What is Three White Soldiers Candlestick Pattern In Forex:

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

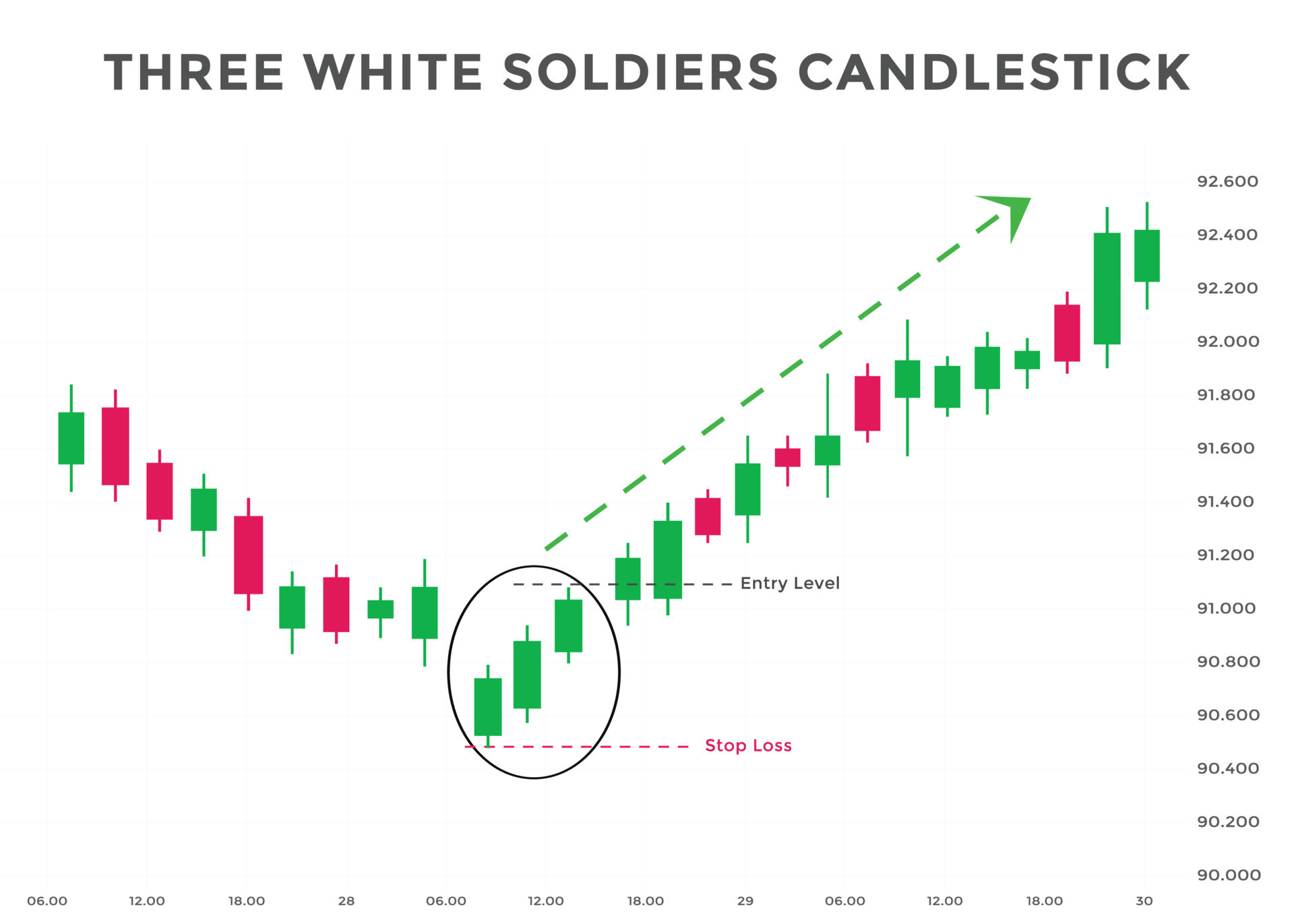

Introduction: Assalamualaikum I hope you all are fine and doing well on forex trading. Aj ki post mein main ap ko Three white soldiers candlestick pattern key bary mein knowledge share krun gi. I hope AP key leay bht help ful ho ga. What is White Soldiers Candlestick Pattern? Dear forex members Three white soldiers candlestick pattern forex market ki technical analysis mean ek bullish reversal pattern hayi. Is pattern ka matlab hota hayi. ki market ki trend downward see upward me shift ho rahi hayi. Is pattern ki recognition kaafi important hai, kyunke yeah traders ko profitable trade entries key liye indicate karta haiy.Candlestick chart me three white soldier pattern me 3 consecutive bullish candles hoti hain. jin mean sabhi candles key opening price closing price see lower hota hayi. Yeah candlesticks long body candles hote hain. Aur each subsequent candle's high previous candle's high see above hota hayi. Formation Of This Pattern: Dear Three white soldier pattern ka formation us waqt hota hai jab market me ek downtrend ho aur phir sudden buying pressure se market me bullish move aa jata hai. Is pattern ko identify karne ke liye traders ko kuch steps follow karne hote hain, jo neeche bataye gaye hain. (a): First pay hmein down trend ko maloom krna hota ha. Sabse pehle traders ko downtrend ko identify karna hota hay. jis see trend reversal hone ki ummeed hoti hai. (b): Second mein candle ko dekhna hota hay. Phr Is key baad traders ko 3 bullish candles ki identify karni hoti hay. jo consecutive hon. Har aek candle ka closing price, previous candle's closing price see above hona chahiey. (c): Dear third mein hmein pattern ki confirmation krni hoti. Agar traders ko three consecutive bullish candles mil jati hay. TOH fir confirm karna hota hai. ki yeah three white soldier pattern hay. Is key liye traders ko yeah dekhna hota hay. ki yeah pattern kisi support level key near form hua hay yah nahie. Expalination: Dear aek baar is pattern ka confirmation mil jata hay.toh traders ko apni stop loss aur target levels set karna hota hay. Stop loss set karna kafi important hota hay. kyun key agar trend reversal nahie hoti hay. toh traders ko loss bear karna pad sakta hay.Is key baad traders ko apne target levels set karne hote hain. jis see unhe profitable exit mil sake. Target levels ko set karne key liye traders ko support aur resistance levels ki analysis karni hoti hay.Three White Soldier pattern bullish reversal pattern hay. jo traders ko profitable trade entries key liye indicate karta hay. Is pattern ko identify karne ke liye traders ko trend analysis aur price action ki analysis karni hoti hay. Agar traders is pattern ko sahi see samajhte hain. aur sahi see execute karte hain.toh unhe profitable trades milne key chances kafi badh jate hain.our dosto main umeed karta hon k aj jo kuch mainy is candlestick pattern k bart mn btaya vo ap ko trading mn bhot help key ga our knowledge mn b izafa key ga. -

#3 Collapse

Three white candlestick pattern Tin Sufaid Sipahiyon Ki Mombatti Pattern ek bullish trend reversal pattern hai jo forex mein istemal hota hai. Yeh pattern tin lambi sufaid mombattiyon se milta hai jo achchhi tarah se diye ki roshni mein dikhte hain. Jab ye pattern banata hai to iska matlab hota hai ki bearish trend ka khatma ho raha hai aur ab market mein bullish trend aane wala hai. Is pattern ko dekhne ke liye traders pehle ek downtrend ya sideway market mein hona chahiye. Fir jab koi bullish trend shuru hota hai to tin lambi sufaid mombattiyon ki series banti hai jismein sabhi mombattiyon ke closing price apni range ke top mein hota hai. Is pattern mein pehli mombatti ki closing price bearish trend ke ant mein hoti hai jabki doosri mombatti ki opening price pehli mombatti ki closing price ke barabar hoti hai. Teesri mombatti ki opening price doosri mombatti ki closing price ke barabar hoti hai.Tin Sufaid Sipahiyon Ki Mombatti Pattern ko samajhne ke liye yeh important hai ki is pattern mein mombattiyon ki range aur inki closing price ki positioning ka dhyan rakha jaaye. Yadi ye pattern sahi tareeke se bana hai to yeh ek reliable bullish reversal signal hai. Lekin yeh bhi dhyaan mein rakha jaana chahiye ki ye pattern false signals bhi generate kar sakta hai agar market mein koi strong resistance zone ya sideway market phase hai. Isliye traders ko aur technical indicators ka bhi use karna chahiye jaise ki moving averages RSI aur MACD sahi entry aur exit points ke liye. Tin Sufaid Sipahiyon Ki Mombatti Pattern ka istemaal karna traders ke liye faydemand ho sakta hai kyunki yeh ek strong bullish trend reversal signal hai. Is pattern ko achchhe se samajhne ke liye traders ko technical analysis ki sahi samajh aur trading experience ki zaroorat hoti hai. What does tell you RVI Teen safed sipahiyon ki mombati ki shakal ka matlab hai ke market sentiment mein kisi stock commodity ya pair mein taqatwar tabdeeli aayi hai. Jab koi mombati bina kisi ya kam shadows ke band hoti hai to yeh ishara karta hai ke bulls ne price ko session ke top pe hi rakha hai. Yani bulls teen mubtala sessions mein rally ko control karte hain aur din ke high ke qareeb close karte hain. Iske alawa yeh pattern doji jaise reversal candlestick patterns ke saath aane se pehle bhi aa sakta hai. Yahan VanEck Vectors Fallen Angel High Yield Bond exchange traded fund (ETF) ke pricing chart mein teen safed sipahiyon ka ek namuna diya gaya hai. Working of three candlestick pattern Jaisa keh teen safaid sipahsalar ek bullish tajziyati pattern hai is ka istemaal entry ya exit point ke tor par kiya jata hai. Traders jo keh security par short hain wo exit karnay ki koshish karte hain aur traders jo keh bullish position lenay ke liye intezaar kar rahe hote hain wo teen safaid sipahsalar ko ek entry mauqa samajhtay hain. Teen safaid sipahsalar pattern ke trade karte samay ehmiyat hai keh zor daar teziyaan waqtan-faqtan overbought halat paida kar sakti hain. Maslan relative strength index (RSI) 70.0 ke level se oopar chala gaya ho. Kuch cases mein teen sipahsalar pattern ke baad kuch dair ki consolidation hoti hai lekin chota aur darmiyani ahd ka bias bullish rehta hai. Zor daar teziyaan aam tor par kisi ahem resistance level ko pohanch sakti hain jahan stock consolidation ka samna kar sakta hai phir tezi se aagey badhta hai. -

#4 Collapse

what is three white soldier candle stick pattern three white soldiers candle stick pattern aik bullish trend reversal candle stick pattern hota hey jo keh forex prices kay chart mein majodah kame kay trend ko identify karta hey pattern mein jare teen long candle stick bante hein jo pechle candle stick ke long body kay andar open hote hein or aik close pechle candle stick ke highs kay oper open hote hein understanding three white soldiers candle stick pattern three white soldiers candle stick pattern price action kay stock , commodity ya pair kay lahaz say market kay jazbaat ke akce kartay hein market kay jazbaat mein zabardast tabdele ke taraf mashwara dayty hein jab aik candle stick chotay ya baghair shadow kay sath close ho rehe hote hey or es bat ko indicate keya jata hey keh bulls kay session kay ley forex market ke range sab say oper rakhnay mein kamyab ho gay hey Basiv tor par bulls poray session ke rally ko sanbhal lein gay jare teen session tak highs tak pohnch jatay hein es ley pattern say pehlay dosree candle stick kay pattern ho saktay hein or reversal janay ke tajweez kartay hein keh jaisa keh Doji trade with three white candlestick pattern three white soldiers candle stick pattern aik bullish basree pattern hey jo entry or exit kay tor par estamal ke ja sakte hey jen ke trader kay pass security ke kame hote hey woh forex market mein out hotay nazar atay hein jo trader ke bullish position laynay ka intazar kartay hein three white soldiers candle stick pattern entry laynay ka chance talash kartay hein frex trading mein three white soldiers candle stick pattern trade kartay time yeh note karna zaroore hota hey yeh forex market mein overbought kay hallat kay tor par paish kar saktay hein ager RSI 70 say oper chala jata hey t yeh overbought kay hallat ko identify karta hey three white soldiers candle stick pattern strong or short entry kay hallat kay tor par identify ke ja sakte hey short or central period mein yeh trend bullish ka he rehta hey important step higher resistance level tak bhe pohnch sakta hey or market mein stable ka amnalysis bhe kar sakta hey

bhali kay badlay bhali

bhali kay badlay bhali

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#5 Collapse

Three White Soldiers Candlestick Pattern Kya Hai? Three White Soldiers Candlestick Pattern ek bullish reversal pattern hai jo trend reversal ko indicate karta hai. Is pattern ki formation three consecutive bullish candlesticks par hoti hai. Ye pattern price action par based hai aur iski madad se traders aur investors market trends ko identify kar sakte hain. Forex trading mein technical analysis ek important aspect hai jiski madad se traders aur investors market trends ko identify kar sakte hain. Candlestick patterns bhi ek aisi technical analysis tool hain jiski madad se traders aur investors price movements aur market trends ko predict kar sakte hain. Three White Soldiers Candlestick Pattern ki formation kaafi simple hai. Is pattern ki formation ke liye pehle candlestick bullish hona chahiye. Iske baad dusre candlestick ki opening price pehle candlestick ke closing price se above honi chahiye aur iske closing price bhi bullish hona chahiye. Teesre candlestick ki opening price dusre candlestick ke closing price se above honi chahiye aur iske closing price bhi bullish hona chahiye. Agar ye three consecutive candlesticks ki formation ho jaati hai toh isko Three White Soldiers Candlestick Pattern kehte hain. Three White Soldiers Candlestick Pattern ki formation bullish trend reversal ko indicate karta hai. Is pattern ki formation ke baad market trend mein bullish movement ki ummeed hoti hai. Ye pattern kaafi strong reversal signal deta hai aur traders aur investors ko market mein entry ya exit points ka faisla lene mein madad karta hai. Is pattern ke baare mein seekhne ke liye, traders aur investors ko market trends ko closely observe karna hota hai aur is pattern ki formation ki pahchan karna hoti hai. Ek baar is pattern ki formation ki pahchan ho jaaye toh traders aur investors ko is pattern ke sahi entry aur exit points ka faisla lena hota hai. Three White Soldiers Candlestick Pattern kaafi versatile pattern hai aur iska istemal stocks, futures aur forex trading mein bhi kiya jata hai. Is pattern ki formation ki pahchan karna traders aur investors ke liye kaafi zaroori hai aur is pattern ki madad se trading karne mein bhi asaani ho sakti hai. Ye pattern kaafi strong reversal signal deta hai aur iska istemal market trend mein bullish movement ki ummeed ko indicate karne ke liye kiya jaata hai. Traders aur investors ko market trends ko closely observe karne ki zaroorat hoti hai aur is pattern ki formation ki pahchan karne ke baad sahi entry aur exit points ka faisla lena hota hai. Three White Soldiers Candlestick Pattern traders aur investors ke liye kaafi faidaymand ho sakta hai aur iski madad se trading karne mein asaani ho sakti hai.

Ek baar is pattern ki formation ki pahchan ho jaaye toh traders aur investors ko is pattern ke sahi entry aur exit points ka faisla lena hota hai. Three White Soldiers Candlestick Pattern kaafi versatile pattern hai aur iska istemal stocks, futures aur forex trading mein bhi kiya jata hai. Is pattern ki formation ki pahchan karna traders aur investors ke liye kaafi zaroori hai aur is pattern ki madad se trading karne mein bhi asaani ho sakti hai. Ye pattern kaafi strong reversal signal deta hai aur iska istemal market trend mein bullish movement ki ummeed ko indicate karne ke liye kiya jaata hai. Traders aur investors ko market trends ko closely observe karne ki zaroorat hoti hai aur is pattern ki formation ki pahchan karne ke baad sahi entry aur exit points ka faisla lena hota hai. Three White Soldiers Candlestick Pattern traders aur investors ke liye kaafi faidaymand ho sakta hai aur iski madad se trading karne mein asaani ho sakti hai.  Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 02:12 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим