Hammer candlestick in trading

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

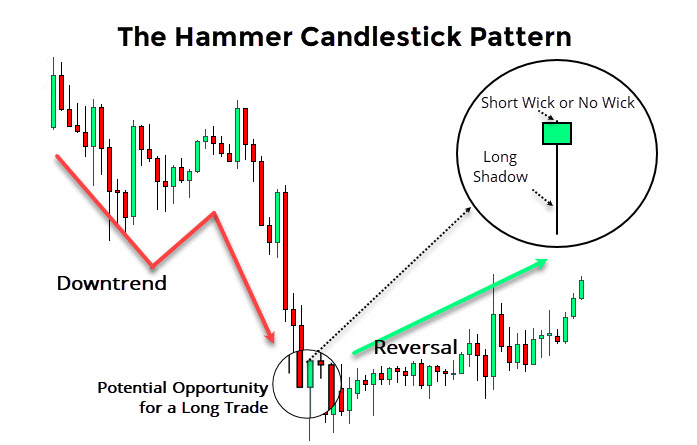

Hammer candlestick in trading maliyati tijarat mein, aik hathora candle stuck aik takneeki tajzia ka namona hai jo market mein mumkina rujhan ko tabdeel karne ka ishara day sakta hai. hathora candle stuck patteren ki shanakht aik lambay nichale saaye aur candle stuck ke oopri hissay ke qareeb waqay aik chhootey se asli jism se hoti hai. patteren ko is ka naam hathoray se mushabihat se mila, jis mein lamba nichala saya hathoray ke handle ki numaindagi karta hai aur chhota asli jism hathoray ke sir ki numaindagi karta hai. hathora candle stuck ka lamba nichala saya is baat ki nishandahi karta hai ke market ikhtitami qeemat ke muqablay mein numaya tor par kam khuli, lekin kharidaron ne qadam barha kar qeemat ko wapas dhakel diya. is se zahir hota hai ke nichli satah par kharidari ka numaya dabao hai, jo is baat ki alamat ho sakti hai ke market –apne rujhan ko tabdeel karne wali hai. hathora ka chhota asli jism is baat ki nishandahi karta hai ke khredar qeemat ko din ki oonchai ke qareeb band karne ke qabil thay, jo ke taizi ki alamat hai. tajir mumkina rujhan ke ulat jane ki tasdeeq ke liye deegar takneeki isharay ke sath mil kar hathoray ki shammen talaash karte hain. misaal ke tor par, agar hathora candle stuck kaleedi support level ke qareeb banti hai, to yeh is baat ki nishandahi kar sakta hai ke khredar qadam badhaane aur qeemat ko buland karne ke liye tayyar hain. hathoray ke patteren ki tasdeeq karne ke liye tajir dosray taizi ke isharay, jaisay barhatay hue hajam ya rsi isharay mein taizi ka farq bhi talaash kar satke hain. yeh note karna zaroori hai ke hathoray ki candle stick –apne tor par aik qabil aetmaad signal nahi hai aur usay dosray takneeki tajzia tools ke sath mil kar istemaal kya jana chahiye. taajiron ko bhi ghalat signals se aagah hona chahiye, jahan aik hathora candle stuck ban sakti hai lekin qeemat isi simt mein jari rehti hai. khulasa tor par, aik hathora candle stuck aik taizi ka namona hai jo market mein mumkina rujhan ko tabdeel karne ka ishara day sakta hai. taajiron ko patteren ki tasdeeq ke liye deegar takneeki tajzia tools ka istemaal karna chahiye aur ghalat signals se aagah hona chahiye . -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

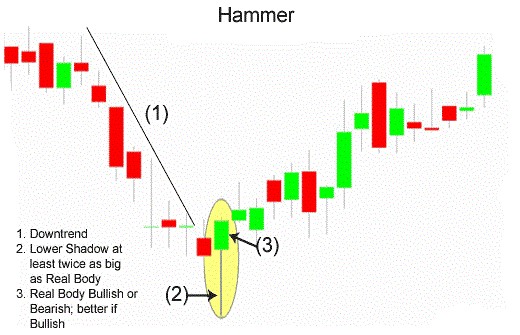

Hammer candlestick in trading arrey traders, is isqab mein, aasaan trading tips par wapas anay ka khirmqdm karte hain, hum sekhen ge ke kis terhan perfect himr candle stuck patteren ko pehchanana hai. himr candle stuck patteren aik taizi se reversal candle stuck patteren hai jo aik haqeeqi hathoray ki terhan lagta hai ,kyunkay is ka nichala hissa mom batii ke oopar lamba aur chhota jism hai ,jahan nichala saya is ke asal jism se kam az kam do gina hota hai.hathora candle stuck patteren aik taizi se reversal candle stuck patteren hai jo neechay ke rujhan ko oopri rujhaan par chhupa sakta hai ,lekin tamam himr candle stuck patteren down trained ko up trained mein tabdeel nahi kar satke hain. sirf 100 % kaamil himr patteren down trained ko up trained mein tabdeel kar sakta hai. aaj hum sekhen ge ke 100 % kaamil himr candle stuck patteren ki shanakht kaisay ki jati hai, to aayiyae setaaray bantay hain .jab hathora mom batii down trained ke nichale hissay mein waqay hoti hai, to ziyada tar tajir sikyortiz kharedtay hain aur tijarat se munafe haasil karte hain. woh sirf is waqt momi bana satke hain jab patteren 100 % perfect hojaye. aayiyae un halaat par aik nazar daaltay hain jo 100 % perfect hathora candle stuck se hoti hain. Number 1 : nichli taang ke sath aik chhota sa sabz jism hona chahiye. taang jism ke size se kam az kam dugna honi chahiye . Number 2 : jaisa ke tasweer mein dekhaya gaya hai, aik choti oopri taang honi chahiye . Number 3 : jaisa ke tasweer mein dekhaya gaya hai, aik choti oopri taang honi chahiye . aayiyae hathoray candle stuck ki kamyabi ke feesad ki chand misalein dekhte hain. yeh 100 % kaamil hathora hai kyunkay is patteren mein tenu sharait hain, is liye is patteren ki kamyabi ki sharah taqreeban 90 % hai .taqreeban 90 % kamyabi haasil karne ke liye, aap ko koi dosra tool istemaal karna chahiye jaisay ke support ya over sealed zonz bollinger baind, moving average waghera .yeh bhi aik perfect hathora hai, sab kuch aik jaisa hai lekin aik choti oopri taang honi chahiye jo yahan nahi hai, lehaza is patteren ki kamyabi ki sharah taqreeban 75 % hai. yeh candle stick bhi aik jaisi hai, lekin candle stuck ki oopri taang zaroorat se thora sa lamba hai, is liye is patteren ki kamyabi ki sharah bhi taqreeban 75 % hai .yeh bhi wohi hai, lekin koi haqeeqi body nahi hai lekin is patteren ki kamyabi ki sharah taqreeban 80 feesad hai, behtareen nateeja haasil karne ke liye, hum is patteren ko sirf is waqt istemaal karte hain jab kam az kam teen ya is se ziyada surkh mom btyon ke baad hathora bantaa hai . -

#4 Collapse

aagah hona chahiye, jahan aik hathora candle stuck ban sakti hai lekin qeemat isi simt mein jari rehti hai. khulasa tor par, aik hathora traffic light aik taizi ka namona hai jo pasar mein mumkina rujhan ko tabdeel karne ka ishara day sakta hai. taajiron ko patternen ki tasdeeq ka liye deegar takneki taziya tools ka tajaaal karna chahiye aur galat signals se agah hona -

#5 Collapse

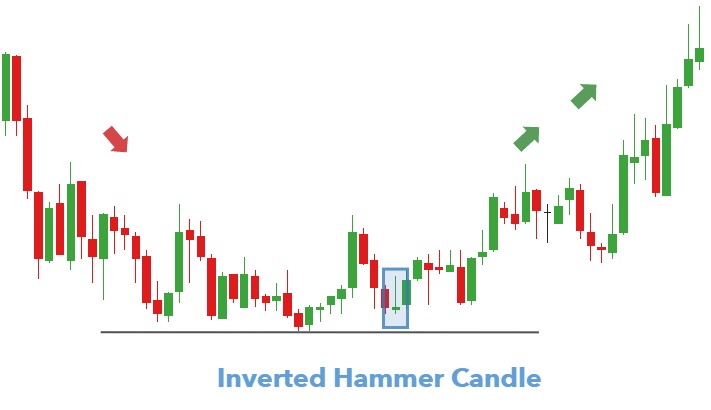

Assalamo Alaekum friends. Kasy hain ap sabMain umed karta hon ap sab bilkul thek thak hon gay. Aj ka jo topic zer e behs hay uska nam hammer candlestick patterns hay . Yeh hamen kia btayega r kia information deta hay yeh dekhty hain. Yeh hamen kia kuch btaya hay yeh ab ham agy mazeed dekhty hain. Built In of Hammer Candlistic Pattern Forex trading mein Inverted Hammer aur Hammer Candle Patterns ki importance kaafi zyada hoti hai. Ye dono candle patterns market trend ka reversal signal dete hain jiski wajah se traders inka istemal karke faidamand trading ke hikmat amli karte hain. Benefits of Hammer Candlistic Pattern Inverted Hammer aur Hammer Candle Patterns ka use karke traders market ki trend ka pata laga sakte hain aur us trend mein hone wale reversal ka pata laga sakte hain. Isi wajah se traders in patterns ko apni trading kay.doran bht zeada ehtyat kay liye istemal karte hain.Inverted Hammer Candle Pattern aam tor par bearish trend kay akhir mein ya trend ki peak par paya jata hai aur bullish trend ki shuruat ka signal deta hai. Jabke Hammer Candle Pattern aam tor par bullish trend kay akhir mein ya trend ki bottom par paya jata hai aur bearish trend ki shuruat ka ishara deta hai.Lekin is baat ka khayal rakhna zaroori hai ke ye patterns aik mukamal tejartii sargarmi nahin hain. In patterns kay sath, traders ko market k tajziya aur trading indicators ka use karna chahiye aur unhe apni trading k sary fesly s kay liye karna chahiye. Isi tarah se traders ye patterns apni routin jo roz marah ke hay mein iska istemal kr kay wh faida kar sakt hain is liye bht se nuqsanat kia hay wh yeh b smjh kar le sakte hain. -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Hammer Candlestick Pattern: A Powerful Tool in Trading Hammer candlestick pattern is a popular technical analysis tool used by traders to identify potential trend reversals and make informed trading decisions. Derived from Japanese candlestick charting techniques, the hammer candlestick pattern is characterized by a distinctive shape resembling a hammer, hence the name. hammer candlestick pattern is referred to as "Hammer Mombatti Ka Pattah" or simply "Hammer Pattah." Let's explore the characteristics, interpretation, and trading strategies associated with this pattern in the context of trading terminology. Hammer Mombatti Ka Pattah: Hammer mombatti ka pattah aik aham technical analysis ka tareeqa hai jisay traders istemaal karte hain taakey potential trend reversals ko pehchaan saken aur samajhdaar trading decisions le saken. Hammer candlestick pattern, Japanese candlestick charting techniques se mutasir hokar bana hai aur iski khaas pehchaan hammer ki shakal jaisi hoti hai, isliye isay hammer candlestick pattern kehte hain. Hammer mombatti ka pattah, yaad rahe ke Roman Urdu mein "Hammer Mombatti Ka Pattah" ya sirf "Hammer Pattah" kehte hain. Chaliye is pattern ke khaas pehchaan, samajhna aur trading strategies ko Urdu trading terminology mein explore karte hain. Hammer Mombatti Ka Pattah Ki Khaasiyat: Hammer mombatti ka pattah ko samajhne ke liye, uski khaasiyat aur pehchaan ko acche se samajhna zaroori hai. Is pattern ki pehchaan kuchh khaas attributes se hoti hai: 1. Shape (Shakal): Hammer mombatti ka pattah ki shakal mombatti ya hammer ki tarah hoti hai, jahan handle (danda) ki tarah patli body hai aur top (sarhad) pe lambi choti wali shadow hoti hai. 2. Single Candle (Ek Mombatti): Hammer mombatti ka pattah single candle pattern hota hai, yani ke sirf aik mombatti se banta hai. 3. Body Position (Body Ki Position): Is pattern mein mombatti ki body candle ke neechay ki taraf hoti hai. 4. Lower Shadow (Neechay Ki Shadow): Hammer mombatti ka pattah mein body ke neechay ki taraf lambi shadow hoti hai, jise lower shadow kehte hain. Hammer Mombatti Ka Pattah Ki Tashkeel aur Tashrih: Hammer mombatti ka pattah ki tashkeel aur tashrih samajhne se aap isay theek se interpret kar sakte hain. Is pattern ki tashkeel mein kuchh ahem cheezain shamil hoti hain: 1. Body Size (Body Ka Size): Hammer mombatti ka pattah mein body ka size chhota hota hai, jo bullish ya bearish trend ke according vary kar sakta hai. 2. Lower Shadow (Neechay Ki Shadow): Hammer mombatti ka pattah mein body ke neechay ki taraf lambi shadow hoti hai, jo body size se 2-3 guna lambi hoti hai. 3. Upper Shadow (Uper Ki Shadow): Is pattern mein upper shadow ki lambai kam hoti hai ya bilkul na hoti hai. -

#7 Collapse

Forex trading mein candlestick patterns ka istemal price movements aur market trends ko samajhne ke liye kiya jata hai. Ek aisa candlestick pattern hai jo traders ki attention mein hota hai, jise Hammer kehte hain. Hammer candlestick pattern ko dekh kar traders ko price movements aur market ki direction ka pata chal jata hai. Hammer pattern ka bunyad asal mein Japanese candlestick charting technique par hota hai. Is technique mein market ki price movements aur trend ko samajhne ke liye different candlestick patterns ka istemal kiya jata hai. Candlestick patterns market ki price action ko depict karte hain, aur inki madad se traders ko market ke future movements ka pata chalta hai. Hammer pattern ek bullish reversal pattern hai jo market mein price trend ko reverse karne ki possibility deta hai. Is pattern ko identify karne ke liye, traders ko pehle to candlestick chart par aik candlestick ko dekhna hota hai. Is candlestick ka shape hammer ki tarah hota hai, jis ki wajah se isay hammer pattern kehte hain. Hammer candlestick pattern ko identify karne ke liye, traders ko iske kuch key features par focus karna hota hai. Sab se pehle to is candlestick ka body kamzor hona chahiye, aur iska shadow kam se kam 2-3 times body ke size ka hona chahiye. Iske elawa, hammer pattern ke upper shadow zero ya near zero honi chahiye. Hammer pattern ko identify karne ke baad, traders ko iski confirmation ke liye price action aur volume ki madad se confirmatory signals ki talaash karni hoti hai. Agar price action aur volume ki taraf se confirmation a jata hai, to traders ko is pattern ke sath sath trading opportunities bhi mil sakti hain.

Hammer pattern ek bullish reversal pattern hai jo market mein price trend ko reverse karne ki possibility deta hai. Is pattern ko identify karne ke liye, traders ko pehle to candlestick chart par aik candlestick ko dekhna hota hai. Is candlestick ka shape hammer ki tarah hota hai, jis ki wajah se isay hammer pattern kehte hain. Hammer candlestick pattern ko identify karne ke liye, traders ko iske kuch key features par focus karna hota hai. Sab se pehle to is candlestick ka body kamzor hona chahiye, aur iska shadow kam se kam 2-3 times body ke size ka hona chahiye. Iske elawa, hammer pattern ke upper shadow zero ya near zero honi chahiye. Hammer pattern ko identify karne ke baad, traders ko iski confirmation ke liye price action aur volume ki madad se confirmatory signals ki talaash karni hoti hai. Agar price action aur volume ki taraf se confirmation a jata hai, to traders ko is pattern ke sath sath trading opportunities bhi mil sakti hain.  Hammer pattern ka use karne ke liye traders ko pehle to market ki trend ka pata karna hota hai. Agar market ki trend down trend hai, to traders hammer pattern ko buy entry ke liye use karte hain. Iske elawa, traders stop loss aur take profit levels bhi set karte hain, jis se unko apni trading positions ki safety aur profits ka pata chal jata hai. Lekin jaisa ke har trading methodology ke sath hota hai, hammer pattern ke bhi kuch limitations hain. Sab se bari limitation ye hai ke isay identify karna traders ke liye challenging ho sakta hai. Agar traders is candlestick pattern ko sahi tarah se identify nahi kar sakte to iski accuracy par asar par sakta hai. Iske ilawa hammer pattern ki accuracy bhi kuch had tak traders ki knowledge aur experience par depend karti hai. Agar traders isay sahi tarah se interpret nahi kar sakte, to iski accuracy par asar par sakta hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Hammer pattern ka use karne ke liye traders ko pehle to market ki trend ka pata karna hota hai. Agar market ki trend down trend hai, to traders hammer pattern ko buy entry ke liye use karte hain. Iske elawa, traders stop loss aur take profit levels bhi set karte hain, jis se unko apni trading positions ki safety aur profits ka pata chal jata hai. Lekin jaisa ke har trading methodology ke sath hota hai, hammer pattern ke bhi kuch limitations hain. Sab se bari limitation ye hai ke isay identify karna traders ke liye challenging ho sakta hai. Agar traders is candlestick pattern ko sahi tarah se identify nahi kar sakte to iski accuracy par asar par sakta hai. Iske ilawa hammer pattern ki accuracy bhi kuch had tak traders ki knowledge aur experience par depend karti hai. Agar traders isay sahi tarah se interpret nahi kar sakte, to iski accuracy par asar par sakta hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#8 Collapse

Hammer candlestick Details neechay ke rujhan mein, hammer candlestick aik taizi ke ulat patteren ke tor par banti hai. yeh dekhte hue ke is ki chouti ke qareeb aik chhota sa jism hai aur neechay ki taraf lamba saya ya batii hai, is ka naam hathora rakha gaya hai. himr candle stick patteren ki numaya khususiyaat darj zail hain : Appearance: Hammer candle stick, jo aksar khuli aur band qeematon ke darmain aik tang tijarti range ko zahir karti hai, candle stick ke oopri hissay mein thora sa haqeeqi body ( ya to taizi ya mandi ) hoti hai. oopar ka saya bohat kam hota hai aur neechay ka saya jism se kaafi lamba hota hai, aksar is ki lambai do ya teen gina ziyada hoti hai . Meaning: hammer patteren mein kami ke rujhan ke ulat jane aur kharidari ke dabao ki zahiri shakal ki paish goi ki gayi hai. is se zahir hota hai ke kharidaron ne mudakhlat ki aur ibtidayi farokht ke dabao ke baad qeemat ko wapas le liya, jis se numaya kam saya reh gaya. sab se oopar ki patli body is baat ki nishandahi karti hai ke farokht knndgan ne dobarah pehal karne ki koshish ki lekin neechay ki taraf dabao ko barqarar rakhnay mein nakaam rahay . Confirmation: tijarat karne se pehlay, tajir aksar himr patteren ki tasdeeq ke liye dekhte hain. izafi taizi ki mom batian, tijarti hajam mein izafah, ya izafi takneeki isharay ya chart patteren ka wujood jo taizi ke ulat jane ka mahswara dete hain, yeh sab tasdeeq ke tor par kaam kar satke hain Importance Of The Trend: hathora candle stick ka zahuur aik qaim mandi ke douran hota hai jab yeh sab se ziyada qabil aetmaad hota hai. is se pata chalta hai ke reechh khatam ho rahay hain aur aik mumkina rujhan tabdeel ho sakta hai. agar patteren taizi ya side way rujhan ke douran zahir hota hai, to is ki ahmiyat ko kam kya ja sakta hai . Stop-loss and Target Levels: mumkina nuqsanaat se bachao ke liye, himr patteren ka istemaal karne walay tajir –apne stap loss aardrz ko himr candle stuck ke kam se neechay rakh satke hain. munafe ke ahdaaf takneeki tajzia ke alaat ya tareekhi muzahmati sthon ka istemaal karte hue qaim kiye ja satke hain . Important Notes : yeh yaad rakhna bohat zaroori hai ke candle stuck ke makhsoos namoonay, jaisay hathoray, ko khud istemaal nahi kya jana chahiye. bakhabar tijarti intikhab karne ke liye, taajiron ko market ke umomi halaat, support aur muzahmat ki satah, aur tasdeeqi signals samait izafi anasir ko mad e nazar rakhna chahiye. mumkina nuqsanaat ko mehdood karne ke liye, rissk managment ki hikmat e amli bhi istemaal ki jani chahiye . -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Introduction of Hammer Pattern candlestick patterns ka istemal price movements aur market trends ko samajhne ke liye kiya jata hai. Ek aisa candlestick pattern hai jo traders ki attention mein hota hai, jise Hammer kehte hain. Hammer candlestick pattern ko dekh kar traders ko price movements aur market ki direction ka pata chal jata hai. Hammer pattern ka bunyad asal mein Japanese candlestick charting technique par hota hai. Is technique mein market ki price movements aur trend ko samajhne ke liye different candlestick patterns ka istemal kiya jata hai. Candlestick patterns market ki price action ko depict karte hain What is Hammer Candlestick Pattern Is pattern ko identify karne ke liye, traders ko pehle to candlestick chart par aik candlestick ko dekhna hota hai. Is candlestick ka shape hammer ki tarah hota hai, jis ki wajah se isay hammer pattern kehte hain. Hammer candlestick pattern ko identify karne ke liye, traders ko iske kuch key features par focus karna hota hai. Sab se pehle to is candlestick ka body kamzor hona chahiye, aur iska shadow kam se kam 2-3 times body ke size ka hona chahiye. Iske elawa, hammer pattern ke upper shadow zero ya near zero honi chahiye. Hammer pattern ko identify karne ke baad, traders ko iski confirmation ke liye price action aur volume ki madad se confirmatory signals ki talaash karni hoti hai. Agar price action aur volume ki taraf se confirmation a jata hai

What is Hammer Candlestick Pattern Is pattern ko identify karne ke liye, traders ko pehle to candlestick chart par aik candlestick ko dekhna hota hai. Is candlestick ka shape hammer ki tarah hota hai, jis ki wajah se isay hammer pattern kehte hain. Hammer candlestick pattern ko identify karne ke liye, traders ko iske kuch key features par focus karna hota hai. Sab se pehle to is candlestick ka body kamzor hona chahiye, aur iska shadow kam se kam 2-3 times body ke size ka hona chahiye. Iske elawa, hammer pattern ke upper shadow zero ya near zero honi chahiye. Hammer pattern ko identify karne ke baad, traders ko iski confirmation ke liye price action aur volume ki madad se confirmatory signals ki talaash karni hoti hai. Agar price action aur volume ki taraf se confirmation a jata hai  Treading aur Phchan krny ka trika Agar market ki trend down trend hai, to traders hammer pattern ko buy entry ke liye use karte hain. Iske elawa, traders stop loss aur take profit levels bhi set karte hain, jis se unko apni trading positions ki safety aur profits ka pata chal jata hai. Lekin jaisa ke har trading methodology ke sath hota hai, hammer pattern ke bhi kuch limitations hain. Sab se bari limitation ye hai ke isay identify karna traders ke liye challenging ho sakta hai. Agar traders is candlestick pattern ko sahi tarah se identify nahi kar sakte to iski accuracy par asar par sakta hai. Iske ilawa hammer pattern ki accuracy bhi kuch had tak traders ki knowledge aur experience par depend karti hai. ​

Treading aur Phchan krny ka trika Agar market ki trend down trend hai, to traders hammer pattern ko buy entry ke liye use karte hain. Iske elawa, traders stop loss aur take profit levels bhi set karte hain, jis se unko apni trading positions ki safety aur profits ka pata chal jata hai. Lekin jaisa ke har trading methodology ke sath hota hai, hammer pattern ke bhi kuch limitations hain. Sab se bari limitation ye hai ke isay identify karna traders ke liye challenging ho sakta hai. Agar traders is candlestick pattern ko sahi tarah se identify nahi kar sakte to iski accuracy par asar par sakta hai. Iske ilawa hammer pattern ki accuracy bhi kuch had tak traders ki knowledge aur experience par depend karti hai. ​

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 02:52 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим