaan hota hai. option ki meyaad khatam honay ki tareekhen aik muqarara schedule ke mutabiq set ki jati hain ( jisay option cycle kaha jata hai ) aur aam tor par rozana ya hafta waar meyaad khatam honay se le kar mahana aur aik saal ya is se ziyada tak hoti hai. hartaal ki qeemat hartaal ki qeemat is baat ka taayun karti hai ke aaya option ka istemaal kya jana chahiye. yeh woh qeemat hai jis ki aik tajir tawaqqa karta hai ke stock ki meyaad khatam honay ki tareekh se oopar ya neechay rahay gi. misaal ke tor par, agar koi tajir shart laga raha hai ke mustaqbil mein international business machine coopration ( ibm ) barhay ga, to woh aik makhsoos mahinay aur aik khaas strike qeemat ke liye cal khareed satke hain. misaal ke tor par, aik tajir shart laga raha hai ke January ke wast tak ibm ka stock $ 150 se oopar jaye ga. is ke baad woh January $ 150 ki cal khareed satke hain . -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

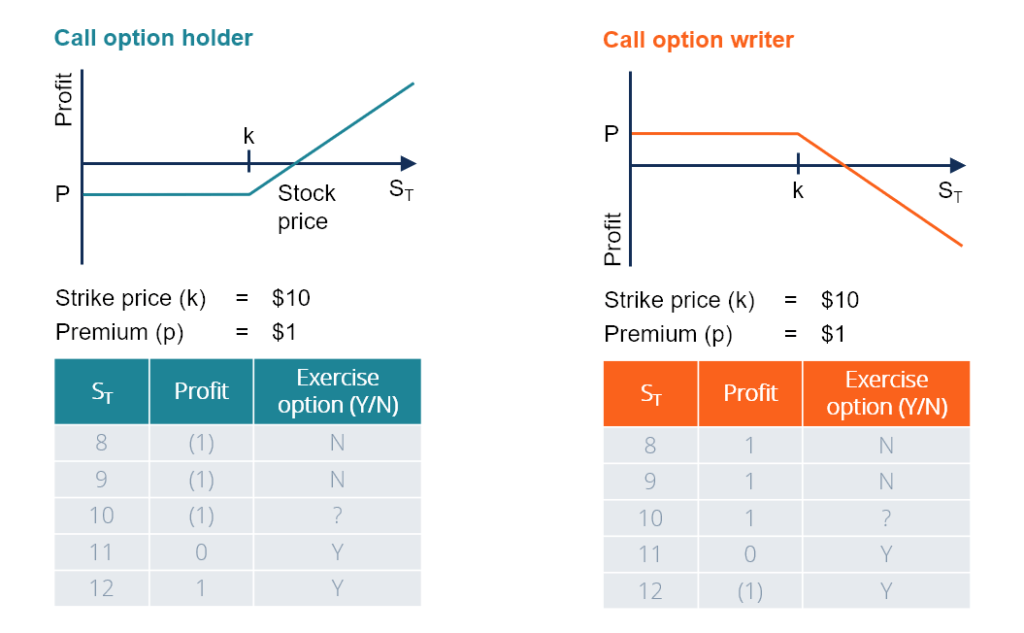

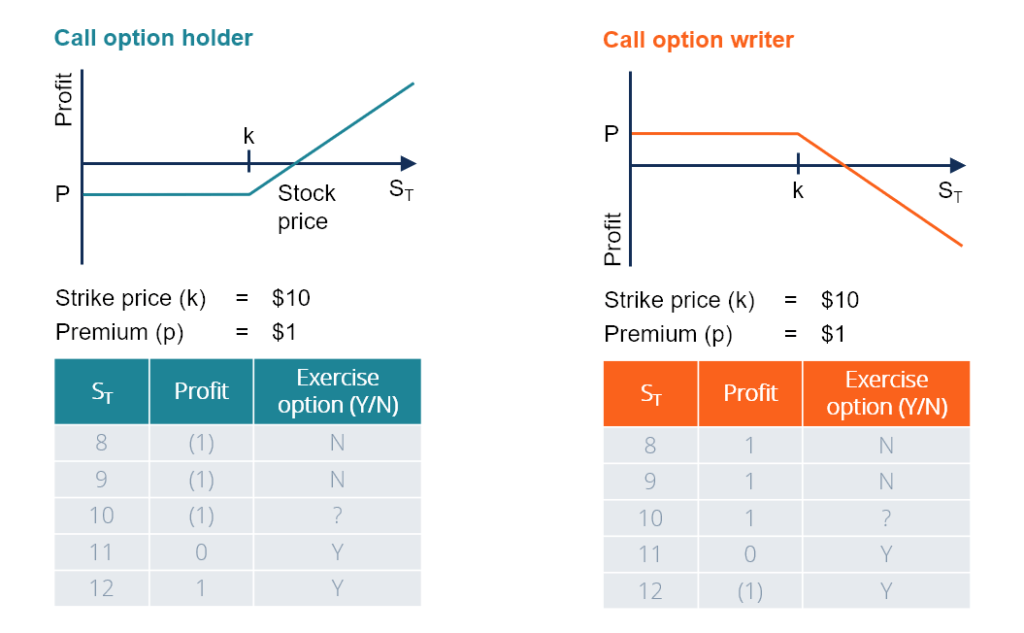

Stock options are contracts that give the holder the right, but not the obligation, to buy or sell a specific stock at a predetermined price, known asthe strike price, within a set time period. These contracts represent the right to purchase or sell shares of stock at a later date, at a predetermined price. Here are some images that can help explain the concept of stock options: 1. Stock Optionthe strike price, within a certain time frame. Here are some visual examples: 1. Call options: Call options give the holder the right to buy a stock at the strike price. If the stock price goes up, the holder can profit by exercising the option and buying the stock at a lower price. 2. Put options: Put options give the holder the right to sell a stock at the strike price. If the stock price goes down, the holder can profit by exercising the option and selling the stock at a higher price. 3. Expiration date: All stock options have an expiration date, after which they become worthless. The expiration date is a crucial factor in determining the value of an option. 4. Strike price: The strike price is the price at which the stock can be bought or sold. It is predetermined at the time the option is purchased. Overall, stock options can be a useful tool for investors and traders to hedge against risk and potentially profit from market movements.If you work hard no body can stop you from success -

#4 Collapse

Walaikum assalam dear brother aapane Ek Achcha topic liya Jis per acche se baith kar baat ho sakti hai agar is topic per Ham Baat Karen To Kuchh Baat Is Tarah Se banti hai ki Staak opsan aik tarah ka jazeera hai jisay bazaar mein istemaal kiya jata hai aur yeh ek qeemat ke ehtamaam ke liye tijarat ke kisi amal ko izhaar karta hai. Yeh aam taur par aik share ke istikrar ko nihayat hi ziadah banata hai aur is ke zariye tijarat ko mazeed taraqqi mil sakti hai. Yeh aik aisa qarz hai jo aam taur par kisi tijarat mein istemaal kiya jata hai aur is ke zariye kisi share ya jazeera ki qeemat mein izafa kiya jata hai. Staak opsan ko do tarah ke tajarbe se istemaal kiya jata hai. Pehle tajurba ka naam "call option" hai jis mein aik shakhs ko jazeera khareedne ya bechne ke liye haq milta hai. Yeh aik aisa tajarba hai jis mein jazeera ki qeemat badhne ke baad aik shakhs ko jazeera khareedne ke liye haq milta hai. Is tarah ki tajarbe mein agar jazeera ki qeemat badhti hai to opsan ka keemat bhi badhta hai aur shakhs ko jazeera khareedne ka haq milta hai. Lekin agar jazeera ki qeemat kam ho jaye to opsan ka keemat bhi kam ho jata hai aur shakhs ko koi haq nahi milta. Dusra tajurba "put option" ke naam se jana jata hai aur is mein aik shakhs ko jazeera bechne ka haq milta hai. Is tarah ki tajarbe mein agar jazeera ki qeemat kam ho jaye to opsan ka keemat bhi ziadah ho jata hai aur shakhs ko jazeera bechne ka haq milta hai. Lekin agar jazeera ki qeemat ziadah ho jaye to opsan ka keemat bhi kam ho jata hai aur shakhs ko koi haq nahi milta. Staak opsan ki tijarat mein kuch khataray bhi hotay hain. Yeh aik risky tijarat hai aur is mein paisa khone ka khatra bhi hota hai. Agar koi shakhs staak opsan tijarat mein paisa lagata hai aur jazeera ki qeemat kam ho jaye to us ka paisa bhi khona ho sakta hai. Is liye is tijarat ko karnay se pehle achi tarah se sochna chahiye aur jazeera ki qeemat aur bazaar ki halat ka bhi khayal rakhna chahiye. Is ke elawa, staak opsan ki tijarat mein maal ke taraqqi ke liye ziadah tar logon ko tajurba chahiye hota hai. Agar koi shakhs is tijarat mein naya hai to woh khud ko ziadah khatray mein daal sakta hai. Is liye is tijarat mein paisa lagane se pehle tajarbe walay shakhs se mashwara karna chahiye. Akhir mein, stock option ki tijarat aik a -

#5 Collapse

What are Stock Option? aik sarmaya car ko aik makhsoos qeemat aur tareekh par stock kharidne ya baichnay ka haq diya jata hai, lekin zimma daari nahi, jab woh stock option ( jisay aykoyti option bhi kaha jata hai ) istemaal karte hain. ikhtiyarat do zaiqoon mein atay hain : pots, jo stock girnay par juaa khailtay hain, aur calls, jo stock bherne par shart lagatay hain . stock ke ikhtiyarat aykoyti ki aik qisam hain aur usay aykoyti aapshnz bhi kaha ja sakta hai kyunkay stock ke hasas ( ya stock index ) un ka bunyadi asasa banatay hain . aymplayi stak aapshnz ( esos ), jo amli tor par cal aapshnz ke masawi hain, aik qisam ka aykoyti muawza hai jo coopration kuch mulazmeen ya aygziktoz ko faraham karta hai. yeh market mein tijarat karne walay stock par darj aykoyti aapshnz se allag hain kyunkay woh mehdood hain . Understading Stock Option mushtaq maliyati alaat ki aik class hai jis mein ikhtiyarat shaamil hain. is ka matlab yeh hai ke bunyadi security ya asasa ki qader un ki qader ki bunyaad ya zareya ke tor par kaam karti hai. kisi company ke stock ke hasas woh hain jo stock ke ikhtiyarat ke muamlay mein woh asasa hai. option aik moahida hai jo do fareeqon ke darmiyan mustaqbil mein pehlay se tay shuda qeemat par stock kharidne ya baichnay ka haq rakhnay ka ehad qaim karta hai. laagat ko aksar werzish ki qeemat ya strike price kaha jata hai. aykoyti ke ikhtiyarat aik aykoyti security se akhaz kiye jatay hain. sarmaya car aur tajir stock ko khareeday ya mukhtasir kiye baghair stock mein lambi ya mukhtasir position lainay ke liye aykoyti ke ikhtiyarat istemaal kar saktay hain. yeh faida mand hai kyunkay ikhtiyarat ke sath position lainay se sarmaya car / tajir ziyada faida uthata hai jis mein sarmaya ki zaroorat hoti hai jo margin par isi terhan ki lambi ya mukhtasir position se bohat kam hoti hai. lehaza, sarmaya car aur tajir, bunyadi stock mein qeemat ki tehreek se ziyada munafe haasil kar satke hain . Trading Stock Option chicago board option exchange ( cboe ), fladilfya stock exchange ( phlx ), aur international sikyortiz exchange ( ise ), deegar aykschinjz ke darmiyan, tijarat ke liye stock ke ikhtiyarat ki fehrist banata hai. istemaal kardah tijarti taknik par munhasir hai, ikhtiyarat khareeday ya farokht kiye jasaktay hain. pichli misaal ko mad e nazar rakhtay hue, aik tajir cal kharidne ya farokht karne ya pitt likhnay ka faisla kar sakta hai agar inhen yaqeen hai ke ibm ke hasas bherne walay hain. is manzar naame mein, premium poat seller ke zariye ada karne ke bajaye wusool kya jaye ga. paanch ibm January ke pots baichnay walay ke liye le kar ayen ge . agar se oopar barhta hai to option ki meyaad khatam ho jaye gi, jo ke farokht kanandah ko poora premium rakhnay ki ijazat deta hai. baichnay walay ko, taham, agar stock strike price se neechay band ho jata hai to usay strike price par bunyadi hasas khareedna hon ge . Example of Stock Option zail ki misaal mein, aik tajir ne paish goi ki hai ke mustaqbil qareeb mein nvidia corp. ( nvda ) ke hasas ki qeemat $ 170 se ziyada ho jaye gi. woh 10 January $ 170 calls kharidne ke liye fi moahida $ 16. 10 kharch karne ka intikhab karte hain, jo fi al haal trading kar rahay hain. is ke nateejay mein tajir kalon ko kharidne ke liye $ 16, 100 kharch kere ga. tajir ko munafe kamanay ke liye stock ko strike price ke ilawa cal premium, ya $ 186. 10 se bherne ki zaroorat hogi. ikhtiyarat ki meyaad khatam ho jaye gi aur agar stock ki qeemat $ 170 se ziyada nah barhay to tajir poora premium zabt kar le ga . How To Calculate the Value of StockOption? aap ke stock aapshnz ki qeemat mojooda stock ki qeemat par mabni hai agar woh firm jis ke liye aap ke paas aapshnz hain awaami tor par darj hai. hasas ki tadaad ki qeemat ka taayun karen jo aap ke paas market ki qeemat par kharidne ya farokht karne ka intikhab hai. agla, –apne ikhtiyar ki qeemat ke liye itnay hi hasas ki khareed o farokht ki qeemat ka taayun karen. aap ke stock option ki qader wohi hai jo inhen allag karti hai . -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What are Stock Option? aik sarmaya car ko aik makhsoos qeemat aur tareekh par stock kharidne ya baichnay ka haq diya jata hai, lekin zimma daari nahi, jab woh stock option ( jisay aykoyti option bhi kaha jata hai ) istemaal karte hain. ikhtiyarat do zaiqoon mein atay hain : pots, jo stock girnay par juaa khailtay hain, aur calls, jo stock bherne par shart lagatay hain . stock ke ikhtiyarat aykoyti ki aik qisam hain aur usay aykoyti aapshnz bhi kaha ja sakta hai kyunkay stock ke hasas ( ya stock index ) un ka bunyadi asasa banatay hain . aymplayi stak aapshnz ( esos ), jo amli tor par cal aapshnz ke masawi hain, aik qisam ka aykoyti muawza hai jo coopration kuch mulazmeen ya aygziktoz ko faraham karta hai. yeh market mein tijarat karne walay stock par darj aykoyti aapshnz se allag hain kyunkay woh mehdood hain . Understading Stock Option mushtaq maliyati alaat ki aik class hai jis mein ikhtiyarat shaamil hain. is ka matlab yeh hai ke bunyadi security ya asasa ki qader un ki qader ki bunyaad ya zareya ke tor par kaam karti hai. kisi company ke stock ke hasas woh hain jo stock ke ikhtiyarat ke muamlay mein woh asasa hai. option aik moahida hai jo do fareeqon ke darmiyan mustaqbil mein pehlay se tay shuda qeemat par stock kharidne ya baichnay ka haq rakhnay ka ehad qaim karta hai. laagat ko aksar werzish ki qeemat ya strike price kaha jata hai. aykoyti ke ikhtiyarat aik aykoyti security se akhaz kiye jatay hain. sarmaya car aur tajir stock ko khareeday ya mukhtasir kiye baghair stock mein lambi ya mukhtasir position lainay ke liye aykoyti ke ikhtiyarat istemaal kar saktay hain. yeh faida mand hai kyunkay ikhtiyarat ke sath position lainay se sarmaya car / tajir ziyada faida uthata hai jis mein sarmaya ki zaroorat hoti hai jo margin par isi terhan ki lambi ya mukhtasir position se bohat kam hoti hai. lehaza, sarmaya car aur tajir, bunyadi stock mein qeemat ki tehreek se ziyada munafe haasil kar satke hain . Trading Stock Option chicago board option exchange ( cboe ), fladilfya stock exchange ( phlx ), aur international sikyortiz exchange ( ise ), deegar aykschinjz ke darmiyan, tijarat ke liye stock ke ikhtiyarat ki fehrist banata hai. istemaal kardah tijarti taknik par munhasir hai, ikhtiyarat khareeday ya farokht kiye jasaktay hain. pichli misaal ko mad e nazar rakhtay hue, aik tajir cal kharidne ya farokht karne ya pitt likhnay ka faisla kar sakta hai agar inhen yaqeen hai ke ibm ke hasas bherne walay hain. is manzar naame mein, premium poat seller ke zariye ada karne ke bajaye wusool kya jaye ga. paanch ibm January ke pots baichnay walay ke liye le kar ayen ge . agar se oopar barhta hai to option ki meyaad khatam ho jaye gi, jo ke farokht kanandah ko poora premium rakhnay ki ijazat deta hai. baichnay walay ko, taham, agar stock strike price se neechay band ho jata hai to usay strike price par bunyadi hasas khareedna hon ge . Example of Stock Option zail ki misaal mein, aik tajir ne paish goi ki hai ke mustaqbil qareeb mein nvidia corp. ( nvda ) ke hasas ki qeemat $ 170 se ziyada ho jaye gi. woh 10 January $ 170 calls kharidne ke liye fi moahida $ 16. 10 kharch karne ka intikhab karte hain, jo fi al haal trading kar rahay hain. is ke nateejay mein tajir kalon ko kharidne ke liye $ 16, 100 kharch kere ga. tajir ko munafe kamanay ke liye stock ko strike price ke ilawa cal premium, ya $ 186. 10 se bherne ki zaroorat hogi. ikhtiyarat ki meyaad khatam ho jaye gi aur agar stock ki qeemat $ 170 se ziyada nah barhay to tajir poora premium zabt kar le ga . How To Calculate the Value of StockOption? aap ke stock aapshnz ki qeemat mojooda stock ki qeemat par mabni hai agar woh firm jis ke liye aap ke paas aapshnz hain awaami tor par darj hai. hasas ki tadaad ki qeemat ka taayun karen jo aap ke paas market ki qeemat par kharidne ya farokht karne ka intikhab hai. agla, –apne ikhtiyar ki qeemat ke liye itnay hi hasas ki khareed o farokht ki qeemat ka taayun karen. aap ke stock option ki qader wohi hai jo inhen allag karti hai . What are Stock Option? aik sarmaya car ko aik makhsoos qeemat aur tareekh par stock kharidne ya baichnay ka haq diya jata hai, lekin zimma daari nahi, jab woh stock option ( jisay aykoyti option bhi kaha jata hai ) istemaal karte hain. ikhtiyarat do zaiqoon mein atay hain : pots, jo stock girnay par juaa khailtay hain, aur calls, jo stock bherne par shart lagatay hain . stock ke ikhtiyarat aykoyti ki aik qisam hain aur usay aykoyti aapshnz bhi kaha ja sakta hai kyunkay stock ke hasas ( ya stock index ) un ka bunyadi asasa banatay hain . aymplayi stak aapshnz ( esos ), jo amli tor par cal aapshnz ke masawi hain, aik qisam ka aykoyti muawza hai jo coopration kuch mulazmeen ya aygziktoz ko faraham karta hai. yeh market mein tijarat karne walay stock par darj aykoyti aapshnz se allag hain kyunkay woh mehdood hain . Understading Stock Option mushtaq maliyati alaat ki aik class hai jis mein ikhtiyarat shaamil hain. is ka matlab yeh hai ke bunyadi security ya asasa ki qader un ki qader ki bunyaad ya zareya ke tor par kaam karti hai. kisi company ke stock ke hasas woh hain jo stock ke ikhtiyarat ke muamlay mein woh asasa hai. option aik moahida hai jo do fareeqon ke darmiyan mustaqbil mein pehlay se tay shuda qeemat par stock kharidne ya baichnay ka haq rakhnay ka ehad qaim karta hai. laagat ko aksar werzish ki qeemat ya strike price kaha jata hai. aykoyti ke ikhtiyarat aik aykoyti security se akhaz kiye jatay hain. sarmaya car aur tajir stock ko khareeday ya mukhtasir kiye baghair stock mein lambi ya mukhtasir position lainay ke liye aykoyti ke ikhtiyarat istemaal kar saktay hain. yeh faida mand hai kyunkay ikhtiyarat ke sath position lainay se sarmaya car / tajir ziyada faida uthata hai jis mein sarmaya ki zaroorat hoti hai jo margin par isi terhan ki lambi ya mukhtasir position se bohat kam hoti hai. lehaza, sarmaya car aur tajir, bunyadi stock mein qeemat ki tehreek se ziyada munafe haasil kar satke hain . Trading Stock Option chicago board option exchange ( cboe ), fladilfya stock exchange ( phlx ), aur international sikyortiz exchange ( ise ), deegar aykschinjz ke darmiyan, tijarat ke liye stock ke ikhtiyarat ki fehrist banata hai. istemaal kardah tijarti taknik par munhasir hai, ikhtiyarat khareeday ya farokht kiye jasaktay hain. pichli misaal ko mad e nazar rakhtay hue, aik tajir cal kharidne ya farokht karne ya pitt likhnay ka faisla kar sakta hai agar inhen yaqeen hai ke ibm ke hasas bherne walay hain. is manzar naame mein, premium poat seller ke zariye ada karne ke bajaye wusool kya jaye ga. paanch ibm January ke pots baichnay walay ke liye le kar ayen ge . agar se oopar barhta hai to option ki meyaad khatam ho jaye gi, jo ke farokht kanandah ko poora premium rakhnay ki ijazat deta hai. baichnay walay ko, taham, agar stock strike price se neechay band ho jata hai to usay strike price par bunyadi hasas khareedna hon ge . Example of Stock Option zail ki misaal mein, aik tajir ne paish goi ki hai ke mustaqbil qareeb mein nvidia corp. ( nvda ) ke hasas ki qeemat $ 170 se ziyada ho jaye gi. woh 10 January $ 170 calls kharidne ke liye fi moahida $ 16. 10 kharch karne ka intikhab karte hain, jo fi al haal trading kar rahay hain. is ke nateejay mein tajir kalon ko kharidne ke liye $ 16, 100 kharch kere ga. tajir ko munafe kamanay ke liye stock ko strike price ke ilawa cal premium, ya $ 186. 10 se bherne ki zaroorat hogi. ikhtiyarat ki meyaad khatam ho jaye gi aur agar stock ki qeemat $ 170 se ziyada nah barhay to tajir poora premium zabt kar le ga . How To Calculate the Value of StockOption? aap ke stock aapshnz ki qeemat mojooda stock ki qeemat par mabni hai agar woh firm jis ke liye aap ke paas aapshnz hain awaami tor par darj hai. hasas ki tadaad ki qeemat ka taayun karen jo aap ke paas market ki qeemat par kharidne ya farokht karne ka intikhab hai. agla, –apne ikhtiyar ki qeemat ke liye itnay hi hasas ki khareed o farokht ki qeemat ka taayun karen. aap ke stock option ki qader wohi hai jo inhen allag karti hai . -

#7 Collapse

Comprehension of investment opportunityIs liye, agar xyz stock $ 100 standard exchange kar raha hai, to $ 120 ki hartaal ki cal mashq karne ke liye faida mand ho jaye gi ( yani, strike cost standard shiyrz mein tabdeel ) sirf is soorat mein poke market ki qeemat $ 120 se barh jaye. ya, agar hasas $ 80 se neechay ajayeen to $ 80 ki hartaal ka poat faida mand hoga. is waqt, dono aapshnz ko un di cash ( itm ) kaha jaye ga, yani un ki kuch androoni qeemat hai ( yani strike cost aur market cost ke darmiyan farq ). basorat deegar, aapshnz out of di cash ( otm ) hain, aur kharji qader standard mushtamil hain ( jisay waqt ki qader bhi kaha jata hai ). otm ke ikhtiyarat ki stomach muscle bhi qader hai kyunkay bunyadi asasa choice ke khatam honay standard ya is se pehlay raqam mein muntaqil honay ka kuch imkaan rakhta hai. yeh imkaan choice ki qeemat mein zahir hota hai. aykoyti ke aik aykoyti security se akhaz kiye gaye hain. sarmaya vehicle aur tajir stock ko khareeday ya mukhtasir kiye baghair stock mein lambi ya mukhtasir position lainay ke liye aykoyti ke ikhtiyarat istemaal kar saktay hain. yeh faida mand hai kyunkay ikhtiyarat ke sath position lainay se sarmaya vehicle/tajir ziyada faida uthata hai jis mein sarmaya ki zaroorat hoti hai jo edge standard isi terhan ki lambi ya mukhtasir position se bohat kam hoti hai. lehaza, sarmaya vehicle aur tajir, bunyadi stock mein qeemat ki tehreek se ziyada munafe haasil kar satke haindate Lapse ikhtiyarat ke muahiday sirf aik makhsoos muddat ke liye hotay hain. usay meyaad khatam honay ki tareekh kaha jata hai. taweel meyaad khatam honay ki tarikhon ke sath darj kardah ikhtiyarat mein ziyada waqt ki qeemat hogi kyun ke bunyadi stock ke ghoomnay ke liye itna hey ziyada waqt hota hai jis mein choice un di cash ban'nay ka ziyada imkaan hota hai. choice ki meyaad khatam honay ki tareekhen aik muqarara plan ke mutabiq set ki jati hain ( jisay choice cycle kaha jata hai ) aur aam peak standard rozana ya hafta waar meyaad khatam honay se le kar mahana aur aik saal ya is se ziyada tak hoti hai. hartaal ki qeemat hartaal ki qeemat is baat ka taayun karti hai ke aaya choice ka istemaal kya jana chahiye. yeh woh qeemat hai jis ki aik tajir tawaqqa karta hai ke stock ki meyaad khatam honay ki tareekh se oopar ya neechay rahay gi. misaal ke pinnacle standard, agar koi tajir shart laga raha hai ke mustaqbil mein worldwide business machine coopration ( ibm ) barhay ga, to woh aik makhsoos mahinay aur aik khaas strike qeemat ke liye cal khareed satke hain. misaal ke pinnacle standard, aik tajir shart laga raha hai ke January ke wast tak ibm ka stock $ 150 se oopar jaye ga. is ke baad woh January $ 150 ki cal khareed satke hain .

Understading Investment opportunitymushtaq maliyati alaat ki aik class hai jis mein ikhtiyarat shaamil hain. is ka matlab yeh hai ke bunyadi security ya asasa ki qader un ki qader ki bunyaad ya zareya ke peak standard kaam karti hai. kisi organization ke stock ke hasas woh hain jo stock ke ikhtiyarat ke muamlay mein woh asasa hai. choice aik moahida hai jo do fareeqon ke darmiyan mustaqbil mein pehlay se tay shuda qeemat standard stock kharidne ya baichnay ka haq rakhnay ka ehad qaim karta hai. laagat ko aksar werzish ki qeemat ya strike cost kaha jata hai. aykoyti ke ikhtiyarat aik aykoyti security se akhaz kiye jatay hain. sarmaya vehicle aur tajir stock ko khareeday ya mukhtasir kiye baghair stock mein lambi ya mukhtasir position lainay ke liye aykoyti ke ikhtiyarat istemaal kar saktay hain. yeh faida mand hai kyunkay ikhtiyarat ke sath position lainay se sarmaya vehicle/tajir ziyada faida uthata hai jis mein sarmaya ki zaroorat hoti hai jo edge standard isi terhan ki lambi ya mukhtasir position se bohat kam hoti hai. lehaza, sarmaya vehicle aur tajir, bunyadi stock mein qeemat ki tehreek se ziyada munafe haasil kar satke hain .

Exchanging Investment opportunitychicago board choice trade ( cboe ), fladilfya stock trade ( phlx ), aur worldwide sikyortiz trade ( ise ), deegar aykschinjz ke darmiyan, tijarat ke liye stock ke ikhtiyarat ki fehrist banata hai. istemaal kardah tijarti taknik standard munhasir hai, ikhtiyarat khareeday ya farokht kiye jasaktay hain. pichli misaal ko frantic e nazar rakhtay tone, aik tajir cal kharidne ya farokht karne ya pitt likhnay ka faisla kar sakta hai agar inhen yaqeen hai ke ibm ke hasas bherne walay hain. is manzar naame mein, premium poat merchant ke zariye ada karne ke bajaye wusool kya jaye ga. paanch ibm January ke pots baichnay walay ke liye le kar ayen ge .agar se oopar barhta hai to choice ki meyaad khatam ho jaye gi, jo ke farokht kanandah ko poora premium rakhnay ki ijazat deta hai. baichnay walay ko, taham, agar stock strike cost se neechay band ho jata hai to usay strike cost standard bunyadi hasas khareedna hon ge .

-

#8 Collapse

stock ke ikhtiyarat maali derivatives hain jo holdar ko aik muqarara muddat ke andar pehlay se mutayyan qeemat par company ke stock ke makhsoos tadaad mein hasas kharidne ya farokht karne ka haq dete hain, lekin zimma daari nahi. yeh ikhtiyarat aam tor par mulazmeen ko un ke muawzay ke package ke hissay ke tor par diye jatay hain ya maali mandiyon mein infiradi sarmaya karon ke zariye khareeday aur farokht kiye ja satke hain . stock ke ikhtiyarat ke baray mein kuch ahem tafseelaat yeh hain : 1. stock ke ikhtiyarat ki aqsam : · cal ke ikhtiyarat : yeh aapshnz holdar ko yeh haq dete hain ke woh pehlay se tay shuda qeemat par, jisay strike price kaha jata hai, tareekh khatam honay se pehlay khareed sakta hai . · pitt aapshnz : yeh aapshnz holdar ko khatam honay ki tareekh se pehlay strike price par bunyadi stock farokht karne ka haq dete hain . 2. grant ki qeemat ( strike price ) : · strike price woh qeemat hai jis par option holdar zair-e nazar stock khareed ya farokht kar sakta hai. yeh pehlay se tay shuda hai aur is waqt muqarrar kya jata hai jab ikhtiyar diya jata hai . · cal ke ikhtiyarat ke liye, strike ki qeemat aam tor par stock ki mojooda market qeemat se ziyada muqarrar ki jati hai . · poat aapshnz ke liye, strike price aam tor par stock ki mojooda market price se kam rakhi jati hai . 3. meyaad khatam honay ki tareekh : · stak ke ikhtiyarat ki meyaad khatam honay ki tareekh hoti hai, jo aakhri tareekh hai jis par option istemaal kya ja sakta hai . · aam tor par, ikhtiyarat ki meyaad khatam honay walay mahinay ke teesray jummay ko khatam ho jati hai, halaank is mein mstsnyat hain. · agar meyaad khatam honay se pehlay kisi ikhtiyar ko istemaal nah kya jaye to woh bekar ho jata hai . 4. westing ka dorania : · mulazmeen ko diye gaye stock ke ikhtiyarat mein aksar westing ki muddat hoti hai, jo ke aik mulazim ke liye company ke liye kaam karne ke liye zaroori hai is se pehlay ke woh –apne ikhtiyarat istemaal kar sakay . · westing ki muddat waqt par mabni ho sakti hai ( misaal ke tor par, aik saal ki chattaan ke sath chaar saal ) ya karkardagi par mabni ( maslan, makhsoos ahdaaf ke husool par mabni ) . · aik baar ikhtiyarat haasil hojane ke baad, mulazim un ki meyaad khatam honay se pehlay kisi bhi waqt istemaal karsaktha hai . 5. androoni qader aur waqt ki qader : · kisi ikhtiyar ki androoni qeemat mojooda stock ki qeemat aur strike price ke darmiyan farq hai. agar option" paisay mein" hai to is ki androoni qader hoti hai . · option ki time value woh izafi qader hai jo option ke khatam honay se pehlay stock ki qeemat mein tabdeeli ke imkaan se mansoob hai. yeh mustaqbil mein munafe bakhash ban'nay ke ikhtiyar ke imkanaat ki numaindagi karta hai . 6. stock ke ikhtiyarat ke fawaid : · stock ke ikhtiyarat mulazmeen ko company ki kamyabi mein hissa lainay aur is ki mustaqbil ki taraqqi mein hissa lainay ka mauqa faraham karte hain . · sarmaya karon ke liye, ikhtiyarat un ki sarmaya kaari ke sarmaye se faida uthany ka aik tareeqa paish karte hain aur bunyadi stock ki malkiat ke baghair market ki naqal o harkat se mumkina tor par munafe haasil karte hain . yeh note karna zaroori hai ke trading stock aapshnz mein khatraat aur paichidgiyan shaamil hain. ikhtiyarat utaar charhao ka shikaar ho satke hain aur un ki qader awamil se mutasir hoti hai jaisay ke stock ki bunyadi qeemat, market ke halaat, meyaad khatam honay ka waqt, aur Muzmer utaar charhao. aapshnz trading mein shaamil honay se pehlay, yeh mahswara diya jata hai ke is mein shaamil micancs aur khatraat ko achi terhan samajh len ya maliyati musheer se rahnumai"Dream bigger. Do bigger"

(mahroosh) :1f607:

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Stock option kia hy ? aik sarmaya car ko mutafiqa qeemat aur tareekh par stock kharidne ya baichnay ka haq deta hai, lekin is ki zimma daari nahi. ikhtiyarat ki do kasmain hain : pots, jo ke aik shart hai ke stock giray ga, ya cal, jo aik shart hai ke stock barhay ga. chunkay is ke paas stock ke hasas ( ya stock index ) is ke bunyadi asasay ke tor par hain, stock ke ikhtiyarat aykoyti ki aik shakal hain aur usay aykoyti aapshnz kaha ja sakta hai. aymplayi stak aapshnz ( esos ) aik qisam ka aykoyti muawza hai jo companiyon ki taraf se kuch mulazmeen ya aygziktoz ko diya jata hai jo muaser tareeqay se cal aapshnz ke barabar hota hai.. Explanation With Example aik tajir ne paish goi ki hai ke mustaqbil qareeb mein nvidia corp. ( nvda ) ke hasas ki qeemat $ 170 se ziyada ho jaye gi. woh 10 January $ 170 calls kharidne ke liye fi moahida $ 16. 10 kharch karne ka intikhab karte hain, jo fi al haal trading kar rahay hain. is ke nateejay mein tajir kalon ko kharidne ke liye $ 16, 100 kharch kere ga. tajir ko munafe kamanay ke liye stock ko strike price ke ilawa cal premium, ya $ 186. 10 se bherne ki zaroorat hogi.sarmaya car aur tajir stock ko khareeday ya mukhtasir kiye baghair stock mein lambi ya mukhtasir position lainay ke liye aykoyti ke ikhtiyarat istemaal kar saktay hain. yeh faida mand hai kyunkay ikhtiyarat ke sath position lainay se sarmaya car / tajir ziyada faida uthata hai jis mein sarmaya ki zaroorat hoti hai jo margin par isi terhan ki lambi ya mukhtasir position se bohat kam hoti hai. lehaza, sarmaya car aur tajir,

Explanation With Example aik tajir ne paish goi ki hai ke mustaqbil qareeb mein nvidia corp. ( nvda ) ke hasas ki qeemat $ 170 se ziyada ho jaye gi. woh 10 January $ 170 calls kharidne ke liye fi moahida $ 16. 10 kharch karne ka intikhab karte hain, jo fi al haal trading kar rahay hain. is ke nateejay mein tajir kalon ko kharidne ke liye $ 16, 100 kharch kere ga. tajir ko munafe kamanay ke liye stock ko strike price ke ilawa cal premium, ya $ 186. 10 se bherne ki zaroorat hogi.sarmaya car aur tajir stock ko khareeday ya mukhtasir kiye baghair stock mein lambi ya mukhtasir position lainay ke liye aykoyti ke ikhtiyarat istemaal kar saktay hain. yeh faida mand hai kyunkay ikhtiyarat ke sath position lainay se sarmaya car / tajir ziyada faida uthata hai jis mein sarmaya ki zaroorat hoti hai jo margin par isi terhan ki lambi ya mukhtasir position se bohat kam hoti hai. lehaza, sarmaya car aur tajir,  Treading with Stock options tijarat ke liye stock ke ikhtiyarat ki fehrist banata hai. istemaal kardah tijarti taknik par munhasir hai, ikhtiyarat khareeday ya farokht kiye jasaktay hain. pichli misaal ko mad e nazar rakhtay hue, aik tajir cal kharidne ya farokht karne ya pitt likhnay ka faisla kar sakta hai agar inhen yaqeen hai ke ibm ke hasas bherne walay hain. is manzar naame mein, premium poat seller ke zariye ada karne ke bajaye wusool kya jaye ga. paanch ibm January ke pots baichnay walay ke liye le kar ayen ge .

Treading with Stock options tijarat ke liye stock ke ikhtiyarat ki fehrist banata hai. istemaal kardah tijarti taknik par munhasir hai, ikhtiyarat khareeday ya farokht kiye jasaktay hain. pichli misaal ko mad e nazar rakhtay hue, aik tajir cal kharidne ya farokht karne ya pitt likhnay ka faisla kar sakta hai agar inhen yaqeen hai ke ibm ke hasas bherne walay hain. is manzar naame mein, premium poat seller ke zariye ada karne ke bajaye wusool kya jaye ga. paanch ibm January ke pots baichnay walay ke liye le kar ayen ge . -

#10 Collapse

What is stock options Full details woh maliyati alaat hain jo maalik ko pehlay se mutayyan qeemat ( jisay Strike price kaha jata hai ) par pehlay se mutayyan muddat ke andar company ke stak ke pehlay se mutayyan tadaad mein hasas kharidne ya farokht karne ka haq dete hain, lekin farz nahi. aam tor par, stock ke ikhtiyarat mulazmeen ko un ke muawzay ke package hissay ke tor par diye jatay hain ya sarmaya karon ke zareya qiyaas aarai ke ozaar ke tor par istemaal kya jata hai . zail mein kuch ahem stock option ki tafseelaat hain : Types Of Stock Option : stock ke ikhtiyarat ki do bunyadi aqsam hain : cal aapshnz ke haamil ke paas strike price par bunyadi stock kharidne ka mauqa hai . bay ikhtiyarat dalain : un mein strike qeemat hoti hai aur holdar ko bunyadi stock farokht karne ki ijazat deta hai . Strike Price : pehlay se tay shuda qeemat jis par option holdar hasas khareed ya farokht kar sakta hai usay strike price kaha jata hai. werzish ki qeemat is ka dosra naam hai . Expiration Date : stock ke ikhtiyarat mein meyaad khatam honay ki aik muqarara tareekh hoti hai jo aakhri din ke tor par kaam karti hai jab woh istemaal kiye jasaktay hain. agar is tareekh tak istemaal nahi kya jata hai to option tamam qader kho deta hai . Vesting Period: Is se pehlay ke mulazmeen ke stock ke ikhtiyarat istemaal kiye ja saken, aksar auqaat vesting ka waqt hota hai. is ka matlab hai ke pehlay se mutayyan waqt ke baad, aam tor par kayi saloon ke baad, mulazim ikhtiyarat ke liye ahal ho jata hai . Exercise: option ki hesiyat is baat par munhasir hai ke option ki Strike price bunyadi stock ki mojooda qeemat se kaisay mawazna karti hai : 1- In-the-Money : agar stock ki mojooda qeemat strike price se ziyada hai to cal ka option un di money hai. agar stock ki mojooda qeemat strike price se kam hai, to poat option paisay mein hai . 2- At-the-Money: ki qeemat stock ki mojooda qeemat ke barabar hai . 3-Out-of-the-Money : of di money : agar stock ki mojooda qeemat strike price se kam hai to cal ka option surkh rang mein hota hai. agar stock ki mojooda qeemat strike price se ziyada hai, to poat option paisay se bahar hai . option khredar option kharidne ke liye jo qeemat ada karta hai usay option premium kaha jata hai. yeh mutadid mutageerat par munhasir hai, Bashmole stock ki qeemat, meyaad khatam honay tak baqi waqt, utaar charhao, aur market ki haalat . Exercise : " werzish" karne ke liye aik option yeh hai ke aap bunyadi stock ko kharidne ya zaya karne ka intikhab karen. hasas kharidne ya tay shuda dyoydnd haasil karne ke liye, is mein option jari kanandah ( aam tor par khud firm ) se rabita karna aur zabardast qeemat ada karna shaamil hai . Important Notes : yeh yaad rakhna bohat zaroori hai ke stock ke ikhtiyarat paicheeda maliyati alaat ho satke hain, aur un ki tafseelaat un sharait aur halaat ki bunyaad par tabdeel ho sakti hain jo coopration inhen faraham karti hai. mukammal aur durust maloomat ke liye, yeh mahswara diya jata hai ke maliyati musheer se baat karen ya makhsoos option ke muahiday ka hawala den . -

#11 Collapse

Stock Option; aik sarmaya car ko aik makhsoos qeemat aur tareekh par stock kharidne ya baichnay ka haq diya jata hai, lekin zimma daari nahi, jab woh stock option ( jisay aykoyti option bhi kaha jata hai ) istemaal karte hain. ikhtiyarat do zaiqoon mein atay hain : pots, jo stock girnay par juaa khailtay hain, aur calls, jo stock bherne par shart lagatay hain .stock ke ikhtiyarat aykoyti ki aik qisam hain aur usay aykoyti aapshnz bhi kaha ja sakta hai kyunkay stock ke hasas ( ya stock index ) un ka bunyadi asasa banatay hain ymplayi stak aapshnz ( esos ), jo amli tor par cal aapshnz ke masawi hain, aik qisam ka aykoyti muawza hai jo coopration kuch mulazmeen ya aygziktoz ko faraham karta hai. yeh market mein tijarat karne walay stock par darj aykoyti aapshnz se allag hain kyunkay woh mehdood hain .yeh yaad rakhna bohat zaroori hai ke stock ke ikhtiyarat paicheeda maliyati alaat ho satke hain, aur un ki tafseelaat un sharait aur halaat ki bunyaad par tabdeel ho sakti hain jo coopration inhen faraham karti hai. mukammal aur durust maloomat ke liye, yeh mahswara diya jata hai ke maliyati musheer se baat karen ya makhsoos option ke muahiday ka hawala den mushtaq maliyati alaat ki aik class hai jis mein ikhtiyarat shaamil hain. is ka matlab yeh hai ke bunyadi security ya asasa ki qader un ki qader ki bunyaad ya zareya ke tor par kaam karti hai. kisi company ke stock ke hasas woh hain jo stock ke ikhtiyarat ke muamlay mein woh asasa hai. option aik moahida hai jo do fareeqon ke darmiyan mustaqbil mein pehlay se tay shuda qeemat par stock kharidne ya baichnay ka haq rakhnay ka ehad qaim karta hai. laagat ko aksar werzish ki qeemat ya strike price kaha jata hai. aykoyti ke ikhtiyarat aik aykoyti security se akhaz kiye jatay hain. sarmaya car aur tajir stock ko khareeday ya mukhtasir kiye baghair stock mein lambi ya mukhtasir position lainay ke liye aykoyti ke ikhtiyarat istemaal kar saktay hain. yeh faida mand hai kyunkay ikhtiyarat ke sath position lainay se sarmaya car / tajir ziyada faida uthata hai jis mein sarmaya ki zaroorat hoti hai jo margin par isi terhan ki lambi ya mukhtasir position se bohat kam hoti hai. lehaza, sarmaya car aur tajir, bunyadi stock mein qeemat ki tehreek se ziyada munafe haasil kar satke hain . Treading with Stock options tijarat ke liye stock ke ikhtiyarat ki fehrist banata hai. istemaal kardah tijarti taknik par munhasir hai, ikhtiyarat khareeday ya farokht kiye jasaktay hain. pichli misaal ko mad e nazar rakhtay hue, aik tajir cal kharidne ya farokht karne ya pitt likhnay ka faisla kar sakta hai agar inhen yaqeen hai ke ibm ke hasas bherne walay hain. is manzar naame mein, premium poat seller ke zariye ada karne ke bajaye wusool kya jaye ga. paanch ibm January ke pots baichnay walay ke liye le kar ayen ge . -

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What is stock options:? Definition: sirr,, [/SIZE][/B][/I][/U]Stock option ( jisay aykoyti option bhi kaha jata hai ), aik sarmaya car ko mutafiqa qeemat aur tareekh par stock kharidne ya baichnay ka haq deta hai, lekin is ki zimma daari nahi. ikhtiyarat ki do kasmain hain : pots, jo ke aik shart hai ke stock giray ga, ya cal, jo aik shart hai ke stock barhay ga. chunkay is ke paas stock ke hasas ( ya stock index ) is ke bunyadi asasay ke tor par hain, stock ke ikhtiyarat aykoyti ki aik shakal hain aur usay aykoyti aapshnz kaha ja sakta hai. aymplayi stak aapshnz ( esos ) aik qisam ka aykoyti muawza hai jo companiyon ki taraf se kuch mulazmeen ya aygziktoz ko diya jata hai jo muaser tareeqay se cal aapshnz ke barabar hota hai. yeh market mein tijarat karne walay stock par darj aykoyti aapshnz se mukhtalif hain, kyunkay woh kisi khaas coopration tak mehdood hain jo inhen –apne mulazmeen ko jari karti hai . [/INDENT][/COLOR] Understanding of stock option: sirr,, [/SIZE][/B][/U][/I][/FONT][/COLOR]Is liye, agar xyz stock $ 100 par trade kar raha hai, to $ 120 ki hartaal ki cal mashq karne ke liye faida mand ho jaye gi ( yani, strike price par shiyrz mein tabdeel ) sirf is soorat mein jab market ki qeemat $ 120 se barh jaye. ya, agar hasas $ 80 se neechay ajayeen to $ 80 ki hartaal ka poat faida mand hoga. is waqt, dono aapshnz ko un di money ( itm ) kaha jaye ga, yani un ki kuch androoni qeemat hai ( yani strike price aur market price ke darmiyan farq ). basorat deegar, aapshnz out of di money ( otm ) hain, aur kharji qader par mushtamil hain ( jisay waqt ki qader bhi kaha jata hai ). otm ke ikhtiyarat ki ab bhi qader hai kyunkay bunyadi asasa option ke khatam honay par ya is se pehlay raqam mein muntaqil honay ka kuch imkaan rakhta hai. yeh imkaan option ki qeemat mein zahir hota hai. aykoyti ke ikhtiyarat aik aykoyti security se akhaz kiye gaye hain. sarmaya car aur tajir stock ko khareeday ya mukhtasir kiye baghair stock mein lambi ya mukhtasir position lainay ke liye aykoyti ke ikhtiyarat istemaal kar saktay hain. yeh faida mand hai kyunkay ikhtiyarat ke sath position lainay se sarmaya car / tajir ziyada faida uthata hai jis mein sarmaya ki zaroorat hoti hai jo margin par isi terhan ki lambi ya mukhtasir position se bohat kam hoti hai. lehaza, sarmaya car aur tajir, bunyadi stock mein qeemat ki tehreek se ziyada munafe haasil kar satke hain

Expiration date ikhtiyarat ke muahiday sirf aik makhsoos muddat ke liye hotay hain. usay meyaad khatam honay ki tareekh kaha jata hai. taweel meyaad khatam honay ki tarikhon ke sath darj kardah ikhtiyarat mein ziyada waqt ki qeemat hogi kyun ke bunyadi stock ke ghoomnay ke liye itna hi ziyada waqt hota hai jis mein option un di money ban'nay ka ziyada imkaan hota hai. option ki meyaad khatam honay ki tareekhen aik muqarara schedule ke mutabiq set ki jati hain ( jisay option cycle kaha jata hai ) aur aam tor par rozana ya hafta waar meyaad khatam honay se le kar mahana aur aik saal ya is se ziyada tak hoti hai. hartaal ki qeemat hartaal ki qeemat is baat ka taayun karti hai ke aaya option ka istemaal kya jana chahiye. yeh woh qeemat hai jis ki aik tajir tawaqqa karta hai ke stock ki meyaad khatam honay ki tareekh se oopar ya neechay rahay gi. misaal ke tor par, agar koi tajir shart laga raha hai ke mustaqbil mein international business machine coopration ( ibm ) barhay ga, to woh aik makhsoos mahinay aur aik khaas strike qeemat ke liye cal khareed satke hain. misaal ke tor par, aik tajir shart laga raha hai ke January ke wast tak ibm ka stock $ 150 se oopar jaye ga. is ke baad woh January $ 150 ki cal khareed satke hain . BEST OF LUCK MY DEAR MEMBERS................,,,,,,,,,,,,,,,,,,

-

#13 Collapse

What is investment opportunitiesDefinition hellos dears jesa ky ap sub ko maloom h..... Investment opportunity ( jisay aykoyti choice bhi kaha jata hai ), aik sarmaya vehicle ko mutafiqa qeemat aur tareekh standard stock kharidne ya baichnay ka haq deta hai, lekin is ki zimma daari nahi. ikhtiyarat ki do kasmain hain : pots, jo ke aik shart hai ke stock giray ga, ya cal, jo aik shart hai ke stock barhay ga. chunkay is ke paas stock ke hasas ( ya stock record ) is ke bunyadi asasay ke pinnacle standard hain, stock ke ikhtiyarat aykoyti ki aik shakal hain aur usay aykoyti aapshnz kaha ja sakta hai. aymplayi stak aapshnz ( esos ) aik qisam ka aykoyti muawza hai jo companiyon ki taraf se kuch mulazmeen ya aygziktoz ko diya jata hai jo muaser tareeqay se cal aapshnz ke barabar hota hai. yeh market mein tijarat karne walay stock standard darj aykoyti aapshnz se mukhtalif hain, kyunkay woh kisi khaas coopration tak mehdood hain jo inhen - apne mulazmeen ko jari karti hai . Comprehension of investment opportunity Is liye, agar xyz stock $ 100 standard exchange kar raha hai, to $ 120 ki hartaal ki cal mashq karne ke liye faida mand ho jaye gi ( yani, strike cost standard shiyrz mein tabdeel ) sirf is soorat mein poke market ki qeemat $ 120 se barh jaye. ya, agar hasas $ 80 se neechay ajayeen to $ 80 ki hartaal ka poat faida mand hoga. is waqt, dono aapshnz ko un di cash ( itm ) kaha jaye ga, yani un ki kuch androoni qeemat hai ( yani strike cost aur market cost ke darmiyan farq ). basorat deegar, aapshnz out of di cash ( otm ) hain, aur kharji qader standard mushtamil hain ( jisay waqt ki qader bhi kaha jata hai ). otm ke ikhtiyarat ki stomach muscle bhi qader hai kyunkay bunyadi asasa choice ke khatam honay standard ya is se pehlay raqam mein muntaqil honay ka kuch imkaan rakhta hai. yeh imkaan choice ki qeemat mein zahir hota hai. aykoyti ke ikhtiyarat aik aykoyti security se akhaz kiye gaye hain. sarmaya vehicle aur tajir stock ko khareeday ya mukhtasir kiye baghair stock mein lambi ya mukhtasir position lainay ke liye aykoyti ke ikhtiyarat istemaal kar saktay hain. yeh faida mand hai kyunkay ikhtiyarat ke sath position lainay se sarmaya vehicle/tajir ziyada faida uthata hai jis mein sarmaya ki zaroorat hoti hai jo edge standard isi terhan ki lambi ya mukhtasir position se bohat kam hoti hai. lehaza, sarmaya vehicle aur tajir, bunyadi stock mein qeemat ki tehreek se ziyada munafe haasil kar satke hain Termination date ikhtiyarat ke muahiday sirf aik makhsoos muddat ke liye hotay hain. usay meyaad khatam honay ki tareekh kaha jata hai. taweel meyaad khatam honay ki tarikhon ke sath darj kardah ikhtiyarat mein ziyada waqt ki qeemat hogi kyun ke bunyadi stock ke ghoomnay ke liye itna hello there ziyada waqt hota hai jis mein choice un di cash ban'nay ka ziyada imkaan hota hai. choice ki meyaad khatam honay ki tareekhen aik muqarara plan ke mutabiq set ki jati hain ( jisay choice cycle kaha jata hai ) aur aam pinnacle standard rozana ya hafta waar meyaad khatam honay se le kar mahana aur aik saal ya is se ziyada tak hoti hai. hartaal ki qeemat hartaal ki qeemat is baat ka taayun karti hai ke aaya choice ka istemaal kya jana chahiye. yeh woh qeemat hai jis ki aik tajir tawaqqa karta hai ke stock ki meyaad khatam honay ki tareekh se oopar ya neechay rahay gi. misaal ke pinnacle standard, agar koi tajir shart laga raha hai ke mustaqbil mein worldwide business machine coopration ( ibm ) barhay ga, to woh aik makhsoos mahinay aur aik khaas strike qeemat ke liye cal khareed satke hain. misaal ke peak standard, aik tajir shart laga raha hai ke January ke wast tak ibm ka stock $ 150 se oopar jaye ga. is ke baad woh January $ 150 ki cal khareed satke hain .

Is liye, agar xyz stock $ 100 standard exchange kar raha hai, to $ 120 ki hartaal ki cal mashq karne ke liye faida mand ho jaye gi ( yani, strike cost standard shiyrz mein tabdeel ) sirf is soorat mein poke market ki qeemat $ 120 se barh jaye. ya, agar hasas $ 80 se neechay ajayeen to $ 80 ki hartaal ka poat faida mand hoga. is waqt, dono aapshnz ko un di cash ( itm ) kaha jaye ga, yani un ki kuch androoni qeemat hai ( yani strike cost aur market cost ke darmiyan farq ). basorat deegar, aapshnz out of di cash ( otm ) hain, aur kharji qader standard mushtamil hain ( jisay waqt ki qader bhi kaha jata hai ). otm ke ikhtiyarat ki stomach muscle bhi qader hai kyunkay bunyadi asasa choice ke khatam honay standard ya is se pehlay raqam mein muntaqil honay ka kuch imkaan rakhta hai. yeh imkaan choice ki qeemat mein zahir hota hai. aykoyti ke ikhtiyarat aik aykoyti security se akhaz kiye gaye hain. sarmaya vehicle aur tajir stock ko khareeday ya mukhtasir kiye baghair stock mein lambi ya mukhtasir position lainay ke liye aykoyti ke ikhtiyarat istemaal kar saktay hain. yeh faida mand hai kyunkay ikhtiyarat ke sath position lainay se sarmaya vehicle/tajir ziyada faida uthata hai jis mein sarmaya ki zaroorat hoti hai jo edge standard isi terhan ki lambi ya mukhtasir position se bohat kam hoti hai. lehaza, sarmaya vehicle aur tajir, bunyadi stock mein qeemat ki tehreek se ziyada munafe haasil kar satke hain Termination date ikhtiyarat ke muahiday sirf aik makhsoos muddat ke liye hotay hain. usay meyaad khatam honay ki tareekh kaha jata hai. taweel meyaad khatam honay ki tarikhon ke sath darj kardah ikhtiyarat mein ziyada waqt ki qeemat hogi kyun ke bunyadi stock ke ghoomnay ke liye itna hello there ziyada waqt hota hai jis mein choice un di cash ban'nay ka ziyada imkaan hota hai. choice ki meyaad khatam honay ki tareekhen aik muqarara plan ke mutabiq set ki jati hain ( jisay choice cycle kaha jata hai ) aur aam pinnacle standard rozana ya hafta waar meyaad khatam honay se le kar mahana aur aik saal ya is se ziyada tak hoti hai. hartaal ki qeemat hartaal ki qeemat is baat ka taayun karti hai ke aaya choice ka istemaal kya jana chahiye. yeh woh qeemat hai jis ki aik tajir tawaqqa karta hai ke stock ki meyaad khatam honay ki tareekh se oopar ya neechay rahay gi. misaal ke pinnacle standard, agar koi tajir shart laga raha hai ke mustaqbil mein worldwide business machine coopration ( ibm ) barhay ga, to woh aik makhsoos mahinay aur aik khaas strike qeemat ke liye cal khareed satke hain. misaal ke peak standard, aik tajir shart laga raha hai ke January ke wast tak ibm ka stock $ 150 se oopar jaye ga. is ke baad woh January $ 150 ki cal khareed satke hain .

-

#14 Collapse

Aslam u alaikum dear What is stock options Definition Name: download (43).jpeg Views: 39 Size: 4.6 KB Stock option ( jisay aykoyti option bhi kaha jata hai ), aik sarmaya car ko mutafiqa qeemat aur tareekh par stock kharidne ya baichnay ka haq deta hai, lekin is ki zimma daari nahi. ikhtiyarat ki do kasmain hain : pots, jo ke aik shart hai ke stock giray ga, ya cal, jo aik shart hai ke stock barhay ga. chunkay is ke paas stock ke hasas ( ya stock index ) is ke bunyadi asasay ke tor par hain, stock ke ikhtiyarat aykoyti ki aik shakal hain aur usay aykoyti aapshnz kaha ja sakta hai. aymplayi stak aapshnz ( esos ) aik qisam ka aykoyti muawza hai jo companiyon ki taraf se kuch mulazmeen ya aygziktoz ko diya jata hai jo muaser tareeqay se cal aapshnz ke barabar hota hai. yeh market mein tijarat karne walay stock par darj aykoyti aapshnz se mukhtalif hain, kyunkay woh kisi khaas coopration tak mehdood hain jo inhen –apne mulazmeen ko jari karti hai . Understanding of stock option Is liye, agar xyz stock $ 100 par trade kar raha hai, to $ 120 ki hartaal ki cal mashq karne ke liye faida mand ho jaye gi ( yani, strike price par shiyrz mein tabdeel ) sirf is soorat mein jab market ki qeemat $ 120 se barh jaye. ya, agar hasas $ 80 se neechay ajayeen to $ 80 ki hartaal ka poat faida mand hoga. is waqt, dono aapshnz ko un di money ( itm ) kaha jaye ga, yani un ki kuch androoni qeemat hai ( yani strike price aur market price ke darmiyan farq ). basorat deegar, aapshnz out of di money ( otm ) hain, aur kharji qader par mushtamil hain ( jisay waqt ki qader bhi kaha jata hai ). otm ke ikhtiyarat ki ab bhi qader hai kyunkay bunyadi asasa option ke khatam honay par ya is se pehlay raqam mein muntaqil honay ka kuch imkaan rakhta hai. yeh imkaan option ki qeemat mein zahir hota hai. aykoyti ke ikhtiyarat aik aykoyti security se akhaz kiye gaye hain. sarmaya car aur tajir stock ko khareeday ya mukhtasir kiye baghair stock mein lambi ya mukhtasir position lainay ke liye aykoyti ke ikhtiyarat istemaal kar saktay hain. yeh faida mand hai kyunkay ikhtiyarat ke sath position lainay se sarmaya car / tajir ziyada faida uthata hai jis mein sarmaya ki zaroorat hoti hai jo margin par isi terhan ki lambi ya mukhtasir position se bohat kam hoti hai. lehaza, sarmaya car aur tajir, bunyadi stock mein qeemat ki tehreek se ziyada munafe haasil kar satke hain Name: images (90).png Views: 29 Size: 5.8 KB -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What is stock options ? Assalamualaikum dear what is stock options Definition. stock option,aik sarmaya dar ko mutafiqa qeemat aur tareeka pr stock kharidna ya baichnay ka haq deta hai Lekin iski zemydari ni.ikhtiyaratki do kasmain hai ; pots, Jo k aik shrt hai k stock giry ga ya cal, Jo k aik sharat hai k stock barhye ga Chonky is k pas stock ki hasas is ki bunyadi asasay k tor pr hai, stock k ikhtitart aykoyti ki aik shkl hai ur usy aykoyti aapshanz kaha ja skta hai. Aymplayi steak aapshnz aik qisam ka aykoyti muawza hai Jo companies ki trf sy Kuch mulazmeen ya aygziktoz ko diya jata hai Jo muaser traqeey se cal aapshanz equal hota hai. Ye market may trade krny waly stock pr dark aykoyti options se different hoti hai, q k wohi kesi khas cooperation take mehdood Hain Jo inhy APNA mulazmeen ko jari krty hai. understanding of stock option is liye agr stock xyz $100 par trade kr rha hai , tu $ 120 ki hartaal ki call mashaq karne k liye benifit ho ga, sirf is situation May JB market ki price $120 sy barh jye ya hasa $80 Sy neechy gir jye ltu iss condition may dono options ko un di money kaha jye gi yani unki kuch internal price hai Expiration data. Ikhtayart k muyady surf aik mukhsus mudt k liye hoty hai , is sy vmayyad khtm hony ki date kaha jata hai llambi myaad khtm ki datedates k sath enter shuda ikhtyaratikhtyarat may zyada time ki zurtrtzurtrt Hogi, q k main stock k gghumny k liye itna hi zyadzyada time hota hai option ki myaad khtm hony ki dates aik mukra. Ye wo value hai jes ki 1 trader hope krta hai k stock ki myaad khtm hony ki date sy oper ya neecneechy rhy gi for example, agr koi trader shart lga rha hai k future may international business machine cooperation increase Hoga, TU wo 1 mkhus month ur khas strike ki khas price k liye call purchase kr sky ga.for example, 1 trader shart lga rha hai k January k mid tk ibm ka stock $150 sy oper jye ga, isky bad wo January may $150 ki call purchase kr skta hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 04:26 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим