Copy Trading.

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Introduction. Copy trading, jo keh forex aur stocks trading mein ek naya concept hai, jis mein traders aur investors doosre traders ke trades ko copy karte hain. Yeh khas tor par beginners ke liye aik aasan tareeqa hai trading karna seekhne ke liye aur experienced traders ke liye aik tareeqa hai apne trading ki performance ko improve karne ke liye.Copy trading kaam karne ke liye, traders ko pehle ek copy trading platform join karna hoga, jis mein woh apne trading account ko link kareinge. Yeh platforms typically brokers, social trading networks, aur third-party service providers dwara offer kiye jaate hain. Jab aap platform mein join karte hain, to aapke paas traders ke profiles, rankings, aur past performance data hota hai, jis se aap unhe choose kar sakte hain jin ke trades aap copy karna chahte hain. Explanation. Jab aap kisi trader ko choose karte hain, to aap unke trades ko apne account mein copy karte hain. Jab unke trades mein changes hota hai, to aapke account mein bhi usi tarah ke changes hote hain. Yeh process typically automated hota hai, jis se aapko manually trades place karne ki zaroorat nahi hoti hai. Copy Trading Ke Advantages. Copy trading ke kuch advantages hain:- Aasan Tareeqe Se Trading Seekhne Ka: Beginners ko trading ki samajh mein aane ke liye, copy trading aik aasan tareeqa hai. Woh experienced traders ke trades ko dekh kar, trading ke concepts aur strategies ki samajh mein aate hain. Is ke saath hi, woh apne trades ko bhi improve kar sakte hain.

- Experienced Traders Ke Trades Copy Karne Se Learning: Experienced traders ke trades ko copy kar ke, traders apni trading ki performance ko improve kar sakte hain. Is ke saath hi, unhe new trading strategies aur techniques bhi learn karne ka moqa milta hai.

- Time-saving: Copy trading automated hota hai, is liye traders ko manually trades place karne ki zaroorat nahi hoti hai. Is se traders ke liye time-saving hota hai.

- Risk of Trading Losses: Jab aap kisi aur trader ke trades ko copy karte hain, to unki trading performance ke hisab se aapki bhi performance hoti hai. Agar trader ki trades loss mein hote hain, to aap bhi losses face kar sakte hain.

- Dependence on Other Traders: Copy trading mein, aap doosre traders ke trades ke upar depend karte hain. Jab unka trading performance acha hota hai, to aapki bhi performance achi hoti hai. Is liye, traders ko kisi bhi trader ke upar zyada depend karna recommended nahi hai.

- High Fees: Copy trading platforms typically high fees charge karte hain, jo ke traders ke liye expensive ho sakte hain. Copy Trading Kaam Kaise Karti Hai? Copy trading kaam karne ke liye aapko ek copy trading platform ki zarurat hoti hai. Ye platform aapko ek list deta hai jisme successful traders aur unke trades hote hain. Aap un traders ko choose kar sakte hain jinke trades aap copy karna chahte hain. Jab aap ek trader ko choose karte hain, to aap unke trades ko automatically copy karne ke liye authorize kar dete hain.

-

#3 Collapse

Copy Trading: Ek Mukhtasir Jaiza

1. Introduction

Copy trading ek aisa trading strategy hai jahan ek trader doosre successful traders ki trading strategies ko follow karta hai. Is ka faida yeh hai ke naya trader un logon ki trading se faida utha sakta hai jo is field mein maahir hain.

2. Copy Trading Kya Hai?

Copy trading ki asal wajah yeh hai ke log trading mein unki knowledge ya skills nahi hoti. Yeh method unhe allow karta hai ke wo experienced traders ki trades ko replicate karein. Is mein, aap apne account ko kisi doosre trader ke account ke sath link kar dete hain.

3. Copy Trading Kaise Kaam Karta Hai?

Jab aap copy trading shuru karte hain, aap kisi ek trader ya ek group ko chun lete hain. Jab wo trader koi trade karta hai, aapka account automatically us trade ko replicate karta hai. Is tarah se aap bina kisi research ke trades kar sakte hain.

4. Copy Trading Ke Fawaid

Copy trading ke bohot se fawaid hain. Aam tor par, naya trader risk kam kar sakta hai, aur unhe trading ki market ki samajh bhi milti hai. Is ke ilawa, agar aap ek achi trader ko follow karte hain, to aapke profits bhi badh sakte hain.

5. Risk Management

Risk management is process ka ek aham hissa hai. Agar aap kisi trader ki copy kar rahe hain, to zaroori hai ke aap unki risk management strategies ko samjhein. Ye aapko behtar decisions lene mein madad dega.

6. Kis Ko Follow Karein?

Yeh sawal aksar naya traders ke liye hota hai. Ek achha trader wo hota hai jo consistent profits kama raha ho aur jiski strategy aapko samajh aaye. Aap un traders ko follow karein jo aapki risk appetite ke mutabiq hon.

7. Trading Platforms

Bohot se trading platforms copy trading ko support karte hain. Aapko dekhna hoga ke kaunsa platform aapke liye behtar hai. Har platform ke apne features aur charges hote hain.

8. Performance Analysis

Kisi trader ki performance ko analyze karna bohot zaroori hai. Aapko unki past performance, risk ratio aur consistency ko dekhna hoga. Is se aap behtar decision le sakte hain.

9. Psychological Factors

Trading sirf technical skills nahi hai; yeh psychological factors par bhi depend karta hai. Aapko yeh samajhna hoga ke jab aap kisi aur ki trades ko follow kar rahe hain, to aapka emotional state kaise affect hota hai.

10. Long-Term vs. Short-Term Strategies

Aapko yeh decide karna hoga ke aap long-term investment chahte hain ya short-term gains. Har trader ki strategy alag hoti hai. Is liye, apni strategy ke mutabiq traders ko select karna zaroori hai.

11. Fees and Commissions

Copy trading mein fees aur commissions bhi ahem hote hain. Har platform alag-alag charges leta hai. Aapko yeh dekhna hoga ke aapke potential profits par yeh charges kis tarah se asar dalte hain.

12. Regulatory Considerations

Copy trading ke liye regulations bhi zaroori hain. Aapko yeh jaan lena chahiye ke jo platform aap use kar rahe hain, kya wo regulated hai ya nahi. Is se aap apne investments ko protect kar sakte hain.

13. Challenges in Copy Trading

Copy trading ke kuch challenges bhi hain. Ek yeh ke aap apne decisions kisi doosre trader par rely karte hain, jo risky ho sakta hai. Agar wo trader achha perform nahi karta, to aapke losses bhi badh sakte hain.

14. Conclusion

Copy trading ek aasan aur faida mand tareeqa hai trading shuru karne ka. Lekin, isme successful hone ke liye zaroori hai ke aap sahi traders ko follow karein aur unki strategies ko samjhein. Is tarah se aap apne investment ko grow kar sakte hain aur trading ki duniya mein apni jagah bana sakte hain. -

#4 Collapse

Copy trading aik aisi investment strategy hai jo aaj kal financial markets, jaise ke forex, stocks, aur cryptocurrency mein bohot mashhoor ho chuki hai. Ye strategy khaas tor par un logon ke liye faida mand hai jo trading ke technical aspects mein maahir nahi hain, ya unke paas waqt aur skill nahi hai trading karne ke liye. Trading ka matlab hai financial markets mein maal (assets) ka lena dena, jo aam tor par profit kamane ke liye kiya jata hai. For example, forex trading mein currencies kharidi aur bechi jati hain, jab ke stock trading mein companies ke shares ka lein-dein hota hai. Cryptocurrency trading mein Bitcoin, Ethereum, aur doosri digital currencies ka business hota hai.

Jo log trading karte hain, wo aam tor par markets ke trend ka analysis karte hain aur apne fund ka faida uthate hain. Lekin trading karna asaan kaam nahi hai. Isme deep knowledge, technical analysis, aur risk management ki zarurat hoti hai. Yahan par copytrading ka concept samne aata hai, jo trading ko simplify kar deta hai.

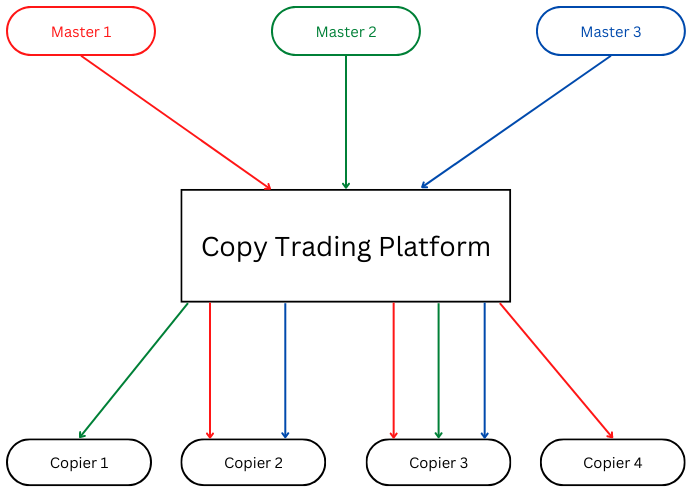

Copy Trading

Copy trading ka matlab hai kisi aur trader ke trades ko apne account mein copy karna. Iska matlab yeh hai ke jab wo trader koi position kholta ya band karta hai, to wohi position aapke account mein bhi automatic khulti ya band hoti hai. Yeh aik tarah ka auto-pilot system hai jo un logon ke liye bohot asani paida karta hai jo khud trading nahi karna chahte, lekin experienced traders ke saath apna profit kamaana chahte hain.

Copy Trading working

Copy trading platforms, jaise ke eToro, ZuluTrade, ya MetaTrader, users ko yeh option dete hain ke wo expert traders ke portfolios ko monitor karen aur unke trades ko copy karen. Aap ko bas aik experienced trader ko select karna hota hai, aur phir platform apne aap us trader ke actions ko replicate kar deta hai.

Steps in Copy Trading- Trading Platform Ka Selection: Pehle aapko aik reliable copy trading platform choose karna hota hai. Popular platforms mein eToro, MetaTrader, aur ZuluTrade shamil hain.

- Expert Trader Ka Election: Aapko kisi experienced trader ka portfolio dekhna hota hai, jisme unka trading history, risk profile, aur performance shamil hoti hai.

- Investment Amount Set Karna: Jab aap trader select kar lete hain, to aapko decide karna hota hai ke kitni amount invest karni hai.

- Auto-Replication Start Karna: Platform apne aap expert trader ke trades ko aapke account mein copy karna shuru kar dega.

1. No Need for Technical Expertise

Agar aap trading ke technical aspects, jaise ke chart analysis, market indicators, aur trends samajhne mein maahir nahi hain, to copy trading aapke liye perfect hai. Aapko kisi bhi tarah ke analysis ki zarurat nahi hoti.

2. Time-Saving

Copy trading un logon ke liye best hai jo full-time job karte hain ya jin ke paas market ko monitor karne ka waqt nahi hai.

3. Access to Professional Expertise

Copy trading aapko experienced traders ki expertise ka faida uthane ka moka deta hai. Aap un professionals ke saath invest karte hain jo trading mein seasoned hain.

4. Risk Diversification

Copy trading ke zariye aap multiple traders ko follow kar ke apne risk ko diversify kar sakte hain. Agar ek trader loss mein hai, to dusra trader aapke losses ko balance kar sakta hai.

5. Learn by Observation

Aap un expert traders ke strategies observe karke khud bhi trading ke baare mein seekh sakte hain.

Disadvantages of Copy Trading

1. No Guaranteed Profits

Trading inherently risky hoti hai. Agar aap jis trader ko follow kar rahe hain wo loss mein jata hai, to aapka bhi paisa khatrey mein hai.

2. Dependence on Others

Copy trading mein aap apne decisions kisi aur par chhod dete hain, jo ke kabhi kabar problem create kar sakta hai, specially agar wo trader galat trades kare.

3. Fees and Commissions

Platforms copy trading ke liye fees ya commissions charge karte hain, jo aapke overall profit ko reduce kar sakta hai.

4. Market Volatility

Koi bhi trader market ki volatility ko control nahi kar sakta, aur kabhi kabar achi strategies bhi unpredictable market conditions ke wajah se fail ho sakti hain.

Key Features of a Good Copy Trading Platform- Transparency: Platform ka user-friendly interface aur trader ki performance ka clear record hona chahiye.

- Risk Management Tools: Stop-loss aur other risk management options available honi chahiye.

- Diverse Range of Traders: Platforms pe different risk levels aur expertise wale traders hone chahiye.

- Real-Time Updates: Trades ko instant execute karne ki capability honi chahiye.

- Regulated Platform: Ensure karein ke platform regulated aur secure ho.

Popular Copy Trading Platforms

1. eToro

eToro duniya ka mashhoor social trading platform hai. Yahan aap experienced traders ke portfolios ko dekh sakte hain aur unko copy kar sakte hain. Yeh platform beginner-friendly hai aur iske user base mein 20+ million log shamil hain.

2. ZuluTrade

ZuluTrade ek aisi platform hai jo global traders ko connect karta hai. Yahan aapko bohot saare options milte hain expert traders ke portfolios ko follow karne ke liye.

3. MetaTrader 4/5

MetaTrader ka signal service feature aapko allow karta hai ke aap expert traders ko copy karein. Yeh platform advanced trading tools ke liye mashhoor hai.

Copy Trading Beginners Ke Liye Tips- Trader Ka Carefully Selection Karein: Un traders ko choose karein jin ki past performance stable ho aur jo consistent profits kama rahe hon.

- Diversify Investments: Ek hi trader par depend na karein; apna capital multiple traders ke beech distribute karein.

- Small Start Karein: Pehle choti investment karein aur market ka maidan samajhne ki koshish karein.

- Regular Monitoring Karein: Copy trading automatic hai, lekin aapko apne portfolio ko monitor karte rehna chahiye.

- Risk Management Tools Use Karein: Stop-loss aur position size ka dhyan rakhein.

Copy trading ek innovative aur user-friendly approach hai jo new traders ke liye financial markets mein entry lena asaan banata hai. Yeh beginners ke liye specially useful hai, lekin iska faida uthana tabhi mumkin hai agar aap careful aur informed decisions lein. Har investment ki tarah, yeh bhi risk-free nahi hai, aur aapko trading ke challenges aur uncertainties ke liye tayar rehna hoga.

Aakhir mein, copy trading ek achha tool hai jo aapko passive income generate karne aur expert traders ke saath apna paisa grow karne ka moka deta hai. Lekin har trader ko apni risk appetite aur goals ke mutabiq iska istamaal karna chahiye.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#5 Collapse

Forex mein copy trading ek aisi strategy hai jisme aap experienced traders ke trades ko apne account par automatically replicate karte hain. Iska faida yeh hota hai ke aap bina apni analysis ke, unke successful strategies ka faida utha sakte hain. Lekin, ismein bhi risk hota hai, kyunke aap dusron ke decisions par rely karte hain. Is liye, copy trading karte waqt apne capital ka proper risk management zaroori hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 11:45 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим