Description of rounding top pattern.

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

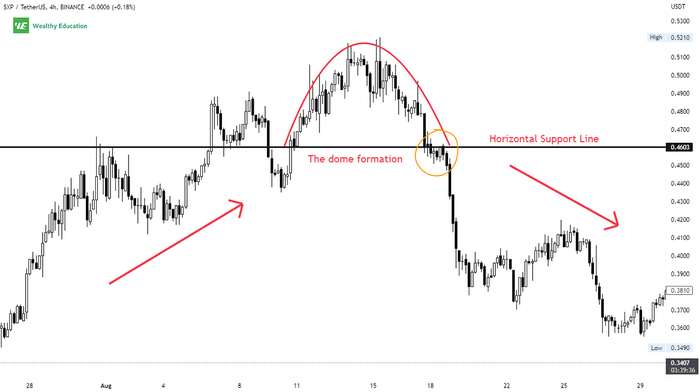

Riends forex marketplace mein Jab Ham buying and selling kar rahe hote hain to hamen is Baat Ka khyal rakhna chahie ke hamen foreign exchange ki basic requirements jo hain method fundamental knowledge hai oss ka pata hona chahie.Aur jab Ham yah samajh jain ke hum ko un sub fundamental factors Ka pata lag Gaya hai Jo trading karne mein hamen principal beneficial data dy sakty Hain,uske baad hello ham eik useful trading kar sakte hain.Agar dekha jaaye to rounding top sample ek bearish reversal chart sample hai joker ek down fashion in step with appear hota hai.Yah pattern rate action mein ek long time reversal ko suggest karta hai.Buying and selling ma oftely aesi stage ati hai jb market ik resistance k andar stuck ho jati hai or trader ko pata chal jata hai ok ye market ki remaining resistance hai or marketplace bar bar es sy hit kar okay wapas ah jati hai. Trader ko es time par sell ki trade open kar leni chahe. Jo dealer es time par sell ki alternate open karta hai wo hamesa kamyab ho jata hai.Yeh bhout acha threat hota hai ok es ma agr small lot sy b change open ki jae to trader ko hamesa acha advantage hasil ho jata hai.Forestall-loss Ko rounding begin or cease point ko milane se jo line Banti Hai Isko r DESCRIPTION OF ROUNDING TOP PATTERN. Respected buyers forex market mein rounding top pattern ki bhout significance hoti hy.Ess sample ki help sy ap market ky trend ki path ko without difficulty discover kerky buying and selling ker sakty heinaur earnings bi ly sakty hein. Jab aap marketplace mein guide degree aur resistance degree in line with one of a kind styles ko take a look at kar rahe hote hain tu ess sample mein aapko Hamesha marketplace mein eik sturdy uptrend Milta Hai jismein help stage sy marketplace ki motion begin hoti hai aur resistance stage ko touch karne ky baad in keeping with help degree ki taraf aati hai aur iski shape u formed hoti hai. Ismein aapko a couple of trades mil sakti hai ismein aapko selling aur shopping for se bahut hi ideal opportunities mil rahi Hoti Hai Jin Se aap maximum benefits Hasil kar sakte hain.Rounding top pattern ko clearly understand Karte Hain To ismein aapke technical analysis bahut hi best ho sakte hain aur aapko bahut jyada benefits mil sakte hain aap Sabhi earnings ko boom kaise karte hain lekin is Patra ko aap hi bahut hi carefully aur attentively apni traded for follow karna hota hai in any other case aapke liye bahut zyada trouble ho sakte hain.Aur ess ky end result mein trade large loss mein bi ja sakti hy. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamu Alaikum Dosto!Round Top Candlestick Pattern

Round top candlestick pattern trading mein use hone wale bohat sarey patterns mein se ek hai. Round top candlestick pattern ko "Bowl" ya "U-shaped" pattern bhi kaha jata hai. Ye pattern bullish trend ke baad trend reversal ke liye use hota hai. Round top candlestick pattern forex market me use hone wale technical analysis tools mein se aik hai. Is pattern ko candlesticks ki formation ko dekh kar recognize kiya jata hai. Is pattern ka main maqsad trend reversal ko predict karna hai, yani ke bullish trend ko bearish trend mein convert hona. Round top candlestick pattern ko bhi "dome top" ke naam se bhi jana jata hai. Round top candlestick pattern ki formation candlesticks ki movement se banti hai. Is pattern mein price initially up-trend se jata hai aur phir kam hona shuru ho jata hai. Jab price apne peak pe pohanchta hai, to iske baad bearish candlesticks ki formation shuru ho jati hai aur price neechay jata hai. Agar is pattern ki formation sahi tareeqe se banti hai to ye trend reversal ka indication deta hai.

Rounding top pattern ek bearish reversal pattern hai jo ek zahir uptrend ke doran hota hai. Isko ek silsila ke price movements se pehchana jata hai jo ek neeche ki taraf murta curve banate hain, jahan curve ke tops keemat mein dhire dhire kami hoti hai. Ye pattern lambi muddat tak ki price movement mein palatne ka ishara kar sakta hai aur isko banne mein kai din ya saalon tak lag sakta hai.

Ye pattern ek dhire dhire keemat mein izafa ke sath shuru hota hai, phir ek consolidation period aata hai jahan keemat dhire dhire ghatne lagti hai, jo rounding top ko banata hai. Ye pattern tasdeeq ho jata hai jab keemat apne support level, jise neckline kehte hain, se guzar jati hai. Neckline wo low points ke darmiyan kheench jata hai jahan pehle se market ko guzarne mein mushkil hoti hai.

Rounding top pattern aksar ek lambi door ke upward trend ke ikhtitam par milta hai aur lambi muddat ke price movements mein palatne ka ishara kar sakta hai. Ye ek inverse saucer pattern ki tarah hota hai aur ek double-top ya triple-top price pattern ke sath ho sakta hai. Ye pattern aksar technical analysis mein istemal kiya jata hai taake price chart mein potential reversal points ko pehchana ja sake.

Rounding top pattern ko trade karne ke liye, traders aksar keemat ko neckline ke neeche bandhne ka intezar karte hain pehle dakhil hone se pehle. Stop-loss order neckline ke upar rakha jata hai kyun keemat breakout ke baad is level ko test kar sakti hai. Take-profit level pehle keemat aur neckline ke darmiyan fasla nap karke usi keemat ko neckline ke neeche istemal karke tay kiya jata hai.

Mehsoos kiya jana chahiye ke chart patterns koi guarantee nahi hote aur unhe becham technical indicators ke sath istemal kiya jana chahiye taake sell signal ko tasdeeq kiya ja sake. Traders neckline ke neeche breakout ke doran trading volume mein izafa dekh sakte hain sell signal ko tasdeeq karne ke liye.

Candles Formation

Round top candlestick pattern ki formation candlesticks ki movement se banti hai. Is pattern mein price initially up-trend se jata hai aur phir kam hona shuru ho jata hai. Jab price apne peak pe pohanchta hai, to iske baad bearish candlesticks ki formation shuru ho jati hai aur price neechay jata hai. Pattern me candlesticks ki formation darja zel tarah se hoti hai:- Initial Candles: Round top candlestick pattern ki aghaz wali candlesticks bullish hoti hai, aur ye candles miqdar me aik se ziada hi hoti hai, jo lagatar aik fosre k baad musalsal banti hai. Ye candles long real bodies me hoti hai, jo k market me pehle se maojood bullish trend ki alamat hoti hai.

- Central Candles: Round top candlestick pattern ki central candlestick mukhtalif formation ki ho sakti hai q k ye aik round shap me banne wala pattern hai, iss waja se pattern me candlesticks bullish, bearish aur doji candlestick ho sakti hai. Ye candles market me waqfa create karti hai, jiss se prices kuch waqat k leye ruk jati hai. Ye candles ziada tar small real body me bnati hai.

- Final Candles: Round top candlestick pattern ki last candles trwnd reversal ki alamat hoti hai, jiss me candlestick ki formation yakdam tabdeel ho jati hai. Ye candles real body me bearish hoti hai, jo k market k sabeqa trend ko tabdeel karnw ka zarya banti hai. Ye candles ya to long real body me bearish banti hai aur ya ye candlestick small real body wali se mel kar banti hai.

Reversal Identification & Explaination

Round top candlestick pattern ko samajhna bohat zaroori hai. Is pattern ko identify karna bohat zaroori hai kyunke is ki wajah se trader apni trading decisions par farq padta hai. Round top candlestick pattern ki formation ki tafseel samajhna bhi zaroori hai kyunke is se trading decisions par farq padta hai. Is pattern ki madad se traders ko trading mein help mil sakti hai. Agar trader ne round top candlestick pattern ko identify kar liya hai to woh apni positions ko close kar sakta hai. Round top candlestick pattern ki formation bohat asan hai. Is pattern ki formation mein market ka trend up hota hai, jab market apni peak ko reach karta hai to price range high point se decrease karna shuru karta hai. Is decrease ki wajah se candlesticks round top shape banate hain. Ye pattern 3 se 6 candlesticks tak banta hai. Jab round top shape ban jata hai to trend reversal ki wajah se price range down hone lagta hai. Round top candlestick pattern ki formation ko samajhna bohat zaroori hai kyunke is se trading decisions par farq padta hai.

Rounding top pattern ek bearish reversal pattern hai jo ek uptrend ka ikhtitam aur ek downtrend ka shuru hone ka ishara deta hai. Isko ek asset ki keemat mein lambi muddat tak izafa ke sath banaya jata hai, phir keemat mein dhire dhire curve ya "saucer shape" hota hai jo ek ulta katori ya "U" shape ki tarah hota hai. Ye pattern aksar ek uptrend ke ikhtitam par paya jata hai aur market ke jazbat mein bullish se bearish ki taraf shift hone ka ishara kar sakta hai.

Rounding top pattern ko pehchane ke liye, traders lambi muddat tak keemat mein izafa ko dekhte hain phir keemat mein dhire dhire curve ya "saucer shape" ko jo ek ulta katori ya "U" shape ki tarah hota hai. Ye pattern aksar jab keemat apne support level ko todta hai, jise neckline kehte hain, tab tasdeeq hota hai. Neckline ko un low points ke darmiyan kheench kar banaya jata hai jahan pehle se market ko guzarne mein mushkil hoti hai. Is level par ek horizontal line draw karke, traders ko mumkinah price movement ko behtar tor par samajhne aur mumkinah market reversals ka intezar karne mein madad milti hai.

Rounding top pattern mukhtalif timeframes mein mukhtalif assets jaise forex, stocks, ETFs, index, cryptocurrency, aur commodity mein paya ja sakta hai. Rounding top pattern ko trade karne ke liye, traders aksar keemat ko support level ke neeche tezi se tootne ka intezar karte hain. Breakout ko behtar taur par unchai trading volume ke sath hona chahiye, kyun ke is se tasdeeq hoti hai ke is karkardagi ke peeche ahem farokht dabaav hai. Traders jab keemat support level ke neeche toot jati hai, tab ek short position mein dakhil ho sakte hain, jisme stop loss ko resistance level ke upar rakha jata hai. Nafa ki had ko rounding top ki unchai ke hisab se tay kiya jata hai, ummeed hai keemat kam se kam ishi unchai ke hisab se chalaygi breakout ki taraf.

Rounding top pattern ek rounding bottom pattern ka ulta hai, jo ek downtrend se uptrend ki taraf hone wale tabdeeli ka ishara deta hai. Rounding bottom pattern ek "U" shape ke roop mein dikhta hai aur isko banaya jata hai jab keemat ek kam point tak pohanchti hai, consolidate hoti hai, aur phir dhire dhire se phir se barhti hai. Iske support ke bajaye, traders ek resistance dekhte hain, jo ek horizontal line se banaya ja sakta hai jo rounding bottom ke do ya zyada unchi points ko jodte hue banai jati hai.

Rounding top aur inverted cup and handle formations pehli nazar mein ek jaise lag sakte hain, lekin unmein farq hota hai jo traders ko bhoolne se bachana chahiye. Rounding top ek bearish reversal pattern hai, jabki inverted cup and handle typically ek bearish continuation formation hota hai. Inverted cup and handle pattern mein handle ka mojood hona ek ahem pehchan karne wala factor hai.

Rounding top pattern ko istemal karke potential bearish reversals ko pehchanne ke liye lambi muddat tak keemat mein izafa ke sath ek dhire dhire curve ya "saucer shape" ko dekha jata hai jo ek ulta katori ya "U" shape ki tarah hota hai. Ye pattern aksar jab keemat apne support level ko todta hai, jise neckline kehte hain, tab tasdeeq hota hai. Neckline ko un low points ke darmiyan kheench kar banaya jata hai jahan pehle se market ko guzarne mein mushkil hoti hai. Is level par ek horizontal line draw karke, traders ko mumkinah price movement ko behtar tor par samajhne aur mumkinah market reversals ka intezar karne mein madad milti hai.

Trading

Round top candlestick pattern par trading karna bohat zaroori hai. Is pattern ki madad se trader trend reversal ko samajh sakta hai. Agar trader ne round top candlestick pattern ko identify kar liya hai to woh apni positions ko close kar sakta hai. Is pattern ki wajah se trader ko kafi profit ho sakta hai. Round top candlestick pattern se related indicators ki madad se traders ko trading ke liye help mil sakti hai. Agar trader ko ye pattern samajh mein a jata hai to woh is ki madad se apni trading ko improve kar sakta hai. Pattern k baad lazmi aik confirmation candle ka hona zarori hai, jo k real body main bearish candle honi chaheye q k ye aik strong bearish trend reversal ka signal hota hai. Pattern ki trend reversal ki confirmation indicators se bhi li ja sakti hai, jis par indication overbought zone me hona chaheye. Kuch aam strategies jo rounding top pattern ke sath bearish market mein trading ke liye istemal ki jati hain:- Intezar ka Intezar: Rounding top pattern par trade karne se pehle wazeh signals ka intezar karna ahem hai. Mishrit volumes ke sath breakout par trade karne se bachen aur amal ke liye pattern ki tasdeeq kiya jaye.

- Sabr aur Khatarnaak Idara: Rounded tops par trading munafa dila sakti hai, lekin is mein sabr aur ehtiyaat ki zaroorat hoti hai. In patterns par trading karte waqt ehtiyaat aur sabr baratna zaroori hai, aur hamesha trading plan ko amal mein lana chahiye taake nuksan se bachne ke liye emosional faisley nahi liye jaen.

- Stop Loss Orders ka Istemal: Apne maal ko mehfooz rakhne aur nuksan ko kam karne ke liye stop-loss orders ko amal mein lana zaroori hai agar trade aapke khilaf jaati hai. Risk ko effectively manage karne ke liye resistance level ke upar ek stop loss lagana madadgar ho sakta hai.

- Munafa Ki Ginti Karna: Jab market aapke faiday mein chalta hai, to trend ka ulta hone se pehle kuch munafa bandhne ka ghoor karen. Mumkinah ulta mein unhe nuksan hone ke bajaaye faiday ko mehfooz karna ahem hai.

- Ghaltiyon Se Seekhna: Trader ke taur par kamyabi ghaltiyon se seekhne aur apne hunar ko waqt guzarne ke saath behtar banane se aati hai. Apne trades ka tajziya karen, sudhar ki jagaon ko pehchanein, aur unhi ghaltiyon ko dohrane se bachen.

- Trend Ke Sath Trading Karna: Rounding top pattern istemal karte waqt trend ke saath trade karna mashoor hai aur us ke khilaf nahi. Iska matlab hai ke jab keemat formation ke niche pohanchti hai aur neckline ko tor kar niche jaati hai, to bearish trend ke saath milte hue chhoti trades ke setups ki talash karna.

- Technical Indicators Ka Istemal Karna: Rounding top pattern ki tasdeeq ko technical indicators aur doosre tools ka istemal karke karna. Sell signal ki tasdeeq karne ke liye neckline ke neeche breakout mein trading volume mein izafa dhoondhein aur apne trading faisley ki aitmad ko barhayein.

- Munafa Ki Nishaandahi Karna: Rounding top pattern ki unchai ke hisab se munafa ki nishaandahi karen. Ummeed hai keemat kam se kam ishi unchai ke hisab se chalaygi breakout ki taraf. Ye aapko haqeeqati munafa ke maqasid ko tasleem karne mein madad karega aur apni trades ko effectively manage karega.

In strategies ka paalan karke, traders bearish market mein rounding top pattern ko tajziya karne aur risk ko manage karte hue munafa ke maqasid hasil karne ke liye tawajju kar sakte hain. -

#4 Collapse

Tajziati Rooshan: Rounding Top Pattern Ka Tafseeli Bayan

Introduction:

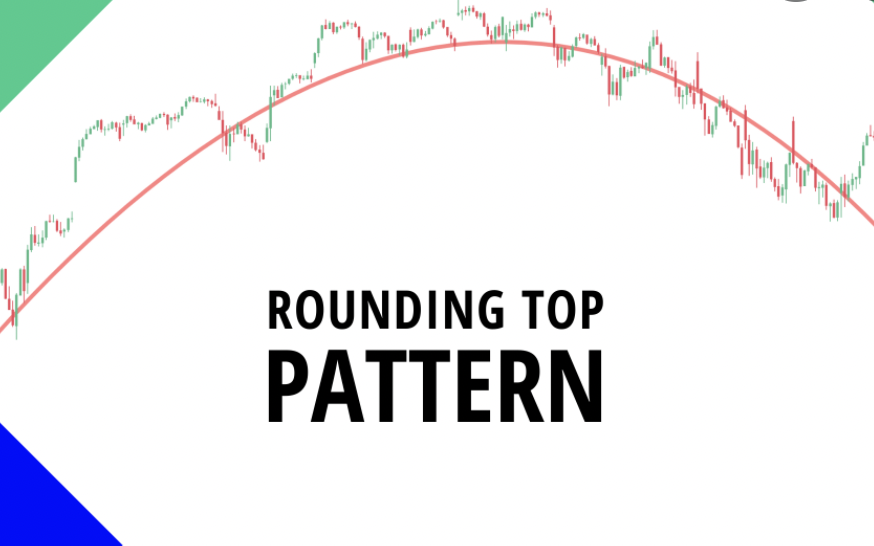

Rounding Top Pattern ek technical analysis tool hai jo ke stock market ya kisi bhi financial instrument ki price movement ko analyze karne ke liye istemal hota hai. Ye pattern bullish trend ke reversal ko indicate karta hai aur traders ko potential price decline ke baray mein agah karta hai.

Kya Hai Rounding Top Pattern?- Rounding Top Pattern ek chart pattern hai jo ke price action ke through represent hota hai.

- Ye pattern typically ek uptrend ke baad form hota hai aur price action ki gradual decrease ko darust karta hai.

Kaise Rounding Top Pattern Ko Pehchanein:- Price chart par dekhein ke price action gradual taur par kam hota ja raha hai.

- Price peaks rounded hote hain, matlab ke sharp peaks ki bajaye gradual curvature hoti hai.

- Volume bhi dekha jata hai, jismein ek gradual decrease hota hai, indicating weakening momentum.

Rounding Top Pattern Ki Takhleeq:- Price action ke sath sath, market psychology bhi is pattern ki takhleeq mein kirdar ada karta hai.

- Jab market participants gradually profit booking karte hain aur naye buyers ka interest kam hota hai, tab ye pattern ban sakta hai.

- Is pattern ki takhleeq mein generally kuch weeks ya months lag sakte hain, depending on the timeframe.

Rounding Top Pattern Ka Matlab:- Rounding Top Pattern ka matlab hota hai ke ek strong uptrend ke baad market ka sentiment change hone wala hai.

- Ye pattern bullish trend ke khatmay ko darust karta hai aur bearish trend ki shuruaat ko indicate karta hai.

- Is pattern ko samajh kar traders apni trading strategies ko adjust kar sakte hain aur potential price decline se bach sakte hain.

Trading Strategies with Rounding Top Pattern:- Short Selling Opportunities: Jab Rounding Top Pattern confirm ho jata hai, traders short selling ki strategies istemal kar sakte hain.

- Stop Loss Placement: Traders apni positions ko protect karne ke liye tight stop loss orders lagate hain, taake in case of unexpected price movements nuqsan kam ho.

Conclusion:

Rounding Top Pattern ek useful tool hai jo ke traders ko market ke price movements ke baray mein agah karta hai. Is pattern ko samajh kar, traders apni trading strategies ko refine kar sakte hain aur potential losses se bach sakte hain. Lekin, hamesha zaroori hai ke market ki overall context aur additional technical indicators ko bhi consider kiya jaye, taake sahi faislay kiya ja sake.

-

#5 Collapse

1. Introduction: Rounding Top pattern ek technical analysis pattern hai jo market charts par dikhai deta hai aur bearish reversal ka indication deta hai. Is pattern ka formation market mein ek potential trend change ko signify karta hai.

2. Formation: Rounding Top pattern ka formation market mein ek uptrend ke baad hota hai. Is pattern mein price gradually ek curve shape form karta hai jise ek "top" ya "crest" ke roop mein dekha ja sakta hai. Price ke gradual decline se ye pattern banta hai.

3. High Points: Rounding Top pattern ke formation ke doran price ke high points typically decline karte hain aur ek round shape banate hain, jisse is pattern ka naam mila hai. Yeh indicate karta hai ke uptrend ke momentum kam ho raha hai aur bearish pressure badh rahi hai.

4. Volume Analysis: Rounding Top pattern ke formation ke doran volume ka bhi analysis kiya jata hai. Agar price ke sath volume bhi decline kar raha hai, to ye pattern aur bhi reliable ho jata hai aur bearish reversal ka indication mazboot hota hai.

5. Trading Implications: Rounding Top pattern ka formation traders ke liye bearish reversal signal hota hai. Is pattern ko dekh kar traders apne long positions ko close kar sakte hain ya short positions enter kar sakte hain. Stop loss orders ka istemal karke aur sahi risk management ke saath, traders is pattern ka istemal karke profit earn kar sakte hain.

6. Confirmation: Rounding Top pattern ke confirmation ke liye traders ko doosre technical indicators ka bhi istemal karna chahiye. Jaise ke volume analysis, aur doosre bearish reversal patterns jaise ke Head and Shoulders pattern ya Double Top pattern.

7. Limitations: Rounding Top pattern ke bhi kuch limitations hote hain jaise ke ye pattern har samay 100% accurate nahi hota hai. Is pattern ke formation ke baad bhi market mein volatility ki wajah se false breakouts ho sakte hain. Isliye, traders ko is pattern ko confirmatory signals ke saath combine karke istemal karna chahiye.

8. Conclusion: Rounding Top pattern ek bearish reversal pattern hai jo market charts par dikhai deta hai aur traders ko bearish trend ke onset ka indication deta hai. Is pattern ko samajh kar traders apne trading decisions ko optimize kar sakte hain aur profit earn kar sakte hain. Lekin, sahi risk management aur confirmatory signals ka hona zaroori hai is pattern ke saath trading karte waqt.

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Description of rounding top pattern.

Rounding Top Pattern

1. Introduction: Rounding Top pattern ek bearish reversal chart pattern hai jo uptrend ke baad market ke trend ko reverse karne ki possibility ko darust karta hai. Is pattern ko sometimes "Saucer Top" bhi kaha jata hai.

2. Formation: Rounding Top pattern ka formation gradual hota hai aur ek extended period mein develop hota hai. Is pattern mein price slowly higher highs banata hai, lekin har high pe previous high se kam increase hota hai. Jab ye pattern complete hota hai, price mein ek plateau ya flat phase dekha jata hai, jisse ki ek rounded shape ban jati hai.

3. Interpretation: Rounding Top pattern bearish reversal ko suggest karta hai aur uptrend ki exhaustion ko darust karta hai. Is pattern mein bulls ki strength dheere dheere kam hoti hai aur bears ki dominance increase hoti hai, jo market ko neeche le jaane ki indication hai. Is pattern ke baad, market usually downtrend mein shift karta hai.

4. Trading Strategy: Traders rounding top pattern ko identify karne ke liye aur entry point determine karne ke liye aur technical indicators jaise ke volume, moving averages, aur oscillators ka istemal karte hain. Ek common trading strategy ye hoti hai ke jab rounding top pattern confirm hota hai, tab traders short positions lete hain ya existing long positions ko close karte hain. Stop loss orders ko set kiya jaata hai above the recent highs to limit losses agar trend reverse hota hai. Take profit levels ko set kiya jaata hai support levels ke neeche, jahan price ka next move expected hota hai.

5. Conclusion: Rounding Top pattern ek bearish reversal signal hai jo uptrend ke exhaustion aur trend reversal ko indicate karta hai. Traders ko is pattern ko sahi tarah se recognize karna aur confirm karna important hai taake accurate trading decisions liye ja sakein.

-

#7 Collapse

Forex Market Mein Round Top Candlestick Pattern:":":":

Forex market mein "Round Top" candlestick pattern ek prakaar ka bearish reversal pattern hai. Yeh pattern generally uptrend ke dauraan dekha jaata hai aur indicate karta hai ki uptrend khatam ho sakta hai aur market downward direction mein move karne wala hai.

Round Top pattern ek round shape ka candlestick formation hota hai jismein price initially up move karta hai, phir ek peak banata hai aur phir wapas downward direction mein move karta hai, jisse ek round shape ka pattern banta hai. Is pattern mein ek ya adhik bearish candlesticks hone ki possibility hoti hai, jo ki indicate karta hai ki buyers ki strength weak ho rahi hai aur sellers ki dominance increase ho rahi hai.

Forex Market Mein Round Top Candlestick Pattern Ke Characteristics:":":":

Round Top candlestick pattern ki mazeed characteristics aur interpretation:- Shape: Round Top pattern ki pehchaan ek round shape se hoti hai, jismein initial uptrend ke dauran price ek peak tak pahunchta hai, phir wapas downward direction mein move karta hai, jisse ek curve ya round shape banta hai.

- Volume: Is pattern ke formation ke samay volume ki bhi ek important role hoti hai. Agar price ke sath volume increase hoti hai, toh yeh pattern ki validity ko aur bhi strong banati hai. Agar volume decrease hoti hai, toh pattern ki validity kam ho jati hai.

- Confirmation: Round Top pattern ko confirm karne ke liye, traders aur investors ko price ke neeche break hone ki wait karni chahiye. Agar price round top pattern ke neeche break karta hai aur downtrend shuru hota hai, tab yeh pattern confirm hota hai.

- Target: Round Top pattern ka target usually us peak level ya phir uske neeche ke support levels ko point karta hai, jahaan se price downward move shuru hui thi.

- Stop Loss: Agar kisi trader ne round top pattern ko spot kiya hai aur use trading decision leni hai, toh woh apne trades ke liye stop loss lagakar apne risk ko manage kar sakte hain. Stop loss ko typically pattern ke opposite side ke breakout level ke just above place kiya jata hai.

-

#8 Collapse

Forex mein rounding top pattern

Rounding top pattern forex mein ek common chart pattern hai, jo aksar bearish trend ke indication ke taur par dekha jata hai. Is pattern mein, price action ek curve ke sath upar ki taraf move karta hai aur phir ek point par peak tak pahunchta hai. Iske baad, price action phir se curve banta hai aur downward direction mein move karta hai.ye aik common pattern h aur apko is k round about chlna chaye.

Explain round about

Is pattern ke baare mein jaankari hasil karne ke liye, aapko price action ki movement ko closely observe karna hoga. Agar aap dekhte hain ki price action ek curve banane ke baad ek peak point par pahunchta hai aur phir downward direction mein move karta hai, toh yeh pattern ban raha hai.is me apko moment k bary me pta chlta rhy ga k price khan up and down hk rhi h.ye apni price k sath sath indication b show krta rehtaa h.

Confirmation

Is pattern ki confirmatory signal aapko price action ke break below the support level dikhayi degi. Agar aap dekhte hain ki price action support level se break karke neeche move kar raha hai, toh yeh confirmatory signal hai ki bearish trend shuru ho chuka hai.is me apko iski value k uo down ka pta hna chaye.

Conclusion

Rounding top pattern ka use karke, aap forex mein trading strategy bana sakte hain. Agar aap is pattern ko samajh lete hain aur iske sath confirmatory signal ko bhi observe karte hain, toh aap market mein profitable trades kar sakte hain.

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Forex Trade Mein Ghoomte Hui Top Patter Ki Tafseelat

Tasveer-e-Aam:

Forex Trading Mein "Rounding Top Pattern" Ka Tazkira

Forex trading ek dynamic aur volatile market hai jahan traders currencies, commodities, stocks, aur indices ke darmiyan exchange karte hain. Technical analysis ek aham hissa hai forex trading ka jisme traders market ke past price movements aur patterns ko study kar future price movements ka andaza lagate hain. Rounding Top Pattern ek aham bearish reversal pattern hai jo traders ko market ke bearish reversals ko pehchanne mein madad karta hai. Jab price ek muddat tak barh raha hota hai aur phir gradual taur par girne lagta hai, to yeh ek potential Rounding Top Pattern ki nishandahi hoti hai.

Rounding Top Pattern Kya Hai? -

Samjhain Is Patter Ki Ahmiyat

Rounding Top Pattern ko samajhne ke liye traders ko price ke gradual girne ki wajah se banne wale curve shape par dhyaan dena chahiye. Is pattern mein price initially uptrend mein hota hai lekin phir gradual taur par girne lagta hai aur ek curve shape banata hai jise "rounding top" kehte hain. Jab yeh curve complete hota hai, yani price ek naye low tak gir chuka hota hai, to yeh ek potential reversal signal samjha jata hai jo ke bearish trend ki shuruaat ko darust karta hai.- Pehchan Karain:

- Rounding Top Pattern Ki Khaas Nishandahiyan

Rounding Top Pattern ko pehchanne ke liye traders ko chart par price ke gradual girne ki wajah se banne wale curve shape par dhyaan dena hota hai. Is pattern ke pehchanne ke liye traders ko volume ki bhi tafseelati nishandahi karni chahiye, kyun ke volume ki kami ya giravat is pattern ki tasdeeq karta hai. Traders ko yeh bhi dekhnay ki zaroorat hoti hai ke curve ke neeche volume ka kya scene hai, kyun ke ek strong reversal ke liye high volume chahiye hoti hai.

Samajhain:

Is Patter Ki Wajahain Aur Peshgoyaiyan

Rounding Top Pattern ka banne ka sabab market sentiment aur supply-demand dynamics mein tabdeeli hoti hai. Jab price ek muddat tak barh raha hota hai aur phir gradual taur par girne lagta hai, to yeh ek indication hai ke buyers ki taqat kamzor ho rahi hai aur sellers control mein aa rahe hain. Is tarah ka pattern dekh kar traders ko samajhna chahiye ke market ka trend badalne wala hai aur unhe apni trading strategy ko adjust karna chahiye. Yeh pattern bearish reversal ke potential ke saath saath ek powerful indicator hai.

Asal Usool:

Rounding Top Pattern Ki Mukhtasar Ta'aleem

Rounding Top Pattern ki mukhtasar ta'aleem yeh hai ke traders ko chart par ek curve shape dhoondhna hota hai jo price ke gradual girne ki wajah se ban raha hota hai. Is pattern ko samajhne ke liye traders ko price aur volume ke darmiyan ta'alluq ko bhi dekha jata hai. Is pattern ka istemal karne se pehle traders ko mukhtalif timeframes aur market conditions par tawajju deni chahiye taake sahi tafseeli analysis ki ja sake.

Peshgoyaiyan:

Kaise Rounding Top Pattern Ko Pehchanain?

Rounding Top Pattern ko pehchanne ke liye traders ko chart par price ke gradual girne ki wajah se banne wale curve shape par tawajju deni chahiye. Is pattern ke sath milta julta volume bhi dekha jana chahiye taake confirm kiya ja sake ke yeh ek sahi reversal pattern hai ya nahi. Agar volume ke sath sath price mein bhi giravat hai to yeh pattern aur bhi strong hota hai.

Trading Mein Istemal:

Rounding Top Pattern Ki Tadabeer

Rounding Top Pattern ko samajh kar traders apni trading strategy ko adjust kar sakte hain aur potential bearish reversals ko pehchan sakte hain. Jab yeh pattern confirm ho jata hai, to traders apne positions ko adjust karke ya new positions lekar market ke bearish movement ka faida utha sakte hain. Yeh pattern short-term aur long-term traders dono ke liye useful hai.

Nuqsaan Se Bachao:

Is Pattern Ki Ahmiyat Samajhain

Rounding Top Pattern ki samajh se traders nuqsaan se bach sakte hain aur market ke reversals ko pehchan kar apni positions ko protect kar sakte hain. Is pattern ko samajh kar traders apni risk management ko bhi behtar bana sakte hain aur apni trading decisions ko improve kar sakte hain. Is pattern ko ignore karna nuqsaan dayak ho sakta hai kyun ke yeh ek powerful reversal indicator hai.

Misaal-e-Amal:

Rounding Top Pattern Ki Amli Dastaras

Misaal-e-Amal ke taur par, agar ek trader ek currency pair ka chart dekh raha hai aur dekhta hai ke price ek muddat tak barh raha hai lekin phir gradual taur par girne lagta hai aur ek curve shape banata hai, aur is giravat ke doran volume bhi kam hoti hai, to yeh ek potential Rounding Top Pattern ki nishandahi ho sakti hai. Agar yeh pattern confirm ho jata hai, to trader apni positions ko adjust karke ya new bearish positions lekar is reversal ka faida utha sakta hai. Misaal-e-Amal par amal karne se pehle traders ko market ke mukhtalif factors aur indicators ko bhi madahne mein madadgar rehna chahiye.

Trading Mein Safalta:

Kaise Rounding Top Pattern Se Faida Uthain?

Trading mein safalta ke liye Rounding Top Pattern ki sahi samajh aur istemal zaroori hai. Traders ko is pattern ko pehchan kar apni trading strategy ko adjust karna chahiye aur market ke reversals ko pehchan kar apne faide ke liye istemal karna chahiye. Sahi risk management aur patience ke saath is pattern ka istemal karne se traders apni trading performance ko behtar bana sakte hain.

Risk Ka Ta'alluq:

Rounding Top Pattern Aur Khatarat

Rounding Top Pattern ko samajh kar trading karne wale traders ko bhi risk ka tawazun banaye rakhna zaroori hai. Is pattern ki galat interpretation ya fake signals ke samne bhi traders ko alert rehna chahiye taake woh apne nuqsanat ko minimize kar sakein. Sahi risk management ke saath traders ko apni positions ko monitor karte rehna chahiye taake unexpected market movements se nuqsaan se bacha ja sake.

Mufeed Mashwary:

Is Pattern Ko Istemal Karne Ke Tareeqe

Rounding Top Pattern ko istemal karne ke liye traders ko chart analysis ke saath sahi samajh aur tajurba ki zaroorat hoti hai. Is pattern ko sahi dhang se interpret karne ke liye traders ko market ke mukhtalif factors ko madahne mein madadgar rehna chahiye. Sahi tafseeli analysis aur research ke saath traders is pattern ko istemal karke apni trading performance ko behtar bana sakte hain.

Aakhri Kalaam:

Rounding Top Pattern Ki Zaroorat Aur Ehmiyat

Rounding Top Pattern ki samajh forex traders ke liye zaroori hai taake woh market ke reversals ko pehchan sakein aur apni trading decisions ko behtar bana sakein. Is pattern ko samajh kar traders apni trading strategy ko improve kar sakte hain aur market ke movements ko behtar taur par samajh sakte hain. Sahi tafseeli analysis ke saath traders ko patience aur discipline bhi maintain karni chahiye taake woh successful trading career ka faida utha sakein. -

#10 Collapse

DESCRIPTION OF ROUNDING TOP PATTERN DEFINITION

Rounding top ek price ka pattern hai Jo technical analysis Mein istemal Hota Hai iski identify Daily ki price ki movement Se Hoti Hai padhe Hue Upar ki taraf Trends ke end per Ek rounding top banta hai and price ka yah pattern long term price ki movement per reversal ki maloomat kar sakta hai rounding top ko pahchanne wale investor Upar ki taraf Trends wali price se niche ki taraf Trends wali price Mein trends main change ki expect Karte Hain Jab price badh rahi ho to volume aamtaur per sabse zyada Honge and sell off phase ke dauran Ek Aur unchai Ka experience kar sakte hain

WHAT IT TELLS INVESTORS

Change Ko Dekhkar traders ko profit Lene apne aap ko unfavorable market mein kharidne Se bachane ya short selling ke zarie falling price se Money kamane ki strategies banane ki allow milti hai Ek rounding top stock ke liye futures Mein Bearish Ka Manzar Pesh kar sakta hai rounding shape Jahan price ka trend high hota hai and Low Hota Hai support price ki level ki buniyad per Pai Jaati Hai Yeh Dobara resistance ko complete karta hai double top pattern Mein security ki price lagatar two ulta U Shakal Dikhai Degi in condition Mein investor Bearish Ka Shikar nahi hai

COMPONENT OF A ROUNDING TOP

And Fhir Bhi Rakhte Hai Ke security ki price Buland tareen levels per Rah sakti hai Kyunki buyers ne two Bar koshish Ki Hai yeah pattern us time Banta Hai Jab investor Bearish ke trend ke khilaf resistance karte hain aur jab vo resistance nahi karte aur pattern se bahar nikalna start kar dete Hain To vah Aisa Tezi se kar sakte hain peak resistance ki represent karti hai peak Ke Darmiyan pull back ko swing lows Kahate Hain technical analysis Ek price ki movement zahar karta hai aap Forex trading Mein acchi trade kar sakte hain

-

#11 Collapse

Rounding Top Pattern Ka Tazkirah

Heading: Rounding Top Pattern Kya Hai?

Rounding Top Pattern ek technical analysis chart pattern hai jo stock market mein dekha jaata hai. Is pattern mein price action ek curving shape banata hai jo ek upward trend ke baad aata hai aur ek potential trend reversal ko darshata hai. Chaliye is pattern ke mukhya features aur uske tajziya karte hain.

Mukhya Features:- Samaapti ki Pehchan: Rounding Top Pattern ek reversal pattern hota hai, yaani ki yeh trend ki ant mein dekha jata hai. Is pattern mein price action ek round shape banata hai jismein prices initially upar jaate hain lekin phir dheere dheere neeche aate hain.

- Volume Kam Hota Hai: Jab rounding top pattern banta hai, volume usually kam ho jata hai. Yeh indicate karta hai ki traders ke interest mein kami aa rahi hai aur potential reversal ke chances hain.

- Resistance Level: Is pattern mein ek resistance level bhi hota hai jo prices ko upar se rokta hai. Jab price is resistance level tak pahunchta hai aur uske baad neeche aane lagta hai, tab rounding top pattern taiyar hota hai.

Tajziya:

Rounding Top Pattern ko samajhna aur uska istemal karna traders ke liye mahatvapurna hota hai. Jab yeh pattern dekha jaata hai, to yeh ek potential signal hota hai ki uptrend khatam ho sakta hai aur bearish trend shuru ho sakta hai. Traders is pattern ko confirm karne ke liye aur additional indicators jaise ki volume aur momentum ka istemal karte hain.

Agar rounding top pattern ko confirm kiya jata hai, to traders short positions lete hain ya existing long positions ko close karke profits book karte hain. Yeh pattern trading strategies ko develop karne mein madad karta hai aur market ke movements ko predict karne mein madad karta hai.

Nateeja:

Rounding Top Pattern ek mahatvapurna technical analysis tool hai jo traders ko market ke trend reversals ka advance indication deta hai. Iske istemal se traders apne trading decisions ko improve kar sakte hain aur market ke saath anukool trade kar sakte hain. Isliye, har trader ko rounding top pattern ke bare mein gahra gyaan hona chahiye taki wo market ke movements ko samajh sake aur safalta ke raaste par aage badh sake.

-

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Rounding Top Pattern

Rounding Top pattern ek technical analysis concept hai jo forex market mein istemal hota hai. Ye pattern ek specific price action ko represent karta hai jo ek trend reversal ko indicate karta hai. Rounding Top pattern ka formation ek dome ya curve shape ka hota hai, jismein initially prices upar jaate hain, phir ek peak reach karte hain, aur phir gradual decline shuru hota hai jisse curve shape banta hai. Ye pattern usually ek uptrend ke baad form hota hai aur downtrend ke onset ko suggest karta hai.

Formation of Rounding Top:

Rounding Top pattern ka formation ek gradual process hota hai, jo typically ek uptrend ke baad develop hota hai. Is pattern mein, initially prices steadily increase karte hain, creating higher highs aur higher lows. Jab prices ek peak level tak pahunchte hain, wahan par ek consolidation phase shuru hoti hai. Is phase ke doran, buyers aur sellers ke beech mein balance shift hota hai aur prices mein stability aati hai. Phir, gradual decline shuru hota hai jisse curve shape form hota hai, indicating weakening of the uptrend. Ye gradual decline curve ke neeche previous support levels ko break karta hai, suggesting a potential trend reversal.

Trade Execution Using Rounding Top:

Rounding Top pattern ke formation ko identify karke, traders ko ek potential trend reversal ka signal milta hai. Is pattern ke formation ke baad, traders ko trading strategy ka istemal karke apne positions ko execute karne ka mauka milta hai. Yahan kuch steps diye gaye hain jo traders Rounding Top pattern ke istemal karke trade lene mein istemal kar sakte hain:- Recognition: Pehli step Rounding Top pattern ko recognize karna hai. Iske liye, traders ko price chart par dome ya curve shape dekhna hota hai jo ek uptrend ke baad appear hota hai. Ismein, prices initially upar jaate hain, phir ek peak reach karte hain, aur phir gradual decline shuru hota hai jisse curve shape banta hai.

- Confirmation: Recognition ke baad, traders ko confirmation ke liye look karna hota hai. Iske liye, volume analysis ki zarurat hoti hai. Rounding Top pattern ke formation ke samay, volume usually decrease hota hai, indicating lack of interest ya conviction in the upward movement. Traders ko ye confirmation ke liye wait karna chahiye ki price decline ke saath saath volume bhi decrease kar raha hai.

- Entry Point: Entry point choose karte waqt, traders ko price break ke baad wait karna chahiye. Jab price curve ke bottom ko break karta hai aur neeche jaane lagta hai, tab traders entry ke liye consider karte hain. Entry point ko choose karte waqt, traders ko risk aur reward ka balance maintain karna chahiye.

- Stop Loss: Har trading strategy mein stop loss ka hona bahut zaroori hai. Rounding Top pattern trading strategy mein bhi, traders ko apne positions ke liye ek stop loss level set karna chahiye. Ye stop loss level usually pattern ke peak ke just above set kiya jata hai, taaki agar reversal na hua to loss minimize ho sake.

- Target Setting: Target setting important hai takay traders apne profits ko maximize kar sakein. Iske liye, traders usually pattern ke starting point se neeche target set karte hain. Isse, agar price expected direction mein move karta hai, toh traders apne profits ko secure kar sakte hain.

- Risk Management: Har trading strategy mein risk management ka hona crucial hai. Rounding Top pattern trading strategy mein bhi, traders ko apne risk tolerance ke according position size adjust karna chahiye. Position size ko control karke, traders apne overall risk ko manage kar sakte hain.

- Monitor Karein: Jab traders apne positions enter kar lete hain, tab unhe market ko closely monitor karna chahiye. Agar koi opposite movement observed hota hai ya stop loss level hit hota hai, toh traders ko apne positions ko adjust ya close kar lena chahiye. Market conditions ko regular intervals par monitor karke, traders apne trading decisions ko adjust kar sakte hain.

- Continued Learning: Trading mein successful hona ek continuous learning process hai. Traders ko hamesha market trends aur patterns ke updates par focus rakhna chahiye taki wo apni strategies ko refine aur improve kar sakein. Market mein hone wale changes ko analyze karke, traders apne trading approach ko adapt kar sakte hain.

Conclusion:

Rounding Top pattern trading strategy ko effectively use karne ke liye, traders ko patience, discipline, aur technical analysis skills ki zarurat hoti hai. Ismein risks hote hain, isliye traders ko apne decisions ko carefully analyze karna chahiye aur risk management principles ka istemal karna chahiye.

-

#13 Collapse

Rounding Top Pattern:

Technical analysis, jese ke share market mein istemal hoti hai, wahan pe patterns ka bohot ahem kirdar hota hai. In patterns mein se ek ahem pattern jo traders ke liye ahem hota hai, woh hai "Rounding Top Pattern". Yeh pattern chart analysis mein istemal hota hai aur traders ko ek nazar deta hai ke market mein possible trend reversal ho sakta hai.

Rounding Top Pattern kya hai?

Rounding Top Pattern ek chart pattern hai jo market ke bullish trend ko indicate karta hai. Is pattern mein, ek stock ya asset ki price gradually badhti hai phir ek muddat ke baad slowly girne lagti hai. Jab ye girne lagti hai, to price ka graph ek curve ki shakal le leta hai, jise hum "rounding top" kehte hain. Yeh pattern ek bearish reversal signal hai, matlab ke bullish trend khatam ho kar bearish trend shuru hone ki alamat hai.

Rounding Top Pattern ki Pehchan

Rounding Top Pattern ki pehchan karna asaan nahi hota, lekin experienced traders isay samajh lete hain. Kuch ahem points hain jo is pattern ki pehchan mein madadgar sabit ho saktay hain:- Gradual Uplift: Rounding Top Pattern ka pehla hissa hota hai gradual price increase. Price slowly aur consistent taur par badhti hai. Yeh bullish trend ko darust karta hai.

- Top Formation: Jab price apni peak tak pahunchti hai, to ek curve shakal ban jati hai, jise rounding top kehte hain. Yeh curve usually smooth hoti hai aur aasman ki taraf jhuki hoti hai.

- Volume Decrease: Rounding Top Pattern ke during, trading volume mein bhi kami hoti hai. Yeh indicate karta hai ke bullish momentum khatam ho raha hai aur bearish momentum shuru hone wala hai.

- Support Break: Jab price curve ki bottom ko break karta hai, matlab ke support level ko tod deta hai, to yeh ek aur confirmation signal hota hai ke bullish trend khatam ho raha hai.

Rounding Top Pattern aur Trading Strategies

Rounding Top Pattern ko samajh kar traders apni trading strategies ko shape kar sakte hain. Kuch traders is pattern ka istemal karte hain taake bearish reversal pehchan sakein aur accordingly apni trades adjust kar sakein. Yeh pattern ko confirm karne ke liye, traders doosri technical indicators aur tools ka bhi istemal karte hain jaise ke moving averages, RSI, aur MACD.

Nateeja

Rounding Top Pattern ek ahem tool hai jo traders ko market trends ka pata lagane mein madad deta hai. Is pattern ko samajh kar, traders apni trades ko better manage kar sakte hain aur loss se bach sakte hain. Magar, zaroori hai ke traders is pattern ko samajhne ke liye sufficient research aur experience rakhein, taake unki trading decisions sahi ho sakein.

-

#14 Collapse

round top pattern

round top pattern ek bearish reversal pattern hai jo tab banta hai jab stock ki kimat kuchh samay ke liye upar ki or badhati hai, fir ek golakar shirsh banati hai, aur fir niche ki or badhane lagti hai। pattern ko iske gol aakar ki visheshta hoti hai, jo kai mahinon ya salon mein ban sakti hai। round top pattern ek bearish signal hai, aur yah ingit karta hai ki kimat mein giravat aane vali hai।

round top pattern ki pahchan karne ke liye, nimnalikhit charanon ko dekhen:- kimat mein upar ki or badhati trend ki pahchan karen।

- gol aakar ki pahchan karen jo kuchh mahinon ya salon mein banta hai।

- kimat mein niche ki or badhati trend ki pahchan karen।

round top pattern ki pahchan karne ke liye ek udaharan yahan diya gaya hai:

is chart mein, aap dekh sakte hain ki kimat mein upar ki or badhati trend hai। fir, kimat ek gol aakar banati hai, aur fir niche ki or badhane lagti hai। yah round top pattern ka ek udaharan hai।

round top pattern ki pahchan karne ke liye kuchh atirikt sujhav yahan diye gaye hain:- pattern ki pahchan karne ke liye kam se kam 50 dinon ke samay seema ka upyog karen।

- pattern ki pahchan karne ke liye volume mein giravat ki talash karen।

- pattern ki pahchan karne ke liye anya bearish sanketon ki talash karen, jaise ki moving average crossover ya resistance level per break।

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

**Rounding Top Pattern Kya Hai?**

Forex trading aur technical analysis mein candlestick patterns market ke price movements aur potential reversals ko samajhne mein madadgar hote hain. In patterns mein se ek important pattern hai "Rounding Top." Yeh pattern market ke potential trend reversals aur bearish signals ko indicate karta hai. Aaiye, detail se samjhte hain ke Rounding Top Pattern kya hai aur isse trading mein kaise use kiya jata hai.

**Rounding Top Pattern Kya Hai?**

Rounding Top pattern ek bearish reversal pattern hai jo generally ek uptrend ke baad develop hota hai. Yeh pattern market ke gradual shift ko bullish se bearish trend ki taraf indicate karta hai aur price action ke smooth transition ko show karta hai. Rounding Top pattern ko identify karke traders market ke potential trend reversal aur bearish opportunities ko capture kar sakte hain.

**Pattern Ki Characteristics:**

1. **Formation:**

- **Initial Uptrend:** Rounding Top pattern tab develop hota hai jab market ek strong uptrend ke baad transition shuru karta hai. Pehli phase mein price steadily increase hoti hai aur higher highs aur higher lows banati hai.

- **Rounded Peak:** Pattern ke mid-phase mein, price movement gradual aur rounded shape ke sath hoti hai. Yeh stage price ke slow aur steady shift ko bearish trend ki taraf show karti hai.

- **Downtrend Confirmation:** Pattern ka final phase bearish reversal ke confirmation ke sath hota hai. Price rounded peak ke baad decline shuru karti hai aur neche ki taraf movement badhati hai.

2. **Price Action:**

- Rounding Top pattern smooth aur rounded shape ke sath develop hota hai, jo gradual market sentiment shift ko indicate karta hai. Yeh pattern strong bullish trend ke baad market ke bearish phase ki transition ko reflect karta hai.

3. **Volume Analysis:**

- Volume bhi Rounding Top pattern ke analysis mein important role play karta hai. Pattern ke shuruat mein volume increase hota hai aur peak ke aas-paas volume gradual decrease hota hai. Yeh decrease market ke waning bullish sentiment ko show karta hai.

**Trading Insights:**

1. **Entry Points:**

- Rounding Top pattern ke complete hone ke baad, traders generally sell positions enter karte hain jab price pattern ke rounded peak ke baad decline shuru karti hai. Entry points ko pattern ke peak ke niche ya recent support levels ke around set kiya jata hai.

2. **Stop-Loss:**

- Stop-loss orders ko pattern ke peak ke thoda upar set kiya jata hai. Yeh risk management tool unexpected price movements aur false breakouts se protection provide karta hai.

3. **Take-Profit:**

- Profit targets ko recent price action aur bearish trend ke analysis ke basis par set kiya jata hai. Traders generally profit targets ko pattern ke height aur market ke bearish potential ke hisaab se adjust karte hain.

**Example:**

Agar GBP/USD pair ek strong uptrend ke baad Rounding Top pattern show karta hai, jahan price gradually rounded peak ke aas-paas move karti hai aur phir decline shuru karti hai, to yeh bearish reversal signal ho sakta hai. Traders is signal ke basis par sell positions enter kar sakte hain aur stop-loss ko pattern ke peak ke upar set kar sakte hain.

**Conclusion:**

Rounding Top Pattern forex trading mein ek valuable tool hai jo market ke bearish reversal aur trend transition ko reflect karta hai. Is pattern ki accurate identification aur confirmation ke sath, traders effective trading decisions le sakte hain aur market movements ko capitalize kar sakte hain. Proper risk management aur profit-taking strategies ke sath, Rounding Top pattern aapki trading strategy ko enhance kar sakta hai aur market trends ko better analyze karne mein madad kar sakta hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 07:22 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим