Three black crows

`

X

new posts

-

#1 Collapseٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

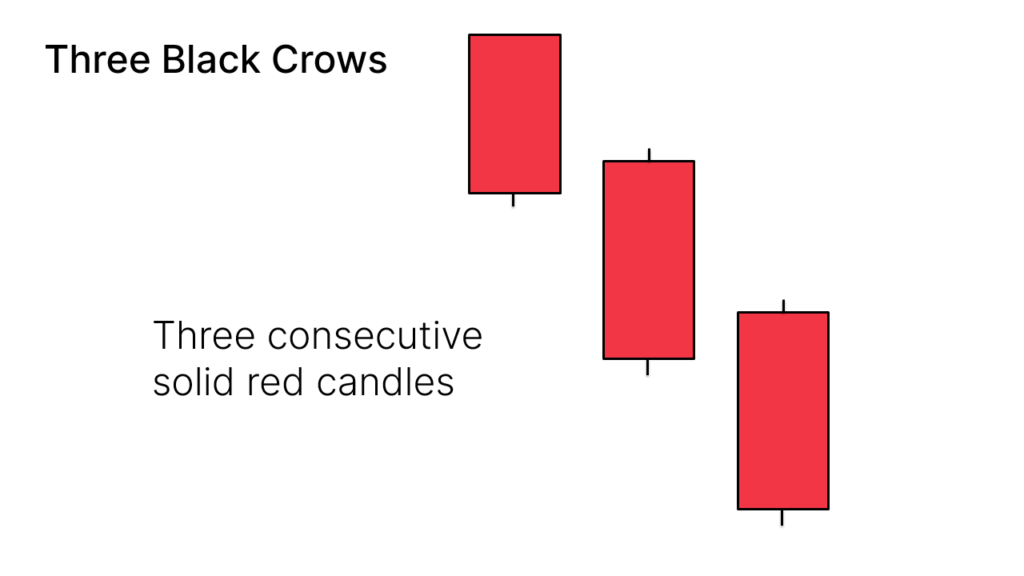

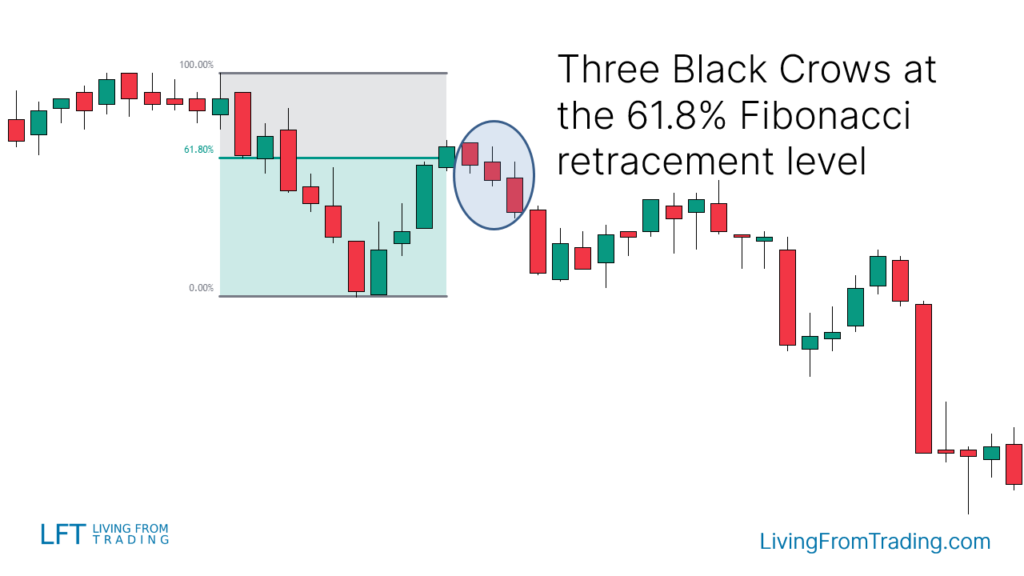

What is three black crows in forexteen siyah kaway aik fiqra hai jo bearish candle stuck patteren ko bayan karne ke liye istemaal kya jata hai jo oopri rujhan ke ulat jane ki paish goi kar sakta hai. candle stuck charts aik khaas security ke liye din ki iftitahi, ziyada, kam aur ikhtitami qeematein dikhata hain. onche harkat karne walay stock ke liye, candle stick safaid ya sabz hai. jab neechay ki taraf barhatay hain to woh siyah ya surkh hotay hain. siyah kaway ka namona lagataar teen lambay jism wali shama daan par mushtamil hota hai jo pichli mom batii ke asli jism ke andar khuli hoti hain aur pichli mom batii se neechay band hoti hain. aksar, tajir is isharay ko dosray takneeki isharay ya chart patteren ke sath mila kar istemaal karte hain jaisay ke ulat jane ki tasdeeq hoti hai . teen kalay kaway aik bearish candle stuck patteren hai jo mojooda up trained ke ulat jane ki pishin goi karne ke liye istemaal hota hai. tajir usay deegar takneeki isharay jaisay ke rishta daar taaqat index ( rsi ) ke sath istemaal karte hain. teen kalay kvon ki mom batian aur saaye ka size yeh faisla karne ke liye istemaal kya ja sakta hai ke aaya ulat jane se wapsi ka khatrah hai. teen kalay kvon ka mukhalif patteren teen safaid sipahi hai, jo neechay ke rujhan ke ulat jane ki nishandahi karta hai . Three black crows explained teen kalay kaway aik basri namona hain, matlab yeh hai ke is isharay ki shanakht karte waqt fikar karne ke liye koi khaas hisaab nahi hai. teen kalay kvon ka patteren is waqt hota hai jab reechh lagataar teen tijarti sishnz ke douran belon ko peechay chore dete hain. yeh patteren qeematon ke chart par teen bearish lambay jism wali mom btyon ke tor par zahir hota hai jis mein chhootey ya baghair saaye ya vicks hotay hain . teen kalay kvon ki aik aam shakal mein, bail session ka aaghaz karen ge jis ki qeemat pichlle band se mamooli had tak ziyada ho gi, lekin poooray session mein qeemat ko neechay dhakel diya jata hai. aakhir mein, qeemat ke dabao mein kam session ke qareeb band ho jaye gi. is tijarti karwai ke nateejay mein aik bohat hi mukhtasir ya ghair mojood saya hoga. traders aksar teen sishnz tak barqarar rehne walay is neechay ki taraf dabao ko mandi ke neechay ke rujhan ka aaghaz qarar dete hain . Example of how to use three black crows basri namona ke tor par, dosray takneeki isharay se tasdeeq haasil karne ke liye teen kalay kvoN ko nishani ke tor par istemaal karna behtar hai. teen siyah kvon ka patteren aur aik tajir is mein jo aetmaad daal sakta hai is ka inhisaar is baat par hai ke patteren kitni achi terhan se zahir hota hai. teen kalay kaway misali tor par nisbatan lambay jism walay bearish candle honay chahiye jo muddat ke liye kam qeemat par ya is ke qareeb band hon. dosray lafzon mein, shama daan ke lambay, asli jism aur mukhtasir, ya ghair mojood, saaye honay chahiye. agar saaye phail rahay hain, to yeh sirf belon aur ke darmiyan raftaar mein aik mamooli tabdeeli ki nishandahi kar sakta hai is se pehlay ke oopar ka rujhan dobarah zahir ho jaye . -

#3 Collapse

Assalamu Alaikum Dosto!Three Black Crows Candlestick PatternThree black crows candlestick pattern teen mutawater bearish candles ka aik bearish trend reversal pattern hai, jiss main sari candles aik strong real body ki bearish candles hoti hai, jo k prices k uptrend main paya jata hai. Ye pattern aik strong signal deta hai, k market ka yahan par demand khatam ho chuka hai, jiss k baad prices ziada supply ki waja se gerna shoro ho jati hai. Price chart pattern hamesha aik leading indicator ka role us waqat play karti hai, jab inn ki market main aik strong hold a jata hai. Three black crows candlestick pattern bhi aik strong bearish trend reversal ka signal deta hai.Candles FormationThree black crows pattern main teen bearish candles aik dosre k bottom par open aur close hoti hai. Ye pattern top price pe bearish trend reversal aur bearish prices par bearish trend continuation ka kaam karta hai, jiss main candles ki formation darjazzel tarah se hoti hai;- First Candle: Three black crows pattern main shamil pehli candle aik strong bearish candle hoyi hai, jo k black ya red color main banti hai. Ye candle long bearish candle hai, jo k market main bearish trend reversal ka ishara deti hai.

- Second Candle: Three black crows pattern ki dosri candle bhi pehli candle ki tarah bearish hoti hai, jiss ka color bhi same black ya red hoti hai. Ye candle pehli candle se ziada strong banti hai, q k aksar ye candle size main pehli candle se ziada hoti hai.

- Third Candle: Three black crows pattern ki teesri candle bhi pehli do candles ki tarah hi bearish hoti hai. Ye candle size main dosri candle ki tarah hoti hai, jo k pehli candle se thori si bari hoti hai. Ye candle bhi color main black ya red banti hai.

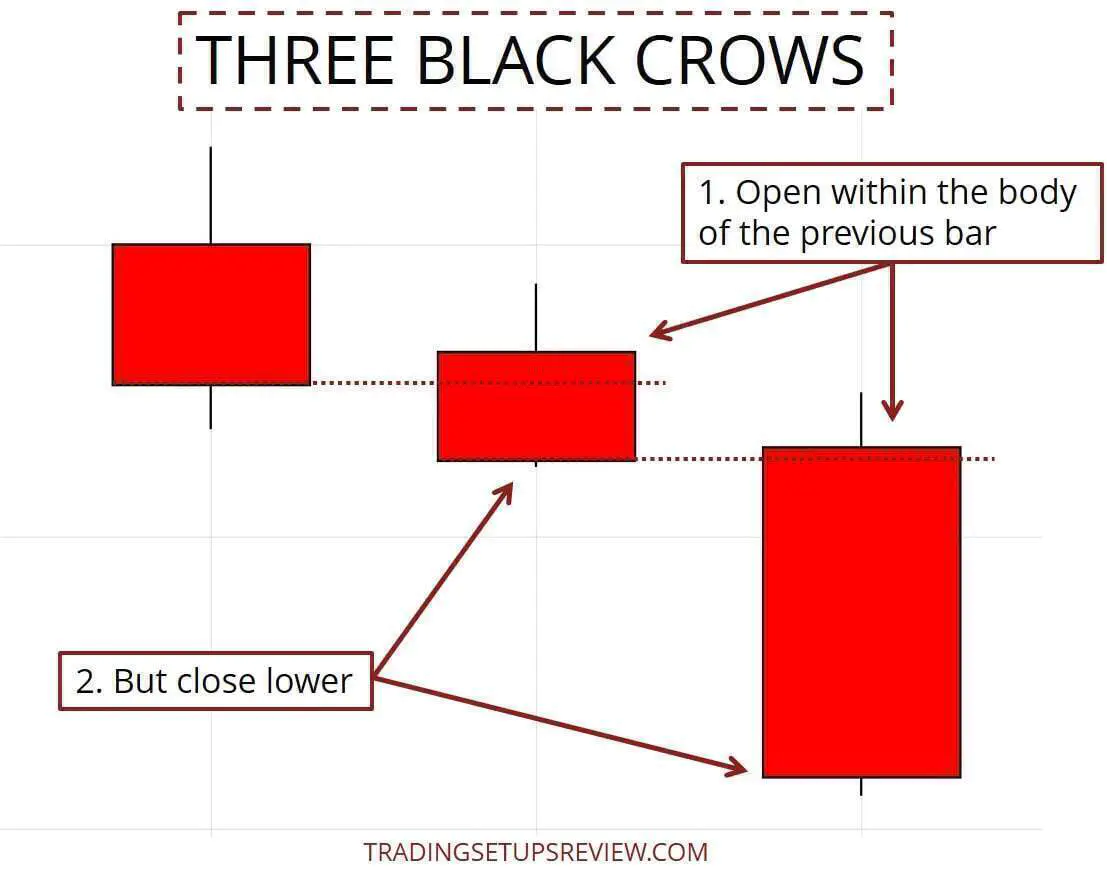

ExplainationThree black crows candlestick pattern teen bearish candles ka pattern hone ki waja se aik bearish signal deta hai. Pattern ki teeno candles mutawater teen bearish marubozu candles banti hai, jiss k upper aur lower sides par aksar shadow nahi banta hai, lekin small si wick banne par bhi ye pattern same kaam karta hai. Pattern ki teeno candles aik dosre k lower side par close hoti hai, jiss main candles ka close price open price ki nisbat kam hoti hai. Pattern ki teeno bearish candle aksar aik dosre k real body main ya aik dosre k close price k baad open hoti hai. Pattern ki teeno candles size main lazmi aik dosre k barabar honi chaheye, ya uss pe kam az kam difference hona chaheye.TradingThree black crows candlestick pattern trading k leye aik strong bearish signal deta hai, jiss par trader market main sell ki entry karte hen. Pattern par trading se pehle aik confirmation candle ka hona zarori hai. Confirmation candle real body main bearish honi chaheye, jo teeno bearish candles k bottom par close honi chaheye, jab k bullish candle banne par entry nahi karni chaheye. Ye pattern sideways ya bearish trend k dowran bearish trend continuation ka kaam karta hai. Pattern ki confirmation indicators jaise, CCI, RSI, MACD indicator aur stochastic oscillator par value overbought zone main honi chaheye. Stop Loss k sab se bottom position ya pehli bearish candle k higher se two pips above set karen. -

#4 Collapse

Technical analysis ke hisab se, traders aksar chart patterns ka sahara lete hain taake market mein mukhtalif trends aur reversals ko pehchaan sakein. Ek aise pattern mein se ek hai Three Black Crows pattern, jo ke bearish reversal pattern ke tor par maqbool hai. Yeh pattern teen musalsal lambi bearish candlesticks se mutasir hota hai jo ke ek uptrend ke baad aata hai, jisse bullish se bearish sentiment ki taraf ek mumkin taqaza zahir hota hai.

Formation Criteria

Three Black Crows aam tor par ek uptrend ki unchi nukar mein banne ka doran banata hai jab bulls apna tawajjuh kho rahe hote hain aur bears market par qabza karne lagte hain. Yeh pattern pehchane ke liye yeh ahmiyat rakhta hai:

a. Three Consecutive Bearish Candlesticks: Pattern three musalsal lambi bearish candlesticks se banta hai, har ek candle pehle candle ke andar open hota hai aur apne qareeb close hota hai. Yeh candlesticks sambhalay hue farokht dabaao aur bearish sentiment mein taqat ka ishara karte hain.

b. Uptrend Preceding the Pattern: Three Black Crows pattern ke banne se pehle, price action mein wazeh uptrend hona chahiye. Yeh uptrend bullish dominance ko darust karta hai, jisse bearish candles ke mutalliq hone wale signal ko zyada ahmiyat milti hai.

c. Minimal or No Upper Shadows: Behtar toor par, pattern banane wali three bearish candlesticks mein se har ek ki upper shadows kam ya koi nahi honi chahiye, yeh dikhata hai ke bears ne poori trading douran bina kisi significant wapas ke bulls ka control rakha.

2. Significance of the Pattern

Three Black Crows pattern traders ke liye ahmiyat rakhta hai kyun ke yeh potential trend reversal ko pehchanne mein madad karta hai, jisse buyers aur sellers ke darmiyan market ke dynamics ka pata chalta hai. Yeh kyun ahmiyat rakhta hai:

a. Bearish Reversal Signal: Ek bearish reversal pattern ke tor par, Three Black Crows bullish sentiment se bearish sentiment ki taraf ek tabadla darust karta hai. Yeh ishara karta hai ke uptrend ko drive kar rahe buyers ka control ghaat ja raha hai, jab ke sellers momentum ikhtiyaar kar rahe hain, jisse ek downtrend ka silsila shuru hota hai.

b. Confirmation of Market Sentiment: Three musalsal bearish candlesticks ke banne se ek taraf bechnay ki dabao ki izhar kardah gawahi milti hai aur buying interest ki kamzori ki khabar milti hai. Yeh bearish sentiment ki tasdiq is pattern ki credibility ko barhata hai.

c. Psychological Impact: Three musalsal bearish candles ka visual representation market ke shirkatdaron par eham asar dal sakta hai, bullish traders ke darmiyan pareshani paida karta hai aur unhe apni positions ko dobara ghor karne par majboor karta hai, jisse aur bechnay ki dabao barhti hai.

3. Trading Strategies

Three Black Crows pattern par trading karne ke liye entry aur exit points, risk management, aur tasdiq ke signals ka dhyan dena zaroori hai takay kamiyabi ki sambhavna ko barha sake. Yeh kuch aam strategies hain jo traders istemal karte hain:

a. Entry Strategy: Traders aam tor par teesri bearish candlestick ke mukammal hone ke baad chhoti position (sell orders) enter karte hain, zyada tar agle trading douran ke opening par, taake downtrend ki mukammal hone ka tasdeeq mil sake. Yeh entry strategy traders ko umeed ki gayi neeche ke momentum ka faida uthane ki izazat deti hai.

b. Stop-loss Placement: Risk ko behtareen tareeqe se manage karne ke liye, traders teesri bearish candlestick ke ooper ke high ya haal hi ki swing high ke ooper stop-loss orders lagate hain, taake agar market ghair mutawaqqa tor par palat gaya aur apna uptrend dobara shuru kiya toh nuqsanain mehdood rahein.

c. Profit Target: Profit targets ko key support levels, Fibonacci retracement levels, ya pehli candlestick ke high aur teesri candlestick ke low ke darmiyan ke fasle ke hisab se set kiya ja sakta hai. Is ke ilawa, traders trailing stop-loss orders istemal kar sakte hain taake downtrend barhta rahein aur faida barh jaye.

d. Confirmation Signals: Jabke Three Black Crows pattern khud mein ek taqatwar bearish reversal signal hai, traders aksar is ke saath dusre technical indicators jaise Relative Strength Index (RSI), Moving Averages, ya volume analysis ka istemal karte hain taake unki trading decisions ko tasdiq mile aur jhootay signals ka risk kam ho.

4. Limitations and Considerations

Jabke Three Black Crows pattern ko potential trend reversals ko pehchanne mein is ki taqat ko samajhna chahiye, traders ko iske hadood aur masail ko bhi dekhte rehna zaroori hai aur apni trading strategies ko isharaat ke sath mila kar aqeedat se istemal karna chahiye:

a. False Signals: Jaise ke koi bhi technical pattern, Three Black Crows pattern bhi bilkul aitmaad nahi hai aur kabhi-kabhi jhootay signals deta hai, khaas tor par ghair mustaqil ya choppy market conditions mein. Traders ko jhootay signals ko filter karne aur unki trades ki kamiyabi ko barhane ke liye mazeed tasdiq ke indicators ka istemal karna chahiye.

b. Context Matters: Three Black Crows pattern ka asar mukhtalif market context, including bunyadi factors, mojooda trends, aur market sentiment par depend karta hai. Traders ko in factors ko mad e nazar rakhte hue apne trading decisions ka faisla karna chahiye.

c. Risk Management: Jabke Three Black Crows pattern potential trend reversals ko pehchanne mein madadgar hota hai, traders ko apna maal barqarar rakhne ke liye risk management par tawajjuh dena zaroori hai. Is mein sahi stop-loss levels, position sizing, aur mukhlis trading practices ka shamil hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#5 Collapse

"Three Black Crows" ek popular bearish candlestick pattern hai jo trading mein use hota hai aur typically downtrend ke indicators ke roop mein dekha jata hai.Is pattern ko Roman Urdu mein "Teen Kaley Kauwe" kehte hain.Is pattern ka appearance yeh hota hai:Teen consecutive long black candlesticks, jin ki closing price pehli candlestick se neeche hoti hai aur har ek candlestick ki opening price pehli candlestick ke neeche hoti hai.Har candlestick ki body lambi hoti hai aur ideally her ek candle ki range pehle ke candlestick ki range ko cover karta hai.Yeh pattern bearish reversal ko indicate karta hai, matlab ke uptrend ke baad aata hai aur downward trend ki shuruaat ho sakti hai.Traders is pattern ko confirm karne ke liye doosre technical indicators aur price action analysis ka istemal karte hain, aur agar yeh pattern sahi tarah se milta hai, toh woh sell positions enter kar sakte hain ya existing long positions ko exit kar sakte hain.Three Black Crows" ek bearish candlestick pattern hai jo trading mein ahmiyat rakhta hai, especially jab market mein trend reversal hone ka indication chahiye hota hai. Is pattern ki ahmiyat ko samajhne ke liye, kuch mukhya points shamil hain:

Bearish Reversal Signal:

Three Black Crows pattern ek strong bearish reversal signal provide karta hai. Jab yeh pattern form hota hai, yeh indicate karta hai ke uptrend khatam ho sakta hai aur downward trend shuru hone wala hai. Is tarah se, traders is pattern ko use karke selling opportunities dhoondhte hain.

Confirmation with Other Indicators:

Three Black Crows pattern ko confirm karne ke liye, traders doosre technical indicators aur price action ko bhi dekhte hain. Agar yeh pattern strong volume ke saath aur kisi important support level ke near form hota hai, toh iska significance aur bhi zyada hota hai.

Risk Management:

Is pattern ka istemal karke traders apni risk management improve kar sakte hain. Agar kisi trader ne long position liya hua hai aur Three Black Crows pattern form ho raha hai, toh woh apni position ko exit karke potential losses se bach sakta hai.

Entry aur Exit Points:

Three Black Crows pattern ke formation ke baad, traders entry aur exit points ko identify kar sakte hain. Yeh pattern ek entry point provide karta hai sell positions ke liye, aur agar already long position hai, toh traders apni position ko exit kar sakte hain.

Psychological Impact:

Is pattern ka appearance market sentiment ko reflect karta hai. Jab Three Black Crows pattern form hota hai, toh yeh investor sentiment ko negative karta hai aur confidence ko shake karta hai, jo bearish trend ko strengthen karta hai.Overall, Three Black Crows pattern ek powerful tool hai jo traders ko market trends ko samajhne aur trading decisions ko improve karne mein madad karta hai. Lekin, is pattern ko doosre indicators aur analysis ke saath milakar istemal karna important hai

- CL

- Mentions 0

-

سا0 like

-

#6 Collapse

"Three Black Crows"

ek mukhtalif aur ahem candlestick pattern hai jo ke technical analysis mein istemal hota hai market trends aur price movements ko samajhne mein. Ye pattern ek reversal pattern hai jo ke market ke uptrend ko indicate karta hai. Is article mein, hum Three Black Crows pattern ke baray mein Roman Urdu mein mukhtasir tafseelat par baat karenge:

Three Black Crows Pattern Kya Hai?

Three Black Crows pattern ek bearish reversal pattern hai jo ke price chart par numaya hota hai. Is pattern mein teen bearish candles shamil hote hain, jo ke ek uptrend ke doran numaya hote hain. Har ek candle mein, opening price upper side par hoti hai aur closing price lower side par hoti hai, jo ke market ke bearish sentiment ko darust karta hai. Ye pattern ek strong reversal signal deta hai aur traders ko ye batata hai ke uptrend khatam ho raha hai aur bearish trend shuru hone wala hai.

Three Black Crows Pattern Ki Key Features:- Teen Bearish Candles: Three Black Crows pattern mein teen bearish candles shamil hote hain, jo ke ek dusre ke neeche close karte hain. Har ek candle ka size dusre se bara hota hai, jo ke bearish pressure ko darust karta hai.

- Lower Lows: Har ek candle ke close price lower low par hoti hai, jo ke bearish sentiment ki tasdeeq karta hai aur market ke downtrend ko indicate karta hai.

- Volume: Is pattern ke formation ke dauran volume bhi zyada hota hai, jo ke pattern ki credibility ko aur bhi zyada barhata hai.

Three Black Crows Pattern Ka Istemal Trading Mein:- Entry Point: Three Black Crows pattern mein entry point usually third bearish candle ke close ke neeche set kiya jata hai. Agar ye pattern sahi tareeqe se confirm hota hai, toh traders short positions le sakte hain.

- Stop Loss aur Take Profit: Har trading decision ke saath, sahi risk management zaroori hai. Stop loss aur take profit levels tay karte waqt, traders ko market conditions aur apni risk tolerance ka bhi khayal rakhna chahiye.

- Confirmation: Three Black Crows pattern ko confirm karne ke liye, traders doosri technical indicators aur analysis tools ka istemal karte hain jaise ke volume analysis, moving averages, aur RSI (Relative Strength Index).

Nateeja:

Three Black Crows pattern ek powerful bearish reversal pattern hai jo ke traders ko market ke uptrend ke khatam hone ka andaza lagane mein madad deta hai. Magar, isko sahi tareeqe se samajh kar aur doosri indicators ke sath istemal karke hi trading decisions lena chahiye.

-

#7 Collapse

Three black crows

Three Black Crows" ek bearish reversal candlestick pattern hai jo aam taur par maali tijarat ke markazon mein dekha jata hai, jaise ke stocks, forex, aur commodities. Ye pattern aksar ek uptrend ke baad aata hai aur market ki tasalsul ko bearish se bullish mein tabdeel hone ka ishara deta hai. Is mein teen mufeed lambi si siyah (ya surkh) candles shamil hoti hain, har ek pehle candle ke andar open hoti hai aur peechle candle ke close se kam hoti hai.

Three Black Crows pattern ki ahem pehchanen darust hain:- Pehli Candle: Pattern ek lambi si siyah candle se shuru hota hai, jo market mein taaqatwar bearish jazbaat ko darust karti hai. Yeh candle peechle candle ke uncha hone ke qareeb kholta hai aur neeche band hota hai, jo dhaari bikri dabao ko darust karta hai.

- Dusra Candle: Doosri candle pehli candle ke andar kholta hai aur niche ki manind giraawat ko jari rakhta hai. Aam taur par yeh bhi ek lambi si siyah candle hoti hai, jo bikri gatividhi mein izafa aur bullish trend ka aur kamzor hona dikhata hai.

- Teesra Candle: Teesri candle doosri candle ke andar kholta hai aur giraawat ko jari rakhta hai. Pichli candles ki manind yeh bhi ek lambi si siyah candle hoti hai aur market ke jazbat ko dhaari bikri dabao ke tahat darust karta hai.

Working principal

Teen mufeed lambi si siyah candles ki shakl mein giraawat, neechay ki neechay aur upar ki bulandiyon mein izafa, taaqatwar se tabdeel hone ki nishandahi karti hai. Yeh ishara deta hai ke khareedne wale market ko kaboo mein nahi rakhte aur bikri dabao ko control karte hain. Traders aksar is pattern ko short-selling ya lambi positions ko chhodne ka ishara samajhte hain.

Treading Strategy

Magar, sirf candlestick patterns par trading karte waqt ahtiyaat baratna zaroori hai. Halan ke Three Black Crows pattern trend ke mukhtalif mor par insight faraham kar sakta hai, lekin trading faislon ko tasdiq karne ke liye mazeed technical indicators, chart patterns, aur bunyadi analysis ka istemal karna munasib hai. Is ke ilawa, nuqsanat se bachne ke liye risk management strategies, jaise ke stop-loss orders lagana aur position sizes ko handle karna, ahem hai.Mukhtasir taur par, Three Black Crows pattern maali tijarat ke markazon mein ek taqatwar bearish reversal signal hai, jo bullish se bearish jazbaat mein tabdeel hone ki nishandahi karta hai. Traders aksar is pattern ko neechay ki keemat ke harkaton se faida uthane ke liye qareeb se dekhte hain, lekin yeh doosri tajziyaat ke saath istemal ke liye zaroori hai, taaake zyada mazboot faislay liye ja sakein.

- CL

- Mentions 0

-

سا1 like

-

#8 Collapse

Three black crows

"Three Black Crows" ek bearish reversal candlestick pattern hai jo market analysis mein istemal hota hai. Yeh pattern market mein hone wale bullish trend ko indicate karta hai aur ek possible trend reversal ko represent karta hai.

Three Black Crows Pattern Kaise Hota Hai:- Three Consecutive Bearish Candles: Is pattern mein, market par teen consecutive bearish (girawat ki taraf jaane wale) candles dikhai deti hain.

- Each Candle Opens Lower than the Previous Close: Har ek bearish candle apne previous candle ke close price se neeche open hoti hai, isse indicate hota hai ke selling pressure badh rahi hai.

- Each Candle Closes Lower than the Previous Close: Har ek candle, apne previous candle ke close price se neeche close hoti hai, jo ke bearish momentum ko darust karta hai.

- Long Real Bodies: Candles ke bodies lambi hoti hain, jisse show ho ke sellers control mein hain.

Three Black Crows Ka Tafsili Tazurba:- Trend Reversal Indication: Three Black Crows pattern market mein hone wale uptrend ya bullish trend ki possible khatmaat ya reversals ko indicate karte hain. Ye pattern traders ko alert karta hai ke bearish pressure badh rahi hai aur bullish trend weaken ho sakta hai.

- Market Sentiment: Is pattern se market sentiment ka pata lagaya ja sakta hai. Three Black Crows dikha sakte hain ke market mein selling pressure dominant ho rahi hai aur buyers weak ho rahe hain.

Akhri Khyal:

Three Black Crows ek powerful bearish reversal signal hai, lekin hamesha yaad rahe ke kisi bhi single pattern par pura bharosa na karein aur doosre technical indicators aur factors ko bhi mad e nazar rakhein trading decisions lene ke liye. Pattern ki confirmation ke liye volume aur doosre confirmation indicators ka bhi tajaweez se istemal kiya ja sakta hai.

- CL

- Mentions 0

-

سا0 like

-

#9 Collapse

"Three Black Crows" pattern ek bearish reversal pattern hai jo candlestick charts par dikhai deta hai. Ye pattern typically uptrend ke baad dikhai deta hai aur ek potential trend reversal ka indication deta hai. Neeche di gayi hai Three Black Crows pattern ko identify karne aur samajhne ke kuch steps:

1. Formation:

Three Black Crows pattern ek series of three consecutive long bearish candles hoti hai, jo typically kisi uptrend ke baad dikhai deti hai. Har candle ka open price previous candle ke close price se ooper hota hai aur close price neeche hota hai.

2. Length of Candles:

Har candle ki length substantial hoti hai, indicating strong selling pressure. Yeh candles typically long bodies ke saath dikhai deti hain, indicating ki sellers control mein hain aur market downward direction mein move kar rahi hai.

3. Absence of Upper Shadows:

Three Black Crows pattern mein har candle ke upper shadows typically bahut chhoti hoti hain ya bilkul hi nahi hoti. Yeh upper shadows absence, ya bahut kam hone ka indication hai ki selling pressure strong hai aur bears control mein hain.

4. Confirmation:

Three Black Crows pattern ki confirmation ke liye, traders usually doosre technical indicators ya price action signals ka istemal karte hain. Jaise ki, agar yeh pattern important support level ke paas dikhai deta hai ya kisi doosre bearish reversal pattern ke saath dikhai deta hai, to iska confirmation hota hai.

5. Volume:

Pattern ko confirm karne ke liye, traders ko volume par bhi dhyan dena chahiye. Agar Three Black Crows pattern ke saath high trading volume dikhai deta hai, toh yeh pattern ka validity aur strength ko confirm karta hai.

6. Risk Management:

Jab Three Black Crows pattern dikhai deta hai, traders ko apne risk management ko bhi dhyan mein rakhna chahiye. Stop loss orders ko set karna zaroori hai taake nuksan ko minimize kiya ja sake agar trade opposite direction mein move karta hai.

Overall, Three Black Crows pattern ek powerful bearish reversal pattern hai jo traders ko potential trend reversal ka indication deta hai. Lekin, jaise har trading pattern ki tarah, is pattern ko istemal karte waqt bhi risk management aur proper analysis ka dhyan rakhna zaroori hai.

-

#10 Collapse

**Three Black Crows Pattern: Forex Trading Mein Iska Kya Matlab Hai?**

Forex trading aur technical analysis mein candlestick patterns market trends aur price movements ko samajhne ke liye use kiye jate hain. In patterns mein se ek important pattern hai "Three Black Crows." Ye pattern bearish reversal signal ko indicate karta hai aur market ke downward trend ka indication hota hai. Aaiye dekhte hain ke Three Black Crows pattern kya hai aur iska forex trading mein kis tarah se istemaal kiya jata hai.

**Three Black Crows Pattern Kya Hai?**

Three Black Crows ek candlestick pattern hai jo ek bearish reversal signal ko represent karta hai. Is pattern ki formation teen consecutive black (ya red) candlesticks se hoti hai jo ek uptrend ke baad banti hain. Har candlestick ke open aur close prices similar hote hain aur inke beech ka range bhi chhota hota hai. Ye pattern market ki strength ke decline aur potential trend reversal ko indicate karta hai.

**Three Black Crows Pattern Ki Formation:**

1. **Pehla Candle:** Pattern ka pehla candle ek strong bullish move ke baad banata hai. Ye candle usually ek large bullish body ke saath hota hai aur iska close price high hota hai.

2. **Doosra Candle:** Pehla candle ke baad doosra candle form hota hai. Is candle ka open price pehle candle ke close price ke near hota hai aur iska close price bhi low hota hai. Ye candle market mein selling pressure ko indicate karta hai.

3. **Teesra Candle:** Pattern ka teesra candle doosre candle ke close price ke near open hota hai aur iska close price bhi low hota hai. Ye candle bhi market mein bearish pressure ko show karta hai aur pattern ko complete karta hai.

**Three Black Crows Pattern Ka Forex Trading Mein Istemaal:**

1. **Bearish Reversal Signal:** Three Black Crows pattern usually ek strong bearish reversal signal hota hai. Jab ye pattern bullish trend ke baad form hota hai, to ye indicate karta hai ke market ka trend downward ho sakta hai. Traders is pattern ko identify karke potential sell opportunities ke liye plan karte hain.

2. **Confirmation:** Pattern ke signal ko confirm karne ke liye traders additional technical indicators ka istemaal karte hain. Jaise ke moving averages, RSI ya MACD indicators ka analysis karke traders pattern ke signal ki confirmation le sakte hain.

3. **Entry Aur Exit Points:** Three Black Crows pattern ke formation ke baad, traders potential sell orders place karte hain. Pattern ke complete hone ke baad, traders stop-loss aur take-profit levels ko set karke apne trades ko manage karte hain.

4. **Risk Management:** Pattern ke signal ke saath risk management strategies bhi implement ki jati hain. Stop-loss orders ko set karna aur position sizing ko manage karna traders ko potential losses se bachata hai.

**Conclusion:**

Three Black Crows pattern forex trading mein ek crucial bearish reversal indicator hai jo market ke downward trend ka signal deta hai. Is pattern ki formation teen consecutive bearish candlesticks se hoti hai jo ek uptrend ke baad hoti hain. Traders is pattern ko use karke potential sell opportunities identify karte hain aur market ke reversal points ko analyze karte hain. Accurate identification aur confirmation ke saath, traders apni trading strategies ko optimize kar sakte hain aur profitable trades execute kar sakte hain.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#11 Collapse

### Three Black Crows Pattern Kya Hai?

**1. Three Black Crows Pattern Ka Taaruf**

- **Definition:**

- Three Black Crows ek bearish candlestick pattern hai jo downtrend ke sign ke tor par use hota hai.

- Yeh pattern market mein reversal aur bearish trend continuation ka indication deta hai.

**2. Pattern Ki Formation**

- **Candle Formation:**

- **First Candle:** Yeh candle ek long black (red) body hoti hai jo previous candle ke closing ke niche close hoti hai.

- **Second Candle:** Yeh bhi ek long black (red) body hoti hai jo pehli candle ke body ke andar open hoti hai aur neechay close hoti hai.

- **Third Candle:** Yeh bhi ek long black (red) body hoti hai jo doosri candle ke body ke andar open hoti hai aur neechay close hoti hai.

- **Pattern Characteristics:**

- Teeno candles ka open price high aur close price low hota hai, aur teeno candles ka body clear aur significant hota hai.

- Candles ke beech mein gap nahi hota, ya gap minimal hota hai.

**3. Pattern Ka Significance**

- **Bearish Reversal Signal:**

- Pattern ke formation ka matlab hai ke market mein bearish sentiment prevalent hai aur price ne continuously lower lows banaye hain.

- Yeh pattern market ki upward trend ko bearish trend mein convert karne ka indication deta hai.

- **Trend Confirmation:**

- Pattern tab confirm hota hai jab third black crow ke baad price lower level ko continue karti hai aur volume increase hota hai.

**4. Trading Strategy Using Three Black Crows**

- **Entry Points:**

- Entry point tab consider kiya jata hai jab third black crow ke close ke baad price further decline karti hai.

- Stop loss ko pattern ke peak ke upar set kiya jata hai taake price ke reversal se bach sakte hain.

- **Take Profit:**

- Take profit targets ko previous support levels aur market conditions ke hisaab se set kiya jata hai.

**5. Risks Aur Limitations**

- **False Signals:**

- Kabhi-kabhi pattern false signals bhi de sakta hai, jise confirm karna zaroori hai.

- Yeh pattern short-term aur medium-term trends ko indicate karta hai, lekin long-term trends ko accurately predict nahi kar sakta.

- **Market Conditions:**

- Market conditions aur external factors, jaise economic news aur events, pattern ki effectiveness ko affect kar sakte hain.

**6. Validation Techniques**

- **Volume Analysis:**

- Volume ko analyze karke pattern ki strength ko validate kiya ja sakta hai. High volume ke saath pattern zyada reliable hota hai.

- **Additional Indicators:**

- Technical indicators, jaise RSI aur MACD, ko use karke pattern ke signals ko confirm kiya ja sakta hai.

**7. Practical Application**

- **Suitable Markets:**

- Three Black Crows pattern forex, stocks, aur commodities markets mein use kiya ja sakta hai.

- Market ki volatility aur liquidity ko consider karke pattern ki analysis ki jati hai.

**8. Pattern Ki Educational Importance**

- **Trend Analysis:**

- Three Black Crows pattern market trends aur price action ko samajhne mein madad karta hai.

- **Technical Analysis Skills:**

- Is pattern ka study technical analysis skills ko enhance karta hai aur trading decisions ko improve karta hai.

Three Black Crows pattern bearish reversal aur trend continuation ka powerful tool hai. Accurate pattern recognition, volume analysis, aur additional confirmation techniques se traders effective trading decisions le sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 10:48 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим